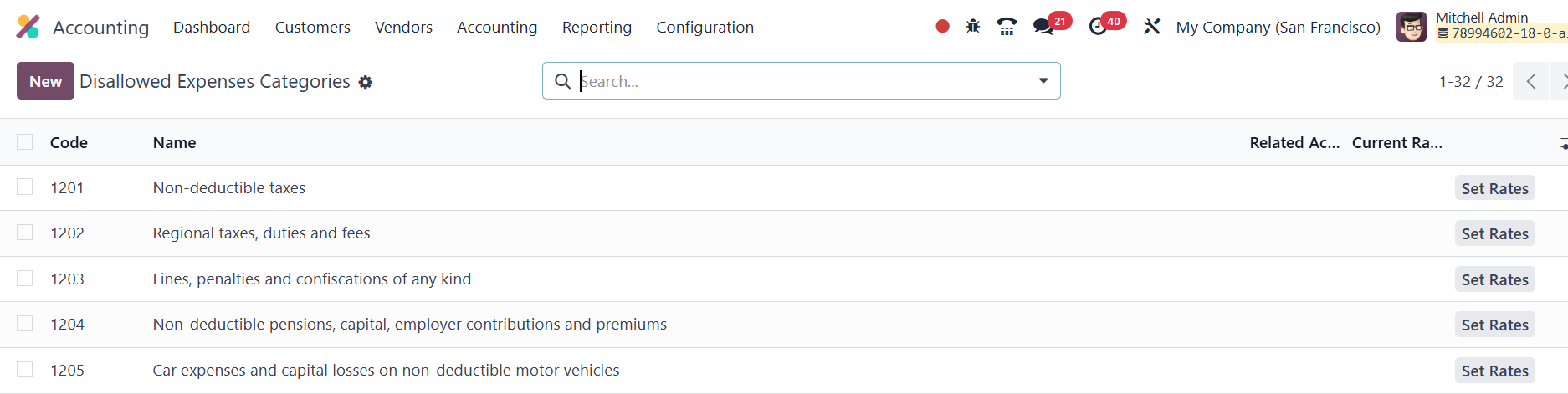

36. Disallowed Expenses

In accounting, disallowed expenses refer to those costs that cannot

be deducted from fiscal results but can be subtracted from the

bookkeeping records. Odoo 18’s Accounting module allows you to

effectively manage and report on these disallowed expenses through

the Disallowed Expenses Categories function. This feature is

accessible from the Configuration menu, allowing users to categorize

and manage these types of expenses.

Once you navigate to the Disallowed Expenses Categories option, you

can view any pre-configured categories. By clicking the New button,

you can create new categories, specifying the Name, Related Account,

and Current Rate for the expense. This helps define the types of

expenses that should be disallowed for tax purposes but still

tracked in the company’s accounting records.

The Set Rates button enables you to define the rates for each type of

disallowed expense.

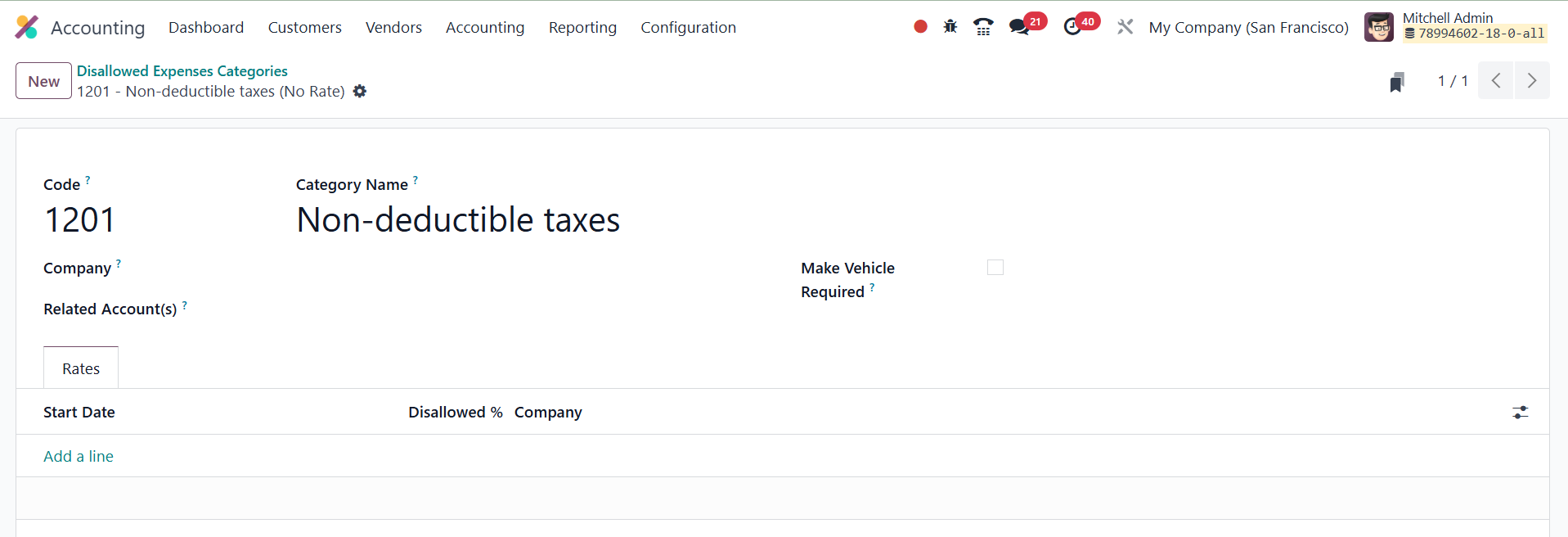

You can easily edit existing categories by clicking on them to access

the form view. Here, you can update information such as the Code,

Category Name, Company, and Related Account associated with the

category.

To apply disallowed expenses, particularly in the context of vendor

bills, you can link the Car Category form, specifying the relevant

start date, Disallowed %, and company. This ensures that any new

expense recorded with this account automatically calculates the

disallowed portion based on the rate defined in the category.

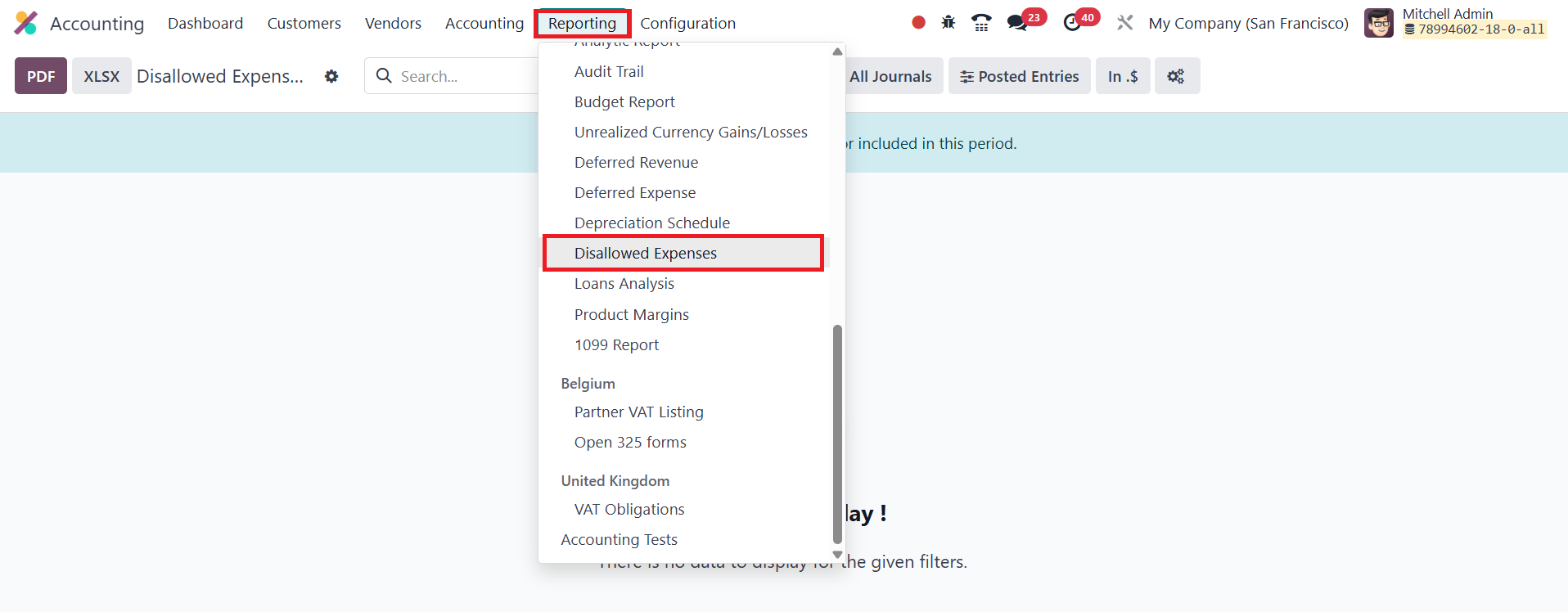

Once your disallowed expenses categories are set, you can generate

real-time financial reports through the Reporting option. The

reports can be easily exported to PDF or XLSX formats using the

corresponding buttons on the screen.

This functionality in Odoo 18 provides a streamlined way to manage

and report on disallowed expenses, offering full visibility and

compliance for your business's financial operations.