16. Assets

In Odoo 18 Accounting, asset

management has been

streamlined to ensure

efficient tracking and

control over long-term

assets. The platform provides

a comprehensive structure for

handling fixed assets; those

that contribute to business

operations over a longer

duration but depreciate in

value over time.

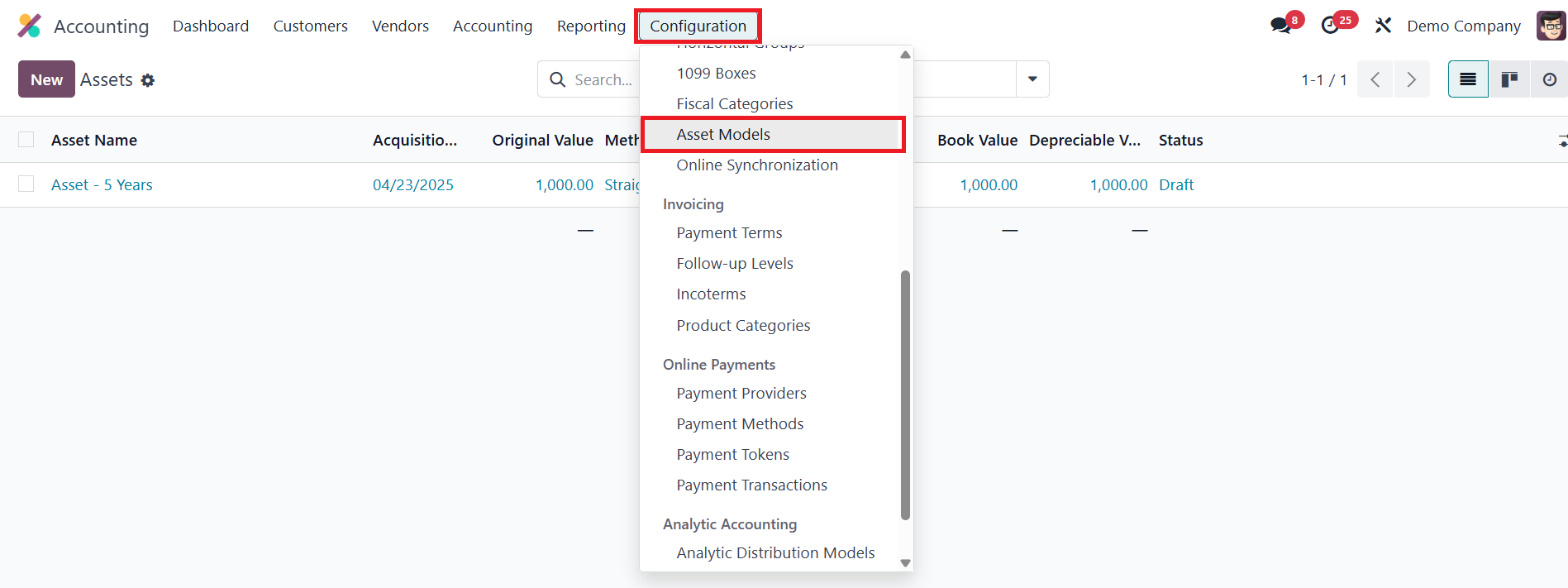

To begin with, users can

configure Asset Models via

the Configuration menu. These

models act as templates that

define the asset’s

depreciation method,

duration, accounts, and

related journal entries.

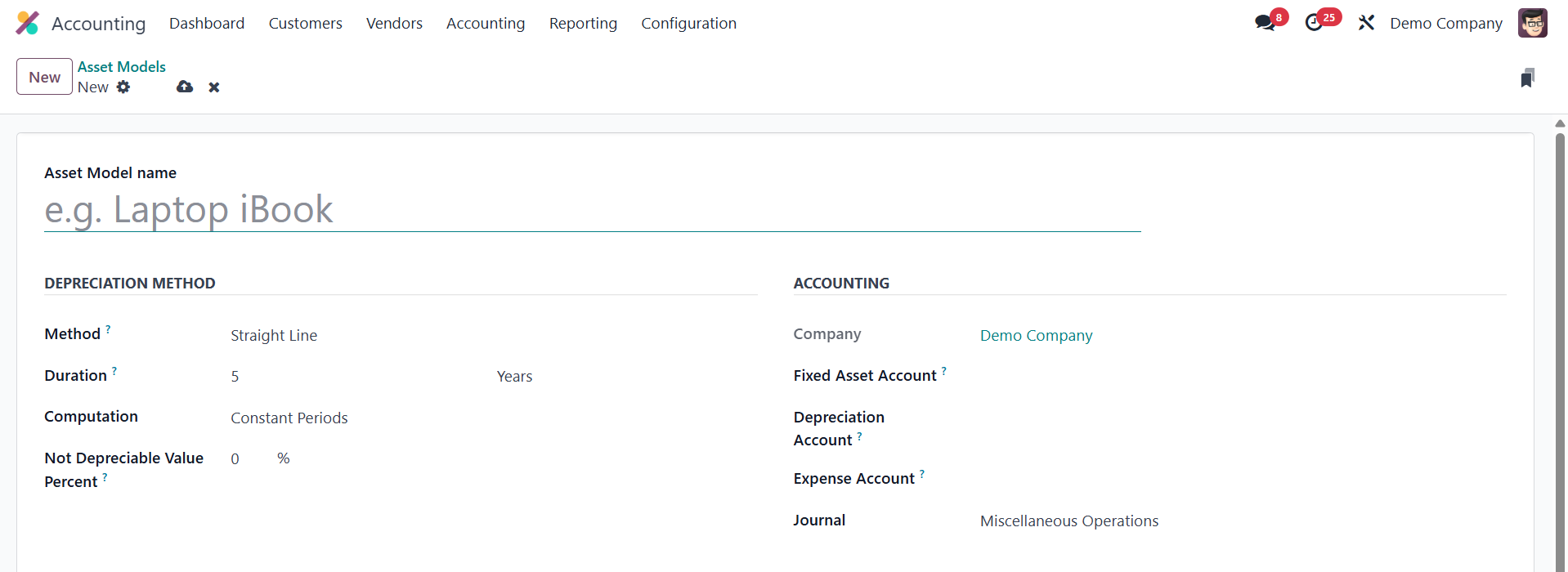

Each asset model includes fields

like the Asset Model Name,

Fixed Asset Account,

Depreciation Account,

Depreciation Method, Number

of Depreciations, and Period

Length.

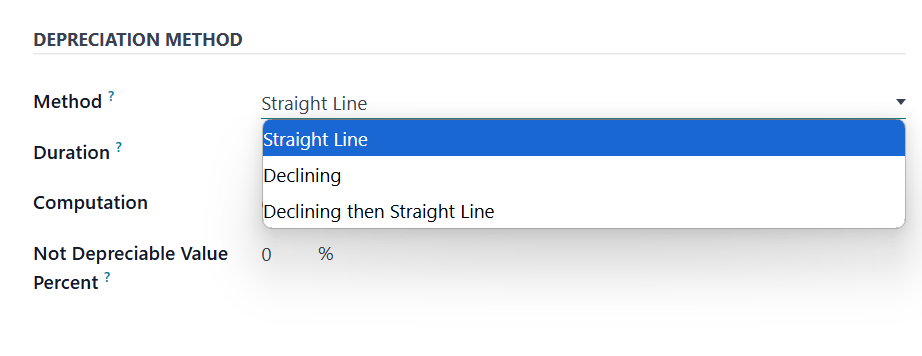

Odoo 18 continues to support the

three familiar depreciation

methods: Straight Line,

Declining, and Declining then

Straight Line. The Straight

Line method evenly spreads

the asset’s value across its

useful life. In contrast, the

Declining method applies a

consistent depreciation

factor to the remaining book

value, resulting in higher

depreciation in the earlier

years. The hybrid Declining

then Straight Line method

begins with the declining

approach and shifts to

straight-line once it becomes

more efficient.

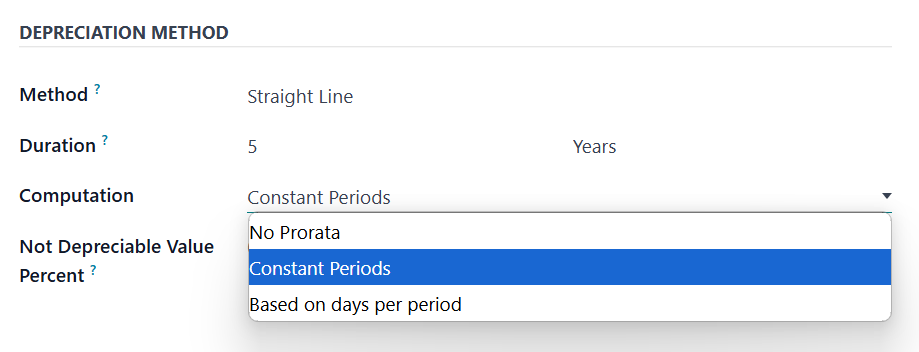

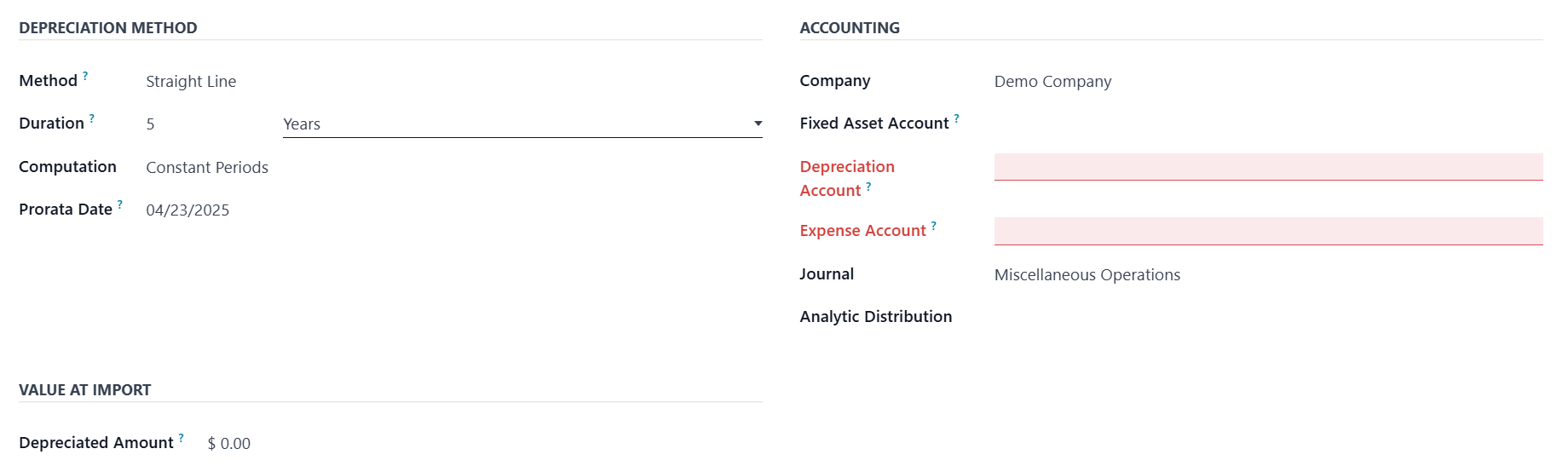

The system also allows you to set

depreciation frequency and

whether the method should

follow constant periods, no

pro-rata, or vary based on

actual days. Account settings

include the Fixed Asset

Account for the original

purchase, a Depreciation

Account for reducing the

asset value, and an Expense

Account to post periodic

depreciation. A specific

Journal can be assigned for

all accounting entries

related to this model.

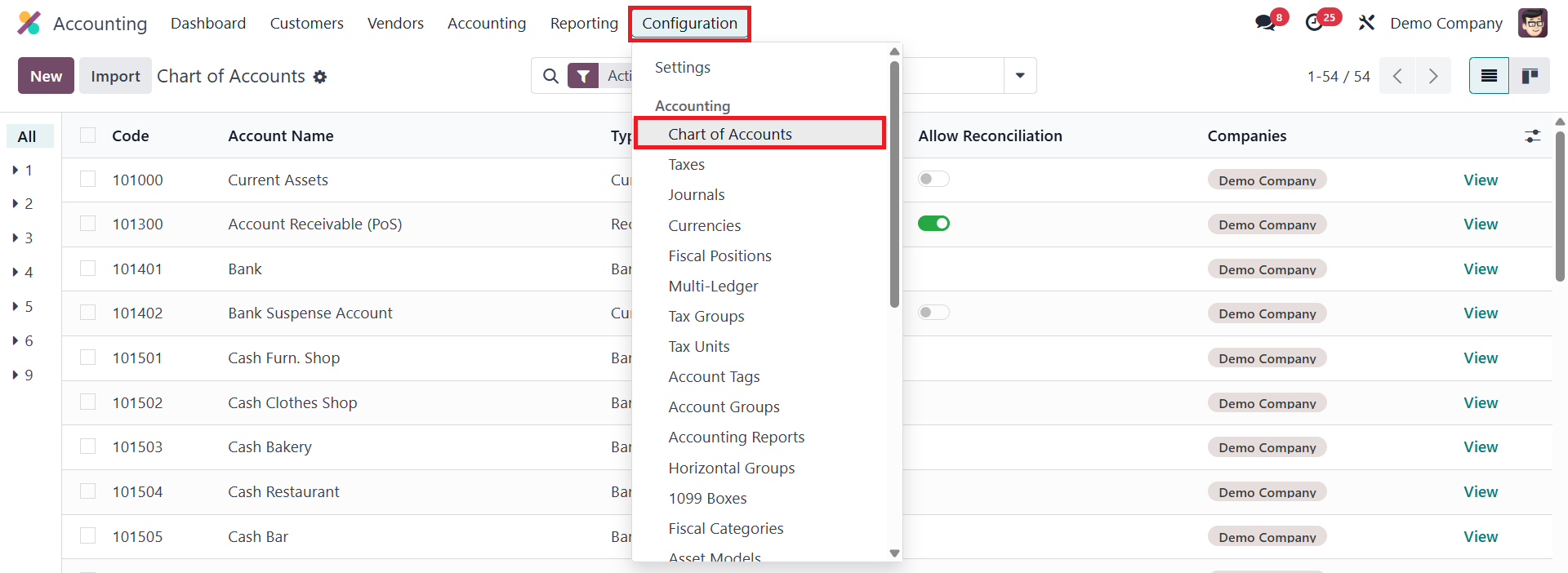

Automating asset creation is made

easy through the Chart of

Accounts.

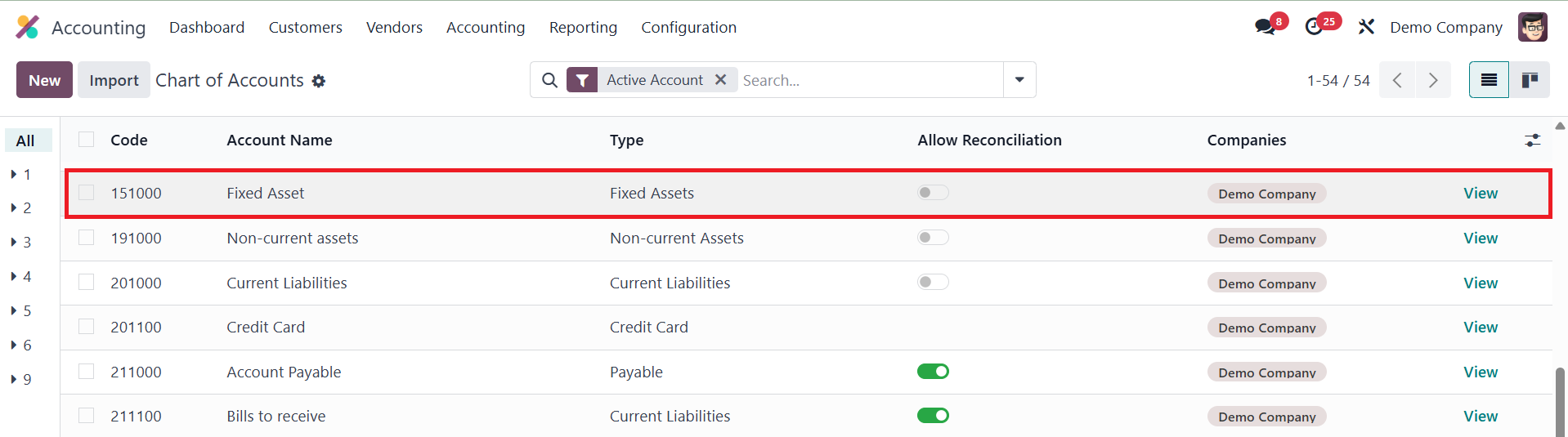

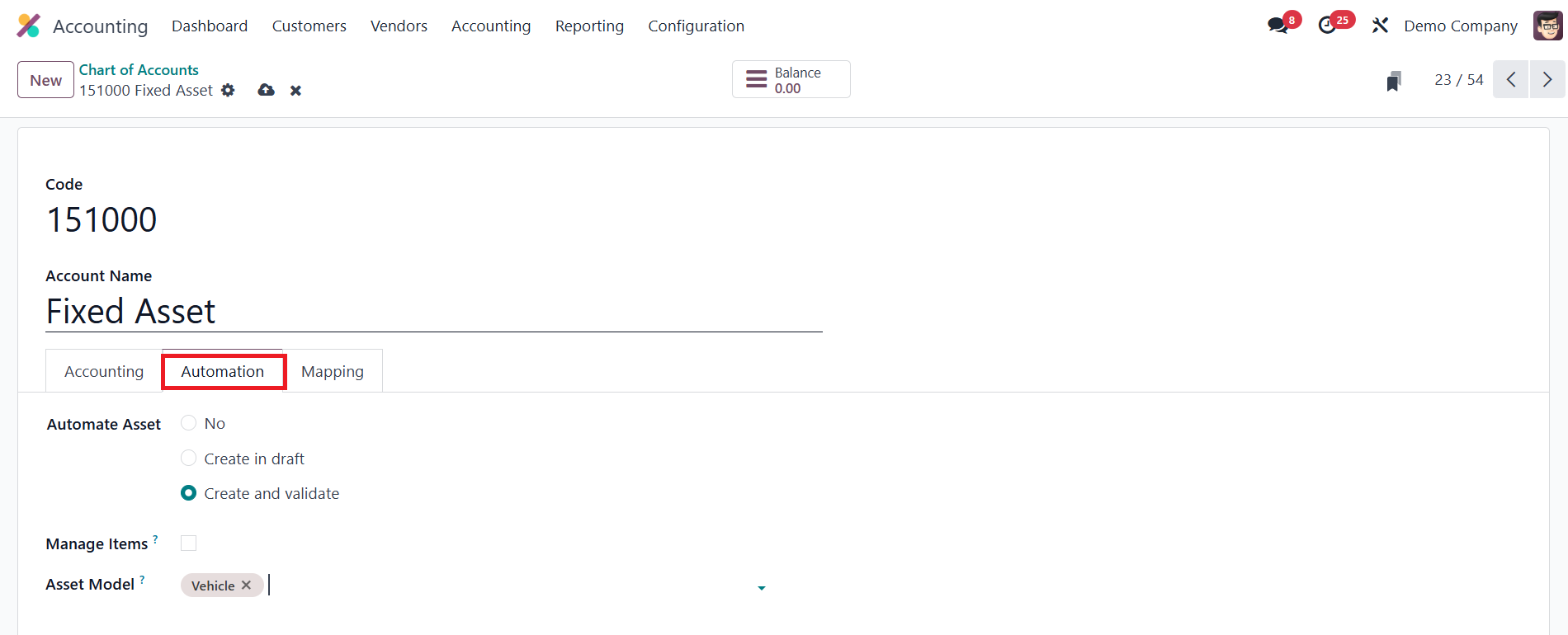

You can select an account and

configure it to automatically

create and validate assets

when vendor bills are posted.

Assigning an Asset Model to the

selected account enables

automatic asset generation

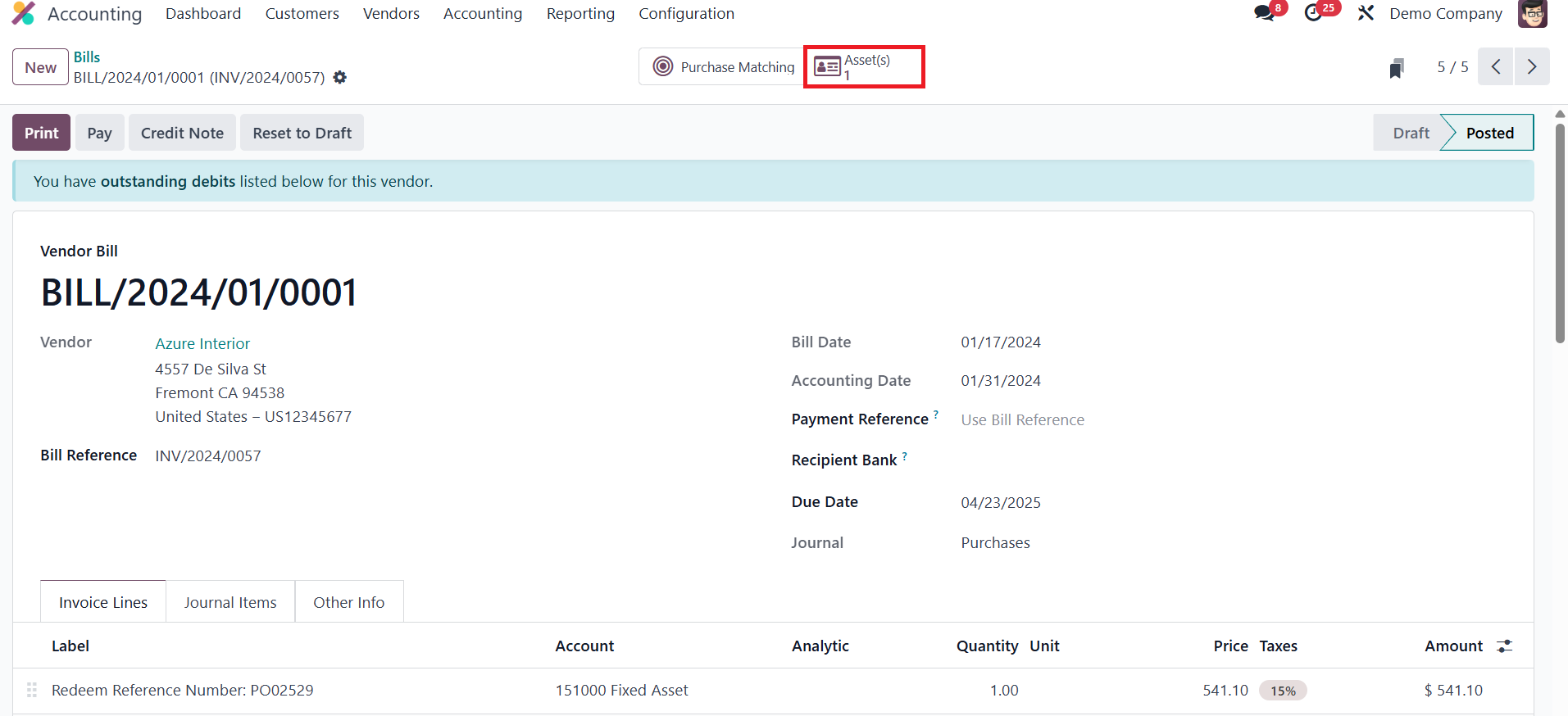

during bill validation. Once

a vendor bill is posted using

this account, Odoo 18

activates the Asset smart

button on the bill.

Clicking this reveals the

corresponding asset record.

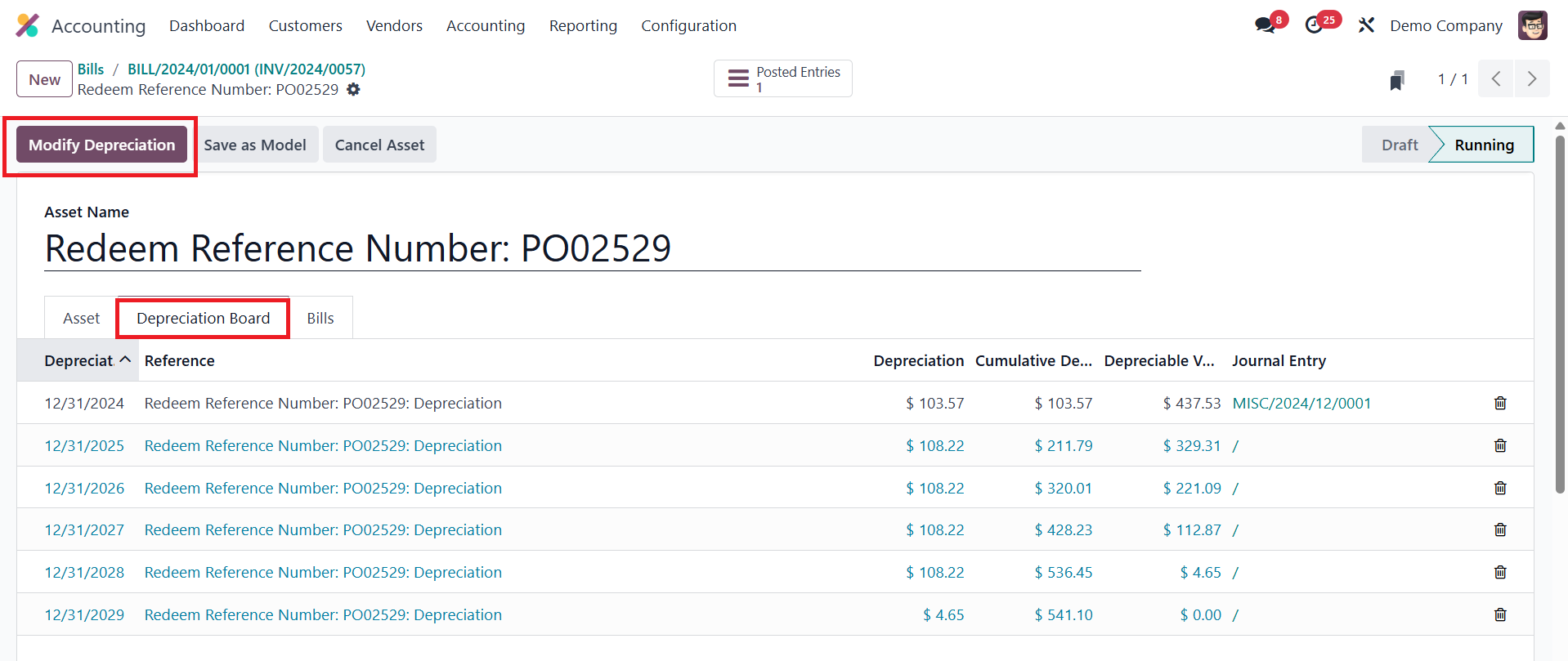

Each asset record includes

detailed tabs such as the

Depreciation Board, where you

can view scheduled

depreciation entries. The

Modify Depreciation button

opens a window where you can

manage asset lifecycle

events; like disposal,

reevaluation, or pausing

depreciation.

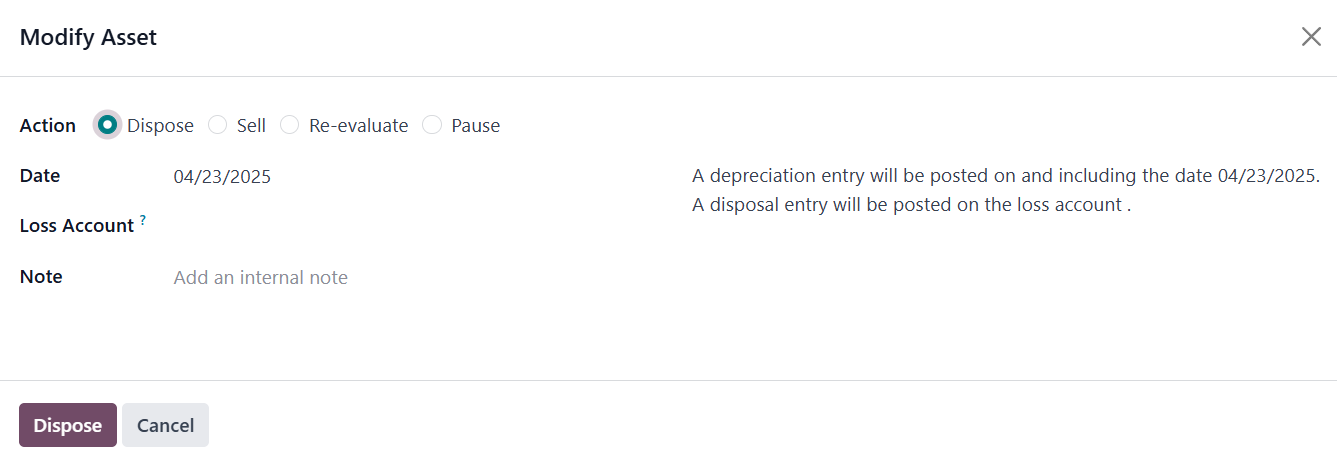

For disposals, you can input the

disposal date, a Loss

Account, and related invoice

information if the asset is

being sold.

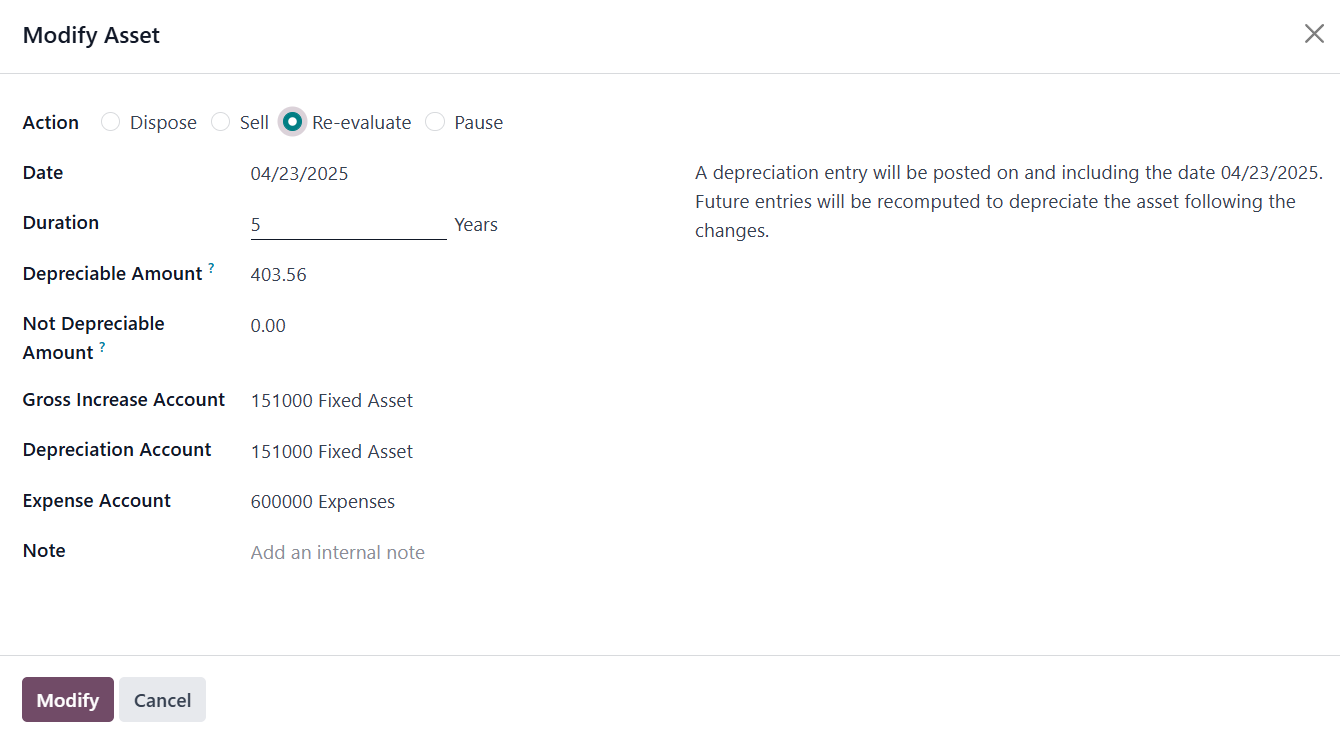

If the action is to reevaluate,

the user can update the

depreciable and

non-depreciable values, along

with related accounts such as

the Gross Increase Account

and Expense Account.

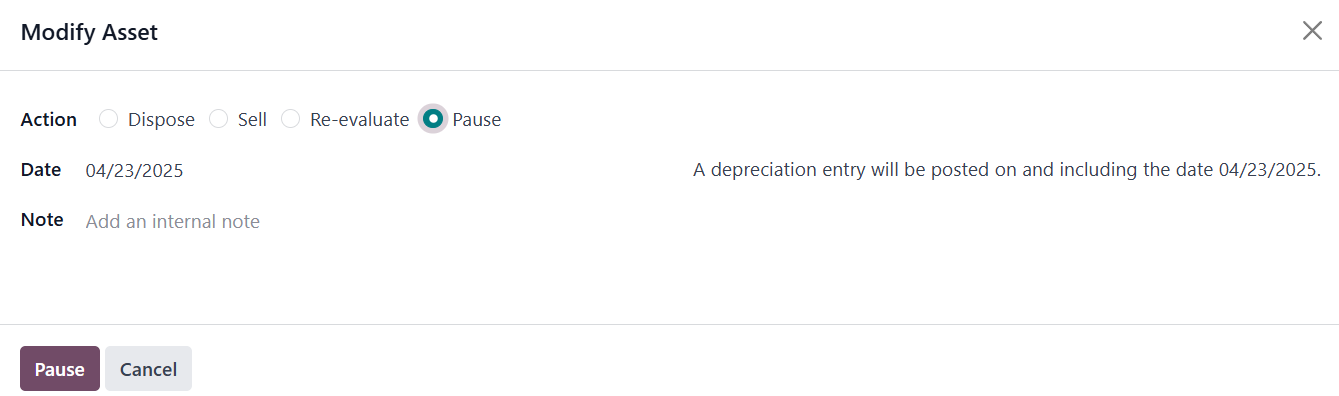

Pausing depreciation temporarily

halts the calculation and

updates the Depreciation

Board accordingly.

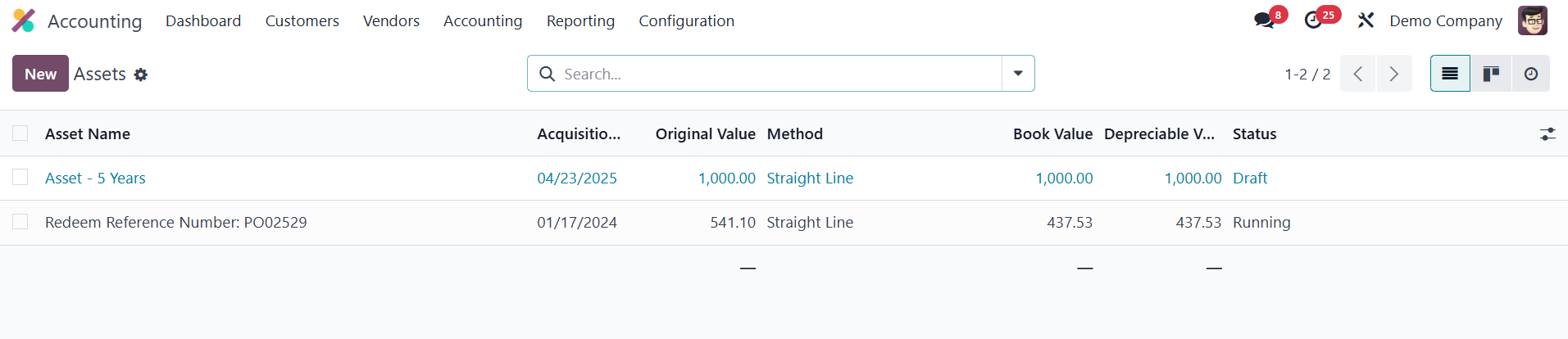

Odoo 18 also allows users to

manage assets manually

through the Accounting menu.

This overview lists all assets

with relevant details like

name, acquisition date,

original value, depreciation

method, book value, and

current status. You can click

the New button to create a

new asset manually.

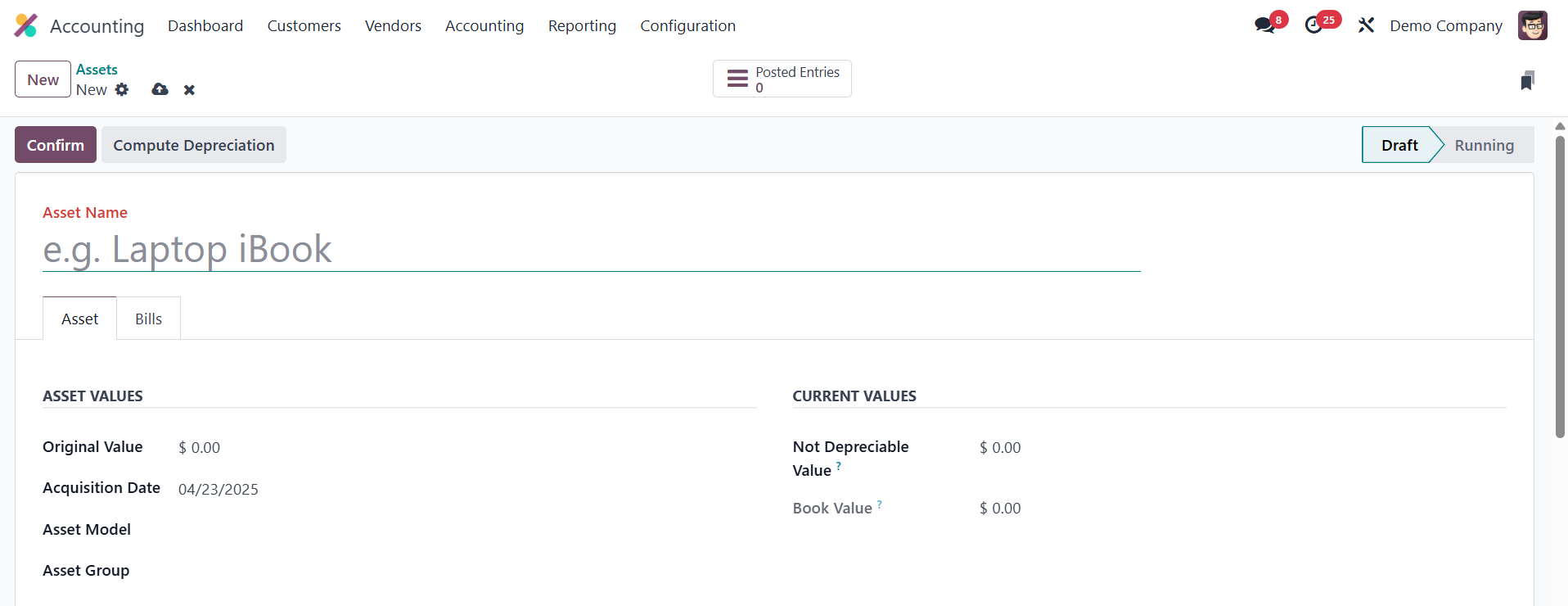

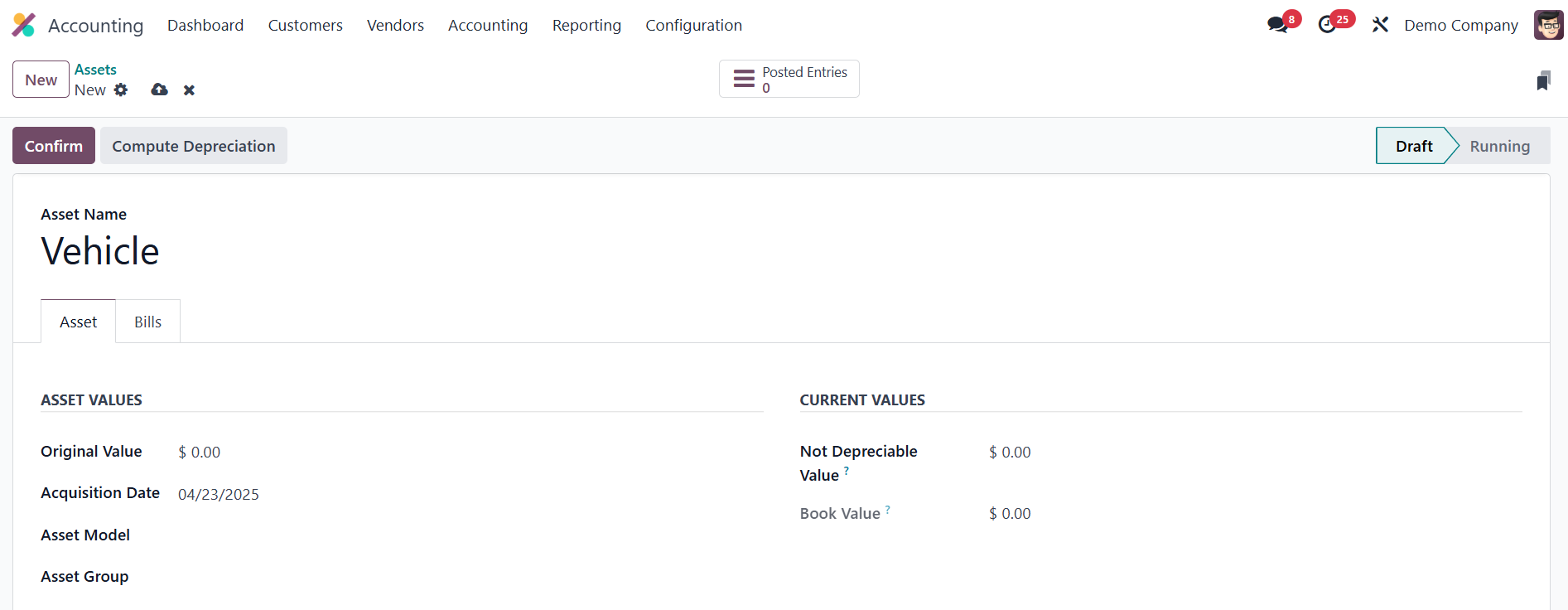

The asset setup window includes

fields such as Asset Name,

Acquisition Date, Original

Value, and links to a

predefined Asset Model. The

model will auto-fill the

depreciation method and

associated accounts.

You can specify any portion of

the value that should not be

depreciated, and manually

enter the depreciated amount

if migrating from a different

system.

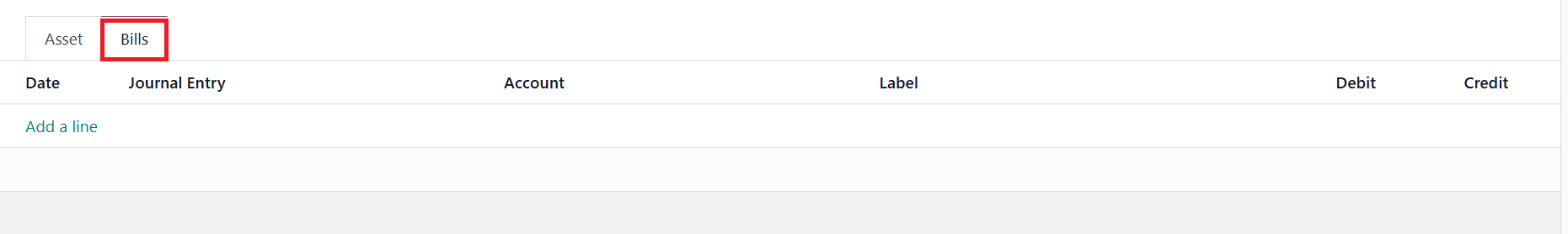

Bills associated with the asset

can be recorded under the

Bills tab.

Once confirmed, the asset status

changes to Running, and the

system begins computing

depreciation.

As with automated entries, users

can modify the asset later

using the Modify button to

reevaluate, pause, sell, or

dispose of it.

With Odoo 18, asset management

becomes more intuitive and

robust, allowing businesses

to maintain clear financial

oversight of long-term assets

while automating key

accounting operations.

16.1 Depreciation Schedule

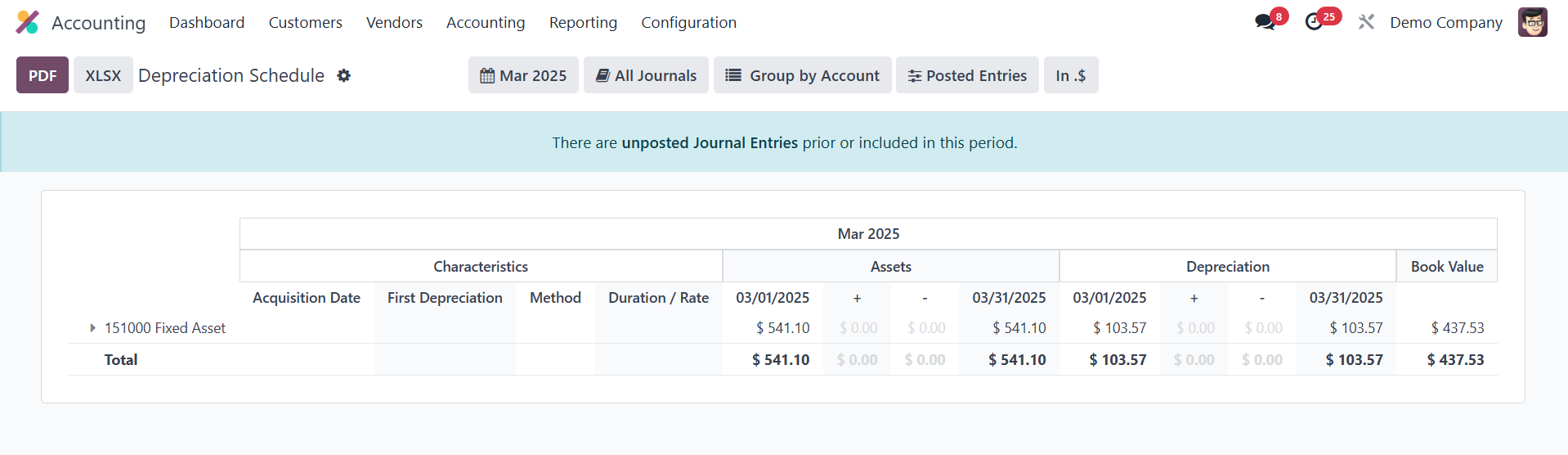

In Odoo 18 Accounting, users can

quickly review an asset’s

entire depreciation history

by opening the Depreciation

Schedule found under the

Reporting tab.

This report lists every

depreciation posting

associated with each fixed

asset, showing the posting

date, journal entry, amount,

residual value, and book

value after each calculation.

Because the schedule

refreshes automatically

whenever a new depreciation

line is posted; whether

generated by the system’s

scheduler, triggered

manually, or created through

a modification such as a

re-evaluation or disposal,

finance teams always have an

up‑to‑date view of how every

depreciation entry affects

the asset’s carrying value

and the company’s financial

statements.