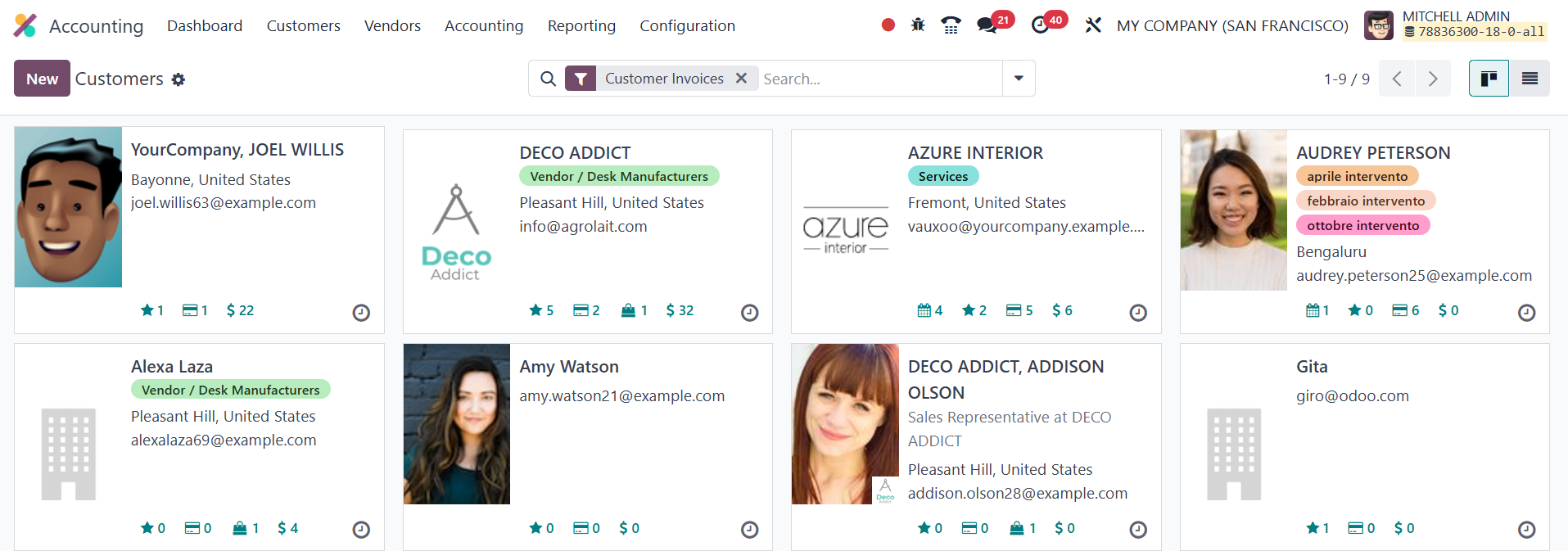

8. Customers

In Odoo 18 Accounting, managing customers is made efficient through

the integrated customer management feature. By selecting the

Customers submenu under the Customers menu, users can view a

comprehensive list of existing customers. The list view provides a

detailed display of customer information, while the Kanban view

offers a more visual representation, although it does not show

opening details at first glance. By default, the view applies the

Customer Invoices filter, which narrows down the list to display

only those partners who are marked as Customers and have at least

one posted invoice or related invoice activity.

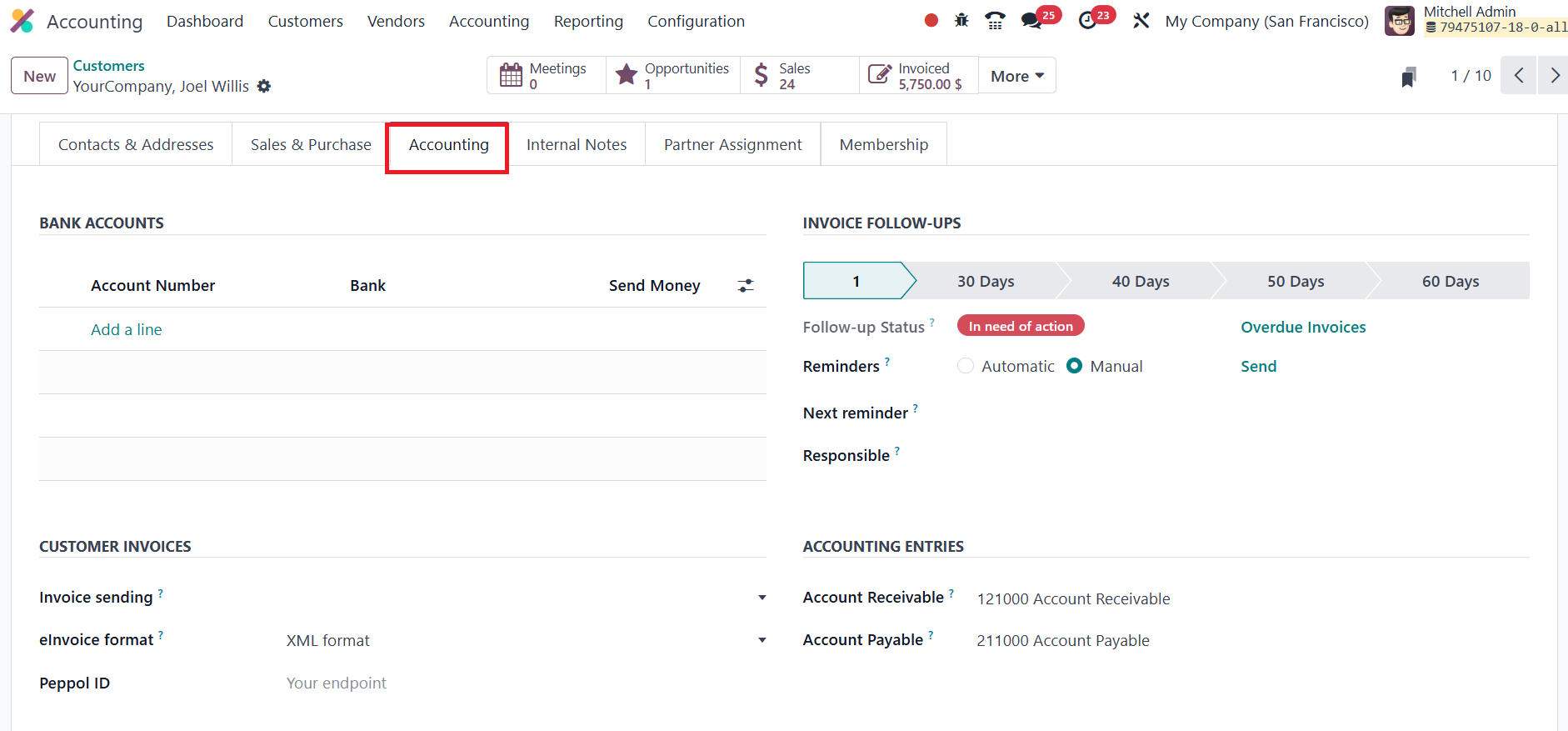

To add a new customer, users can click the New button, which opens a

form where essential customer details can be entered. These include

the customer's name, contact information, associated company, and

fiscal details. The Accounting tab in Odoo allows businesses to

efficiently manage a customer's financial information. Under the

Bank Accounts section, users can add details such as the customer’s

account number and bank name by clicking the Add a Line button.

The Invoice Follow-ups feature helps businesses track overdue

invoices and ensure timely payments. The Follow-up Status provides a

quick overview of an invoice's current follow-up stage. Odoo

supports both Automatic and Manual Reminders; automatic reminders

are triggered based on predefined rules, such as a set number of

days after the invoice due date, while manual reminders offer more

flexibility by allowing users to initiate them as needed. Businesses

can also choose to send these reminders through various channels,

such as email, depending on customer preferences. The Next Reminder

field indicates when the next reminder is scheduled to be sent,

ensuring consistent communication, while the Responsible field

designates the team member or department accountable for managing

the follow-up.

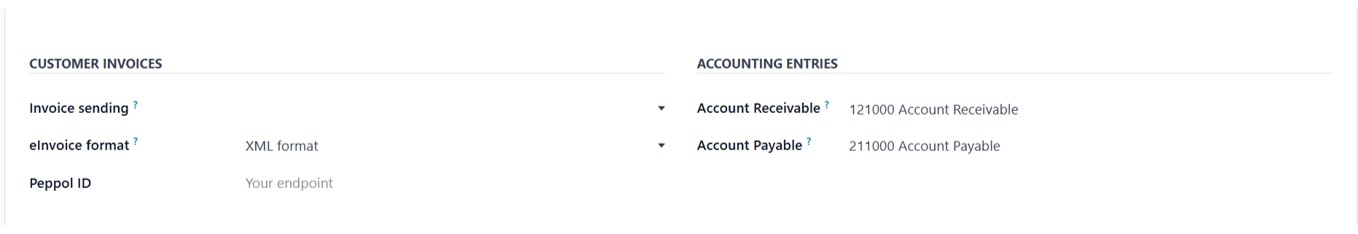

The Account Receivable field is used to track payments owed by the

customer, recording all outstanding invoices and providing a clear

view of receivables. Similarly, the Account Payable field monitors

amounts the company owes to vendors or suppliers, ensuring accurate

tracking of payables. In the Customer Invoices section, the Invoice

Sending option allows businesses to define the preferred delivery

method for invoices; such as email, printed copies, or other

specified channels, ensuring timely and efficient communication. The

eInvoice Format feature supports the generation of electronic

invoices in standardized formats, helping businesses comply with

regional or international e-invoicing regulations. The Peppol ID is

used for customers participating in the Peppol e-invoicing network,

facilitating secure and standardized digital invoice exchange.

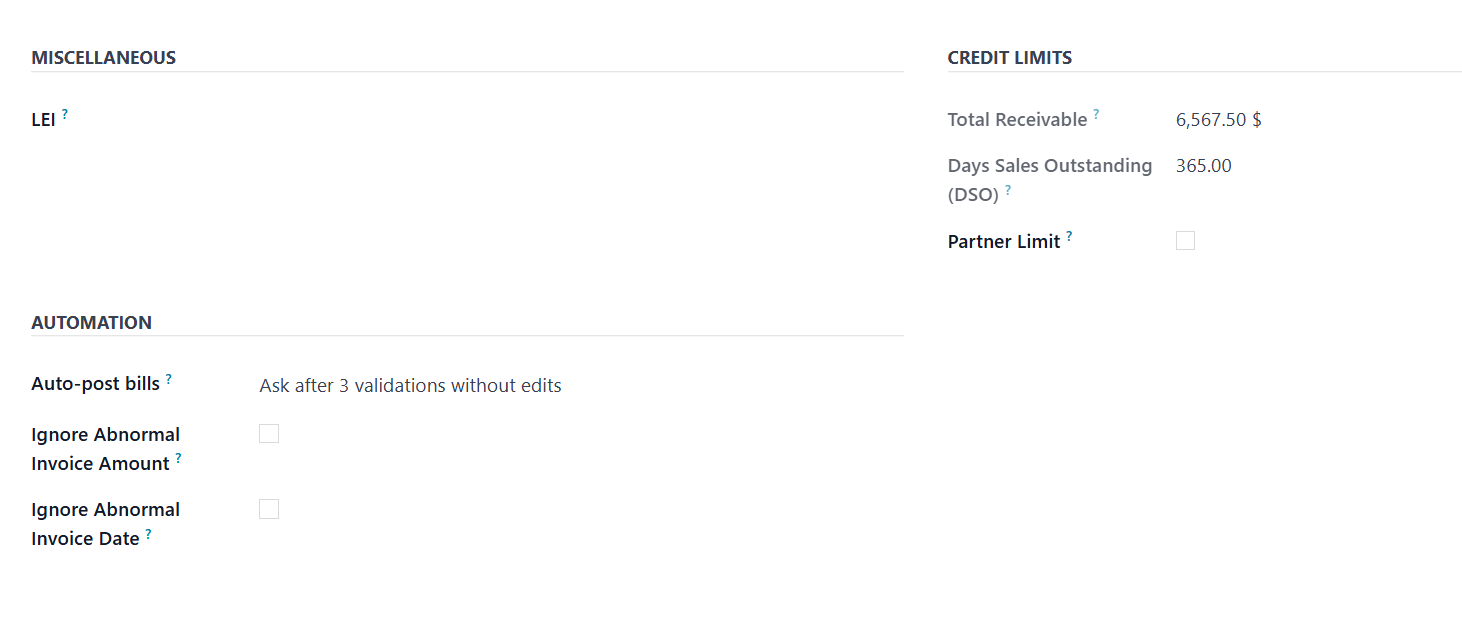

Additionally, the LEI (Legal Entity Identifier) option, available

under the Miscellaneous section, allows users to assign a globally

recognized unique identification code to legally distinct entities

involved in financial transactions, enhancing transparency and

regulatory compliance.

The Credit Limits section includes key financial indicators such as

Total Receivable, Days Sales Outstanding (DSO), and Partner Limit.

Total Receivable shows the total amount a customer owes the business

at any point in time, covering all unpaid invoices and pending

receivables. DSO is a financial metric that calculates the average

number of days it takes for a business to collect payment after a

sale, offering insights into cash flow efficiency. The Partner Limit

sets the maximum credit amount the business is willing to extend to

a specific customer, helping manage credit risk effectively.

The Auto-post Bills feature, when enabled, allows vendor bills to be

posted automatically without manual validation, streamlining

accounting workflows; particularly useful for recurring or trusted

transactions. To enhance data accuracy and prevent potential errors

or fraud, the Ignore Abnormal Invoice Amount setting flags invoices

with values that deviate significantly from typical amounts.

Similarly, the Ignore Abnormal Invoice Date option helps identify

invoices with unexpected or irregular dates, ensuring that financial

records remain consistent and reliable.