Invoicing

The user-friendly application Odoo ERP includes a well efficient and reliable invoicing module that can be integrated with all other Odoo modules such as sales, purchase, inventory, and many more. Using this module we can instantly generate Odoo invoices and can send them through email with few steps.

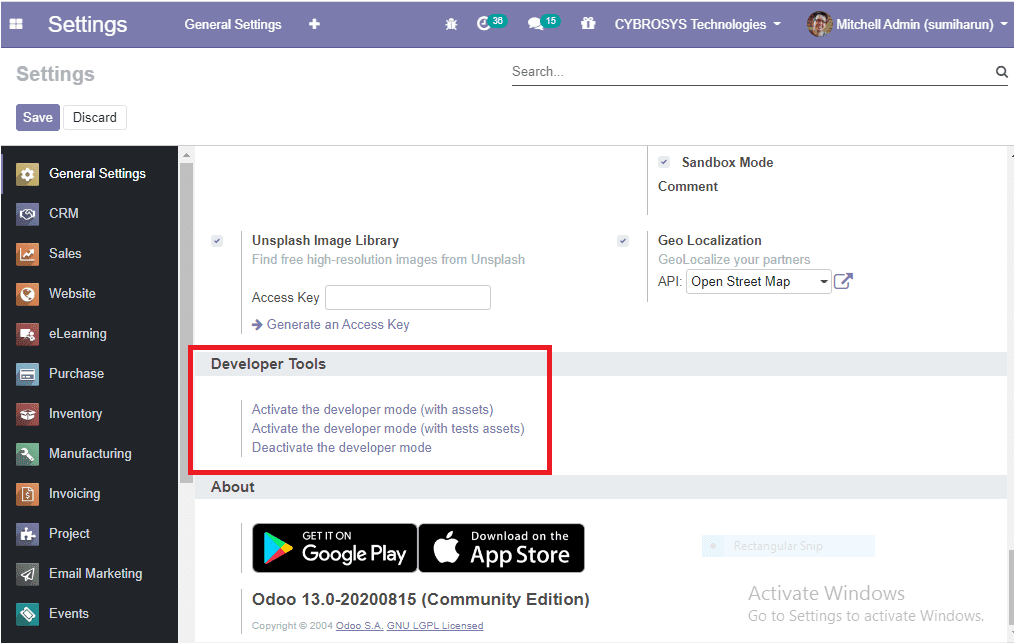

Before entering the invoicing module let me inform you that for getting the complete features in this module you want to activate the developer mode from the settings.

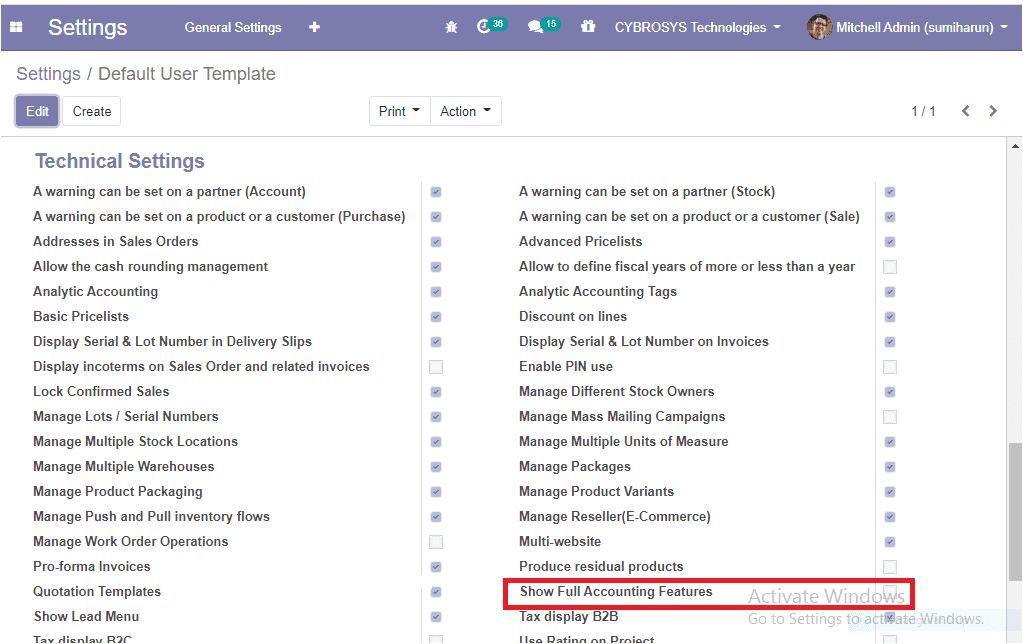

Now you can move on to the user’s menu available in settings and there you can see the option Show Full Accounting Features under the technical settings. Enable this option for getting all the accounting features to your invoicing module. The image of the window is depicted below.

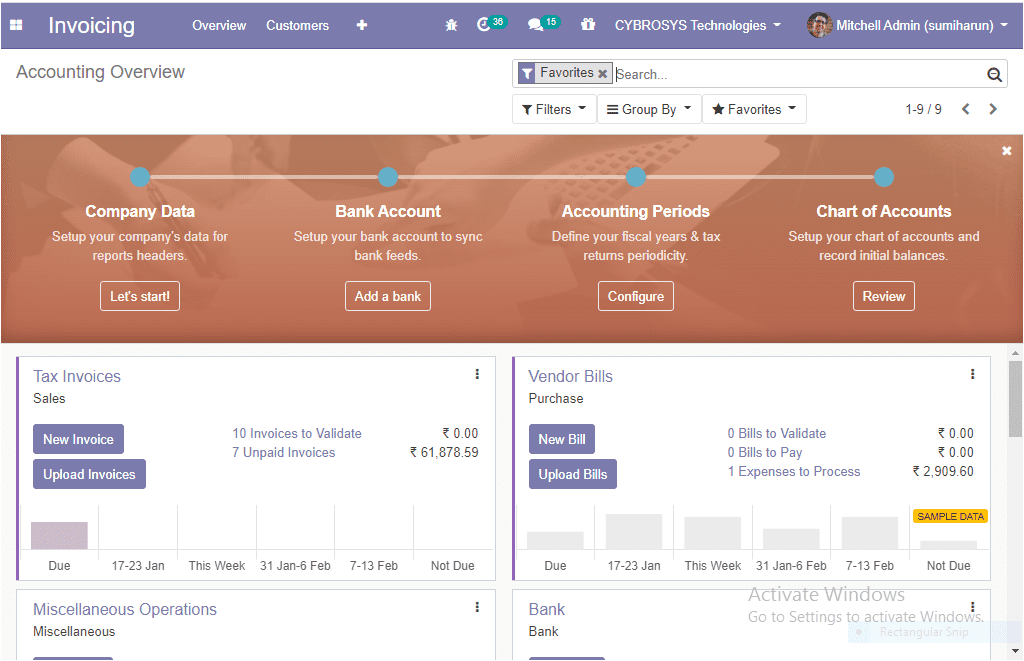

Accounting Dashboard

The invoicing module of the Odoo community edition provides you with a structured and user-friendly accounting dashboard that will help you to manage all the accounting aspects of your company. You can conduct operations such as tax invoices, vendor bills, cash, export invoices, retail invoices, point of sale, expenses, miscellaneous operations, and bank reconciliations from the accounting dashboard itself. You can access the accounting dashboard directly by entering the invoicing module. The image of the accounting dashboard is depicted below.

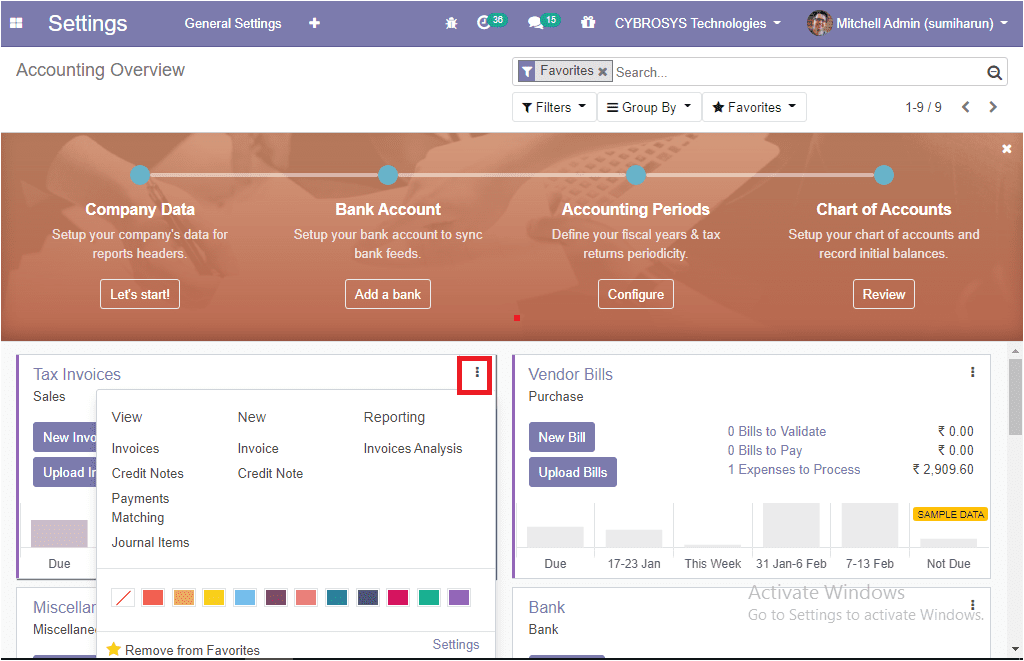

Here in this dashboard window, you can view the above-mentioned operations and you can select the menu icon available in each tab described in the platform.

You can see the options for creating and uploading new invoices, bills, miscellaneous entries, bank account configuring options, etc in the respective tabs. If you are clicking on the three dots available at the upper right corner of each tab you will be depicted with a new drop-down menu along with the options view, new, and reporting. Under the view tab, there are options to navigate invoices, credit notes, payment matching, and journal items menu. You can create new invoices and credit notes by selecting the respective menu available under the new tab. Additionally, under the reporting section, you can view each report analysis.

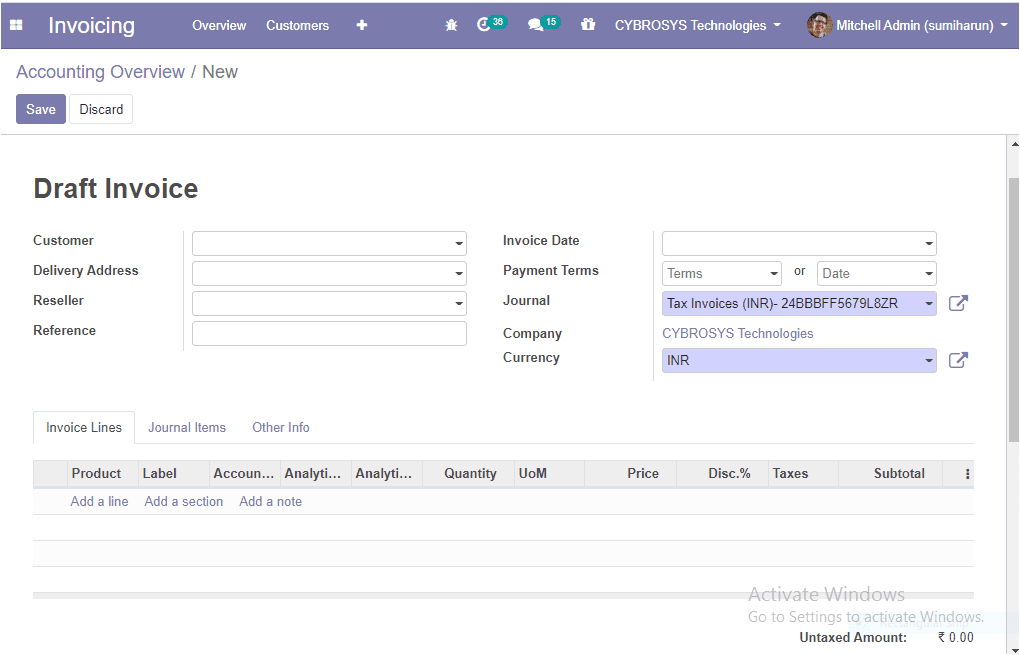

For creating new invoices you can select the create option and you will be depicted with a new window where you can provide customer details, delivery address, reseller, can allocate invoice/bill date, payment terms, journal entries, company details. You can also add the product details by selecting the add a line option available under the invoice lines menu. It is also possible to add a section and a note under the invoice lines.

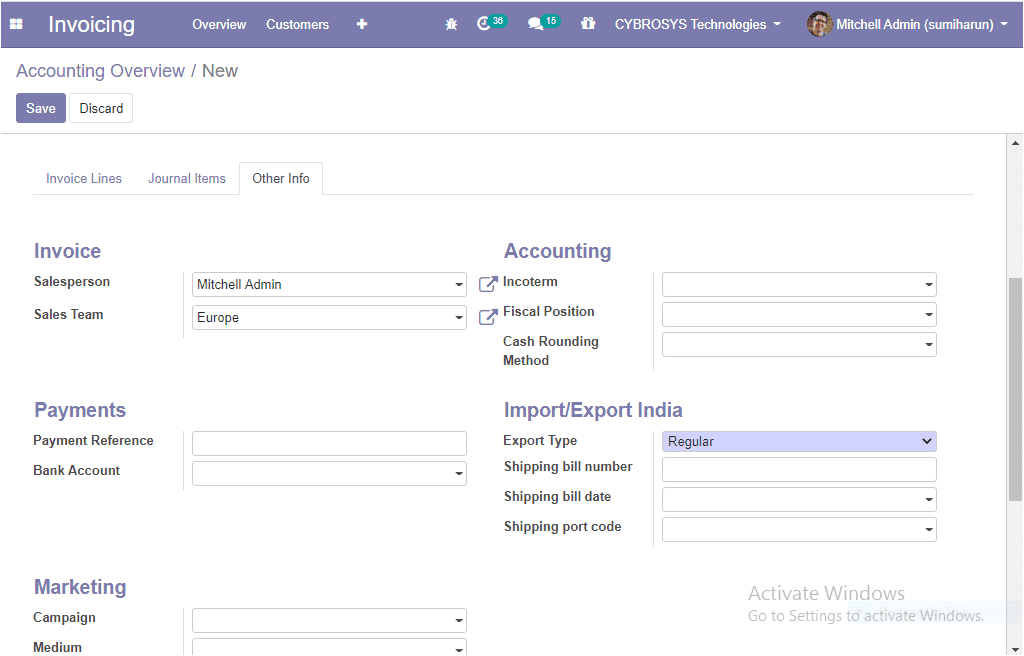

Under the other info tab, you can provide the details such as a salesperson, sales team, accounting details, payment details, marketing details, import or export details.

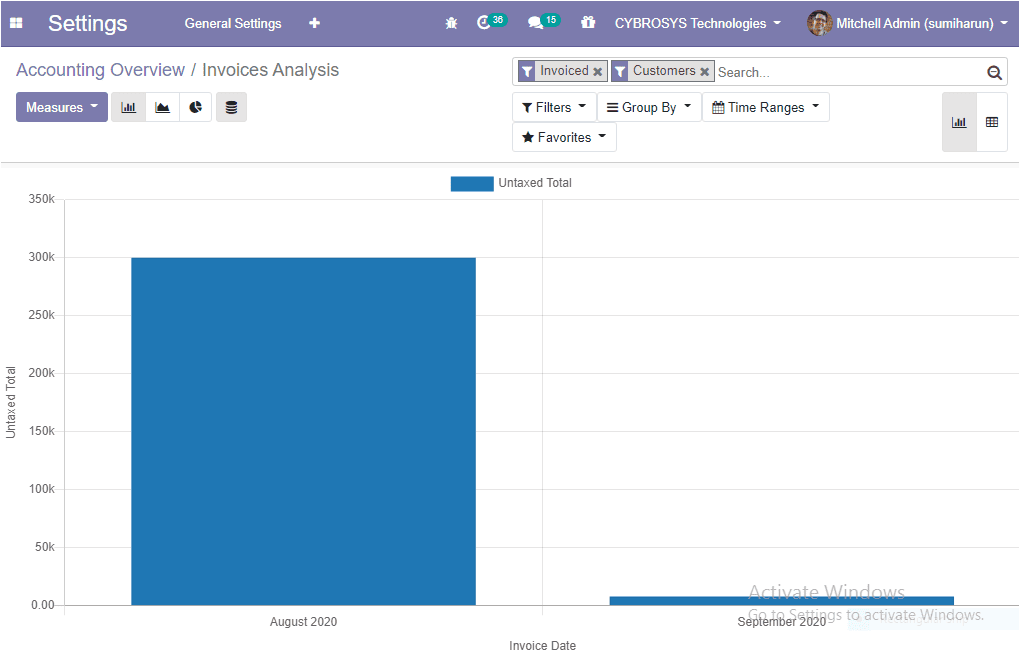

The data can be filtered and grouped by for sorting out required data using the default or customizable options available in the platform.

So far we were discussing the accounting dashboard in the platform and now let us discuss the various configurations that are available.