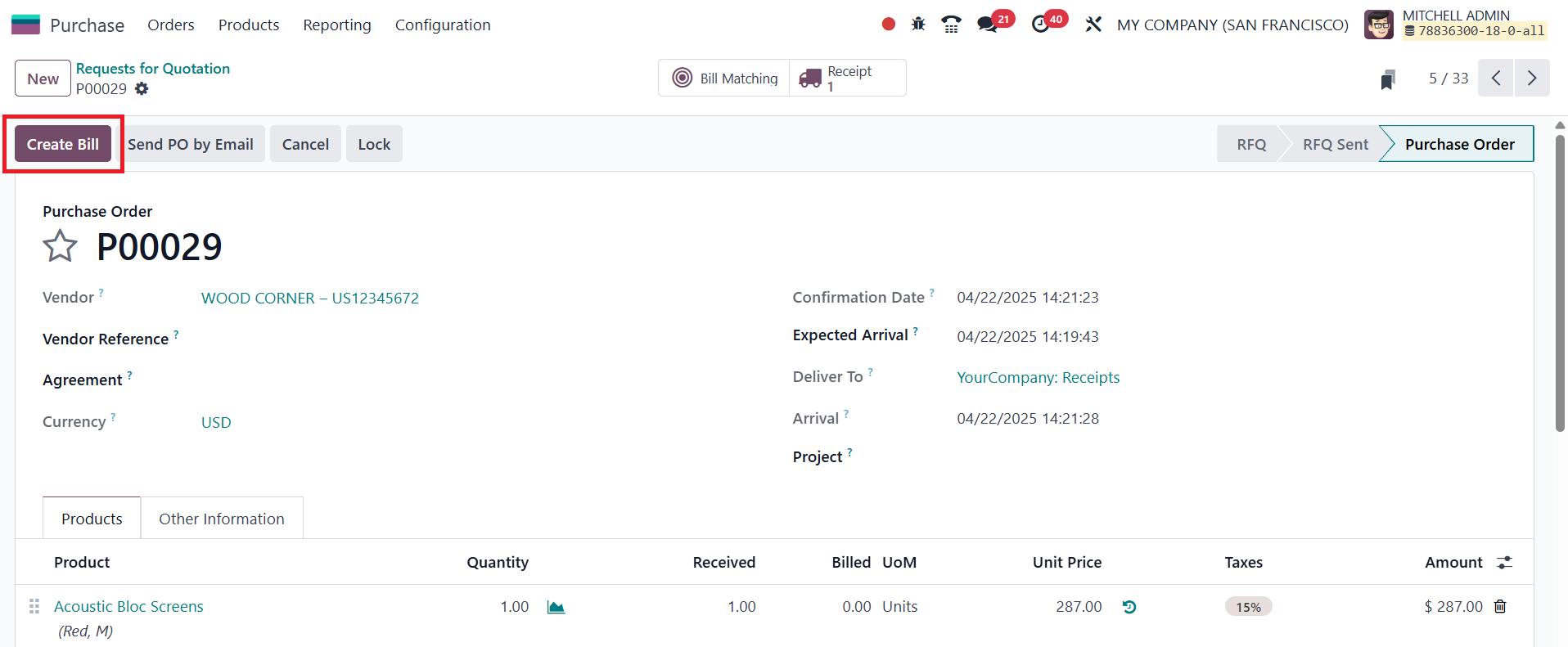

9. Bills

In Odoo 18 Accounting, vendor bills are essential records that

reflect the amounts payable to vendors for goods or services

purchased. When a purchase is confirmed through a purchase order,

Odoo provides the option to automatically generate a corresponding

vendor bill by selecting the Create Bill option.

This integration streamlines the process and ensures that payment

obligations are accurately documented.

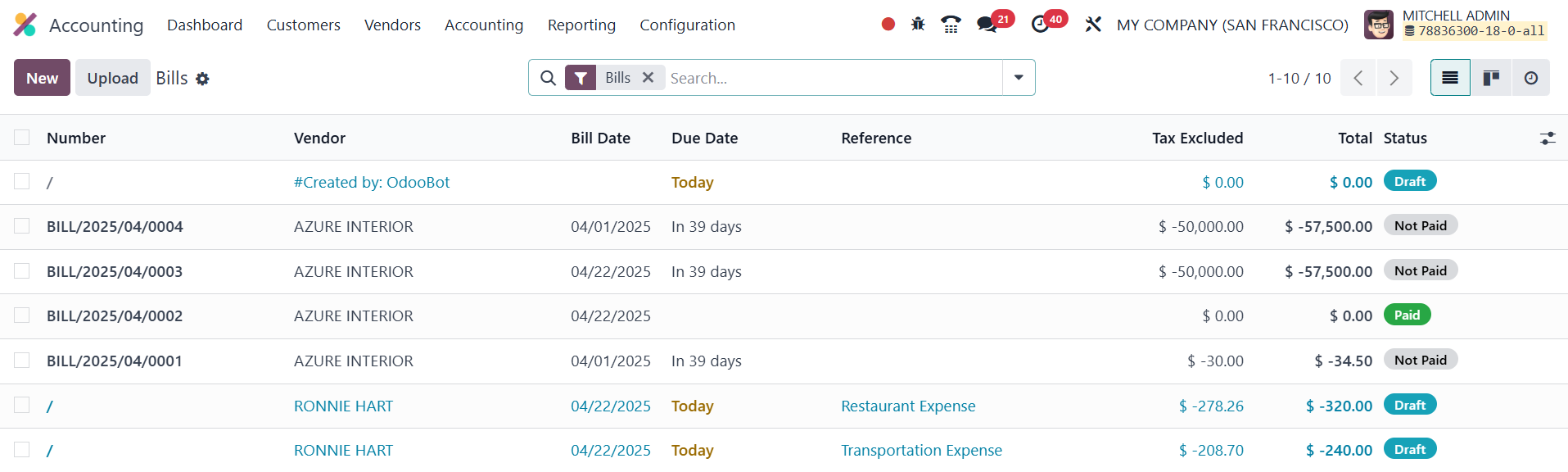

Vendor invoices created through the Purchase module are automatically

reflected in the Accounting module, making it easy to manage and

track all vendor-related financial transactions. To access these

records, navigate to the Bills option under the Vendors menu in the

Accounting module.

The list view displays details such as the bill number, vendor name,

bill date, due date, reference, payment status, tax information,

total amount, and the bill’s current status. Users can also switch

between the Kanban and List views for different visual perspectives.

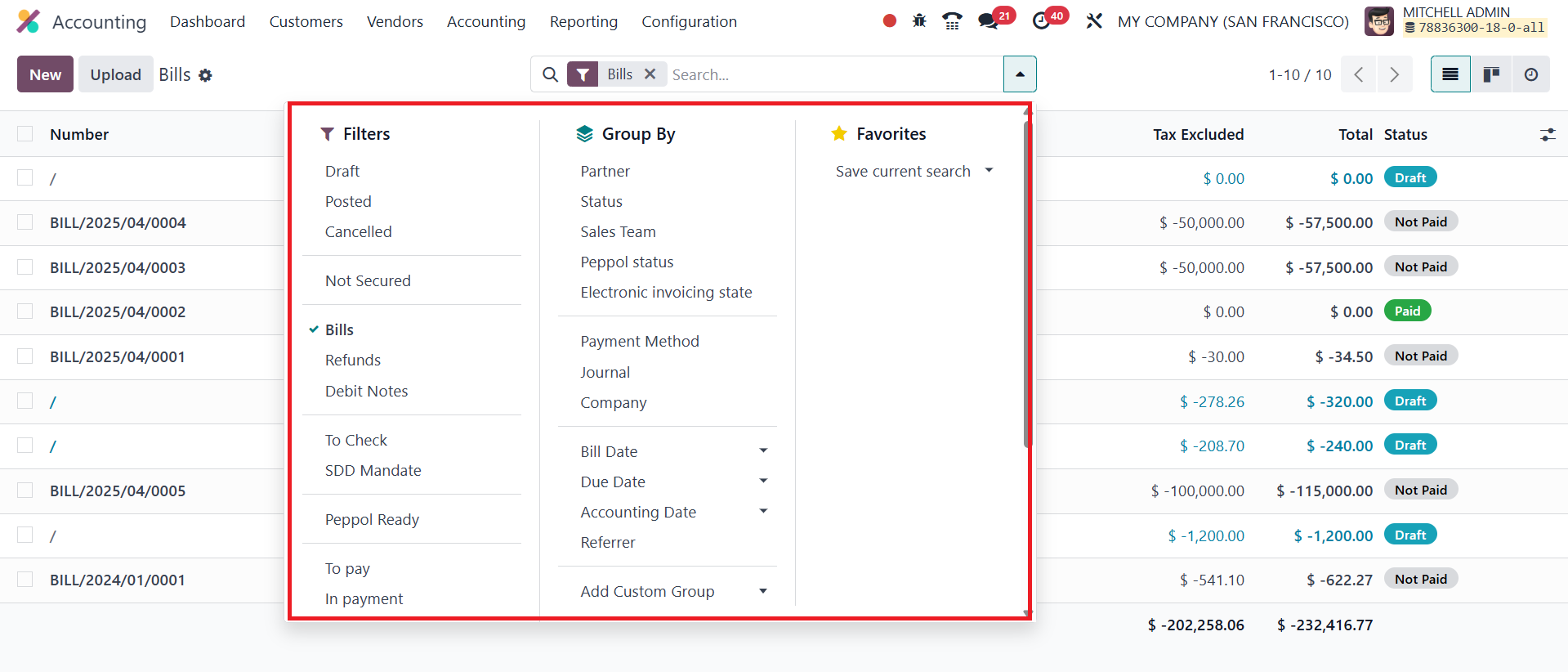

Filtering and grouping options are extensive in this section. Default

filters include categories like Draft, Posted, Cancelled, Bills,

Refunds, Debit Notes, To Check, To Pay, In Payment, Overdue, and

more. Additionally, users can apply custom filters and groupings

such as Partner, Salesperson, Status, Sales Team, Preferred Payment

Method, and various date-related options. This helps in organizing

and analyzing vendor bills more efficiently.

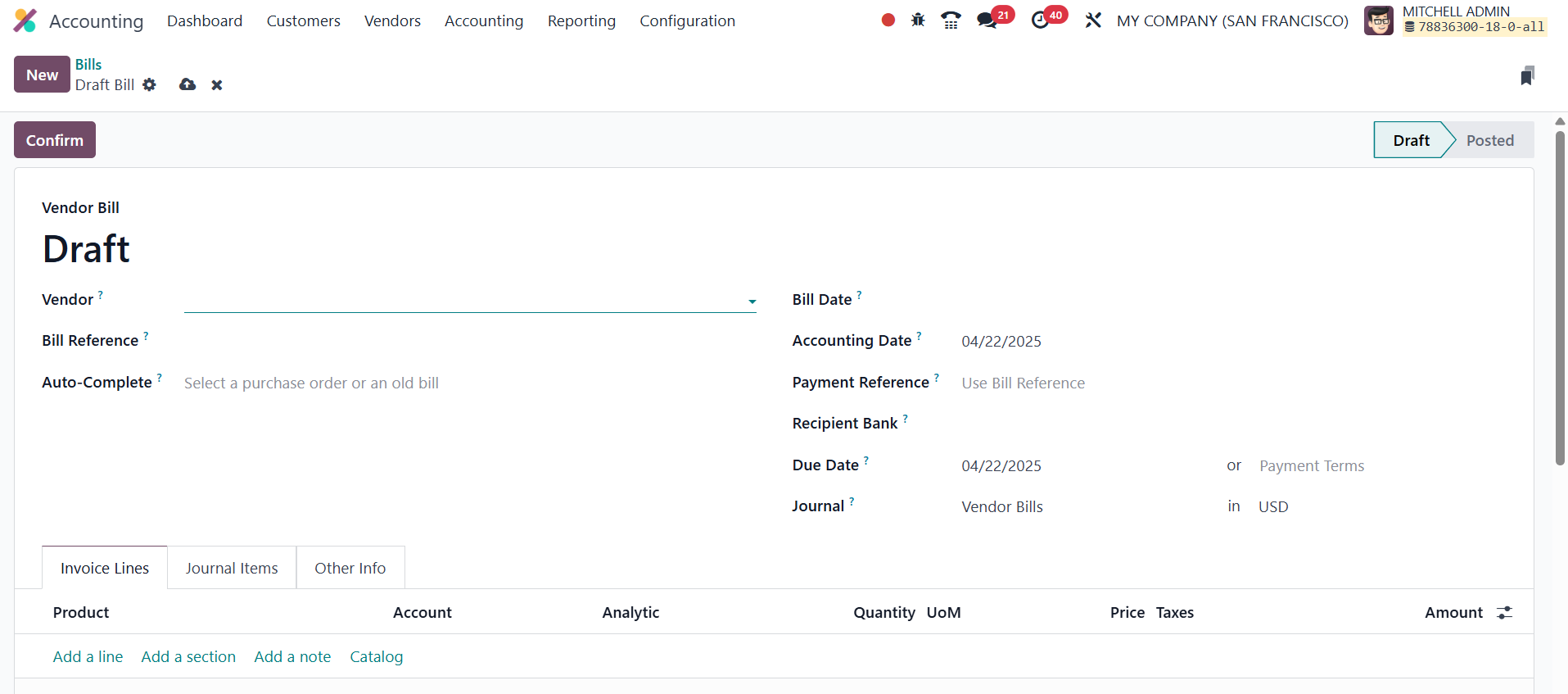

To manage vendor bills, users can either upload invoice copies using

the Upload button or create them manually by clicking the New

button.

While creating a new bill, users must enter key details such as the

Vendor, Bill Reference, Bill Date, Accounting Date, Payment

Reference, Recipient Bank, and Due Date. In Odoo 18, the Vendor

field identifies the supplier issuing the bill, the Bill Reference

tracks the original invoice number provided by the vendor, the Bill

Date records the date the bill was issued, the Accounting Date

determines when the transaction is posted in the accounting books,

and the Recipient Bank Account indicates the vendor’s bank account

where the payment will be transferred. The Due Date specifies the

deadline by which the vendor bill must be paid, calculated based on

the payment terms set for the vendor. If a previous bill or purchase

order is linked in the Auto-Complete field, Odoo can auto-populate

the rest of the fields to save time and reduce errors.

The bill form includes tabs like Invoice Lines, Journal Items, and

Other Info, where users can input line items, review accounting

entries, and provide additional information. Once all required

details are completed, clicking the Confirm button changes the

bill's status from Draft to Posted, making it ready for further

processing or payment.

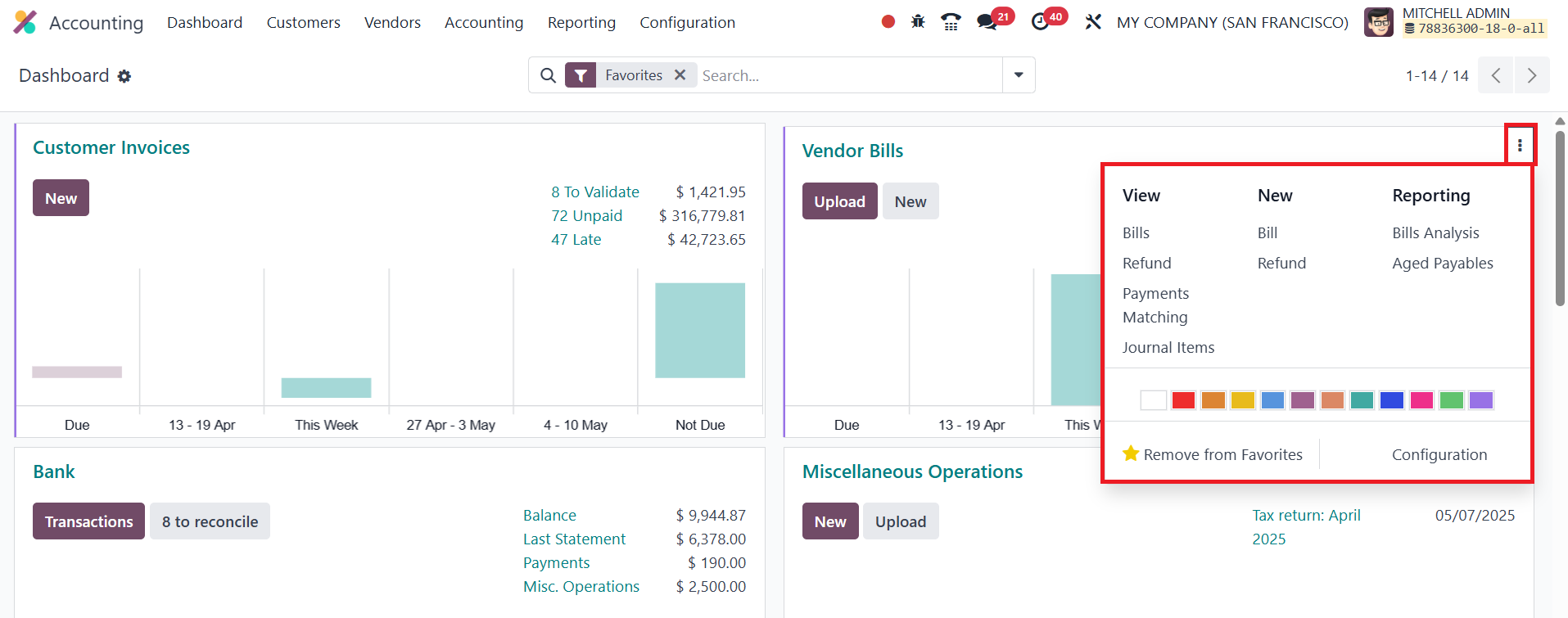

The Accounting Dashboard also facilitates vendor bill management,

allowing users to create bills, refunds, and journal entries

directly. Additionally, the Payment Matching feature helps reconcile

invoices with corresponding bank statements. Using the options

available in the New session, it is possible to create a new Bill

and Refund from the dashboard itself. The user will get Bills

Analysis and Aged Payables as Reporting options here.

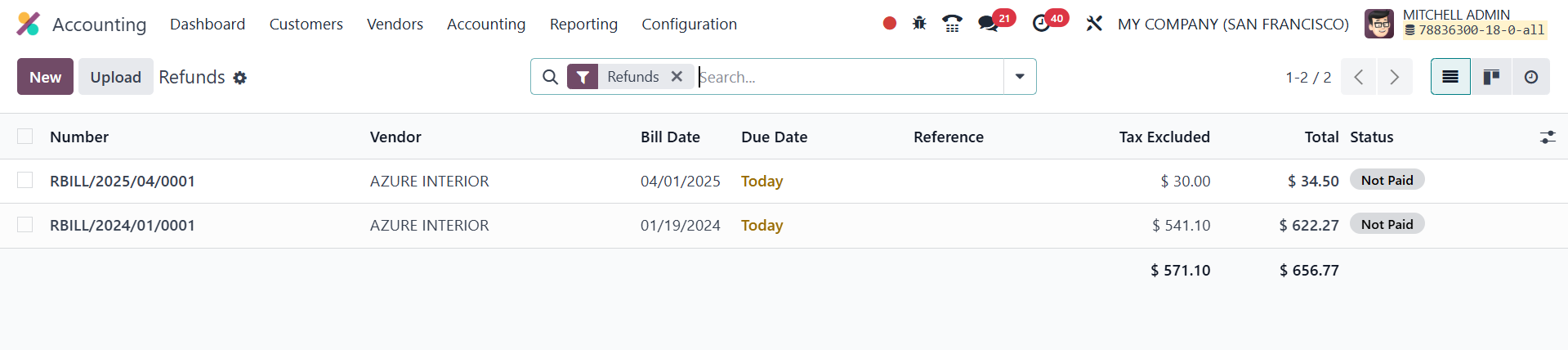

Vendor refunds are also handled smoothly in Odoo 18. From the Vendors

menu, users can access the Refunds section to create and manage

credit notes.

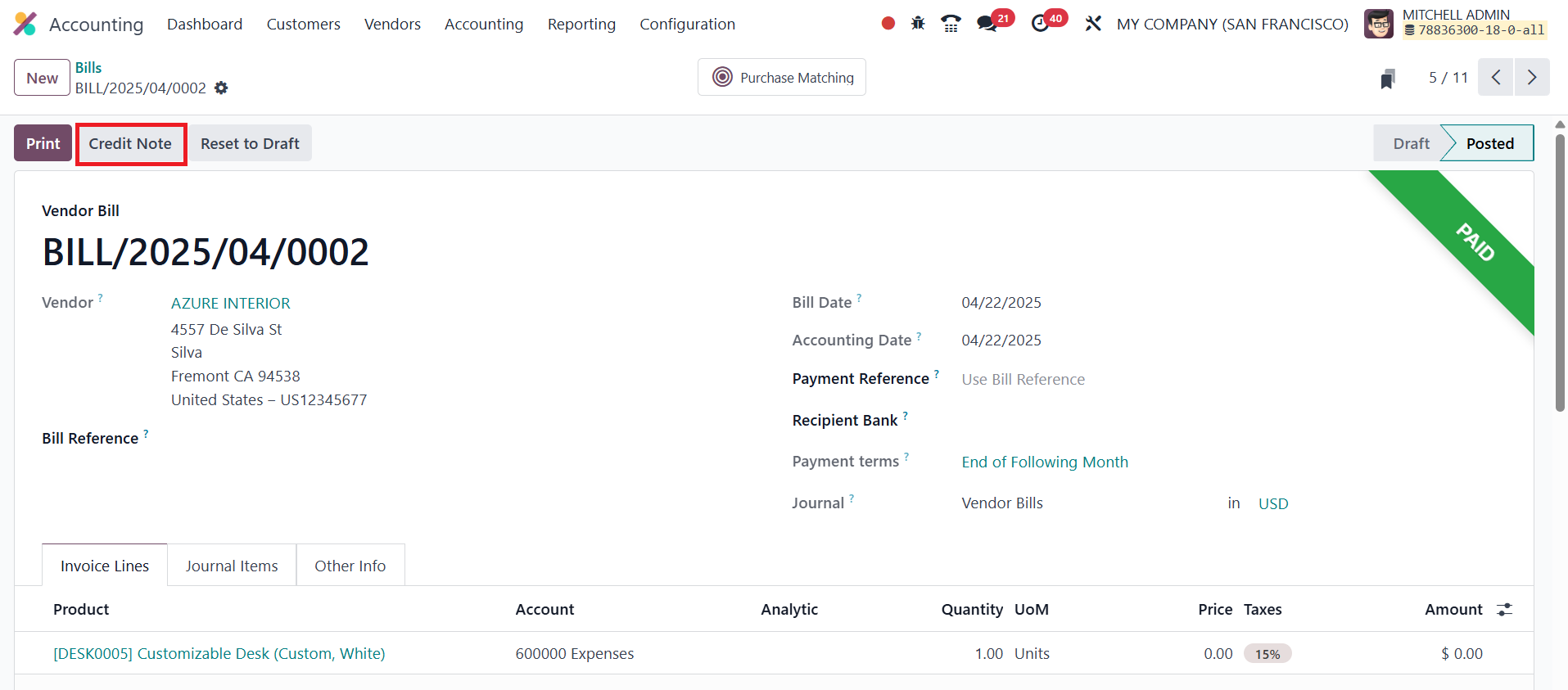

When viewing a vendor bill, the Add Credit Note button lets users

initiate a refund process, which then appears in the Refunds

section.

New refunds can also be created manually using the New button,

following a process similar to vendor bill creation. The Purchase

Matching smart tab in Odoo 18 allows users to easily match a vendor

bill with its corresponding purchase order, ensuring consistency

between ordered, received, and invoiced quantities and helping to

detect any discrepancies.

Overall, Odoo 18 offers a comprehensive and user-friendly system for

managing vendor bills and refunds, streamlining vendor relationships

and financial operations.