31. 1099 Boxes

It is essential to generate 1099 income statements for contract

workers who receive payments of $600 or more and work in the US, as

these reports are required to submit tax information for services

provided throughout the fiscal year. The Odoo Accounting module

makes it easier to generate 1099 reports electronically and export

related CSV files containing all the necessary data for submission.

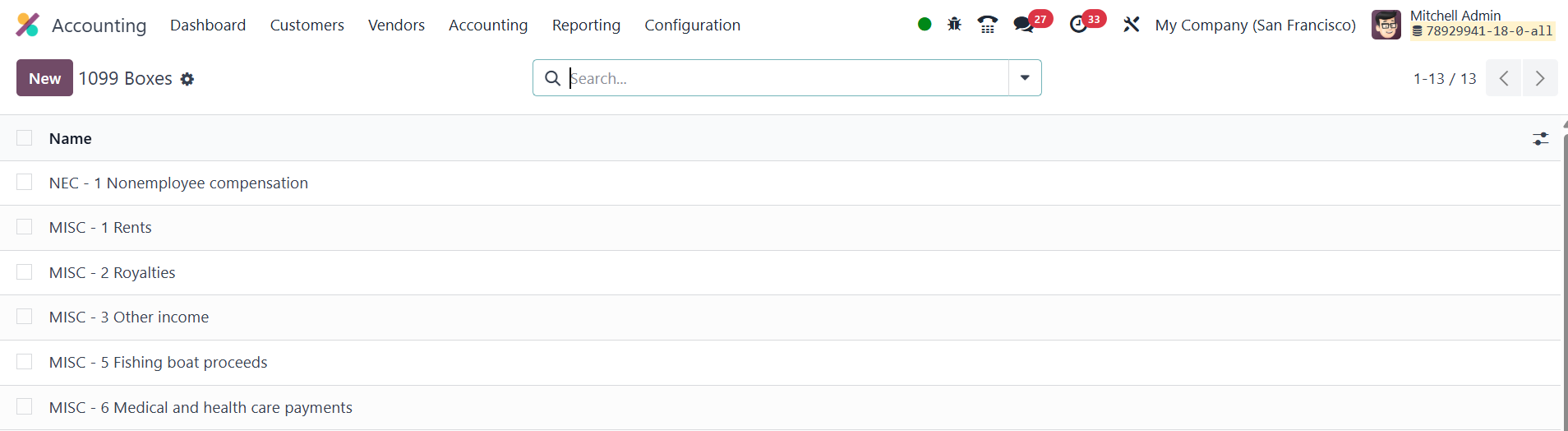

To create 1099 reports, you need to start by selecting the 1099 Boxes

option under the Configuration menu in the Accounting module. Here,

you can create and manage 1099 boxes, which are the categories under

which the payments are reported. To create a new box, click the New

button, where you can define the name and description of each 1099

box.

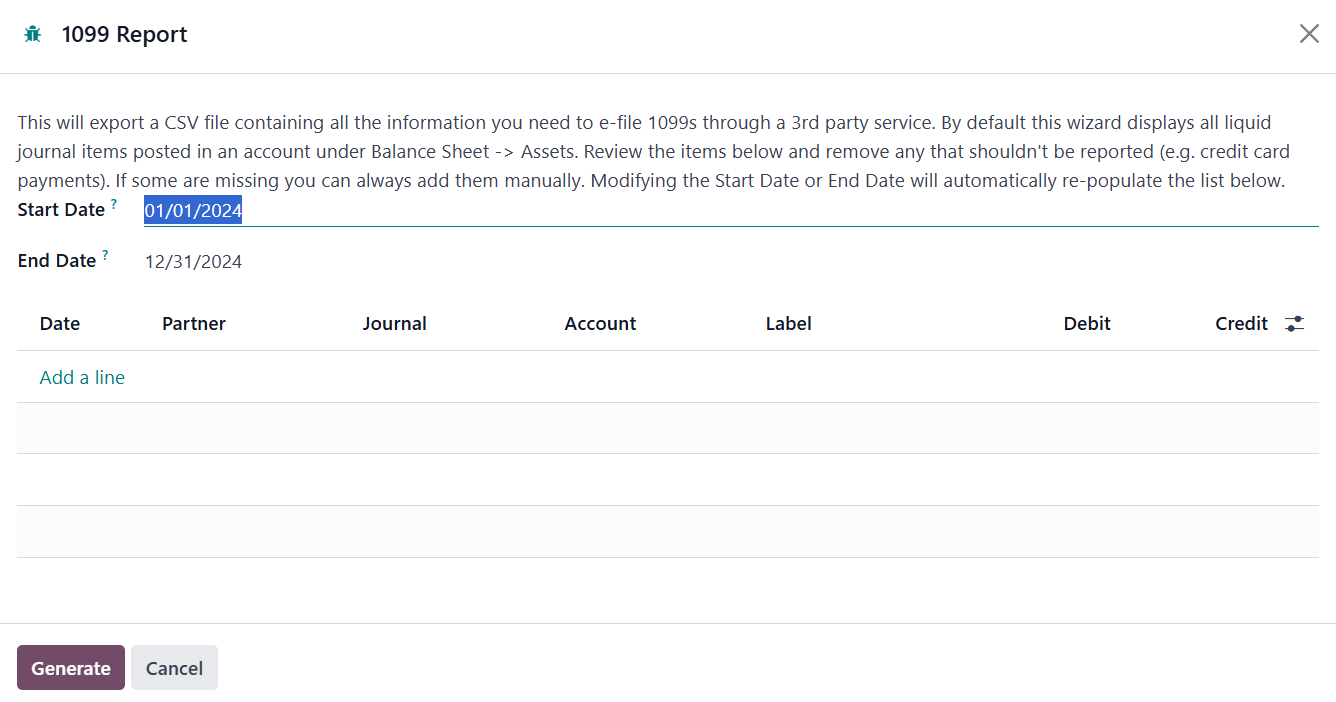

When it's time to generate the report, go to

Accounting ▸ Reporting ▸ 1099 Reports. Select the start and end

dates for the fiscal year, and click Generate. This will pull up a

list of journal entries that have been tagged with the relevant 1099

box information. The pop-up window will display details such as the

date, partner, journal, account, label, debit, and credit for each

entry. You can review and edit any entries as needed, and manually

add missing information if necessary.

Once all information is correct, click Generate again to export the

report as a CSV file. The CSV file will contain all the necessary

data for electronic filing, formatted for easy submission to

third-party e-filing providers or directly to the IRS. This process

simplifies and automates the creation of 1099 reports, ensuring

compliance and reducing the potential for errors.