40. Deferred

Management

In Odoo 18 Accounting, Deferred

Management provides a

streamlined way to handle

prepaid expenses and unearned

revenues, ensuring your

financial reporting aligns

with accrual accounting

principles. When a business

pays for goods or services in

advance or receives payment

before delivering its

service, Odoo automatically

generates deferral journal

entries that spread the

recognition of those

transactions over the

appropriate future periods.

40.1 Deferred Revenue

Deferred revenues, also known as

unearned revenues, represent

payments received from

customers for goods or

services that are yet to be

delivered. Since the company

has not yet fulfilled its

obligation, these revenues

cannot be recognized

immediately in the profit and

loss statement. Instead, they

are recorded as current

liabilities on the balance

sheet until the revenue can

be earned, either all at once

or gradually over a specified

period.

For instance, if a company sells

a one-year software license

for $1200 and invoices the

customer upfront, the revenue

cannot be fully recognized at

the time of invoicing.

Instead, the entire amount is

posted to a deferred revenue

account. Over the next 12

months, $100 is recognized

each month as earned income,

aligning with the delivery of

the licensing service.

In Odoo 18 Accounting, this

process is efficiently

managed through the Deferred

Revenue feature, which

automates the generation of

multiple journal entries

based on the deferral model.

These entries are posted

periodically, monthly,

quarterly, or as configured,

ensuring that revenue is

recognized accurately and in

compliance with accrual

accounting standards.

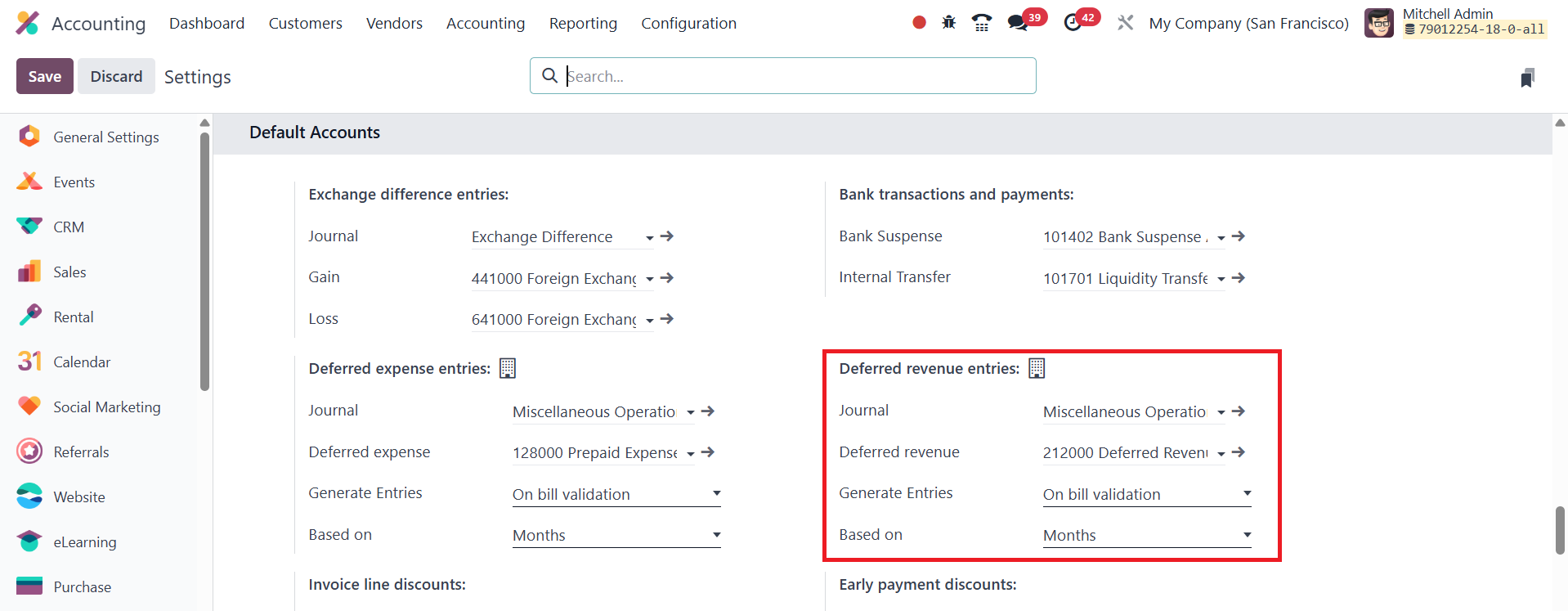

In Odoo 18 Accounting, managing

deferred revenues is

streamlined through the

configuration options

available under the

Accounting Settings. Within

this module, there is a

specific section titled

Default Accounts, which

displays all the default

accounts used by the company.

Among these, the Deferred

Revenue Account is

prominently listed, serving

as the account where unearned

income is temporarily

recorded until it is eligible

for recognition.

Alongside the deferred revenue

account, users can also

define the journal that will

be used to log deferred

entries. Odoo provides

flexibility in how deferred

entries are generated.

Businesses can choose to

generate these entries

automatically upon bill

verification, enabling an

automated workflow that

ensures timely recognition of

revenue. Alternatively, they

can opt for the Manual &

Grouped method, which allows

users to have more control

over when and how the entries

are created and grouped.

Odoo also allows users to define

how the deferred entries

should be calculated. There

are options to calculate

entries based on days, which

ensures a daily level of

precision, or based on

months, for evenly spread

monthly revenue recognition.

Additionally, the Full Months

option ensures that revenue

is recognized from the

beginning to the end of

calendar months.

Generate Entries on Bill

Validation

In Odoo 18 Accounting, when the

option Generate Entries on

Bill Validation is enabled,

the system is configured to

automatically create deferred

revenue or deferred expense

entries at the moment a bill

is confirmed. This means that

as soon as a bill is

validated, Odoo will

immediately generate the

necessary journal entries to

begin the deferral process.

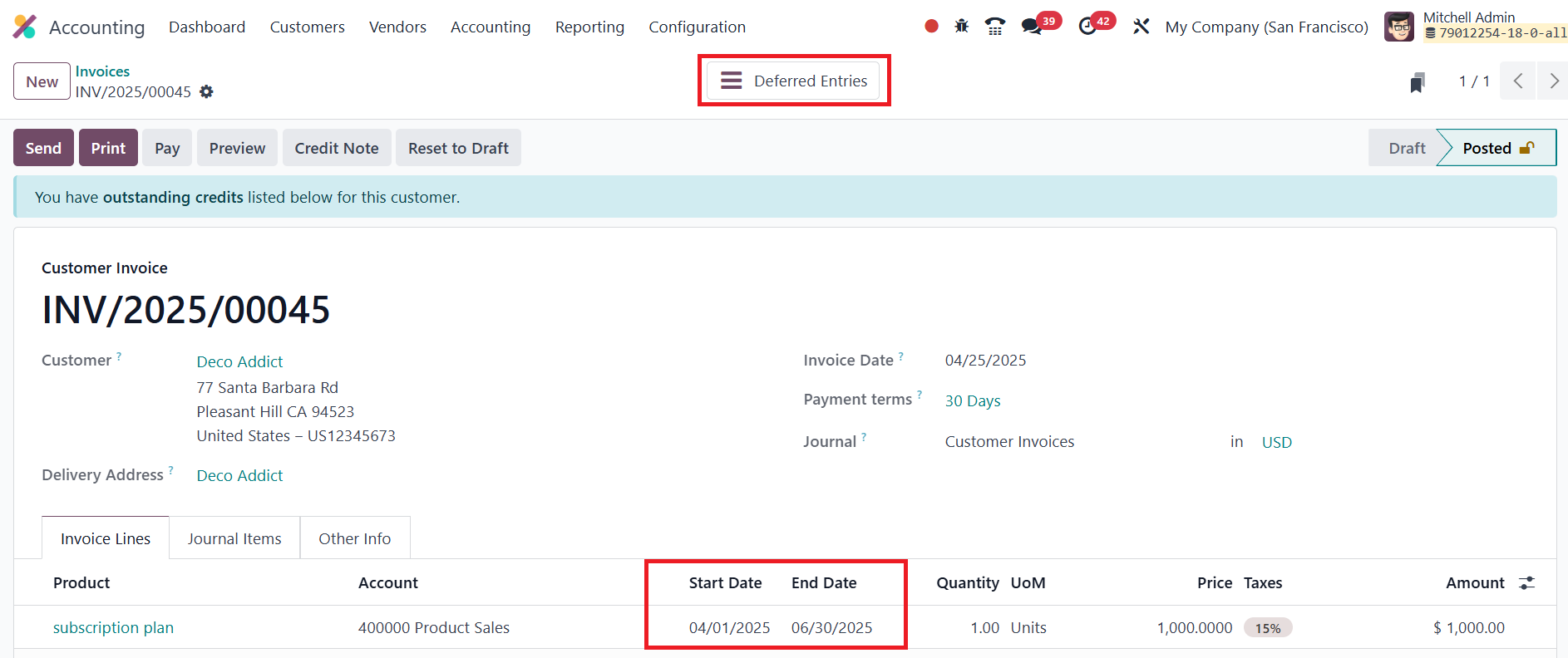

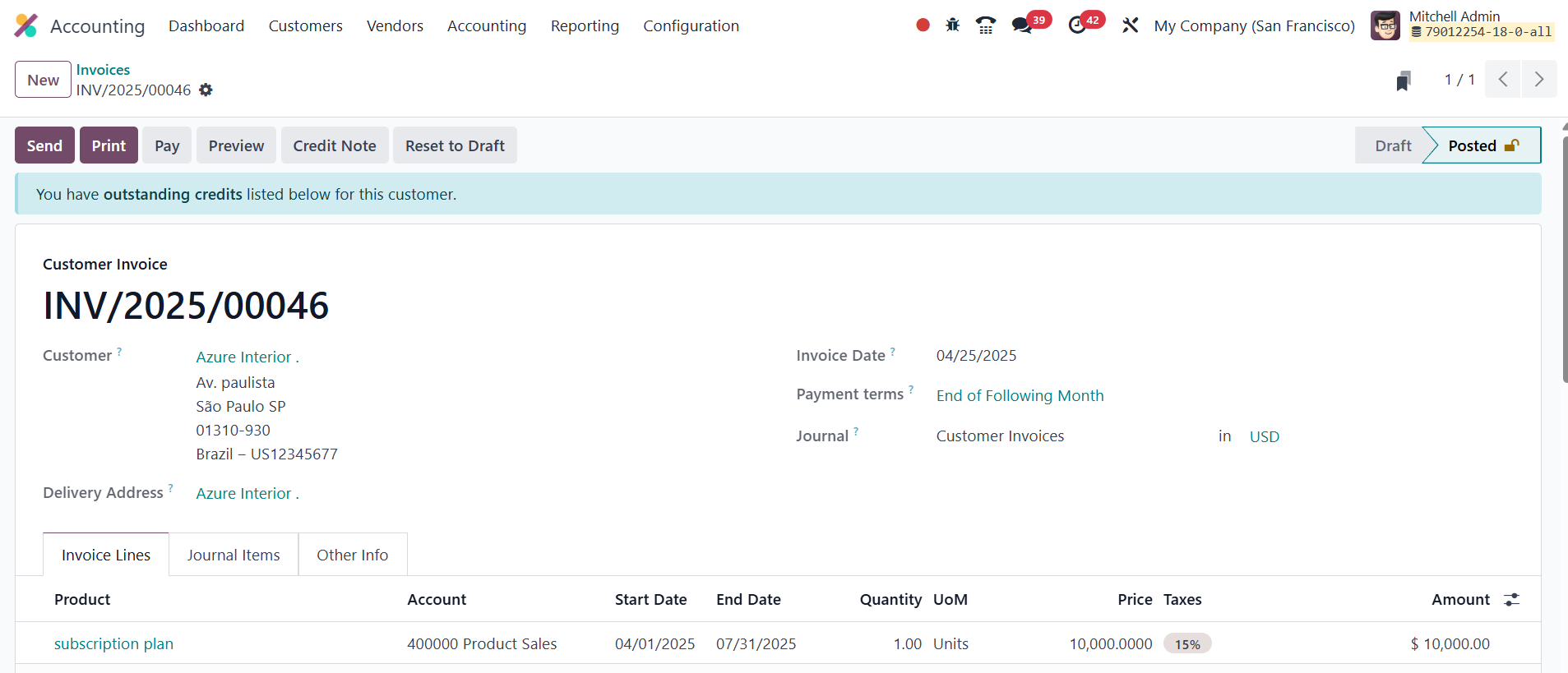

Let’s consider a scenario where a

customer subscribes to a

service plan offered by the

company. To process this in

Odoo 18 Accounting, we begin

by creating a new invoice.

Navigate to the Customer menu

and select the Invoices

option. To initiate a new

invoice, click the New

button.

Start by selecting the Customer

name for whom the invoice is

being generated. Then, fill

in other important details

like the Invoice Date,

Payment Terms, and Journal.

In the Invoice Line section,

add the relevant product or

service; in this case, the

subscription plan, along with

the appropriate quantity.

This section also includes

two important fields labeled

Start Date and End Date,

which define the duration of

the service or subscription

being invoiced.

Once all the details are filled

in correctly, the invoice can

be confirmed. After

confirmation, Odoo will

automatically generate the

corresponding accounting

entries, including deferred

revenue entries if

applicable, based on the

duration provided. To view

the deferred entries, simply

click on the smart tab that

appears after confirming the

invoice.

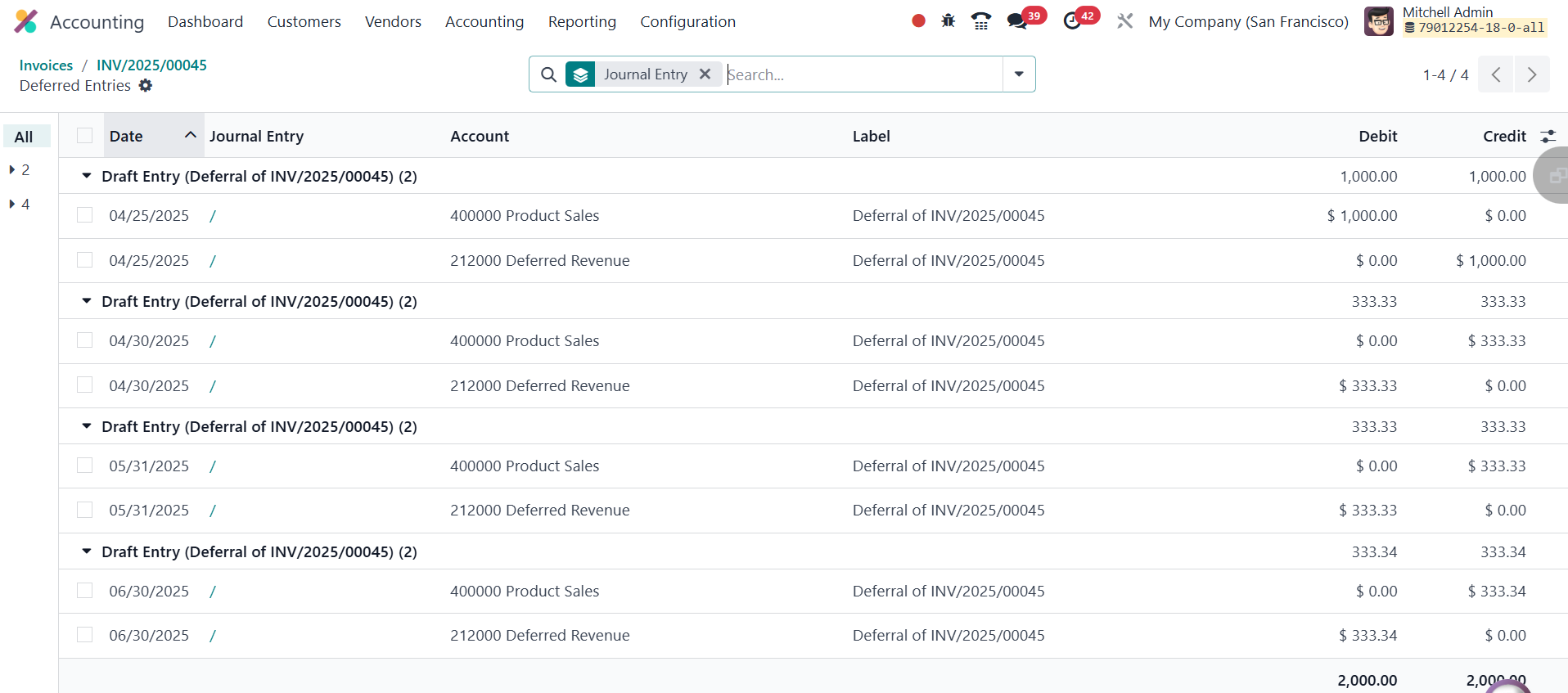

In Odoo 18 Accounting, once the

invoice is confirmed and

deferred entries are

generated, two types of

journal entries are created

to manage deferred revenue

recognition. The first entry,

dated on the same day as the

invoice’s accounting date,

transfers the total invoice

amount from the income

account to the deferred

revenue account. This initial

entry ensures that the

revenue is not immediately

recognized in the Profit and

Loss statement since the

service or product is to be

delivered over time.

Following this, a series of

deferral entries are

automatically generated on a

monthly basis (or based on

the configuration: daily,

monthly, or full months).

These recurring entries

gradually move the amount

from the deferred revenue

account back to the income

account. This process

continues over the duration

defined by the Start Date and

End Date in the invoice,

ensuring that revenue is

recognized progressively, in

alignment with the actual

delivery of goods or

services.

Generate Entries Manually and

Grouped

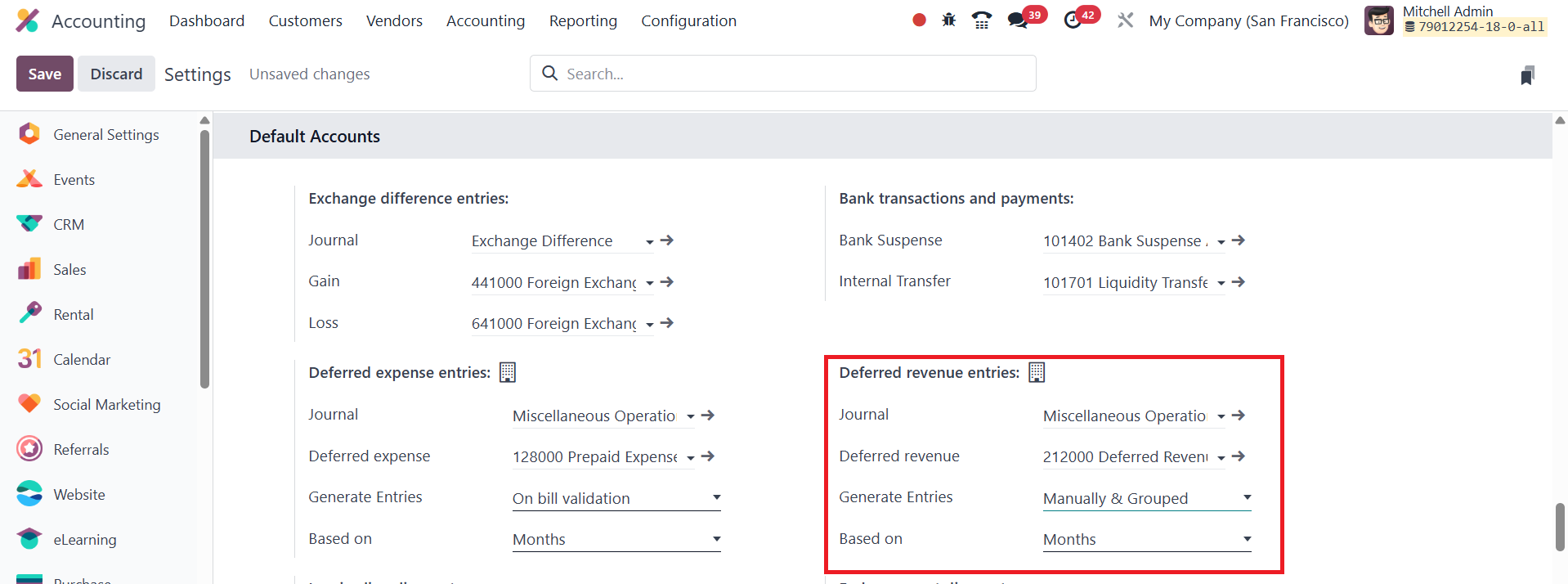

In Odoo 18 Accounting, an

alternative method for

generating deferred entries

is Manually & Grouped, which

provides more control over

the creation of journal

entries for deferred

revenues. Unlike the

automatic generation method,

in this mode, journal entries

are not created automatically

at the time of bill or

invoice confirmation.

Instead, the user must

generate the entries

manually. To enable this

method, navigate to the

Accounting Settings, and

under the Deferred Entries

section, locate the field

labeled Generate Entries.

Change this field’s value to

Manually & Grouped. Once this

setting is applied, the

system will stop

automatically creating

deferral entries, and users

will need to manually trigger

the process each month or as

required.

After saving the changes to the

deferred entry settings and

selecting "Manually &

Grouped", the next step is to

create and confirm a new

invoice. Navigate to the

Customer > Invoices menu, and

generate a new invoice by

filling in the necessary

details such as the customer

name, invoice date, journal,

and product details.

Once the invoice is confirmed, no

deferred journal entries will

be automatically created, as

the system now expects the

user to handle them manually.

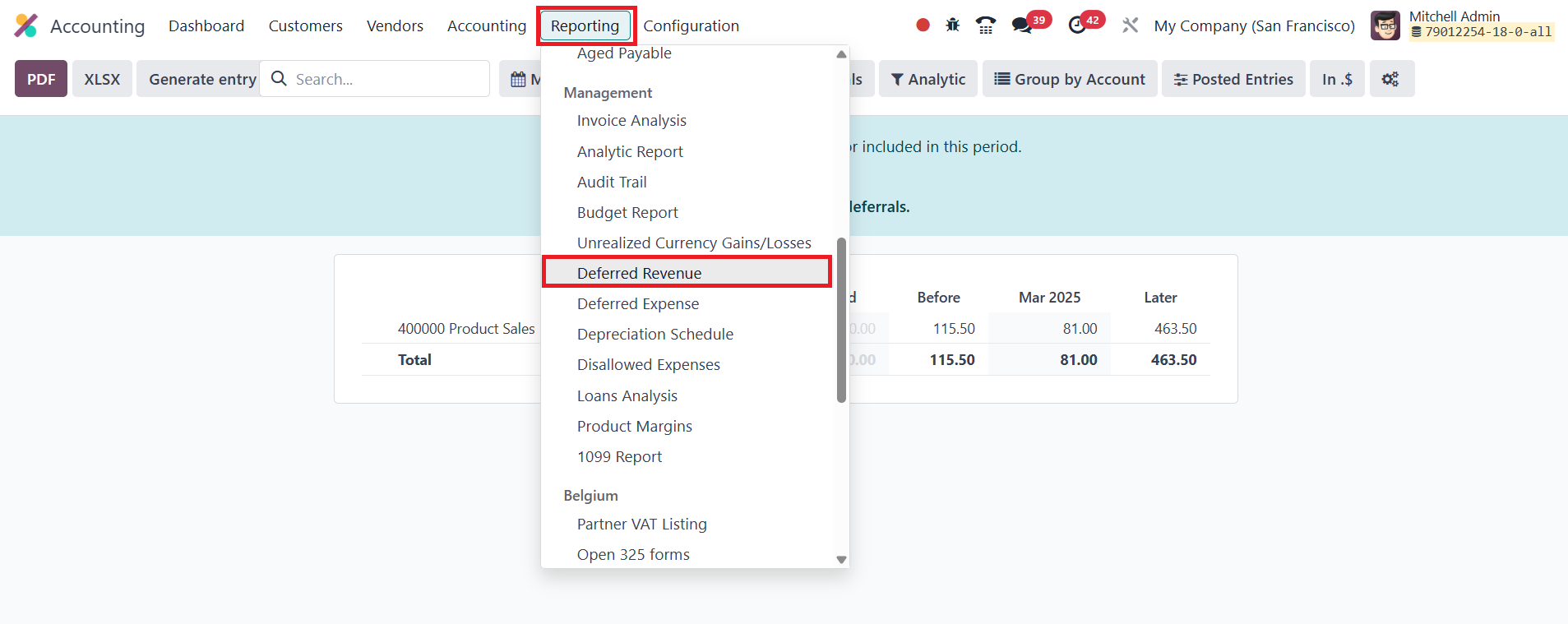

To proceed with generating and

viewing the deferred entries,

Odoo provides a dedicated

report named Deferred Revenue

Report, which is accessible

under the Reporting menu.

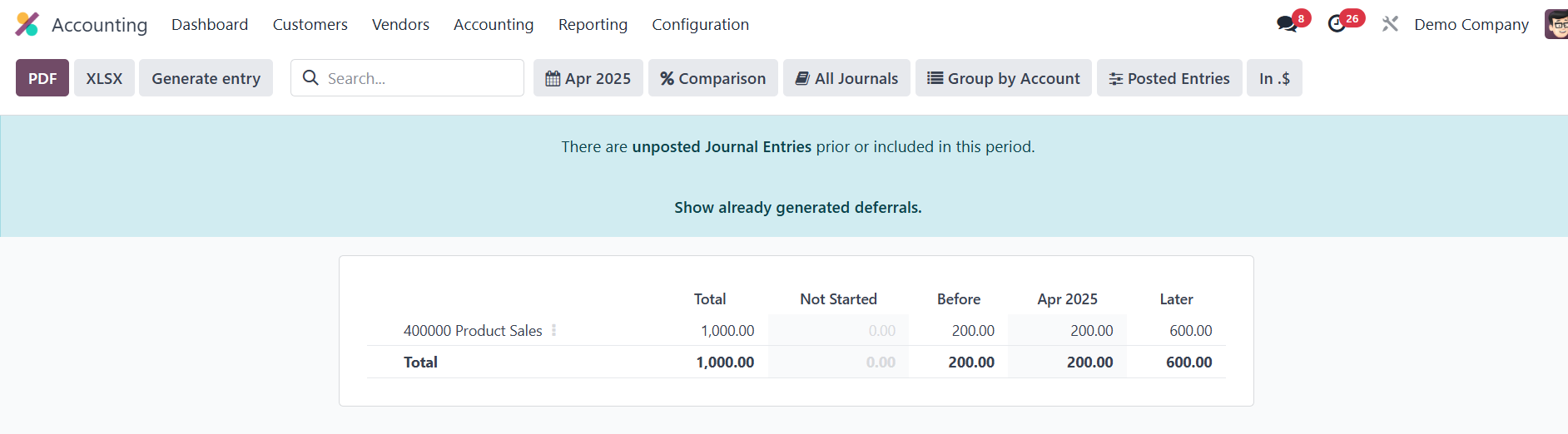

At the end of each month, to

recognize deferred revenues

go to Accounting > Reporting

> Deferred Revenue.

Click the Generate Entries

button.

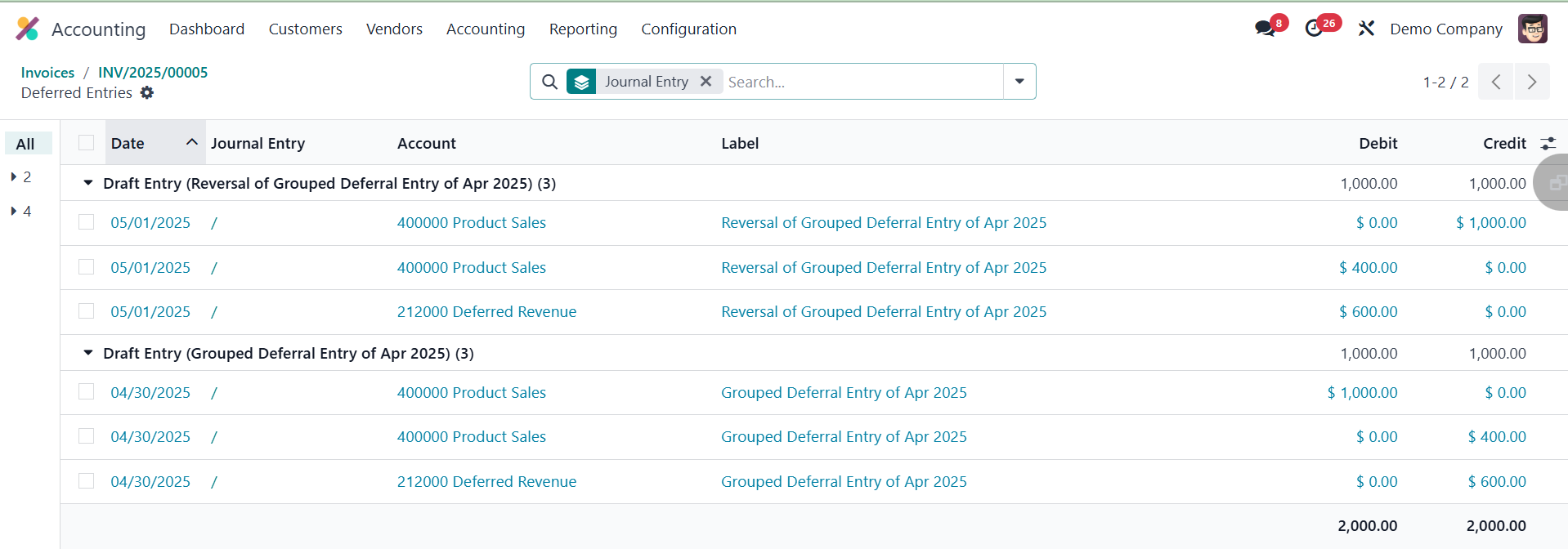

This action will generate two

deferral entries. You can

observe the deferred entries

using the smart button

available in the invoice. The

first entry is created at the

end of the month. This entry

recognizes part of the

deferred revenue for that

specific period and moves it

from the deferred revenue

account to the income

account. The second entry is

created on the following day

(the first day of the next

month). This entry reverses

the previous entry,

effectively canceling it, and

ensures that the deferred

revenue is correctly reset

for the next accounting

period.

40.2 Deferred Expense

Deferred expenses or prepayments

(prepaid expenses) are

financial transactions where

a company pays for goods or

services in advance of

receiving or using them. Even

though the payment has been

made, the benefit of that

expenditure is still to be

realized in the future.

Such costs are treated as assets

on the company’s balance

sheet, as they represent

economic value that will be

consumed over time. Because

the company hasn’t yet

received the product or

service, or has received it

but hasn’t used it, the

expense cannot be recorded

immediately on the profit and

loss statement (income

statement). Instead, these

expenses are deferred,

meaning their recognition is

postponed until the

appropriate time period when

the actual benefit is

realized. Once the service is

delivered or the product is

utilized, the deferred

expense is gradually

expensed, either all at once

or over a specific period,

depending on the nature of

the payment and usage.

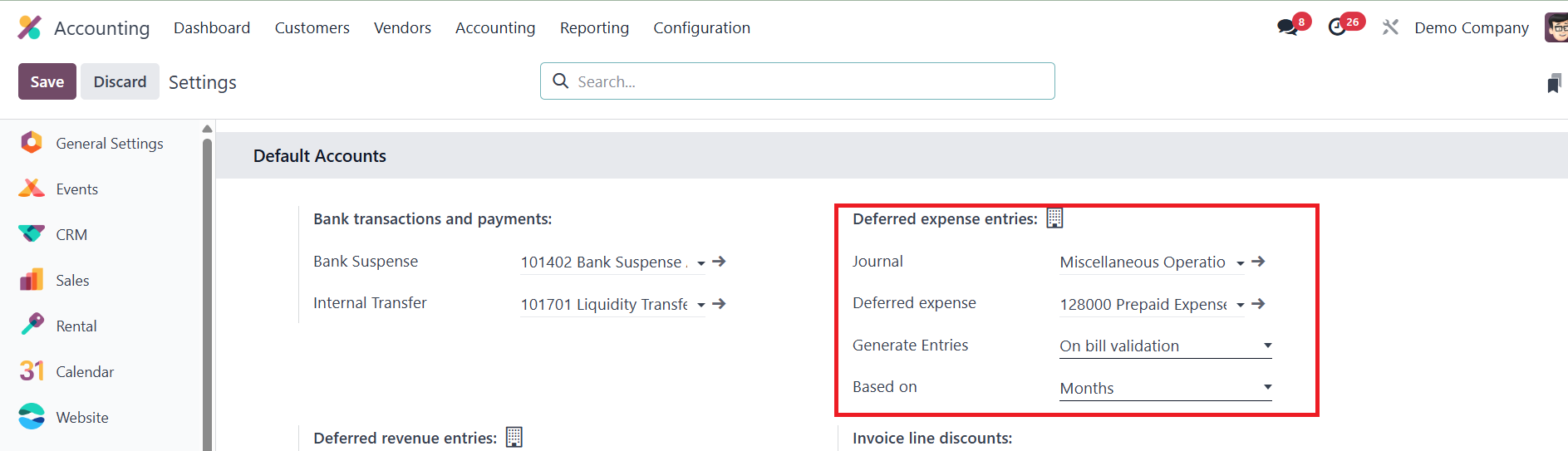

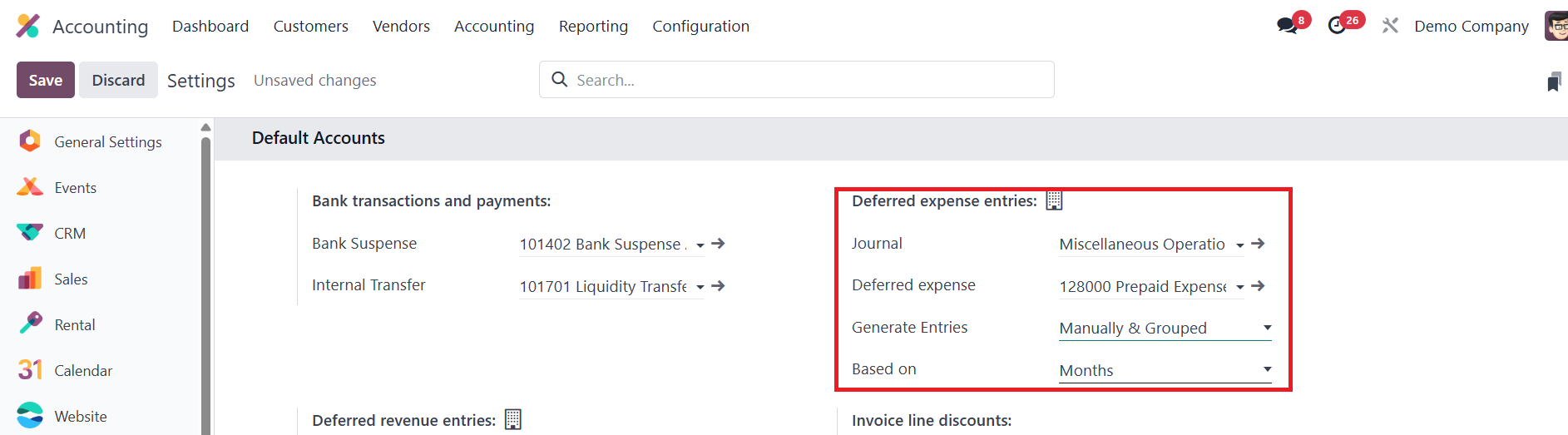

To manage deferred expenses in

Odoo 18 Accounting, start by

opening the Accounting module

and navigating to the

Configuration menu. From

there, select Settings.

Inside the Settings page,

scroll down to locate the

section labeled Default

Accounts. Under this section,

you’ll find the configuration

options related to Deferred

Expense Entries.

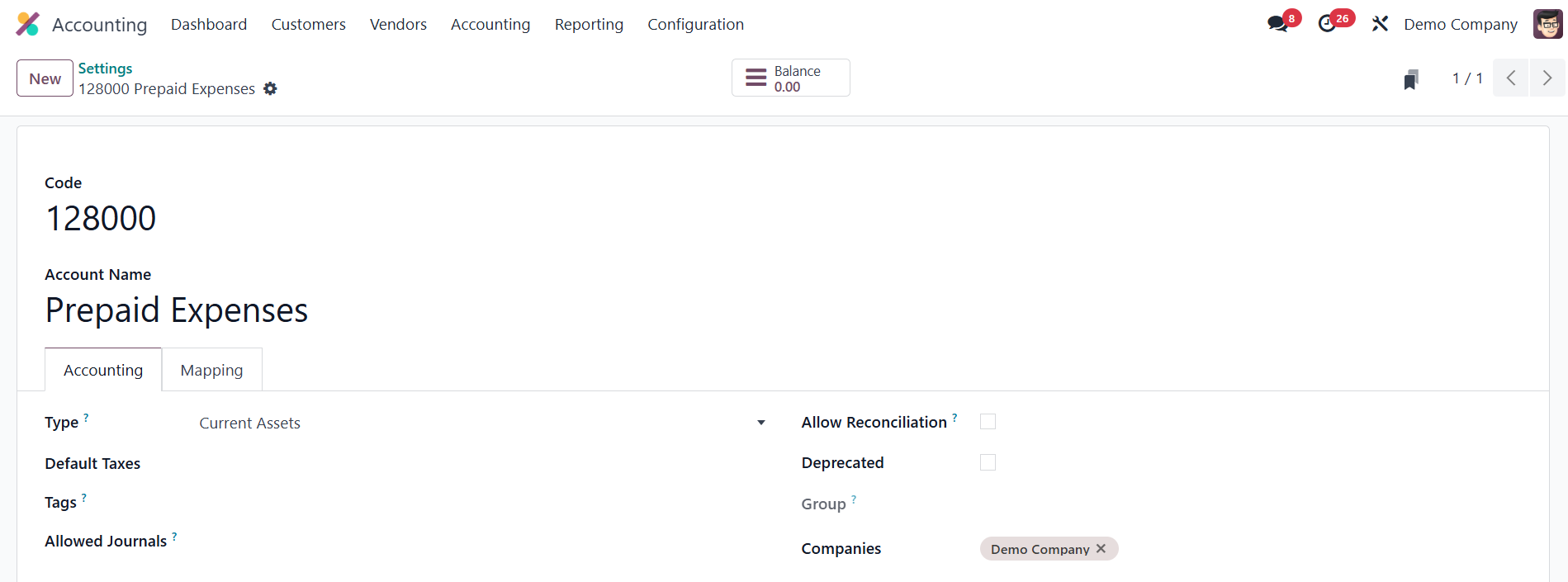

Here, the Journal used for

recording deferred expense

entries is specified first.

Just below that, the Deferred

Expense Account is listed.

This account typically falls

under the Current Assets

category, as deferred

expenses represent payments

made in advance for future

benefits.

You can click the internal link

provided to open and review

the account details directly

from the settings page.

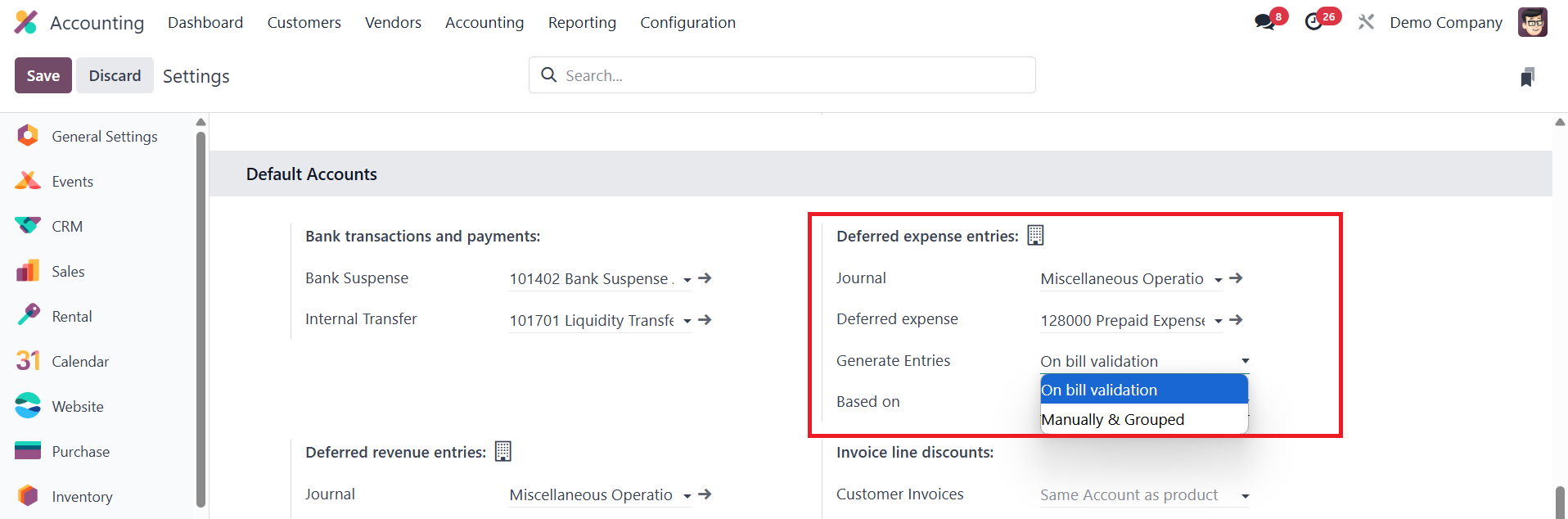

Users have two options for

generating the journal

entries associated with

deferred expenses:

Generate Entries on Bill

Validation:

In this method, deferred entries

are automatically generated

when a vendor bill is

validated. This is a

convenient option as it

automates the process and

ensures accurate posting

without requiring manual

intervention.

Generate Entries Manually:

When this method is selected,

journal entries are not

created automatically.

Instead, the user must

manually generate the

entries; usually at the end

of each period based on the

schedule of the deferred

expense.

Additionally, Odoo allows for

flexible calculation methods

for the depreciation of

deferred amounts. The

available methods include:

Based on Days, Based on

Months, and Full Months.

Depending on the selected

option, the deferred amount

will be amortized accordingly

over the predefined period.

Generate Entries on Bill

Validation

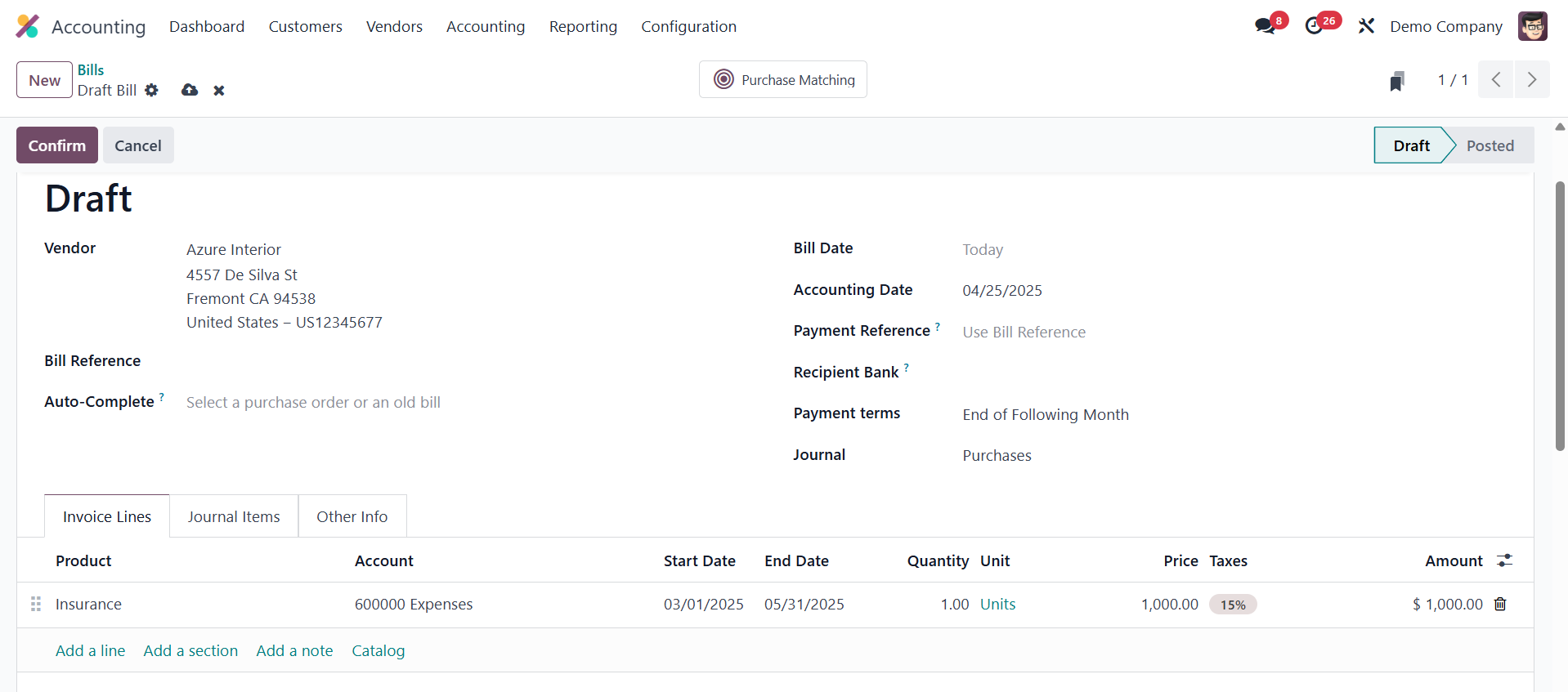

If the Generate Entries

field in Odoo

Accounting is set to

On bill validation,

the system

automatically creates

the required deferral

entries when a bill is

validated. This

configuration

simplifies the

handling of deferred

expenses, ensuring

that accounting

entries are generated

promptly without

manual effort. To

explore this feature,

start by creating a

new vendor bill. This

can be done by

navigating to the

Vendor menu and

selecting the Bills

option. Click the New

button to open the

bill creation form.

Begin by entering the

vendor’s name, and

then fill in other

details such as the

Bill Reference, Bill

Date, Accounting Date,

Payment Reference,

Recipient Bank,

Payment Terms, and the

appropriate Journal.

The Auto-Complete

field available in the

form can speed up the

process by fetching

details from previous

bills or related

purchase orders.

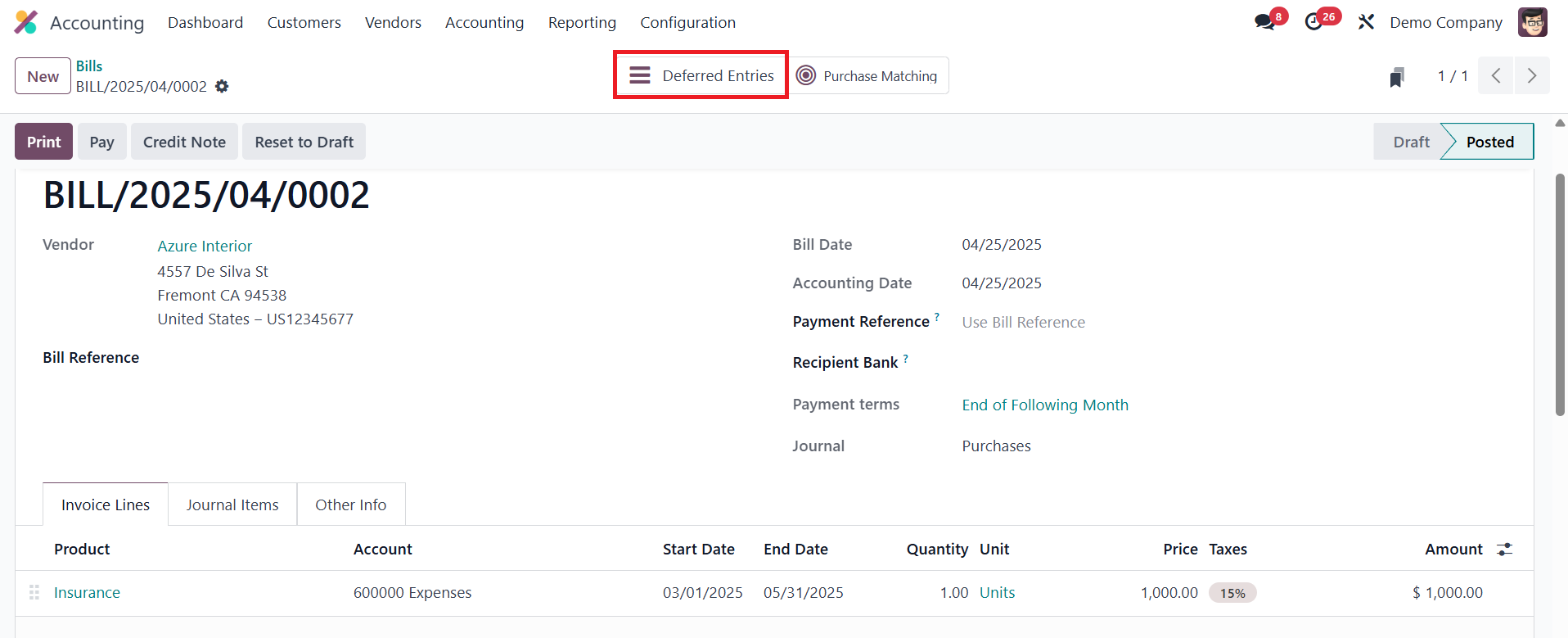

In this example, consider

that the company is

creating a bill for a

service product like

Insurance, which

covers a period of

three months. Within

the Invoice Line

section, select the

product and mention

both the Start Date

and End Date to define

the coverage duration

of the service

clearly.

Once all necessary details

are provided, confirm

the bill. Upon

confirmation, the

bill’s status changes

to Posted. At this

point, a smart tab

named Deferred Entries

becomes visible at the

top of the bill page.

Clicking on this tab

provides access to the

automatically

generated deferral

entries.

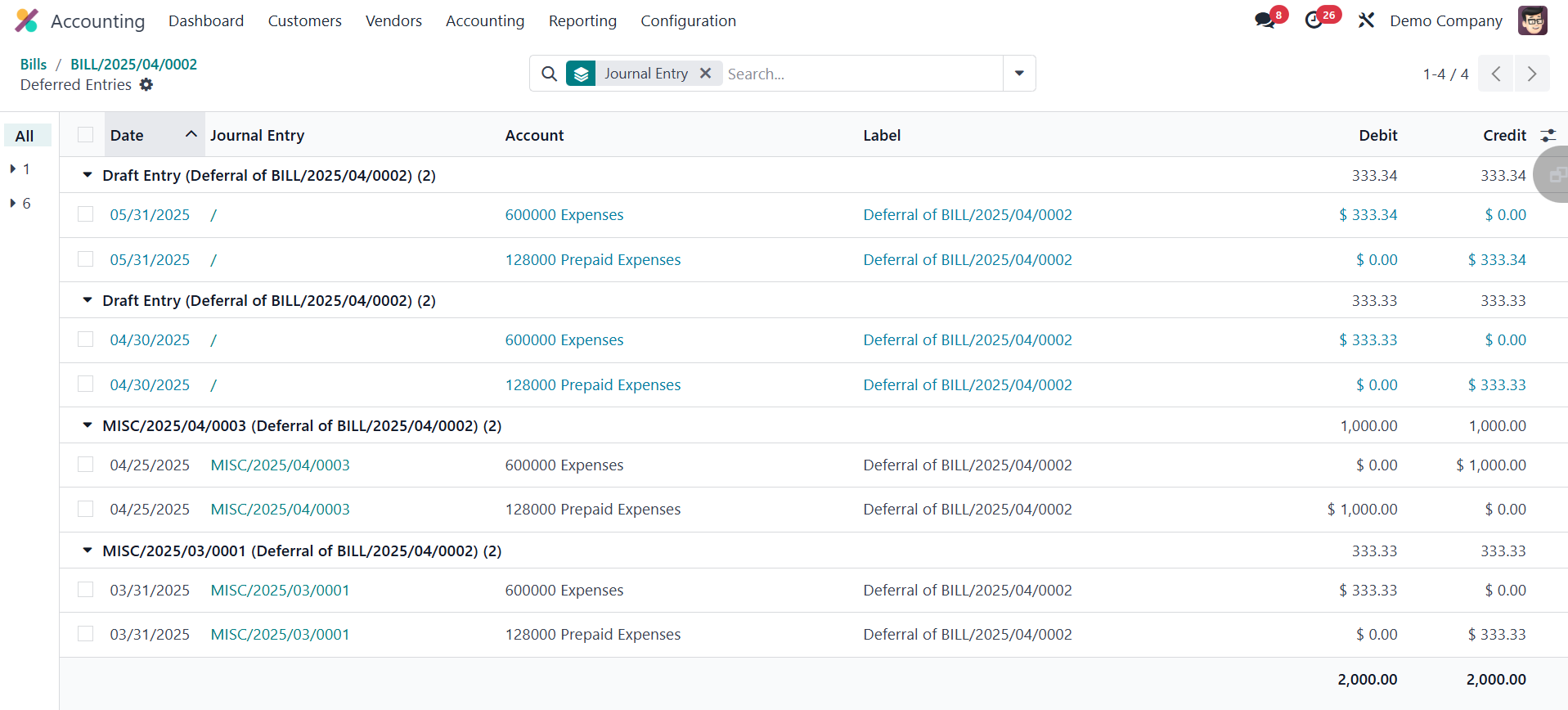

When a bill is validated

under the deferred

expense configuration

in Odoo 18 Accounting,

two types of journal

entries are created to

ensure accurate

recognition of the

expense over time.

The first entry, which is

dated the same day as

the bill’s accounting

date, transfers the

total bill amount from

the expense account to

the deferred expense

account. This action

ensures that the

expense is not

immediately recognized

in the profit and loss

statement, aligning

with accrual

accounting principles.

The subsequent entries are

the deferral entries,

which are posted month

by month. These

entries gradually move

the expense amount

from the deferred

account back to the

expense account,

effectively

recognizing the

portion of the expense

that corresponds to

each accounting

period. This monthly

distribution continues

until the full amount

is recognized over the

defined duration,

offering a clear and

precise representation

of the company’s

financial commitments

and improving the

accuracy of financial

reports.

Generate Entries

Manually and

Grouped

If your company deals with

a large number of

deferred revenues or

expenses and you wish

to minimize the volume

of automatically

generated journal

entries, Odoo 18

Accounting offers a

practical solution by

allowing you to

generate deferral

entries manually. To

enable this, navigate

to the Settings under

the Configuration menu

of the Accounting

module.

In the Deferred Entries

section, change the

Generate Entries field

to Manually & Grouped

and save the settings.

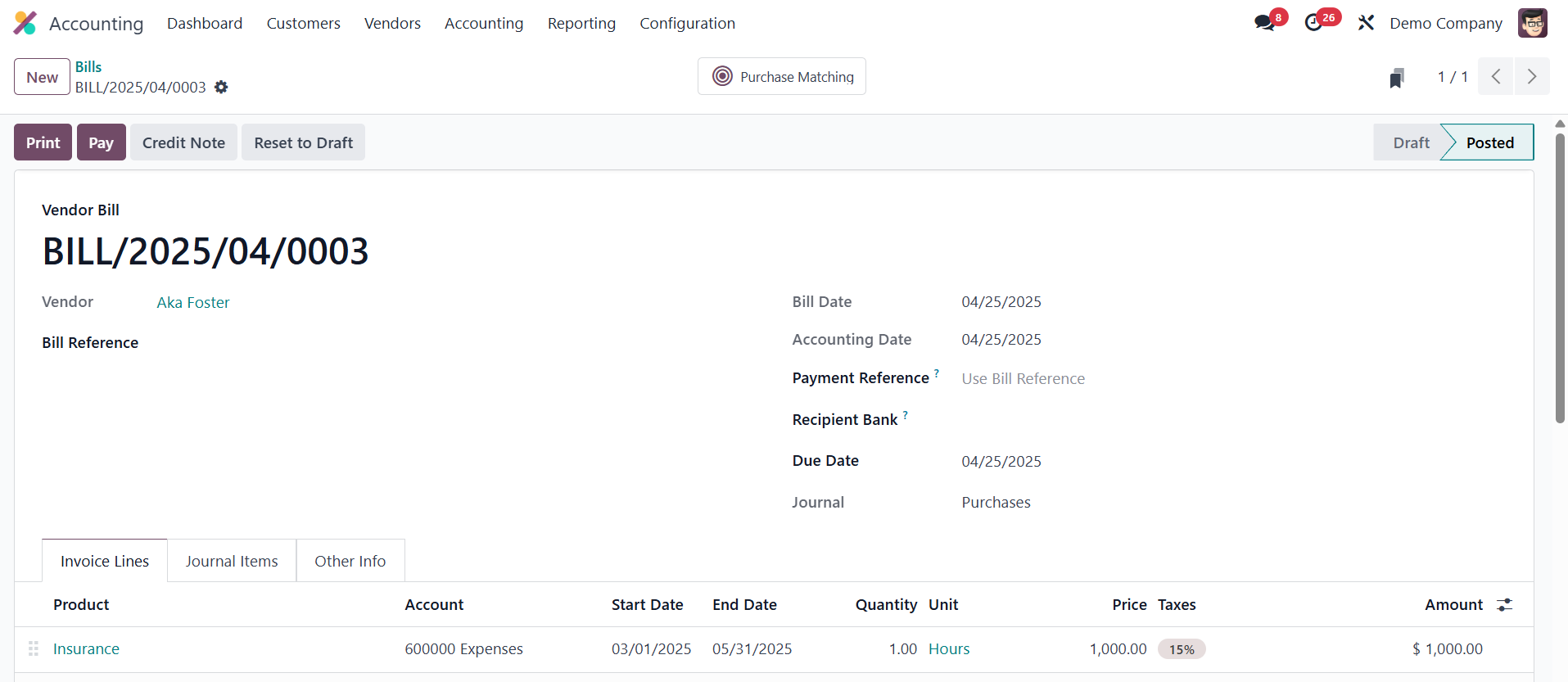

Once this configuration is

set, proceed to create

a new vendor bill.

Begin by adding the

vendor name and

filling in the

necessary bill details

such as Bill

Reference, Bill Date,

Accounting Date,

Payment Terms, and

Journal. Then, add the

required product. In

this case, let's

consider the Insurance

service product again.

Mention the Start Date

and End Date inside

the invoice line to

indicate the deferral

period.

After confirming the bill,

you’ll notice that no

journal entries are

created automatically

because the deferral

process is now manual.

To generate the

deferred journal

entries, go to the

Reporting menu. Under

the Management

Reports, you’ll find

the Deferred Expense

Report.

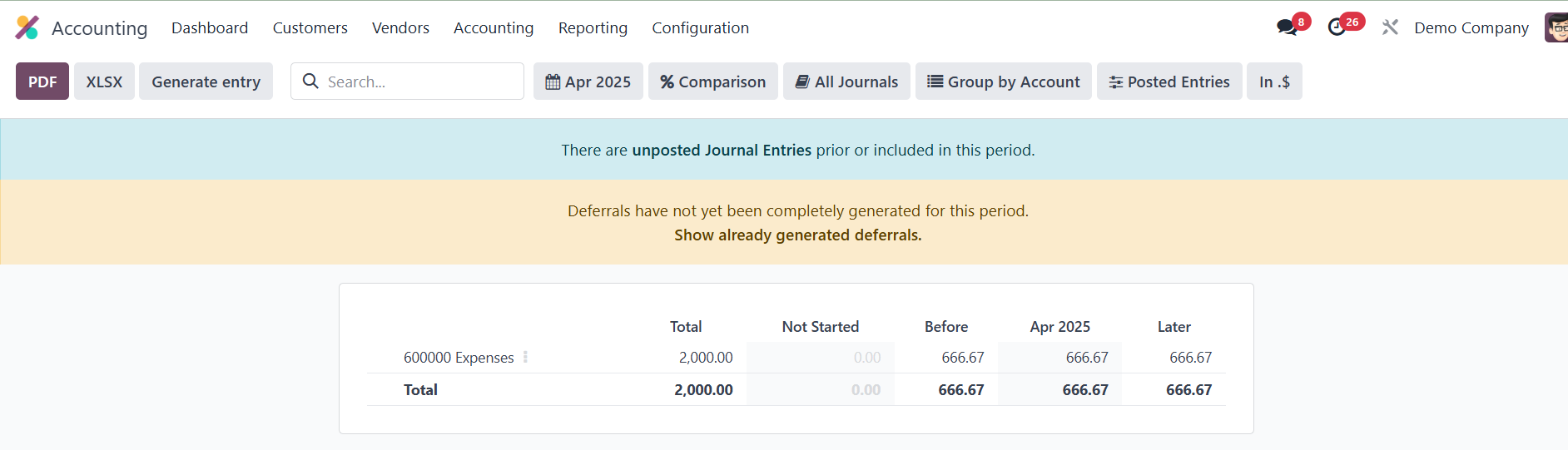

At the end of each month,

to manage manually

grouped deferred

expenses, users should

navigate to the

Deferred Expenses

Report. In this

section, click on the

Generate Entries

button. This action

triggers the creation

of two key deferral

entries for each

account.

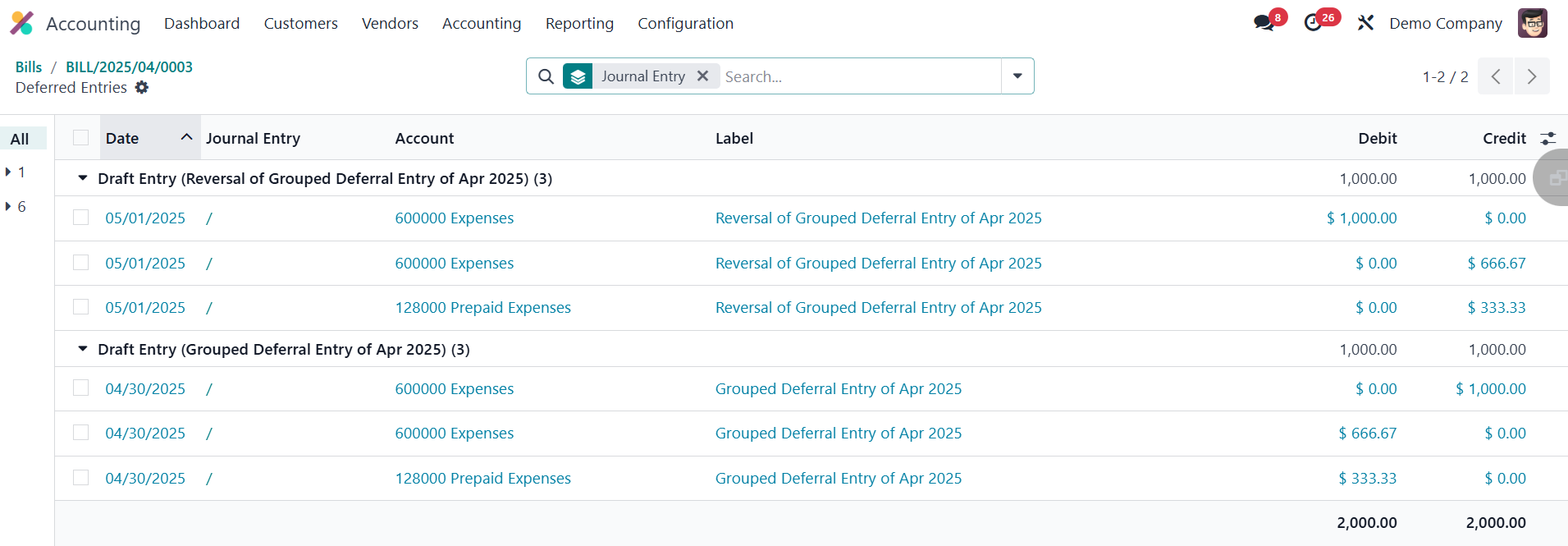

You can observe the

deferred entries using

the smart button

available in the

invoice. The first

entry is dated on the

last day of the month.

It aggregates all the

deferred amounts for

that month, thereby

recognizing a portion

of the expense that

corresponds to the

current accounting

period. This allows

the organization to

reflect the actual

consumption of the

prepaid expense over

time. The second entry

is a reversal of the

first, and it is dated

on the first day of

the following month.

Its purpose is to

cancel out the

previous month's

deferral entry,

resetting the balance

so that a new entry

for the next period

can be generated

accurately.