With Odoo16, introduced a new accounting feature Storno Accounting. Storno accounting

can be defined as the process of reversing original journal account entries by adopting

negative figures. This business practice of Storno Accounting is commonly used in

Eastern European countries. Some countries where Storno Accounting is mandatory

includes:

Once the encoding document is chosen, save the changes.

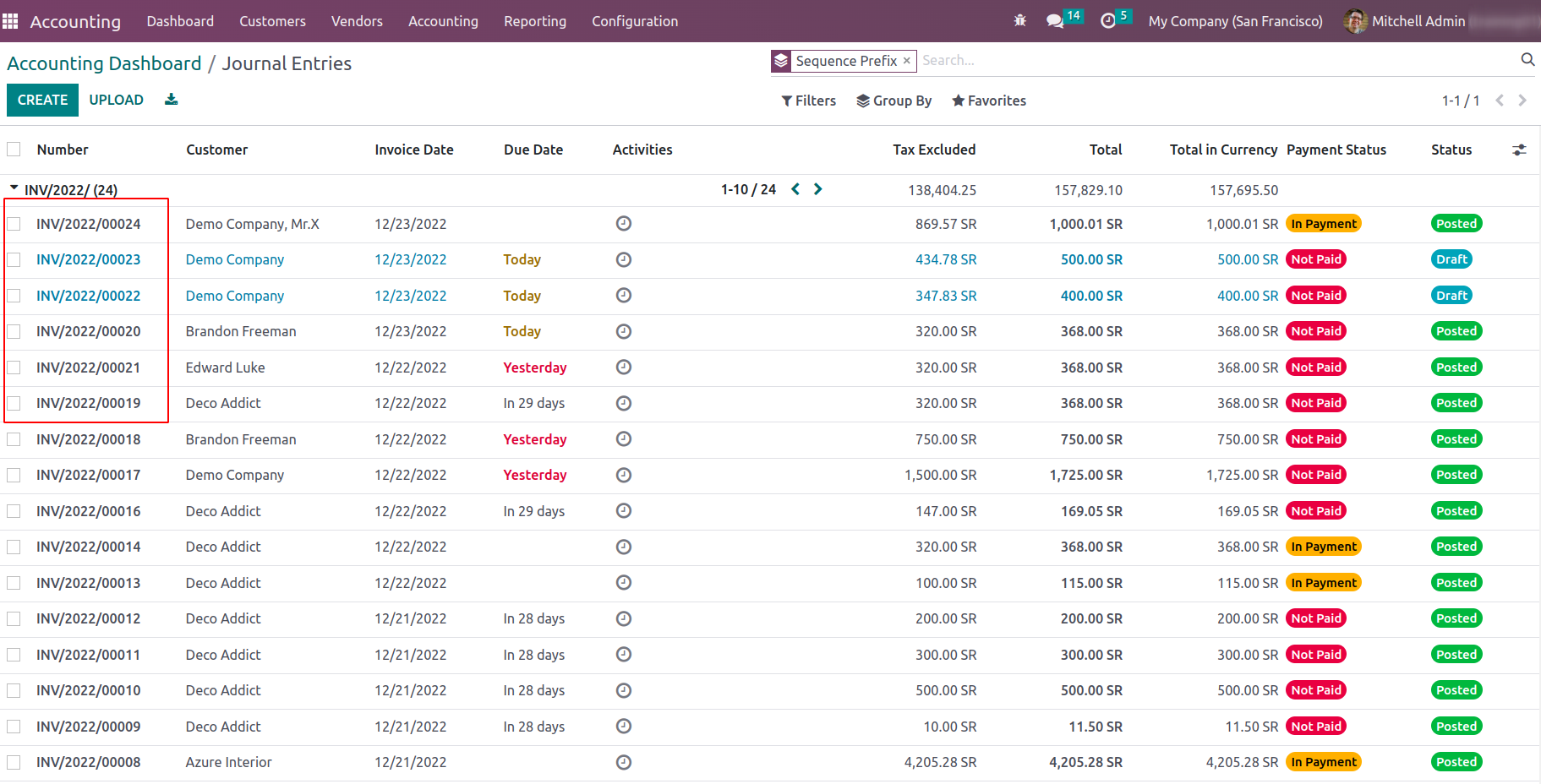

Invoice/bill encoding will be altered by accounting firm mode. On all invoices/bills,

the document's sequence becomes editable. The Invoices/bills will have a new field

called "Total (tax inc.)" that will appear in the document with the correct account

and tax, hence accelerating and controlling the encoding.

On confirming the sequence change to sequential order and the warning for sequence

gap will be removed from the accounting dashboard.

The Odoo Accounting module will act as the solution provider for the business operations

management operations of an Organization's beginning in dedicated tools and solutions

providers that will pave the way for the effectiveness in finance management of

the company. The Odoo Accounting book provides you with a complete insight into

the accounting management operations of your organization. In the book, we initially

discussed the overview of Odoo. Then we moved on to the aspects of the Configuration

options and tools available in the Odoo Accounting module, which will prove the

base for the operations and its management.

In the next chapter, we focused on the Configuration tools in the Accounting module

where all the configuration options such as the Accounting configurations, Payment

Options, Management Options, Analytical Accounting, Configuring Invoicing, and the

Configuring Bank Payments, which provides an insight on how the Configuration tools

in Odoo can be configured as per the best of needs that is available. In the fourth

chapter, we focused on the Financial management aspects of vendors and customers

with Odoo Accounting. The Accounting Module Dashboard, Customer Finance management

with the Odoo Accounting module, and the Vendor management operations of the Odoo

Accounting module were described.

In the fifth chapter of the book, we focused on the Accounting management tools

in the Odoo Accounting module, where the Accounting Management tools, Accounting

Management Actions, Accounting Ledgers, Journal Management, and Other Miscellaneous

entities management will be described in detail. Further, in the 6th chapter, we

described on the Reporting the best feature of Odoo Accounting, where the topics

such as Audit Reports, Management based Reporting, Partner Reports, and the US GAAP

reports were described in detail along with the illustrations of the Odoo platform,

which has been described.

In the 7th chapter of the Accounting book of Odoo, we focused on the Configurations

of Admin settings of the Odoo platform, where the aspects of User settings, Company

settings, and the Translation settings of the Odoo platform and its operations in

the Accounting module were described in detail. Finally, in this last chapter, the

new accounting practice Strono Accounting and Accounting firms mode introduced in

Odoo 16 is defined.

In general, it could be said that the Odoo Accounting module filled the gap in the

Odoo resource regarding the need for Functional reference materials in regards to

the Odoo Accounting module.