Journal entries are the first step in the accounting cycle and are used to record

all financial transactions in the accounting system. A journal entry is simply an

accounting record of a business transaction that includes the details of the transaction,

such as the date, amount, account affected, and a brief description of the transaction.

Journal entries are a key part of the double-entry accounting system, which requires

that every financial transaction be recorded in at least two accounts.

In Odoo 16 Accounting, Journals are the documents that are used to record accounting

transactions. Journals are used to record sales, purchases, receipts, payments,

and other transactions which affect the financial position of the company. Journals

also provide a summary of the company’s financial position at any given point in

time. It can be used to reconcile accounts, analyze financial trends, and produce

reports. It will provide a record of the date, amount, and purpose of each transaction.

Journals can be created for specific periods such as monthly, quarterly, and annually.

As we know, Journals are the significant facets of accounting operations in any

company that will help you to define the specific operations as categorizing and

the financial operations are based on it. Every type of business requires journal

entries and maintains them. The Odoo Accounting module possesses a powerful feature

that allows for the creation and management of custom journals. Using this option,

you can define every journal. For managing it, Odoo furnishes a separate menu called

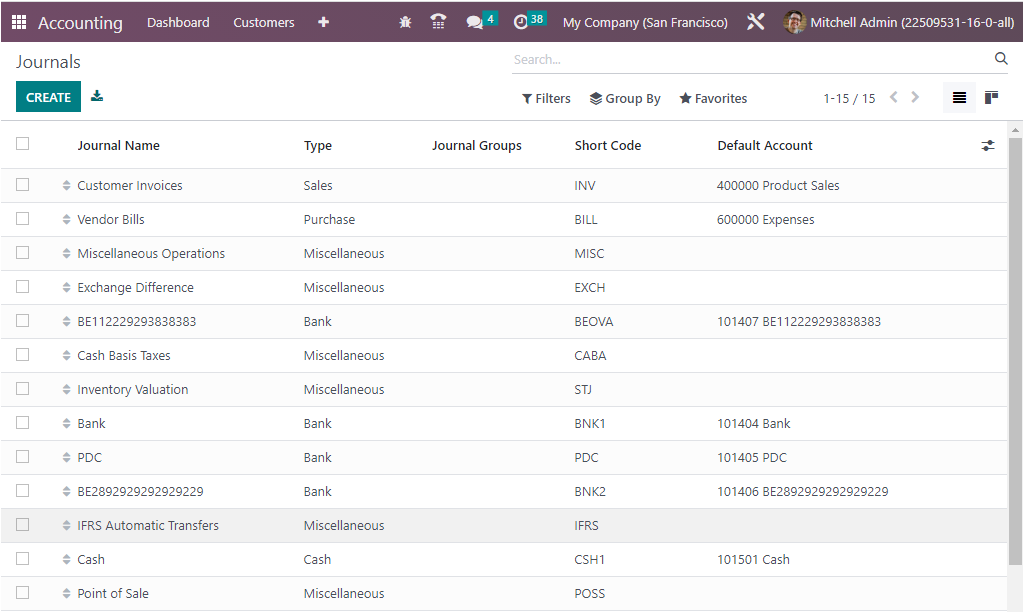

Journals under the Accounting section of the Configuration menu. The screenshot

of the Journals window is depicted below.

The Journals window clearly depicts the preview of the previously configured Journals

and also offers a CREATE button to create a new Journal. The window depicts the

significant details of the Journals, such as Journal Name, Type, Journal Group,

Short Code, and Default Account, as seen in the image above. The window can be viewed

in both Kanban and List view by choosing the respective menu icon placed on the

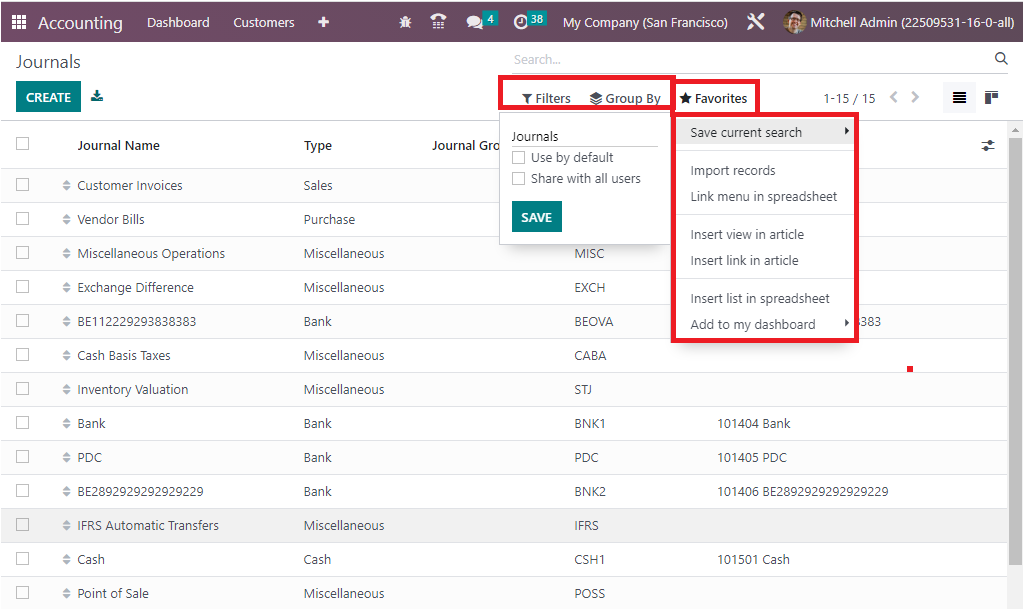

top right corner of the window. The default and customized Filters and Group By

options are also available together with the Search bar. The Favourite tab includes

various menus such as Save current search, Import records, Link menu in spreadsheet,

Insert view in article, Insert link in article, Insert list in spreadsheet, and

Add to my dashboard performing respective operations.

All these options are very useful for quickly retrieving the needful journal from

the longer list of defined journals. In addition, the dedicated Odoo module is very

comfortable in specifying the journal Types based on the default ones that are already

defined. Also, you can choose a journal type for a respective journal that is being

defined. The journal can be Sales, Purchase, Cash, Bank, and Miscellaneous.

The Sales journals in Odoo Accounting are journals used to record all sales transactions

in a company. These transactions may include Sales orders, deliveries, invoices,

customer payments, and any other related transactions. Sales Journals allow for

easy tracking of all sales-related information and can be used to generate various

reports such as Sales reports, sales trend analysis, and more.

Purchase Journals can be used to record all the purchase transactions that are related

to the business. These journals are used to track the cost of the goods and services

purchased and to create financial statements. The journal entries are used to record

the debit and credit side of the purchase and to post the entries to the general

ledger. The Purchase Journals are used to track the cost of the goods and services

and any tax associated with the purchase. The purchase journals are used to record

the purchase of inventory, the purchase of raw materials, and the purchase of finished

goods.

As we defined earlier, the Sales Journal is used to define all the Sales operations

entries of an organization likewise, the Purchase journal defines all the purchase

operations of the company. Similarly, the Cash Journal will define all the cash

operations entries with respect to the functioning of the company. Moreover, the

same as in the case of Bank Journal, where all the Bank based transactions are being

entered.

A miscellaneous Journal in Odoo Accounting is a type of journal entry used to record

any transactions that do not fit into the standard categories of transactions. It

can be used to record such items as discounts, returns and allowances, bank charges,

and other miscellaneous items. It is also a way to adjust the account balance of

any accounts that require adjustments outside of the normal accounting period. The

Miscellaneous Journals in Odoo Accounting include:

- General Journal

- Adjustment Journal

- Inventory Adjustment Journal

- Currency exchange journal

- Stock valuation

- Expense Journal

- Journal Entries

- Tax Journal

The Miscellaneous journal will allow you to manage all the entries which do not

fall into the other journals.

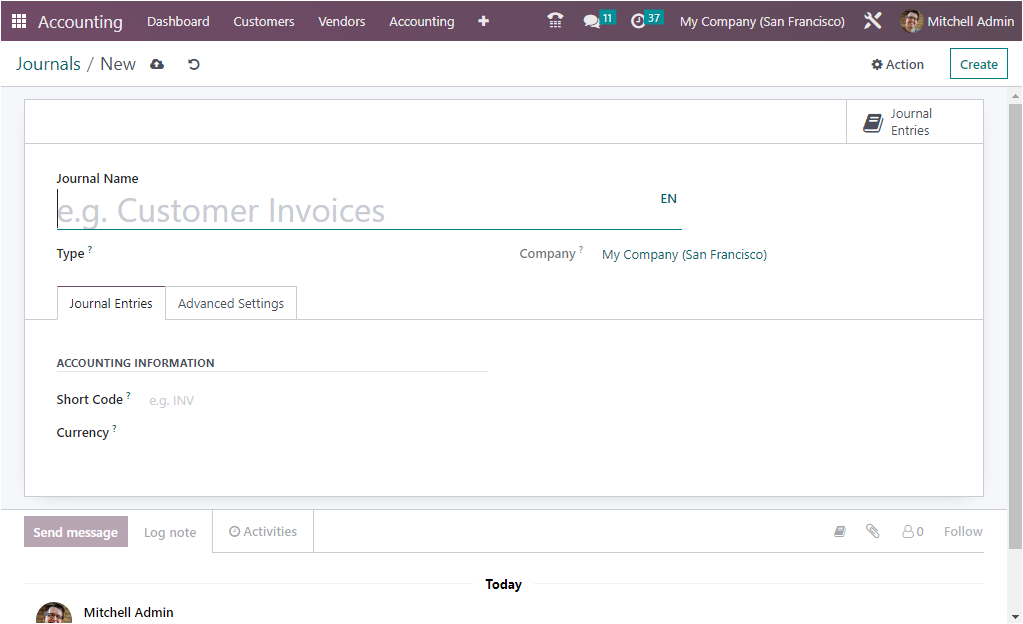

Now, to configure a new Journal, go for the CREATE button that can be accessed from

the top left corner of the Journals window.

First of all, in the creation form, you can mention the Journal Name. Then you can

pick the corresponding Journal Type using the dropdown menu. The dropdown menu depicts

all the journals, such as Sales, Purchase, Cash, Bank, and Miscellaneous. In addition,

the Journal Entries menu will allow you to define the Accounting Information, such

as Short Code and Currency. The Short Code field can be filled with the shorter

name which you want to display. The journal entries of this journal will also be

named using this prefix by default. It is very useful for ensuring that the invoices

and the credit note entries starts with the allocated code. For example, if we define

short code as INV, then when generate invoices, it will start with the term INV

and then follows the sequence number. Also, the currency used to enter statements

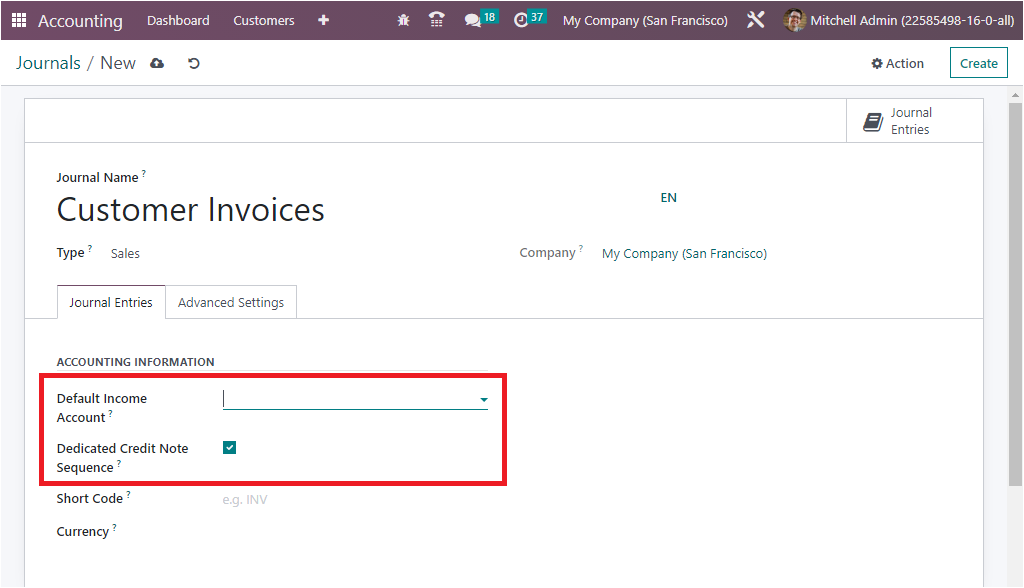

is mentioned in the Currency field. Additionally, based on the selected Type of

journal, the window will display additional fields. If you select Sales as the type,

you will get additional fields such as Default Income Account and Dedicated Credit

Not Sequence. You can create a new one or can also select the default one from the

dropdown menu. The Dedicated Credit Note Sequence option can be activated if you

don’t want to share the same sequence for invoices and credit notes made from this

journal.

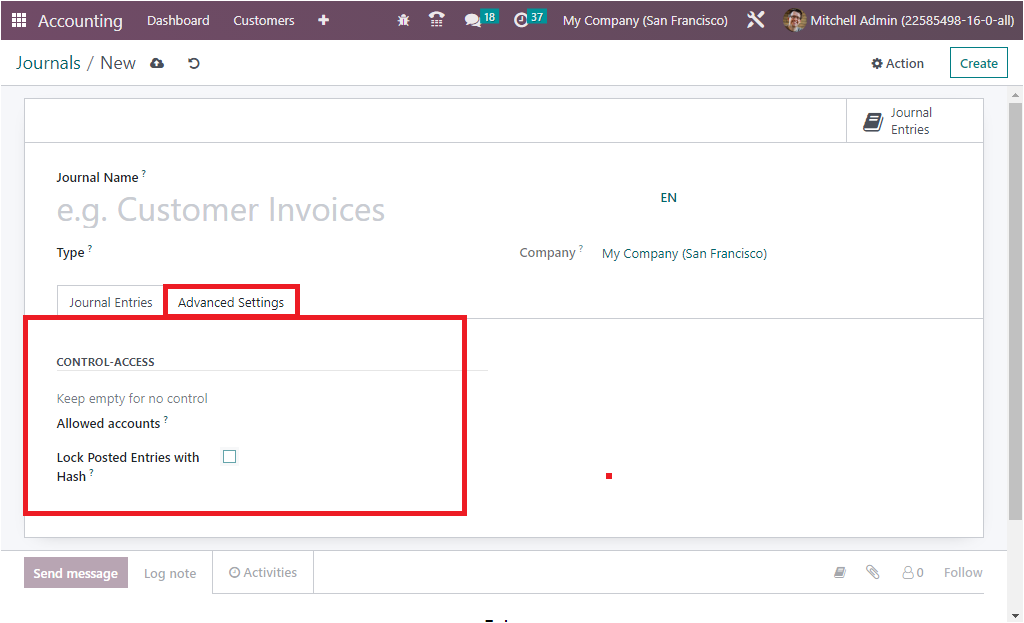

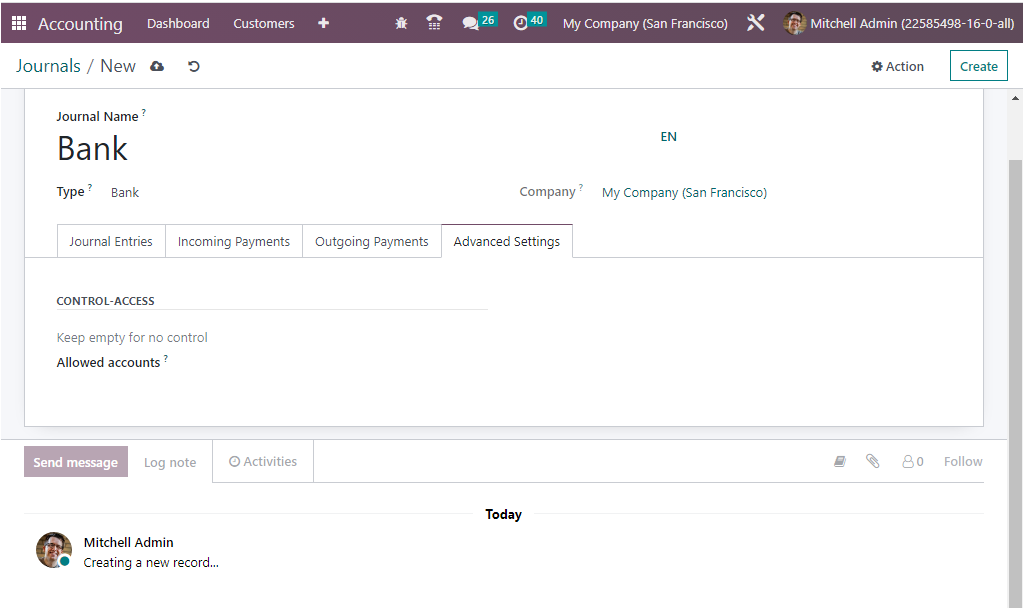

Further, under the Advanced Settings tab, you have the CONTROL ACCESS section, where

you can specify the Allowed accounts in the corresponding field with the help of

the dropdown menu. If you don't want any control, you can keep these fields empty.

The ‘Lock Posted Entries with Hash” field can be enabled or disabled. The accounting

entry or invoice receives a hash as soon as it is posted and cannot be modified

anymore if when you activate this field. This is very advantageous to ensure that

any invoice created under a specific journal does not undergo any changes. That

means it cannot be reset to draft or modified to any form once it is posted.

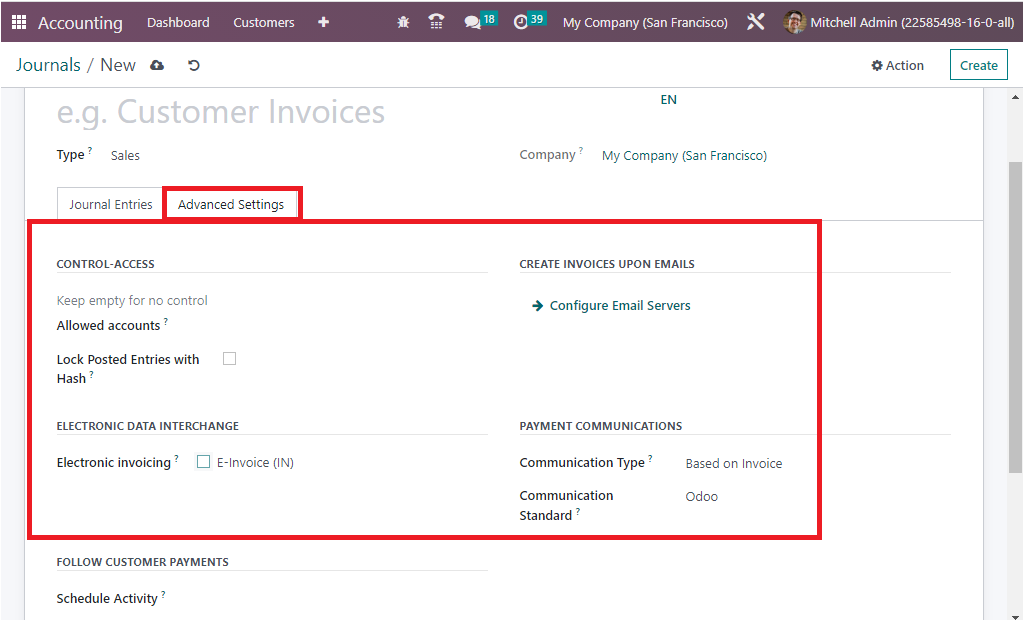

If the Type is Sales, you will also depict the additional fields under different

sections, such as PAYMENT COMMUNICATIONS, CREATE INVOICES UPON EMAILS, and FOLLOW

CUSTOMER PAYMENTS.

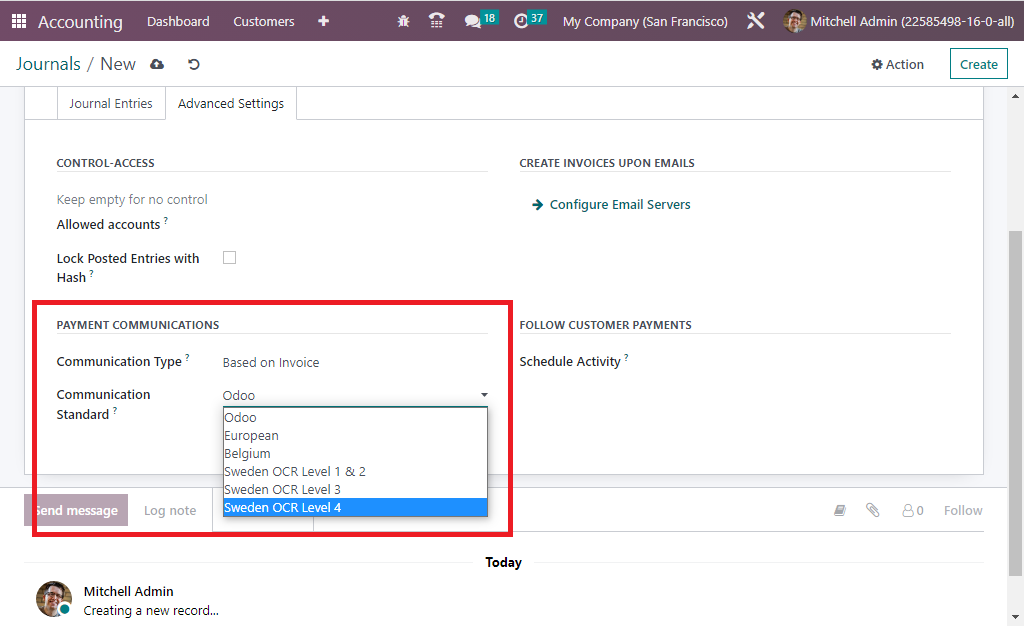

PAYMENT COMMUNICATION includes Communication Type and Communication Standard fields.

In the Communication Type field, you can set the default communication that will

appear on customer invoices, once validated, to help the customer to refer to that

particular invoice when making the payment. Here you have three options to choose

from, which are Open, Based on Customer, and Based on Invoice. Like wise, you can

also describe the Communication Standard field. With this field, you can choose

different models for each type of reference the default one is the ‘Odoo reference.’

Further, you can configure Email Servers in the CREATE INVOICES UPON EMAILS section.

It will be effective for making sure that if the email is being received under the

respective server domain, an invoice will be created. Also, the ELECTRONIC DATA

INTERCHANGE section allows you to send XML /EDI invoices through Electronic invoicing.

For that, you can activate the E-Invoice(IN) option. Electronic Invoicing will be

available if the respective module for ‘e-invoicing’ is installed, which will be

available with accounting localization. On enabling this feature an XML/EDI document

will be generated and attached along with invoices and credit notes.

Also, you have the field to Schedule Activity for the following customer payments.

When you define any activity, it will be automatically scheduled on the payment

due date, improving the collection process. You can choose the activity with the

help of the drop-down menu.

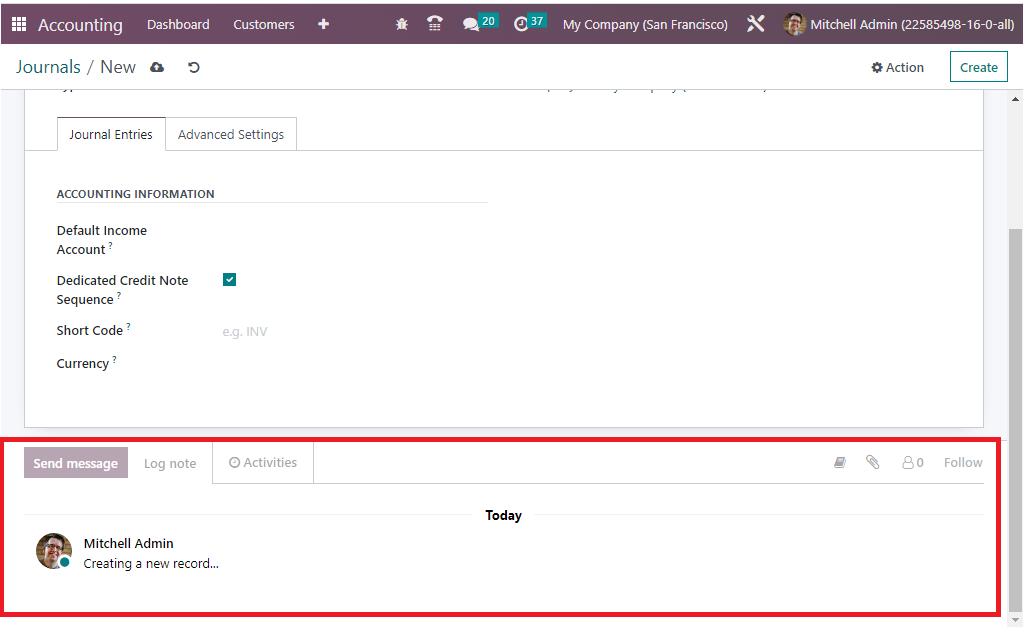

Finally, you have the option for sending messages as well as for describing log

notes to the followers of the corresponding journal. These followers may be the

other users of your Odoo platform who may be employees of your company or associated

members. The Send Message option is very useful for notifying any relevant information,

and the Log Note option assists you in marking the changes done by the employees

and details it together with the time and date.

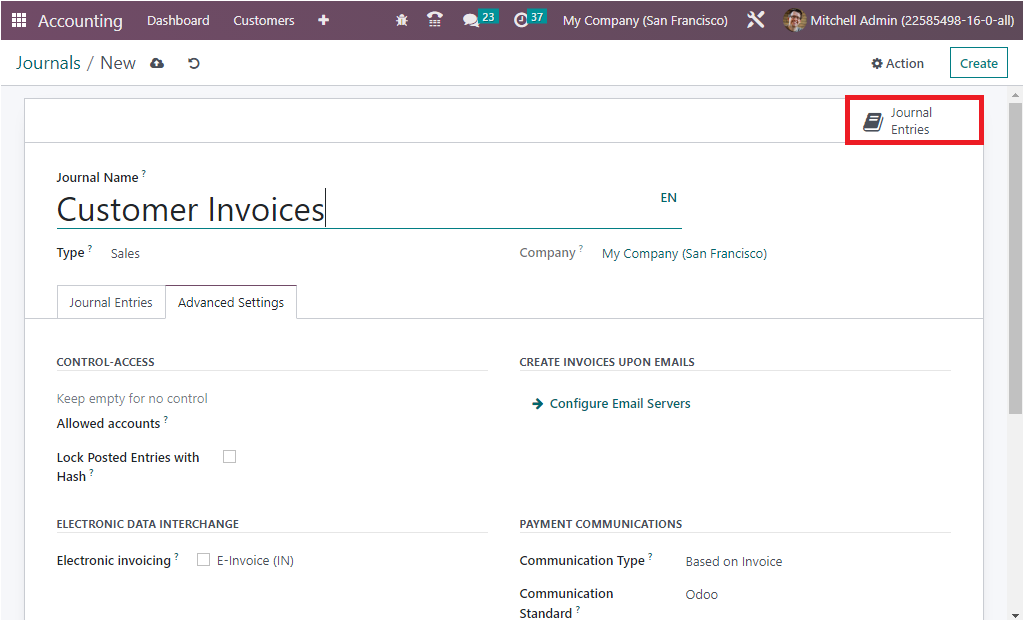

In addition to all these options, you can view the smart tab on the top right corner

of the window, as picturized in the image below.

The smart tab ‘Journal entries’ will show all the journal entries recorded in that

particular journal.

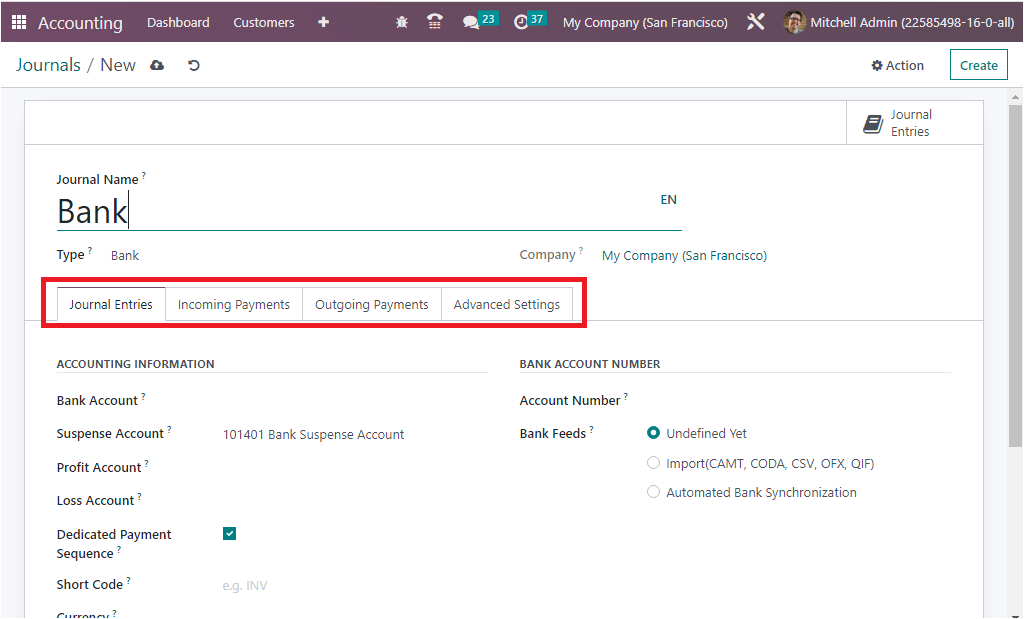

Now we are clear on the configuration of the Sales journal type. The Journal creation

steps of the Sales, Purchase and Miscellaneous are the same in the Odoo. now let

us discuss the configuration steps of the Bank journal, which show differences from

the Sales, Purchase, and Miscellaneous journal types.

When you select the Journal Type as Bank, the creation window will depict the different

tabs such as Journal Entries, Incoming Payments, Outgoing Payments, and Advanced

Settings.

Under the Journal Entries tab, you are required to describe the detail regarding

Journal Entries. So you can define the ACCOUNTING INFORMATION such as the Bank Account,

Suspense Account, Profit Account, Loss Account, Short Code and Currency details.

The Suspense Account is used to post bank statement transactions until the bank

account is reconciled to the payments, so the suspense account will function as

the temporary account till the reconciliation of the bank statement transactions

for the respective journal operation. Likewise the Profit Account is used to register

a profit when the ending balance of a cash register differs from what the system

computes. Similarly, the Loss Account are beneficial to register a loss when the

ending balance of the cash register differs from what the system computes. The section

also displays the Dedicated Payment Sequence option for activating.

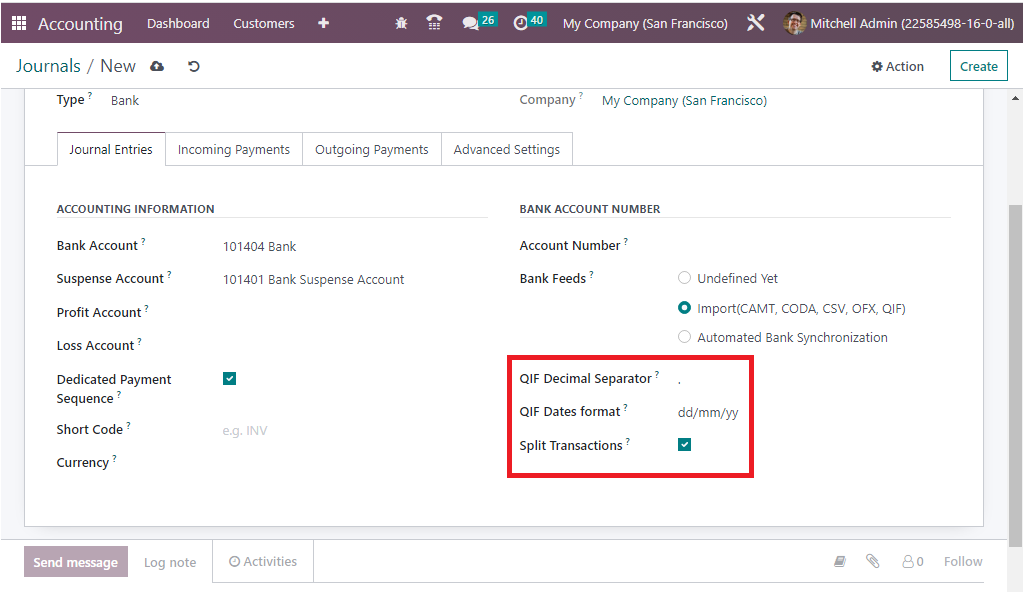

Furthermore, in the ‘BANK ACCOUNT NUMBER’ section, the Account Number can be defined

in the corresponding field. Also, you have the option to define Bank Feeds, and

based on your selection, the bank statement registration will be done. Here you

have three options such as Undefined Yet, Import(CAMT, CODA, CSV, OFX, QIF), and

Automated Bank Synchronization. When you are choosing the Import option, you will

depict further fields such as QIF Decimal Separator- which is applicable to avoid

conversion issues and QIF Dates format - here, you can choose either dd/mm/yy or

mm/dd/yy based on the company. The third field is Split Transactions which can be

activated for split collective payments for CODA files. The Import option allows

you to import details from the dashboard.

Automated Bank Synchronization can be chosen for making the Odoo platform accessible

for fetching the invoice payment information straightly from the bank servers. Also,

from the Dashboard, you will prevail the review of the synchronized operations.

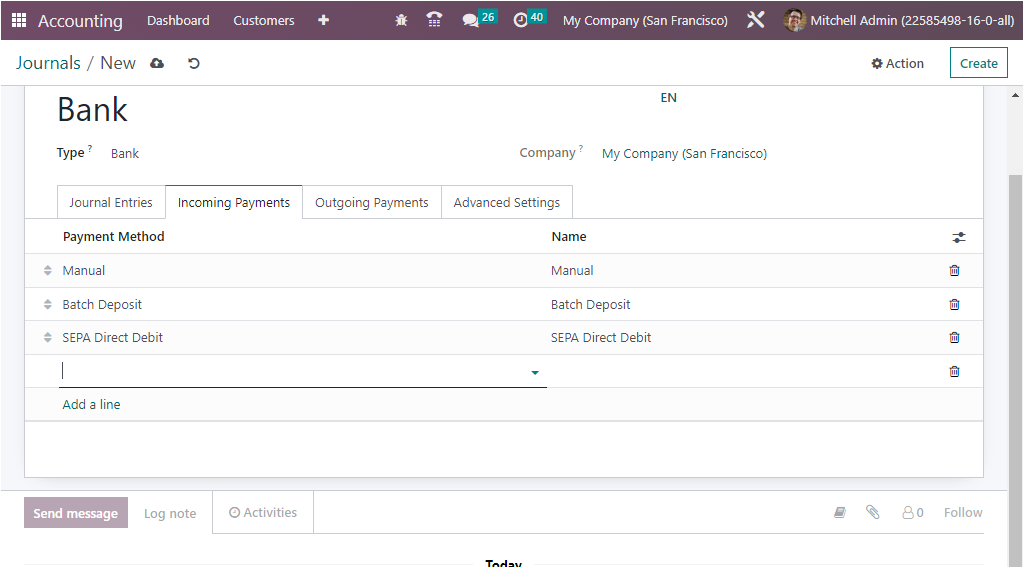

Now in the Incoming Payments tab, the incoming payment configuration details can

be defined. So you can define the Payment Method and Name using the Add a line option.

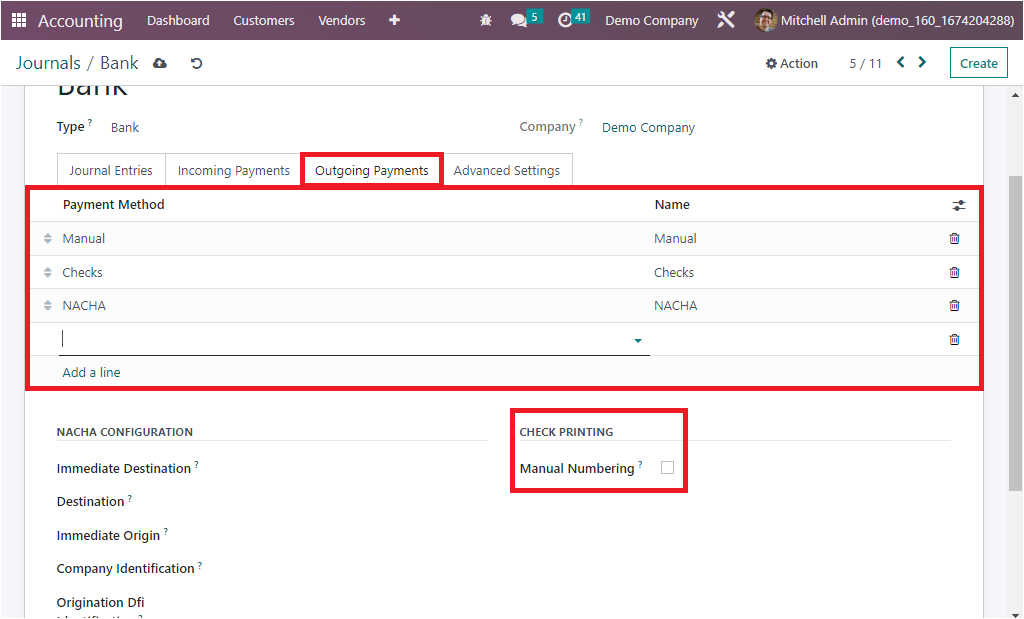

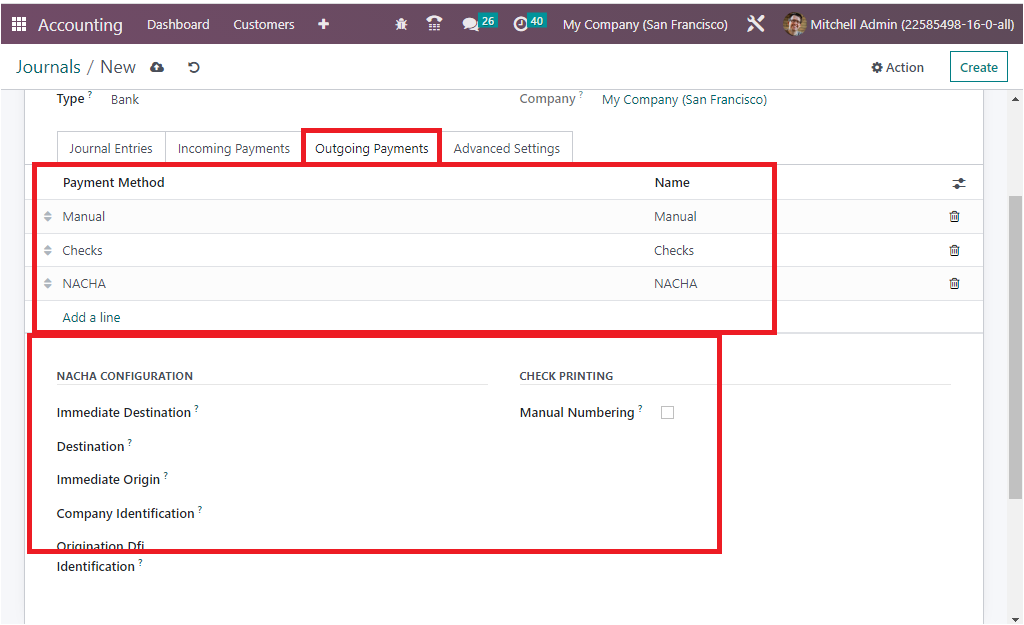

Under the Outgoing Payments tab, you have to configure the outgoing payment methods.

It is almost the same with the Incoming Payments, so you can define the ‘Payment

Method’ and ‘Name’ using the Add a line option. You can view the dropdown menu and

can choose the method and can apply. If the payment method is a new one, you can

configure it without much effort. Moreover, the Manual Numbering field displayed

in the CHECK PRINTING section can be activated if your preprinted checks are not

numbered.

Also you have the NACHA CONFIGURATION and where you have a lot of fields such as

Immediate Destination, Destination, Immediate Origin, Company Identification, Origination

Dfi Identification, and all these details will be provided by the bank. Also, Manual

Numbering under the CHECK PRINTING field can be checked if your pre printed checks

are not numbered.

NACHA Configuration

NACHA is an acronym for National Automated Clearing House Association compatible

ACH file, which will be available in US localization in order to generate the NACHA

file. Details like immediate destination, immediate origin, company identification,

and origination Dfi identification can be provided at the required place. When you

are approved to transmit payments via ACH, your bank will often give you the details.

Vendor payment can be done with this payment method and its corresponding NACHA

file can be generated.

If we consider the Outstanding Account operations, it will be like, whenever a customer

generates the payment for the invoice, it doesn’t credit the bank account directly,

instead, it will be fall into the Outstanding Receipt Account, which can be defined

here. After reconciling the Bank statement and the payment automatically or manually,

only the payment will be credited to the bank account of the company. Likewise,

when we consider the case of Purchase payment, the amount for the vendor bill will

be generated from the Accounts payable, and will be moved to the Outstanding Payments

Account and then, when the bank statement reconciliation takes place in relation

with the vendor bill bank will be reconciled with outstanding payment entries instead

of the payable account.

The last tab available in the Journals configuration, Advanced Settings, is same

as the Sales, Purchase, and Miscellaneous accounts. So the account operation details

for the Cash and the Bank journals can be configured based upon the operational

requirements.

These are the right way you can define and edit the Journals and these journals

can be used for defining journal entries for an organization’s finance management.

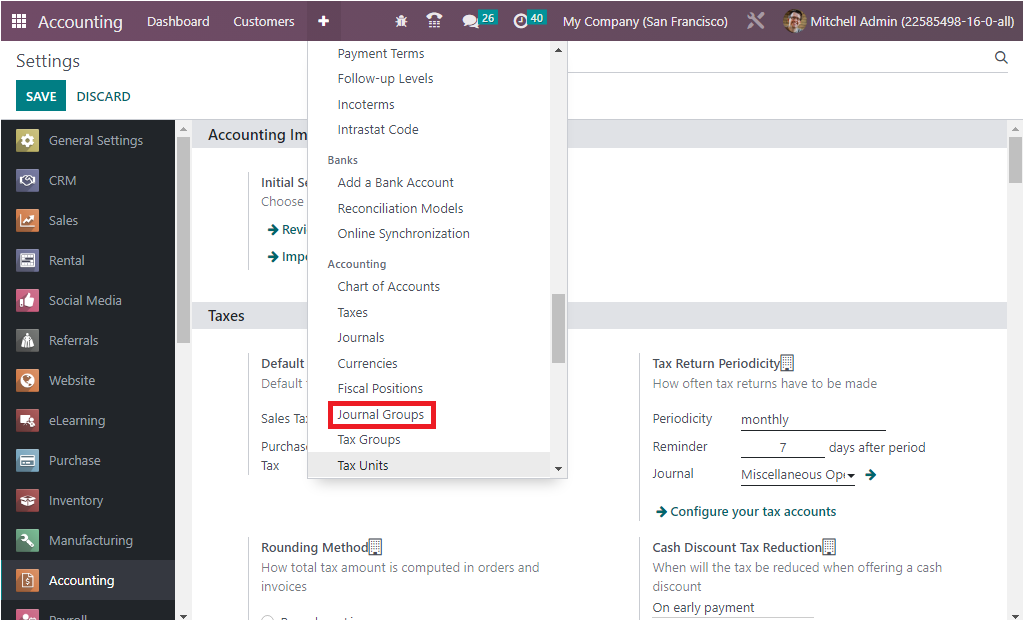

Now we have every aspect regarding the Journal configuration and now we can take

a look at the Journal Groups which is significant for classifying the journals.

Group your journals

Categorization is an important factor in business operations where you will get

a chance to categorize various elements of business operations. Which will help

you to segregate the whole operation into delicate discs. The Odoo platform allows

you to define multiple journals for the smooth functioning of the accounting operations

of a company. While defining journal entries in different journals, there is a great

chance for mixing up the entries. So the Odoo platform developed a unique feature

to group the journals. This advanced feature will be excessive support for the classification

of all the configured journals.

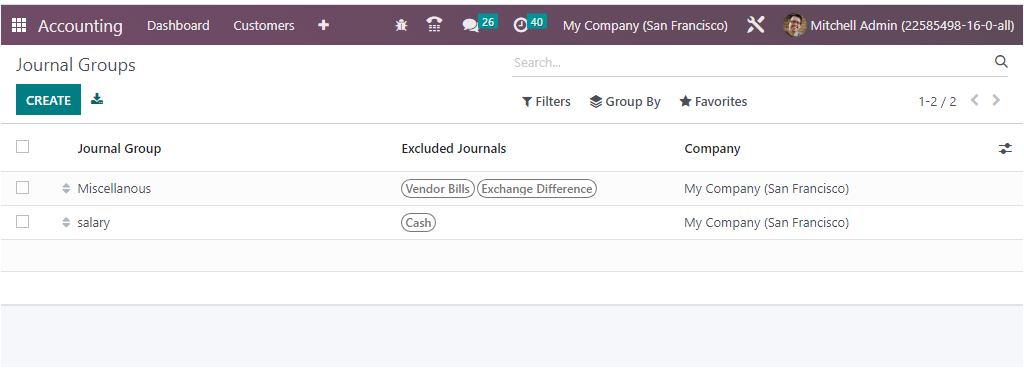

To get access to the Journal Groups menu, go for the Configuration menu of the Accounting

module, where you can view all the journal groups previously described in the Journal

Groups window as shown below.

When you click on the Journal Groups menu, you will enter into the window.

The CREATE button allows you to create new Journal Groups. The moment you go over

the CREATE button, a new line will be displayed in the same window for configuring

journal groups. There you can provide the Journal Groups Name, and can give out

the Excluded Journals. The Company field will be auto-allocated and can be altered.

The different sorting functionalities available in the Odoo is also available in

this window. The default and customizable filters and Group By options help you

to quickly sort out the required groups.

In the Odoo Accounting module, Journal Grouping is one of the outstanding features

that allows you to organize your accounting journals into groups. The groups can

be used to better manage accounting information and simplify reporting. This feature

makes it easier for users to track and view your transactions in one place. Journal

grouping also helps to ensure accuracy in the financial records by providing a centralized

way to compare the different types of transactions. These categories can then be

used to organize and analyze financial data in a more efficient manner. This feature

can be used to group journals by company, type of transaction, or other criteria.

This allows users to quickly search for and access specific journals when needed.

Journal gro

uping also helps users keep their accounts organized, as journals can

be grouped according to the type of transaction. It also helps with accounting reconciliation,

as users can easily identify which journals need to be reconciled.

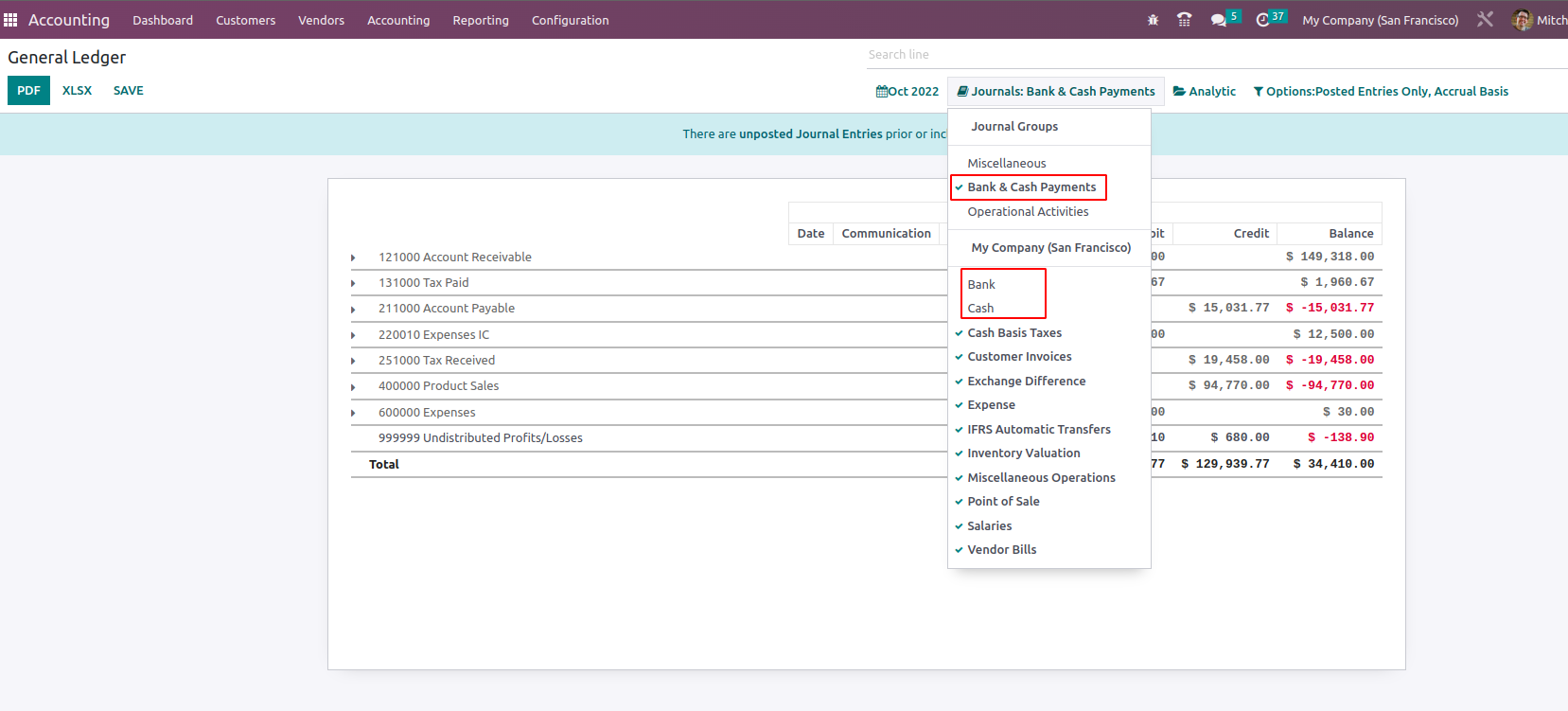

These Journal groups are used in reporting to display relevant data together. You

can fulfill the Filtering and Group By aspects of different journal’s operations

and accounting operations. The Odoo platform gives extreme prominence for report

generation, and various kinds of accounts-related reports can be obtained within

seconds with the help of filtering tools. You only need to set Journal Types as

the filtering aspect to make the process easier.

It is also possible to select the Chart of Account Types for the respective one

while defining it because it has the convenience of sorting out the needs of the

accounting information as regards to the Chart of Account Types which are being

defined.

The Chart of Account Types can be also be selected for the respective one while

defining it, this will be beneficial for the filtration aspects of the accounting

information with respect to the Chart of Account Types which are being defined.

As the journal group ‘Bank & Cash Payments’ is chosen in the report, it will exclude

the accounts mentioned in the journal from the filter of reports.

So the Journal Group feature has a significant impact on the accounting department

of any organization for the smooth running of journal management operations.

We had an understanding of everything regarding the Journal Groups functionality,

and now let us catch a glimpse of the Currency Management tool available in the

Odoo Accounting module in the following section.