25. Chart of Accounts

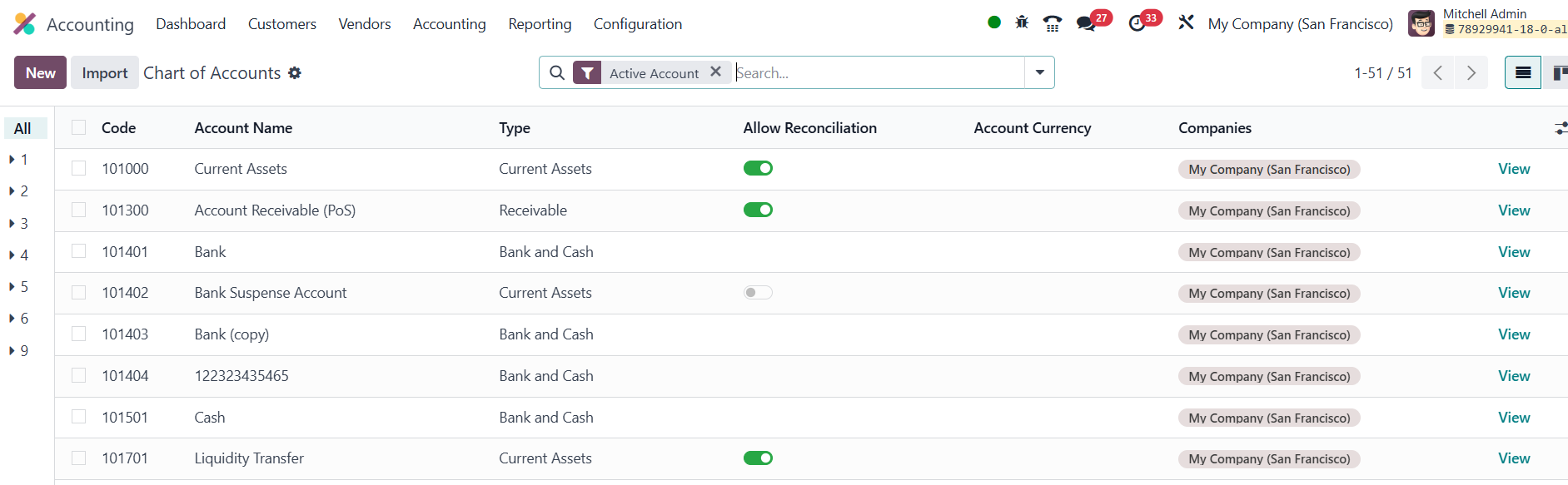

In Odoo 18 Accounting, the Chart of Accounts is a structured list of

accounts used to record and categorize financial transactions.

Opened from Accounting → Configuration → Chart of Accounts, it

appears as a fluid grid that lists each account’s code, name, type,

working currency, and owning company. The Type field is especially

powerful because it tells Odoo where the account belongs on

statutory reports, which fiscal‑year closing rules to trigger, and

whether the account supports reconciliation for matching invoices

with payments.

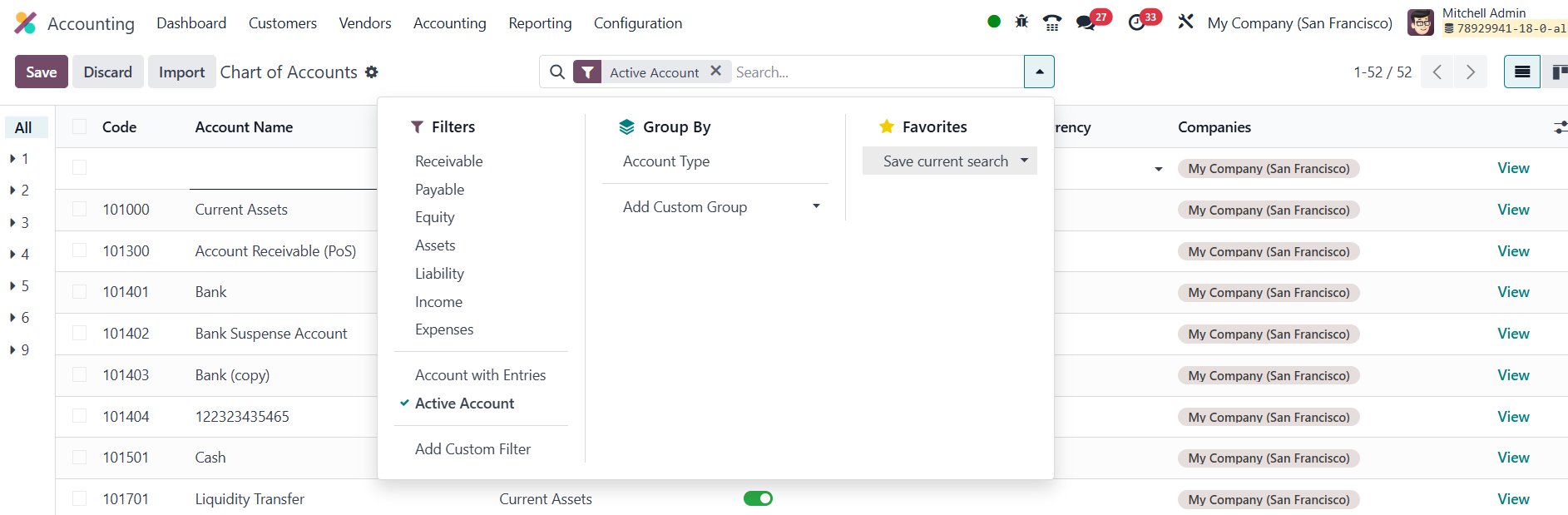

Built‑in one‑click filters; such as Receivable, Payable, Equity,

Assets, Liabilities, Income, and Expenses, let you zero in on

specific subsets, while custom filters and groupings give you

endless ways to slice the data without ever exporting to a

spreadsheet.

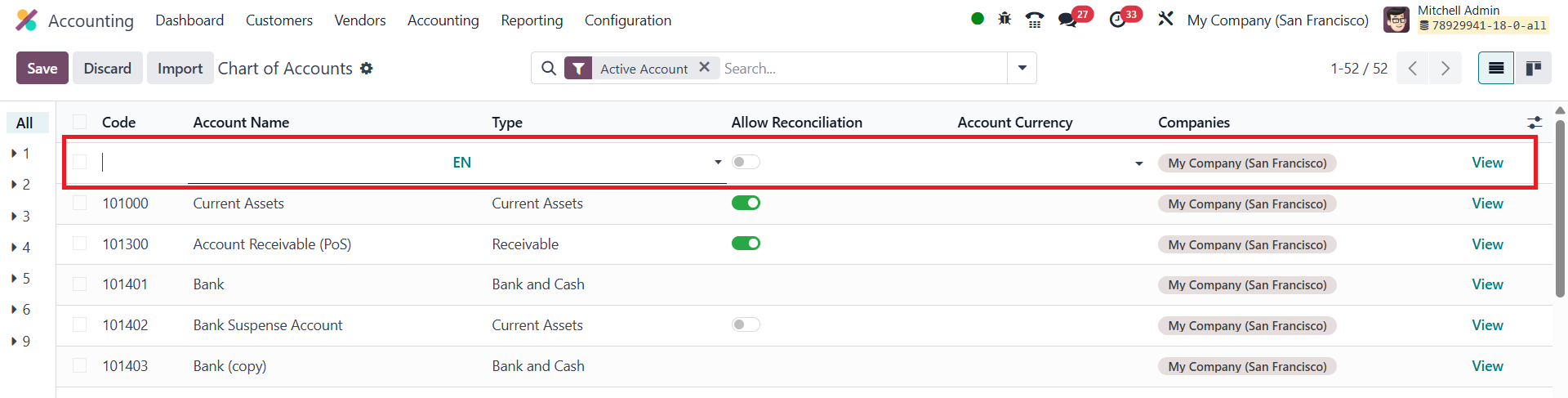

Creating a new account is as simple as clicking New; a blank row

appears in the list so you can key in the code, name, type,

currency, and reconciliation flag on the spot, with real‑time

validation to prevent duplicates. If you need deeper settings; you

can hit View to open the full form and fine‑tune every parameter.

The Account Code serves as a unique identifier for each account,

helping users quickly locate and reference specific accounts in

financial reports and transactions. The Account Name provides a

descriptive label for the account, making it easier to understand

its role in the company’s finances. The Account Type indicates the

nature of the account; whether it is an asset, liability, income, or

expense account, which determines how it behaves in financial

statements. Additionally, Tags can be applied to categorize accounts

for easier filtering and more detailed financial reporting, enabling

businesses to group and analyze accounts based on custom

classifications or operational needs.

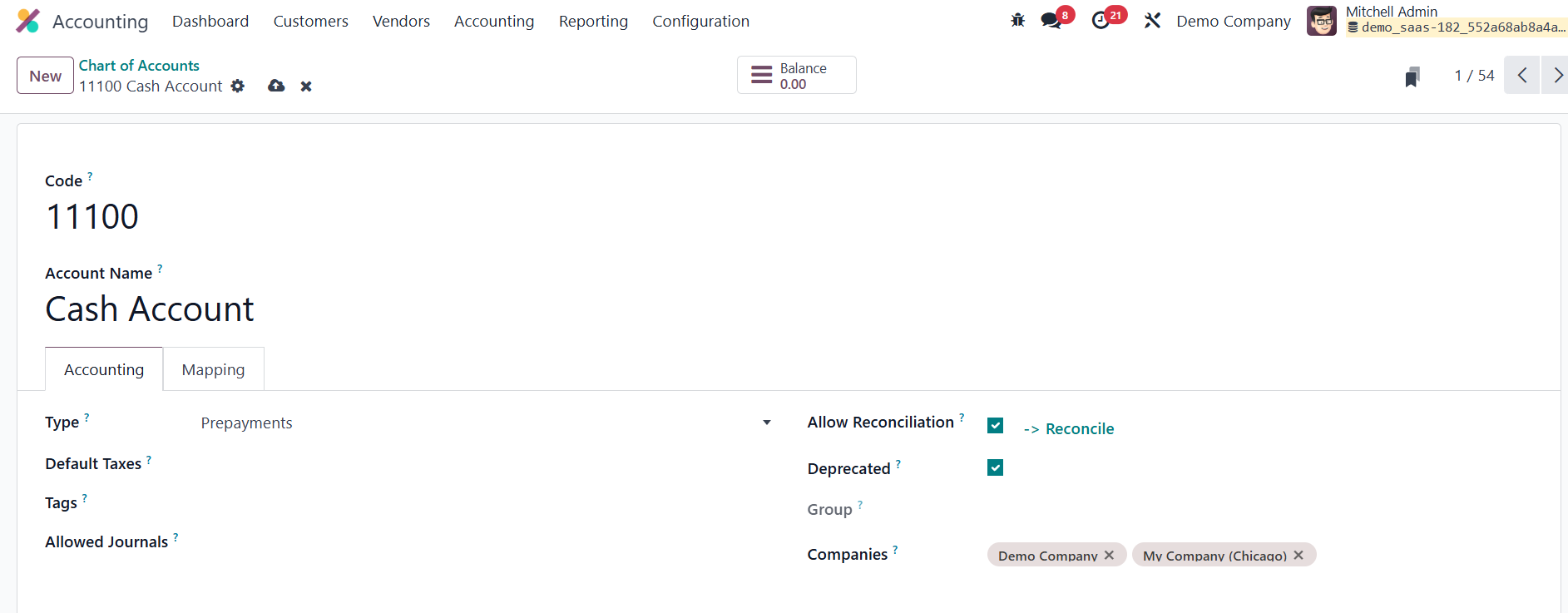

In the form view of the Chart of Accounts in Odoo 18, the Default

Taxes field allows users to specify default tax rates that should

automatically apply when the account is used in transactions. The

Allowed Journals field defines which journals can post entries to

the selected account. Once an account has been used in a

transaction, it cannot be deleted to preserve the integrity of past

financial records. However, if the account is no longer needed for

future use, it can be made inactive by checking the Deprecated

option in the account’s settings. The Shared Accounts feature in

Odoo 18 enables the creation of a single account that can be

utilized across multiple companies, making it particularly

beneficial in a multi-company setup.

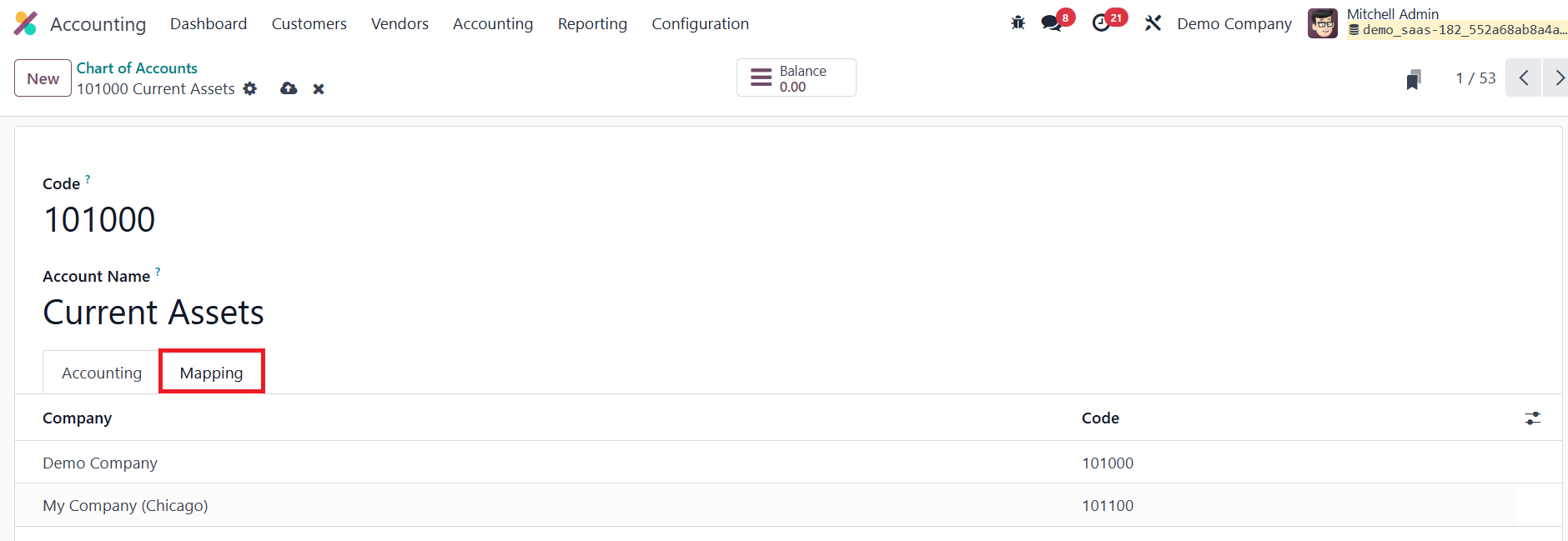

In Odoo 18, the mapping feature within the Chart of Accounts is

designed to align and link individual accounts across multiple

companies or subsidiaries. This functionality is especially useful

in a multi-company environment, where different companies may use

distinct account structures but still need to consolidate or

coordinate financial reporting.

Clicking the Balance button reveals the account’s current debit,

credit, and net totals.

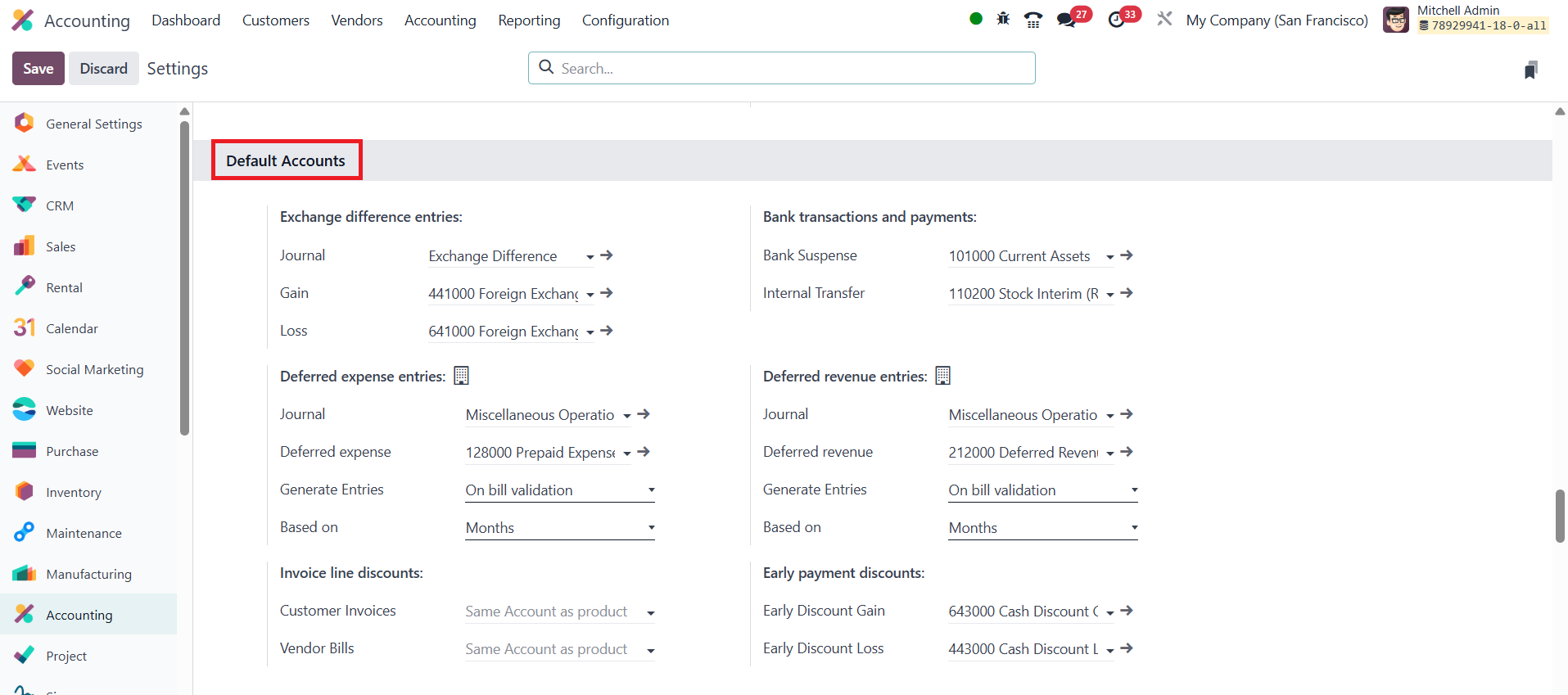

25.1 Default Accounts

In Odoo 18 Accounting, the Default Accounts section lets you

pre‑define which ledgers and journals the system should use when it

automatically books specialised entries. Doing this once ensures

every subsequent transaction lands in the right place without an

accountant having to pick accounts manually.

Exchange‑difference entries deal with currency revaluations that

arise when you settle a foreign‑currency invoice or run a period‑end

remeasurement. Here you tell Odoo which journal should host those

automatic movements and which two profit‑and‑loss accounts will

capture a gain or a loss. For Deferred expense entries, you define

how prepaid costs are capitalised and later amortised. The journal

you specify is where every recognition entry will be posted month

after month. The Deferred Expense account, usually a current‑asset

sub‑ledger, temporarily stores the full prepayment. In

Generate Entries you set whether those amortisation moves should

appear immediately in Draft, be Posted right away, or be created

later manually. Finally, Based on lets you choose the anchor date

for the schedule: either the vendor bill’s invoice date or explicit

service start/end dates.

When you give line‑level price reductions, the Invoice line discounts

mapping decides which contra account absorbs them. One account

handles discounts you grant on Customer Invoices, and another

offsets discounts you receive on Vendor Bills. Under Bank

transactions and payments, two clearing accounts keep cash‑book

activity orderly. Bank Suspense account is the default interim

ledger used when imported statement lines haven’t yet been matched

to invoices, bills, or miscellaneous entries. Odoo allows you to

manage internal money transfers, requiring a minimum of two bank or

cash accounts. Internal transfer accounts are necessary to

facilitate the transfer process. Additionally, you can configure a

default internal transfer account in this section for ease of use.

Deferred revenue entries mirror deferred expenses but for unearned

income such as multi‑period service contracts. You choose a journal

for monthly recognitions, a Deferred Revenue liability account to

hold the initial credit, set the Generate Entries timing, and decide

whether the schedule should reference the invoice date or explicit

service dates.

Finally, Early‑payment discounts handle the financial impact of

settling invoices before the due date. When you pay a supplier early

and earn a price break, the discount portion is booked to the

Early Discount Gain account. Conversely, when your customer pays

early and you forgot part of your revenue, the system posts that

concession to Early Discount Loss. Because these defaults are in

place, each early‑payment event is recognised instantly and

consistently without additional clicking.

Setting these default accounts once aligns every automated posting

with your chart of accounts, keeps suspense and clearing ledgers

tidy, and gives management and statutory reports a clean,

reconcilable audit trail.