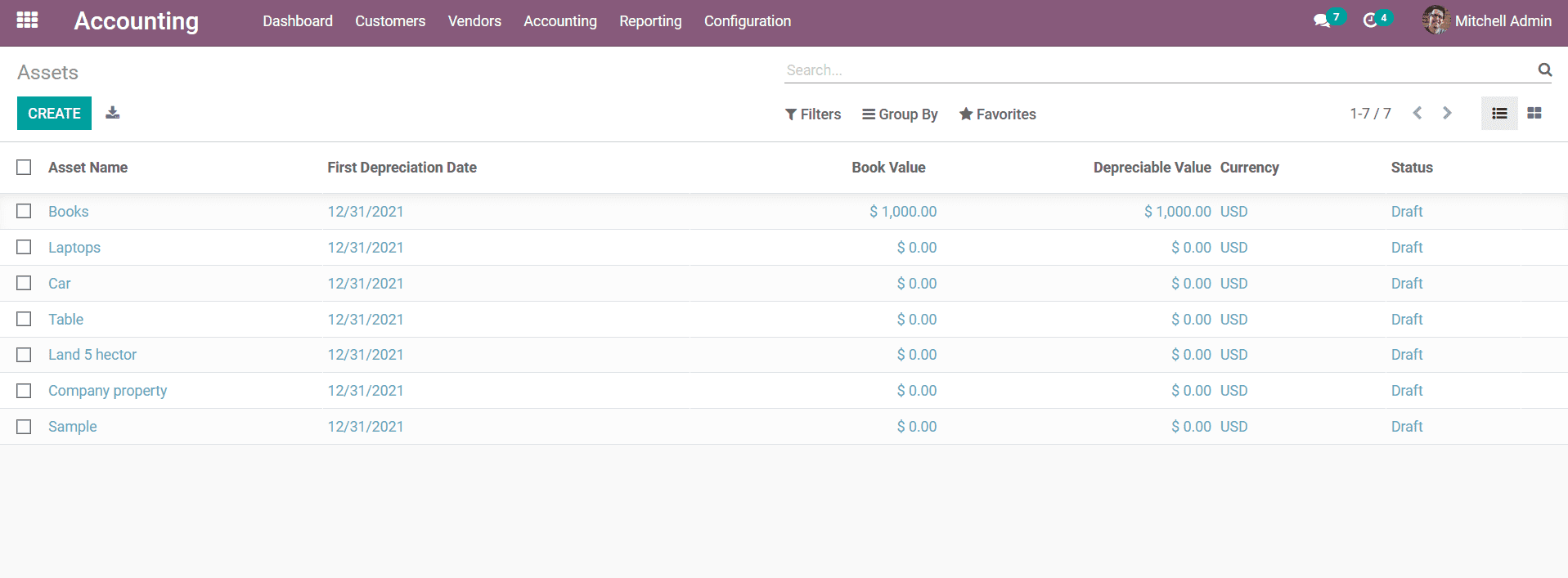

Assets

The management of the Assets in the hand of the company is an important aspect of

the financial management operations. As the companies keep on growing and their

assets both financial as well as non-financial keep on growing the management aspects

of them might get out of hand. Therefore, the need for a dedicated Assets management

solution or tools is essential. The Odoo platform has a dedicated Assets management

menu defined in the Accounting module where all the Assets of the company can be

defined. To access the option, you can select the Accounting menu in the module

and select the Assets option which will depict you with the window as shown in the

following screenshot. Here all the defined assets will be depicted with the Assets

Name, First Depreciation Date, Book Value, Depreciation Value Currency as well as

the Status of the Asset. You will also have the Filtering as well as Group by options

that are available which will help you to retrieve the respective Assets from the

menu.

You will have the provision to edit the defined Assets by selecting them from the

menu and to create new Assets you can select the Create option that is available.

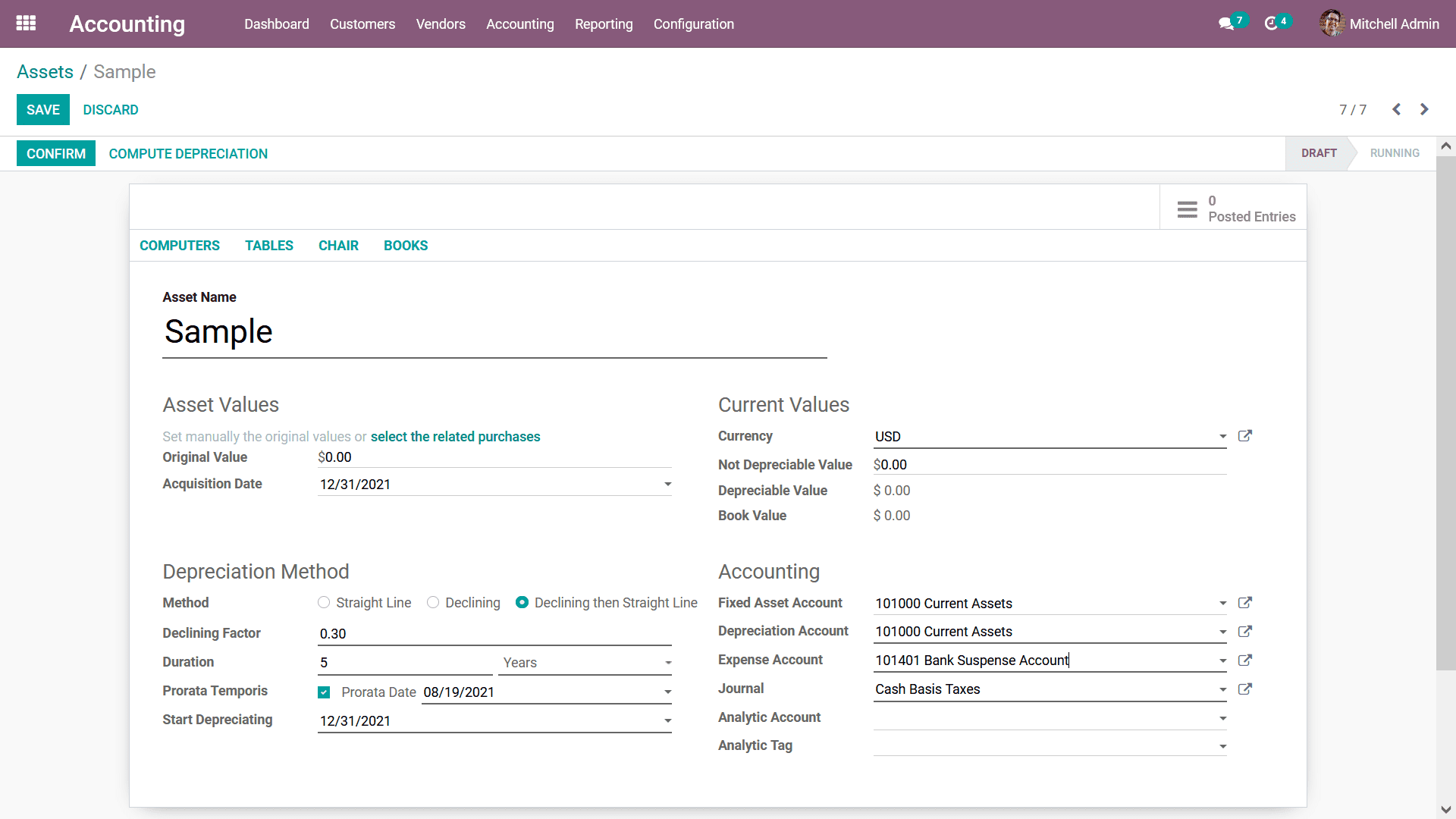

Upon selecting to Create New Assets you will be depicted with the form as depicted

in the following window. Here, initially, you have to provide the Assets Name, then

define the Assets Values such as the Original Value, and the Acquisition Date. Additionally,

either Asset Value can be directly added to create the Asset or you can choose the

Asset from any related purchase. Therefore, its purchase amount will be taken to

the Asset Value. Next, the Current Values should be defined where the Currency,

Non Depreciative Value, Depreciative Value, and Book Value can be defined. Under

current values, only the currency and non-depreciable values are updated. The Non-depreciable

value is the amount that you will get at the time of selling that product and it

will not depreciate any further. For example, if the asset value is 1000 and the

non-depreciable value is 200, then the depreciable value will be 800 and it is the

residual value on which the depreciation is calculated.

Furthermore, the Depreciation Method aspects can be defined such as the Method as

a Straight Line, Declining or Declining then Straight Line. Straight Line depreciation

is where the Asset value will not depreciate but will remain constant throughout

the operation of the Asset in the company or for the specified Duration which has

been defined. Declining depreciation is the method of Asset where the Value of the

Asset will depreciate based on the Depreciation Factor which has been provided.

Declining then Straight Line Depreciation is the one where initially the Asset Value

Will Depreciate based on the Depreciation Factor which has been defined and then

will change to a straight line model after the specified period.

Further, the Declining Factor can also be defined along with the duration of the

Declination in years or months. The Prorata Temposis can be enabled and the data

from which the depreciation should be calculated can be defined. Additionally, there

is a section where the Start Depreciation can be defined. The Current Value details

of the respective Assets Can be defined as the aspects such as the Currency, Not

Depreciable Value, Depreciable Value as well as the Book Value can be defined.

Moreover, an Asset can be assigned to be functioning with an Existing Depreciation

Schedule by defining it in the Asset menu where the Depreciation Amount, Existing

Depreciation, and the First Depreciation Date can be defined. The configuration

of the Existing Depreciation Schedule will ensure that the Assets get depreciated

based on the existing terminology.

The Accounting aspects of the Budget can also be defined where the Fixed Asset Account,

Depreciation Account, Expense Account, Journal, Analytical Account, and the Analytical

Tags can be defined by selecting them from the drop-down menu of the respective

option that is available.

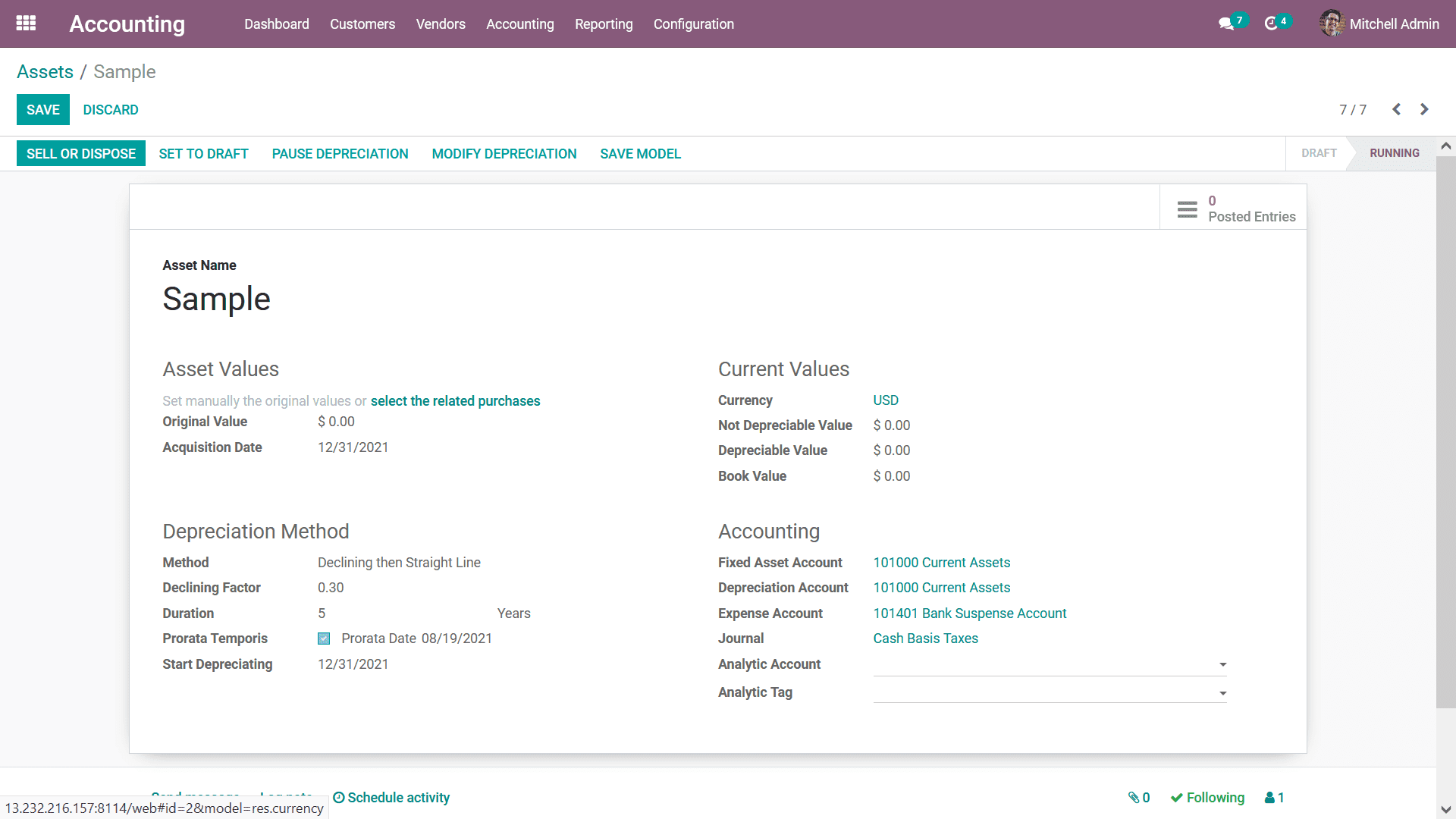

Once the details and the configuration aspects of the Asset are being defined you

can save the Asset in the window and you will be depicted with Compute Depreciation

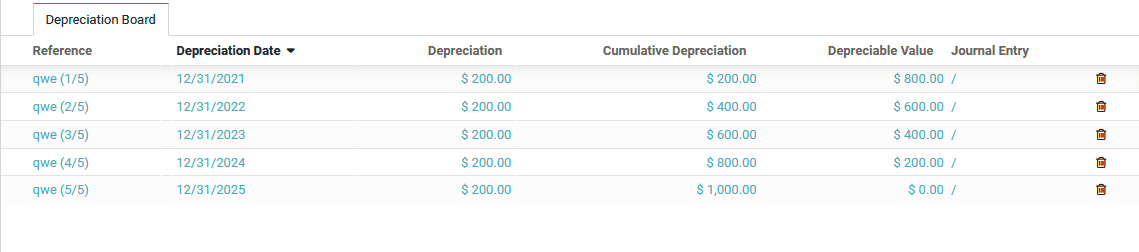

options. Upon selecting the Compute Depreciation, the depreciation of the Asset

will be computed and displayed in the Depreciation Board as depicted in the following

image. Here the Depreciation aspects and the computation will be defined. The Reference

of the Depreciation, Depreciation Date, Depreciation amount, Cumulative Depreciation,

the Depreciation Value, and the Journal Entry details with respect to the Depreciation

will be mentioned.

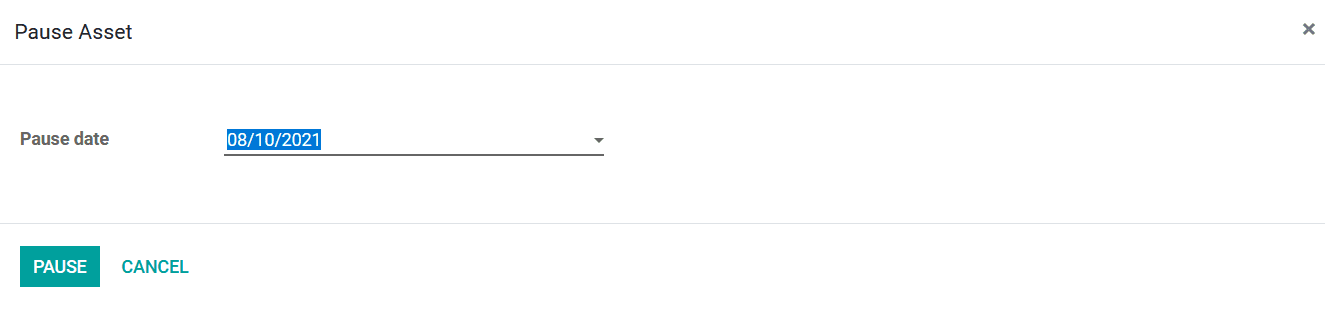

Once the Asset has been defined you can save the menu and Confirm the operations

which will depict you the window with various other options such as Pause Depreciation,

Modify Depreciation, Save Model, Sell or Dispose and Set as a Draft option. You

can choose the Pause Depreciation options which will pause the process of the Asset

Depreciation and upon selecting the option you will be depicted with the pop-up

window as shown in the below screenshot. Here you can define the Pause date of the

deprecation and these can be custom-defined ones which can be previous to current

date as well as in future of the current date as well as the same days as today.

Once the date is being defined you should select the available Pause option.

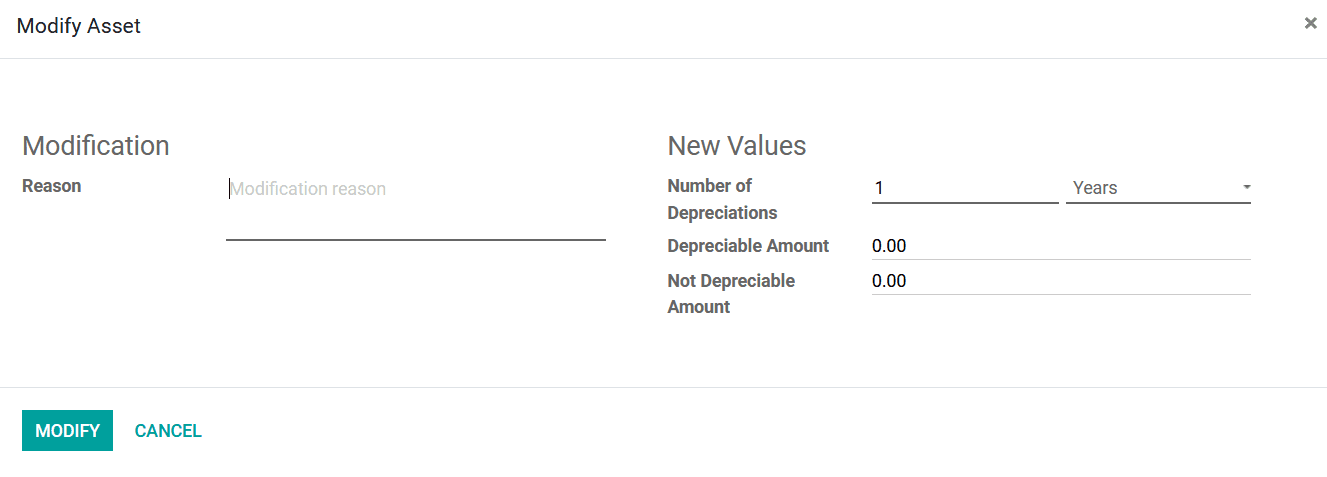

The next option available in the Assets menu is the Modify Depreciation option which

will help you to modify the depreciation values and various aspects in regards to

the ones which have already been defined. Upon selecting the Modify Depreciation

option you will be depicted with the pop-up window as depicted in the following

image. Here the Reason for the Modifications should be defined. Additionally, New

Values in respect to the Modification can be defined such as the Number of Depreciation

and the duration in years, months, or days. Furthermore, the Depreciation Amount

and the Non-Depreciation Amount can also be defined.

Finally, for the modification to run you should select the Modify option that is

available which will modify the depreciation operations of the Asset being defined.

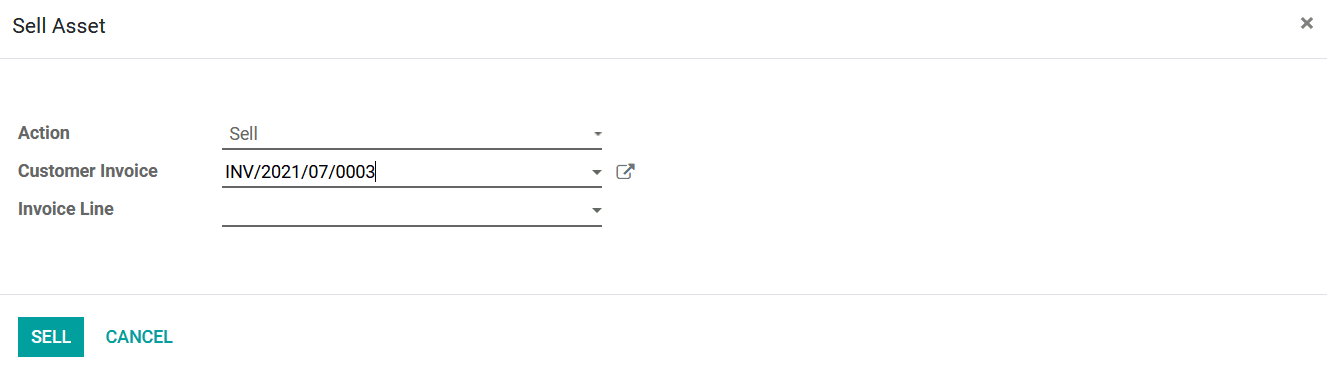

The next option available under the Asset menu is that of the Sell Asset which will

make sure that the Asset has been defined as sold once it moved out of the hand

of the company. You can select the sell Asset option which will depict you with

the pop-up image as depicted in the following screenshot. Here, the Action, Customer

Invoice, and the Invoice Line details can be defined by selecting the required option

from the drop-down menu. Once the configuration aspects have been defined you can

select the Sell option available which will make the Asset as sold.

The Asset management menu available under the Accounting module will help you to

define the various Assets of the company in a defined and well-structured manner

and will also support the Depreciation operations on them. You can refer to section

3.3 Of the book where the Asset Models, their configuration and the operations aspects

are being well defined to have a clearer understanding of the operations aspects

of the Assets. Let's now move on to understand the aspects of the Deferred Revenues

management menu available in the Odoo Accounting module in the next section of this

chapter.