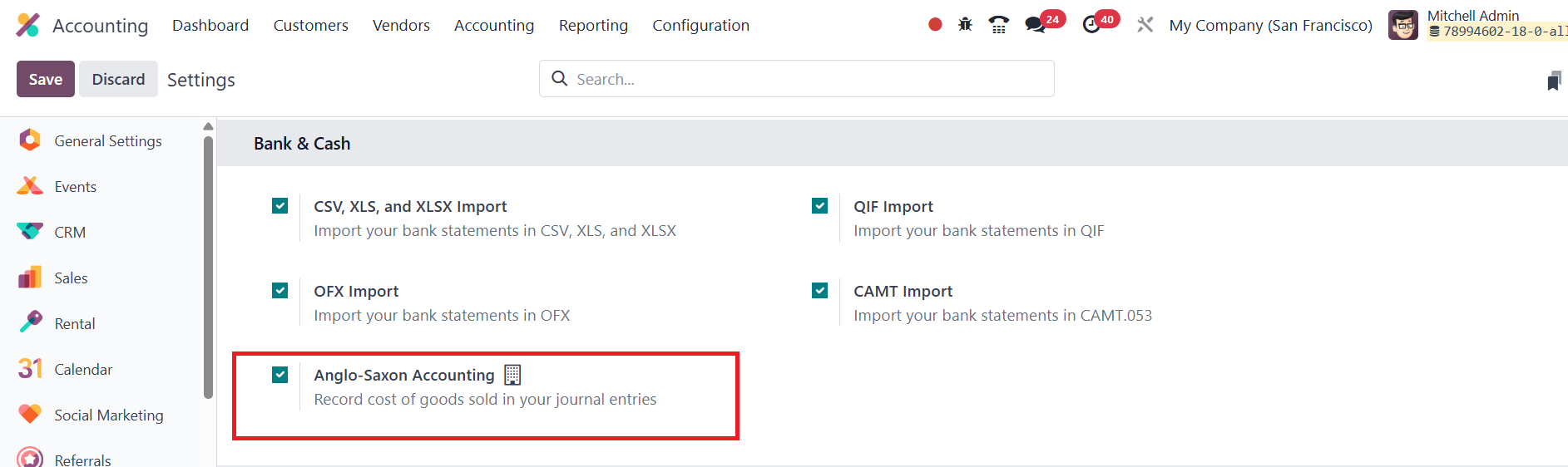

38. Anglo-Saxon Accounting

Anglo-Saxon Accounting is one of the two primary accounting methods

used globally, with Continental Accounting being the other. The

Anglo-Saxon approach is commonly preferred by smaller communities

and is available in Odoo 18's enterprise edition. To enable it, you

must activate Developer Mode and navigate to the Settings menu

within the Accounting module.

The primary distinction of Anglo-Saxon accounting lies in its

treatment of expenses related to goods. In this method, the costs of

sold products are only recognized once the goods are sold or

delivered to the customer. This differs from Continental Accounting,

where the cost is recognized immediately upon receipt of goods into

stock.

For example, in Anglo-Saxon accounting, even if you create a purchase

order for a product or receive the goods, the expense account

remains unaffected. The expense will only be recognized when an

invoice is generated and the goods are billed to the customer.

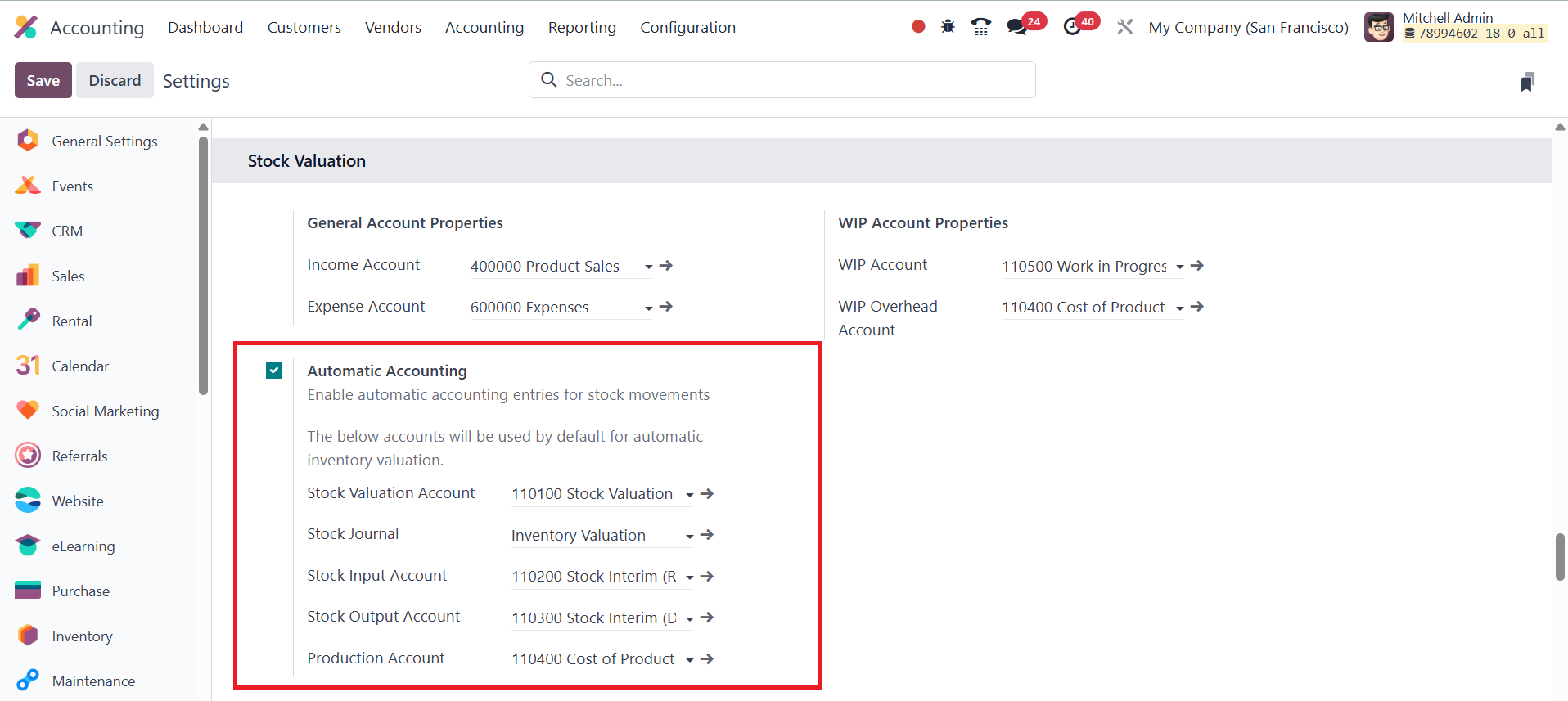

To automate this process in Odoo 18, you need to set up Automatic

Accounting in the product's settings and activate automatic

accounting entries for stock movements under the Configuration

Settings of the Accounting module.

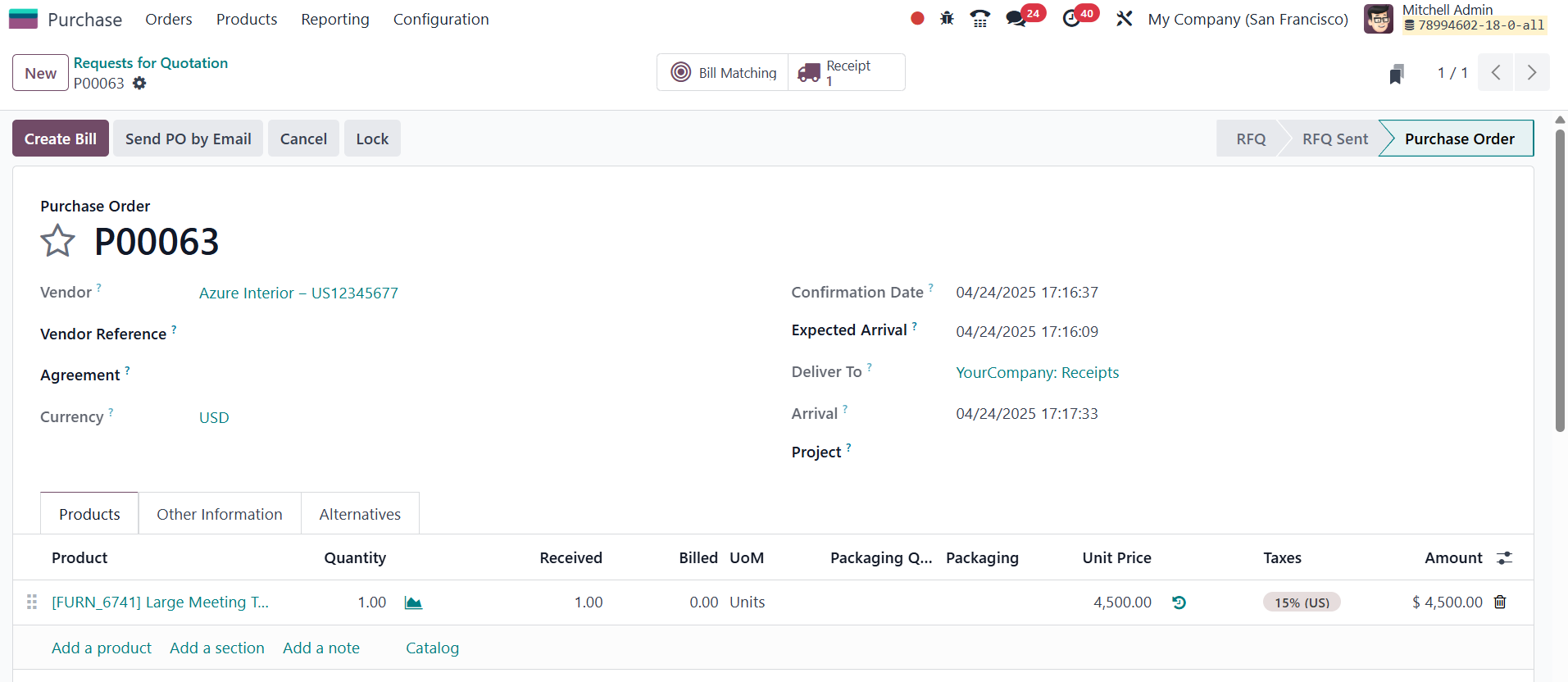

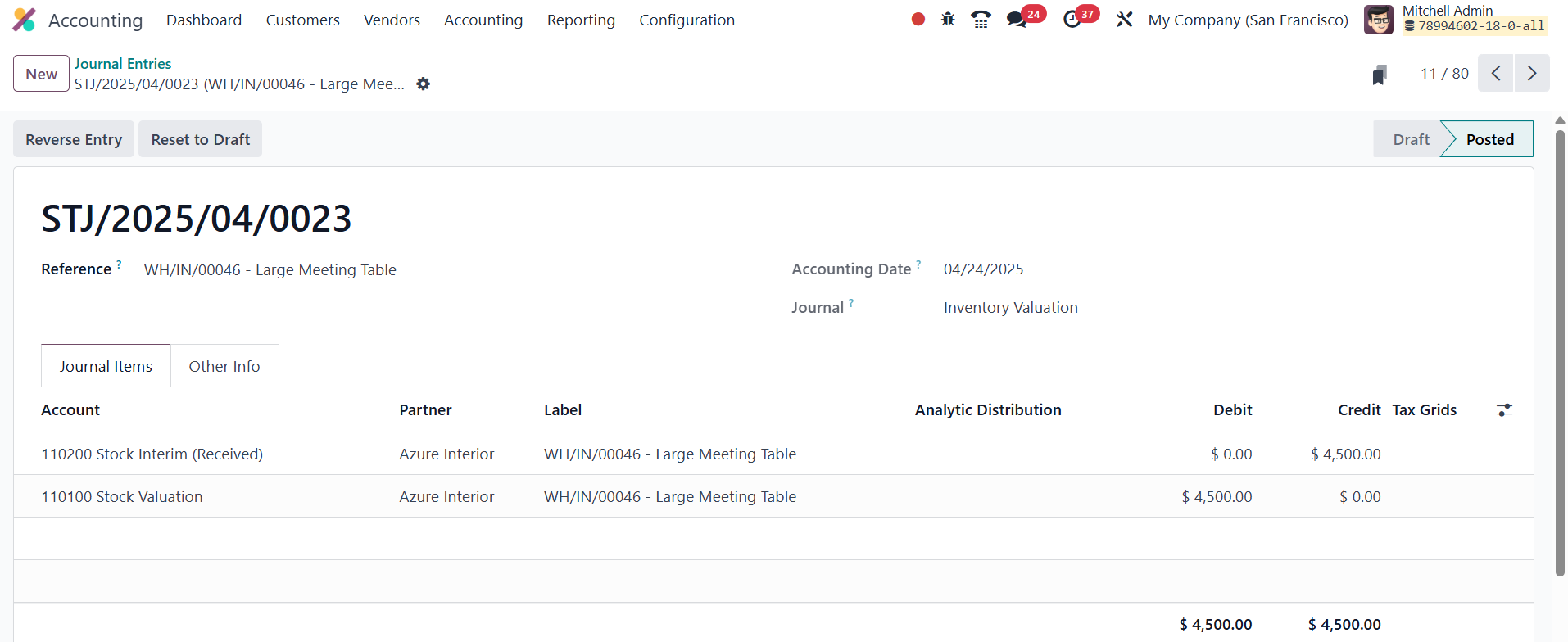

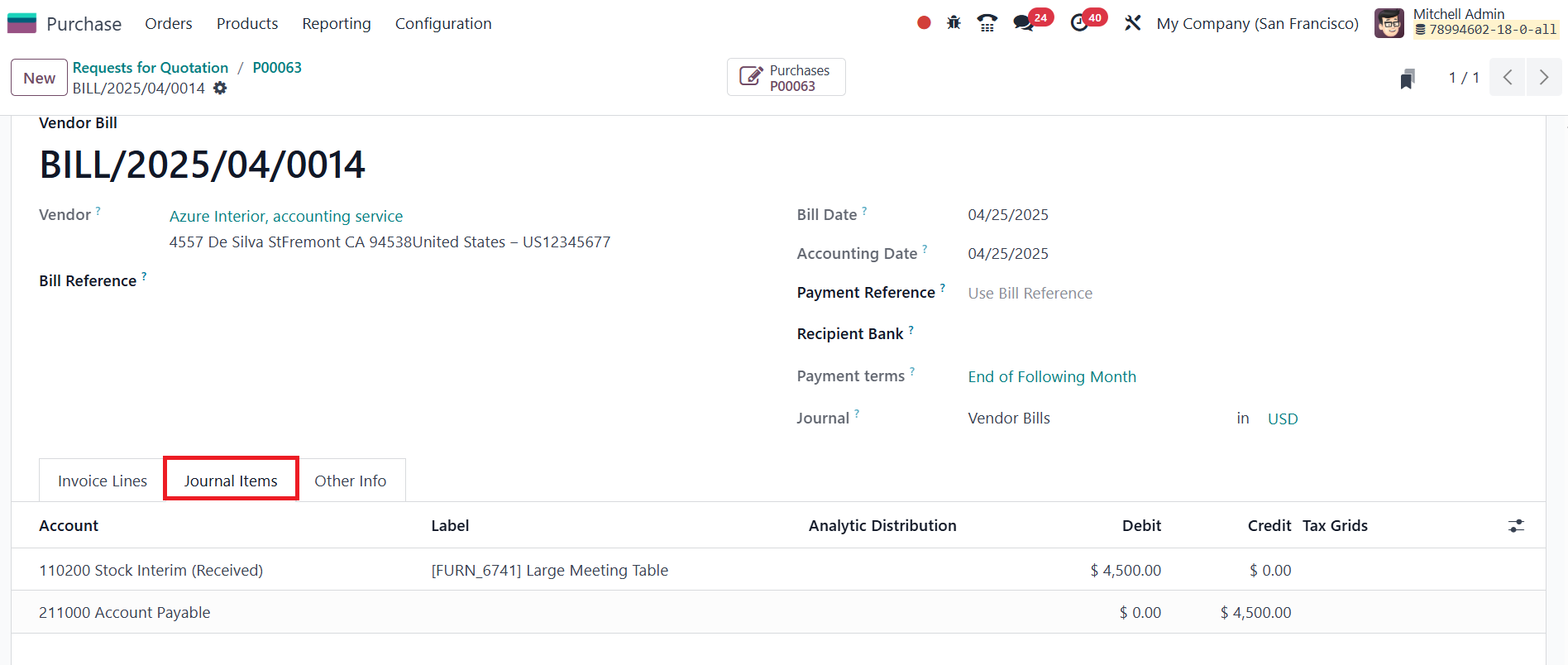

Once the purchase order is confirmed, and the goods are accepted, you

can verify the associated journal entries within the Journal Entries

section of the Accounting module.

However, at this point, the expense account remains unaffected.

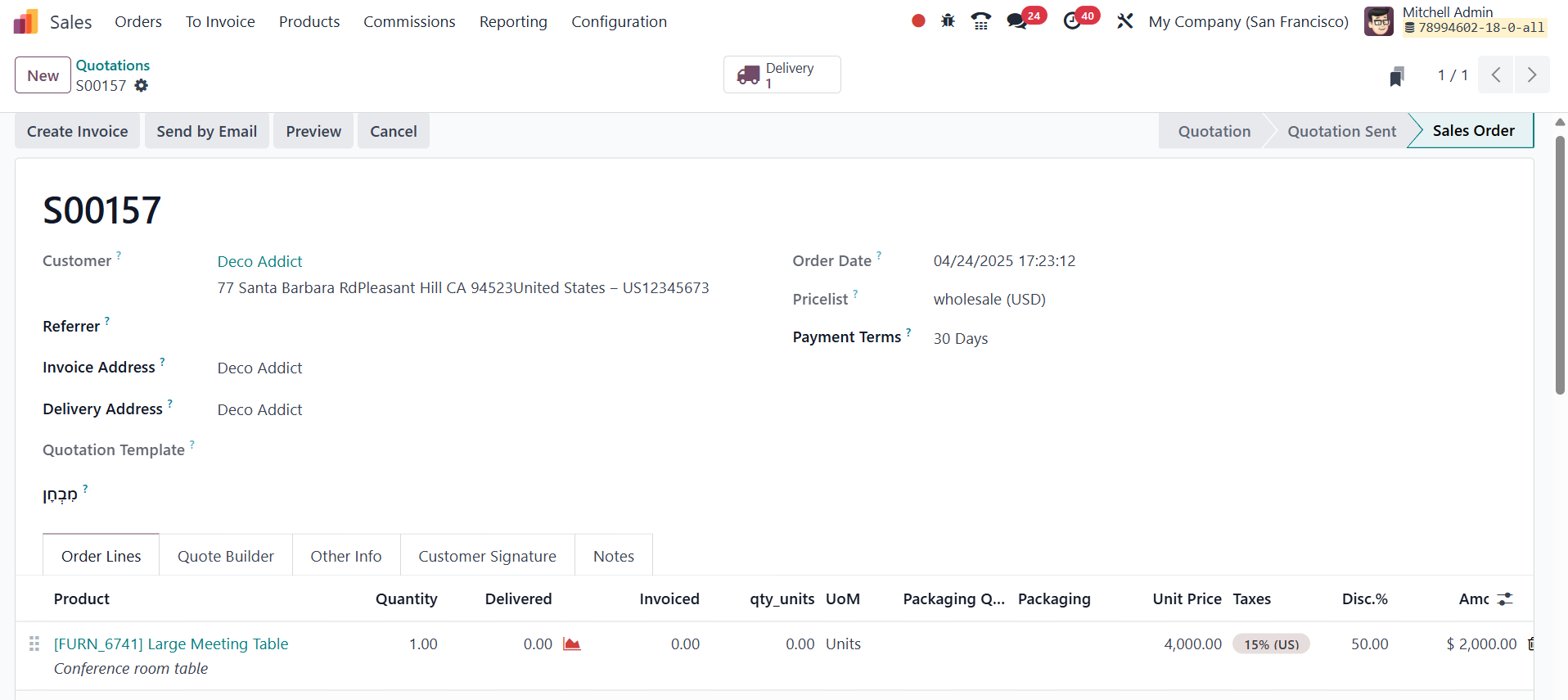

When dealing with sales, the impact of Anglo-Saxon accounting on the

expense account becomes clearer.

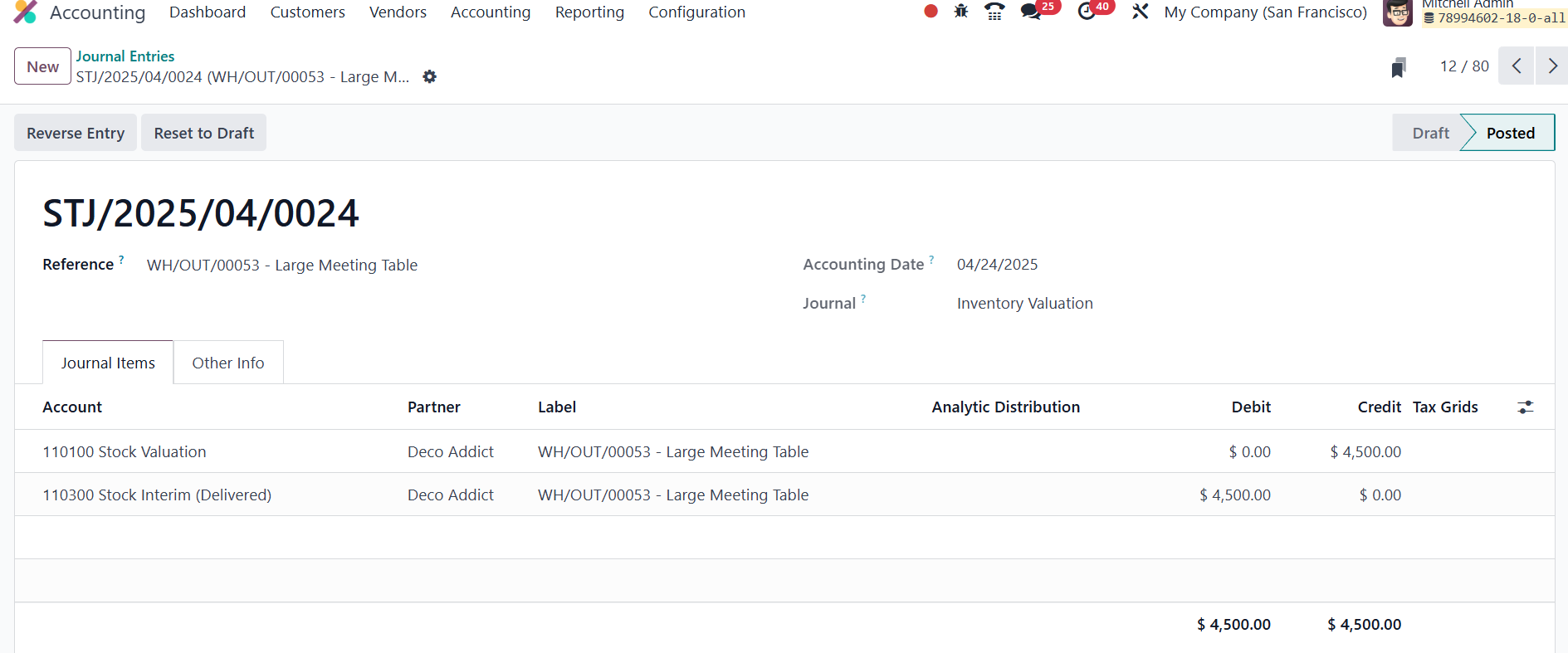

After confirming a sales order and validating the delivery, you can

see the related journal entries for the sale in the Accounting

module.

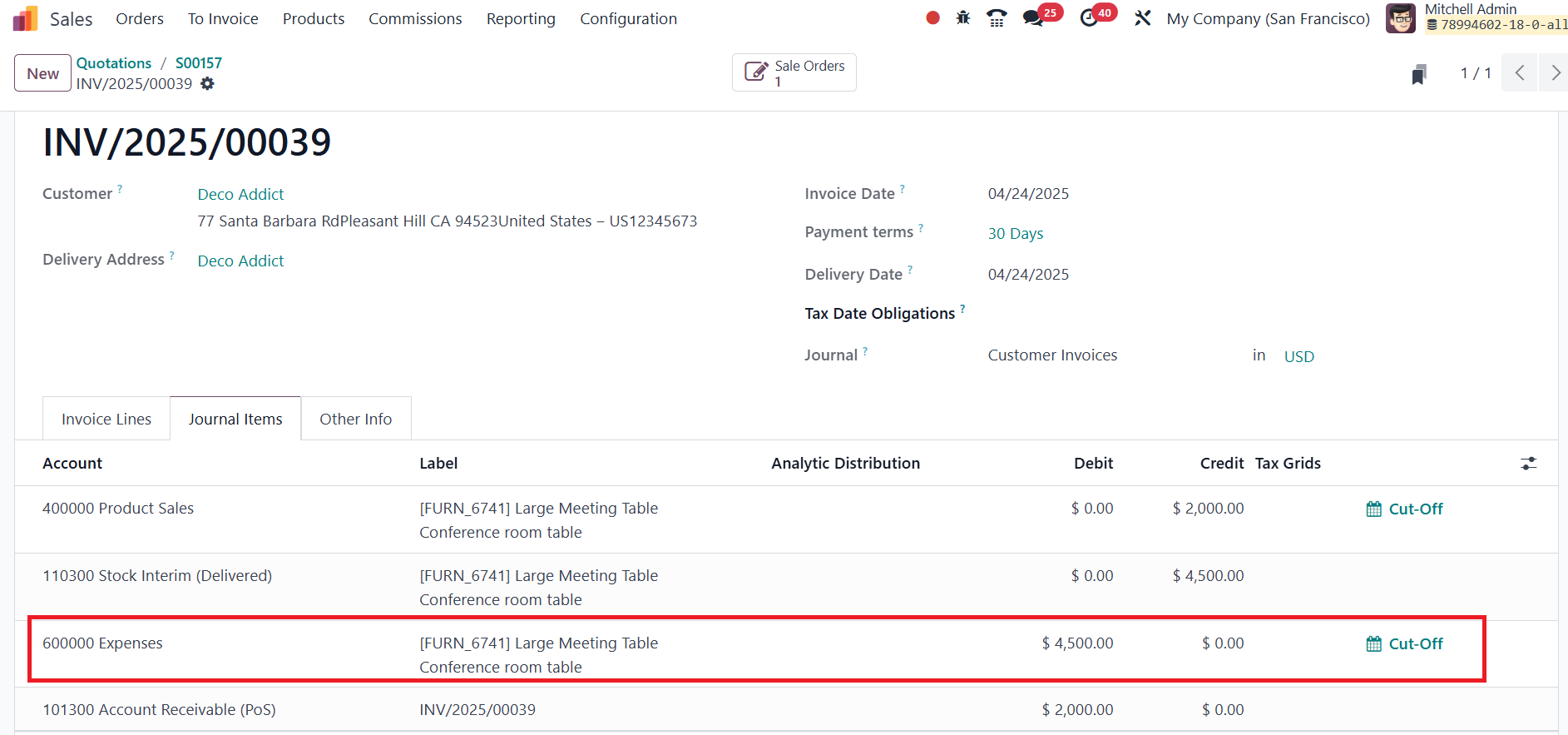

After the sales invoice is generated and confirmed, the product's

cost is recognized as an expense.

Thus, in Anglo-Saxon accounting, costs are only recognized after the

sale is completed and invoiced, providing a more straightforward and

delayed recognition of expenses in contrast to Continental

Accounting, where expenses are recognized sooner.