In today’s fast-paced business environment, managing vendor bills and payments effectively is essential for maintaining strong supplier relationships and a healthy cash flow. Odoo 18 is the latest version of the platform, which offers improved features in its Accounting module to streamline and simplify the entire process, from payment reconciliation to vendor billing.

Vendor Bill Creation

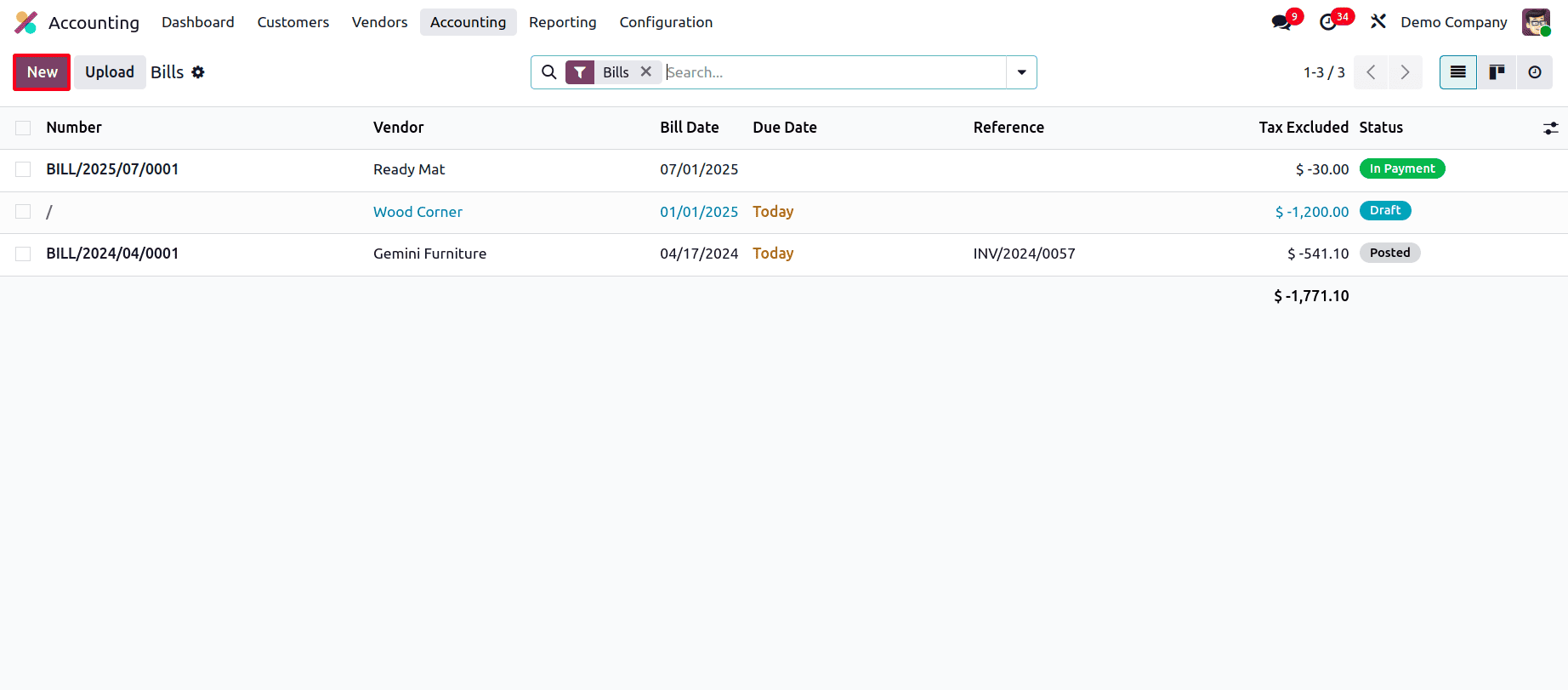

To create a vendor bill in Odoo 18, navigate to the Accounting app and select Bills from the Vendors menu. An exhaustive list of all vendor invoices entered into the Odoo Accounting module is shown in this view. It includes key details such as the bill number, vendor name, bill and due dates, reference, related activities, tax-excluded amount, total amount, currency, payment status, and other relevant information for easy tracking and management.

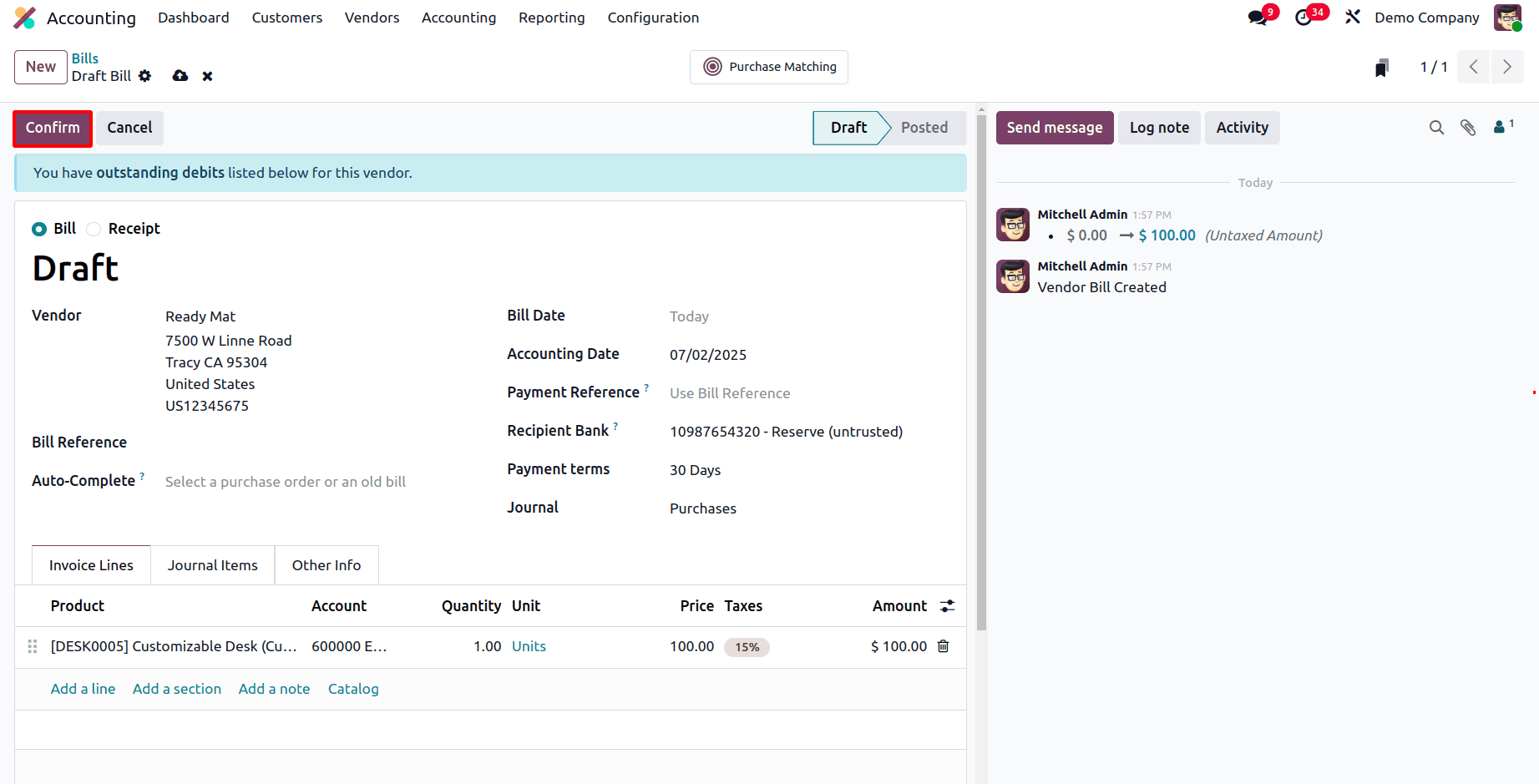

In order to begin entering a new bill, click the New button. In the form, fill in essential details such as the vendor's name, bill reference, bill date, due date, recipient bank account, journal, and payment reference. Next, add invoice lines for the relevant products or services, apply the applicable taxes, and enter the pricing information. If the bill is linked to a purchase order, Odoo’s auto-fill feature can be used to automatically populate the invoice lines, reducing manual input and minimizing errors. Click confirm to complete the bill after you've checked all the information. This instantly creates the relevant journal entries in the system and changes its status from draft to posted.

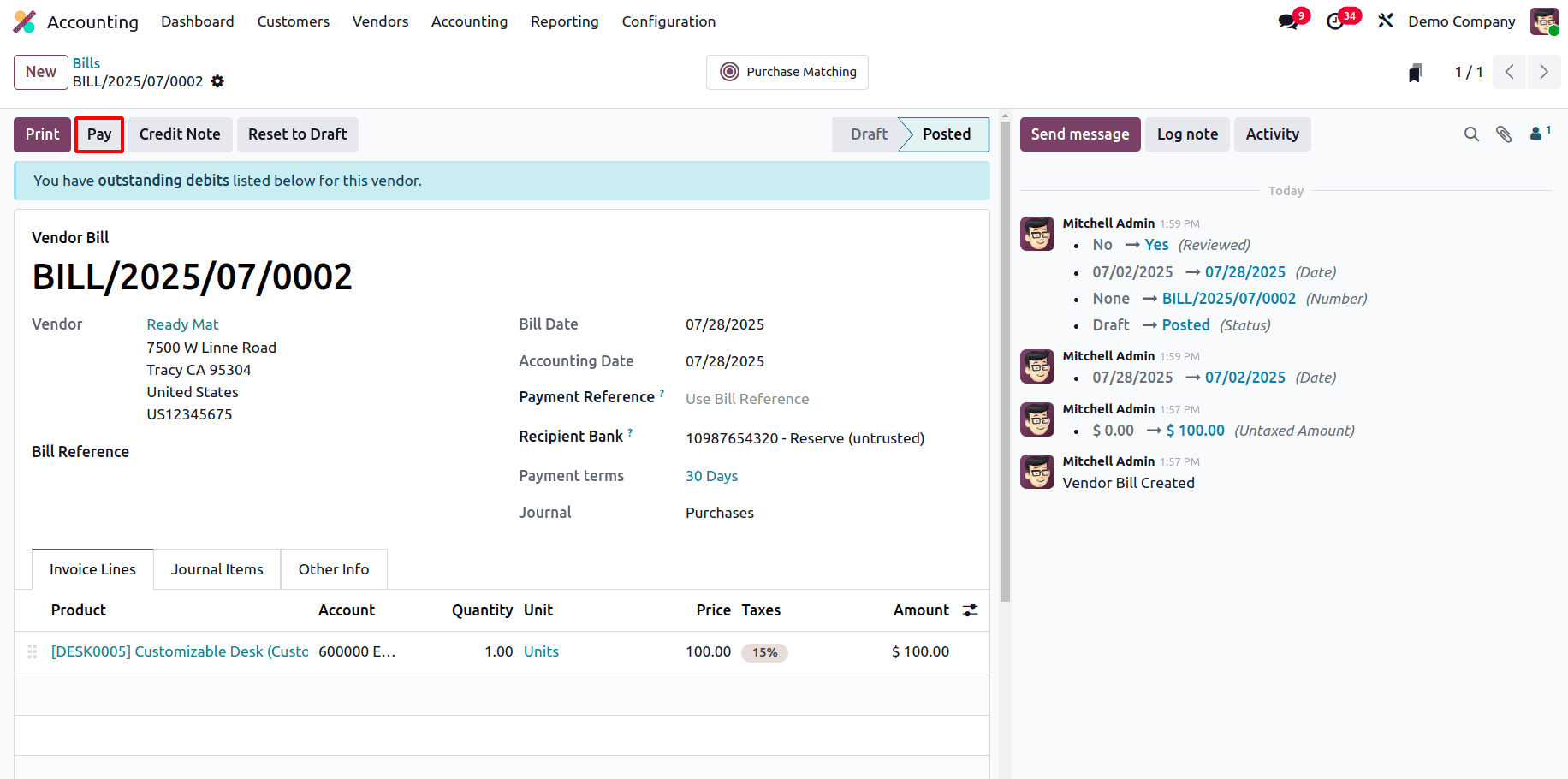

The next step is to click the 'Pay' button to start the payment procedure when the vendor bill has been verified.

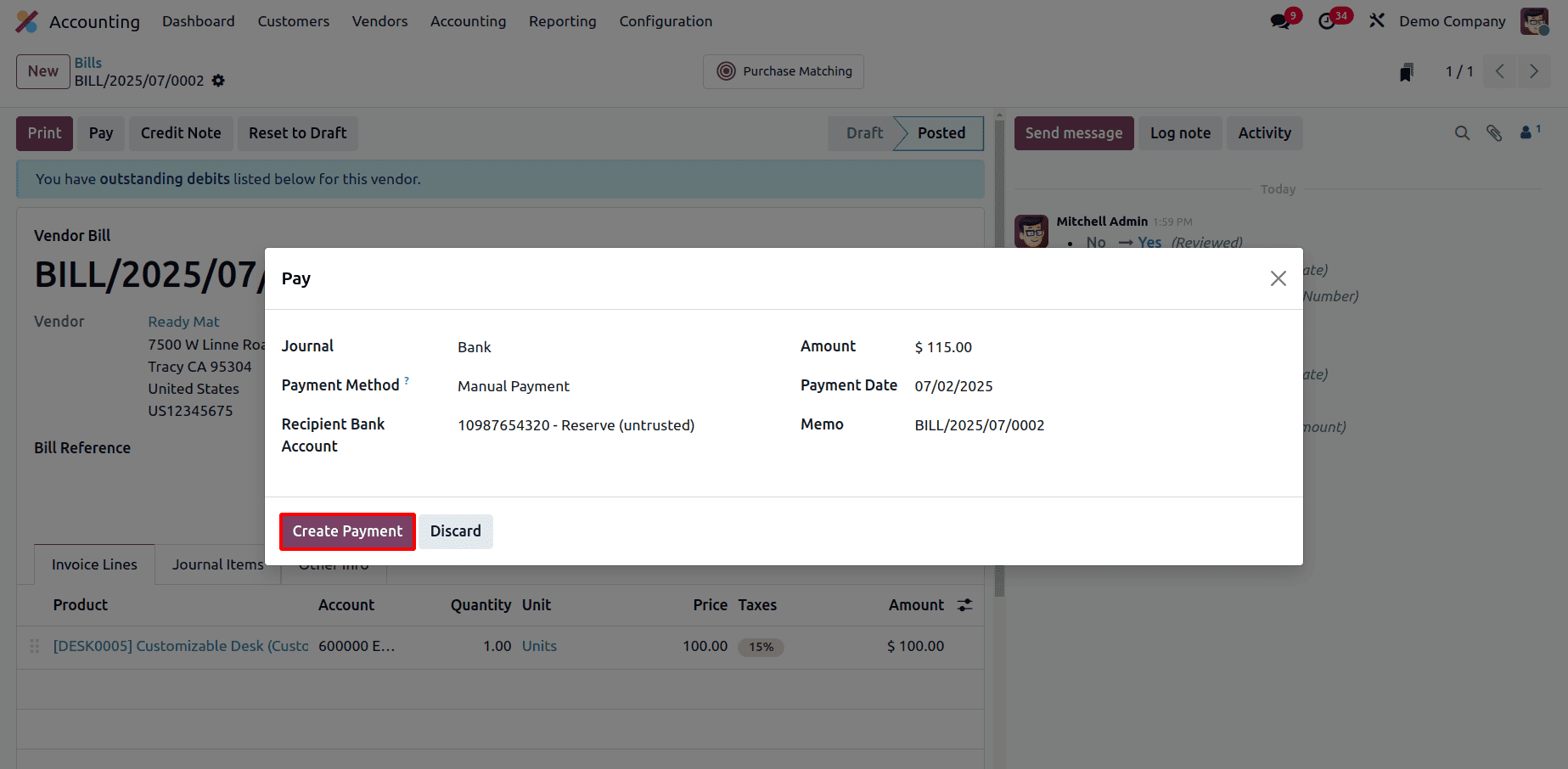

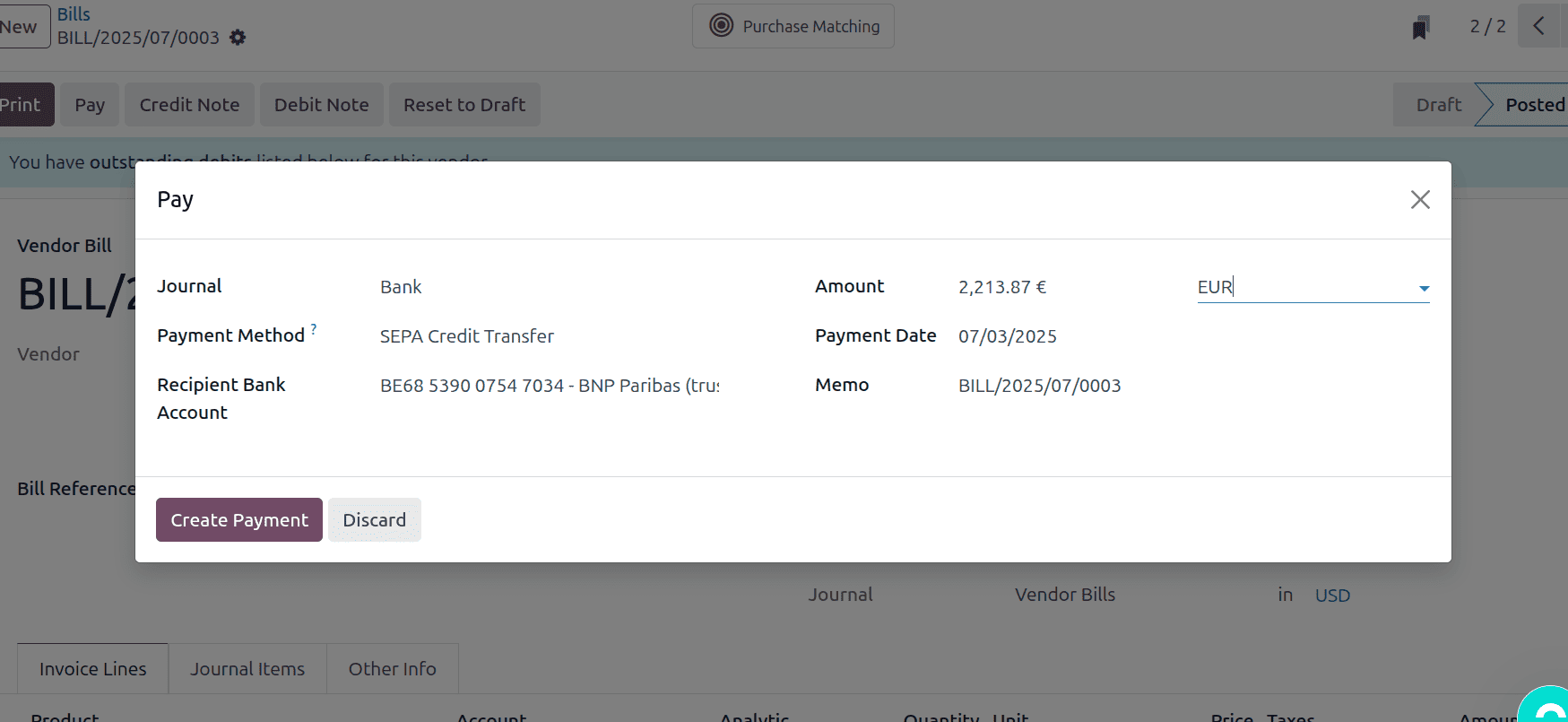

From the pop-up window that appears, simply select the appropriate payment journal, choose the payment method, and enter the recipient’s bank account along with any other necessary details. To complete the transaction, click the "Create Payment" button once all fields are filled out.

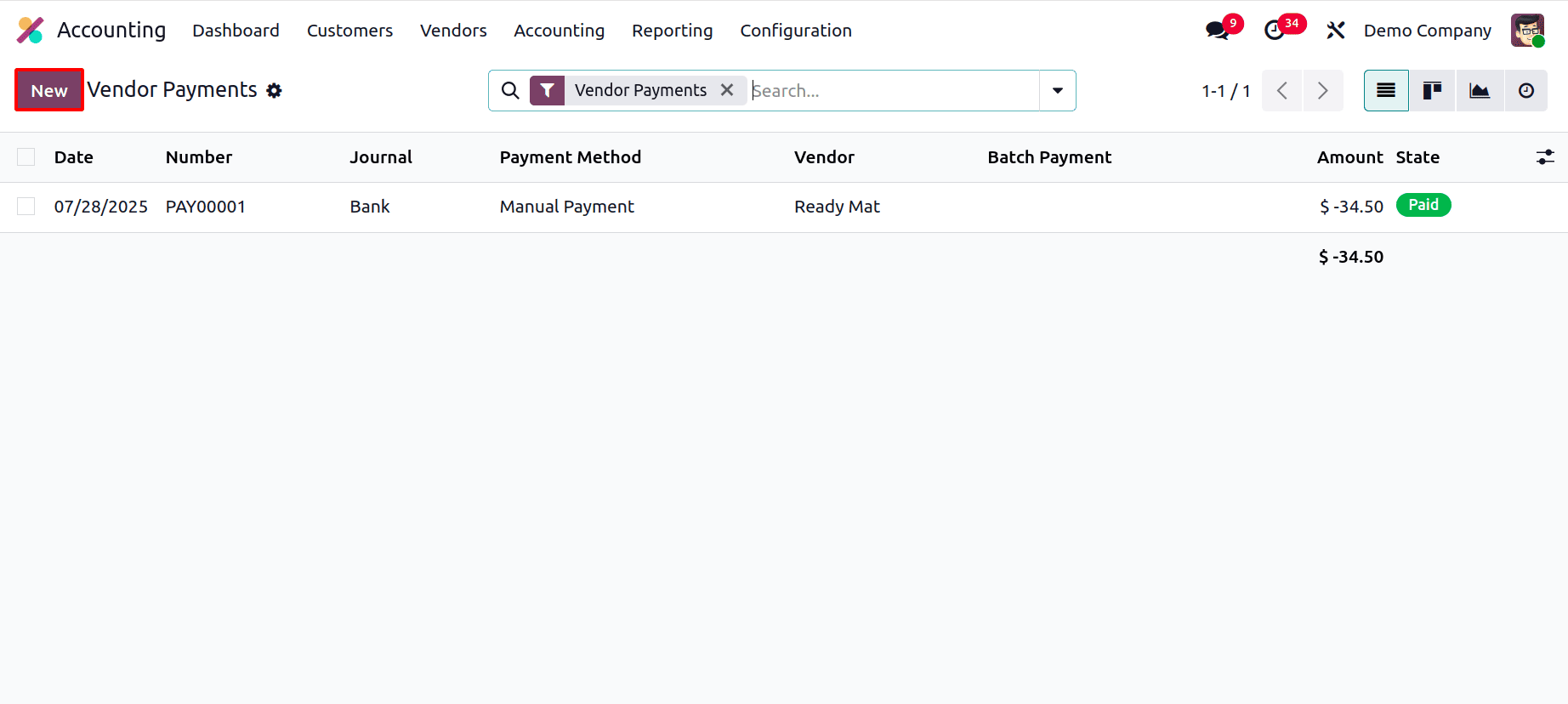

Payment Management

Odoo 18 streamlines the management of vendor payments, giving businesses greater transparency and control over their financial operations. Users can monitor upcoming due dates, track pending payments, and initiate transactions directly within the system.

With built-in support for multiple payment gateways, Odoo ensures that payments are processed quickly and securely. Additionally, integration with bank feeds enables real-time updates to financial data, helping maintain accurate records and allowing any issues or mismatches to be resolved promptly.

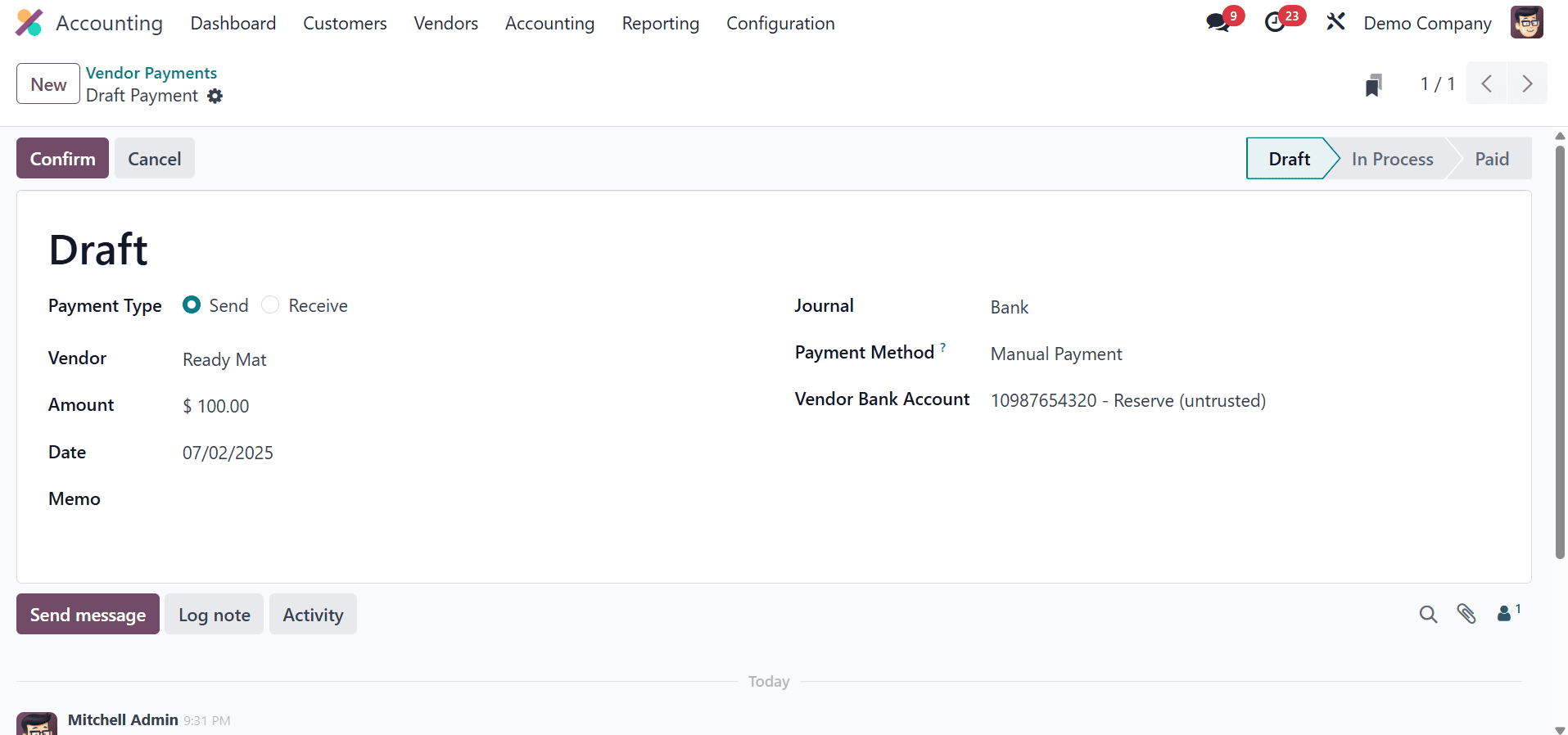

Click the "New" button in Odoo 18 to record a new vendor payment. The payment details, including the Payment Type, Amount, Date, Journal, Payment Method, Vendor Bank Account, and an optional Memo for reference, can be entered on the form that appears.

Click "Confirm" to complete the payment after entering all the necessary information. This operation logs the transaction and makes the appropriate update to your finances.

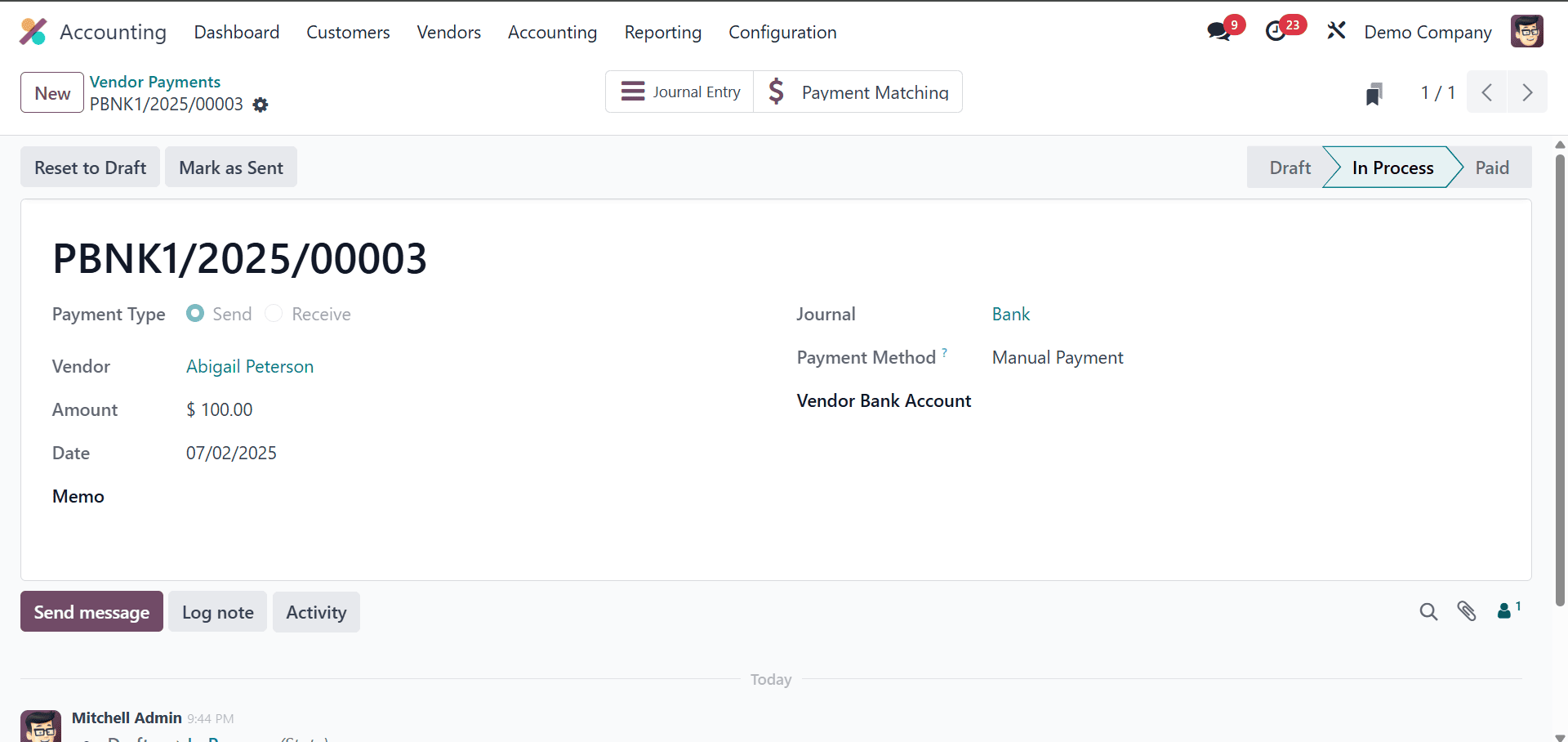

Vendor Payment Ledger Posting

In Odoo 18, every vendor payment automatically generates corresponding journal entries, ensuring your accounting records stay accurate and up-to-date, which reflects the financial movement between accounts, such as reducing your bank balance and clearing the outstanding payable amount. Odoo handles this behind the scenes, giving you clear visibility into your financial transactions without the need for manual bookkeeping. It helps maintain a reliable audit trail and supports better financial decision-making.

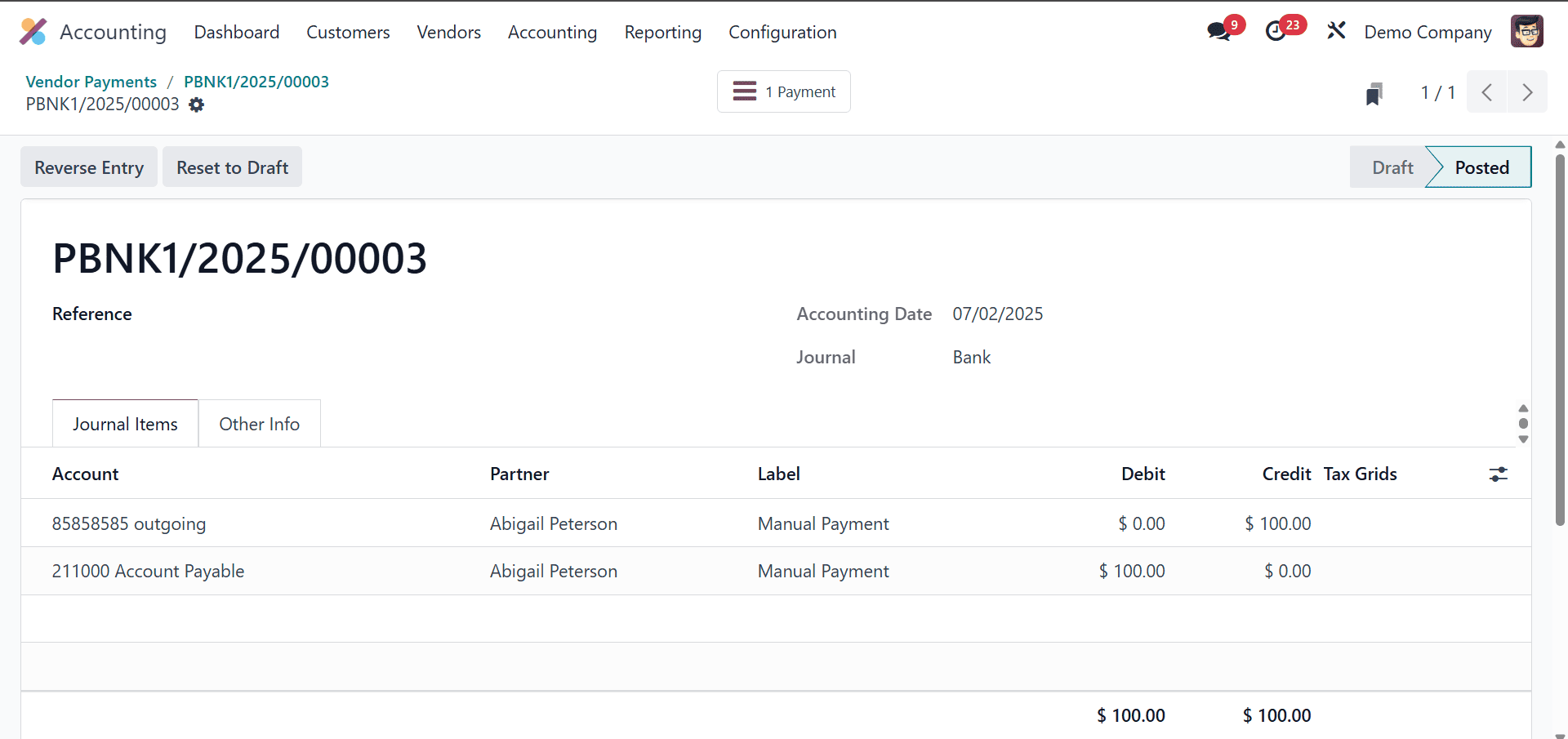

Once a vendor payment is confirmed and validated in Odoo 18, the system automatically generates a corresponding journal entry to reflect the transaction in your accounts. You’ll notice a smart button labeled Journal Entry appears on the payment form. Clicking this button allows you to view the detailed accounting entry, including the debit and credit postings, accounts affected, and any related references. This guarantees openness and maintains the accuracy and traceability of your financial records.

In this vendor payment entry from Odoo 18, we see a journal posting that reflects a $100.00 payment made to the vendor. The entry is dated July 2, 2025, and recorded in the Bank journal. Here, the ‘Account Payable’ account is debited by $100.00, which indicates a decrease in the company’s liability since this account is of type liability, and liabilities decrease on the debit side. On the other hand, the ‘Outgoing’ account is credited by $100.00, signifying a reduction in assets, as assets decrease with a credit. This double-entry ensures that the payment clears the amount owed to the vendor while reflecting the corresponding outflow from the company’s bank account, fully aligned with standard accounting principles and Odoo’s financial logic.

Vendor Batch Payments

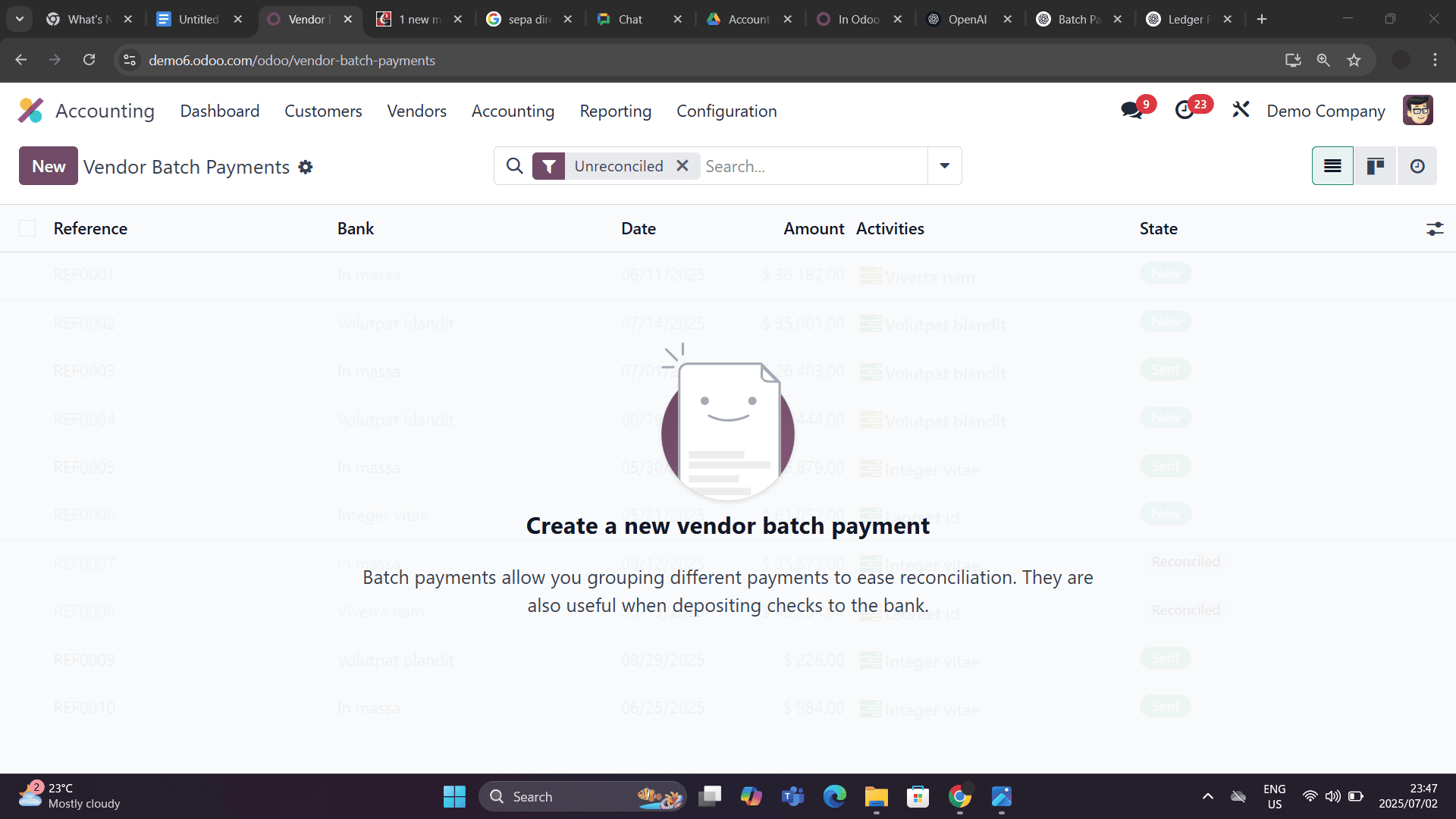

In Odoo 18, managing multiple vendor payments is easier using the Batch Payments feature. By combining various separate vendor payments into a single batch, you can expedite your payment process and save a significant amount of time.

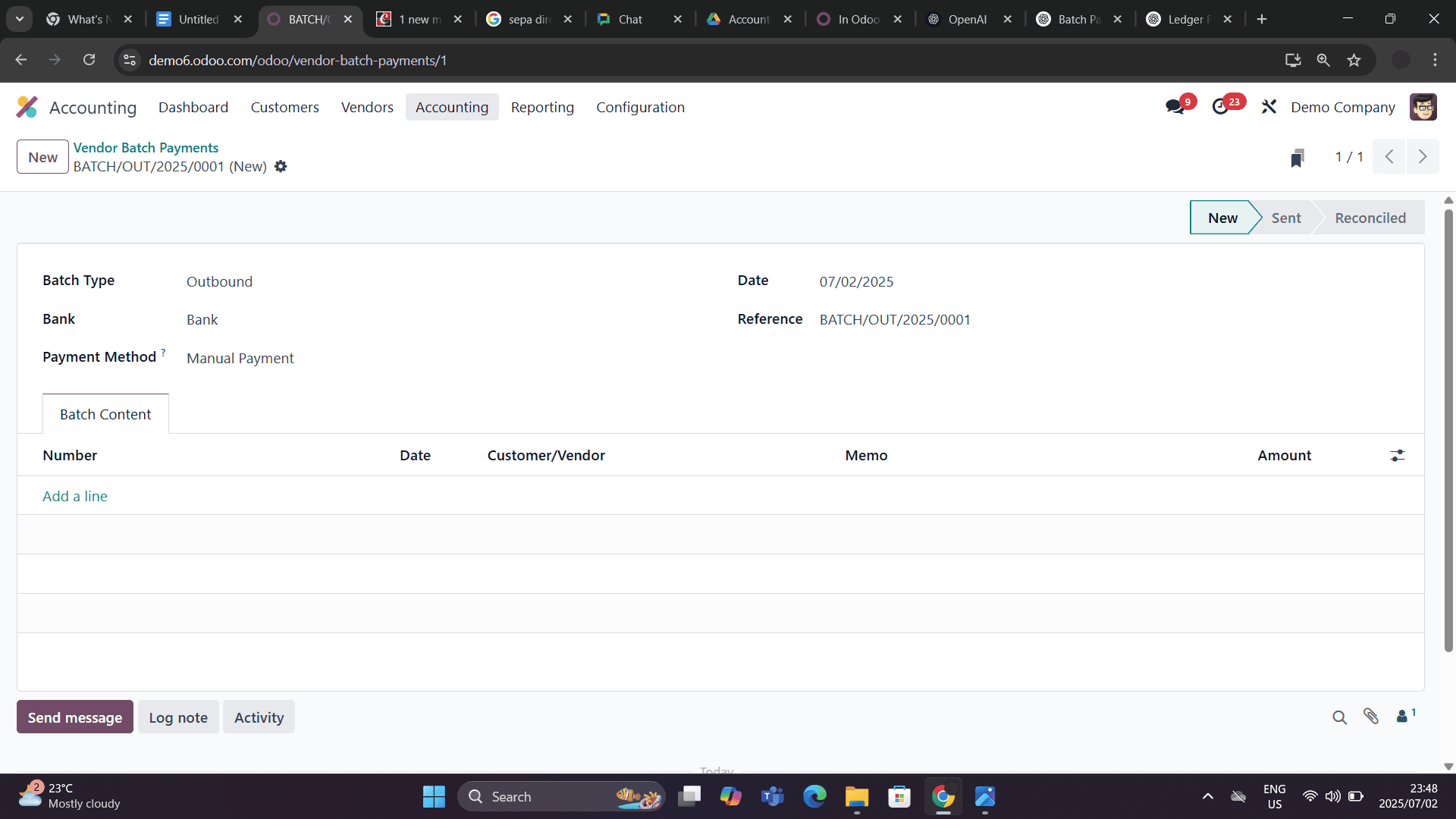

In Odoo 18, click the "New" button at the top of the Batch Payments page to generate a new batch of payments. This opens a form where you can enter all the necessary details to configure the batch.

In order to identify the batch, you must enter crucial information here, including the Batch Type, Bank, Payment Method, Date, and Reference. To add individual payments to the batch, click the "Add a line" button under the Batch Content tab.

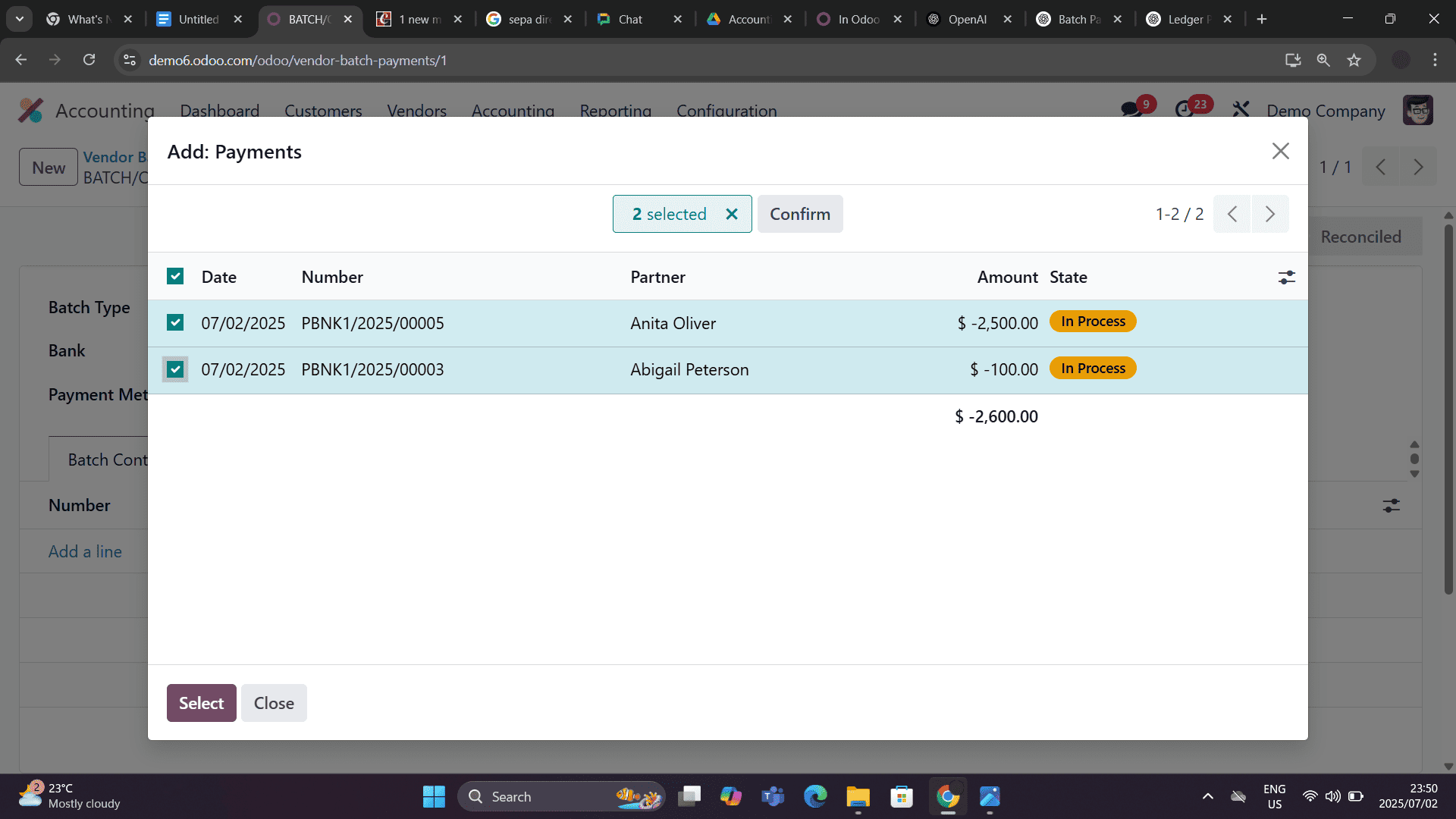

A pop-up window will appear where you can select the relevant Payments. For each entry, you’ll see fields like Number, Date, Vendor, and Amount. Simply select the appropriate payments to include them in the batch, and Odoo will handle the rest, keeping everything organized and ready for validation.

SEPA Credit Transfer

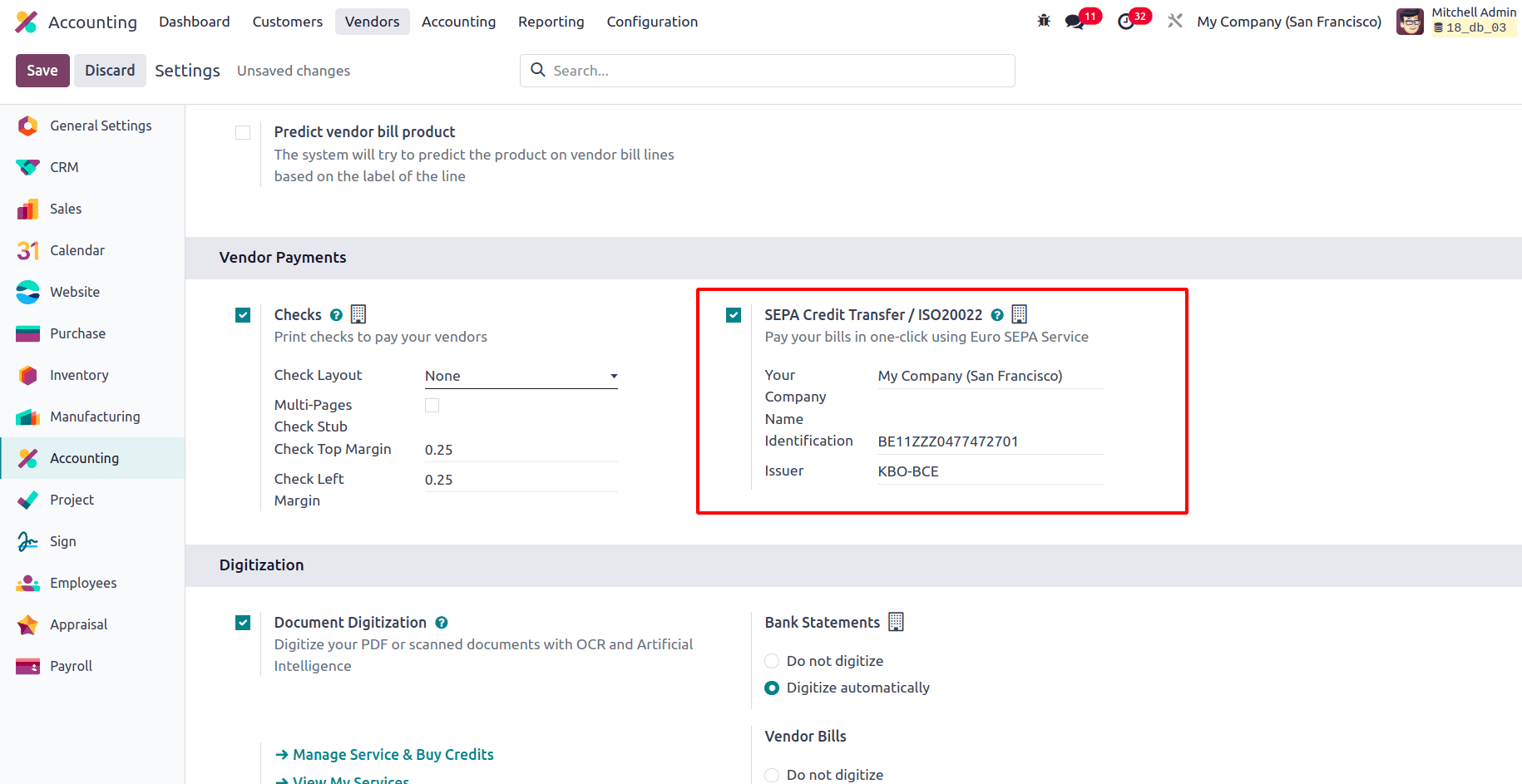

In Odoo 18, the SEPA Credit Transfer feature streamlines the management of cross-border euro payments within the Eurozone. This tool allows businesses to create standardized XML files that banks use to process euro-denominated transfers across SEPA member countries. Odoo helps cut down on manual labour, minimises the possibility of mistakes, and guarantees adherence to European payment laws by automating this procedure. It’s a reliable and efficient way for companies to handle supplier payments and other transfers within the SEPA network.

In the Accounting settings, ensure that the SEPA Credit Transfer feature is enabled. Additionally, verify that the company information, such as the company name, identification number, and issuer, is accurately configured.

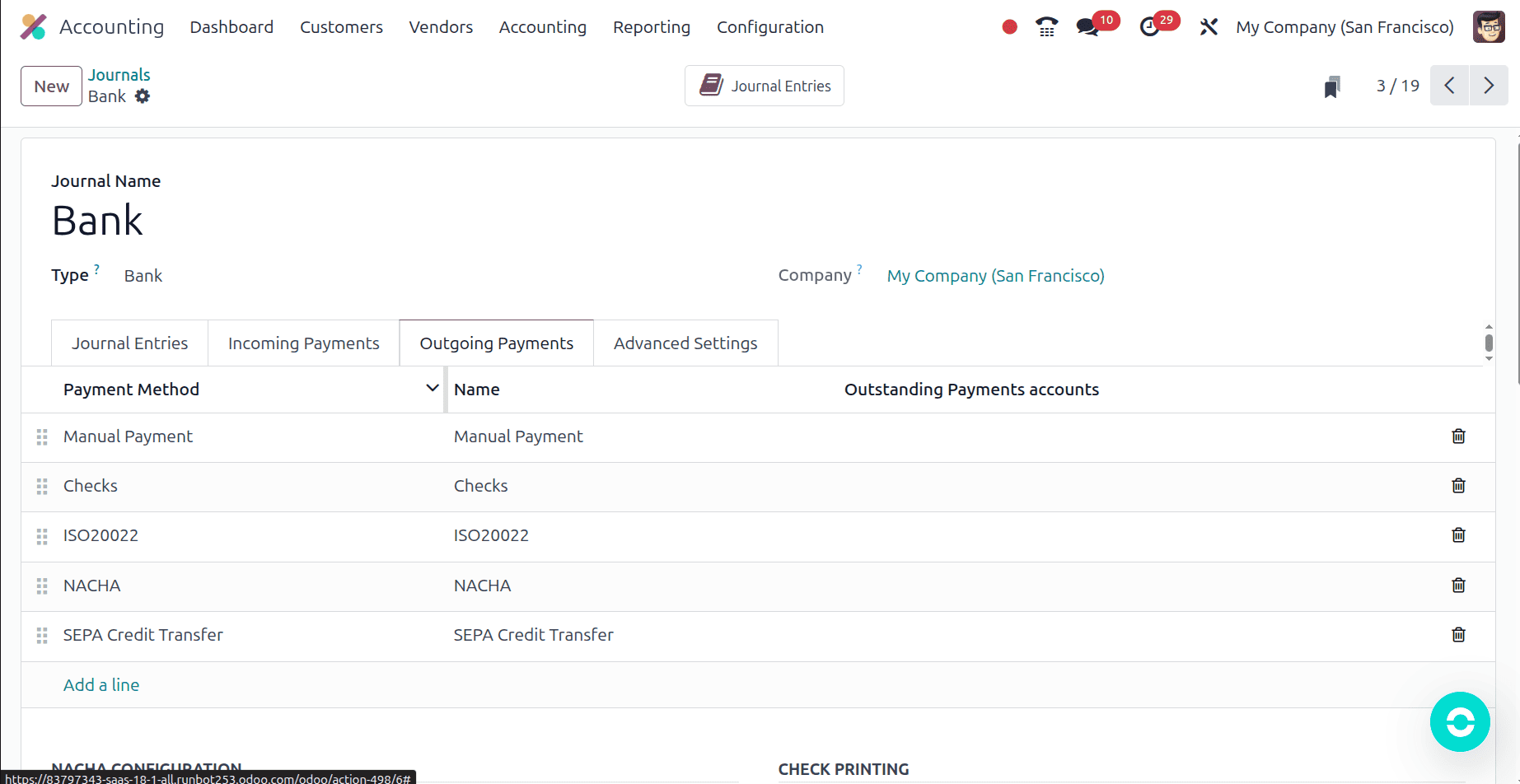

Make sure that "SEPA Credit Transfer" is chosen as the outgoing payment method in the Bank Journal setup. Additionally, to facilitate SEPA-compliant transactions, confirm that the associated bank account has a valid IBAN number.

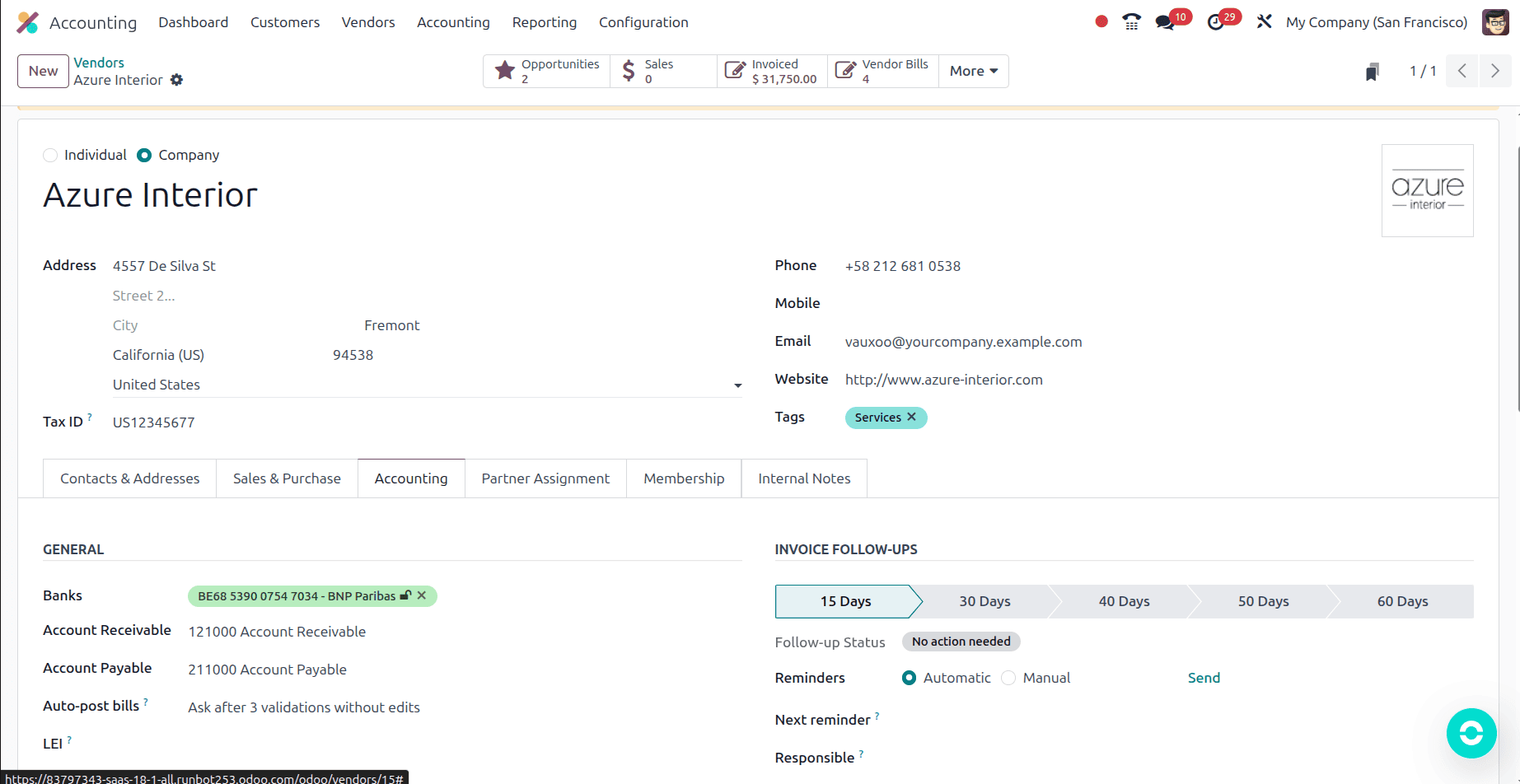

Make sure the vendor has a working bank account and that the "Send Money" option is turned on in the vendor configuration. Processing SEPA Credit Transfers to the vendor's account requires this.

Once a vendor bill has been created, record the payment. Make sure that SEPA Credit Transfer is chosen as the payment method and that EUR is selected as the currency when creating the payment. To create a payment file that complies with SEPA, these parameters must be met.

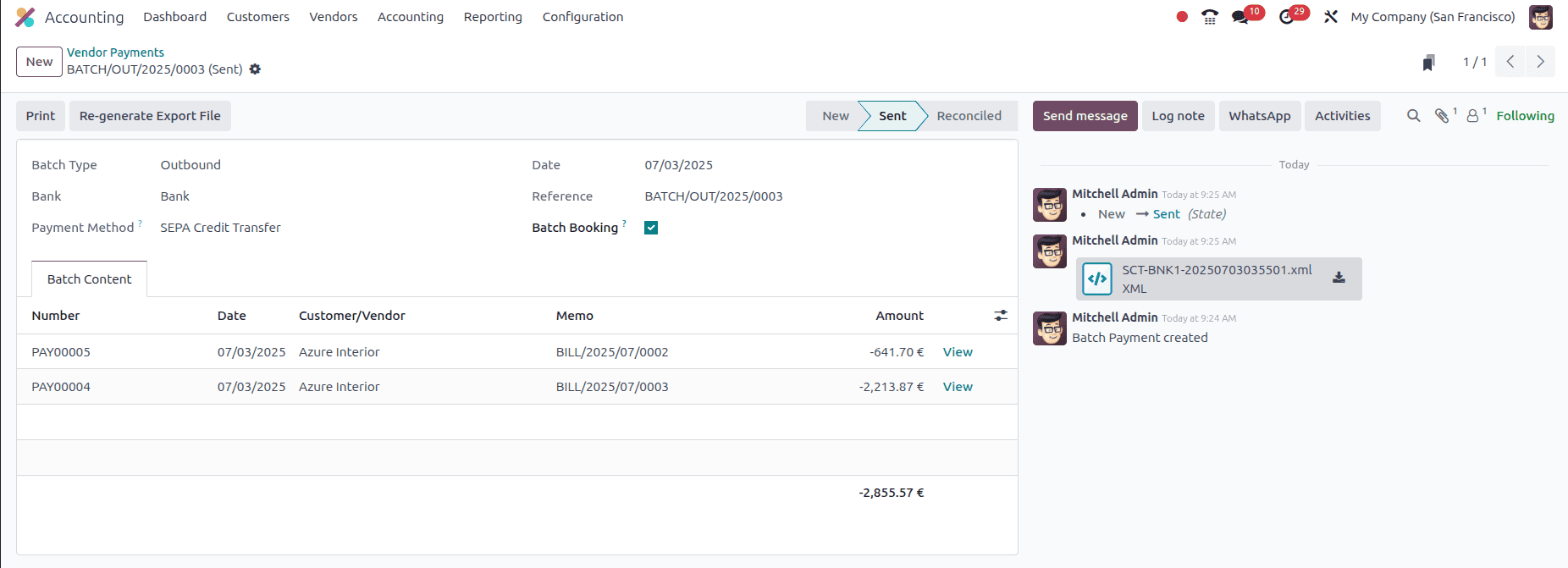

Even if there is just one payment, batching of payments is necessary when utilising SEPA Credit Transfer in Odoo. To create the SEPA-compliant XML file, this step is required. The XML file is automatically generated and available for download for submission to the bank's web portal after the batch payment has been verified. This file makes it possible for the bank to process the payment successfully. Furthermore, Odoo ensures correctness and flexibility in the payment process by offering the opportunity to regenerate the XML file if necessary.

To read more about How Vendor Check Payments Can Be Handled in Odoo 18 Accounting, refer to our blog How Vendor Check Payments Can Be Handled in Odoo 18 Accounting