Taxes are an important part of the business process and must be managed

accurately to ensure the business is compliant with local regulations.

In Odoo 16 Accounting, taxes can be configured in the Accounting

application. This section will provide a step-by-step overview of how to

configure taxes in Odoo 16. Taxes play a critical role in accounting as

they are an expense that must be accounted for on financial statements.

Accounting for taxes requires an understanding of the various tax laws

and regulations, as well as the ability to accurately record, report,

and pay taxes to the relevant tax authorities. Tax accounting involves a

combination of both accounting and taxation knowledge.

Tax accounting involves the preparation of tax returns, calculating the appropriate tax liability, and filing returns with the appropriate tax authorities. It also consists of the recording of transactions related to taxes, such as payments, credits, and deductions. Moreover, the preparation of financial statements to report the tax liability of a company or individual.

Tax accounting is also used to calculate the amount of money that should be withheld from employee wages for taxes. Additionally, tax accounting is used to calculate the amount of money that should be withheld from employee wages for benefits and other deductions. It also involves the preparation of tax projections and budgets, which can be used by a company or individual to plan their tax liabilities and cash flow. Tax planning is important for ensuring that a company or individual complies with the applicable tax laws and regulations. However, it is a complex field that requires a thorough understanding of the various tax laws and regulations. Professional accountants and tax preparers can provide assistance in preparing, filing, and paying taxes. Additionally, software programs like Odoo Accounting can be used to automate the process of preparing, filing, and calculating taxes.

Taxes are considered as the liability that must be paid by the customer to the service provider for the favor. The organizations are also liable to pay the equivalent amount to the government or the authorities when conducting tax filing. The countries follow different types of taxes, and almost all countries operate it with different percentages, and it purely depends on the local governing authorities. That is why the accounting management tool that you apply in your business must have the power to configure customized taxes of different operations, and the Odoo Accounting software is very efficient for it.

The Odoo 16 Accounting platform is very comfortable for configuring all types of taxes for their sales, purchases, and services offered, and it can be defined based on the country in which the business operates. This feature can be included in one among the localization tools offered by the Odoo platform.

To configure taxes for your business operation, you can follow the below steps.

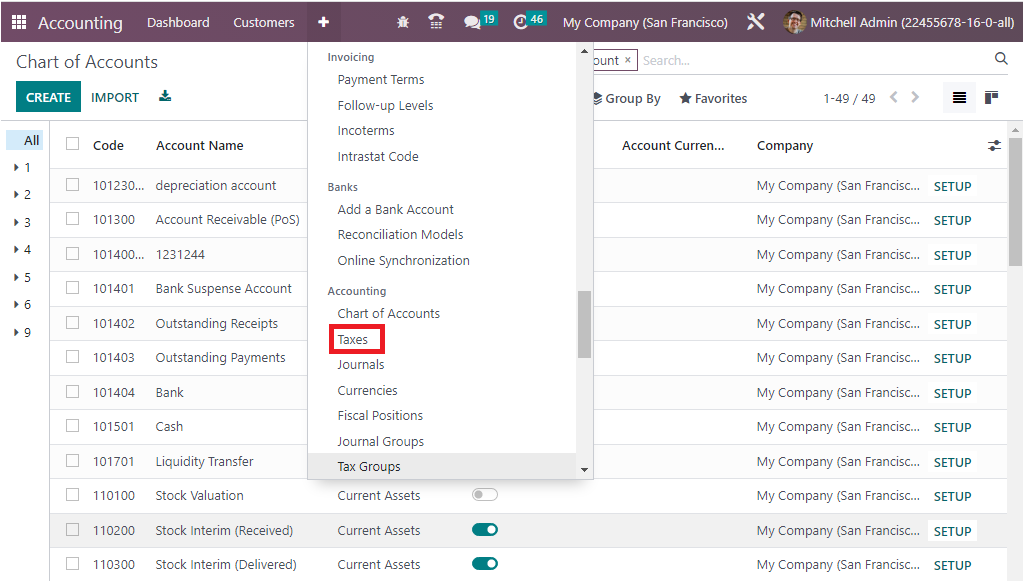

Step 1:Go to the Accounting module and click on the “Configuration” menu available in the left pane.

Step 2:On the Configuration menu, click on the ‘Taxes’ menu available under the Accounting section, as shown in the image below.

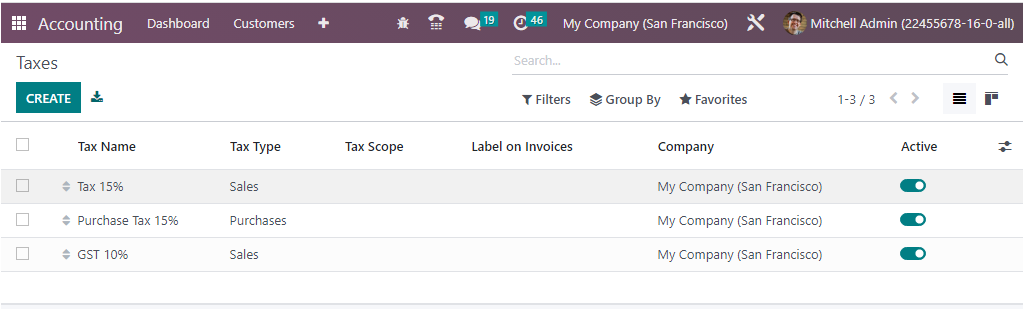

Step 3:In the Taxes window, click on the CREATE button to create a new tax. In addition, the Taxes window will display all the previously configured taxes details as illustrated in the figure below. It is also possible to edit the existing taxes.

The window will display the essential details of the configured taxes, such as Tax Name, Tax Type, Tax Scope, Label on Invoices, and Company. Apart from these options, you can also view a boolean field named Active for enabling or disabling the specific tax.

So using the Odoo platform, it is very simple to establish tax computation for the corresponding taxes which are already defined. In addition, the platform supports various default tax computations such as Group of Taxes, Fixed, Percentage of Price, and Percentage of Price Tax Included.

Fixed Tax Computation in Odoo Accounting is an automated tax calculation system that allows for the calculation of taxes based on a predefined set of rules and tax rates. This system can be used to calculate taxes, sales, and purchases, as well as for payroll and other financial transactions. This system is beneficial for businesses that have a large number of transactions and need to quickly and accurately calculate taxes. Fixed tax computation in Odoo is also beneficial for businesses that need to maintain accurate records for tax compliance.

The Group of Taxes Computation in Odoo Accounting is a feature that allows you to set up and manage different tax rates, as well as to group taxes and apply them to transactions. It allows users to create different tax groups, assign taxes to them, and apply them to their transactions. This helps to ensure that all taxes are applied correctly and consistently.

In the case of the Percentage of Price Tax Computation, it depends on the type of taxes being applied. For example, a standard VAT rate may be set at 20%, while a Custom Duty may be set at 10%. Each type of tax can have its own rate, and can be applied to different types of transactions. It will be based on the fixed percentage which is set.

Finally the Percentage of Price Tax Included computation is determined by the configuration of the tax rules. When the tax rules are configured, the percentage of the tax included in the price will be calculated automatically based on the applicable tax rate. The percentage of the price tax included computation is found in the tax configuration settings in Odoo Accounting. The tax amount will be included in the prize amount.

Back to the Taxes window,

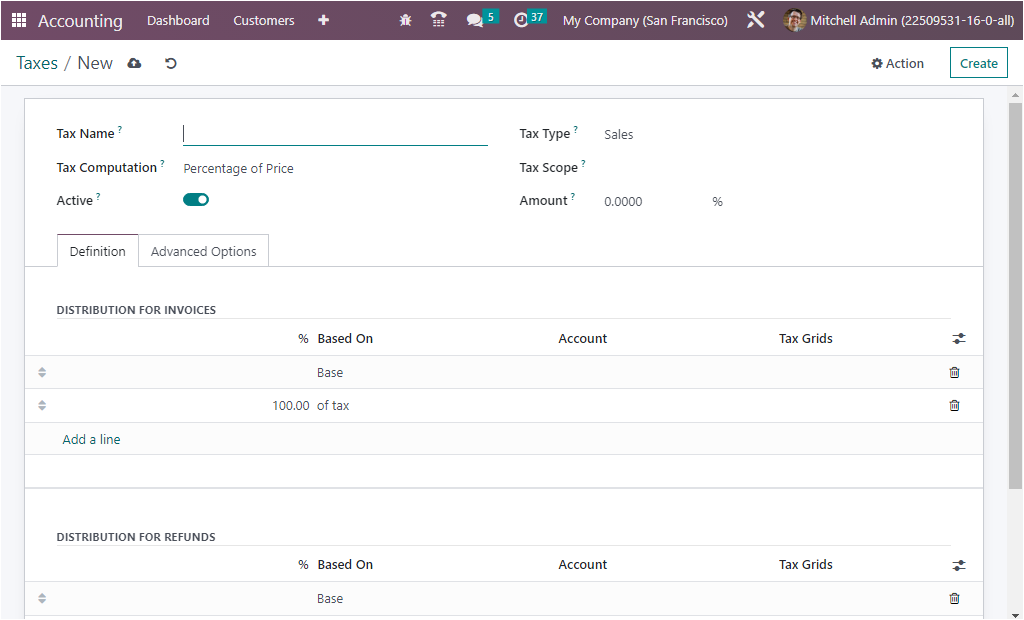

Step 4: In the Creation window of the Taxes, you can view various fields which are required to fill in to create a tax. The screenshot of the Creation form is given below.

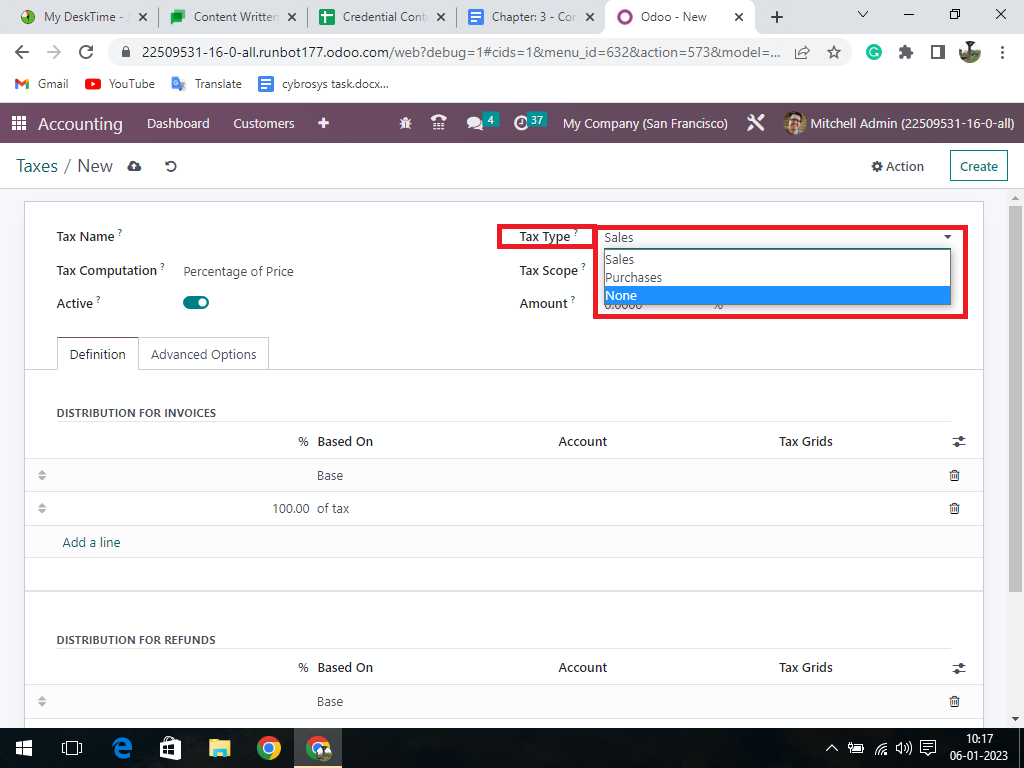

Here in the window, first, you can allocate the name of the tax in the Tax Name field. Next, you can mention the Tax Type. it can be either Sales, Purchase, or None, and it can be selected using the dropdown menu.

This Tax Type determines where the tax is selectable. The ‘None’ option denotes that the tax can’t be used by itself. However, it can still be used in a group. After filling this field with the suitable option, you can fill in the Tax Scope field. It can be selected as either Services or Goods. By applying this field, you can restrict the use of taxes to a type of product, like services or goods. Then you can mention the tax amount in percentage in the Amount field.

More than that, you can decide on the Tax Computation with the help of the dropdown. The drop down includes the options such as Group of Taxes, Fixed, Percentage of Price, Percentage of Price Tax Included, and Python Code. based on the selected option, you can define the Definition tab. Then you have the boolean field to set the Tax active, and you also have the provision to set the active to false to hide the tax without removing it.

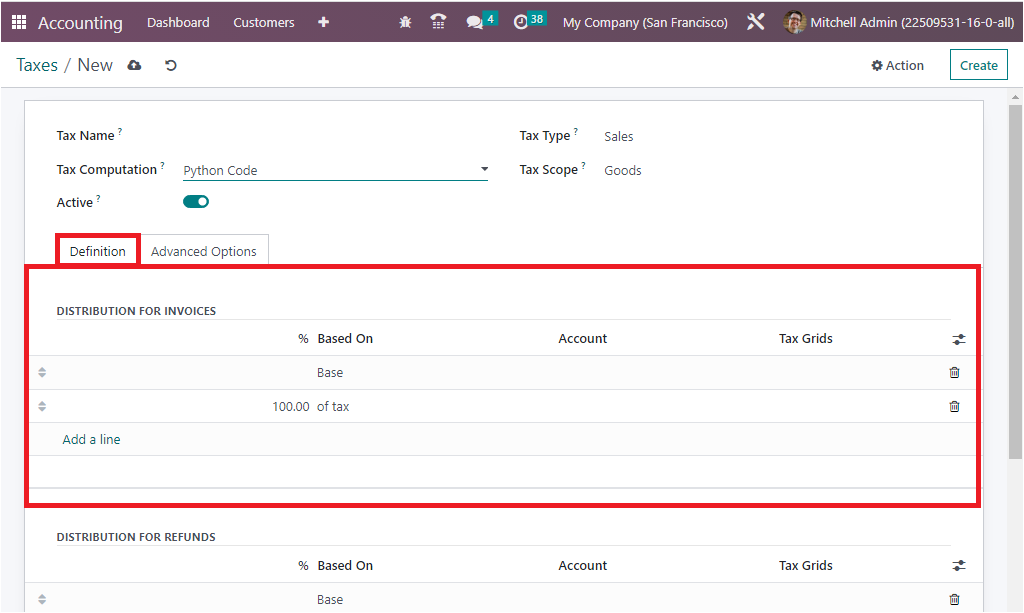

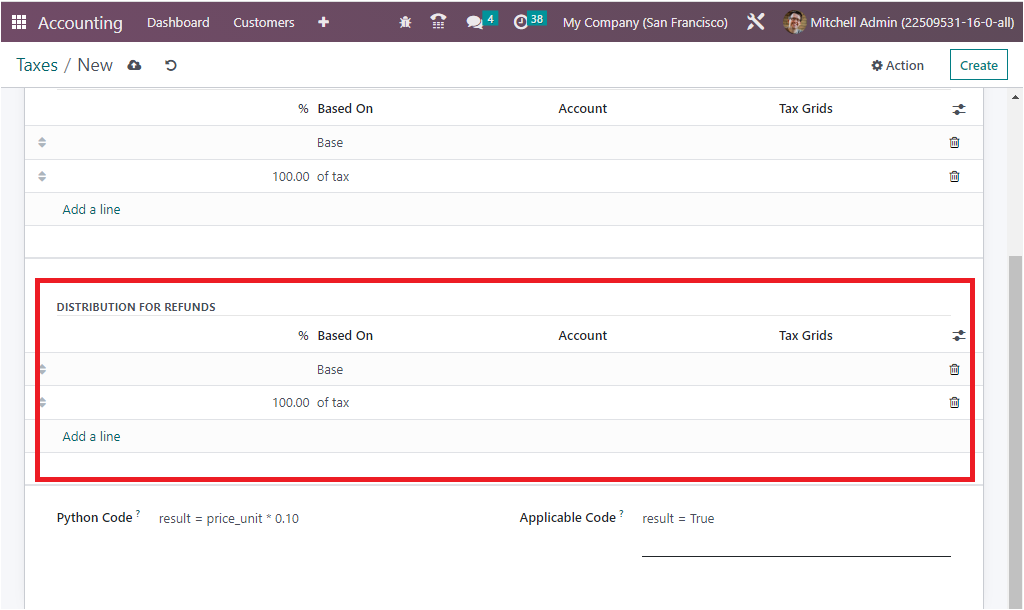

Moreover, you can also define the definition of the tax on the different facets of the business operations under the Definition tab. In all tax computations other than the Group Of Taxes, you should describe the Distribution of Invoices under the DISTRIBUTION FOR INVOICES section. Where you can define the Tax definition, the Percentage of which it is Based On, the Account on which to post the tax amount, and the Tax Grids using the Add a line option.

It is also possible to remove the existing definition and add a new one with the help of Add a line. Likewise, you are also able to define the DISTRIBUTION FOR REFUNDS using the same method.

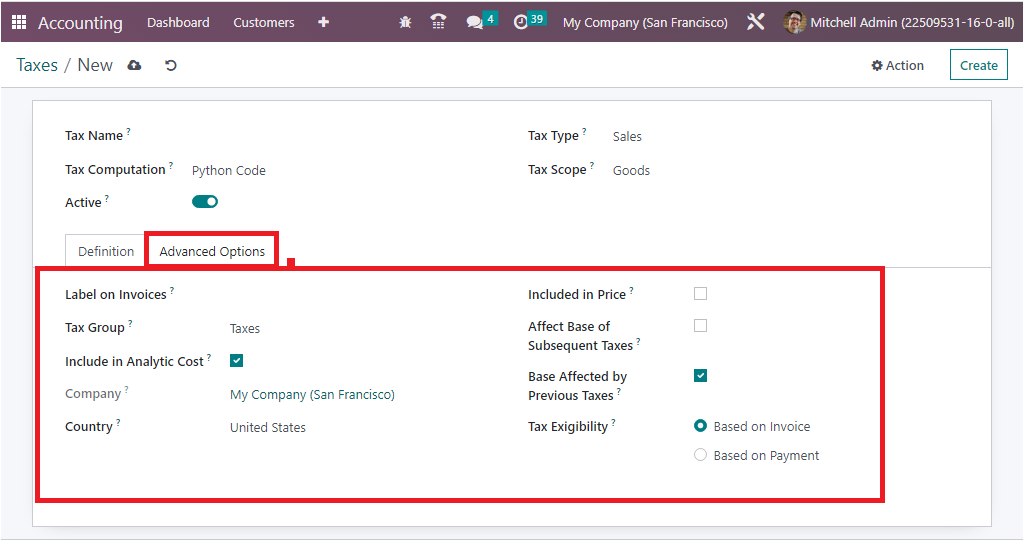

Furthermore, the Advanced Options tab available under the Taxes creation window included further fields such as Label on Invoices, Tax Group of the defined tax, and many more. The ‘Include in Analytic Cost’ can be disabled or enabled. If you enable this option, the amount computed by this tax will be assigned to the same analytic account as the invoice line. Then you can define the Company and the Country for which this tax is applicable in the respective fields.

In addition, you can check the box near the option ‘Included in Price’ if the price you use on the product and invoices includes this tax. Similarly, you have the ‘Effect Base of Subsequent Taxes’ field, which can be enabled for setting taxes with a higher sequence than this one will be affected by it, provided they accept it. Also, you have the ‘Base Affected By Previous Taxes’ field, which can be activated or deactivated. If you set this field active, taxes with a lower sequence might affect this one, provided they try to do it.

And finally, you have the Tax Eligibility field, where you have two options, which are Based on Invoice, and Based on Payment. If you select Based on Invoice, the tax is due as soon as the invoice is validated. If it is based on payment, the tax is due as soon as the payment of the invoice is received. The creation widow of the taxes for the advanced options is highlighted in the screenshot below.

Tax Groups

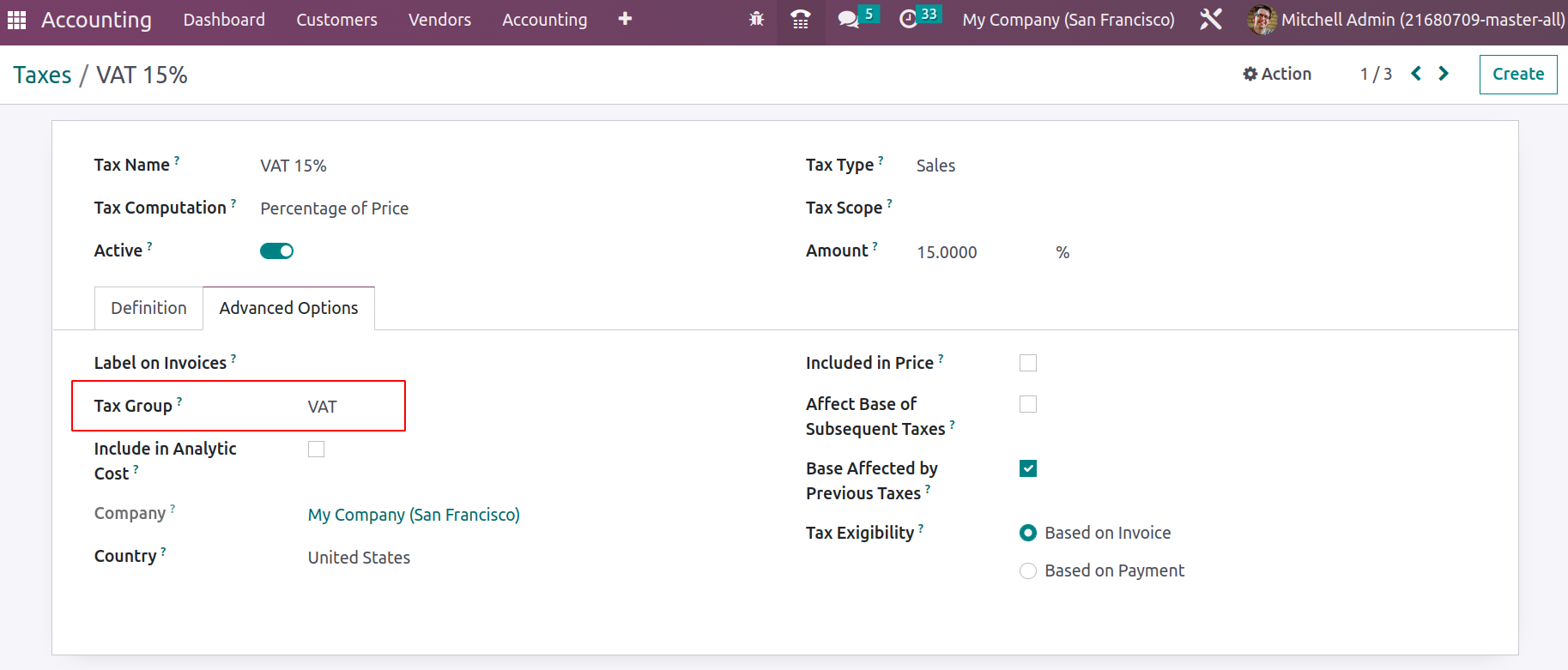

Tax groups are applied in the advanced settings of tax configuration in order to classify different taxes.

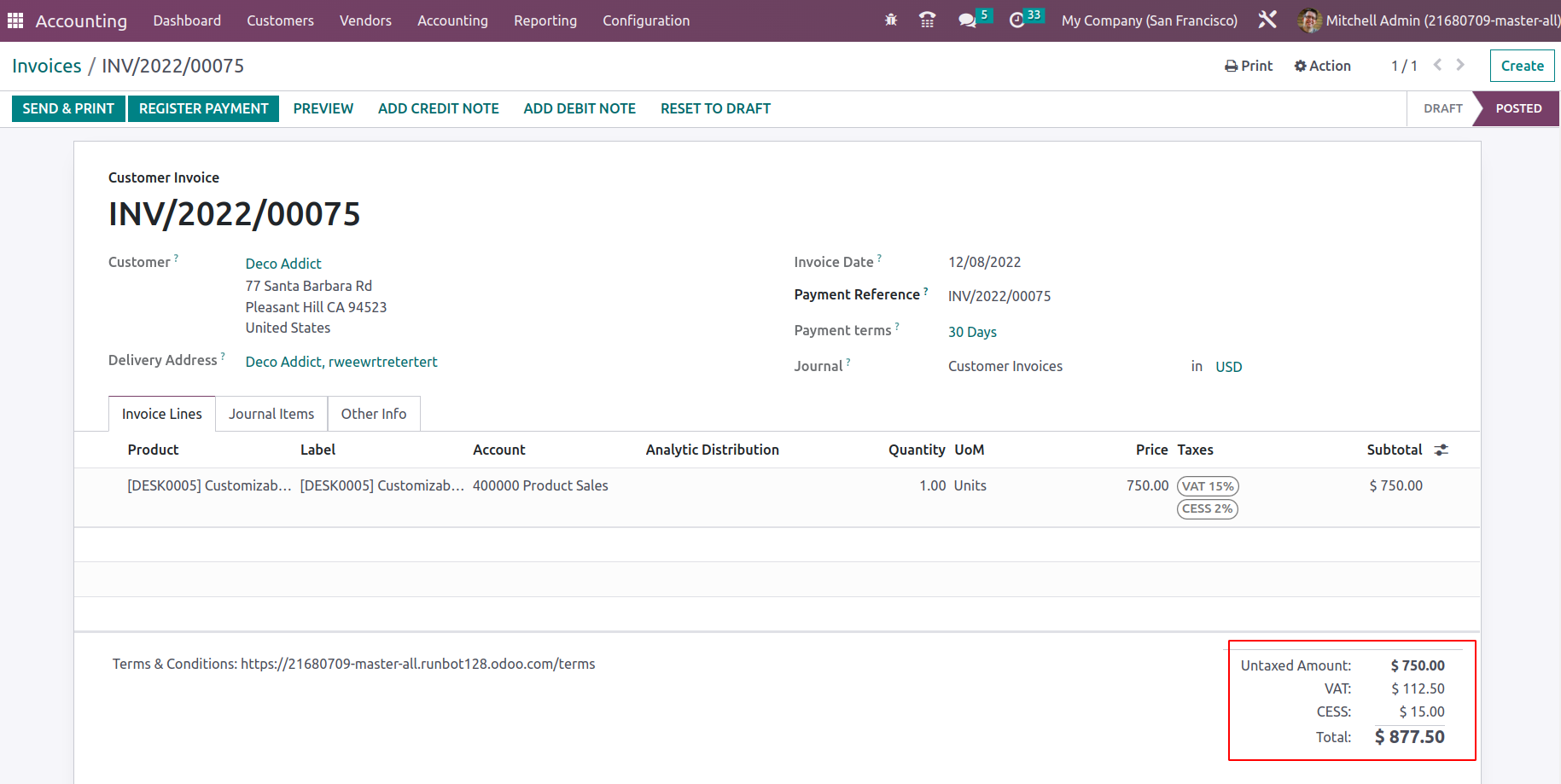

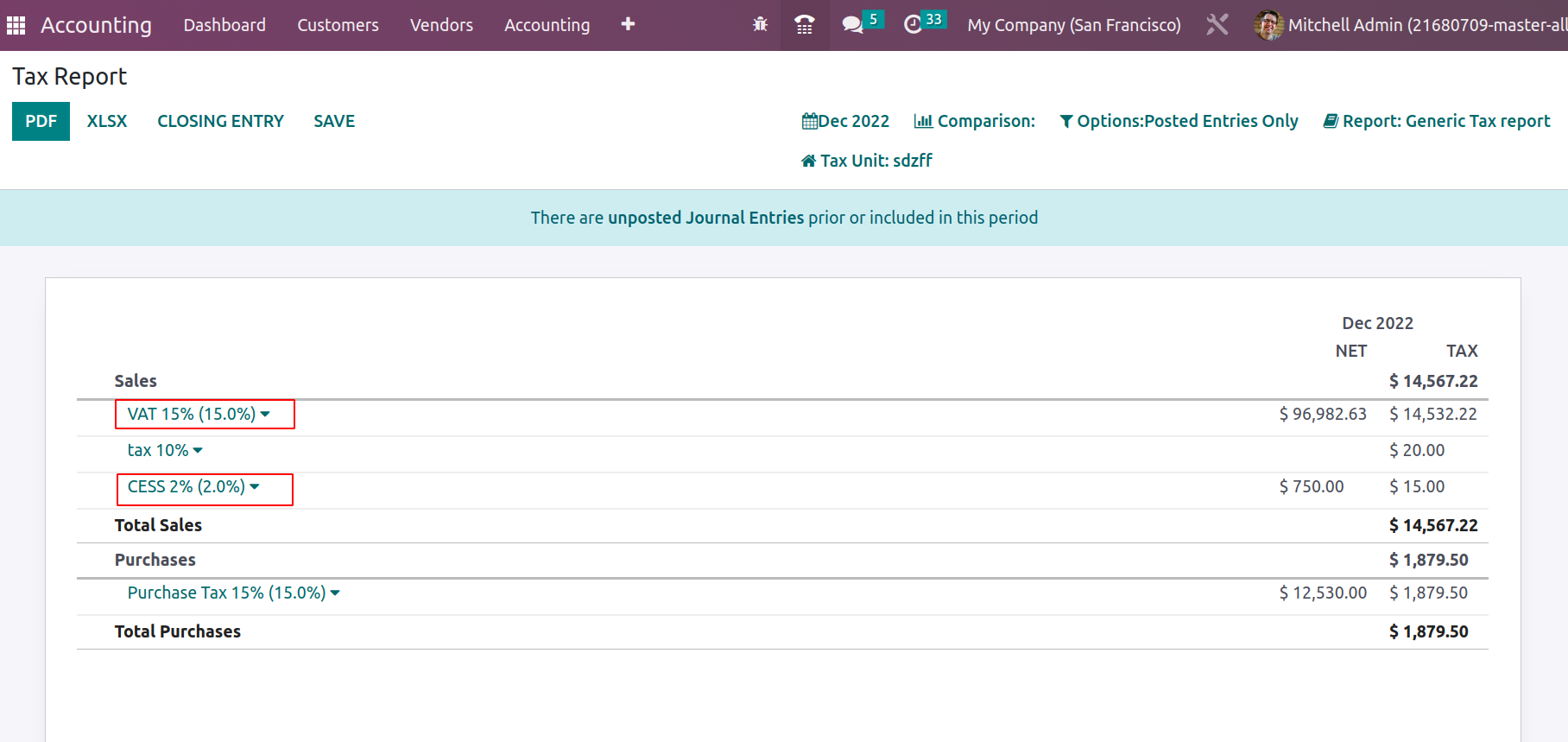

Depending on the country, there will be different types of taxes, including VAT, CESS, Retention Taxes, GST, etc. As tax is configured in odoo and applied on invoices/bills, which calculates the total, including tax amount.

In some scenarios, multiple taxes can be applied to an invoice. So in order to identify each tax distinctly, we can apply a tax group. Thus in the tax report and invoice, it depicts individual taxes.

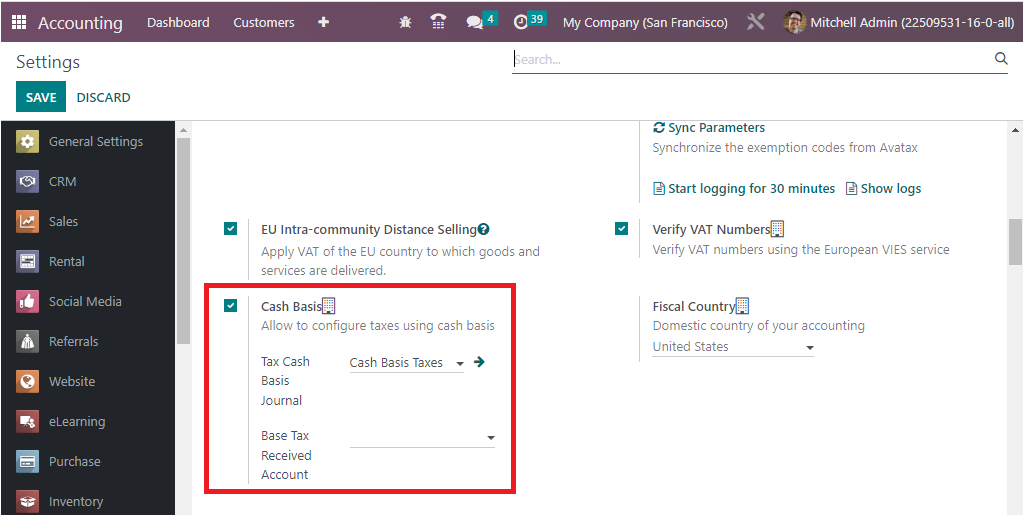

Cash Basis Tax Configuration

Cash Basis Tax configuration is the method of accounting in which revenue is recognized when money is received, and expenses are recognized when money is paid out. This type of accounting is convenient for businesses that don’t have many sales but do have a lot of expenses. This is one among the important aspects during operating with cash operations of your organization. The functioning of Cash basis in Odoo is configured in the manner that taxes are recorded when the payment is complete and not at the time of the product or service delivery and the validations of the invoice.

This feature allows you to book and report your taxes on a cash basis instead of an accrual basis. This can be useful for smaller businesses that need to report their taxes on an immediate basis, or for businesses that have to comply with specific regulations. With the Cash basis tax configuration, Odoo 16 Accounting will record your taxes as you pay them, giving you a more accurate and up-to-date view of your financial situation. This can help you better plan for tax payments and make sure you stay on top of your taxes.

To make available the Cash Basis Taxation in your Odoo platform, you are required to initially activate the Cash Basis option from the Configuration Settings window of the Odoo Accounting platform. Here in Settings, under the ‘Taxes’ section, as shown in the image below.

If you want to configure taxes using a cash basis, you should define the Tax Cash Basis Journal and the Base Tax Received Account. So it will create an entry for such taxes on a given account during reconciliation. Once you activate the option from Settings, then only you will be able to define the tax due in the Tax configuration window, as we mentioned earlier. This means, at the time of configuring taxes, the Advanced Options tab will display the option called Tax Eligibility, as shown below.

So when the Cash Basis Tax has been defined, the tax on the product or service will be credited to the temporary tax account and upon reconciliation. The corresponding amount will be credited to the Tax Received Account.

It is quite clear everything about the configuration of taxes and now let us discuss how to define Horizontal Groups in the next section.

This option will give an additional hit with the tax configuration and finance management of a company to comply with the rules of the state or the region of operation.