Vendor Management

Just as the management aspects of the Customer are vital in a business the need

of efficient Vendor management operations is required for the smooth functioning

of the company. In a business there are multiple vendors of options for all the

products and the chances of having multiple vendors for the same product is also

high. Choosing the right vendor for your business will be based on different parameters

of operations such as cost, quality as the service provided are certain of the prominent

aspects that the business will consider.

The vitality of management tools that help with the aspects of multiple Vendor management

and that too effectively is vital for business operations. The main vitality will

revolve around the effectiveness in the management of the Accounting aspect which

is only possible with the help of a dedicated Accounting tool. The Odoo Accounting

module will support the aspects of Vendor management as well as the management of

multiple Vendors in operations in a business. Moreover, the Odoo platform has a

dedicated Vendor management tab which will aid in the effectiveness in operation

with the dedicated and distinctive tools and menus which will be supporting it.

The Vendor management tab has tools for the Vendor bills, Refunds, Vendor Receipt

management, Bill payments, Batch payments on vendor bills, Products menu based on

vendor description, and a Dedicated vendor management menu. Let's now move on to

understand these menus and options in the Vendors tab in the Accounting module one

by one from the next section.

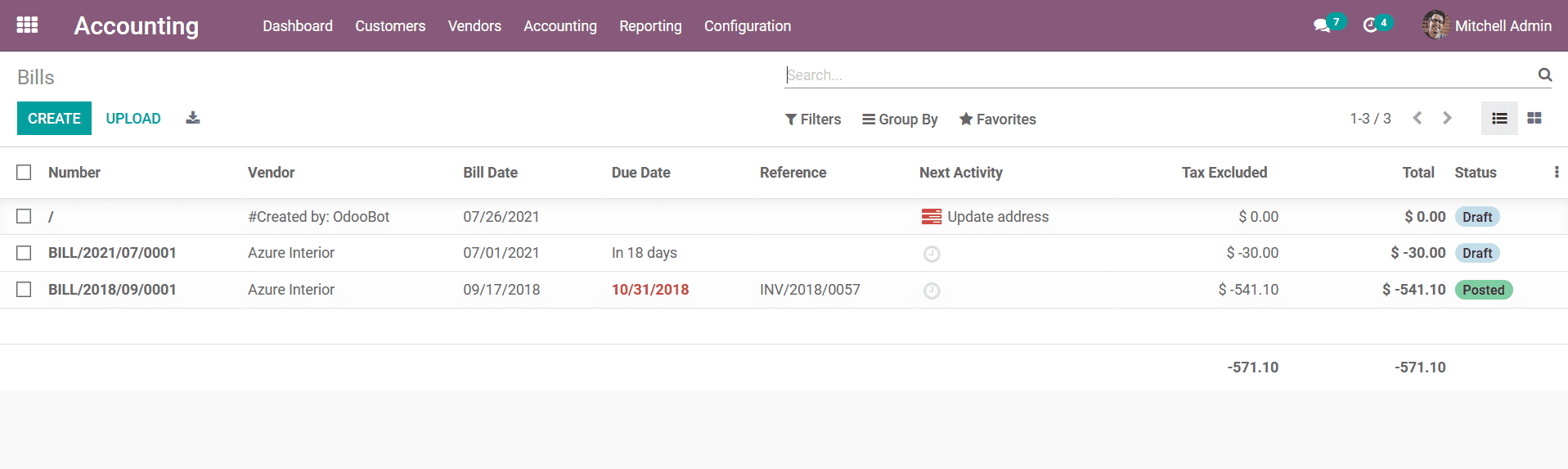

Vendor bill management

The vital aspect regarding the operations is the bill management for the purchases

which have been done. The vendors will generate the bills based on the agreed-up

terms on the product cost and the quantities which have been delivered or will be

delivered. The Dedicated Vendor Bill management menu can be accessed from the Vendors

tab of the Odoo Accounting module. Here all the Vendor bills which have been generated

towards the company will be depicted. The Bills will be defined with the Number,

Vendor, Bill date, Due Date, Reference, Next Activity, Tax Excluded details, Total

amount on the bill, and the Status of the bill be defined. You will have the provision

to edit the bill details that have been defined by selecting the respective Bill

and choosing the edit option available.

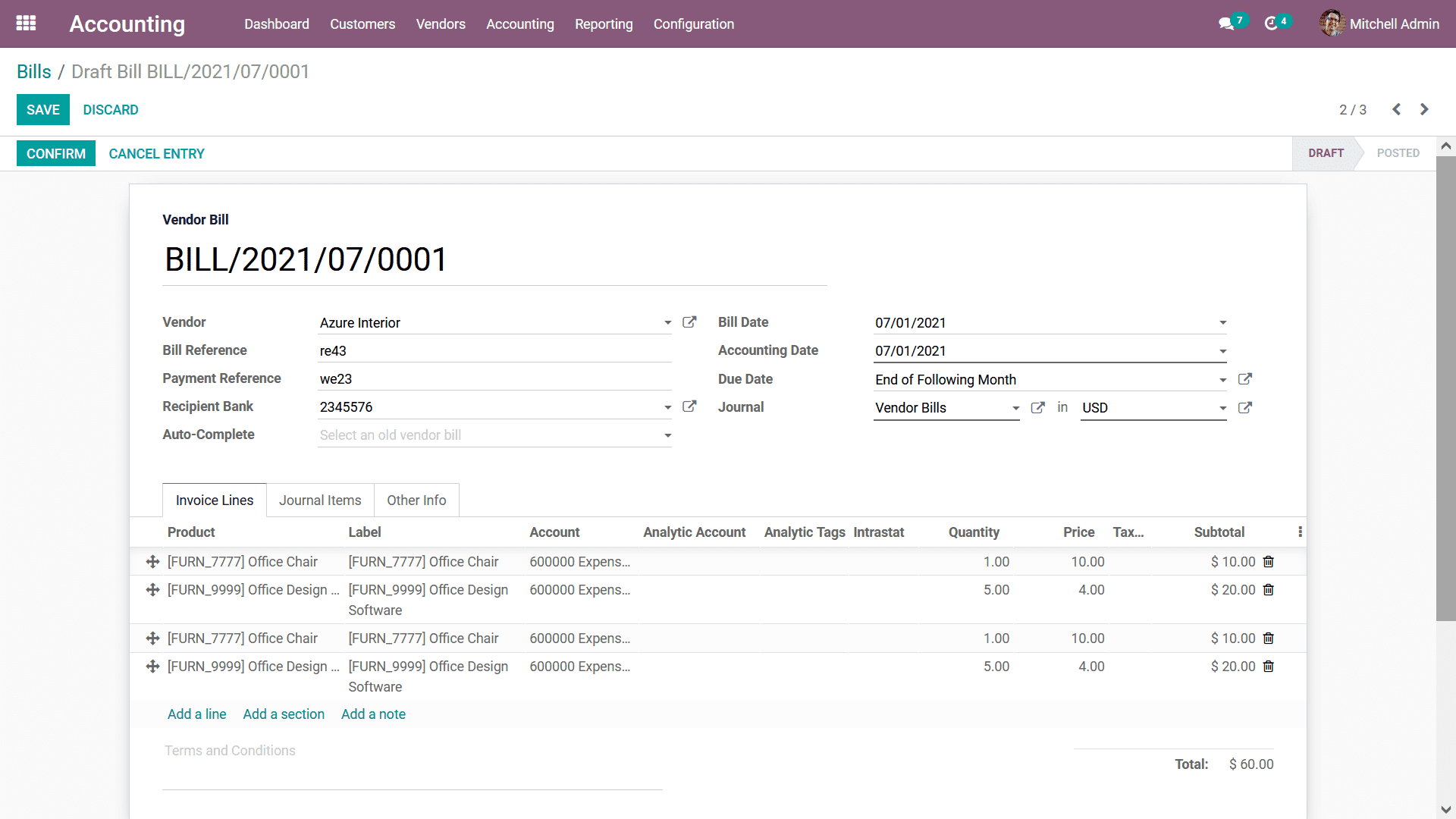

To Create a new bill, you can opt for the Create options which will depict you with

the Bill creation window depicted in the following screenshot. The Vendor Bill number

will be auto depicted and you will have to define the Vendor details, Bill Reference,

Payment Reference, Receipt Bank, Auto-Complete details, Bill Date which is the date

on which the bill is created, Accounting Date is the date at which the entries are

to be recorder in the Ledger, Due Date, Journal details, and the Currency in which

the operations are conducted. Moreover, the Invoicing lines for the respective Vendor

Bill can be defined by selecting the Add a line option available. Here, the Product

details, Label, Account details along with Analytical Accounting information, Quantity,

Price, Tax information as well as the Subtotal will be defined. New sections can

be added by selecting the Add a Section and notes can be added to the bills by selecting

the Add a Note option available.

Furthermore, the Autocomplete fields can be used to generate the bill of purchase

orders in a quick manner. Instead of adding the Products, Quantities, Price, and

other aspects separately in the Order Line, we can choose the Purchase Order at

Autocomplete field. So all the details of the Purchase Order will be auto-updated

to the Bill form. Additionally, we can also add multiple Purchase Orders, so that

a single bill against multiple purchase orders for the specific vendor can be generated.

Once we save all this data, the Vendor Bill Number is generated automatically and

the source document in the list view of the bill shows the source documents i.e.

the Purchase Order numbers separated with a comma for the generated bill.

Under the Journal Items tab, the Ledgers affected during the Bill creation can be

seen and once the Products have been added to the Order line, the Journal Items

will automatically depict the Accounts that are affected and the amounts which are

credited or debited.

Moreover, in Continental accounting during the Bill creation process, Account Payable,

Expense Account, and Tax Account get affected. The Account Payable is in the nature

of Assets and since the Asset is decreasing, the Account Payable is credited. Additionally,

the Expense Account is of nature Expense and as the expense is increasing and thus

Expense Account gets debited and the tax account is also debited.

Whereas for Anglo-Saxon Accounting the Ledgers get affected at the time of bill

creation differs. Here, the Account Payable will be credited and the stock Input

Account and Tax Account will be debited. because Anglo Saxon Accounting Expense

Accounts will be affected once the Sales have been validated.

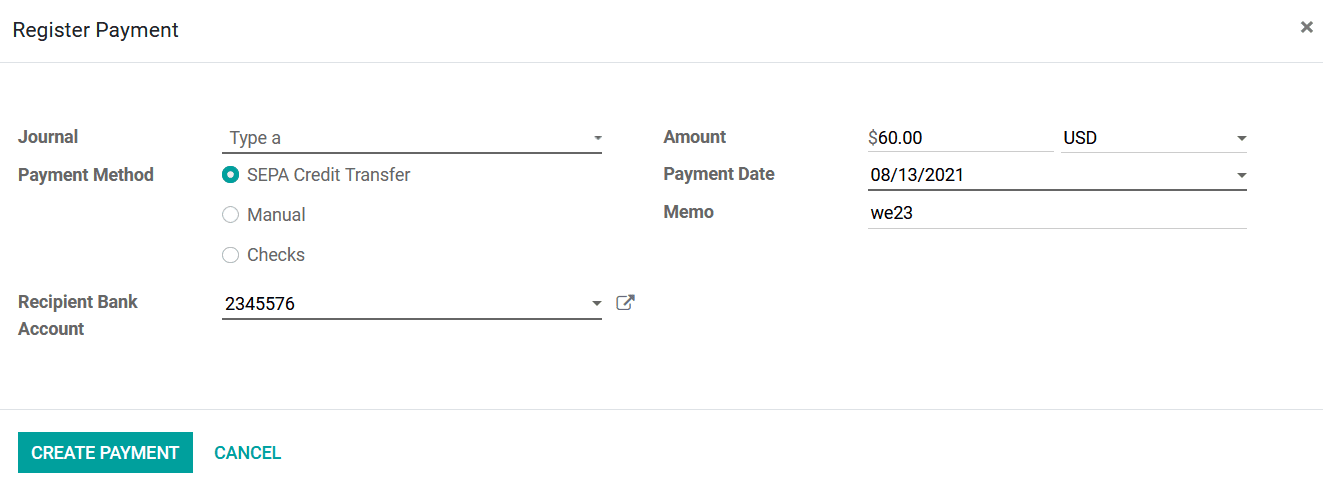

Once the Vendor bill has been defined you can select to Register the Payment of

the vendor bill on selecting the Confirm option available. You will be depicted

with the Register Payment menu as Shown in the following screenshot. Here the Journal

details and the Payment method can be defined as SEPA Credit Transfer, Manual, or

Checks. The Receipt Bank Account details along with the Amount, Payment Date, and

the Memo details can be defined. Once all the aspects have been defined you should

select the Create Payment options that are available.

Once the payment has been completed the Account Payable will be debited and the

Outstanding Payments Account gets credited. This Outstanding Payments Account will

be added in the Bank or Cash Journal configuration for which the entries are moved

to Outstanding Payment Account and only after reconciliation with Bank Statement

the amount will be moved to the bank. That is instead of reconciling Bank Transaction

with Account Payable it will reconcile with outstanding Payment Account.

So after reconciliation, the Outstanding Payments Account gets debited and Bank

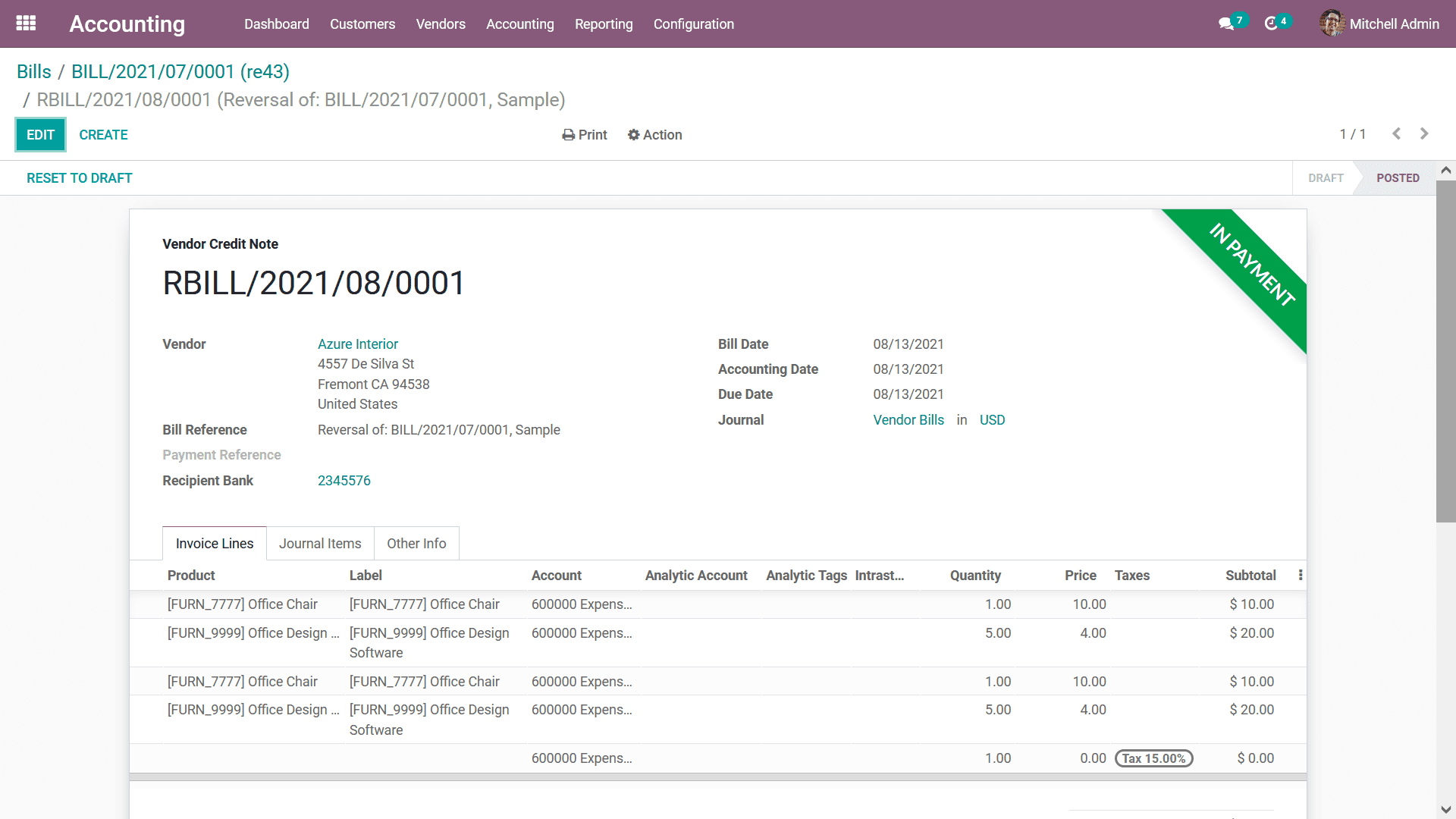

Account is credited. Once the payment has been registered and the payment has been

processed the respective Vendor bill will be depicted with a label as In Payment

as shown in the following screenshot. If the payment has been completed the label

will be depicted as Paid.

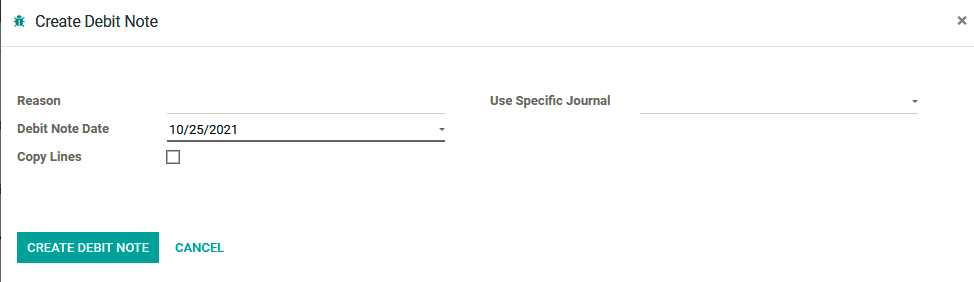

Furthermore, there is also an option to define the Debit Note for the respective

vendor bill by selecting the Debit Note options available in the menu. Upon selecting

to create a Debit note you will be directed to the pop-up window as depicted in

the following screenshot. Here, the Reason for the refund along with the Debit Note

Date and the specific journal to be used can be mentioned under the Use Specific

Journal. Moreover, the Copy Lines option can be enabled which will be beneficial

in the aspects of copying the Credit lines in case of requirement of corrections.

As the Debit Note description has been completed the next you can select the Reverse

options available which will reverse the Vendor Bill Payment generated and send

the Credit Note to the respective vendor. The Credit Note feature as available in

the Customer's configuration here also in the Vendor menu is a useful feature for

the Accounting operations management of the respective vendor operation. Let's now

move on to the next featured menu under the Vendor management, the Refunds menu

in the next section.