Configuring Bank Payments

Integrating the bank operations with company accounting will be beneficial for the

finance management operations and the Odoo platform supports it. Odoo allows you

to define the bank accounts as well as the payment of your company related to the

respective accounts to be limited efficiently. Furthermore, the reconciliation feature

available will ensure that both the bank accounts operations and the company operational

ledgers are in direct correlation. Let us now understand the two options available

under the Configuring Bank Payments in the configuration tab of the Odoo Accounting

module.

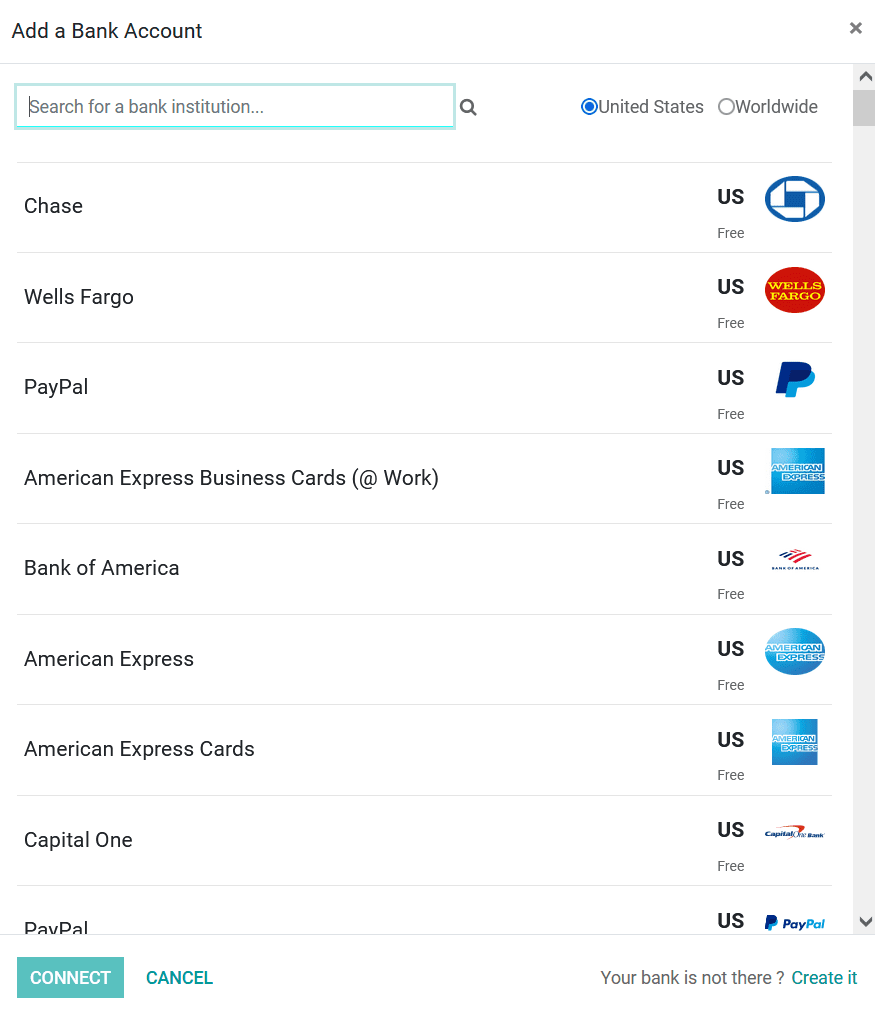

Add a bank Account

The Add, a bank Accounts option, is the primary one under the Configuring Bank Payments

section, which is available in the Configuration tab of the Accounting module. You

can define the bank accounts on the menu as shown in the bow screenshot which will

be depicted to you upon selecting the Add a bank Accounts menu. Here you can choose

your bank from the list and select to configure it with operations on the Odoo platform.

If your Bank is not defined in the menu you can select the Create it option available

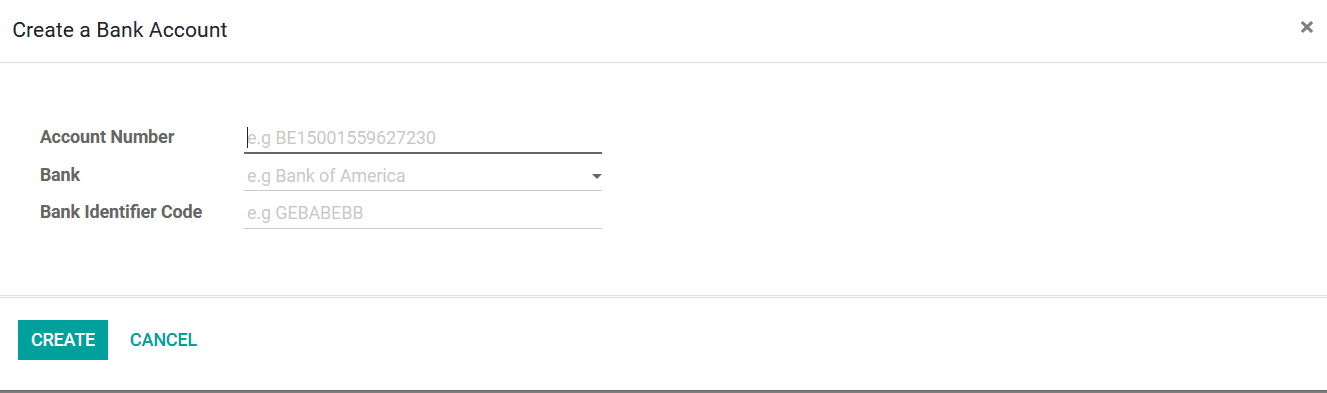

on the left side at the end of the menu. Upon selecting to Create a bank account

you will be depicted with the following Create a Bank Account window. Provide the

Account number, Bank details, and the Bank Identification Code.

Finally, select the Create option available which will open your bank account in

the Odoo platform. As we are clear on how to Add a Bank Account to the Odoo platform

let's now move on to the next section where we will describe the Reconciliation

Models tool available in the Configuration menu of the Odoo Accounting module.

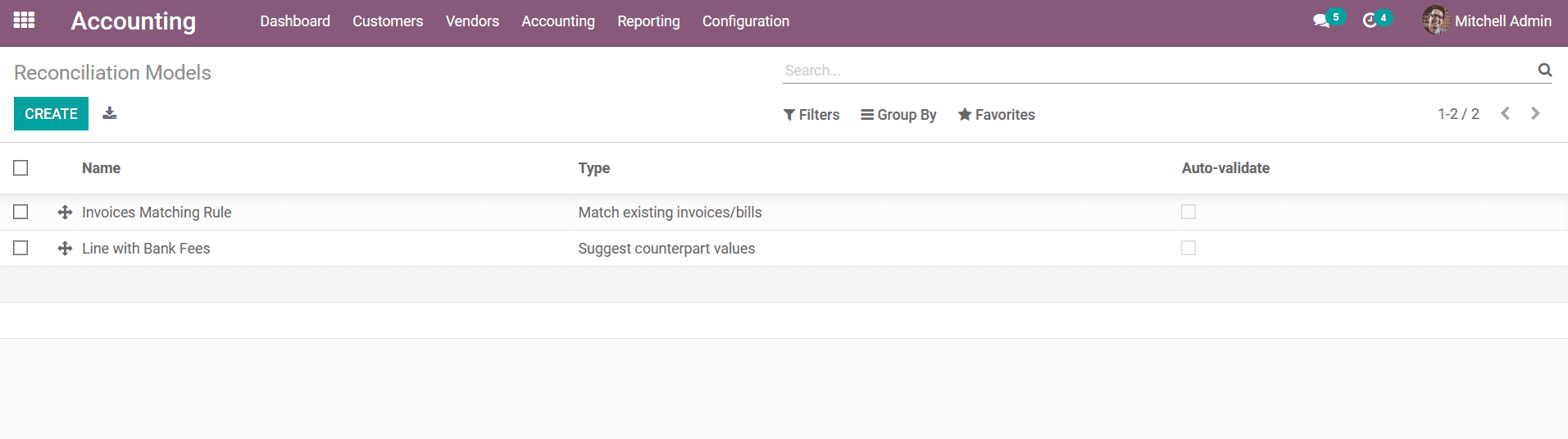

Reconciliation Models

The Reconciliation Models menu will depict the various Reconciliations which are

defined to be operations in the Odoo platform. In the Reconciliation Models menu,

all the models will be depicted along with Filter as well as Group by options helping

you to sort out the required Reconciliation Models that have been defined.

In Odoo you can define the Reconciliation Models in three types by default; Manually

create a write-off on the clicked button, Suggest counterpart values, and Match

existing invoices/bills. Manually creating a write-off on the clicked button will

provide you with buttons on the Manual Operations tab, which can fill all the details

of the reconciliation to be done automatically. Moreover, each of the buttons being

defined will act as a different Reconciliation model of operations in Odoo. Whereas

choosing the Suggest counterpart values Reconciliation model will ensure that the

immediate counterpart values should only be validated. Furthermore, this model will

ensure that the automation is based on the set of rules defined in the Reconciliation

Model.In Odoo you can define the Reconciliation Models in three types by default;

Manually create a write-off on the clicked button, Suggest counterpart values, and

Match existing invoices/bills. Manually creating a write-off on the clicked button

will provide you with buttons on the Manual Operations tab, which can fill all the

details of the reconciliation to be done automatically. Moreover, each of the buttons

being defined will act as a different Reconciliation model of operations in Odoo.

Whereas choosing the Suggest counterpart values Reconciliation model will ensure

that the immediate counterpart values should only be validated. Furthermore, this

model will ensure that the automation is based on the set of rules defined in the

Reconciliation Model.

The Match existing invoices/bills Reconciliation model automatically sets the correct

customer invoices and the vendor bills that match the payment amount. Once the entries

are validated, the Reconciliation operations are carried out automatically. In addition,

all the Reconciliation is carried out based on the rules defined in this mode while

configuring it.

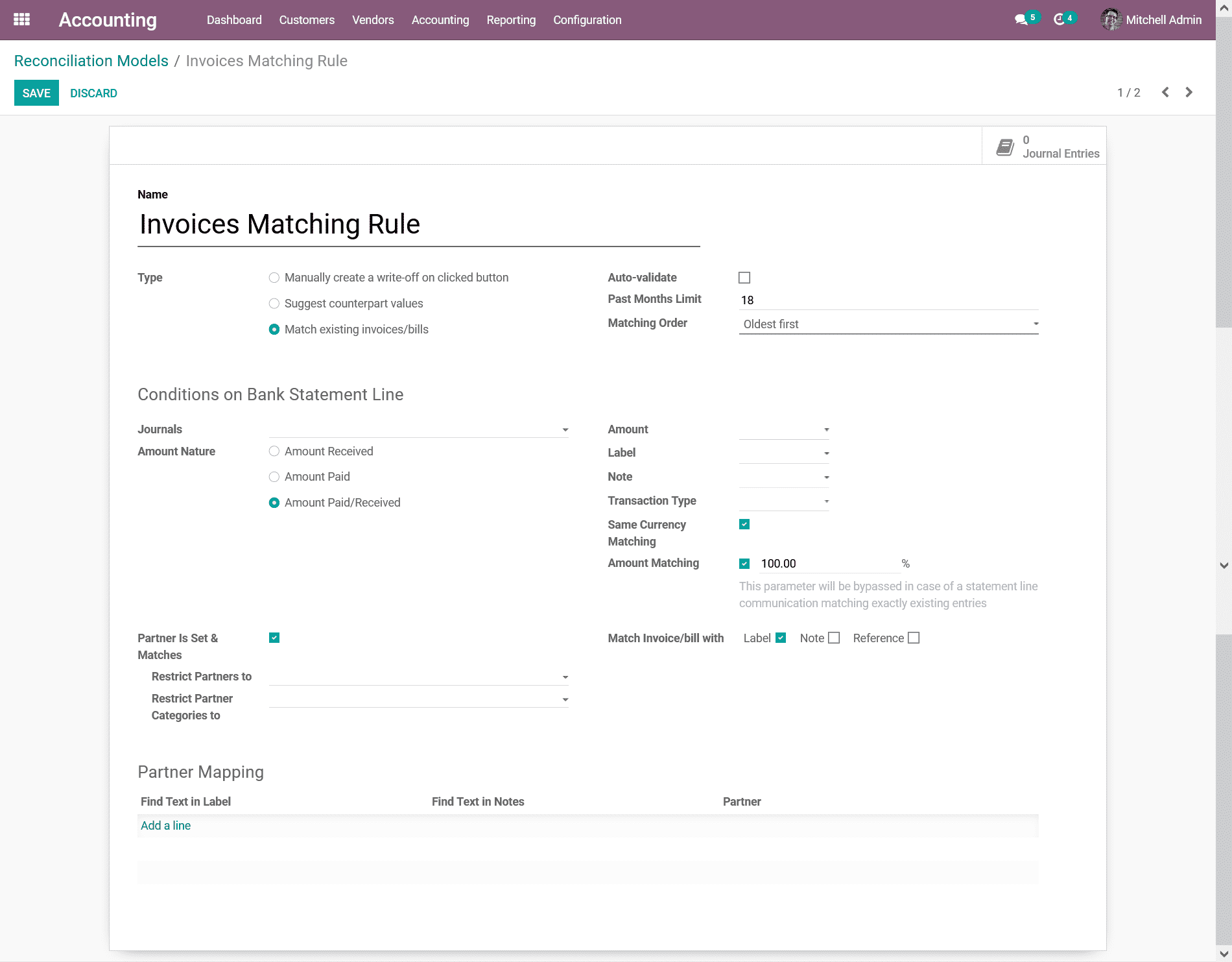

You can create new Reconciliation Models by selecting the Create option, which will

direct you to the window depicted in the following screenshot. Here, the Name of

the Reconciliation Models should be initially defined further; the Type can be defined

as Manually Create a write-off on the clicked button, Suggest counterpart values,

Match existing invoices/ bills. Further, you can enable the Auto - Validate, Past

Months Limit, and the Matching Order.

The Conditions on Bank Statement Line options such as the Journals of operations

can be defied; further, the Amount Nature can be set as Amount Received, or Amount

Paid or Amount Paid/ Received. Additionally, the Amount, Label, Note, Transaction

Type can be described, which will act as a filtering aspect based on the conditions

provided in the bank statement. The Same Currency Matching and the Amount matching

can be enabled or disabled based on the operations need of the respective Reconciliation

Model. Furthermore, the Match Invoices/bills can be defined to be Label, Note, or

Reference, which will also act as a filtration aspect in the bank statements. You

can also enable the Partner to be set & Matches can also be defined where the partner

restrictions options such as the Restrict Partners to and Restrict Partner Categories

To can be defined.

In addition, the Partner Mapping options can be defined in the respective menu where

the Field Test in Label, Find Text in Notes, Partner can be defined by selecting

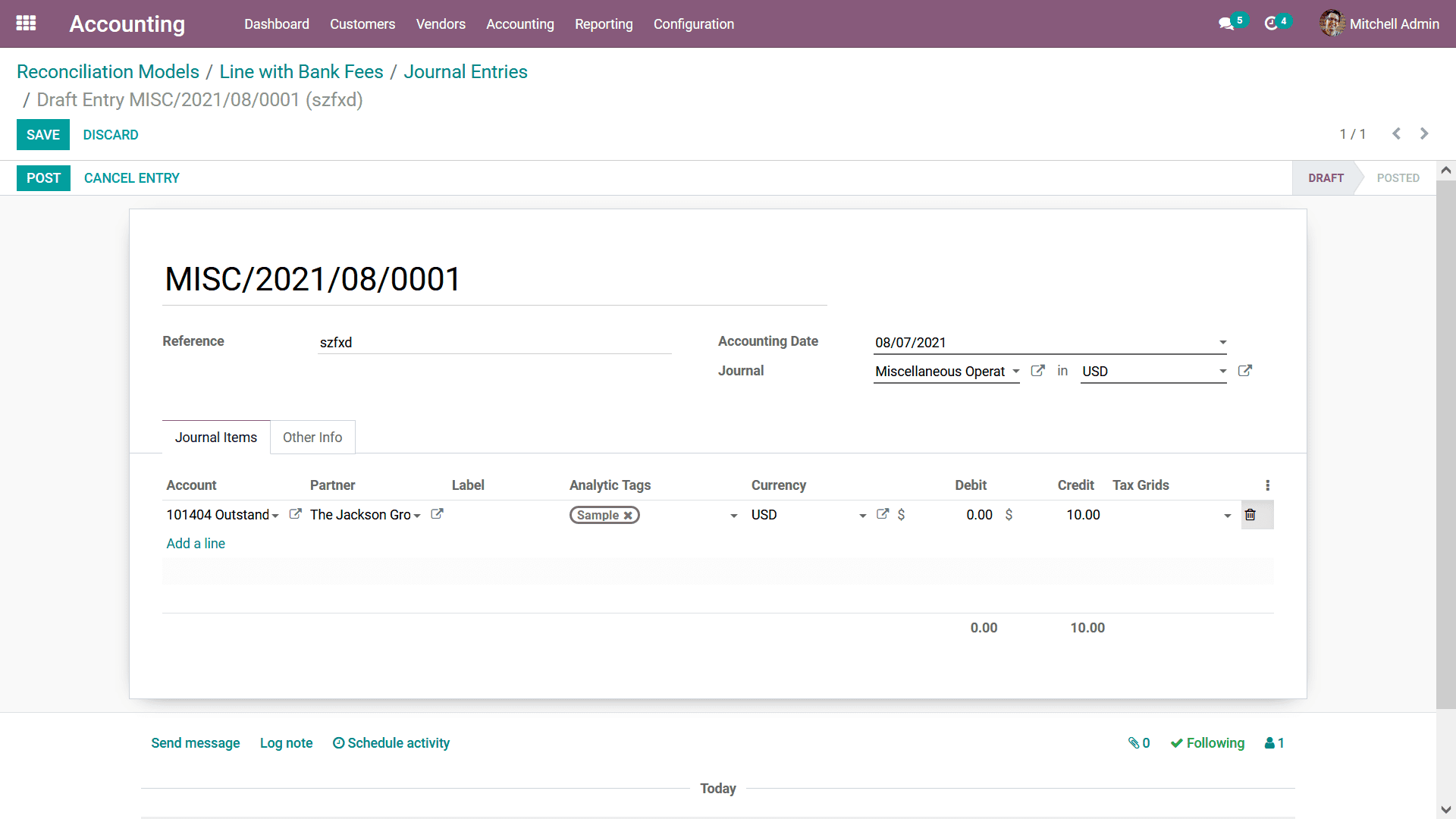

the Add a line option. Moreover, the Journal entries concerning the Reconciliation

Model that have been defined can be viewed after selecting the Journal smart option

available in the respective Reconciliation Model window. The Journal entries description

can be viewed upon selecting each entry in the Journal menu of the respective Reconciliation

Models.

Defining the reconciliation models will be an effective way to ensure that your

bank statements are challenges to the company's financial operations. The aspects

of Configuring Bank Payments by using the dignified menus in the Odoo Accounting

Module will aid your company’s effective financial management.

In Conclusion, in this chapter, we entirely focused on the Configuration tools and

menus available in the Odoo Accounting module, which will aid for the smoother financial

management of your company with effectiveness in operation. These tools will bring

advancements to the financial management operations and increase the productivity

aspect of the functioning.

In the next chapter, we will be moving on to understanding the various tabs of operations

in the Odoo Accounting module where the distinctive aspects of financial management

can be defined and managed.