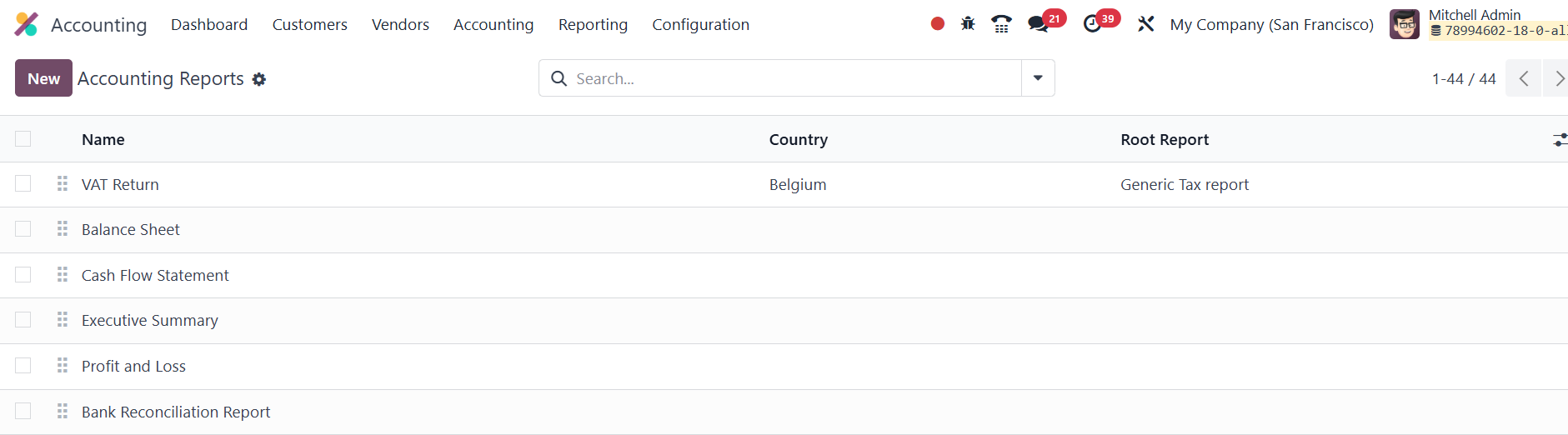

35. Accounting Reports

Odoo offers a robust and user-friendly reporting framework that

allows businesses to generate detailed financial reports like tax

reports, balance sheets, and income statements. To create or

customize these reports, go to Accounting ‣ Configuration ‣

Management: Accounting Reports.

Here, you have the option to create either a root report or a

variant.

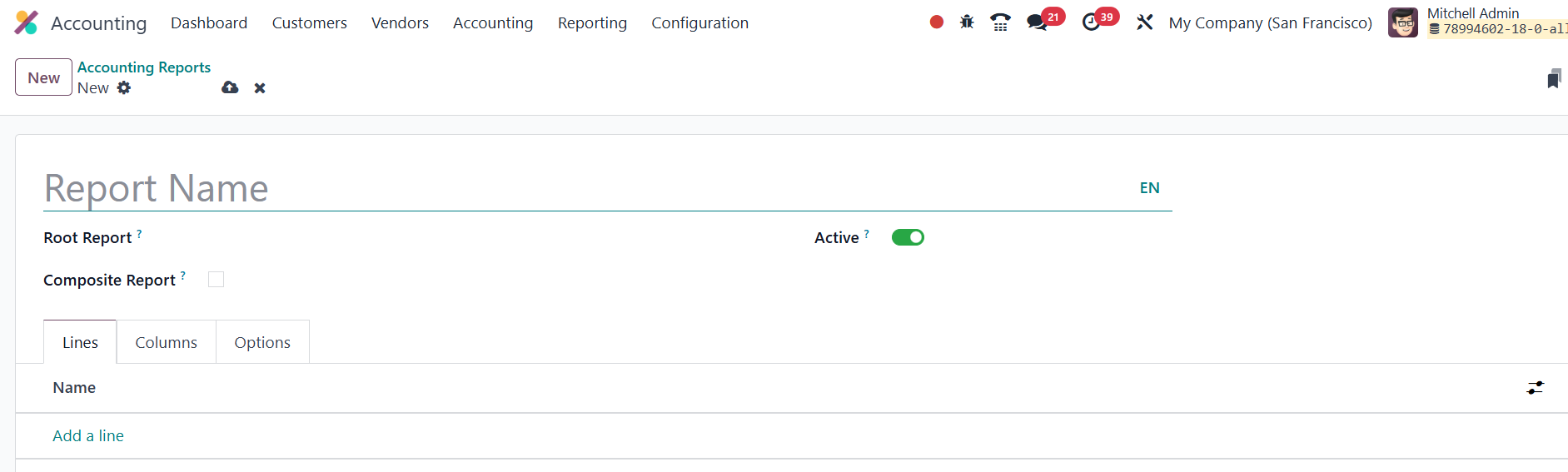

A root report serves as a generic template that can be customized

further for specific accounting practices. If a report doesn't

reference another as a root, it is automatically treated as a root

report itself. After creating your report, you will need to add

lines to it, either by clicking Add a line to create a new entry or

by selecting an existing one for modification.

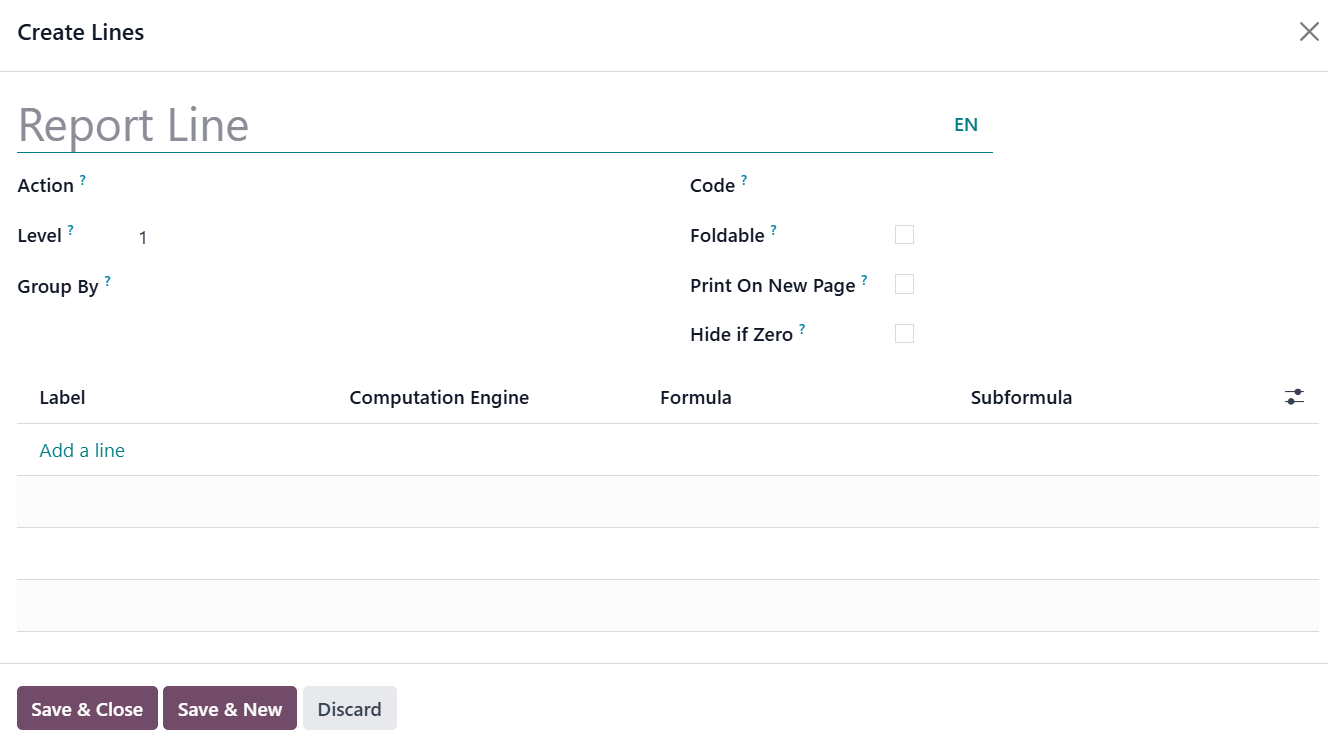

Each line requires a Name, and you can optionally assign a Code to

each line if you intend to use it in formulas. When creating an

expression in Odoo 18, you must assign a unique label to identify it

within each line. This label ensures that the expression can be

distinctly referenced. Additionally, you must specify both a

Computation Engine and a Formula. The computation engine determines

how the formula and any subformulas are interpreted; different

engines may use different logic or syntax. Notably, Odoo allows

mixing expressions that use various computation engines within the

same line, offering flexibility for complex calculations and

reporting needs.

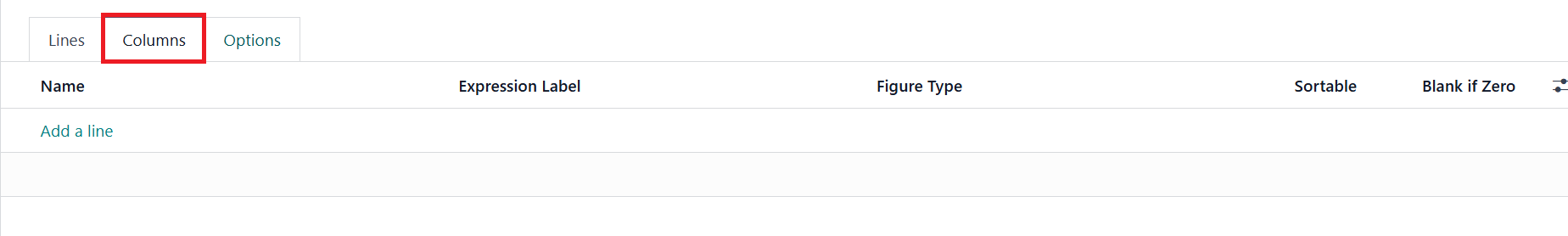

Reports in Odoo can accommodate multiple columns, with each column

pulling values from expressions defined in the lines.

The expression_label field of each column defines the label of the

expression that will display its value. If a line does not have an

expression in the field, no value will appear in that column. For

reports with multiple columns, ensure that each column has a

distinct expression_label to differentiate the displayed values.

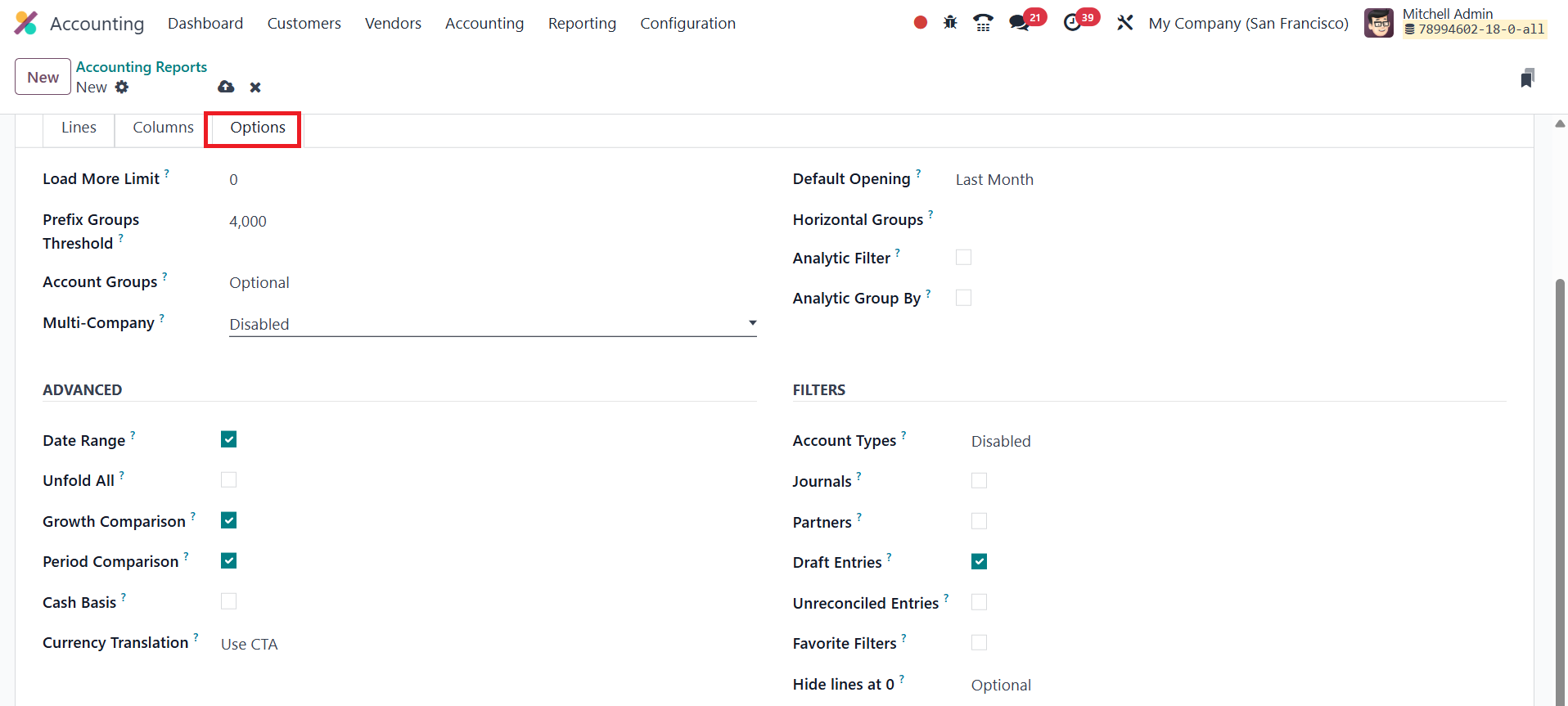

The Load More Limit allows you to adjust the number of records

displayed at once. This is particularly useful when working with

large datasets, ensuring the report loads efficiently.

The Account Groups function offers three settings: Always, Optional,

and Enabled by Default, allowing you to control the inclusion of

account groups in the report. You can also customize the

Multi-Company Filter by enabling the Use Company Selector or Use Tax

Unit options. If multi-company reporting is not required, you can

disable this feature. For reports like the Aged Receivable, you can

set a Default Viewing Period, ensuring that the report is displayed

for a specific time period by default.

Further customization can be made by adding Horizontal Groups to

organize data visually and enabling Analytic Filters and Analytic

Group By for enhanced sorting and grouping options. These settings

provide more flexibility when analyzing financial data.

In the Advanced Options section, you can enable features like the

Date Range filter, which allows you to specify a date range for the

report, and the Unfold All option to expand all data rows. For those

seeking comparative analysis, the Growth Comparison and Period

Comparison features enable side-by-side financial data analysis

across different periods. Additionally, enabling Cash Basis Mode

allows for cash-based accounting reports. The Filters section also

lets you add specific filters like Account Types, Journals,

Partners, Draught Entries, and Unreconciled Entries to refine the

report further.

These advanced customization features provide comprehensive control

over how your reports are structured and displayed, allowing

businesses to gain deeper insights into their financial data.