The Odoo Accounting module is a comprehensive software solution for businesses of all sizes. It is designed to provide users with an easy-to-use platform for managing their financial operations, from invoicing and payments to bank reconciliations and financial statements. The Odoo Accounting module integrates with other modules, such as Sales, Purchase, and Inventory, to provide a comprehensive view of a business’s financial operations. With its ample amounts of features, users can easily manage their finances, keeping track of their income and expenses in real-time. The Odoo Accounting module also offers useful features such as multi-currency support, integrated tax calculation, and budgeting tools.

Additionally, users have the provision to access a variety of analytics and reports to better understand their financial data. In the first chapter, we discussed the importance of accounting and the various fields and tools equipped in the Settings menu of the Odoo 16 Accounting module. Now let us move on to gain knowledge in the configuration tools and the available menus in the Odoo 16 Accounting module.

In this chapter, we will take up the configurational tools available in the Odoo accounting module, such as:

- Accounting configurations

- Payment Options

- Asset Models

- Analytical Accounting

- Configuring Invoicing

- Configuring bank Payments

Every feature available under the Configuration tools will be carefully examined here.

Accounting Configurations

There are several accounting configurations in Odoo that can be used for

managing your business finances and bookkeeping.

It possesses the foremost priority among other configurations.

Accounting Configuration in Odoo is an eminent feature that allows you

to configure financial records in the system. It enables you to manage your accounts, define taxes,

configure invoices, and reconcile bank transactions. It also allows you to create chart of accounts,

manage budget, and set up multi currency accounting, and so on. In addition, it includes

a range of options for managing payment terms and can be used to generate reports.

The accounting configurations must be framed before starting the organization's

financial management operations. As a result, once the accounting configurations are

established, putting changes into the aspects will be very difficult, as it affects

all the operations of the company. The two main aspects that must be configured under

this tab in the initial stage are Chart of Accounts and Taxes. So we can deeply understand

the configurational aspects of accounting in the following sections.

Creating a Chart of Accounts

The Chart of Accounts is an essential component of financial management operations in a company.

It is a list of all the financial accounts a business uses to keep track of its income, expenses,

assets, liabilities, and equity. The Chart of Accounts typically includes asset accounts such as cash,

accounts receivable, inventory, and fixed assets; liability accounts such as accounts payable and loans;

and equity accounts like sales and expenses accounts such as cost of goods sold and operating expenses.

The Chart of accounts is an important tool

for financial reporting, as it helps to ensure that financial transactions are recorded in the correct accounts.

A Chart of accounts has a crucial role in accounting as it defines the structure of the accounts used in the financial reports. It is a key tool for tracking the financial health of a business and allows users to quickly assess their overall performances. It also helps to ensure that financial transactions are accurately and correctly reported. It will support the creation, edit and view of all financial accounts easily and also make it possible to customize and manage your financial statements and reports.

Odoo’s Chart of accounts is a standard, double-entry bookkeeping system comprising balance sheets, income statements, and other accounts. It is customizable allowing you to create your own accounts and categories, as well as configure the system to meet your specific accounting requirements. The system will always make certain that the records of your financial operations remain excellent and able to use future requirements. The main and first thing that you initiate your accounting and financial management with the Odoo accounting system is the configuration of the Chart of Accounts. It is just because all the future operations are determined based on it. Odoo provides the provision to create a custom chart of accounts based upon the business needs and which will be a great support for having complete governance of the management of the financial operations.

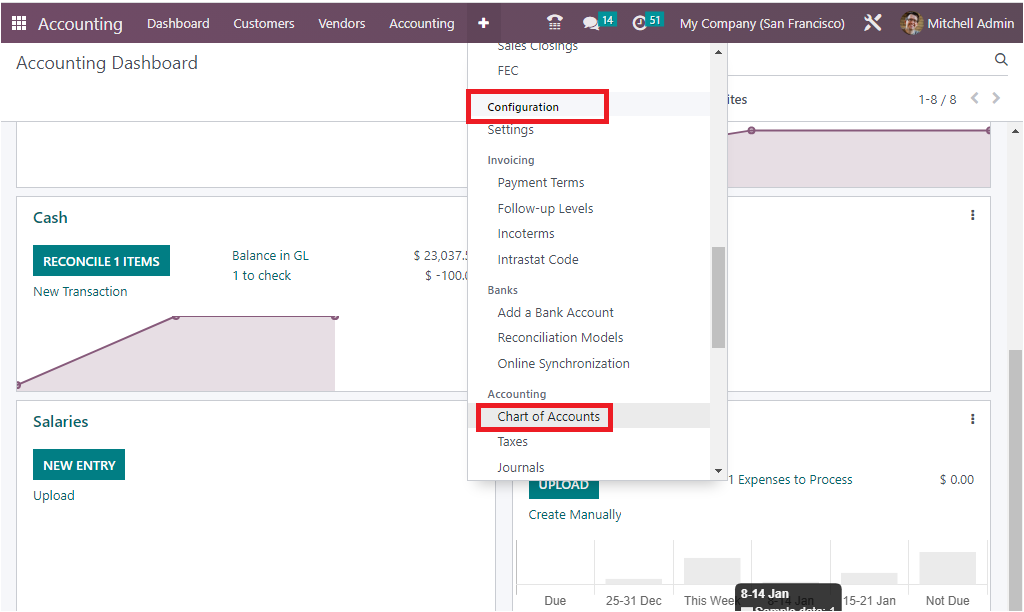

It is very simple to define the chart of accounts in Odoo. you just need to select the Chart of Account menu in the Accounting section available under the Configuration tab of the Odoo 16 Accounting module as shown in the image below.

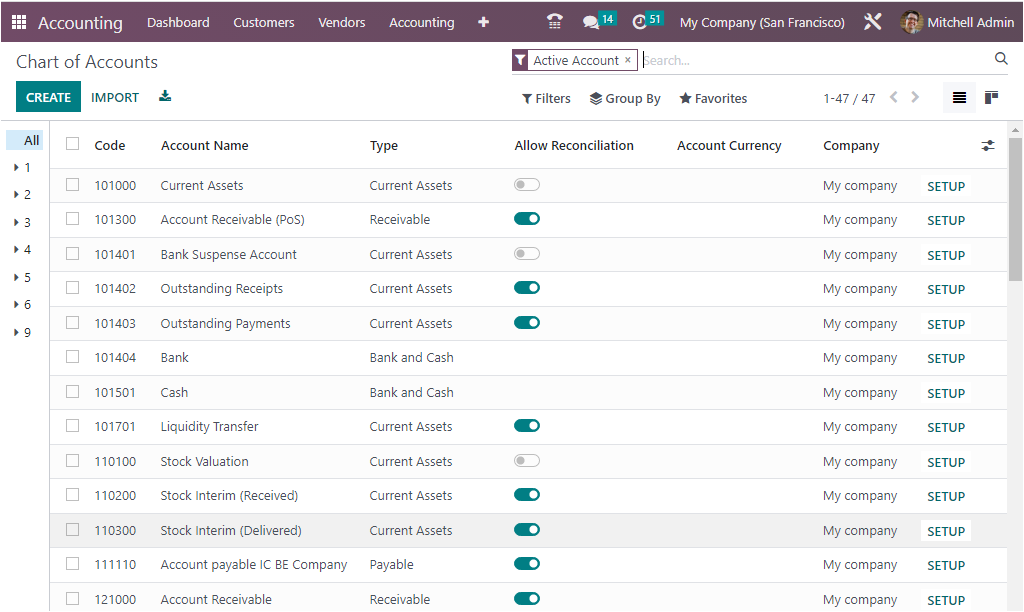

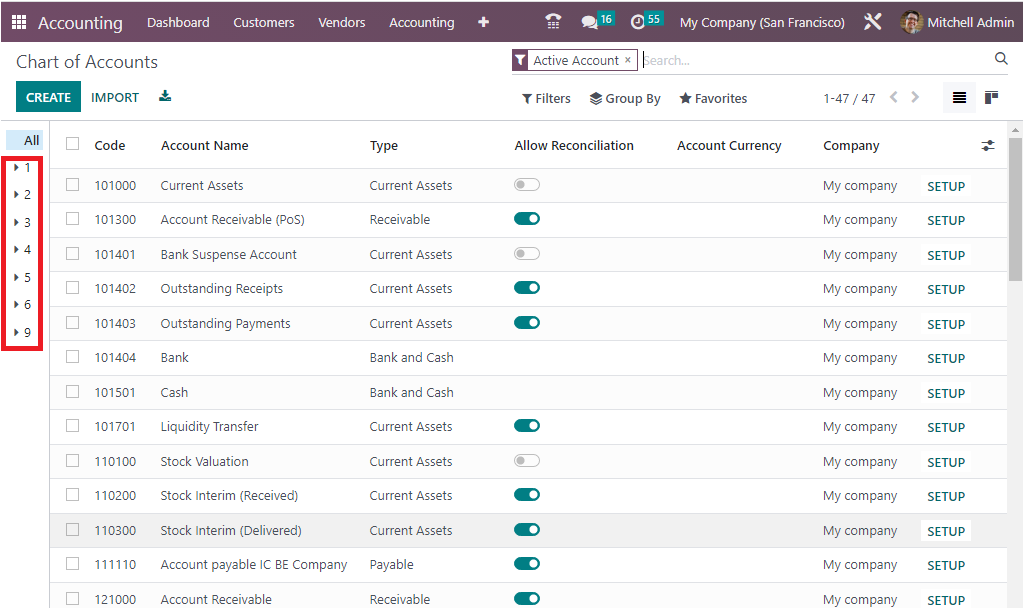

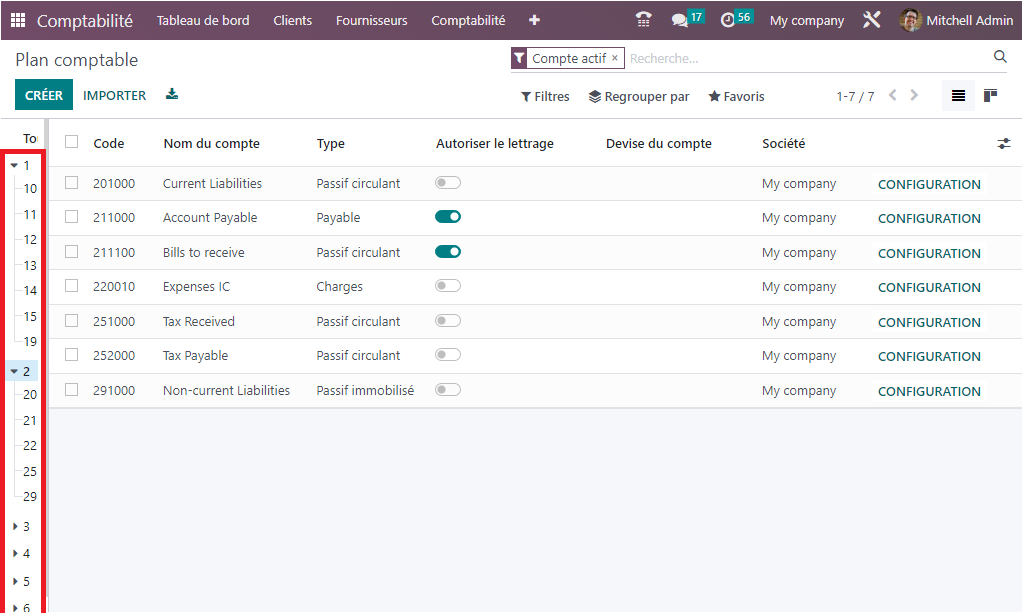

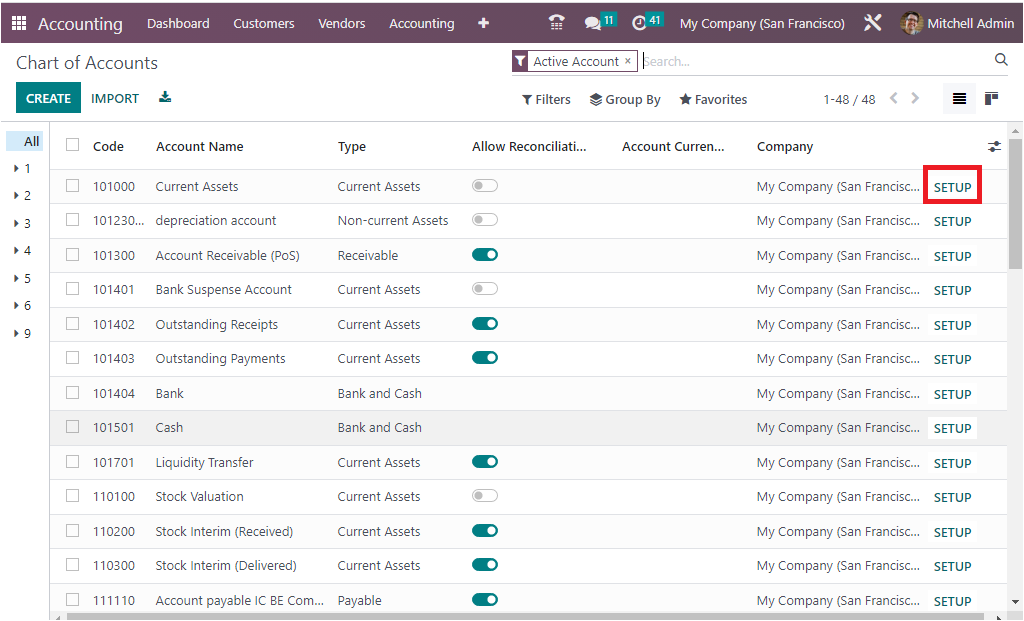

The Chart of Accounts window will be capable of displaying all the preconfigured chart of accounts details as depicted below.

All the derived Chart of Accounts records are displayed with essential details such as Code, Account Name, Type, Account Currency, Company and other details as shown in the above screenshot. You can also view an option which can be enabled or disabled. If you are enabling this option, you will be able to configure reconciliation of the respective chart of account. As it is a list view, you can also view the details in Kanban view by selecting the Kanban view menu icon. The powerful sorting options such as Filters, Group By and Search option can be used for obtaining any of a particular Chart of Accounts. The Group By option allows you to make a defined group of records based on similarities or other criteria.

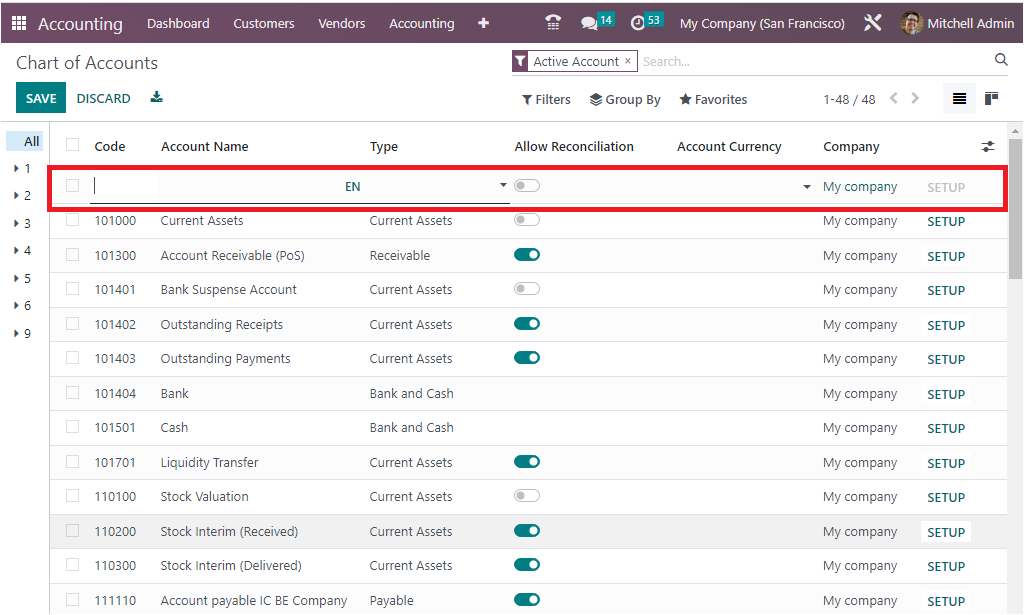

To create a new Chart of Account, you can click on the CREATE button available in the top left corner of the window. Now the system will depict a fresh raw in the same window to define a new chart of account as shown below.

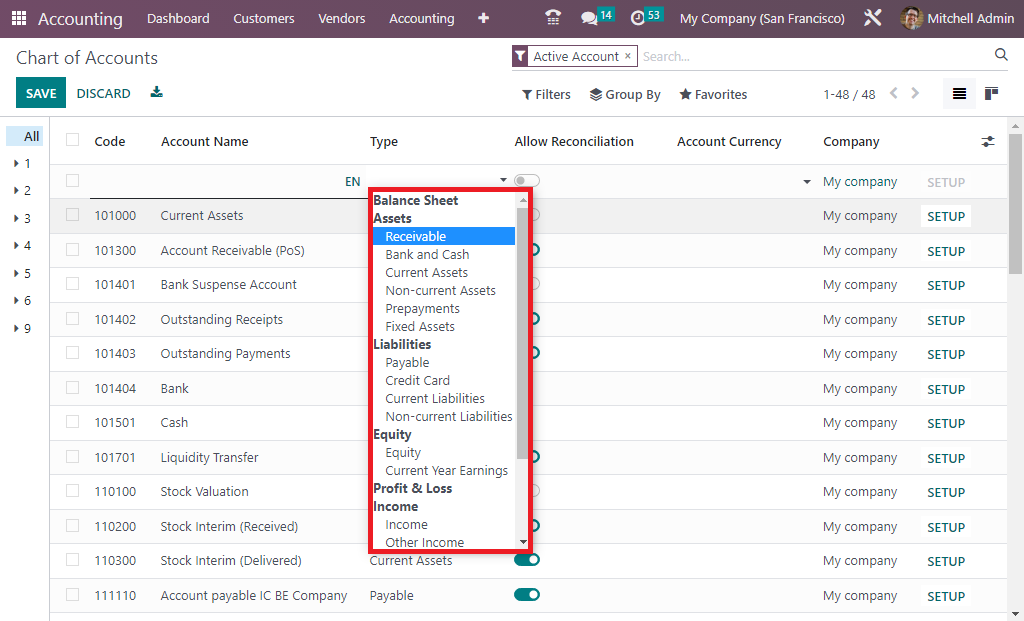

Here you can provide the Account Name in the assigned field. Then you can select the Account Type in the Type field with the help of the dropdown menu. The dropdown menu will display all the default types. It can be either Asset, Liability, Equity, Profit&Loss, Expense, Income or Other. In addition, a number of sub types of accounts will also be there under each type as shown in the screenshot below.

Further, you can enable or disable the Allow Reconciliation field based on your preferences. Also, mention the Account Currency and the Company.

The hierarchy of the Chart of Account operations of the Odoo platform can simply be defined at the time of the initial stage. Just after the establishment of your business operations, the concerned responsible team can configure the hierarchy of operations for the respective chart of accounts.

On the extreme left side of the Chart Of Accounts window, you will be able to view the numbers as it mentions the hierarchy. For that, you only need to select the arrow options, which are depicted on the left side of the window, as shown in the image below.

Each of these numbers are clickable and will be able to expand by clicking the arrow icon. By selecting the arrow, you will be able to view the respective hierarchy of operations.

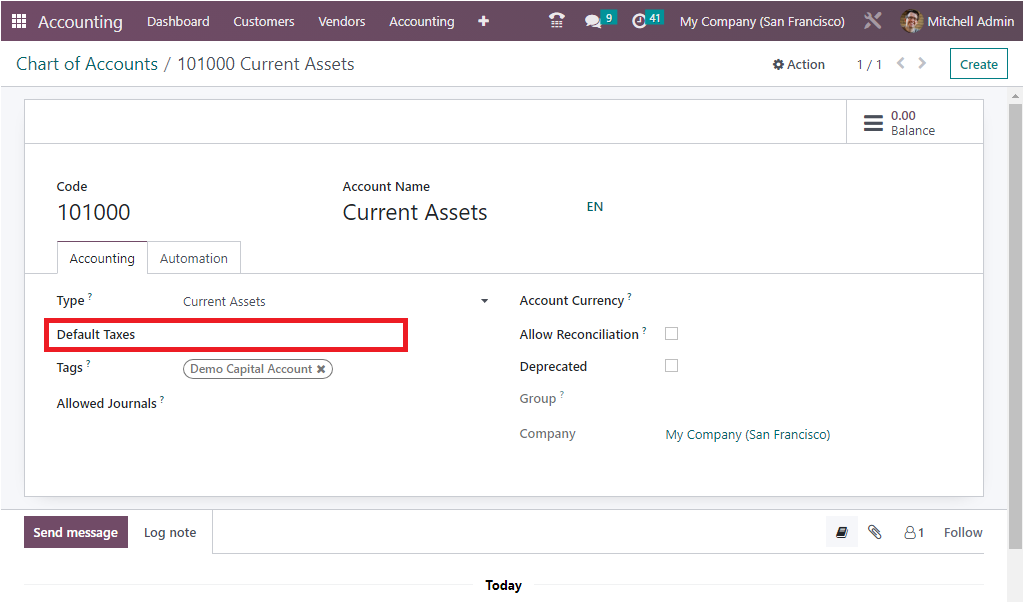

Further, the corresponding journal entries with respect to the Chart of Account will be able to define, and this will act as a clear cut definition of the financial operations of the Chart of Accounts in the company. Similarly, it is also possible to define the by default tax of operations for the corresponding chart of accounts, and this will be very useful for stating that the financial operations performed are together with the taxes which have been defined.

In addition, you are allowed to choose and describe the tax for the respective chart of accounts on the basis of the region of operation of the company.

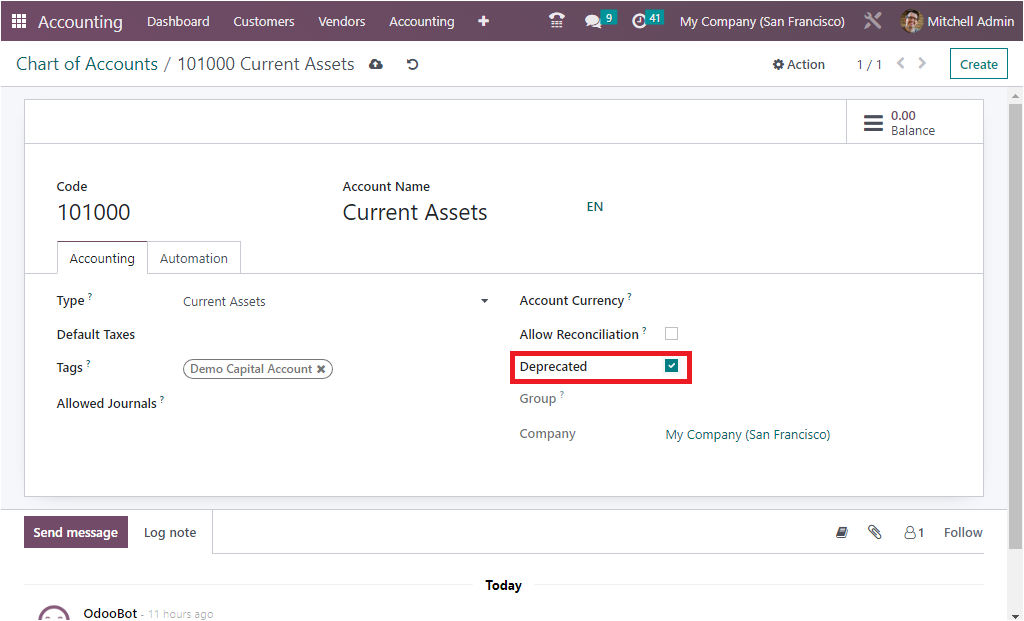

Furthermore, the ‘Deprecated’ option allows you to block the usage of this specific chart of accounts. To do so, you can activate the Deprecated option in the Char of account menu, as highlighted below.

However, this unique feature is only visible for the Chart of Accounts ones that are in functioning. If you are required to end the use and operate with a Chart of Account, you cannot directly delete it from running as it includes the whole and financial data of operations that were being applied and of much value in the future. In these situations, the Deprecate option is very helpful. Enabling this option will allow you to stop its operation in finance management. But still, you will obtain the corresponding entries and data of the chart of account but not in operation.

How to create a new Chart of Accounts?

To create a new chart of accounts with the Odoo 16 Accounting module, you only need to go for the CREATE button available on the Chart of Accounts window as we mentioned earlier. In the depicted new line, you can describe the new Chart of Account. After providing the Code, Account Name, and the Type of the Chart of Account, you can also configure the Reconciliation option. After that, you can apply the SETUP option, which is available under each of the Chart of Accounts, which is marked in the given image.

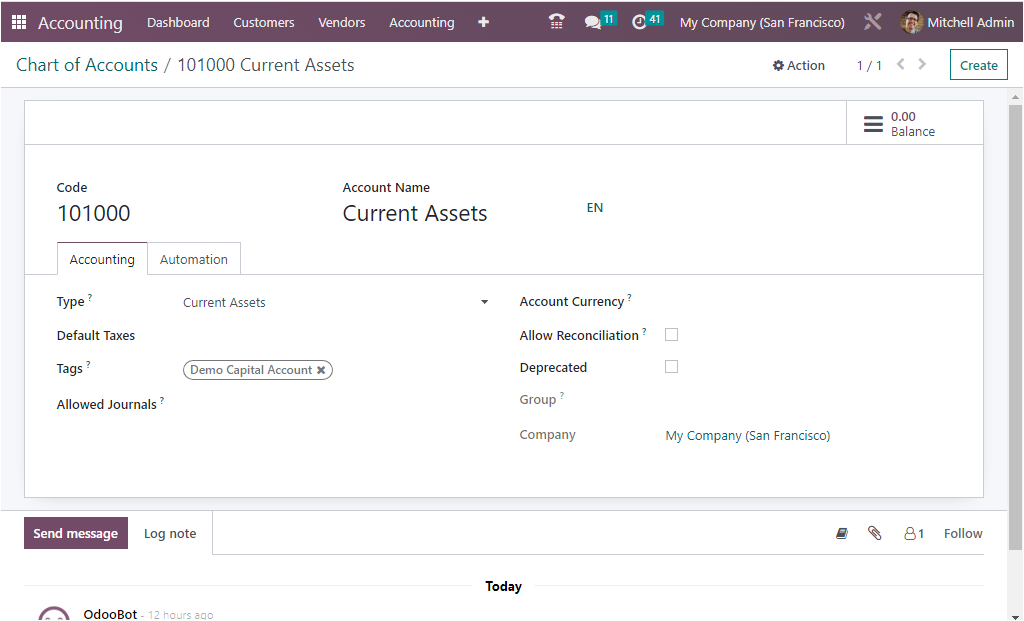

The SETUP option navigates you to another window where you can set up the configuration aspects of the corresponding Chart of Account. The below image depicts the mentioned window.

In this configuration window of the Chart of Account, you can define the required details. The already mentioned details, such as Code, Account Name, and Account Type, will be displayed. Further, there are options under the Accounting tab and the Automation tab. Under the Accounting tab, you can define the Account Type. The account type is used for information purposes to generate country-specific legal reports and set the rules to close a fiscal year, and for generating opening entries. Then you have the Default Taxes option, which we mentioned earlier. Then in the Tags field, you can mention the optional tags which you need to assign for custom reporting. Now in the Allowed Journals field, you can list the journals in which journals this account can be used. If you leave this field empty, it can be used in all journals. Then you have the option to mention the Account Currency. So that you can force all journal items in this account to this specific currency. If no currency is set, entries can use any currency. Next, you can enable the Allow Reconciliation field if this account allows invoices and payments matching of journal items. In addition, you have the Deprecated option, which we described earlier.

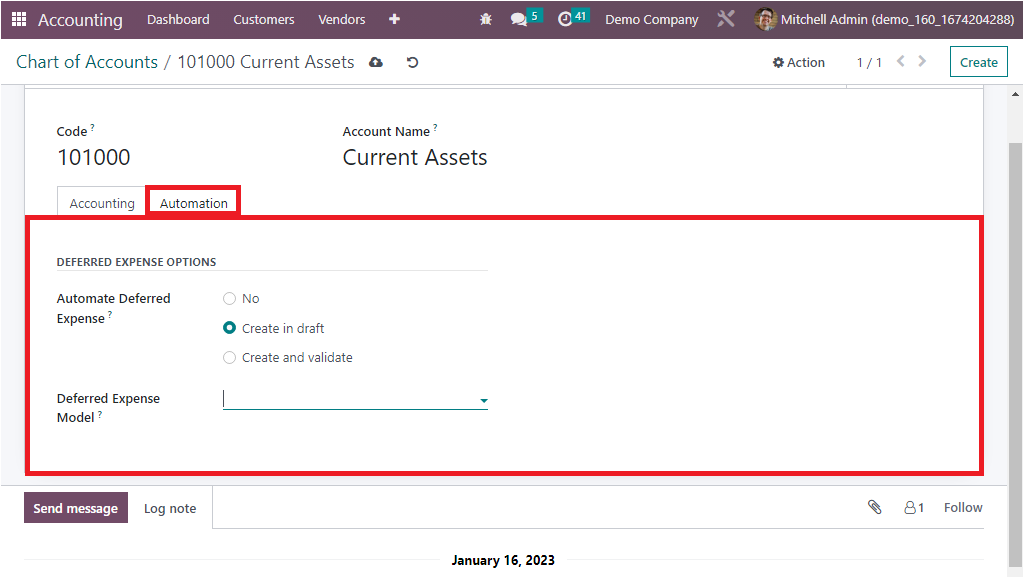

Now under the Automation tab, you have the DEFERRED EXPENSE OPTIONS, under which you can choose the required options from ‘No, Create in draft, or Create and Validate’ to Automate Deferred Expense. If you set the field other than “ no”, you should choose the Deferred Expense Model in the specified field.

The Automated Deferred Expenses field described here allows you to automate the recognition of expenses that are expected to be incurred in the future. You can configure it in three ways as ‘Create in draft, Create and Validate and No.’

It is also possible to edit the Chart of account, on moving the cursor to the respective fields, it can be editable, and an upload icon appears at the top to save the changes. Also, the ‘Create’ button now appears in the top right corner of the form view; this makes the Chart of account creation more easier. Besides, the smart tab ‘Balance’ shows the balance amount in that account that is generated from different journal entries.

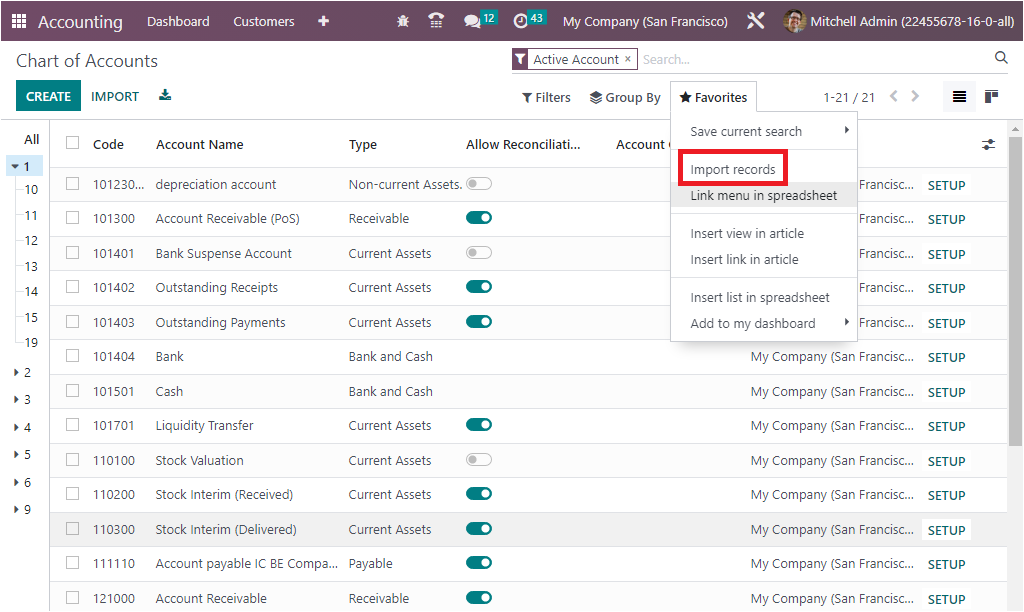

With the Odoo 16 Accounting module, you can create or import a number of Chart of Accounts in accordance with the requirements of the business operation. This facility is very helpful for you to summarize the accounting operations of each finance management. You can easily find the Import records option. Under the ‘Favorites’ menu, have the option to ‘import records’, where the details of the Chart of Accounts can be imported in xlsx or CSV format.

So far, we have been discussing the Chart of Accounts option and now let us move on to the next session Configuring Taxes, where we can discuss the facets of configuring taxes on the company operations based on the region.