Product And Taxes

Applying Default Taxes on Products or Sales Order

Odoo helps you to automatically update Tax/Duties charged on a product in a particular

country. This feature helps to generate default charges set in sales order and invoices.

This will be done based on the details provided in the product’s Invoicing tab.

This feature can be useful when your organization engages in a deal with an organization

operating in the same country or state.

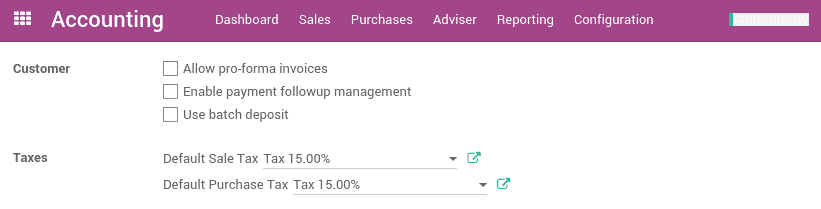

This feature helps all the new products/ items entered in the Odoo to take the default

charge set in the Accounting/Invoicing settings.

However, you can change the default charges set for any item by going to Invoicing>Configuration>

Settings

For multi-companies, the sales and purchase taxes will have different value based

on the operations of the company. In such instances, you can login into the different

companies and change the field for each company.

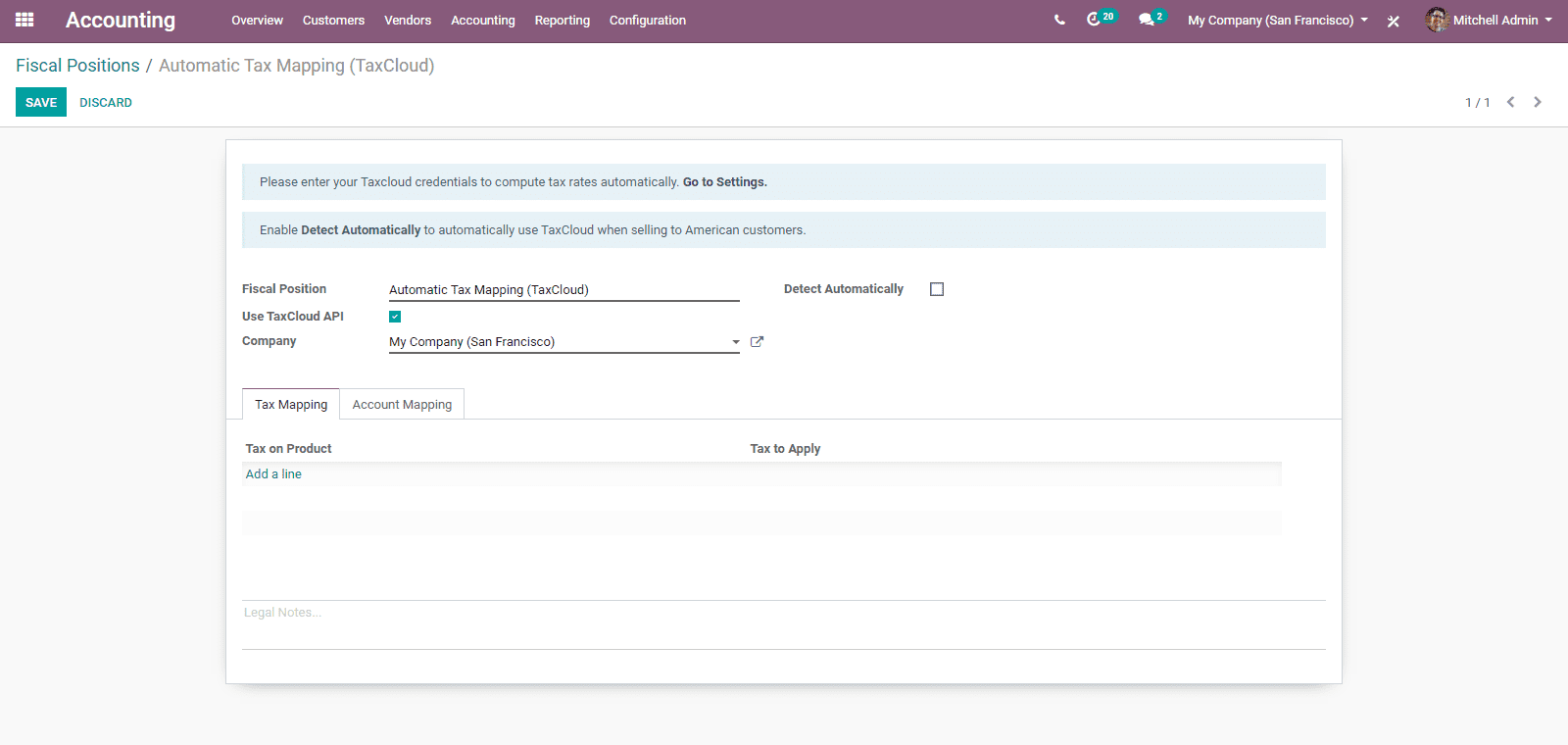

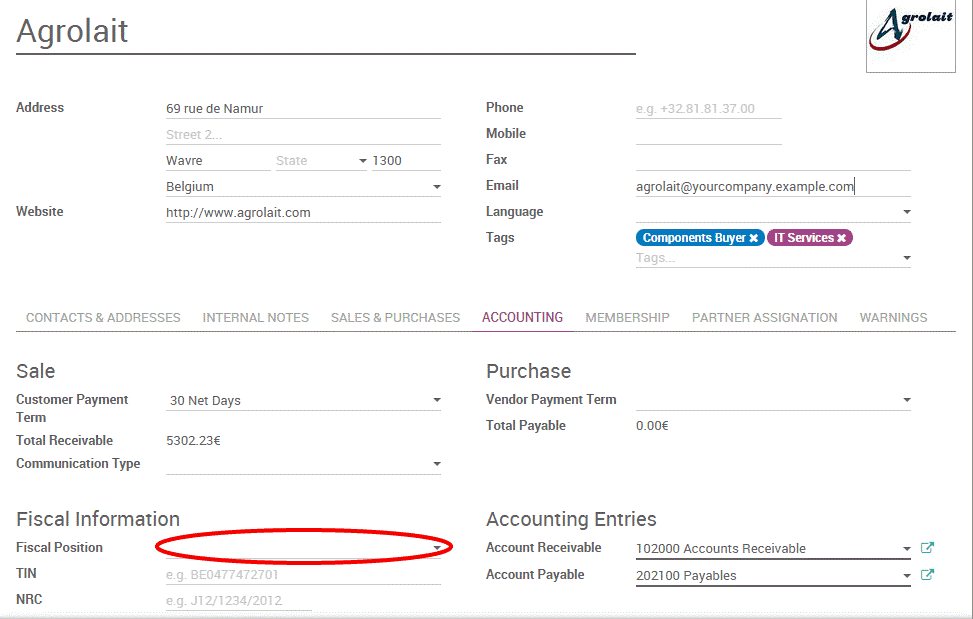

Applying taxes conditioning customer status or localization

The sales tax is always related to client status or localization. In order to outline

diverse charges, Odoo has introduced the element Fiscal Positions.

The fiscal position manages a lot of principles that maps default charges (as characterized

on item structure) into different tax assessments. In Odoo, the fundamental fiscal

positions are organized in a way to automatically make them agree to the client

confinement/localization. However, a user may have to make fiscal positions for

explicit use cases. In order to characterize fiscal positions, you can go to Invoicing/Accounting

‣ Configuration ‣ Fiscal Positions

Adapt Taxes To Your Customer Status

If a client falls into a particular tax collection rule, the user will have to apply

a duty mapping. By this you can create a fiscal position and allot it to your clients.

Odoo will help you to utilize the specific fiscal position for any order/invoice.

Adapt Taxes To Your Customer Address (Destination-Based)

Depending on localization, sales taxes can be of two types, origin based or destination

based. Most states or countries want the seller to collect taxes based on the destination

or the location of the buyer. At the same time, some others require to collect tax

based on the tax rate at the seller’s office.

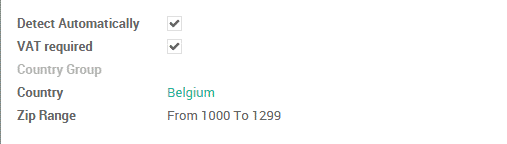

If you want to depend on the destination-based rule, create one fiscal position

per tax-mapping to apply.

- Here, you can Check the case Detect Automatically

- You can select a country group, country, state or city to trigger the duty mapping.

If fiscal position is chosen, then Odoo will pick the fiscal position matching to

the transportation address. This will be made on making a request.

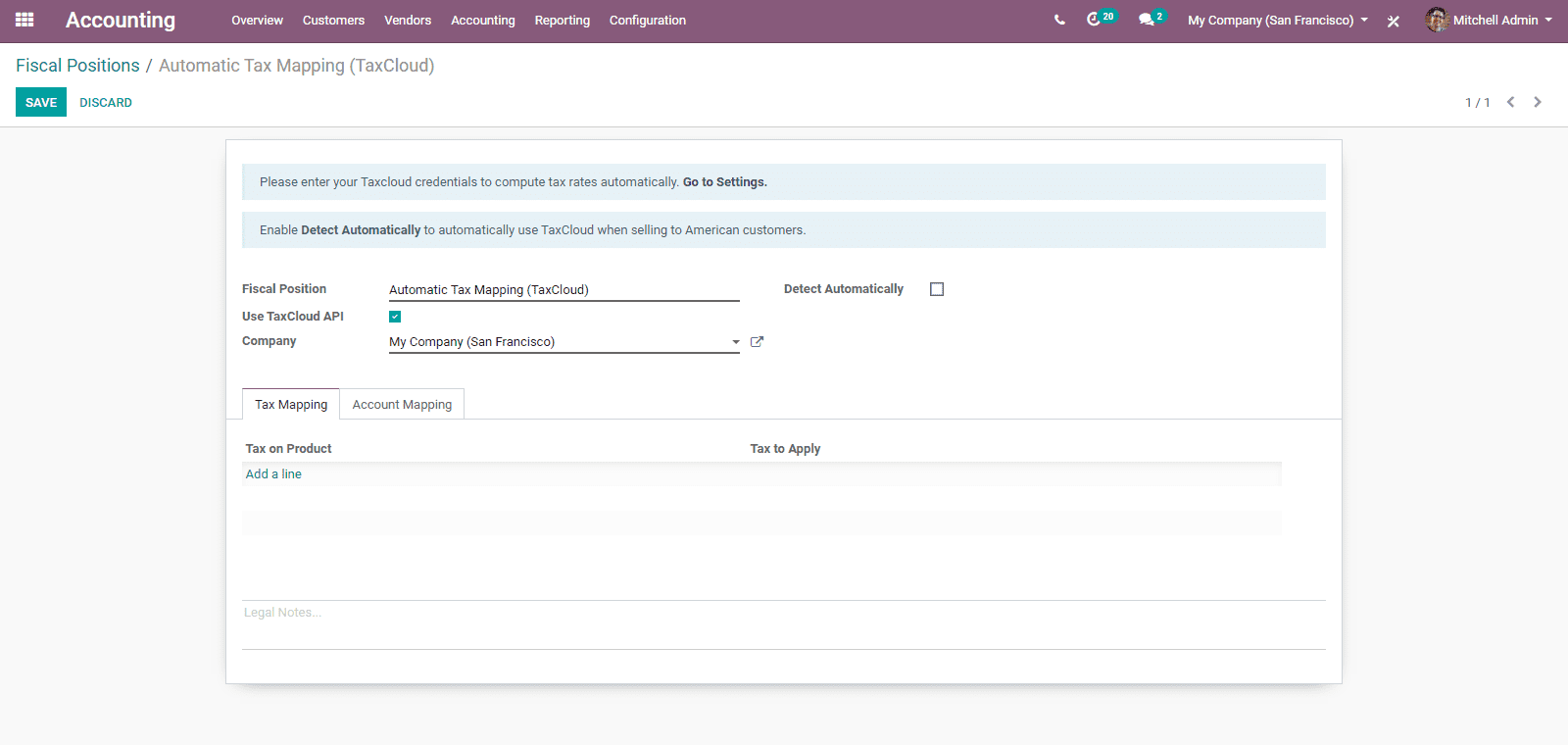

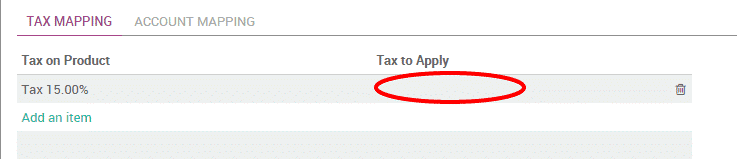

Specific use cases

In the case of some fiscal positions, you will have to evacuate a tax. Here, rather

than supplanting by another, you have to simply keep the Tax to Apply field empty/

unfilled.

If you want to replace a tax by two other taxes for some fiscal positions you can

do it by just creating two lines having the same Product Tax.

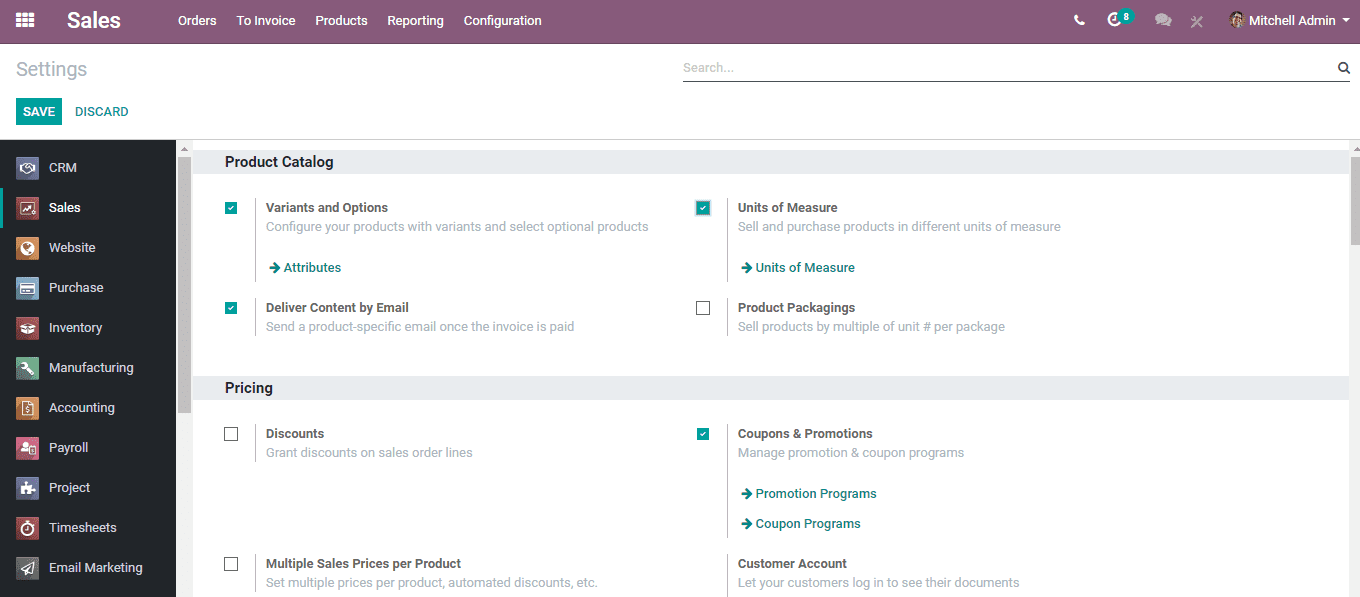

Sale and Purchase in Different Unit of Measure

Dealing with products in various units of measures is always very important. Take

an instance when you purchase items in a country where the metric measuring standard

is of utilization and sell them in a different country where the imperial framework

is utilized. Here, you should change over the units. Odoo helps to work with various

units of measure for one item.

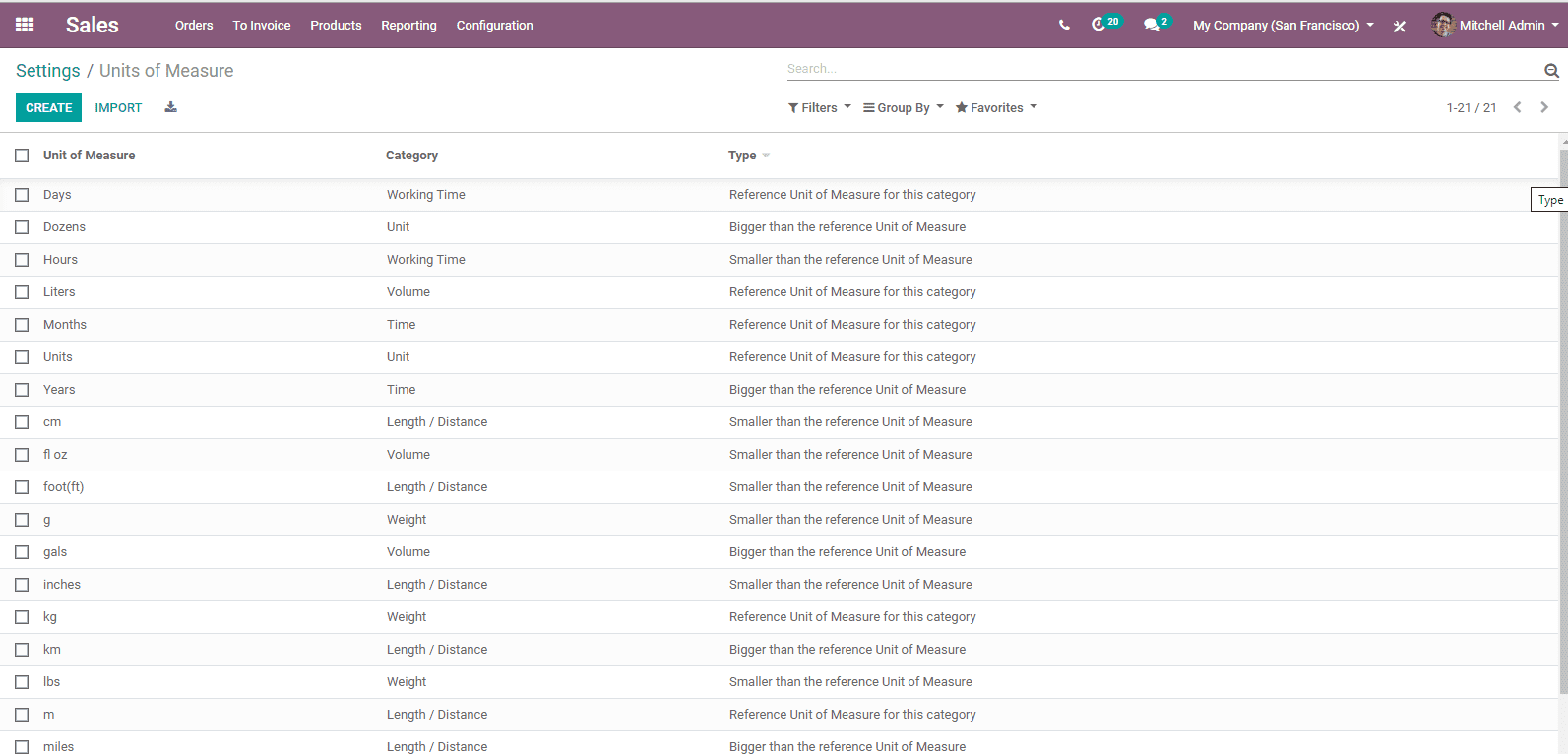

In order to do this, go to Sales/Configuration / Settings and Activate Units of

Measure under Product Catalogue

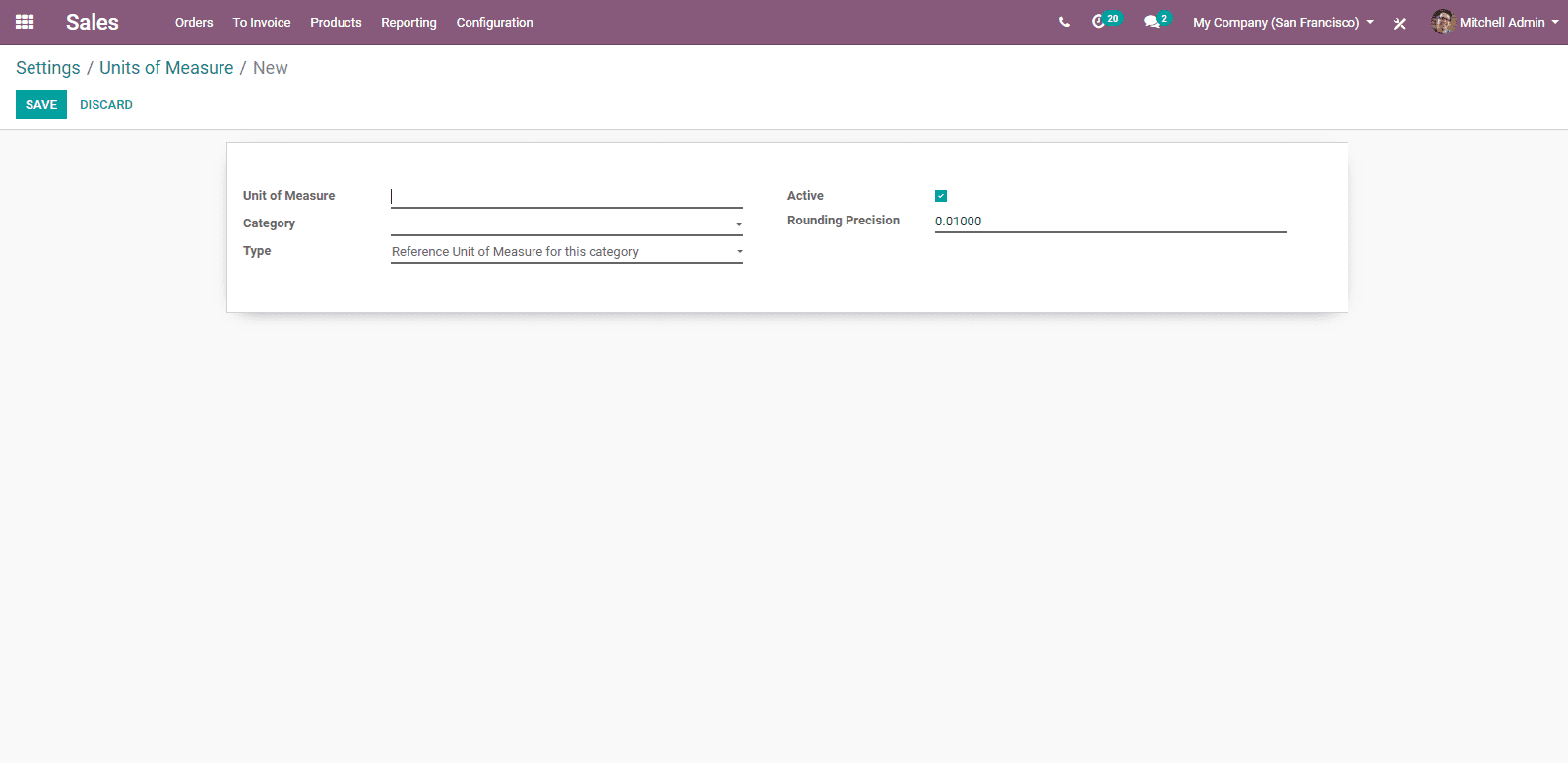

To create a new unit of measure click the create button.

You can name units of measure and define its category. In Odoo, conversion between

two units of measure is possible only if they belong to the same category. Here,

the Conversion will be done based on the ratios.

Odoo automates the rounding adjustments when inter-unit exchanges are performed.

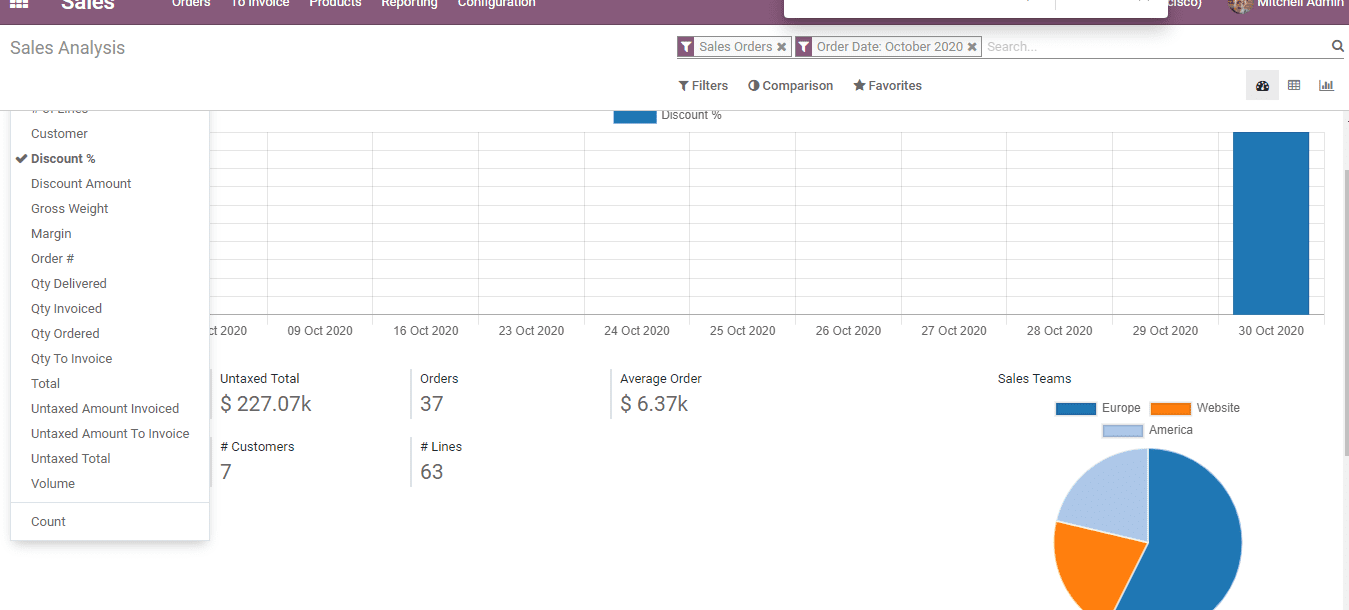

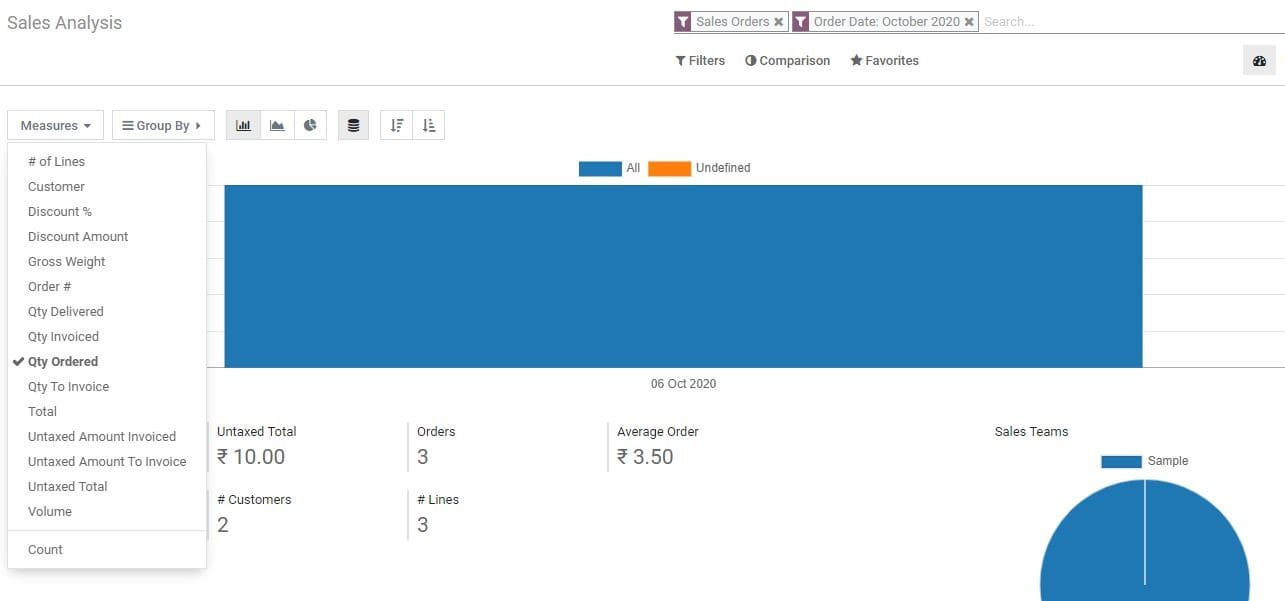

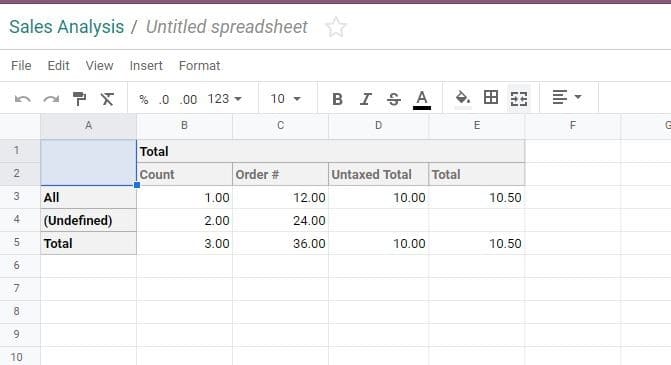

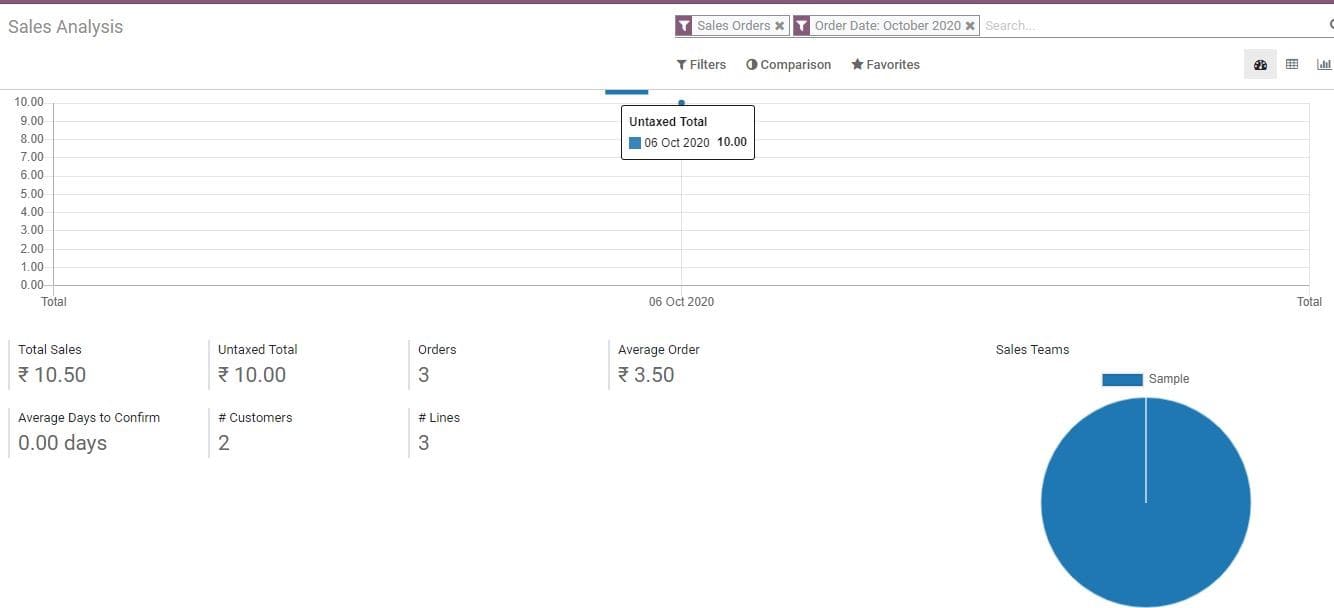

Reporting

Constant monitoring of the performance of a team is essential for the success of

the business. The Reporting section of Odoo Sales plays an important role in helping

a comprehensive overview of the sale performance. This helps to determine business

decisions for the growth of sales.

You can generate Sales report by going to Sales>Reporting Sales

We can consider Sign as a quick method to send, sign and approve documents. This

will help a user to complete the preparation of a document in a simple way by dragging

and dropping blocks. This will also help the user to manage signature requests and

track the status of already sent documents.