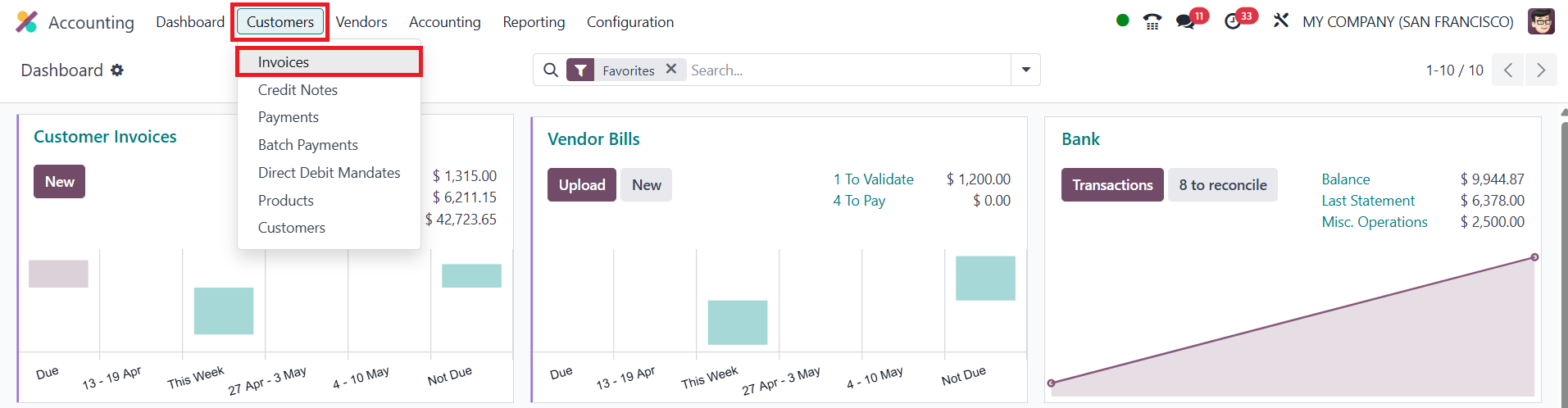

1. Customer

Invoices

Odoo 18 continues to streamline

business workflows by

offering multiple methods for

automating the generation of

customer invoices based on

the nature of operations and

the modules in use. In the

Sales module, once a sales

order is confirmed, Odoo 18

automatically generates a

draft customer invoice, ready

for verification. Users can

review these drafts before

finalizing and dispatching

them to customers. All

automatically and manually

created invoices are then

centralized in the Invoices

dashboard found under the

Customer menu of the

Accounting module.

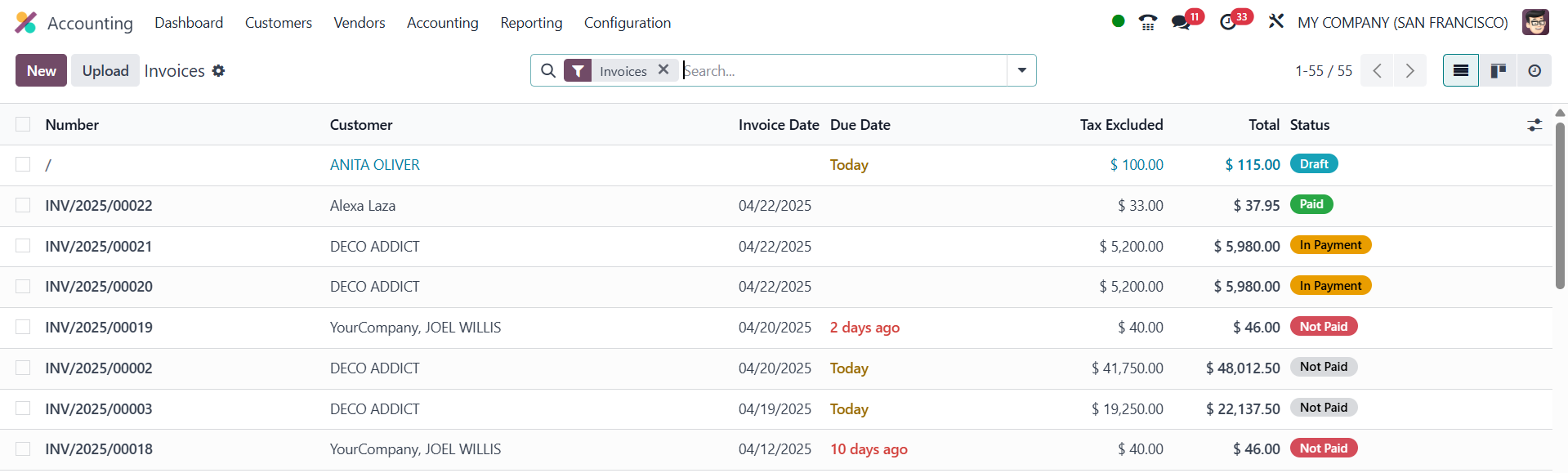

In the Odoo 18 Accounting module,

users can view a

comprehensive list of all

invoices.

This list view displays critical

information such as Invoice

Number, Customer Name,

Invoice Date, Due Date,

Tax-Excluded Amounts, Total,

and Invoice Status. Moreover,

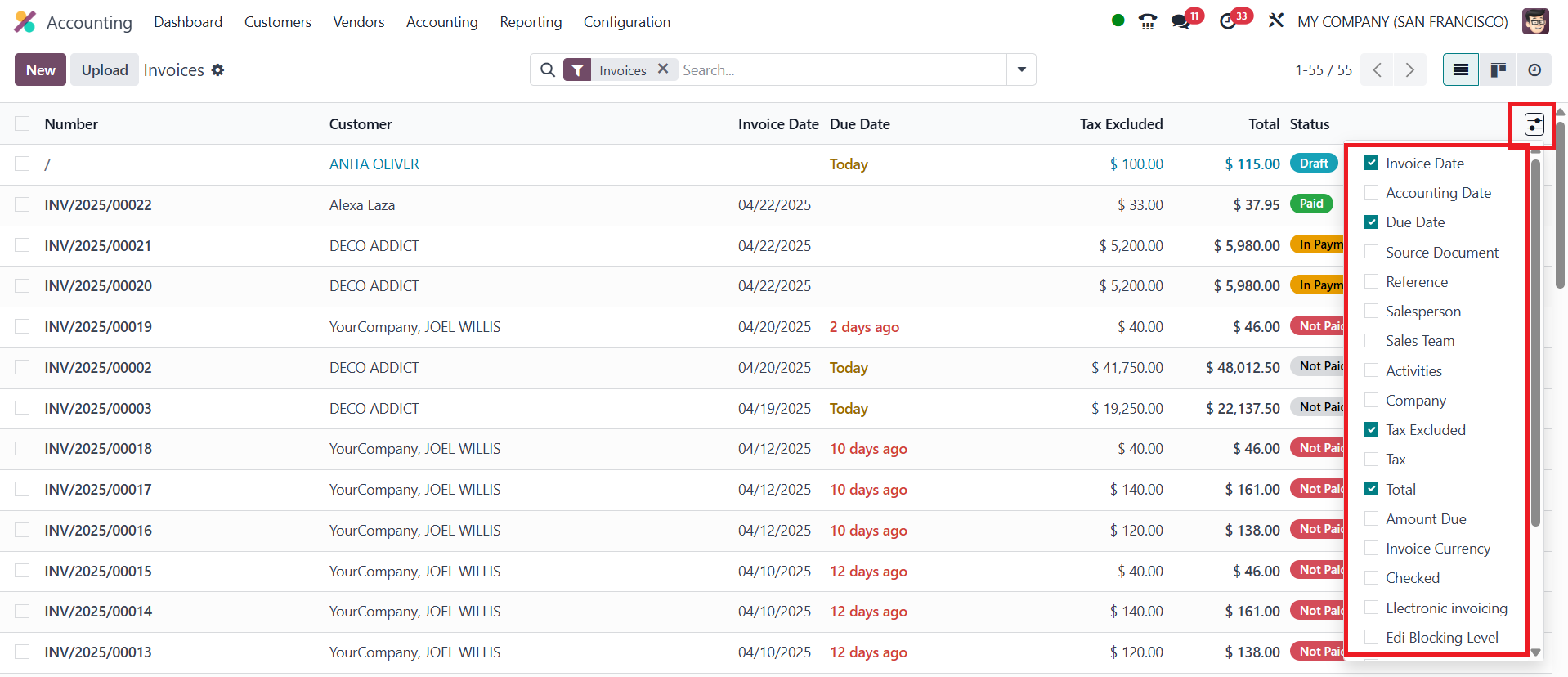

this view is fully

customizable, users can

expand the columns to display

more fields relevant to their

workflow.

By using the small icon located

next to the Status field, one

can enable or disable various

fields, including Accounting

Date, Source Document,

Activities, Salesperson,

Sales Team, Reference,

Company, Amount Due, Invoice

Currency, Electronic

Invoicing Status, and more.

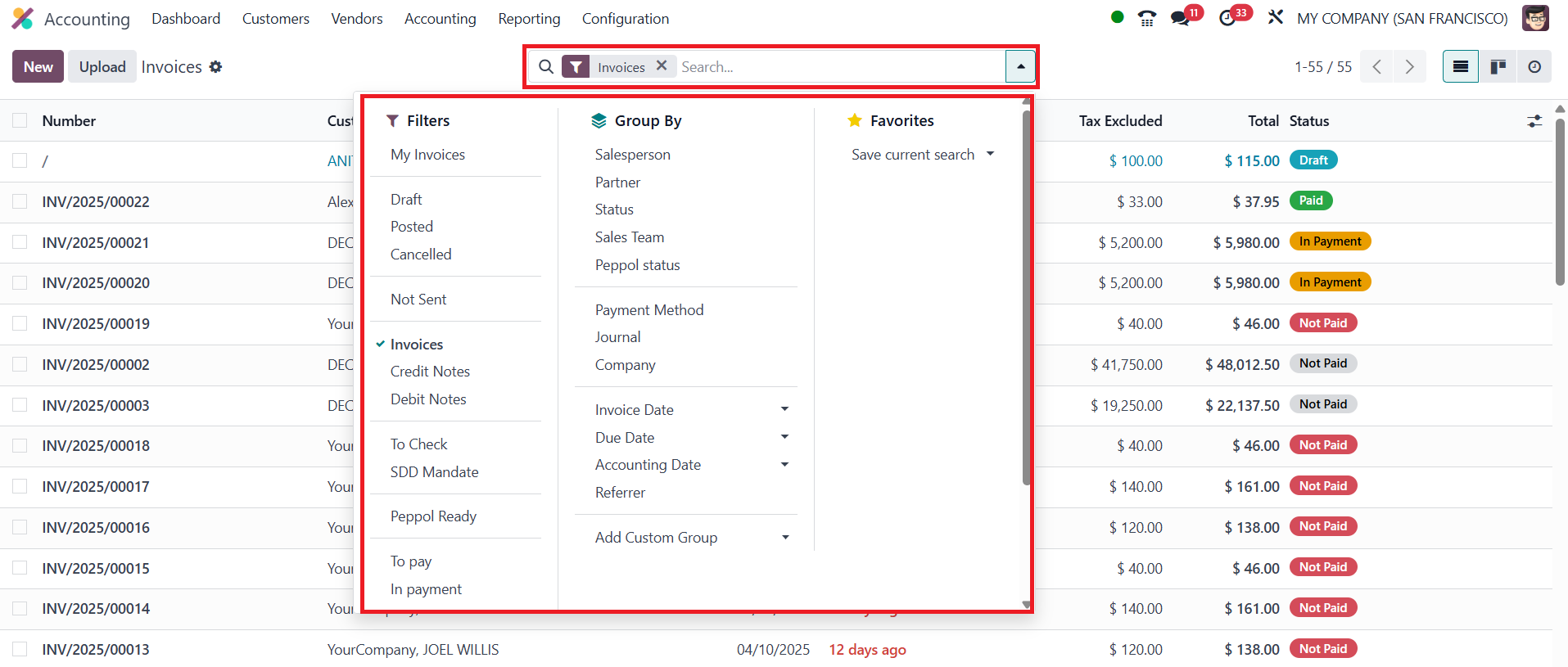

To efficiently manage large

volumes of invoices, Odoo 18

offers powerful sorting and

filtering capabilities. The

default Filters allow users

to categorize invoices based

on criteria such as My

Invoices, Draft, Posted,

Canceled, Not Sent, Invoices,

Credit Notes, Debit Notes, To

Check, SDD Mandate, To Pay,

and In Payment. Additionally,

the Add Custom Filter option

empowers users to define

specific conditions tailored

to their unique invoicing

processes. The Group By

functionality enhances

visibility by enabling

grouping based on

Salesperson, Status, Sales

Team, Payment Method, Invoice

Date, Referrer, and other

fields. The option to create

custom groups is also

available for advanced

segmentation.

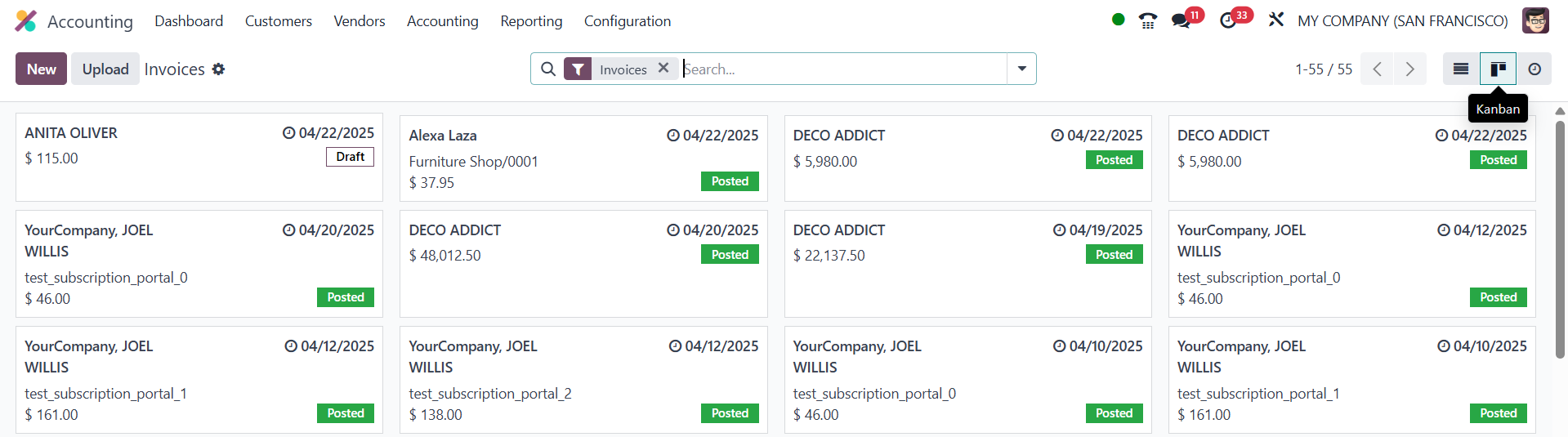

The module provides multiple

viewing options for invoices.

Apart from the list view, the

Kanban view offers a visual

workflow interface.

Within this view, users can

quickly access options to

upload existing invoices

using the Upload button or

create a new invoice from

scratch by selecting the New

button. Clicking "New" opens

the invoice creation form,

where essential details are

filled in.

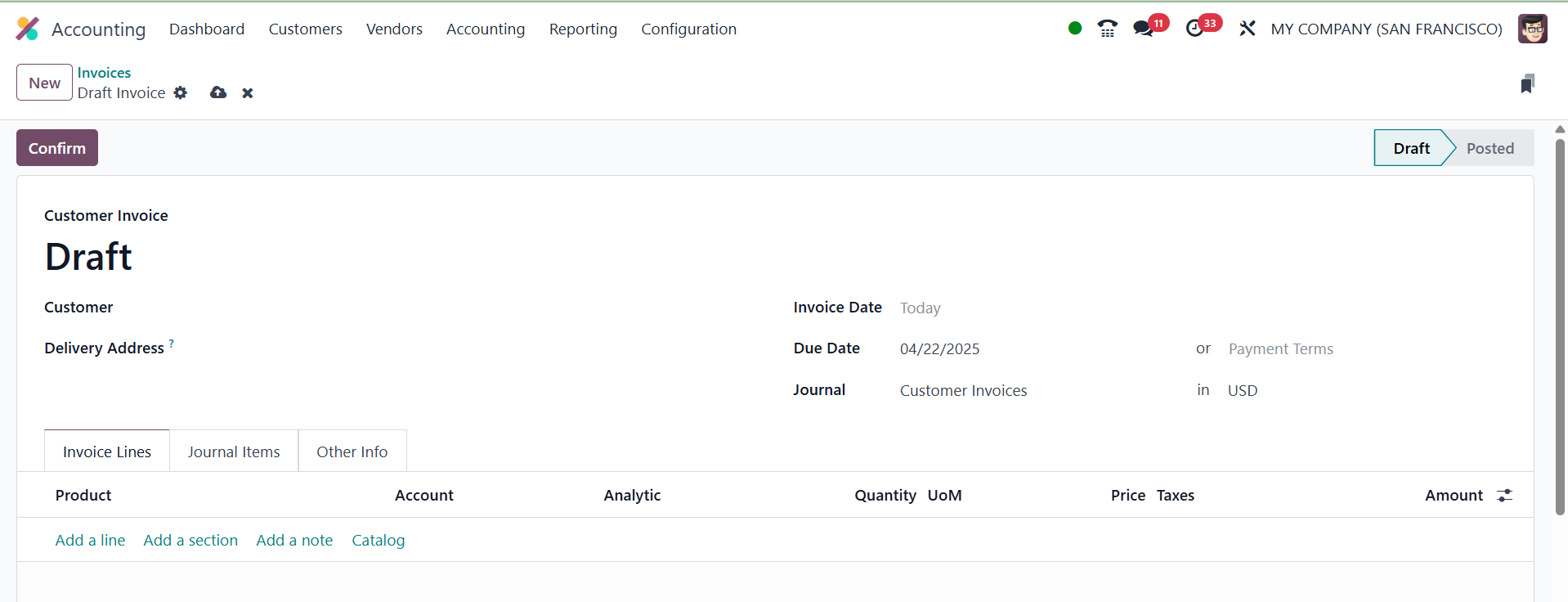

While drafting a new invoice,

users must specify the

Customer Name and the

Delivery Address, followed by

entering the Invoice Date and

a Payment Reference. Based on

customer configurations, the

Payment Terms may auto-fill,

but a manual Due Date can

also be set if needed. It’s

crucial to select an

appropriate Journal for

recording the invoice.

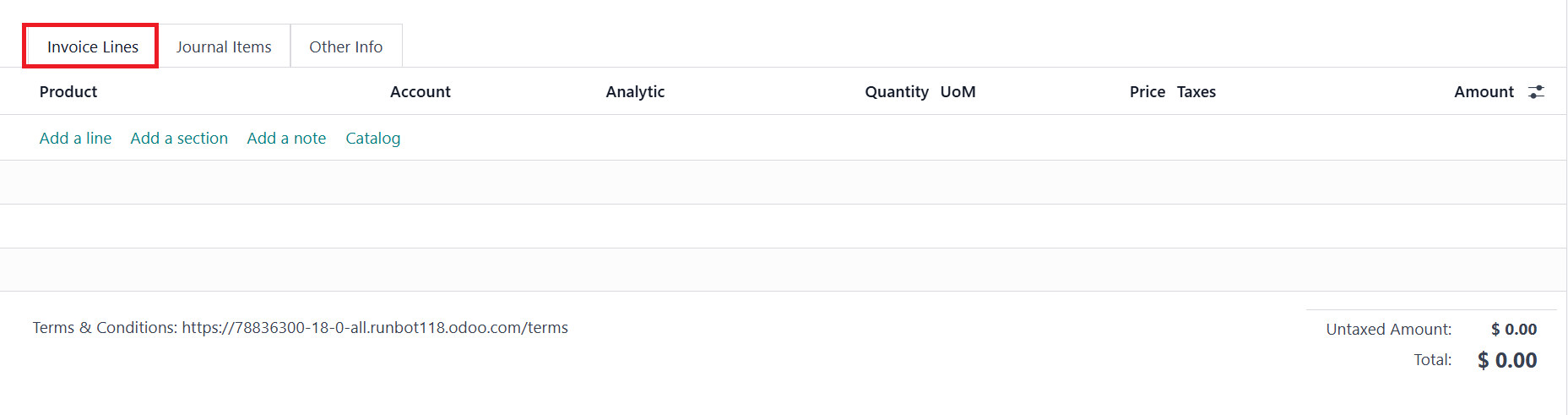

The invoice form is divided into

three primary tabs: Invoice

Lines, Journal Items, and

Other Info. In the Invoice

Lines tab, individual product

or service items can be added

using the Add a Line button.

Each line entry includes

fields for Product, Account,

Analytic Account, Quantity,

UoM, Price, Taxes, and

Amount. If the invoice is

auto-generated from a sales

order, these fields are

automatically populated from

the order lines. For better

clarity, users can use Add a

Section to insert headers or

Add a Note for additional

comments. The Untaxed Amount,

Taxes, and Total are

automatically calculated and

displayed at the bottom of

this section.

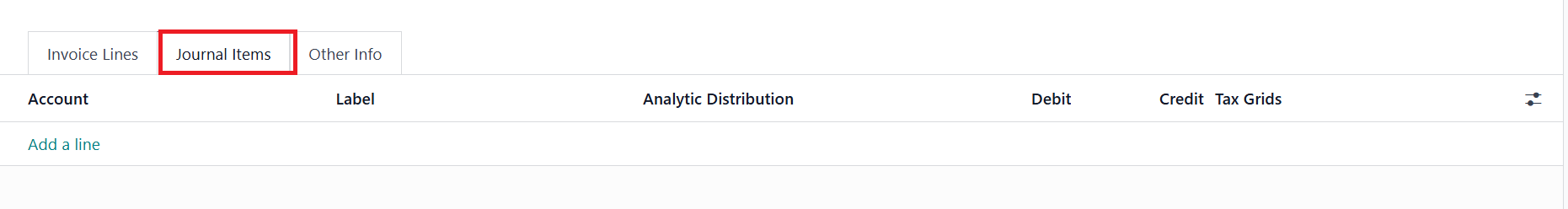

Under the Journal Items tab, the

system displays accounting

entries linked to the

invoice. It includes details

such as Account, Label,

Analytic Distribution, Debit

and Credit amounts, and

applicable Tax Grids. Users

can manually modify these

entries, add new lines, or

delete existing ones using

the provided buttons.

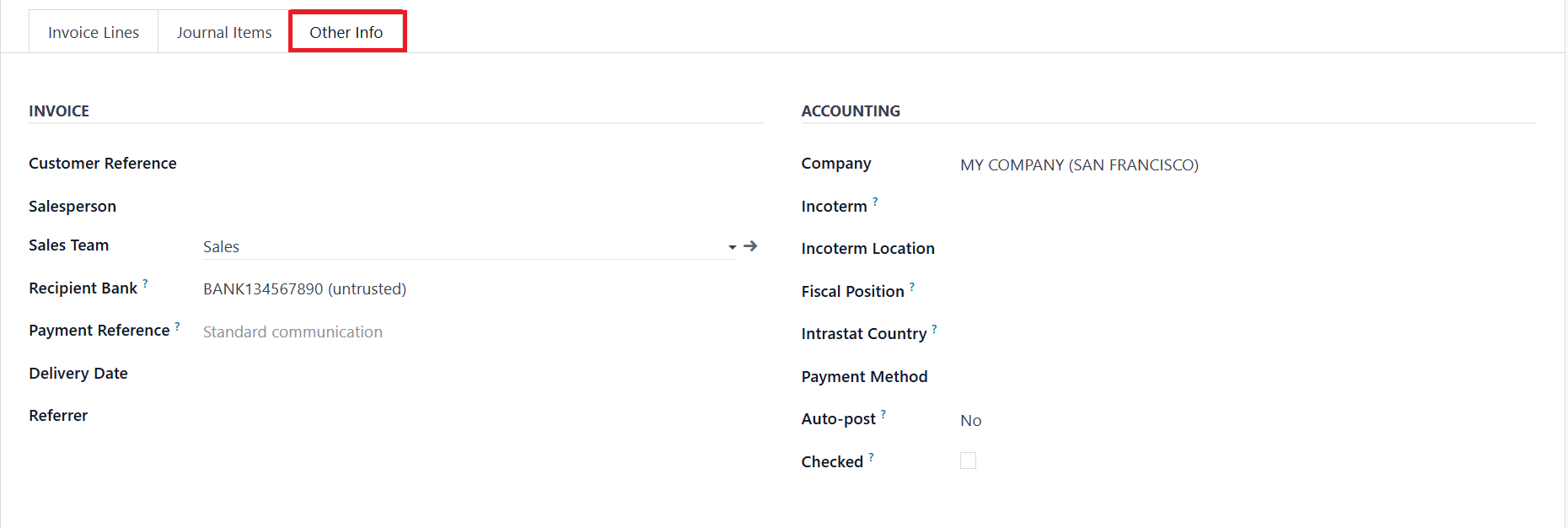

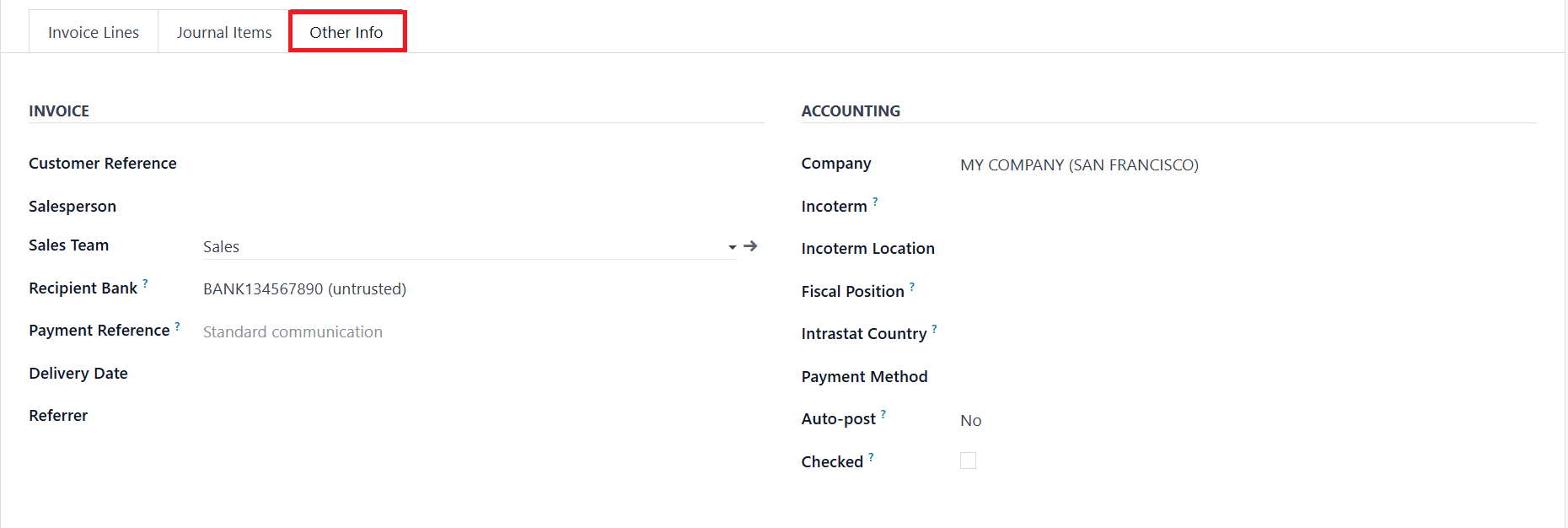

The Other Info tab consolidates

all auxiliary information.

Users can assign the invoice

to a Salesperson, Sales Team,

and Referrer. The Customer

Reference and Recipient Bank

Account for receiving

payments can also be

configured.

Furthermore, the Marketing

section allows input for

Campaign, Medium, and Source.

Under Accounting, users can

specify Company, Fiscal

Position, Incoterms, Incoterm

Location, Payment Method, and

Intrastat Country to

fine-tune tax rules and

compliance settings. For

entries needing further

review, the To Check flag can

be activated.

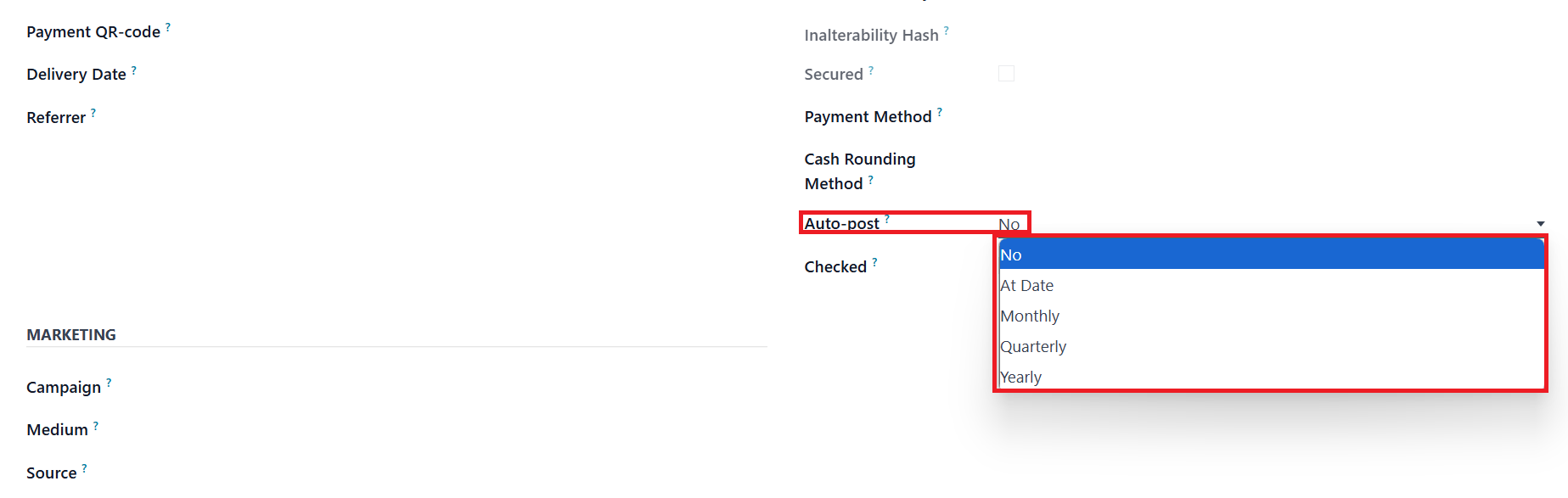

A notable enhancement in Odoo 18

is the Auto Post feature.

Users can choose a periodic

schedule; Monthly, Quarterly,

or Yearly, for automatically

posting invoices.

Alternatively, users can opt

for manual posting by setting

Auto Post to “No.” The Auto

Post Until field can define

how long the automation

should continue.

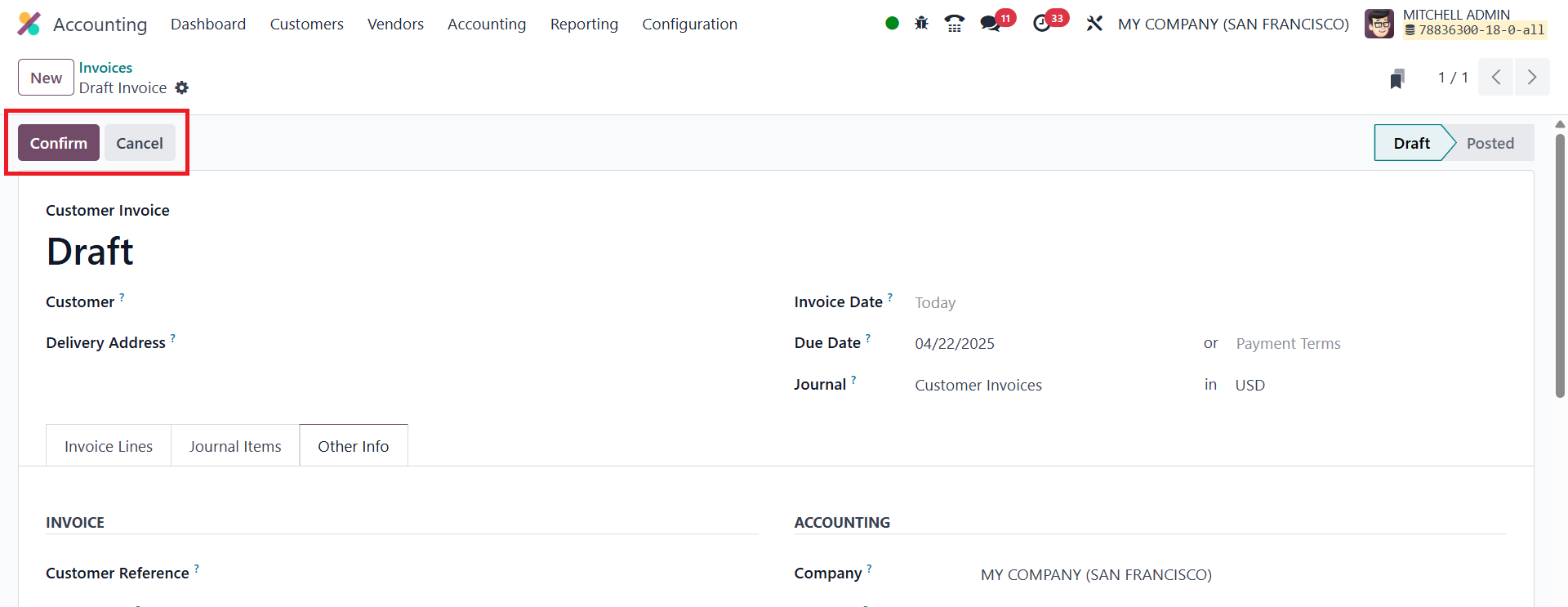

Once all the details are entered,

the draft invoice can be

finalized by clicking the

Confirm button.

This action changes the status

from Draft to Posted.

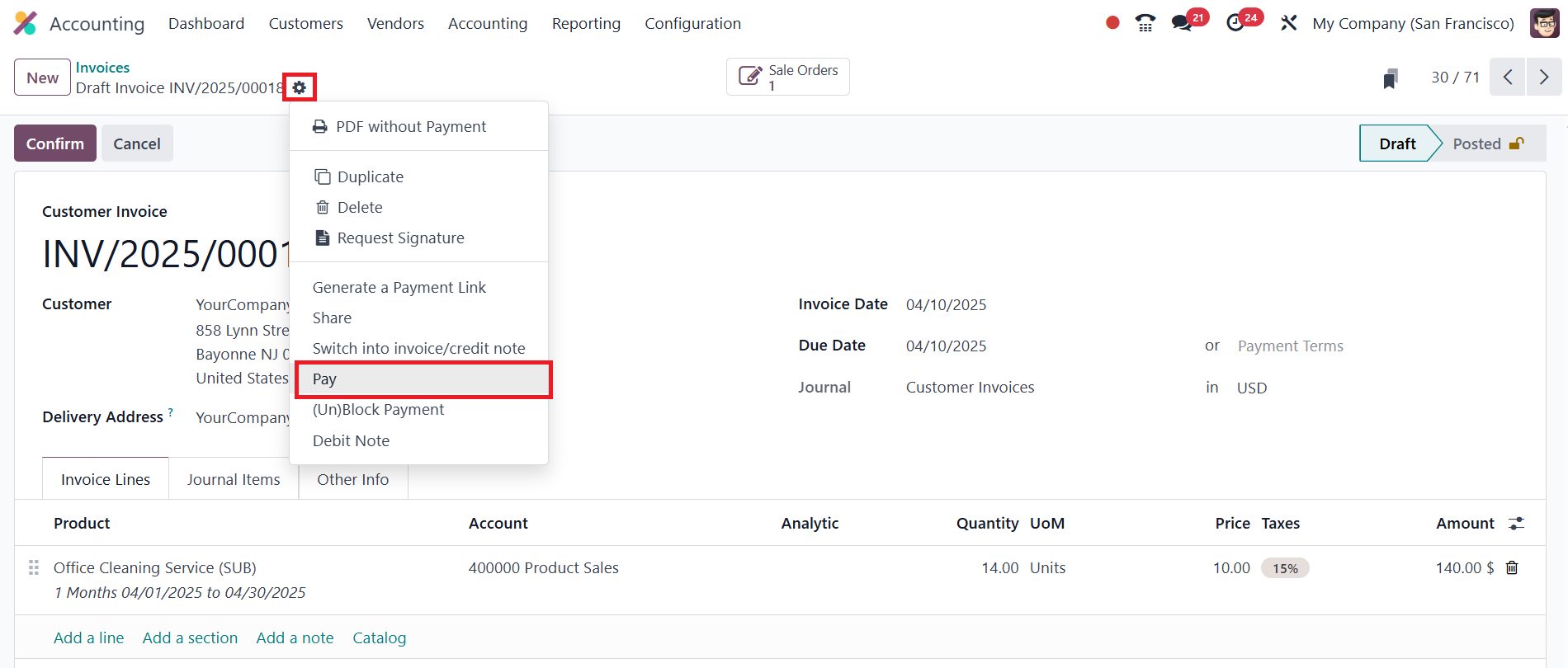

In Odoo 18, payments can now be

registered for draft invoices

directly from the Actions

menu.

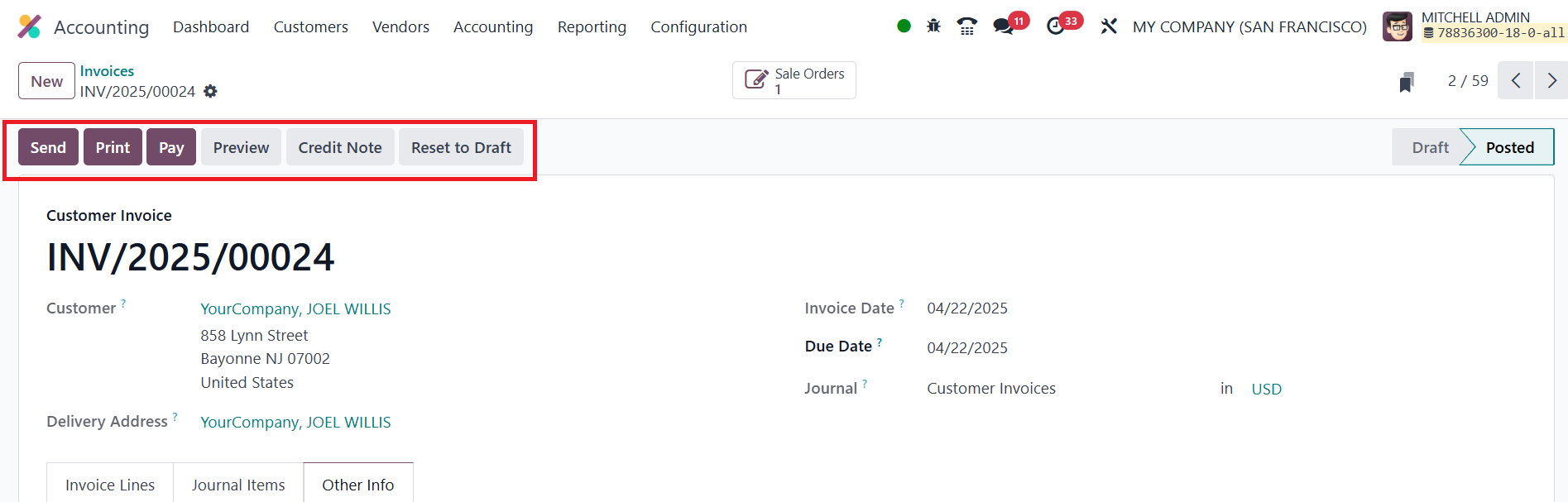

If necessary, a posted invoice

can be reverted to draft

using the Reset to Draft

option. The Preview button

allows users to view the

invoice as the customer would

see it.

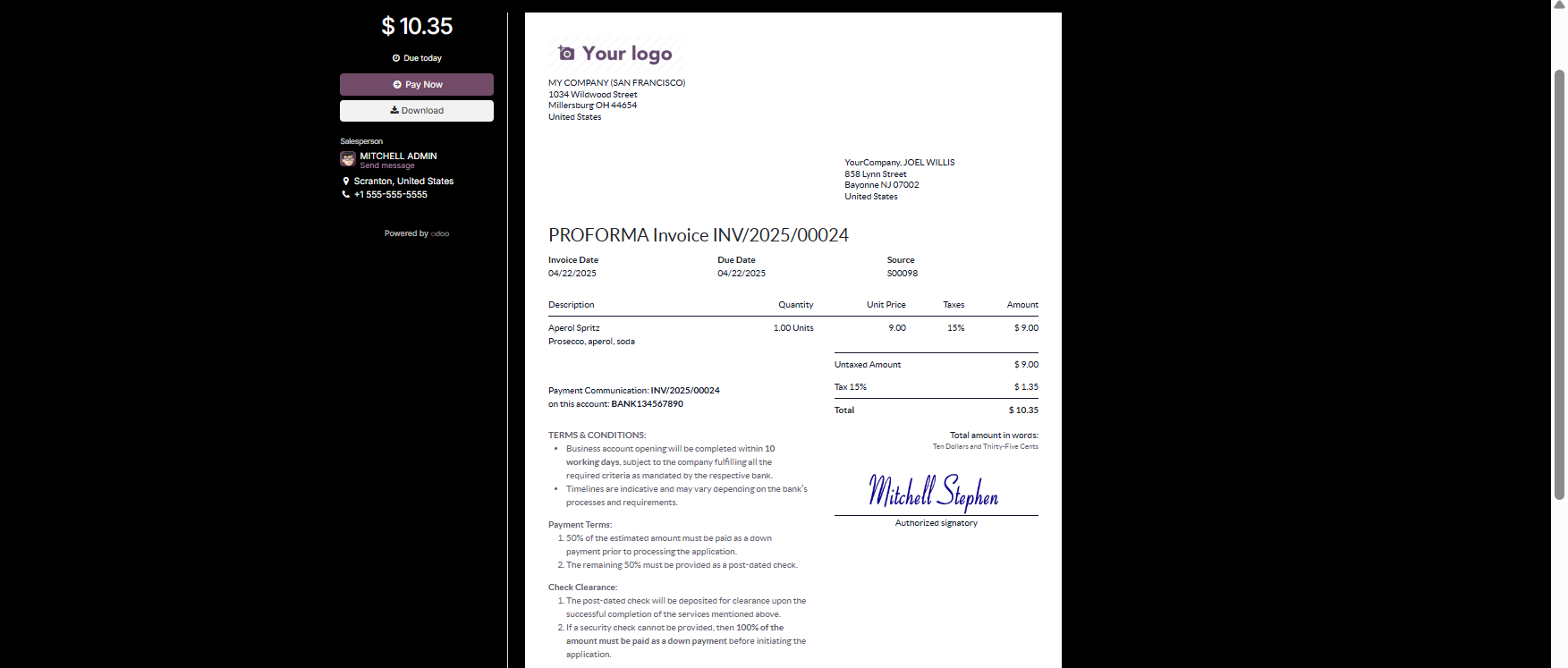

The client preview page gives

customers the ability to

view, download, print, and

pay the invoice using their

preferred payment method.

Customers can also send

messages directly to the

assigned salesperson through

this interface. To email the

invoice, users can select the

Send option, which opens an

auto-generated email template

where recipients, subject

lines, and body content can

be customized.

Once the invoice is attached and

email fields are finalized,

clicking Send will deliver

the invoice to the customer.

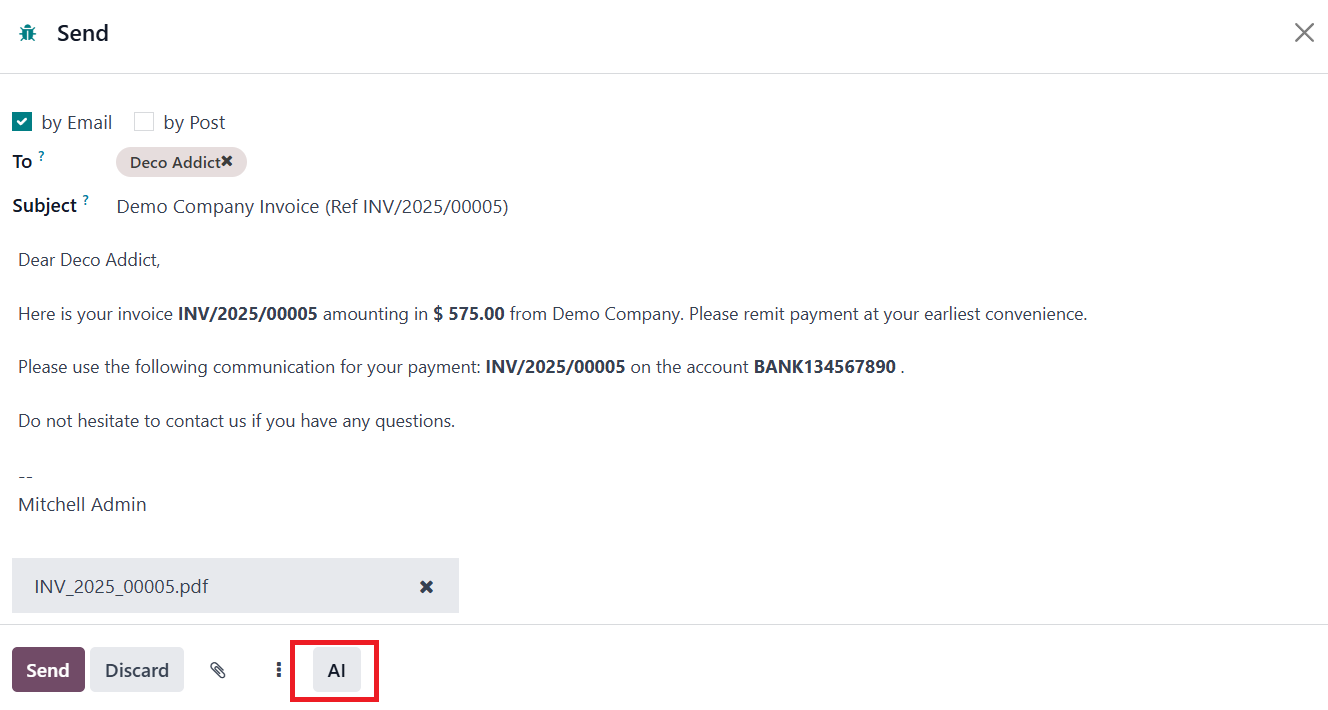

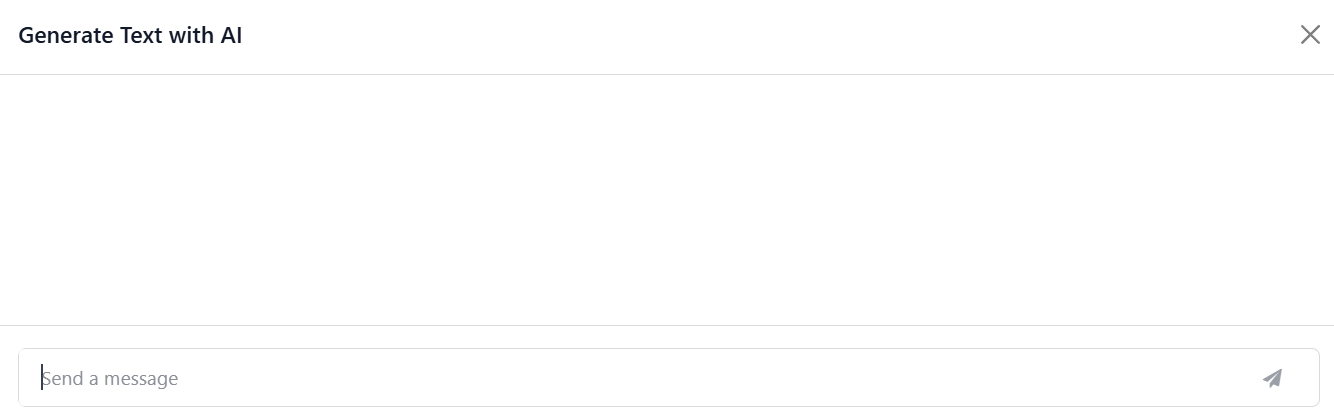

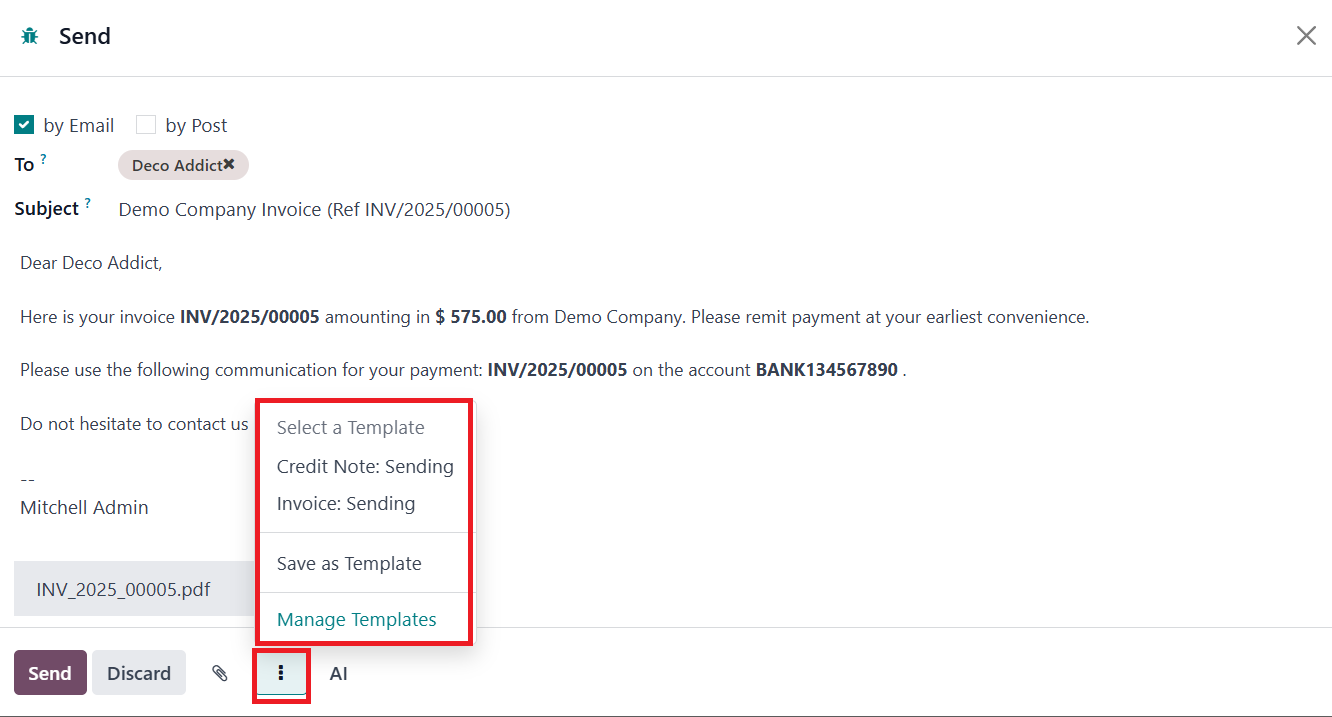

When you click on the Send option

for a customer invoice in

Odoo 18, a popup window

appears allowing you to

manage the email content

before sending it to the

customer. The AI feature

helps you generate a

professional email message

using AI assistance.

Clicking the AI option will open

a new pop-up window as shown

above, where you can generate

email content with the help

you AI.

By clicking on the three dots

icon, you can access a menu

to choose from existing email

templates. If you've created

a new email draft that you

want to reuse in the future,

the Save as Template option

lets you save it as a new

template. All saved templates

can be accessed and organized

through the Manage Templates

option.

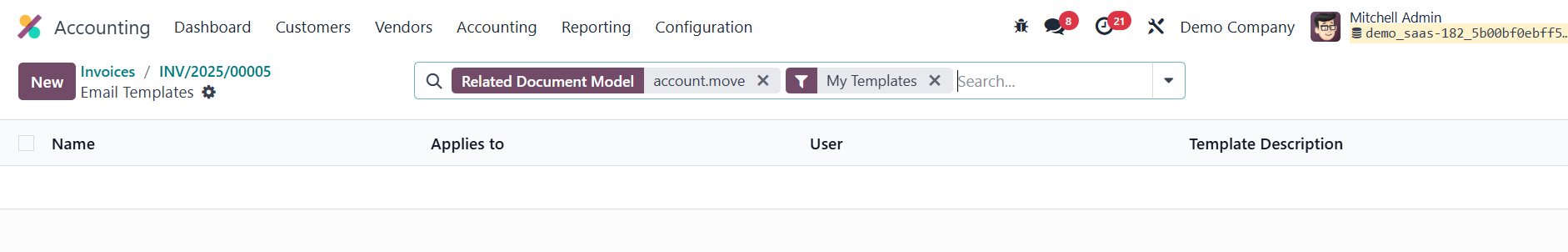

A new window will appear as shown

above, where you will get the

Email Templates recorded in

your system. Use the New

button to create a new

template.

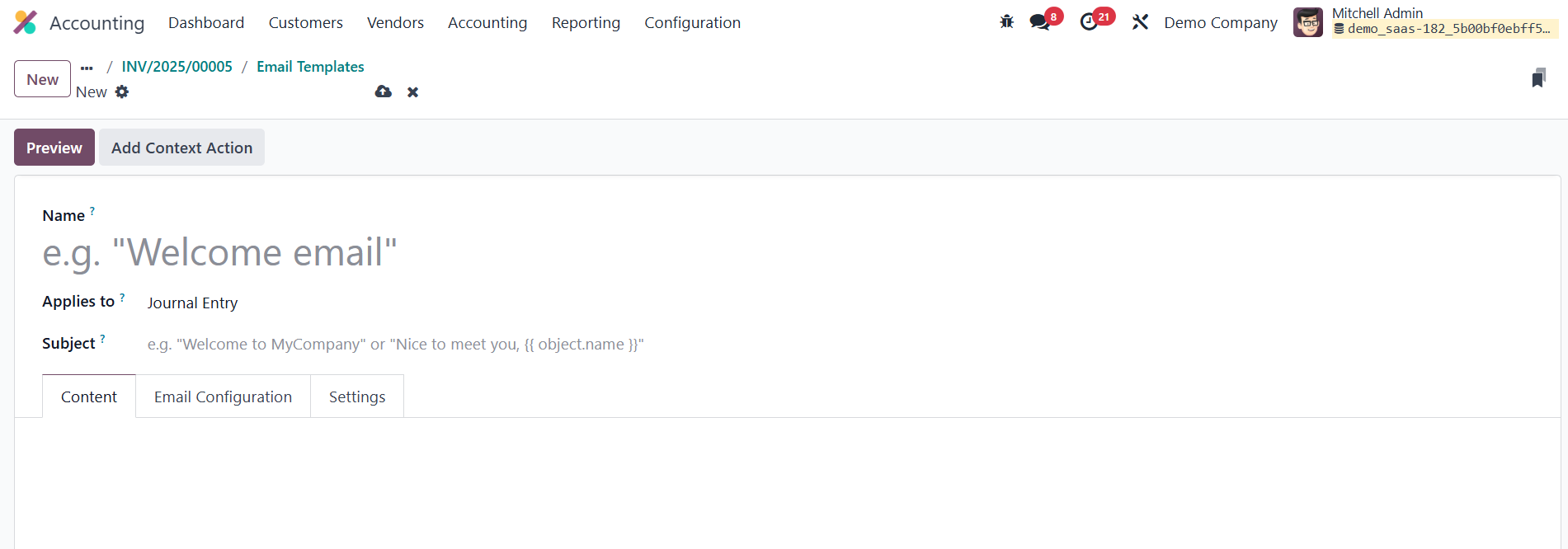

Here, you can assign a Name to

the template. The Applies to

field in the email template

creation window is used to

specify the model or document

type to which the email

template will be linked. In

the Subject field, you can

specify the subject of the

mail content. The mail

content can be added under

the Content tab of the Email

Template.

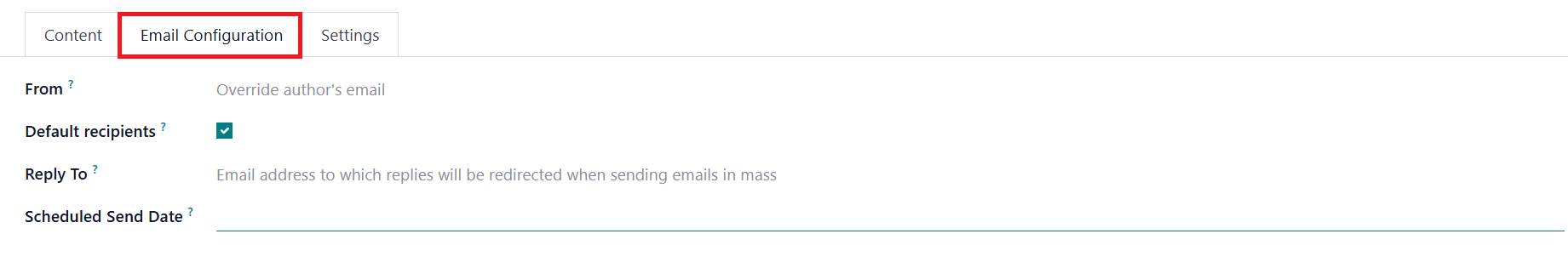

Under the Email Configuration

tab, mention the From,

Default Recipients, Reply To,

and Scheduled Send Date.

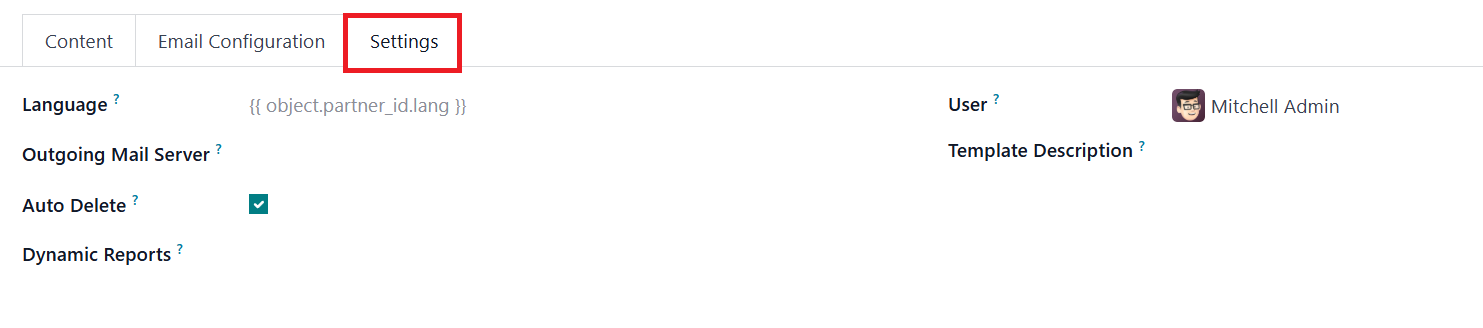

Using the Settings tab, you can

set the Language, Outgoing

Mail Server, Dynamic Report,

User, and Template

Description. The Auto Delete

option in email templates

determines whether the email

generated using the template

should be automatically

deleted after being sent.

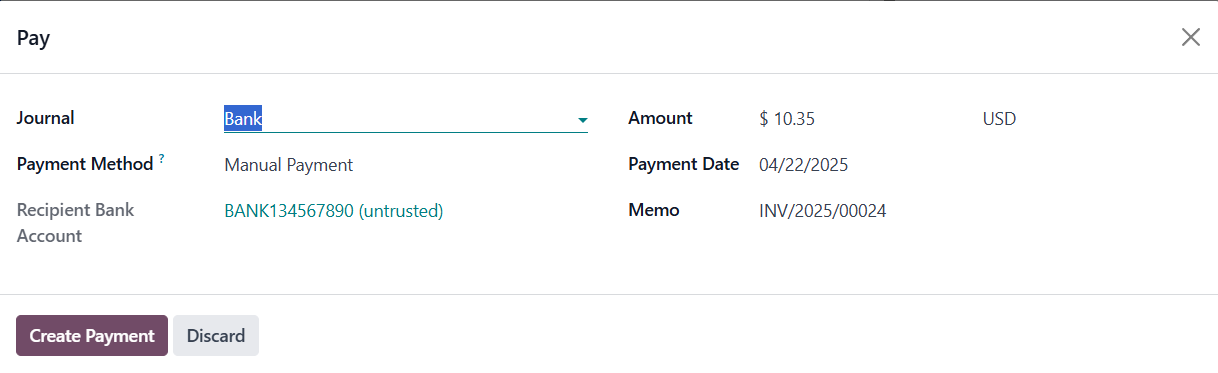

Upon successful customer payment,

the Pay option is used to

record the transaction.

Odoo 18 opens a pop-up window

showing the Journal, Payment

Method, Recipient Bank

Account, Amount, Payment

Date, and Memo. These fields

can be edited if necessary.

Clicking the Create Payment

button completes the

registration process, and the

invoice status updates to In

Payment.

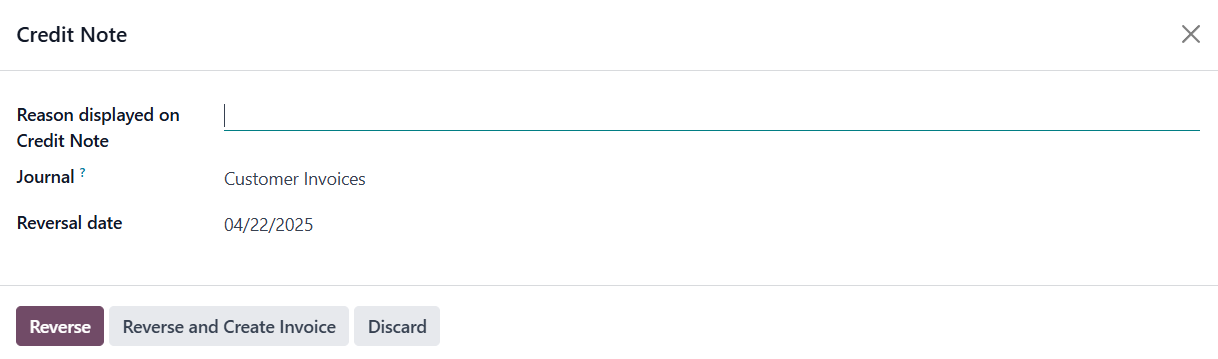

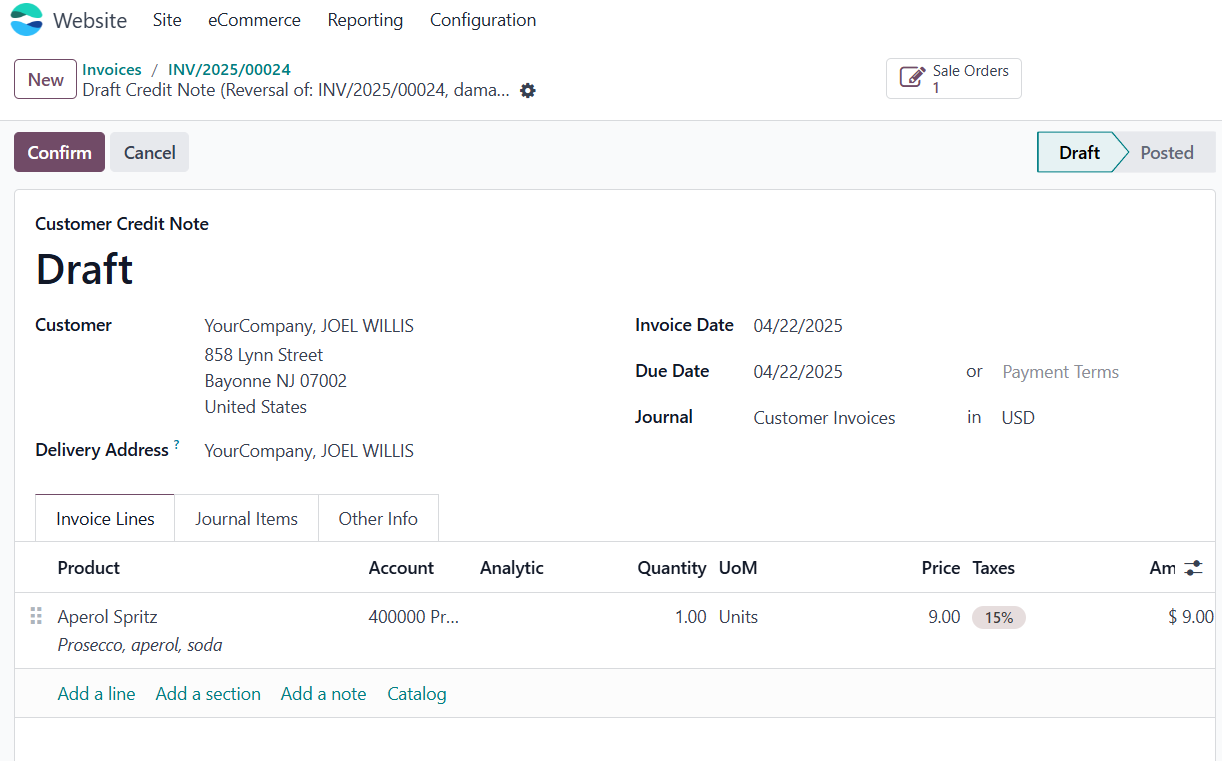

In cases where customers return

products, receive damaged

goods, or reject services,

businesses can issue a Credit

Note.

The Add Credit Note button

initiates this process,

bringing up a wizard where

users must specify the Reason

for the credit note. The

Reversal Date can be either

the original journal entry

date or a specific date.

There’s also an option to

select a specific journal via

the Journal field. Once the

reversal details are set,

clicking Reverse generates a

draft credit note.

The system will then direct the

user to a new window where

the draft credit note is

displayed. Clicking Confirm

validates it, and users can

later use the Pay option to

handle the credit note

payment process.