Configurations

There are various default configuration options and menus available in the accounting

module which will help the users with the financial aspects of the company for the

users.

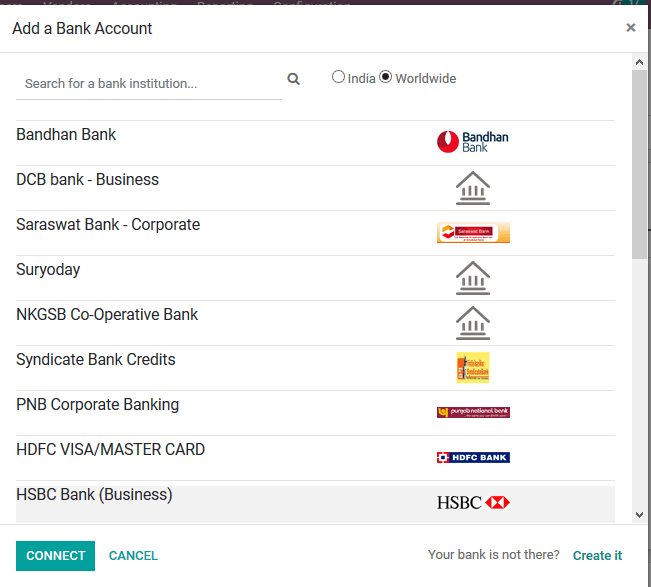

Bank accounts

The user can add a bank account by selecting the add a bank account option that

can be accessed from the configuration tab of the module.

Here the user can choose from the bank accounts available and connect with it, if

not the user can select the create option available

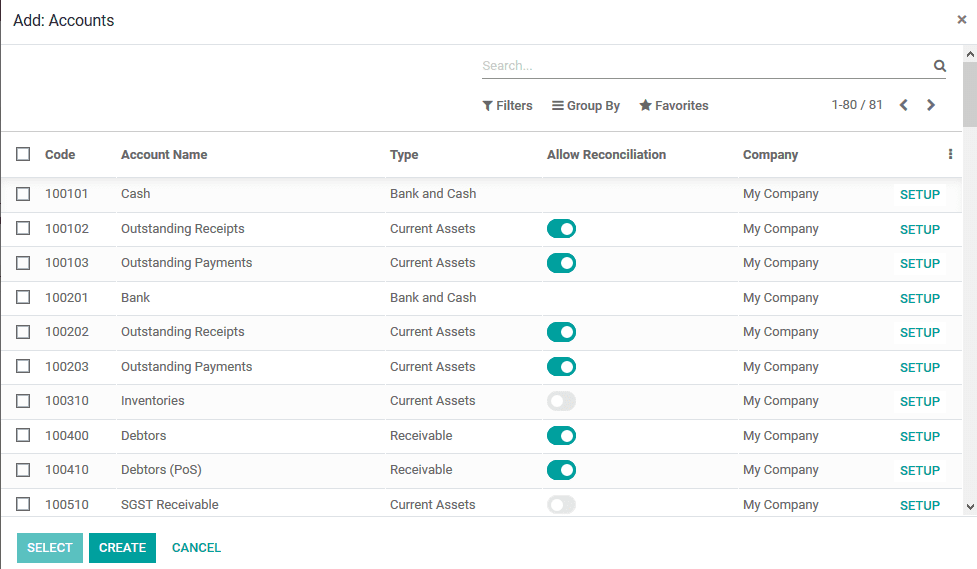

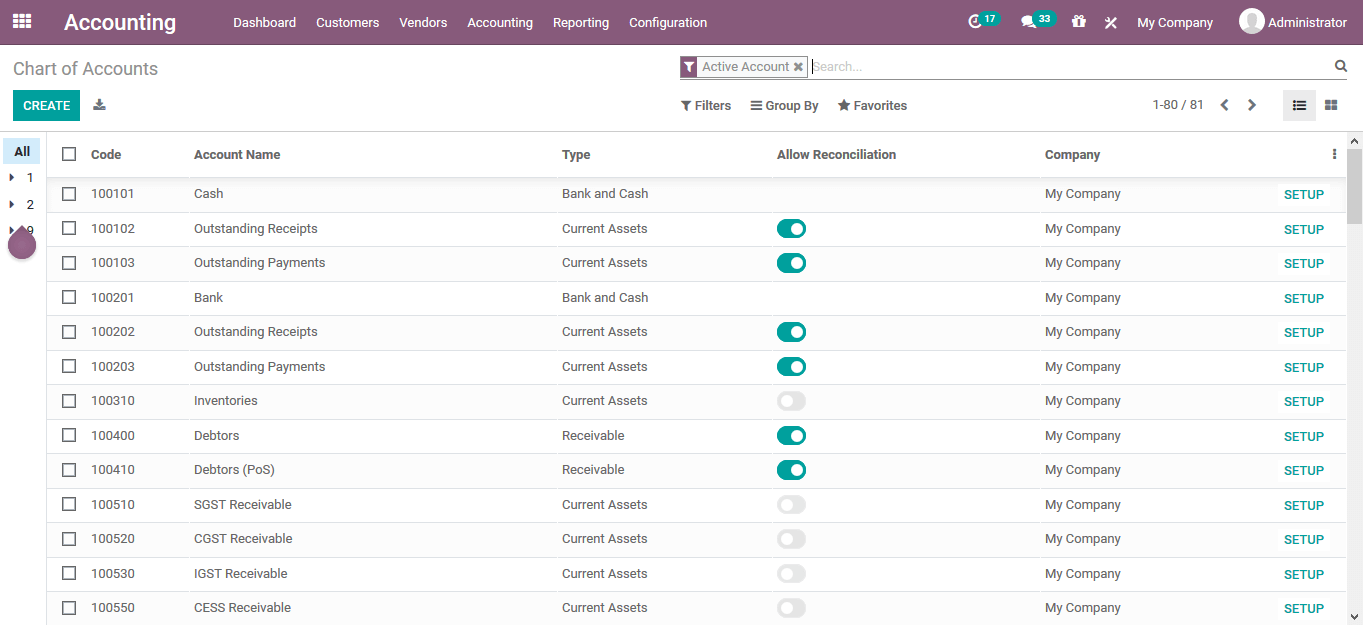

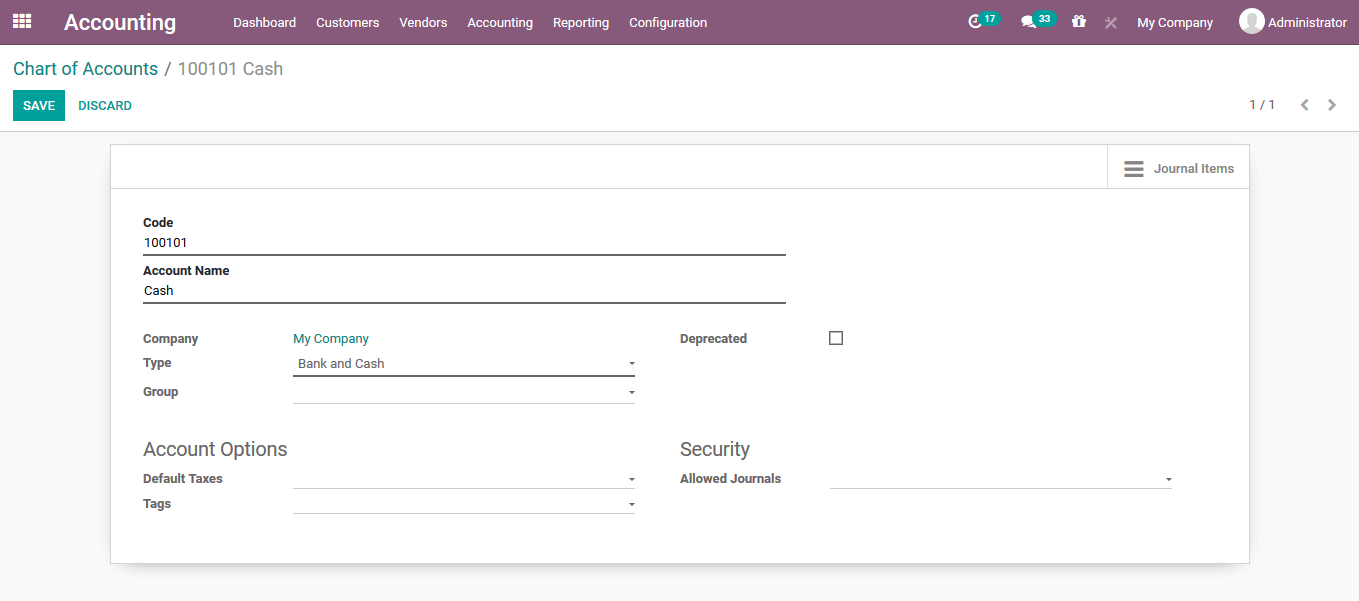

Chart of accounts

The carts are accounts information which are described to be used in the various

business operations of the company. The chart of accounts operation will help the

user with the description of the various financial operations conducted in the company

based on the ledgers defined. These charts of accounts can be viewed from the menu

accessible from the configuration tab. All the charts of accounts described in the

platform can be viewed from the menu and the user can select to add the new ones

using the create option available.

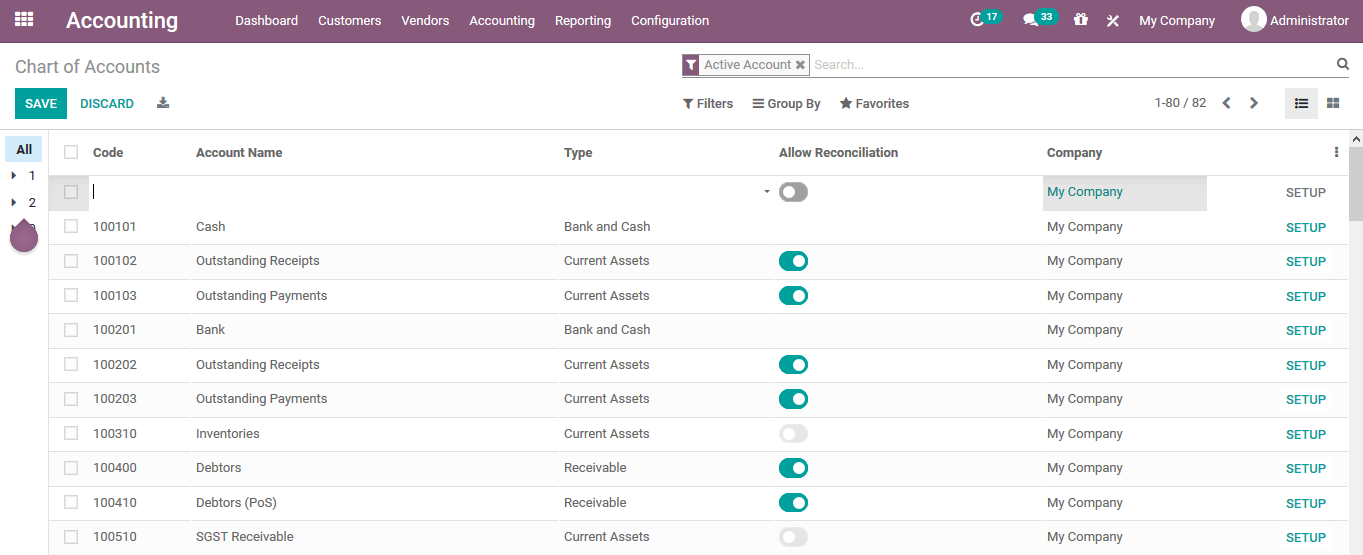

On selecting to create a new chart of account the user can define it in the menu

itself providing the code, account name, type, enable or disable reconciliation,

and allocate a company of operation.

Under the setup window available under each of the chart of accounts the users will

be provided with the various operations to describe the accounting aspects of the

respective chart of account.

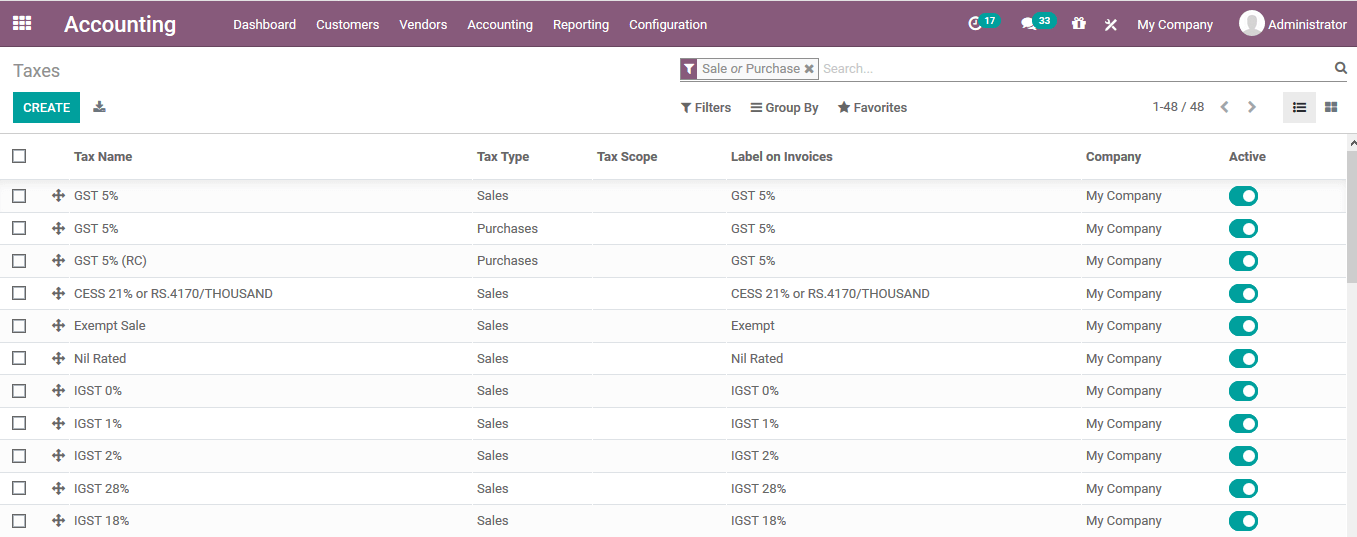

Taxes

The taxes of the company operations are an aspect which is unavoidable as it would

allow the companies to stick to the authoritarian rules imposed by the governments

of the operational regions. The Odoo platform allows the users to create and configure

various taxes for the company operations under the taxes menu accessed from the

configuration tab of the module.

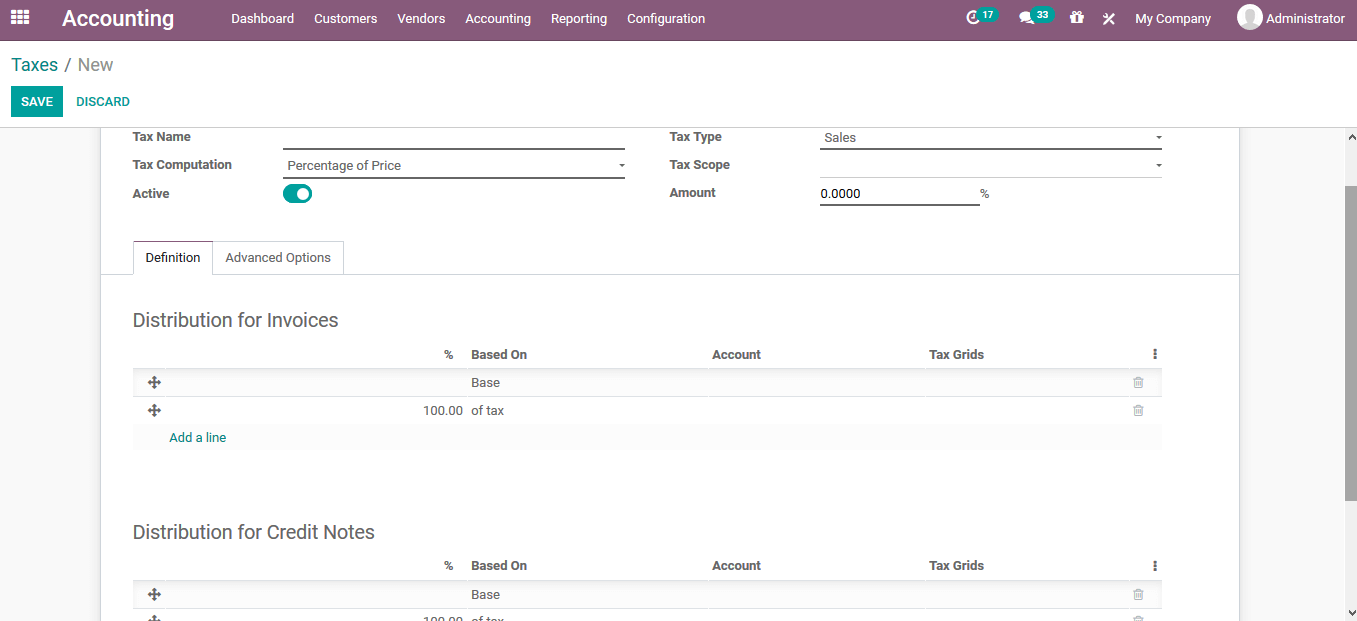

The user can create a new tax using the creation window available. In the creation

window the user can provide the tax name, tax computation, tax type, tax scope and

amount. The user can activate the tax to operate by enabling the activate option.

The taxing rule for the distribution of invoices and credit notes can be configured

under the definitions tab.

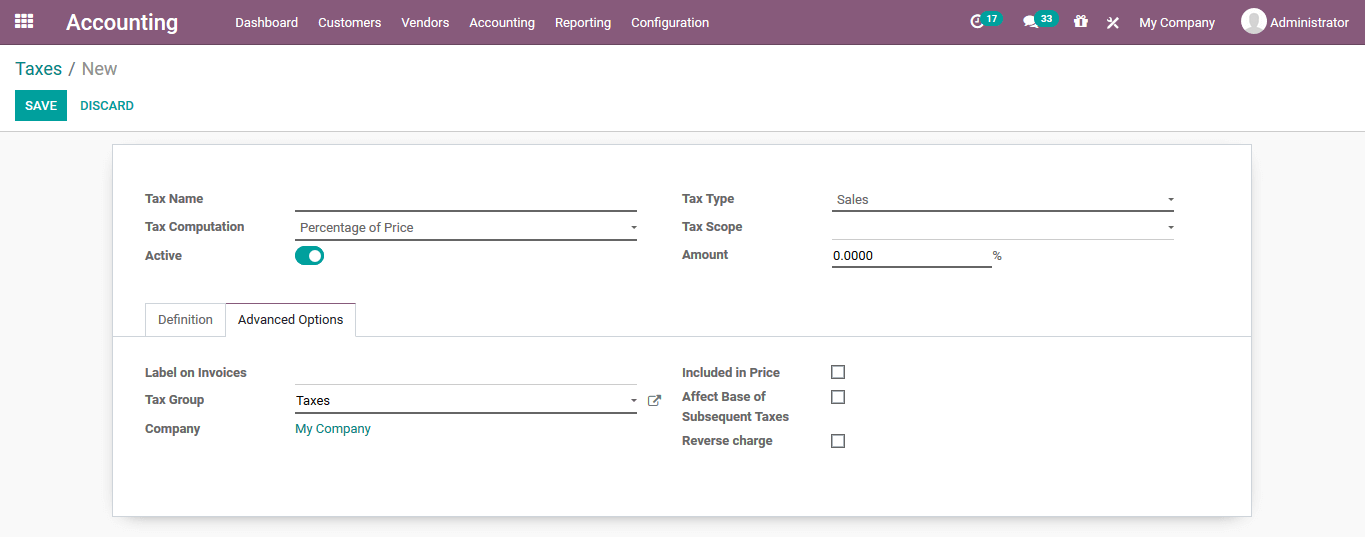

Under the advanced options menu, the user can assign the label on invoices, tax

group, and company to which the tax is allocated. The options such as including

the taxes in the price, affect the base of subsequent taxes and the reverse charges

can be enabled or disabled.

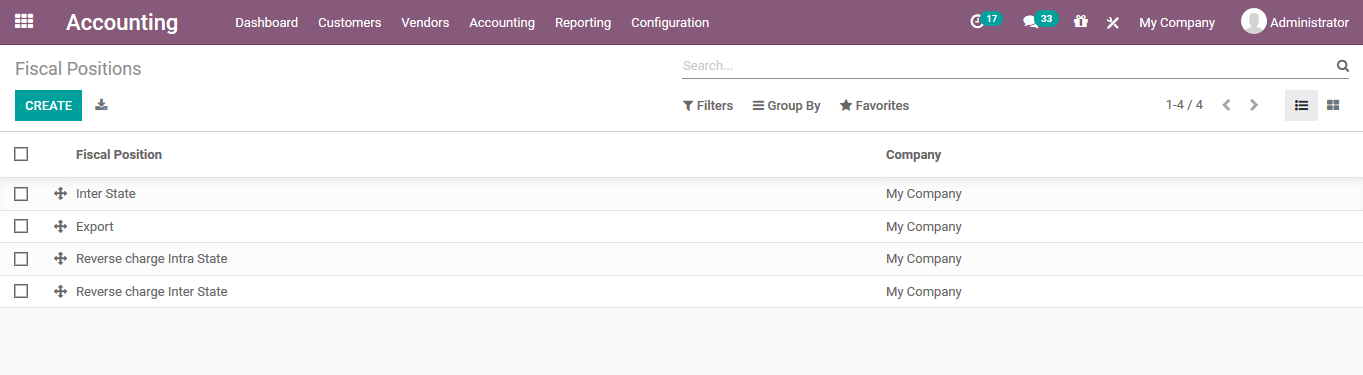

Fiscal positions

The fiscal position of the accounting operations will help the users operating with

multiple currency and company operations. The fiscal position will help the users

to configure the taxes and accounts specific to the country or region of operations.

The fiscal positions of the platform are defined under the fiscal position menu

accessible from the configuration tab. In the menu the user will be depicted with

all the fiscal positions defined and the user can edit the details by selecting

the respective one and the user can also create a new one using the creation window

available.

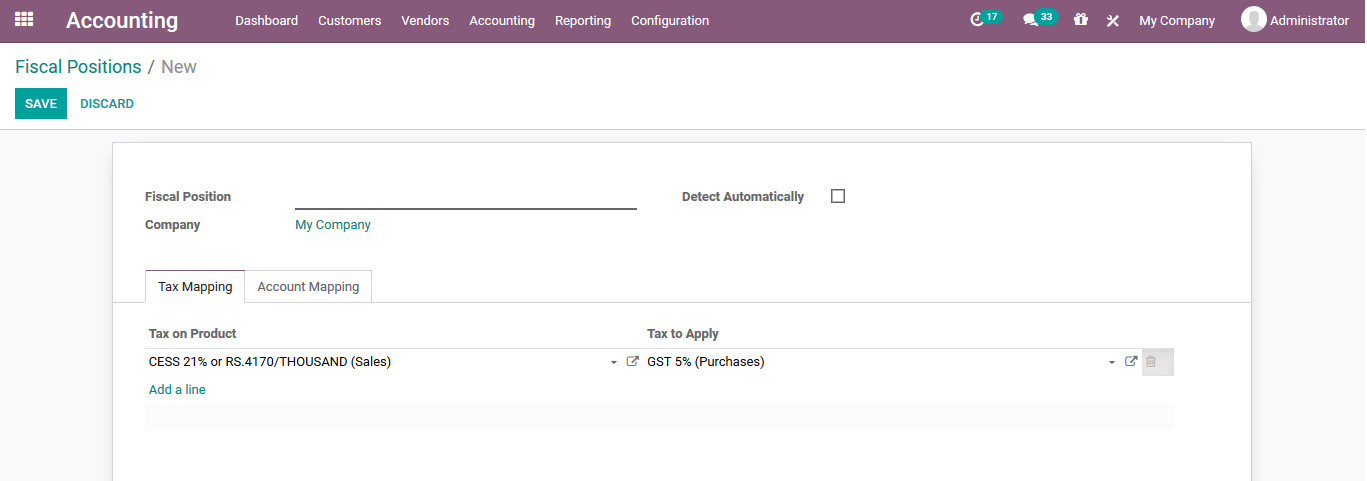

In the fiscal position creation window the user can provide a name for the fiscal

positions. Under the tax mapping the user can allocate a mapping by selecting the

add a line option available. Provide a tax on product and a tax to apply for the

fiscal position. Additionally, the account mapping can also be provided under the

respective menu.

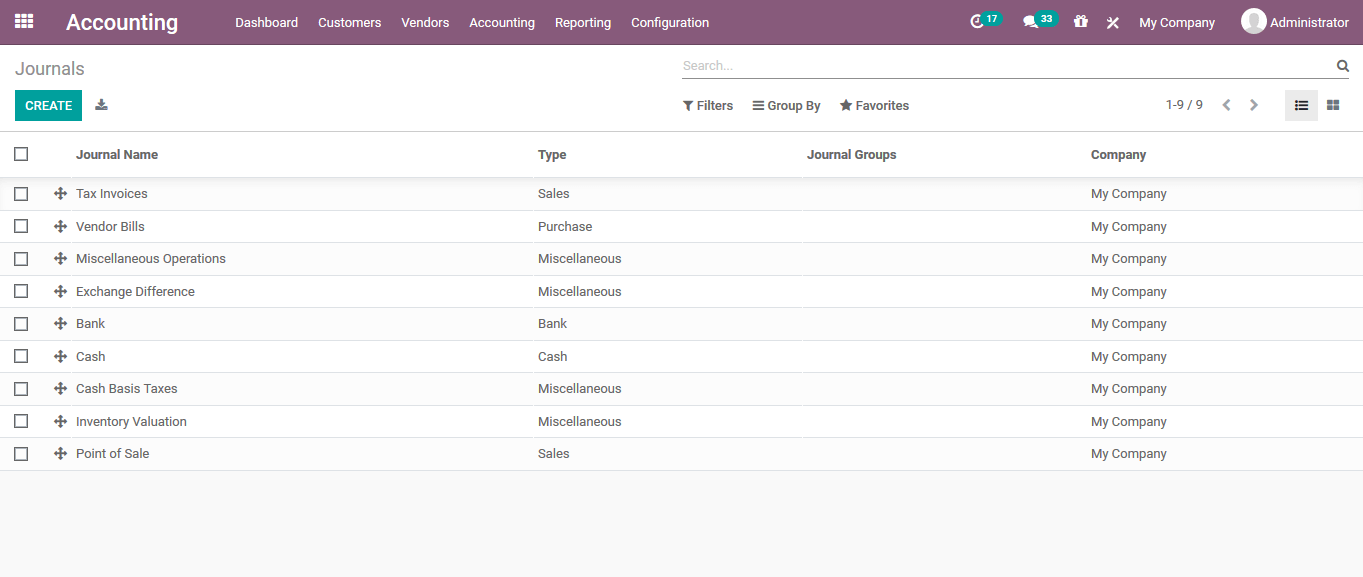

Journals

The book keeping is an important aspect while dealing with the accounting operations

of the company. The journals are an efficient data recording aspect of the accounting

operations with respect to the transactions conducted. The journals menu can be

accessed from the configuration tab of the accounting module. Under the journals

menu all the journals described in the platform are listed out and the user can

create new ones.

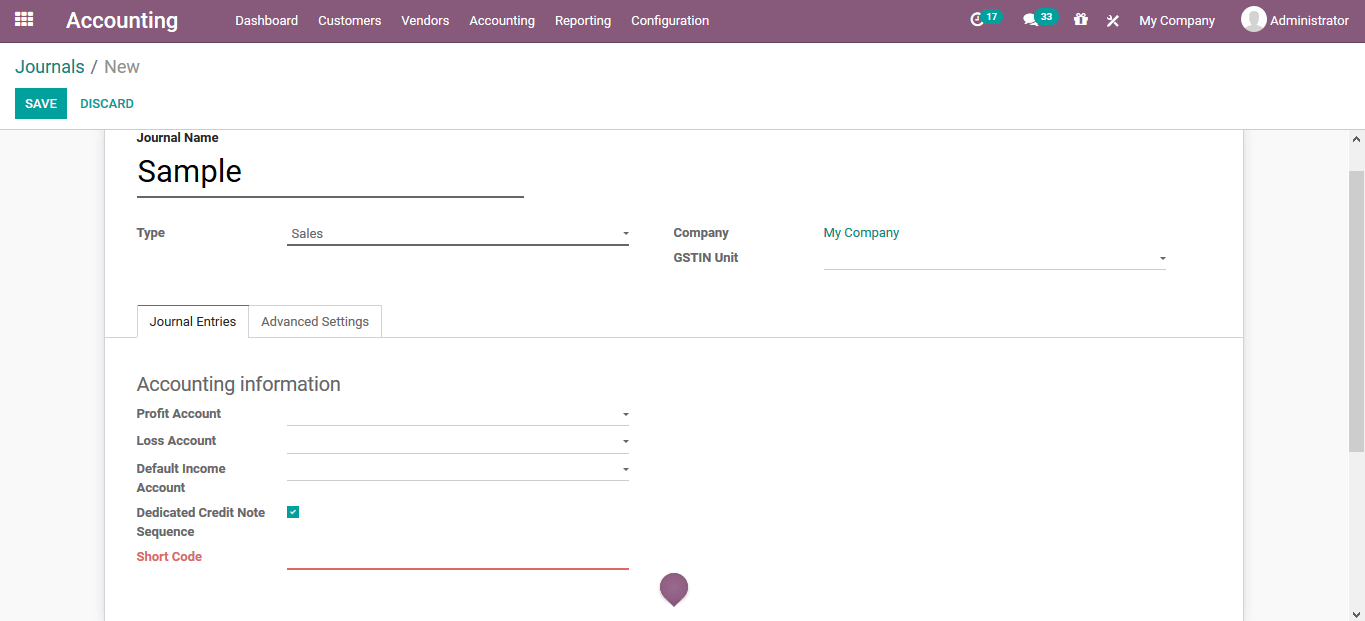

In the journal creation window the user can provide a journal name, allocate type

and the taxing information. Under the journal entries the various accounting information

of the journal can be defined such as profit account, loss account, default income

account, dedicated credit note sequence can be enabled or disabled and the short

code for the journal can be assigned.

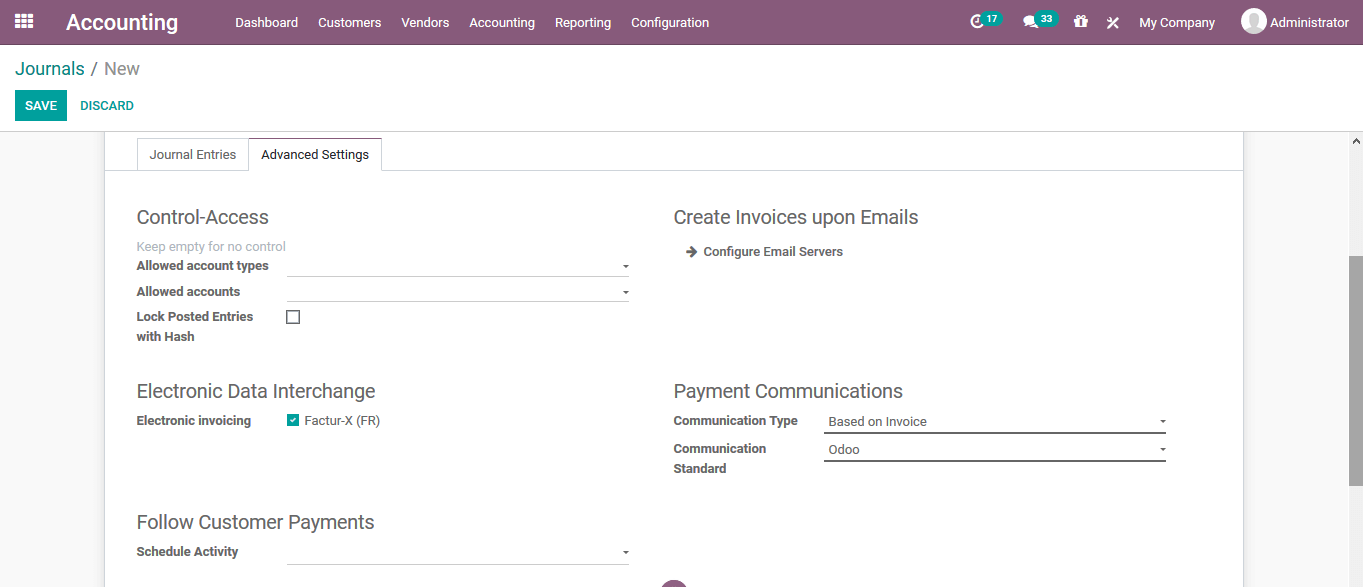

Under the advanced settings the control access information such as allowed account

types, allowed accounts and icon posted entries can be enabled. There are also various

options for electronic data interchange and follow customer payments can be configured.

Additionally the payment communications for the communications type and the communications

standard can be configured.

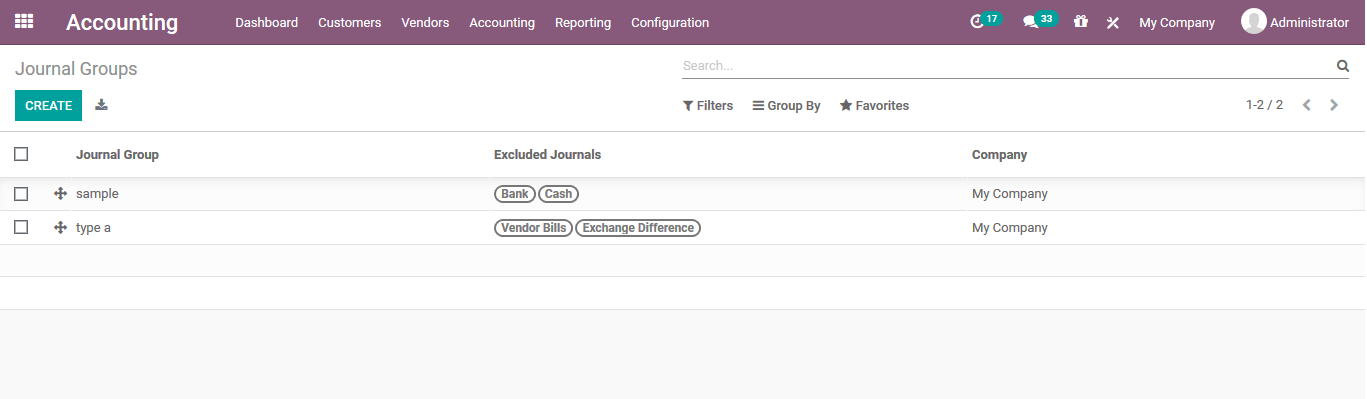

Journal types

The journal entries of the platform should be configured for the operation under

the journal types defined. The journal types for the platform can be defined under

the journal types menu accessible from the configuration tab. Under the journal

types the user can view all the enlisted ones and can create new one using the create

option.

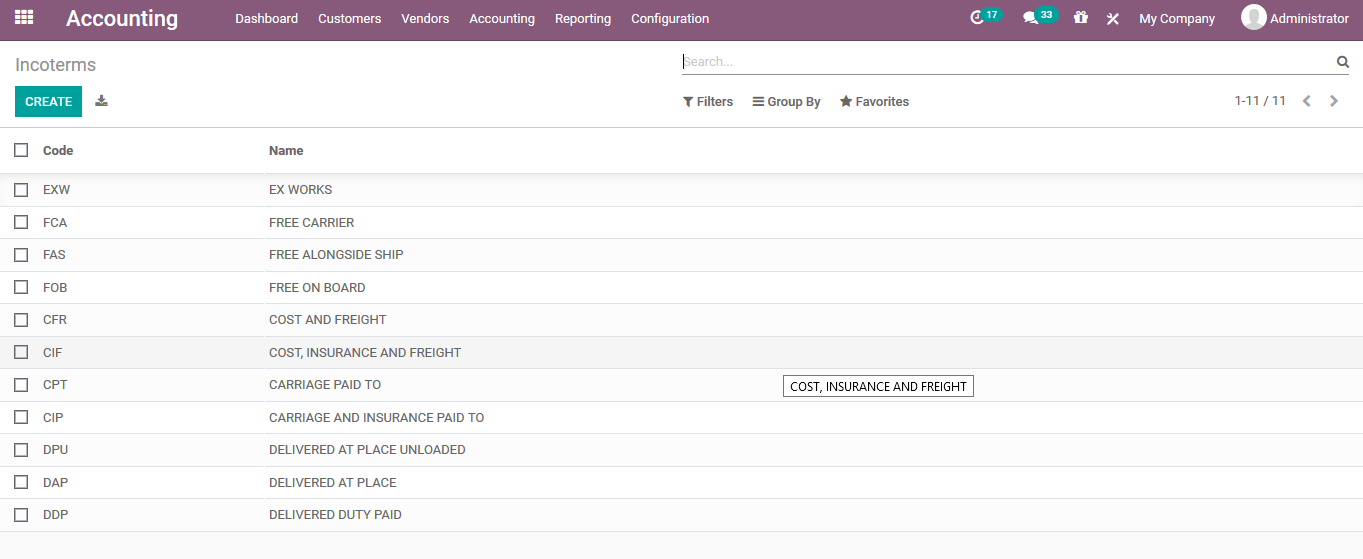

Intercoms

The Intercoms is the abbreviation for the international commercial terms. There

are fifteen terms of business terminologies accepted between the seller and the

purchaser. Intercoms are trade terms described by the International Chamber of Commerce(ICC)

which are globally accepted in the international and domestic business operations.

The intercoms menu can be accessed from the configuration tab of the module and

the user can view all the intercoms described in the platform which are enlisted.

The user can create a new one using the create option available.

On selecting to create a new one the user can do it in the same menu itself. The

created intercoms should be acceptable for all the businesses operations of the

company.

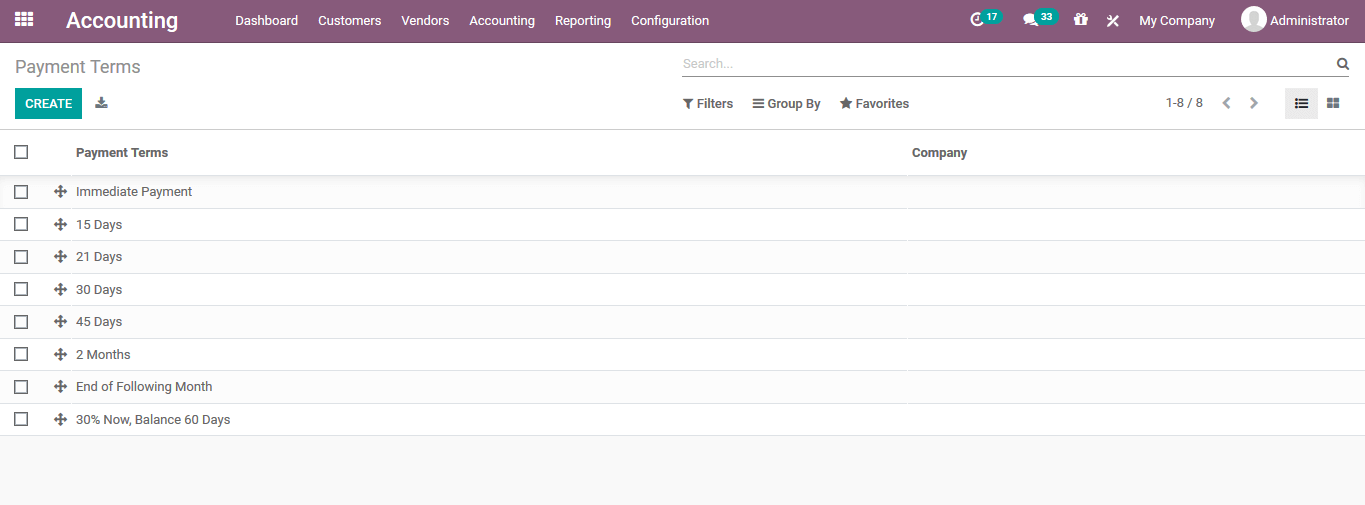

Payment terms

The payment terms are the ways in which the customers and the company are supposed

to make the payments of the products and services. The Odoo platform allows the

user to describe the various payment terminologies of the company operations. The

payment terms can be described in the payment term menu accessible form the configuration

menu of the module.

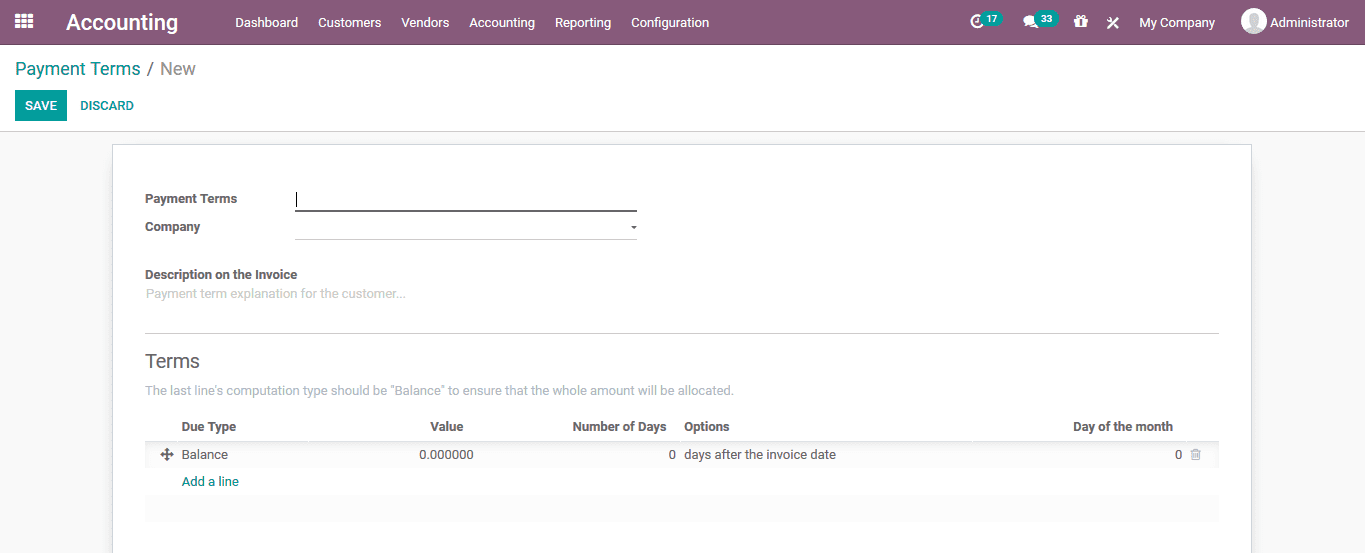

Under the payment terms creation window the user can provide a name for it, assign

the company where this payment terminology should be used and describe details that

should be mentioned on the invoice can be provided. Under the terms menu the user

can define the terminologies of the respective payment terms operation.

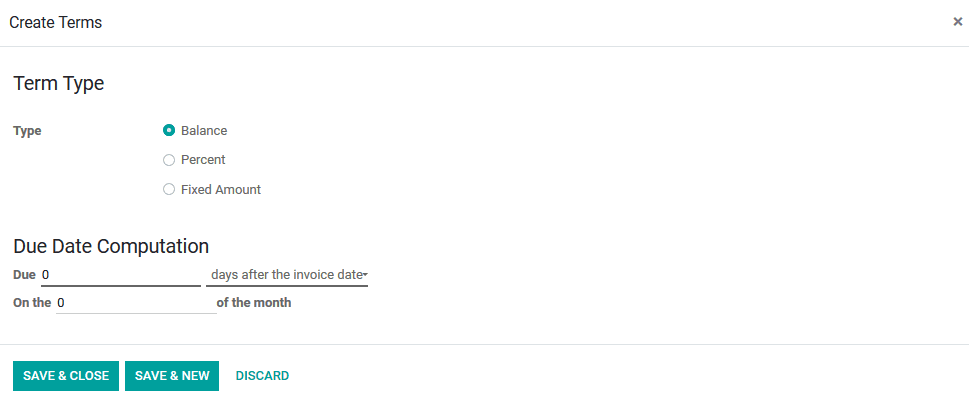

If the user wants to add payment terms he/she can choose the add a line option available

and will be depicted with the following window as shown below. Here the terms type

can be mentioned and the due date of the operation can be described. The terms type

can be assigned as balanced, percentage or fixed amount. Additionally, the due date

computation can be made based on the days after the invoice date, last day of the

following month or the last day of the current month.

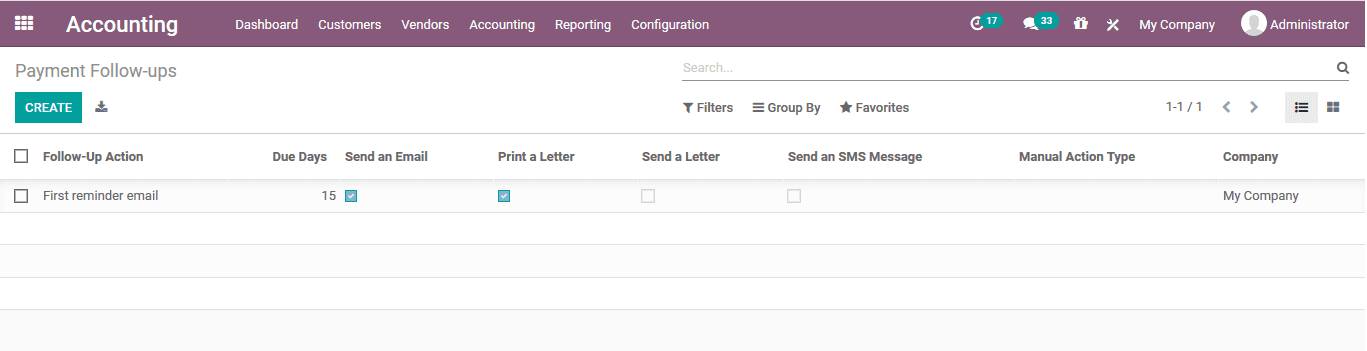

Payment follow ups

It's essential for any company operations when there is a due payment and the customer

has not yet been paid. The Odoo platform allows the users to create and configure

various follow up operations for the payments under the payment follow up menu accessible

from the configuration tab of the module. In the payment follow ups menu all the

follow up operations are defined and the user can create a new one using the create

window available.

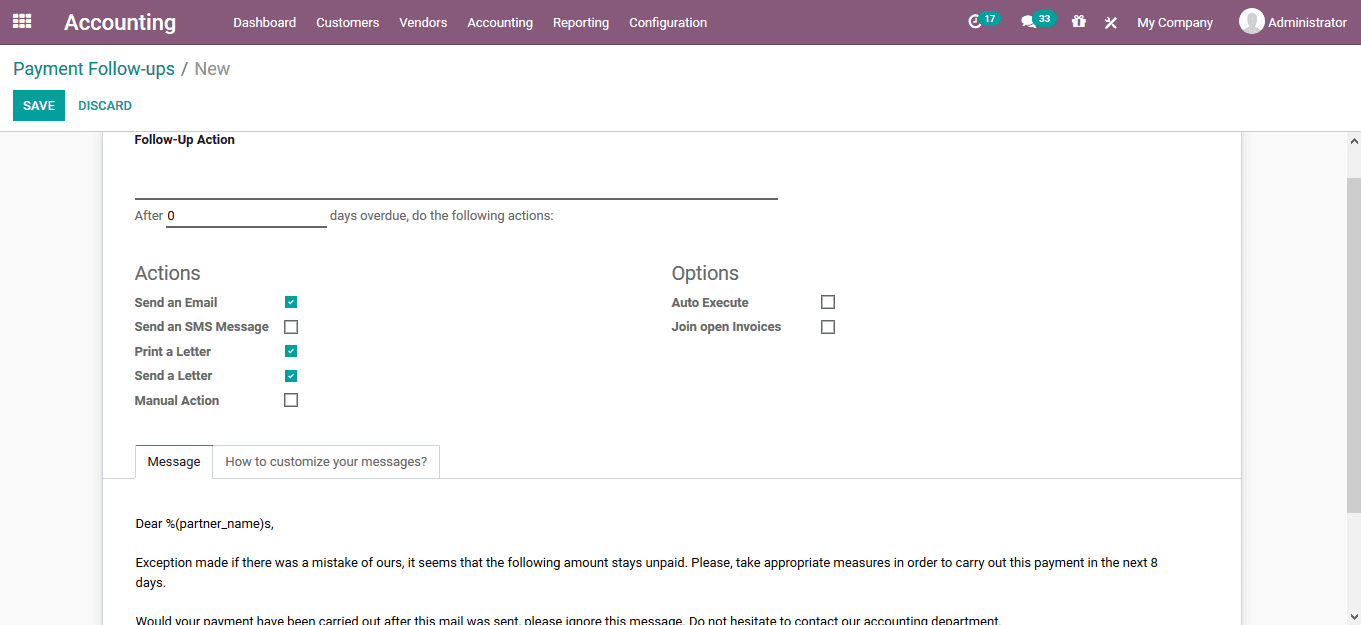

Under the follow up description menu the user can select the name for the follow

ups action and the due date of the action. The various actions of the follow up

provider can be configured. The follow ups actions such as emails, SMS, letter or

a manual action can be triggered by enabling it under the accounting tab. Under

the options tab the auto execute and the join open invoices can also be provided.

Under the message tab the user can customize it by editing the description and suiting

it as per the company demands.

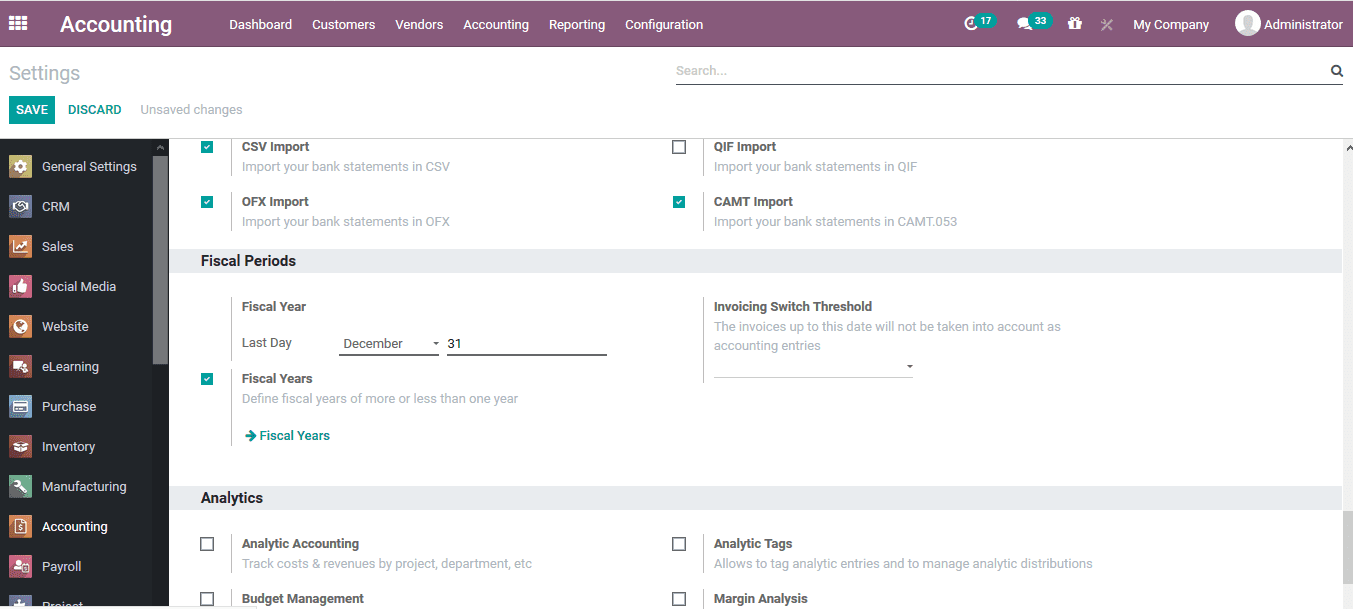

Fiscal year

The fiscal year is a distinctive operational period allocation of the company operations

which will allow the users with the book keeping aspects of the company along within

the budget summaries and the tax filings. The fiscal year is usually configured

with the financial year described by the governmental organizations as it will help

the users to describe and file the tax returns of the company.

The fiscal year option can be provided in the settings menu of the accounting module

accessible from the configuration tab. Under the fiscal periods menu the user can

enable the fiscal year option, describe the fiscal year and the invoice switching

threshold.

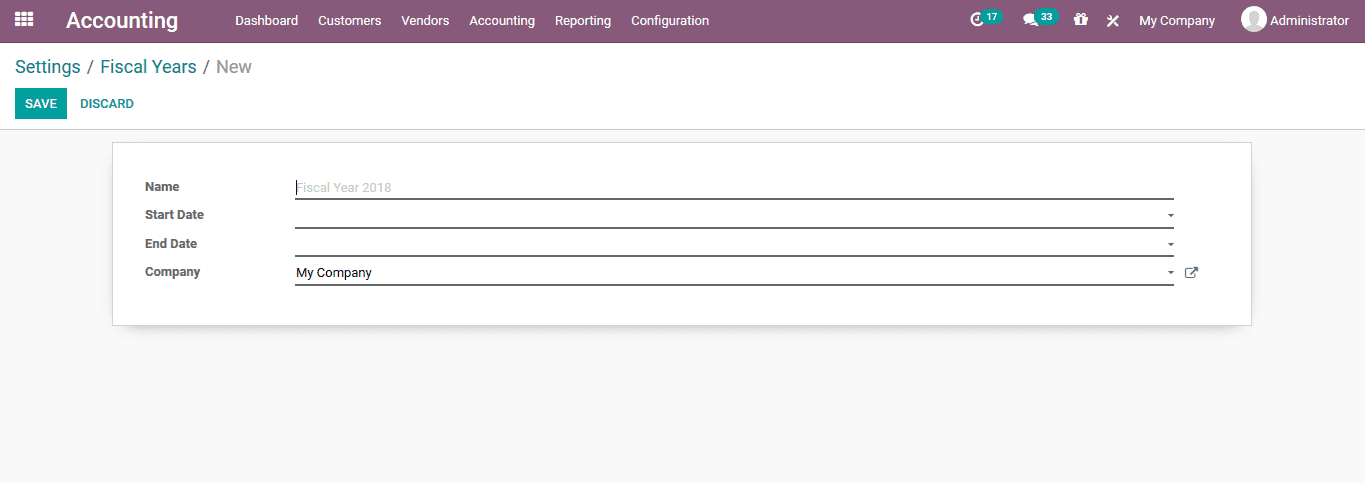

All the fiscal years can be viewed in the fiscal year menu accessible from the settings

menu itself under the fiscal periods menu. In the menu all the fiscal years are

defined and the user can create a new one using the create option available. In

the fiscal year creation window the user can assign a name, duration of operations

including the start date and the end date of the fiscal year and the company allocation

for the same.

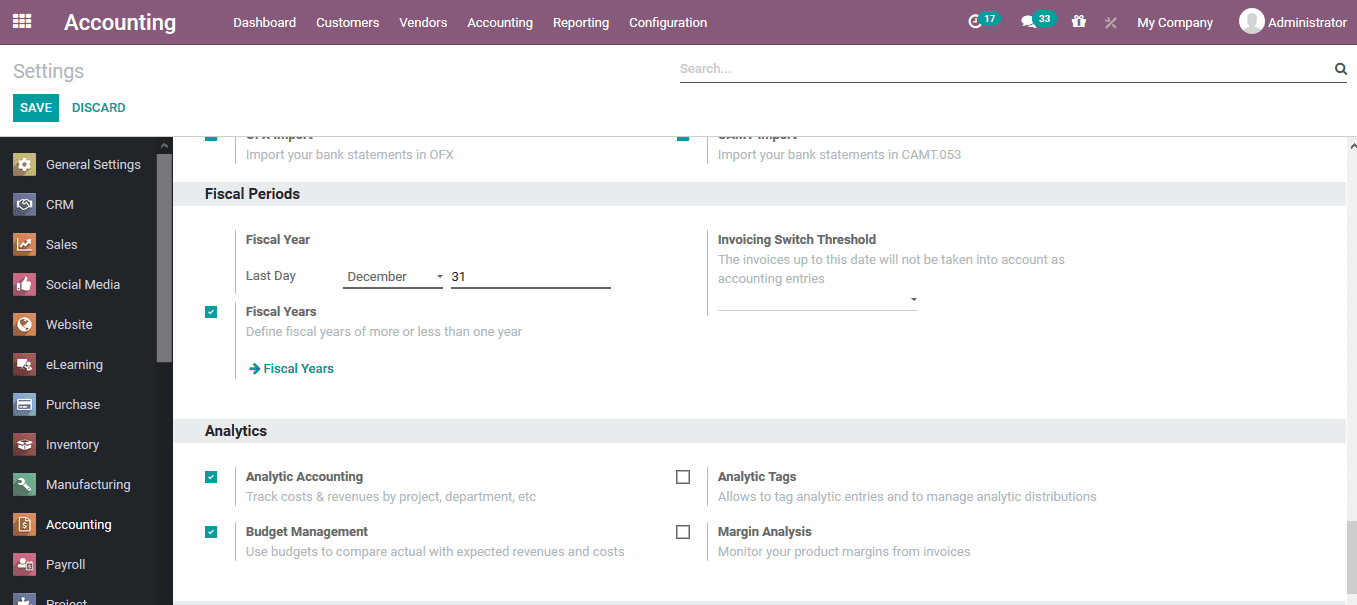

Budgetary positions

The budgetary positions allow the user to create spending plans for the specified

chart of accounts. This will help the users in the aspect of budget allocations

in the company. The budgetary positions can only be assigned if the budget management

option of the accounting module is enabled. Under the analytics menu of the settings

module the user should enable the budget management options and save it. Therefore,

under the configuration tab the user can view the new option budgetary position.

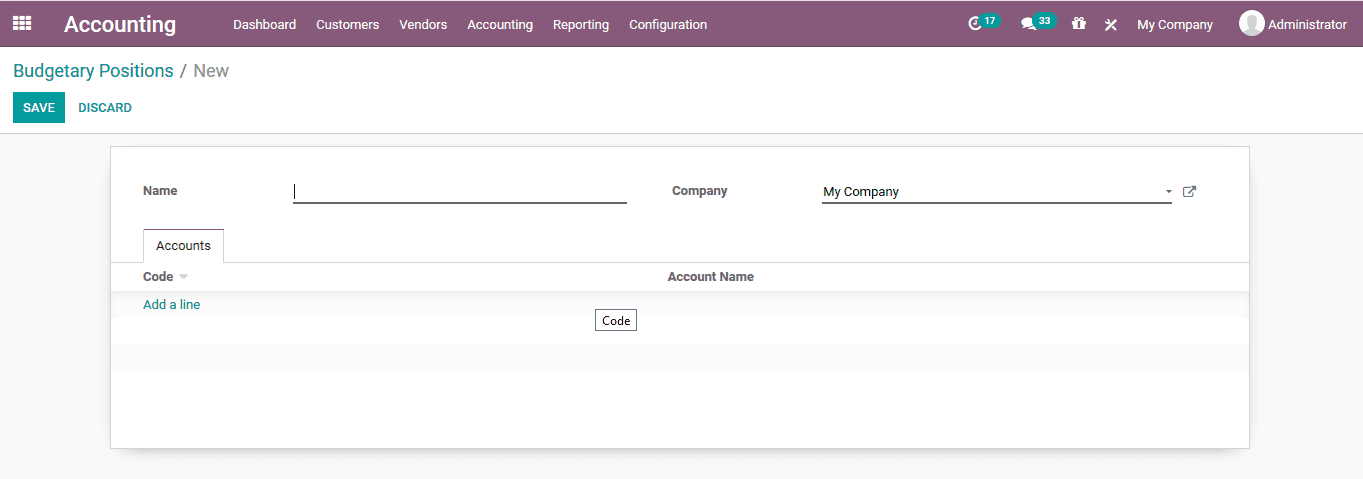

On selecting the budgetary position option the user will be depicted with the menu

containing the budgetary listing and the user can create new ones by selecting the

create option available. In the budgetary creations window the user can provide

a name and allocate the company of operations.

Under the accounts may the user can allocate the various charts of accounts to deal

with the budgetary operations by selecting the add a line option available. On selecting

the add a line option the user will be depicted with the following window to choose

the respective chart of accounts for the budgetary position.