Configurable Options in the Accounting Module

The Accounting module of the Odoo platform will provide the complete operational

management of the financial aspect of any company operations. As Odoo is a customizable

software the various aspects of financial management as well as accounting operations

can be customized. Furthermore, the Odoo platform is provided with a settings menu

in the Accounting module where various default options are available to be configured.

The settings menu is available in all the modules of Odoo providing the users with

the full freedom of configuring the operational management and function of each.

You will have configurable options that are available in the form of enabling and

disabling it using a selection box. There will also be options from which you can

choose the entity from the drop-down menu helping you to configure the operation.

All these forms of options are described based on the custom operational need. You

will also have the provision to bring in custom options while developing the platform

which can be done with the help of expert Odoo developers. Installing various third-party

Odoo apps available in the Odoo app store will bring configurable options to the

allocated modules helping you to define the operations. Additionally, using the

Studio module you will be able to customize the available default modules. You will

also be able to create custom modules using the Odoo studio module with configurable

options just as in all other default modules.

The accounting module has a long list of configurational options that are available

under the Settings tab for you to configure. These options will allow you to define

the operations of the accounting operations as well as finance management just as

you need. Moreover, these are default options that are available in both the community

as well as enterprise editions of Odoo. However, the functional options are limited

in the community edition and are way more advanced in the enterprise edition. Let's

now move on to understand the functionality of each option available in the Settings

tab of the Accounting module from the next sections.

Define the taxes based on the region

Configure your operational taxes for the functional aspects of your company under

the Taxes tab of the Settings module. The taxes defined here will be applicable

to both the sales and purchase operations if a specified tax is not set on the product

or else the taxes defined here will be taken into account for the operations. Let's

now look into the options in the Taxes configuration aspects in the Accounting module

settings menu.

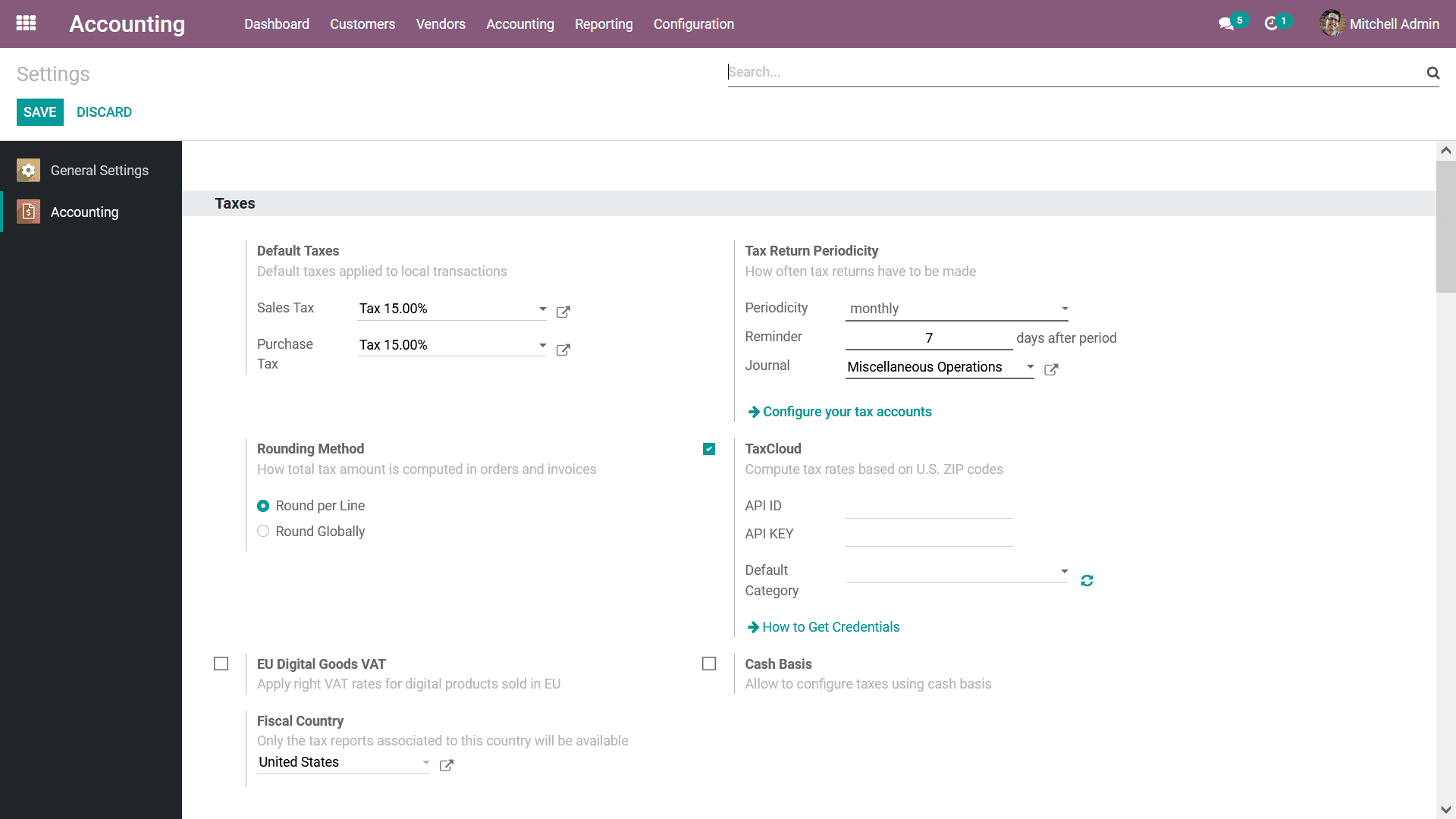

Default Taxes

Initially, in the Taxes section, you will be able to configure the Default Taxes

for the operation of the business on the platform. These taxes are applied to all

the local transactions that are being defined in the platform. Here the Sales Tax

and the Purchase Tax can be selected from the drop-down menu available. The taxes

can be defined in the Taxes accessible from the Configuration menu of the Accounting

module, here you just allocate the respective taxes to be operational based on your

need. The following screenshots depict the Default Taxes configuration menu under

the Settings tab of the Accounting module.

Tax Return Periodicity

The tax that is collected should be returned to the authorities during the specific

intervals, it can be based on the operational principle of the industries as well

as the authorities. The return filing interval will be based on the authorities

and it can be every month, quarterly, or half-yearly, or every year. You can configure

the return aspects under the Tax Return Periodicity menu which will imply how often

the tax returns have to be made.

Under the menu, you can configure the Periodicity which can be set as Annually,

Semi-annually, Every 4 months, Quarterly, Every 2 months, or Monthly. Furthermore,

you can also configure a Reminder which can be set for the days after the period.

Moreover, the Journal in which the taxes collected will be stored can be defined

in the menu, these will be the Journals that have been already defined in the platform

for the operations.

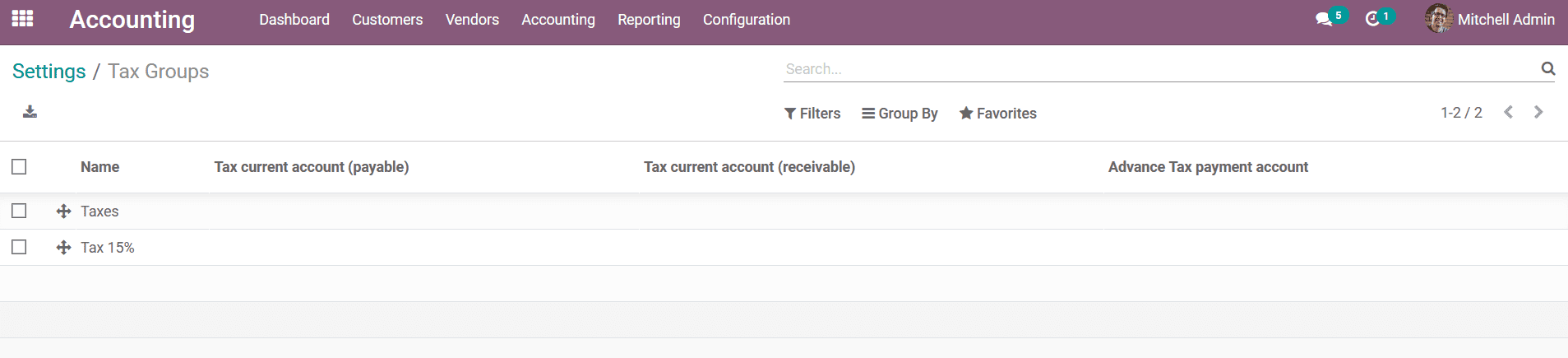

You can also configure the tax accounts by selecting the Configure Your Tax accounts

option available which will direct you to the Tax Groups window where the account

details of the Taxes can be defined. Here, the taxes defined will be depicted and

you can choose each of them to configure the Tax account. You can allocate the Tax

current account(payable), Tax current account (receivable), and the Advance Tax

payment account, in the Tax Groups menu just as depicted in the following image.

Rounding Method

Another aspect that can be configurable in the Taxes menu will be the Rounding aspects

of the taxes received, which can be based on two options that are available by default

in Odoo. It can be Round per line or Round Globally these two options can be chosen

based on your need for the operation.

Taxcloud

Considering a business operating in the US the TaxCloud computation will determine

the taxes on the sales, purchase as well all other company operations. The configuration

of the TaxCloud will be based on the US ZIP codes which is one of the localization

elements of the Odoo platform. The TaxCloud option can be enabled or disabled in

the Taxes configuration menu just as depicted in the image here, you will also be

able to describe the API ID, API Key as well as the Default Category which can be

custom-defined. There is also an option available to keno about the credential aspects,

you can choose the how to get credentials option which will take you to the TaxCloud

configuration webpage where you can abstain from the credentials or the account.

EU Digital Goods VAT

If the country in which your business functions while selling digital-based products

by your business you are liable to be following the EU Digital Goods VAT guidelines.

The Odoo considers this as a localization aspect and provides you with an option

to enable or disable the EU Digital Goods VAT based on the European Union. Additionally,

the Fiscal Country of operations can be selected from the drop-down menu, which

will provide the tax allocation concerning the selected country for your Odoo related

operations.

Cash Basis

The Taxes menu has a Cash Basis option allowing you to manage the operations of

taxes on the payments received through cash. This option can be enabled or disabled

based on the company policy.

Let's move on to understand the next operational menu under the settings which are

based on the currency management in the next section.

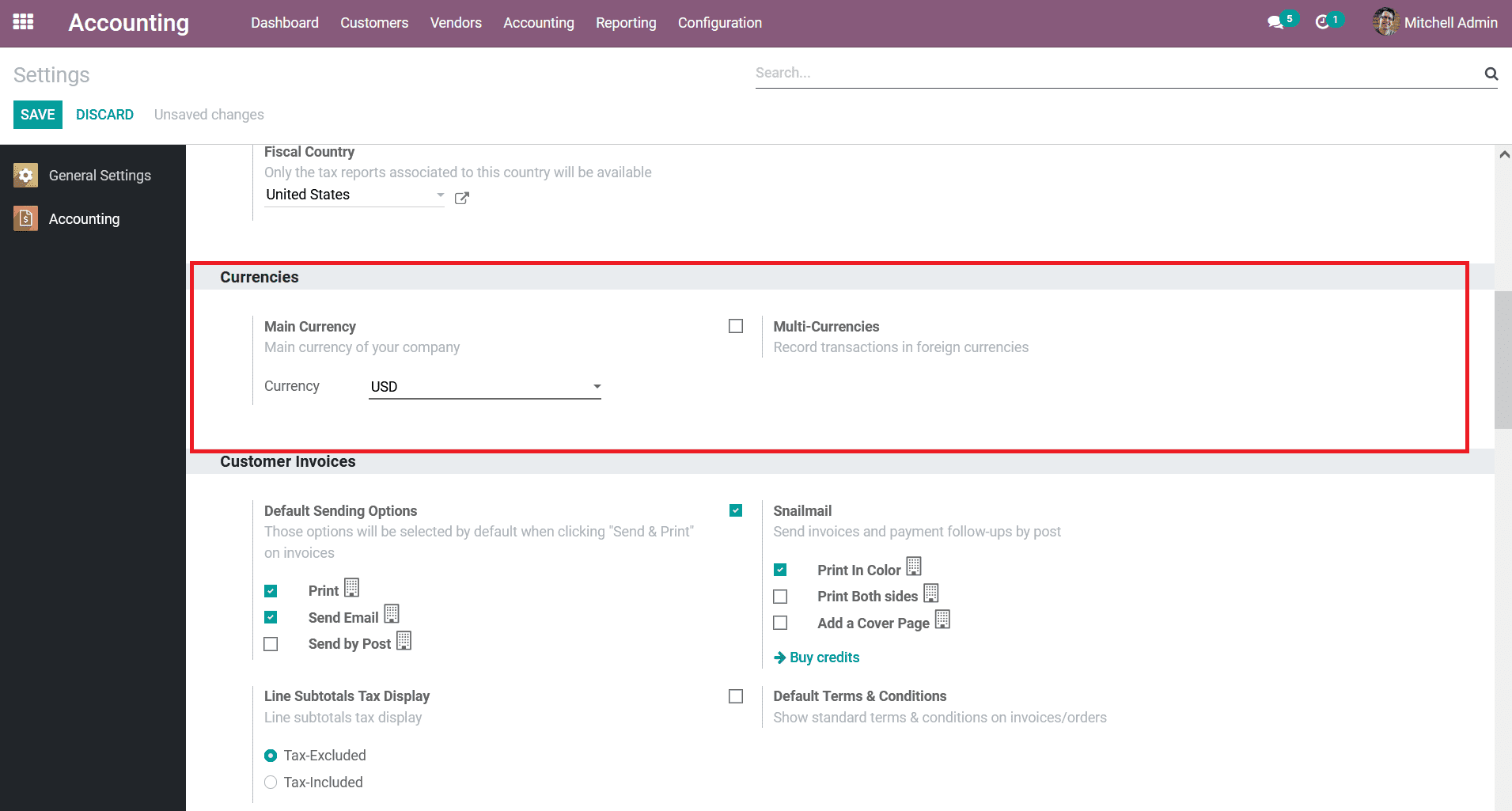

Having an excellent currency management system will do wonders

The Currencies menu available under the Settings tab of the Accounting module will

help you to define the currency-based operations of the company functioning with

Odoo. Here, in this menu, the Main Currency for the operation of the company can

be defined. The Currency can be chosen from the dropdown menu available in the option.

All the currencies of the world will be defined over here. Additionally, the main

currency of operations will be the currency in which the company is defined and

the additional currencies which are supported by your company operations can be

chosen.

Moreover, if your country functions as an international label you need to run your

business in multiple countries and the currency management of each country should

be done effectively. Therefore, the Odoo platform has an option to configure the

Multi-Currency option helping you to record the traction in any currency of the

world. Let's now move onto the next menu available under the Settings tab of the

Accounting module, the Invoice management in the next section.

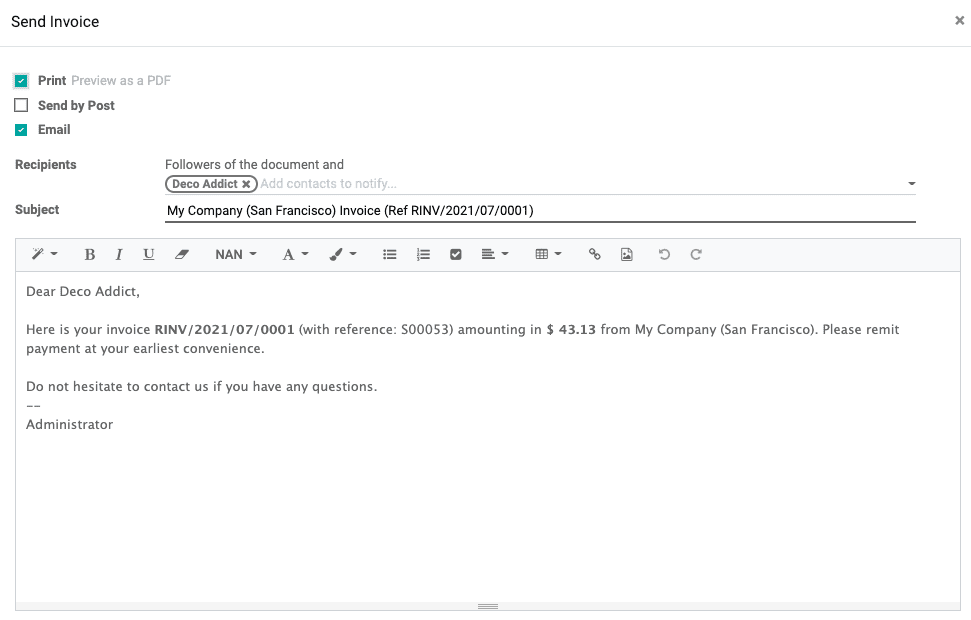

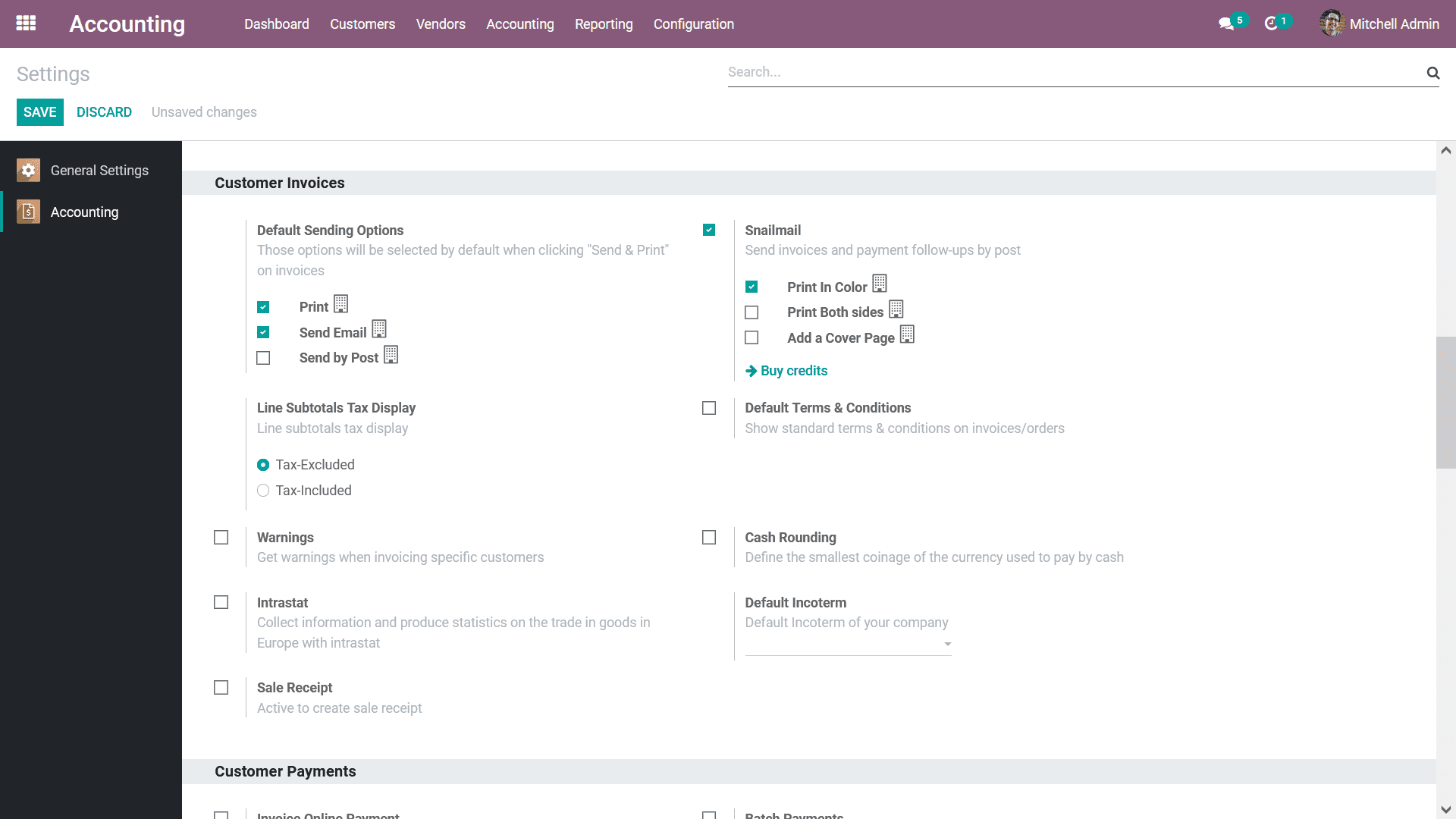

Complete and effective invoice management

Sending out the Customer Invoices along with the aspects of the management will

help you with the complete and effective operation of the invoice generation. Initially,

you need to configure the default settings option available in the Customer Invoices

section. The Default Settings Options on the invoice generation and Send & Print

can be configured. The sending options of the invoices can be configured as Print,

Sent Email, or Send by Post, if these options are configured, you can find them

depicted in the Send Invoice window just as depicted in the following image for

you to choose.

In addition, the Line Subtotal Tax Display on the invoices which are being generated

can be configured as either Tax-Excluded or Tax-Included based on the operational

demand of the business or as per the guidelines by the authorities.

Snailmail is another localization feature available helping you to send out the

invoices by post directly. You can enable the Snailmail option available under the

Customer Invoices and configure the invoices directly to the customer. The Snailmail

can be configured with the default options such as the Print in Colour, Print both

sides, or Add a cover page. The operations of Snailmail are integrated based on

the expense of credits therefore, the platform also has a Buy Credit option available

in the Settings menu which will direct you to the webpage where you can buy Odoo

credit for Snailmail.

Additionally, you have various other options to be configured under the Customer

invoices by enabling or disabling the respective options such as the Default Terms

& Conditions which will be depicted in the invoice, Warnings, Cash rounding, Intrastat,

Default incoterm and Sales receipt. Let's understand these options in detail.

Warnings

Enabling the warning option available will help you to set warnings on respective

customers that have been defined in the Odoo platform. These warning messages will

be displayed to you once the invoices are being generated. Moreover, these warnings

can be custom-defined based on your need to inform the operators based on the customer.

Thus you will be able to block the sales and the invoice generation to the respective

customer.

Cash rounding

In the retail time operations of the business the chances of having the exact cash

in change as well the counter having coins to return the balances of the purchase

are low therefore, you will round the invoice prices to a whole number. With Odoo

you can define the Cash Rounding operation based on your custom requirement on the

currency with which you operate. You can enable the Cash rounding option available

here and then you will be depicted with a Cash rounding menu icon where the Cash

Roundings will be defined.

Intrastat

Another element of localization regarding the operations of the business in Europe

by Odoo is the configuration of Intrastat which can be done here by enabling the

option. Upon enabling the option, you will be depicted with the option to set the

Default incoterm which can be selected from the drop-down menu.

Default Incoterm

Along with the capability to set up the Default Incoterm, the Odoo Accounting module

settings have an option to set the Default incoterm by default. Moreover, there

is a drop-down menu available for you to choose the Default Incoterm.

Sales Receipt

Upon enabling the Sales Receipt option, a receipt on the sales of the product can

be generated after the sales are conducted. This will ensure that the same quantity

of products is sold, invoiced, and delivered.

There are all the aspects of configuration available under the invoice management

of the customers under the accounting module. Let's now move on to the next section

where the configuration options regarding the Customer Payments management are in

the next section.

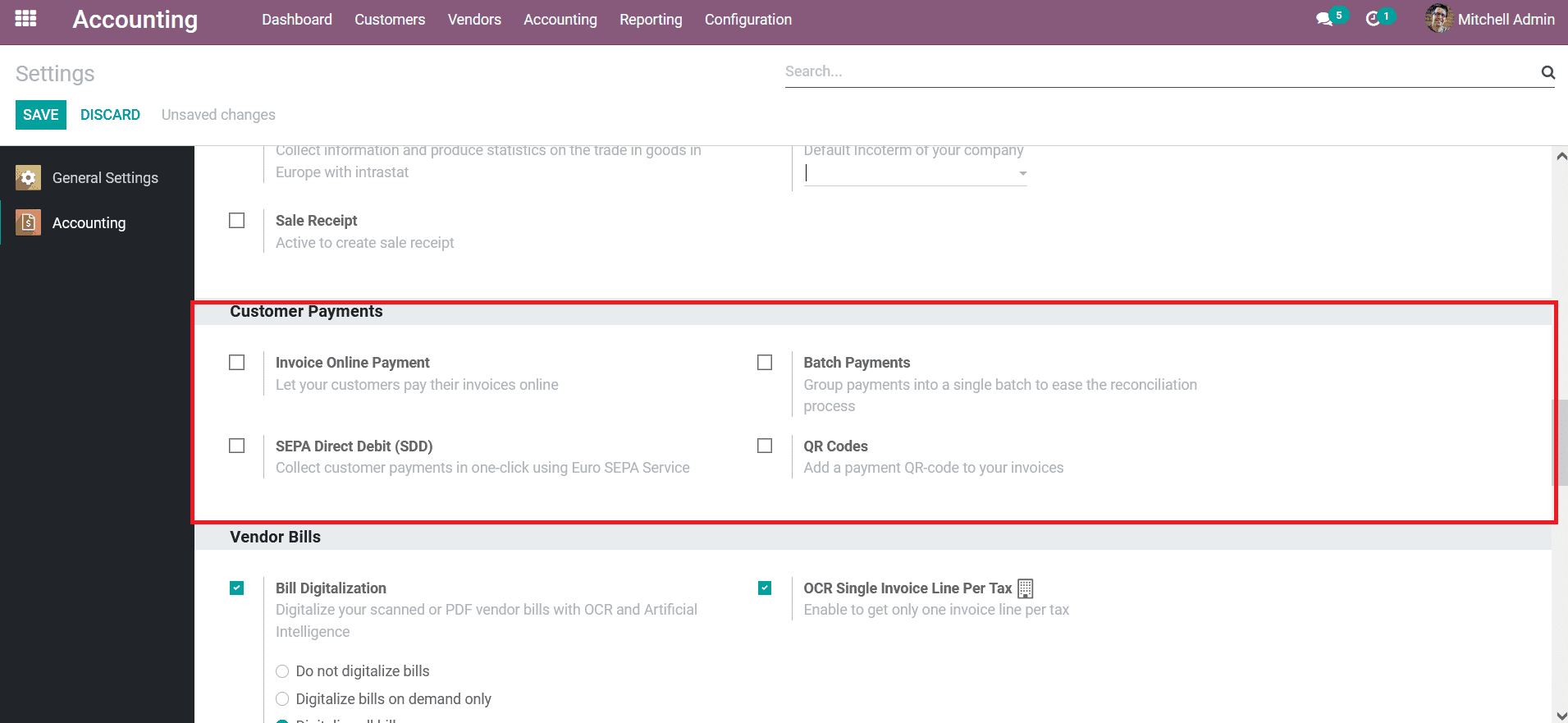

Streamline the customer payments

Customer Payment management is of vital importance regarding the financial operations

of any company and the settings menu of the Odoo Accounting module will have various

configuration options regarding it. You can enable options such as Invoice Online

Payments to help the invoices of the customers to be paid online. Additionally,

the Batch Payment option can be enabled which will allow the customer to pay for

the invoices in a batch. The SEPA Direct Debit(SDD) is a localization tool helpful

for European countries helping you to collect payment from customers in one click

from the Euro SEPA services. The following image depicts the Customer Payments management

options available in the Settings menu of the Accounting module.

Enabling the QR Codes will help you to add a QR code to your invoices which the

customers can scan to generate the payments. With all these options you will be

able to define and function with the Customer Payment management effectively. Until

now we were discussing customer invoice generation and payment management. Let's

now move on to understanding the aspects of Vendor bill management in the next section.

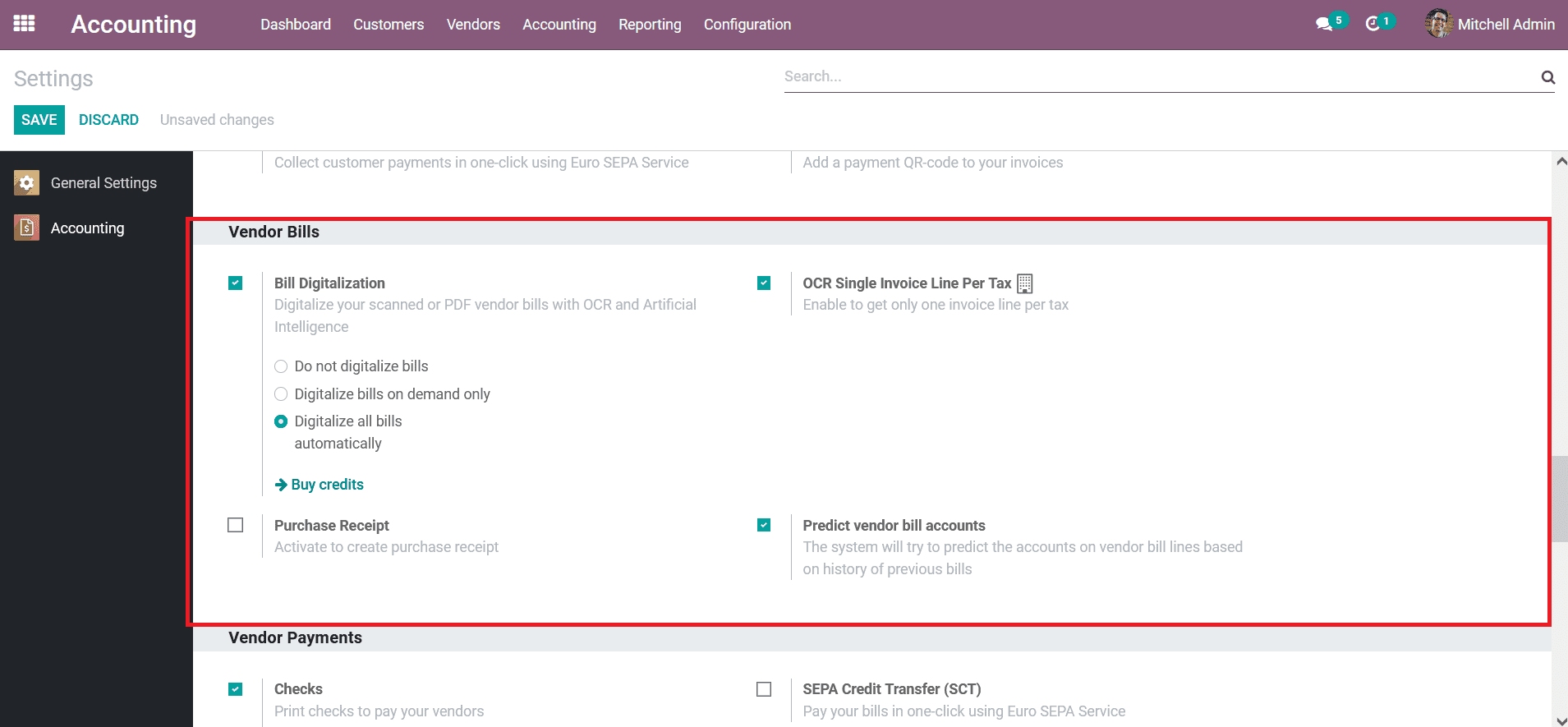

Well defined vendor bills configuration tools

The vendor bills of the products which have been purchased can be easily managed

in Odoo with the Odoo accounting module. For the effective management of the Vendor

Bills, you need to configure the respective options in the settings menu of the

Accounting module. In the menu you will have options such as Bill Digitalization

which can be configured as Do not digitalize bills, Digitalize bills on-demand only,

or Digitalize all bills automatically. In case you need to digitize bills you need

to expense certain credits which can be brought by selecting the Buy Credit options

available. Furthermore, you can enable the OCR Single Invoice Line Per Tax option

helping you to get only one Invoice Line per tax. In addition, the Purchase Receipt

option can be enabled to create the purchase receipts to be product procurement

operations.

The Predict vendor bill accounts is an advanced option of the Accounting module

of the Odoo platform helping you with providing a predictive insight on vendor bills

based on the previous bills from the vendors. These are the various options available

under the Vendor Bills which you can configure. Let's now move on to the aspects

of Vendor Payments management options available in the settings menu.

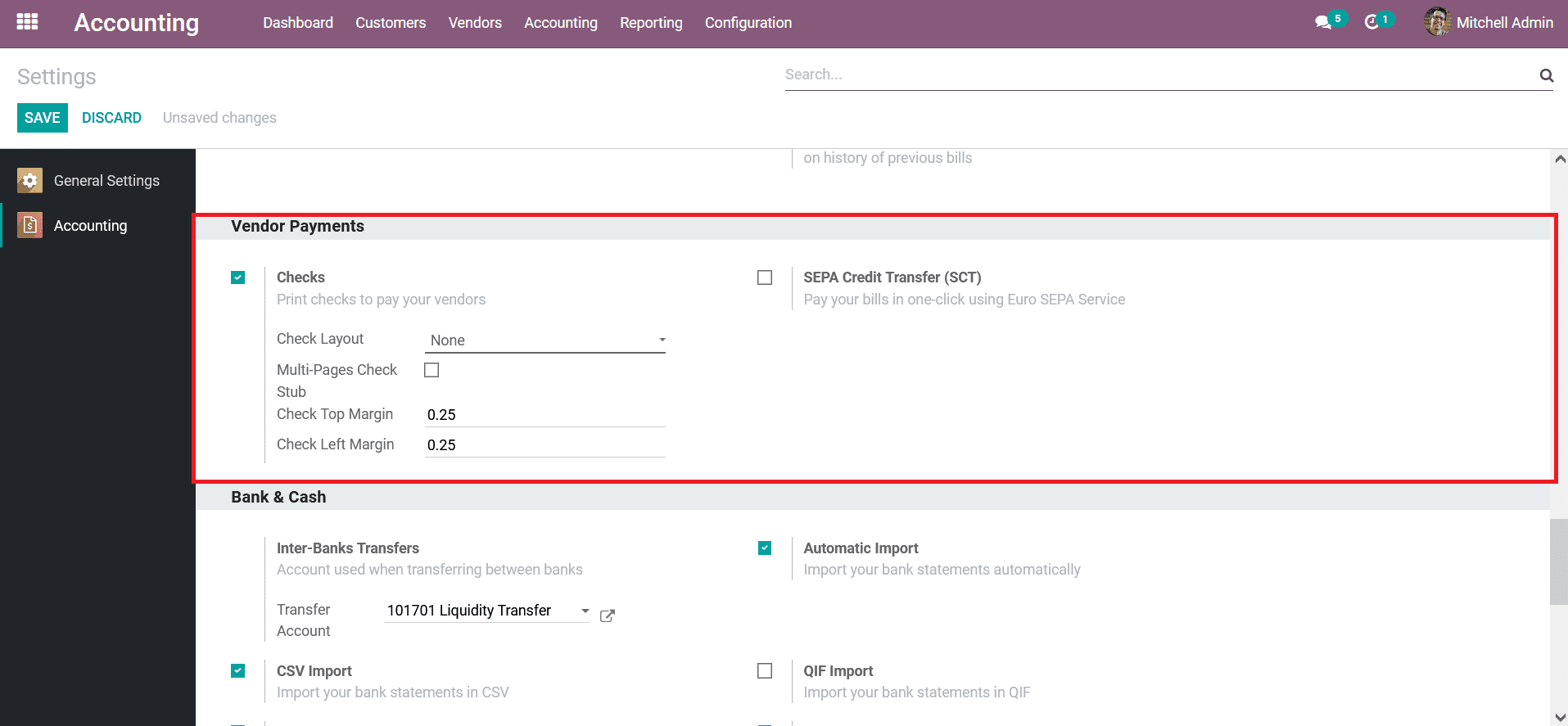

Full control on vendor bill payment

The Odoo Accounting module has advanced options to manage the operations of the

Vendor Payments which will be helpful for the accounting management options of the

company. You can configure the Checks option by enabling it and defining the Check

Layout by selecting it from the dropdown menu. Furthermore, you can enable the Multi-Pages

Check Stub and configure the Check Top Margin as well as the Check Left Margin.

Additionally, the SEPA Credit Transfer(SCT) option is also available for business

in European countries allowing you to pay the bills in a click using the Euro SEPA

services. Let's now move on to understand the options available in the Odoo Accounting

Module Settings menu regarding the Bank & Cash management in the next section.

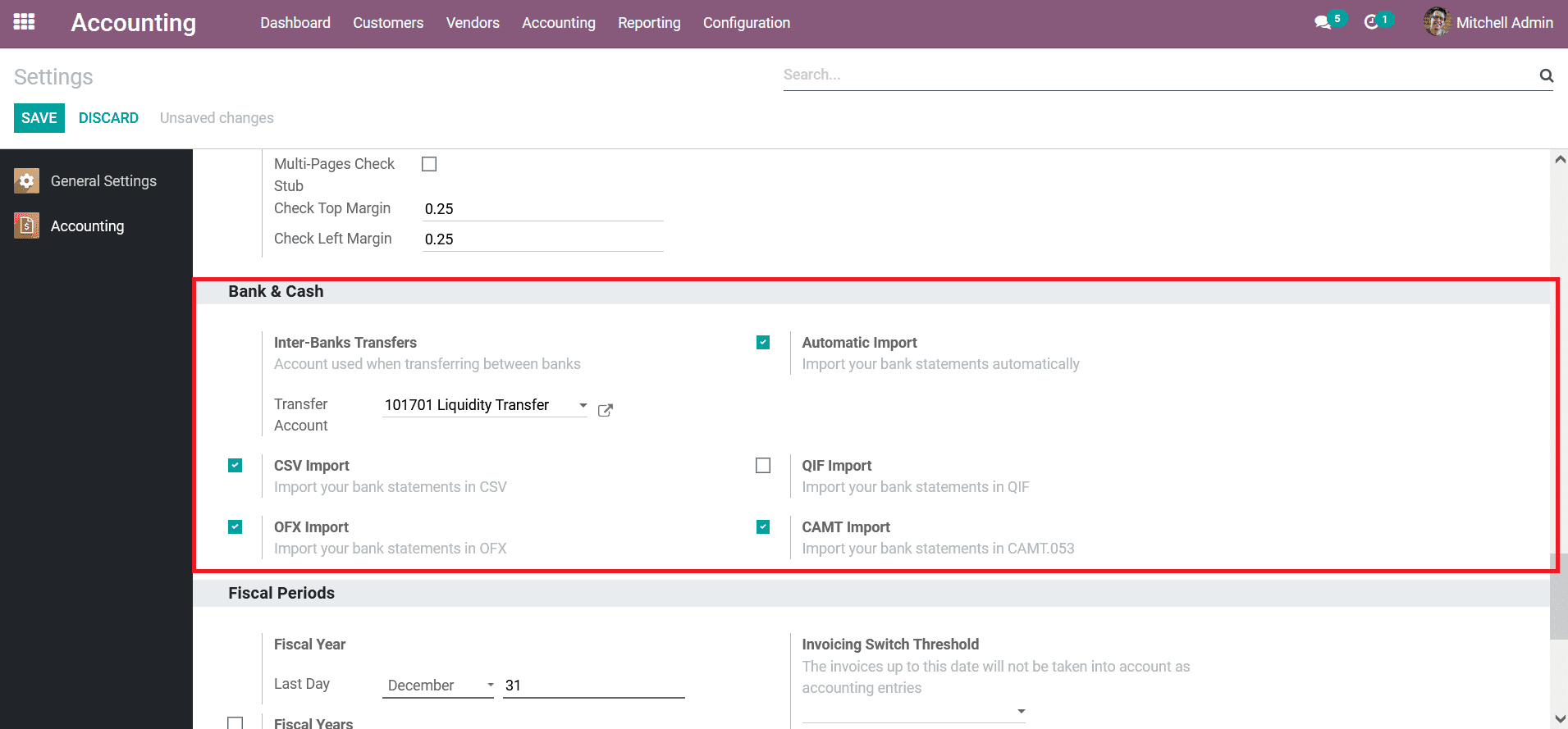

Managing the finances with bank and cash management

The Bank and Cash management options available in the settings menu of the Accounting

module will provide you with a complete insight into the effectiveness of operations.

You can configure the Inter- Banks Transfers under the menu by describing the Transfer

Account and functioning with it. Furthermore, the Automatic Import option can be

enabled which will allow you to import the bank statements automatically. Additionally,

you can enable the CVS Import option to import the bank statements in the CSV file.

The same can be done by enabling the QIF Import to import the bank statements in

QIF format.

In addition, you will also have the QFX Import as well as the CAMT Import option

which can be enabled to import the bank statements in respective formats. Let's

now move on to understand the Fiscal Periods configuration aspects of the Odoo Accounting

module in the next section.

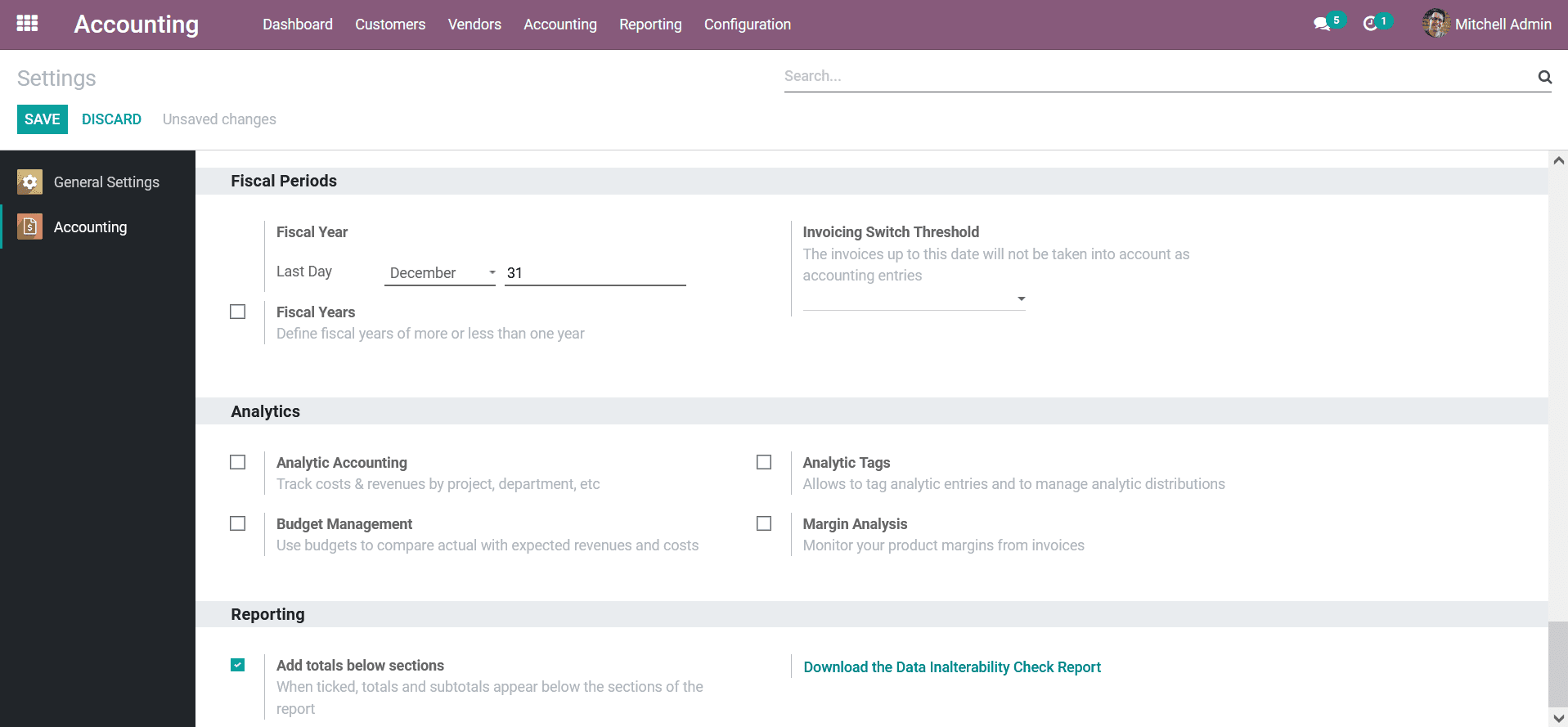

Configurable fiscal periods and positions

You will be able to define the Fiscal period of operations of your company in Odoo

under the Accounting module. Under the Fiscal period tab, you can configure the

Fiscal Year by defining the Last day along with the month. If the Fiscal operations

are to be conducted based on Fiscal Years you enable the option. Furthermore, you

can set a threshold for the invoices by describing the Invoicing Switch Threshold

by selecting the date from the calendar. The Invoicing Threshold can be configured

as any date which will ensure that all the entries before the respective date will

be set to the canceled state. Moreover, the reporting aspect, as well as the revenue

involved, will also be nullified and you will start to operate the business with

Odoo as a fresh start from the respective date set as the threshold.

The setting up of threshold is a useful feature during the development of Odoo as

it will allow you to remove all the test data in the aspects of invoices, vendor

bills, and the revenue involved in them. This means once the threshold is set after

all the test operations are complete the platform will reset to a new form ensuring

that all the test operations remain canceled. Let's now move on to understanding

the Analytical Accounting and Budget Management aspects of the Accounting module

in the next section.

Analytical accounting and budget management

The Odoo Accounting module supports the aspects of Analytical Accounting helping

you to move a step ahead in the financial management operations of your company.

All the configurational aspects regarding Analytical Accounting can be configured

under the Analytic menu of the Settings tab of the analytical module. You can enable

and disable the aspect of Analytical Accounting for your business operations using

the option in the menu. Furthermore, the Analytical Tags can be enabled as per the

need of the operations to simplify the classification aspects of Analytical accounts

and their operations.

In addition, the Budget management options will ensure that you are provided with

effective management of the operations regarding the financial budget as well as

the assets that you have at the company's disposal. Moreover, enabling the Margin

Analysis option will allow you to monitor the product margins from invoices. The

options available under the Analytical Accounting configuration are depicted in

the settings menu of the Accounting module. Let's now move on to understand the

aspects of the configuration of report creation under the analytical reports.

Create informative reports

You will be having two options under the aspects of the configuration of the Report

generation under Analytical Accounting. Initially, you will have an option that

can be enabled to Add Totals below the sections which will describe the total amount

of the aspects of the report at the bottom. In addition, you will also be able to

Download the Data Inalterability Check Report from this menu by selecting the option

and the report will be downloaded to your system.

There are various configurable options available in the settings menu of the Accounting

module of the Odoo platform which can be described based on the operational need.

You can easily configure them to obtain the required functional operational control

of the financial aspects of your business.

In concussion in this chapter initially, we were discussing the basics of Odoo and

its configuration aspects of installations as well as hosting. Then we move on to

understanding the localization aspect of the platform and further to the configuration

aspects of the Odoo Accounting module. All the options in the settings menu of the

Accounting module were discussed in detail in this chapter.

In the next chapter, we will be focusing on the configuration tools that are available

in the accounting module in detail.