Deferred revenue management

Deferred revenue is the advance payment which has been recorded under the liability

account of the beneficiary until an internal task is triggered on the product conveyance.

In layman's terms it can be defined as the advance payment received by the company

but it’s not regarded as revenue thus making it unable to be reported as the company

income. The deferred revenues menu can be accessed from the configuration tab on

selecting the deferent revenue model the user will be depicted with the menu with

the list of all deferred revenues. The user can create a new deferred revenue model

using the create window available.

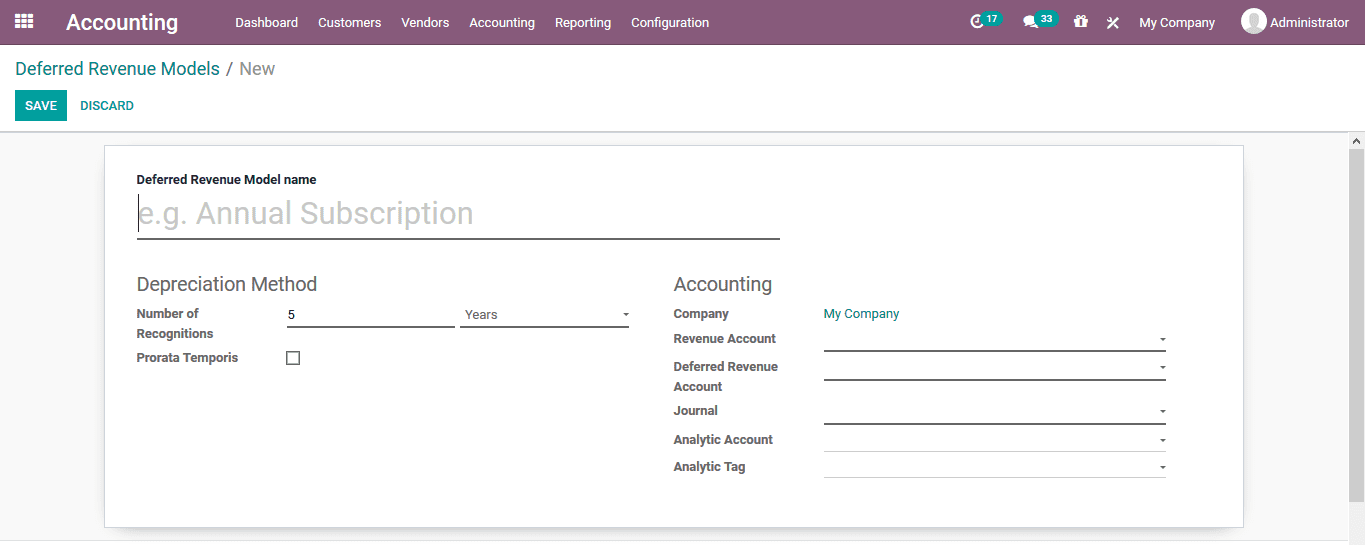

In the deferred revenue creations window the user should add a name for it. Under

the depreciation method menu, the user can allocate the depreciation number of recognition

and the years of it. The prorata temporis can be enabled to make the first depreciation

entry of the asset to be done as per the purchase date rather than the fiscal year

operations defined in the platform.

In the accountancy menu the user can allocate the company, revenue account, deferred

revenue account, journal, analytical accounting and the analytical tag.

As the deferred revenue models are being defined the user can now create and allocate

different revenues to the module. Under the accounting tab the user can view the

different revenue menu ico. On the selecting menu the user can view all the deferred

revenues described and the user can select the create option available.

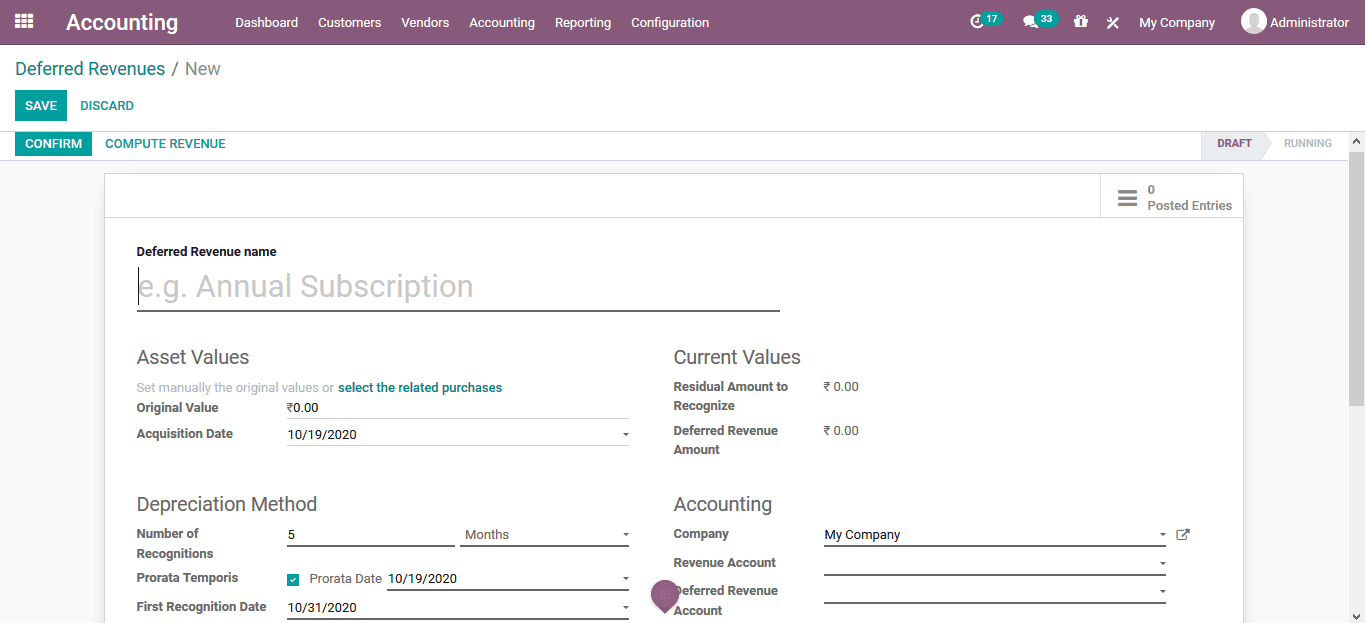

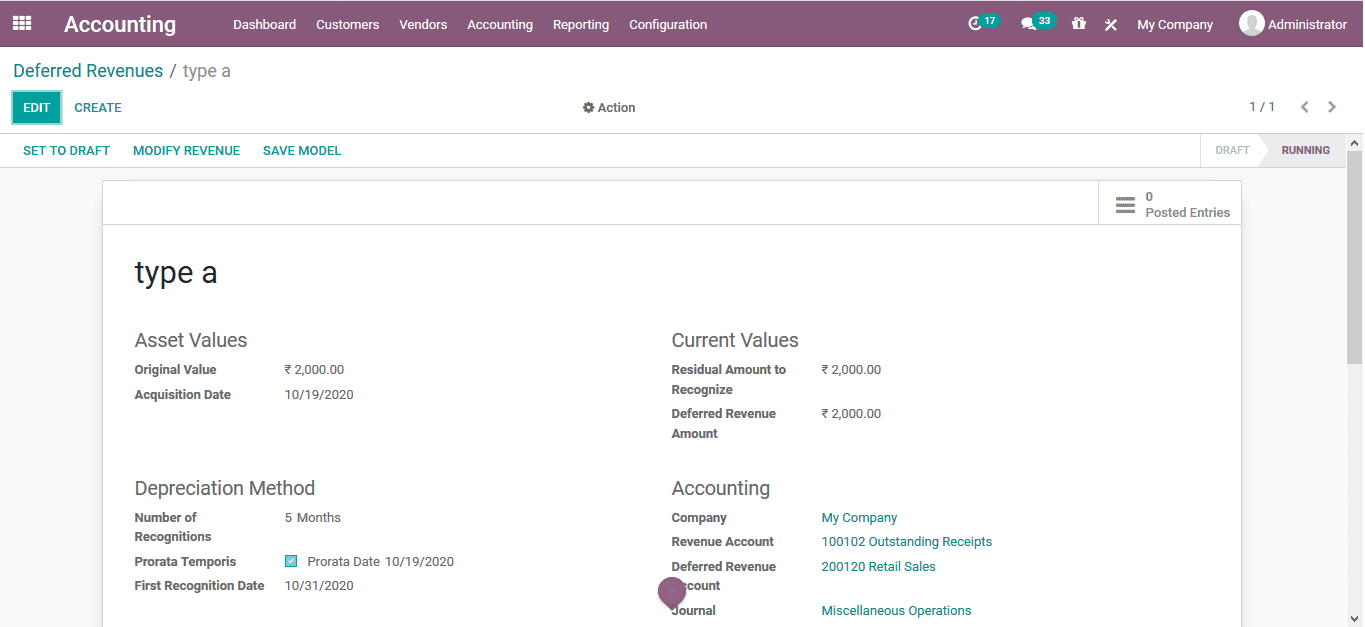

In the creation menu provide the deferred revenue name. Under the asset value provides

the original value and the acquisition date of the revenue. Furthermore, under the

depreciation method the user can select the number of recognitions in the duration,

enable the prorata temporis and describe the first reception date. Under the current

values the residual amount to recognize and the different revenue amount are being

described. Moreover, under the accounting menu the company allocated can be defined,

revenue account and the deferred revenue account can be described along with the

journal details, analytical account and the analytical tag can be defined.

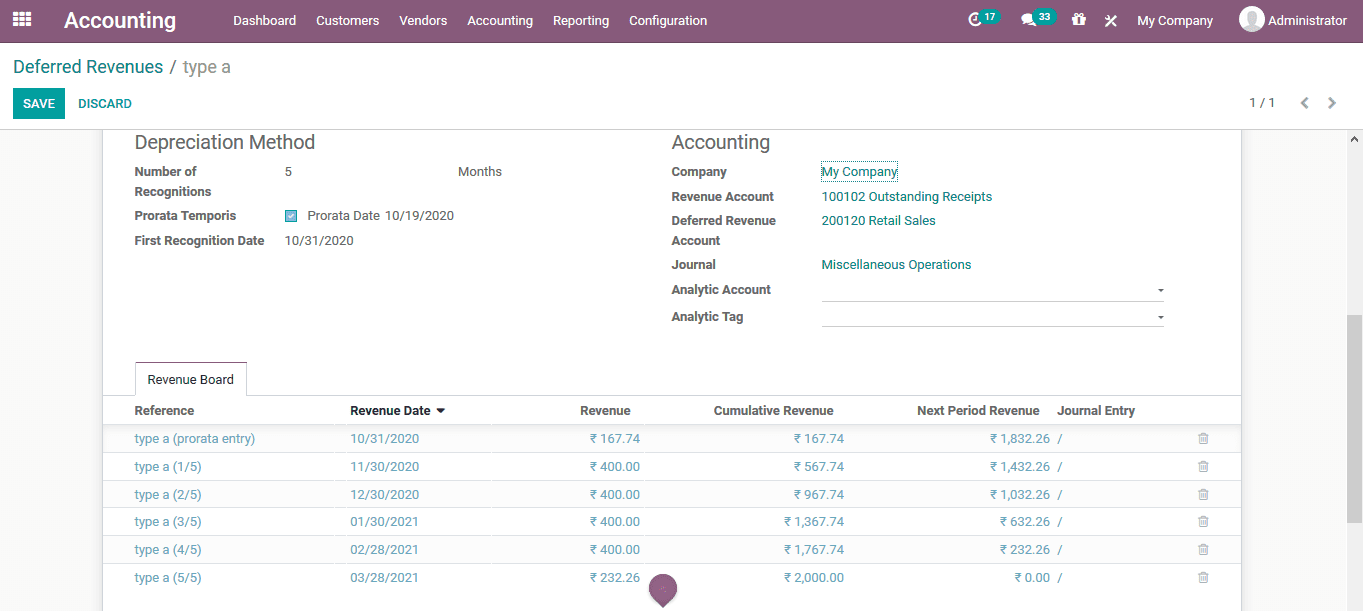

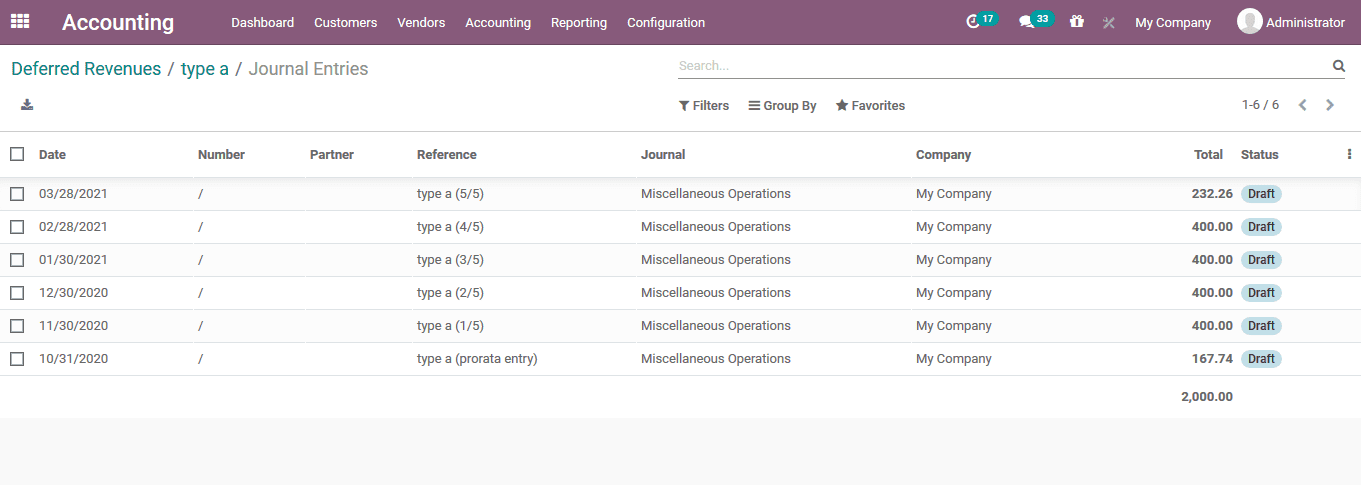

Once the deferred revenue details are being provided and verified they can save

it and confirm the operation. Once the operation is confirmed it starts to run on

the platform. The user can view the revenue board under the respective deferred

revenue description

On selecting verifying list, the user can select the post entries options available

which will post the respective revenues in the journal. On selecting to post the

user will be depicted with the posting details in a menu and the user can verify

them.

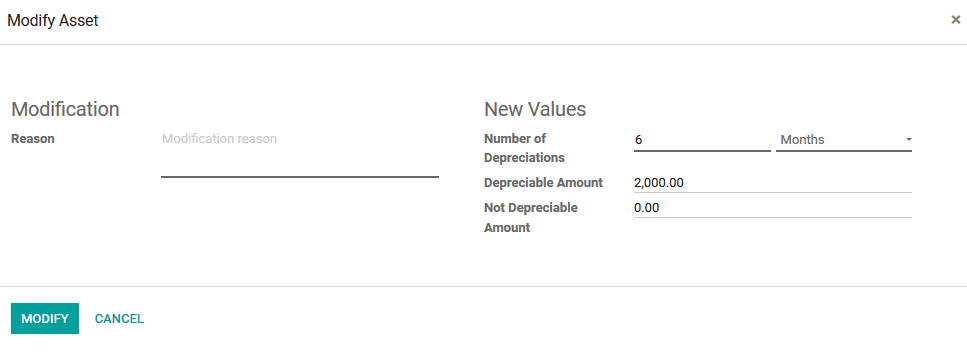

After the revenue has been confirmed and posted the user can modify it if needed

by selecting the modify option now available.

On selecting to modify the revenue the user will be depicted with the following

menu. Here the reason for modifications can be provided and the new values of the

deferral revenue can be configured. The number of depreciations, depreciable amount

and the non-depreciable amount can be described.