The Fiscal Position in Odoo 16 Accounting module is a mapping of tax rules that can be applied to a customer, supplier, or product. It allows you to assign different tax rules to customers based on their country, state, and other criteria. This helps you manage the different tax regulations in different countries. This is useful for companies that sell products or services to customers in multiple countries. This is very advantageous for handling the taxation requirements of different countries and allows for easy compliance. This feature enables you to configure tax rules in different ways according to the customers' location or product type. It can be used to define different tax rates for different customers or products. This account management entity is the perfect solution for the financial management of a company worldwide. This tool has the power to automatically adapt the taxes and the financial accounts described for the transactions.

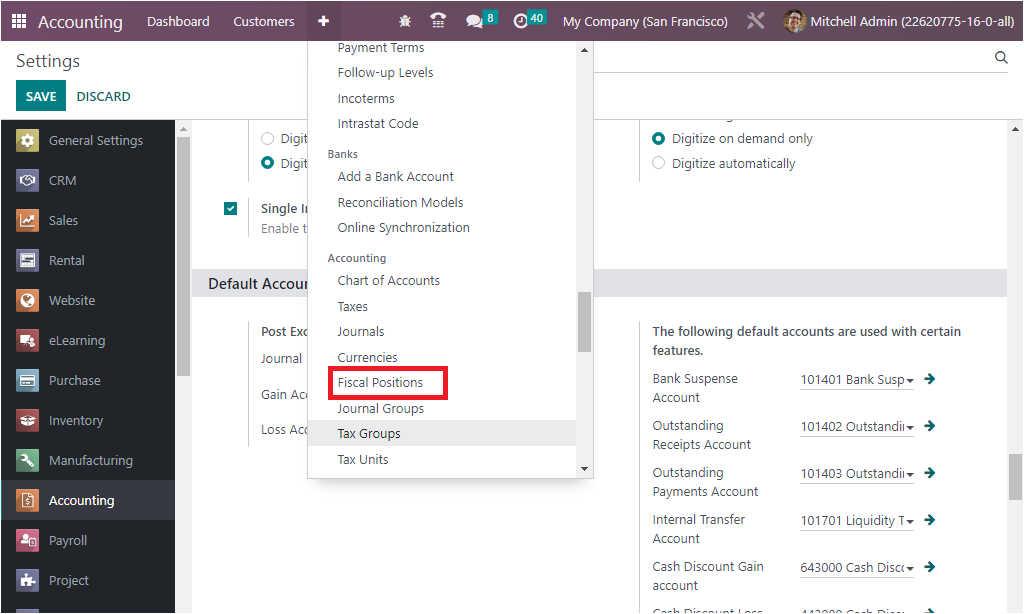

The Odoo Accounting software provides a space for the menu Fiscal Positions, which can be accessed under the Accounting section of the Configuration tab.

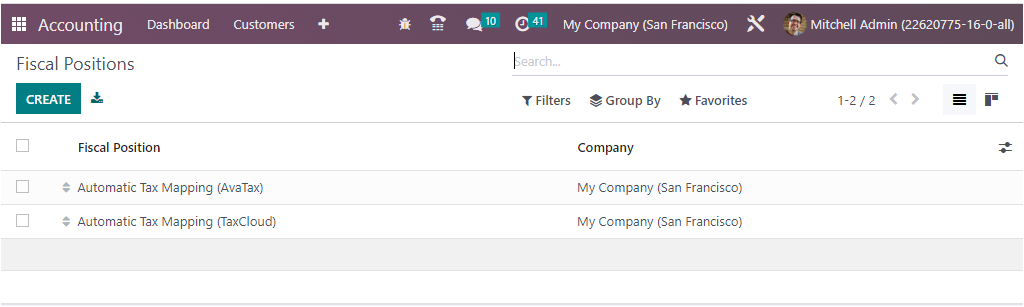

The Fiscal Positions menu performs as the key to the Fiscal Positions window, where you can manage all the fiscal position entries. The window will showcase every predefined Fiscal position, as illustrated in the image below.

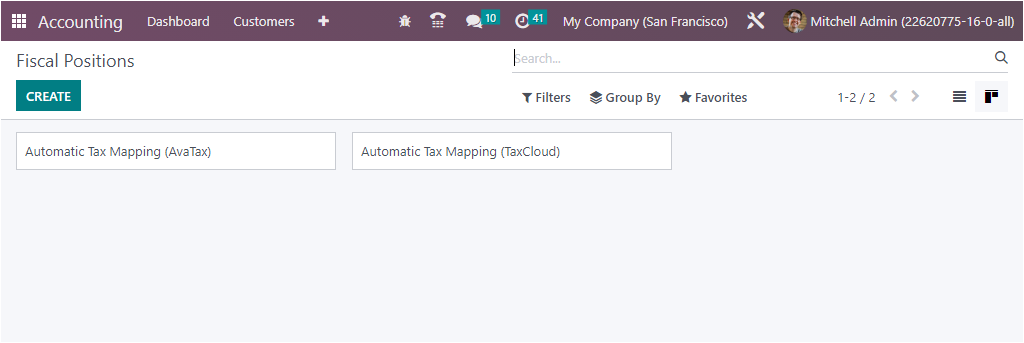

The window can be accessed in both Kanban and List view. The Kanban view of the window is given below.

All the fields that the window displays will be selectable, and it is also possible to select the already defined fiscal position records to view the complete details of the respective one. In addition, the Filters, Group by, and Search options allow you to retrieve the required Fiscal Position if the platform manages more Fiscal Positions. The Favourites tab includes the options such as Save current search, import records, Link menu in spreadsheet, Insert view in article, Insert link in article, Insert list in spreadsheet, and Add to my dashboard options.

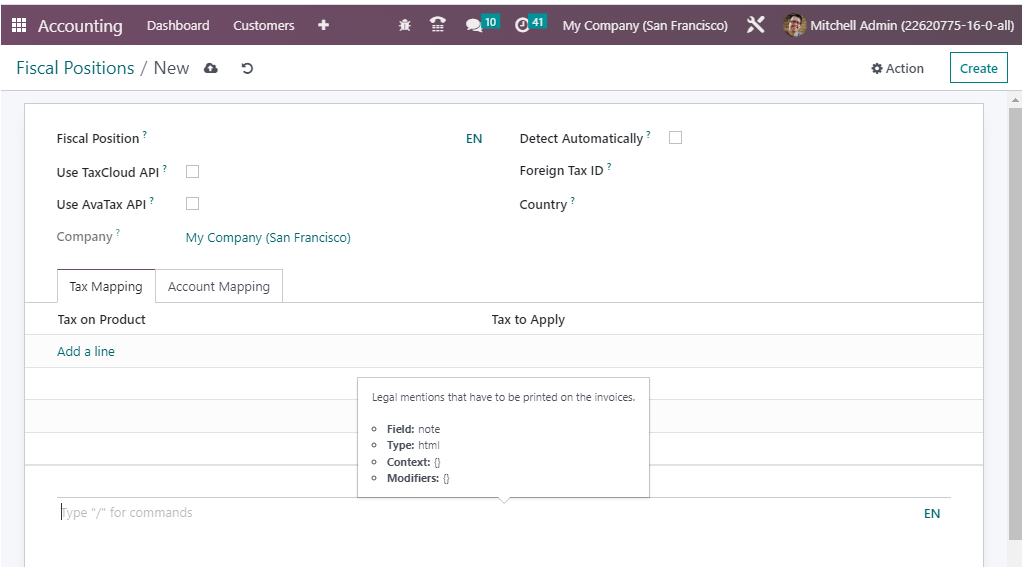

The CREATE button is a fine way to define required Fiscal Positions. The creation form of the Fiscal Positions is given below.

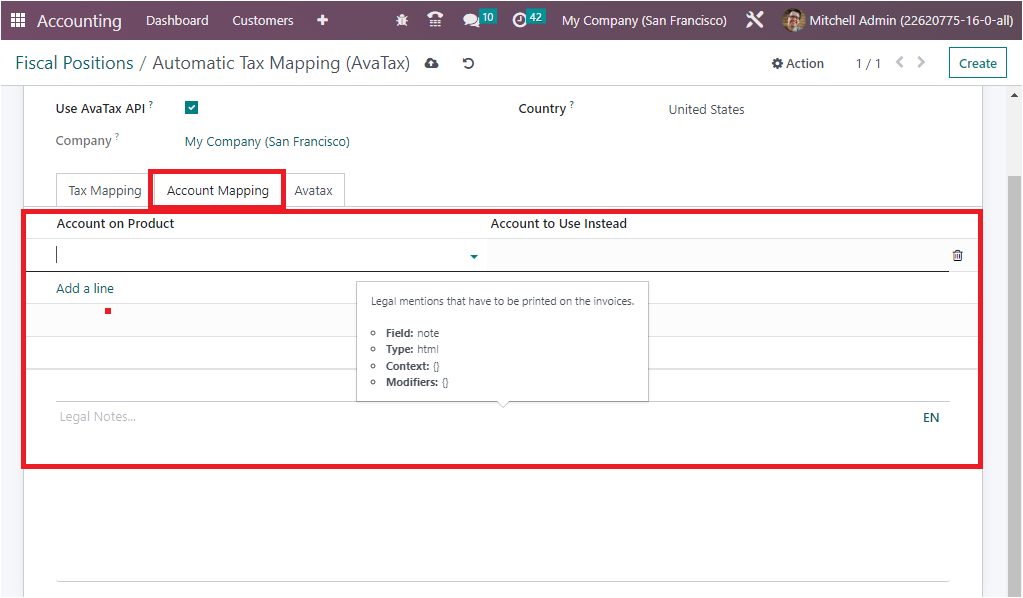

Here you can define the fiscal position name in the Fiscal Position field. Then you can view various fields to configure, such as Use TaxCloud API, Use AvaTax API, Detect Automatically, and Foreign Tax ID. All these fields can be enabled or disabled based on the preferences. If you activate the Use TaxCloud API option, you should enter your taxcloud credentials to compute tax rates automatically. Likewise, the Detect Automatically field makes you able to apply this fiscal position automatically with respect to the country, country group, localities, or the federal state of the partner operation. Furthermore, you have the option to specify the Country where you can mention the country if you want to apply only to a particular country. Now under the Tax Mapping tab of the configuration window, you can define the ‘Tax on Product’ together with the ‘Tax to Apply.’ So the corresponding tax which is required to apply to the product can be specified. Additionally, if the fiscal mapping is confirmed by the Odoo system when the partner is allocated for the operation, the matching product tax will be employed in accordance with the fiscal position. Similarly, the Accounting Mapping tab allows you to mention the Account on Product and the Account to use Instead of using the Add a line option. Further, you can type the legal note in the provided Legal Note line, which is the legal mentions that have to be printed on the invoices.

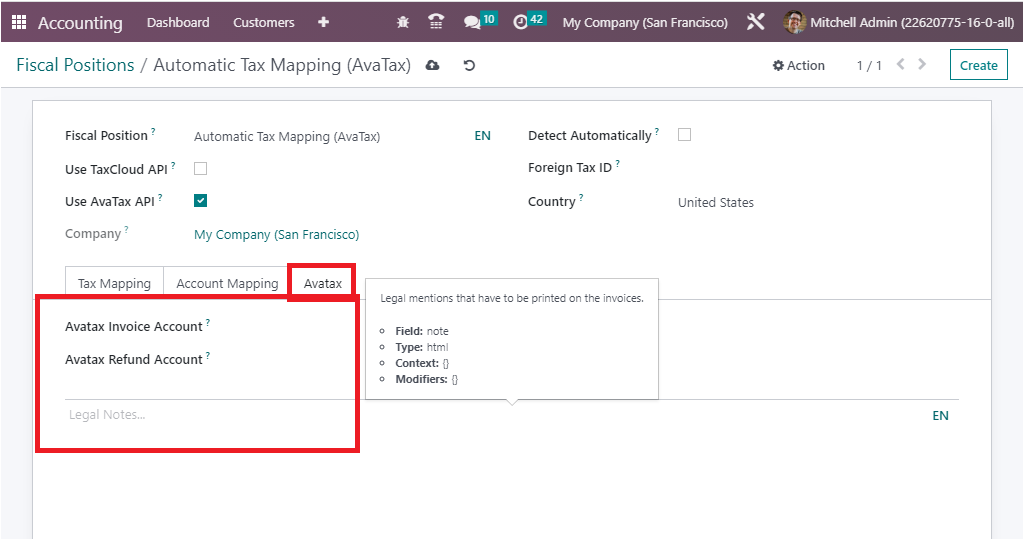

Similarly, under the Avatax configuration tab of the Fiscal Positions creation form, you can define the Avatax Invoice Account and the Avatax Refund Account, which are the account that will be used by Avatax for invoices and refunds, respectively. Here also, you can add Legal Notes in the provided space.

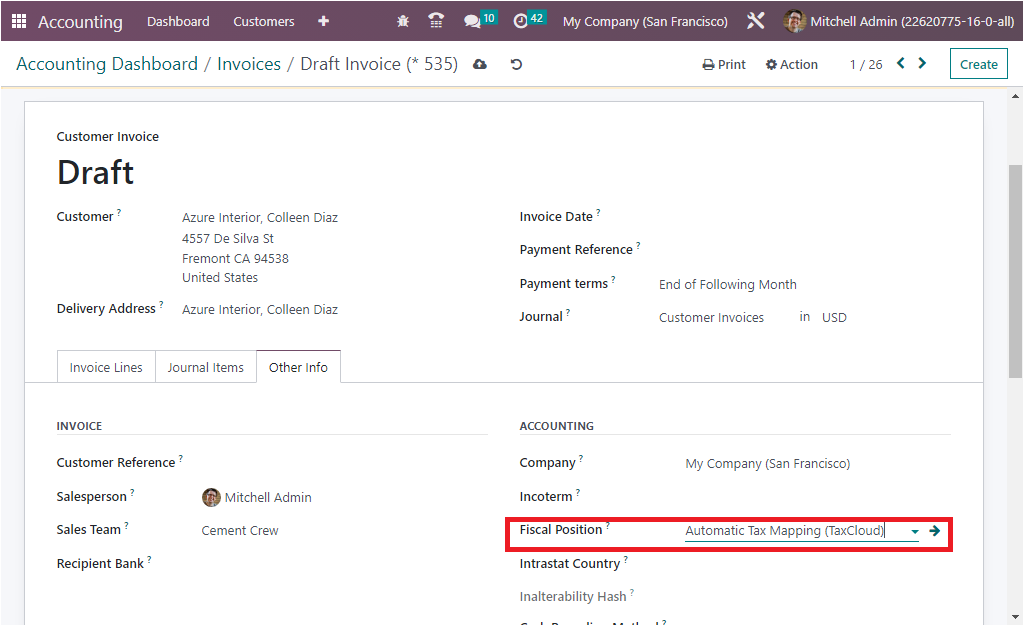

After configuring all these aspects, you can apply to the invoices and bills so that the tax and the accounts will be mapped according to the rule defined as shown in the example.

Fiscal position is automatically detected for partners according to the country group, country, federal states provided.

As we are clear on the Fiscal Position menu and its configuration aspects, lets now move on to the Online Synchronization aspect of the Odoo Accounting module.