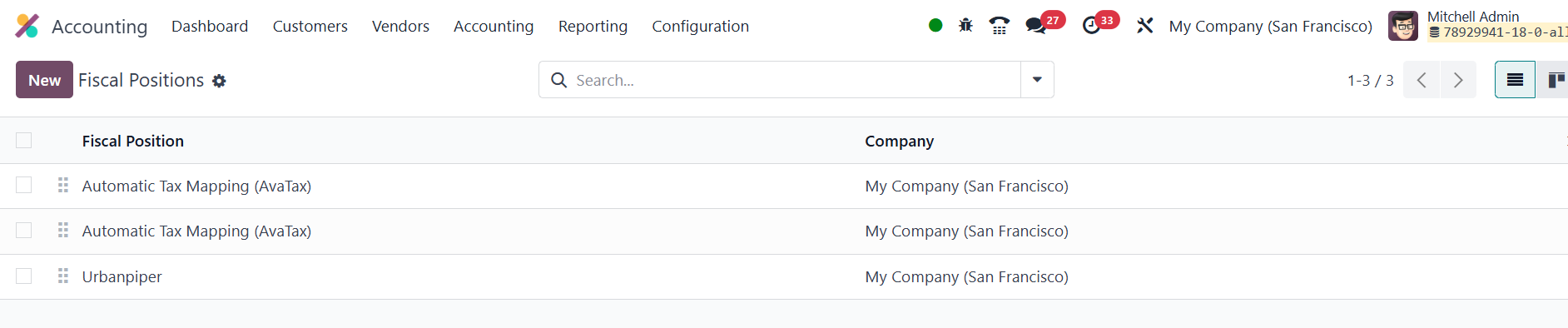

28. Fiscal Position

In Odoo 18 Accounting, fiscal positions let you adapt taxes and

accounts automatically whenever business is conducted in a

jurisdiction with rules that differ from your own. You configure

them from Accounting ▸ Configuration ▸ Fiscal Positions, where a

list of existing fiscal positions appears with their names and

associated companies.

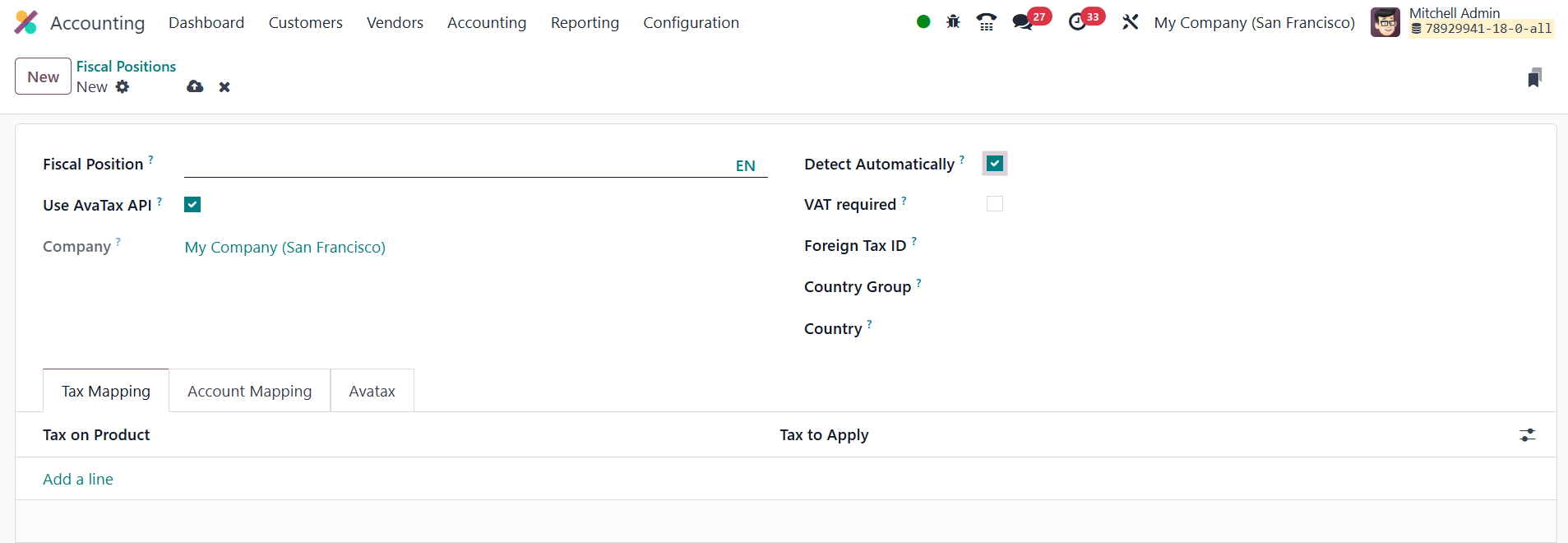

To create one, click New and assign a clear label.

Several automation options are available. Activating Detect

Automatically tells Odoo to apply the fiscal position whenever the

delivery address matches the chosen Country or Country Group; you

can additionally require that the partner have a VAT number by

ticking VAT Required. The Foreign Tax ID field stores your own tax

registration for that territory.

Under Tax Mapping, you define substitutions: specify the original tax

in Tax on Product and the replacement in Tax to Apply.

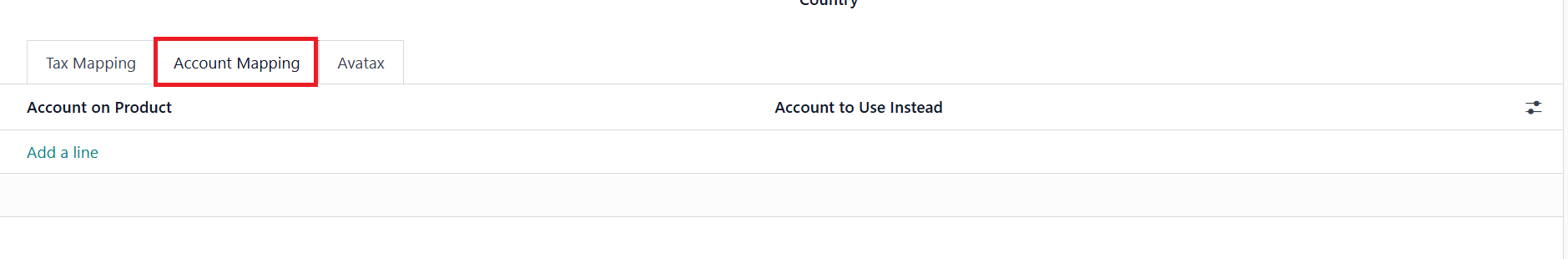

The Account Mapping tab works the same way for ledger accounts,

letting you switch to region‑specific accounts when needed.

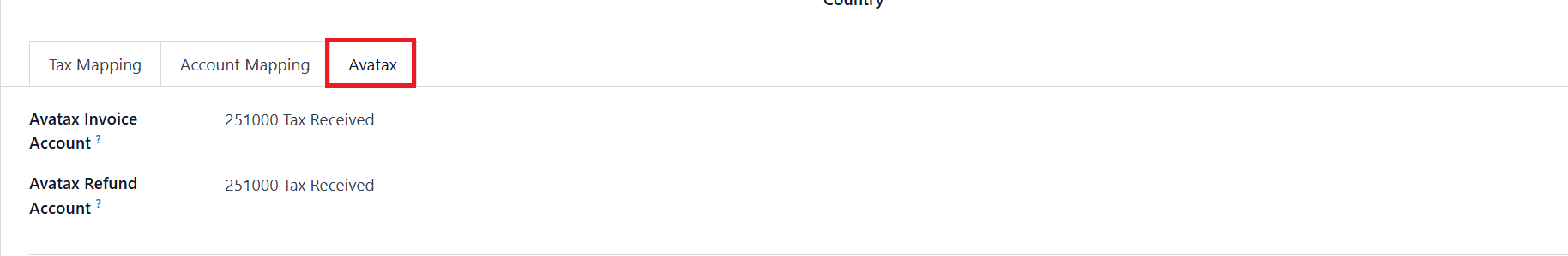

If you turn on Use AvaTax API, an AvaTax tab appears where you choose

an invoice account, a refund account, and any legal notes that must

be printed on documents generated under this fiscal position.

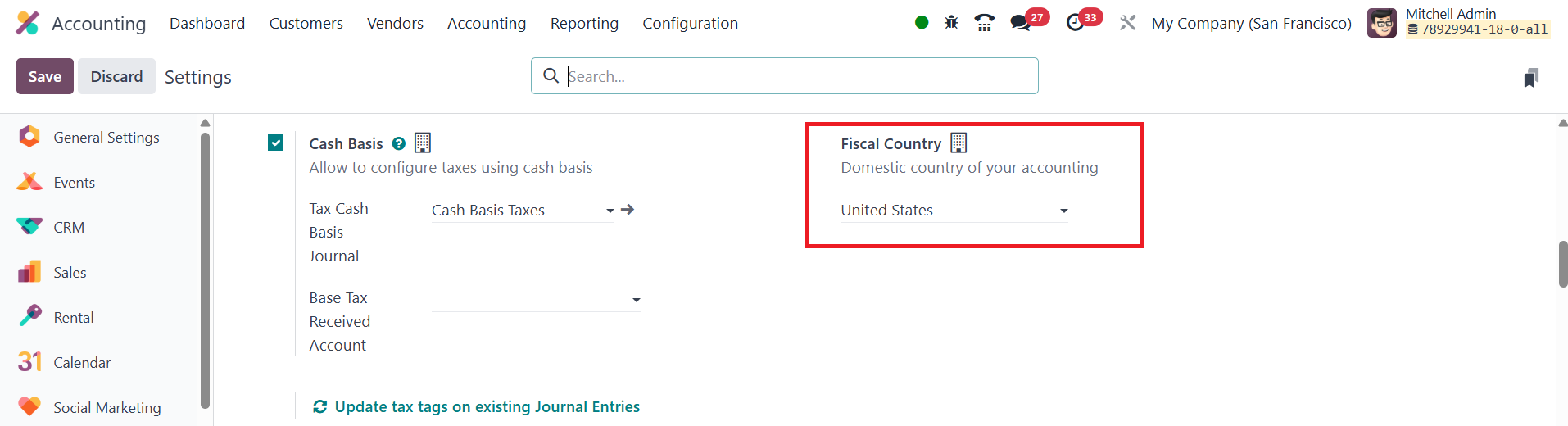

Global settings that influence fiscal positions are found in

Accounting ▸ Settings. In the Taxes section, set your home Fiscal

Country.

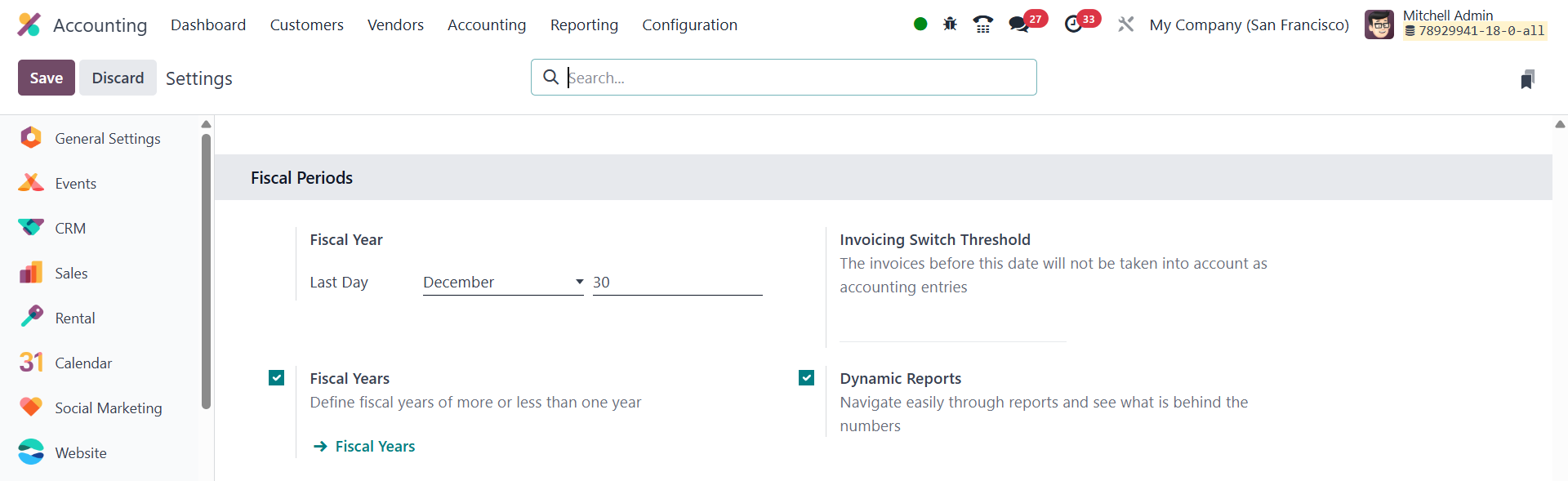

In the Fiscal Period section, specify the last day of your financial

year so Odoo can automatically open new periods; enable Fiscal Years

if you operate with periods longer or shorter than 12 months.

Finally, use Invoicing Switch Threshold to declare a date after

which draft invoices remain in the Invoicing and do not post to the

general ledger until they are validated.

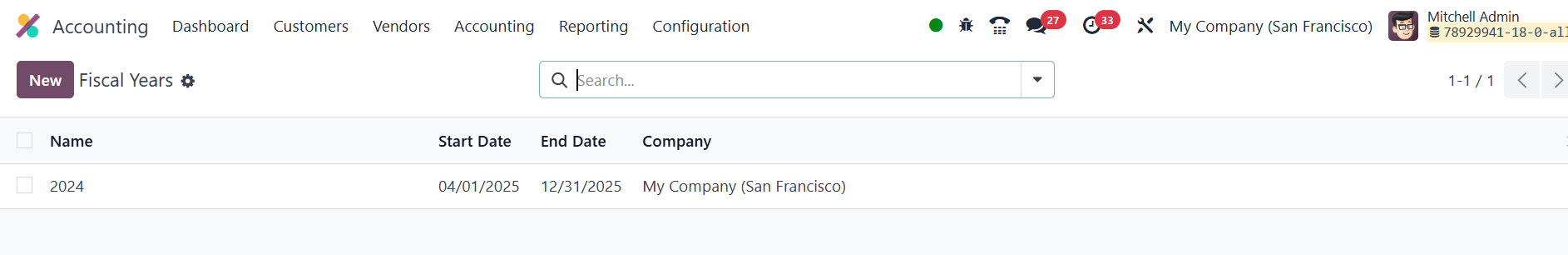

Once you activate the Fiscal Years from the Settings menu, you will

get an option to manage the Fiscal Years under the Configuration

menu.

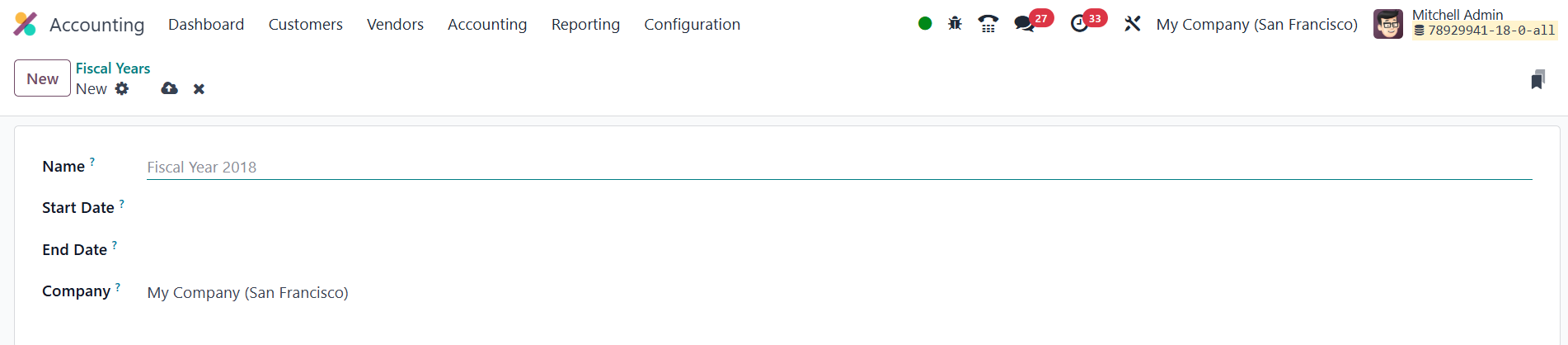

Clicking the New button will open a window to configure the details

of the new fiscal year.

You can mention the Name, Start Date, End Date, and Company of the

fiscal year in the given fields.