12. Journal Entries

In Odoo 18 Accounting, a Journal Entry represents the detailed

recording of a financial transaction within a selected journal. Each

entry captures key elements such as the accounting date, amounts to

be debited and credited, a reference note, and a description of the

transaction. Odoo follows the Double Entry Bookkeeping System,

meaning each journal entry must contain at least one debit line and

one corresponding credit line, and the total debits must always

equal total credits. The individual lines that comprise a journal

entry are referred to as Journal Items.

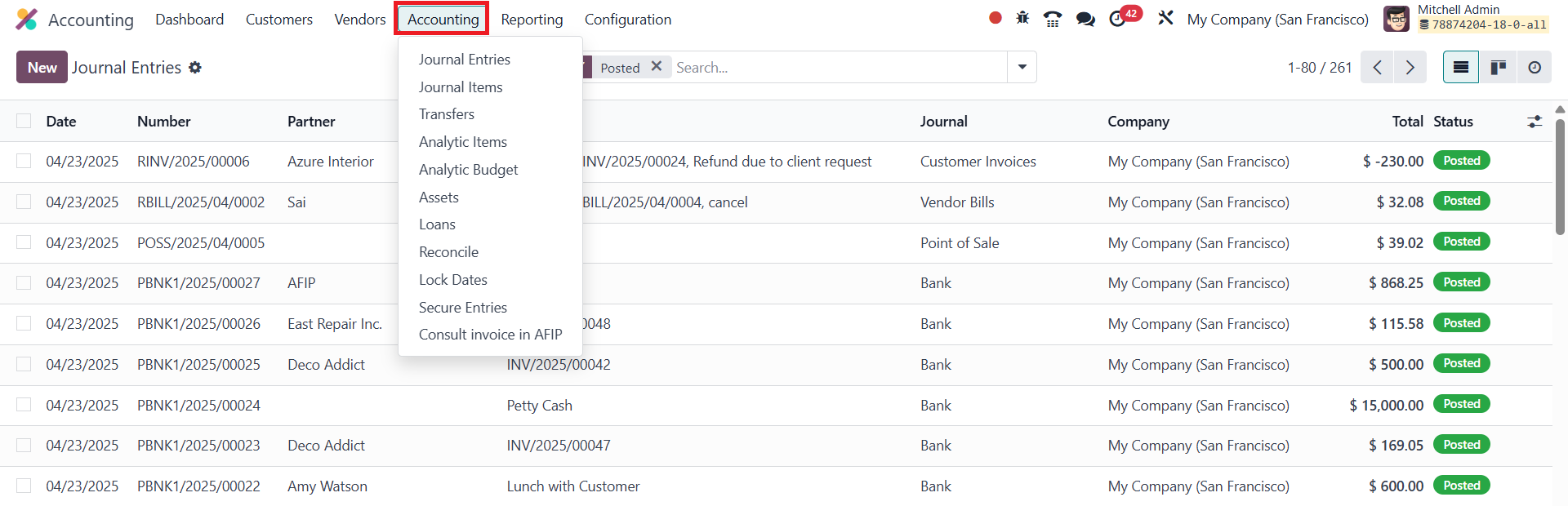

You can access and manage journal entries from the Accounting menu

under the Journal Entries section.

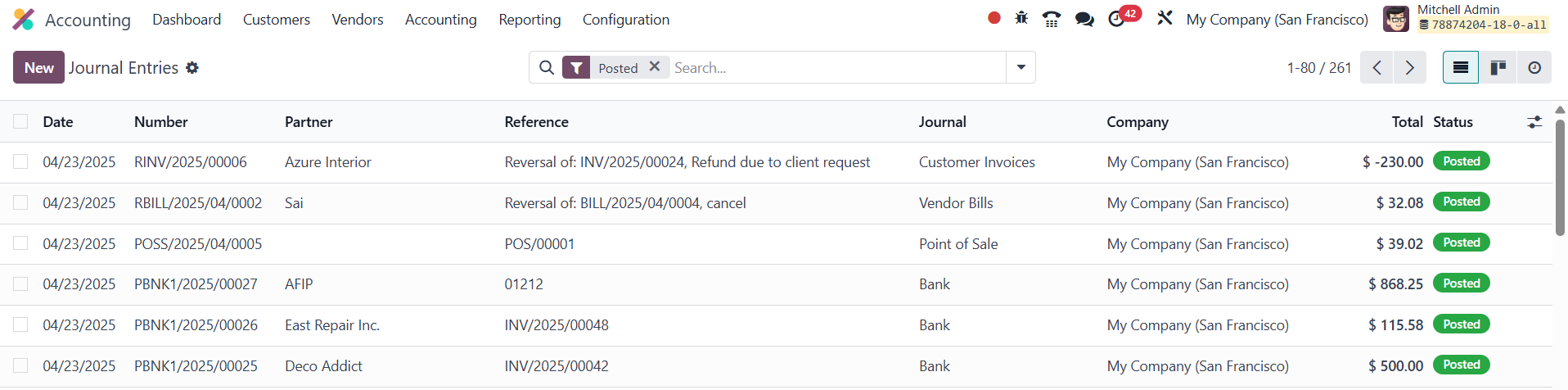

The list view presents essential information for each entry,

including the Date, Entry Number, Partner, Reference, Journal,

Company, Total Amount, and Status. To create a new entry, simply

click the New button and begin filling in the details.

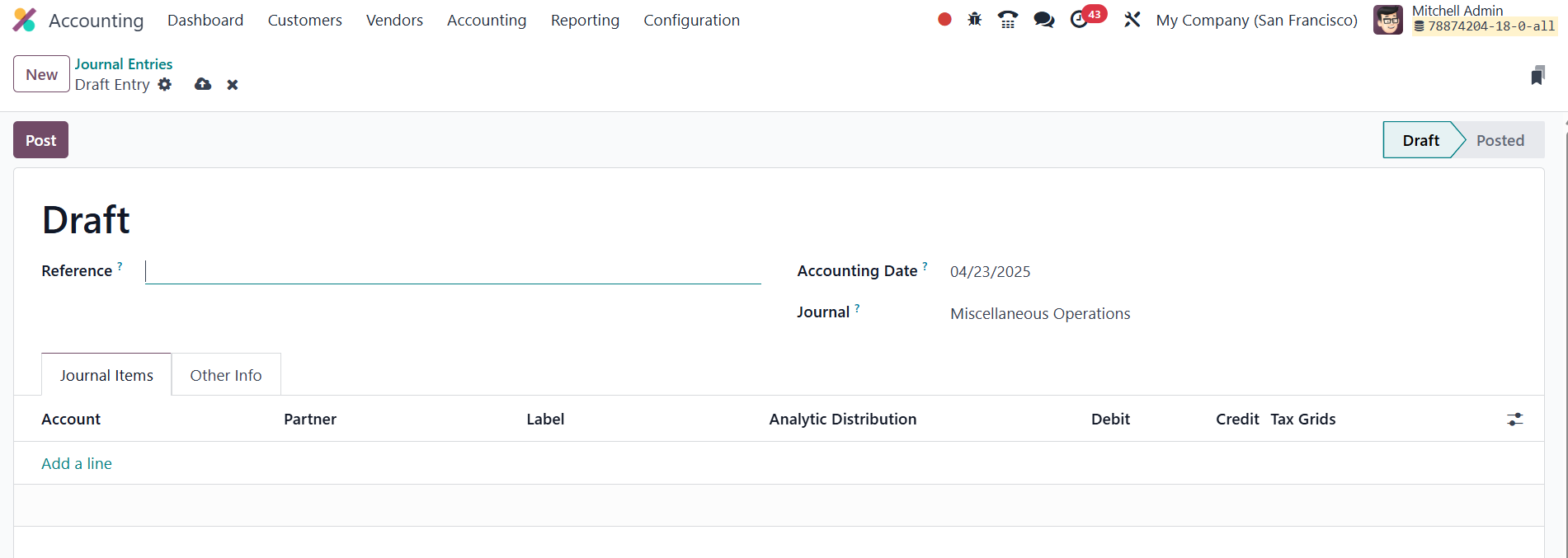

The Reference field allows you to cite source documents, and the

Accounting Date reflects when the transaction should be posted. You

must choose an appropriate journal and use the Add a Line button to

input journal item details like the Account, Partner, Label,

Analytic Distribution, Debit, Credit, and applicable TaxCloud

information.

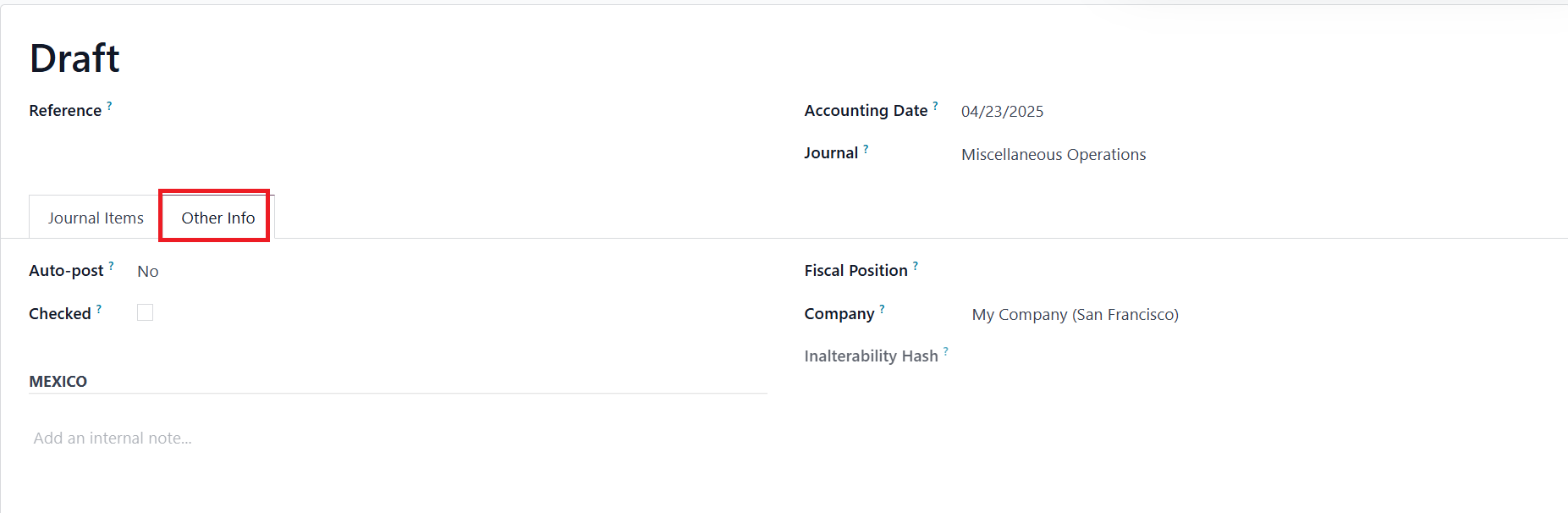

In the Other Information tab, the Auto-post option ensures the

journal entry is automatically posted on the selected accounting

date. You may also enable the Checked flag for entries requiring

verification. Mention the Fiscal Position and Company in the

corresponding fields. Once the data is finalized, clicking the Post

button will officially record the transaction.

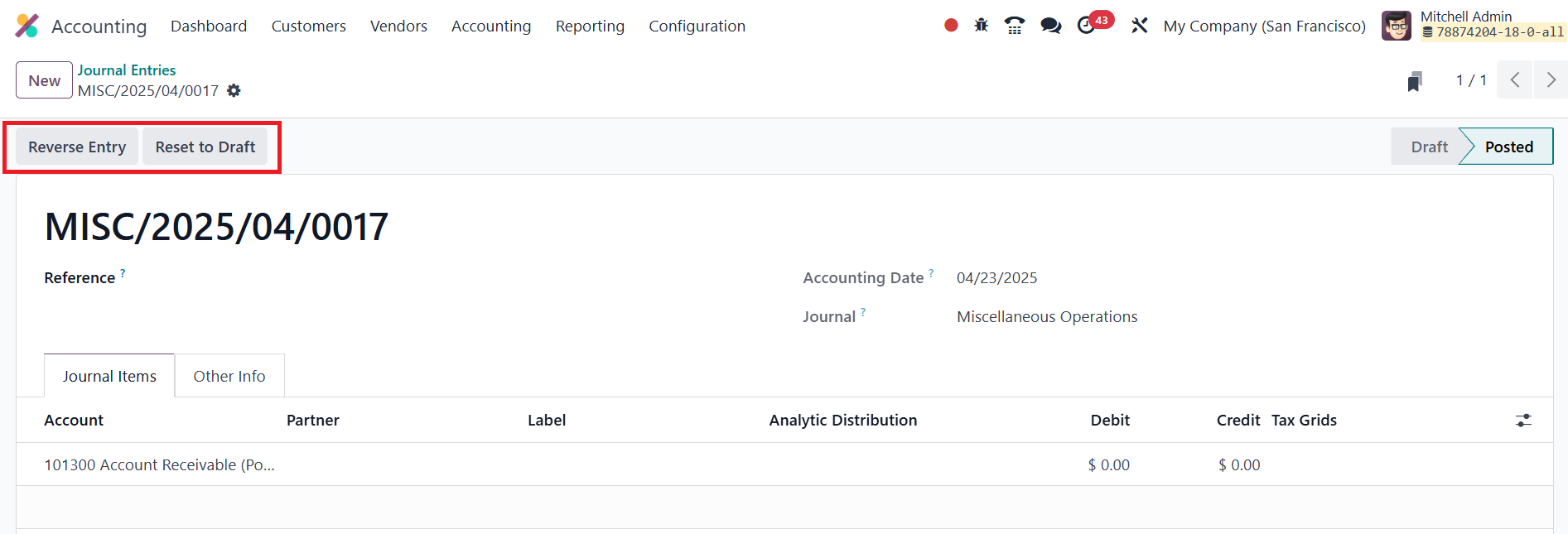

After posting, a Reverse Entry option becomes available, allowing you

to undo the entry if needed.

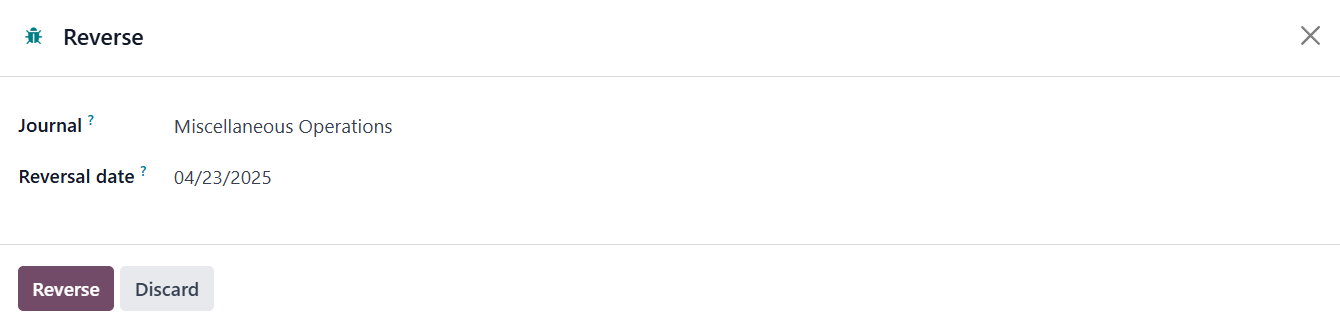

You can choose the Reversal Date (either the same as the journal

entry date or a specific date) and designate a Journal for the

reversal. The reversal is completed upon clicking the Reverse

button, ensuring accurate and flexible accounting adjustments when

necessary.

12.1 Journal Items

In Odoo 18 Accounting, the Journal Items section provides a

comprehensive platform to review every line item recorded within

your various journal entries. Each journal item represents a single

debit or credit entry, and together, they constitute the full

accounting movement in accordance with the double-entry system.

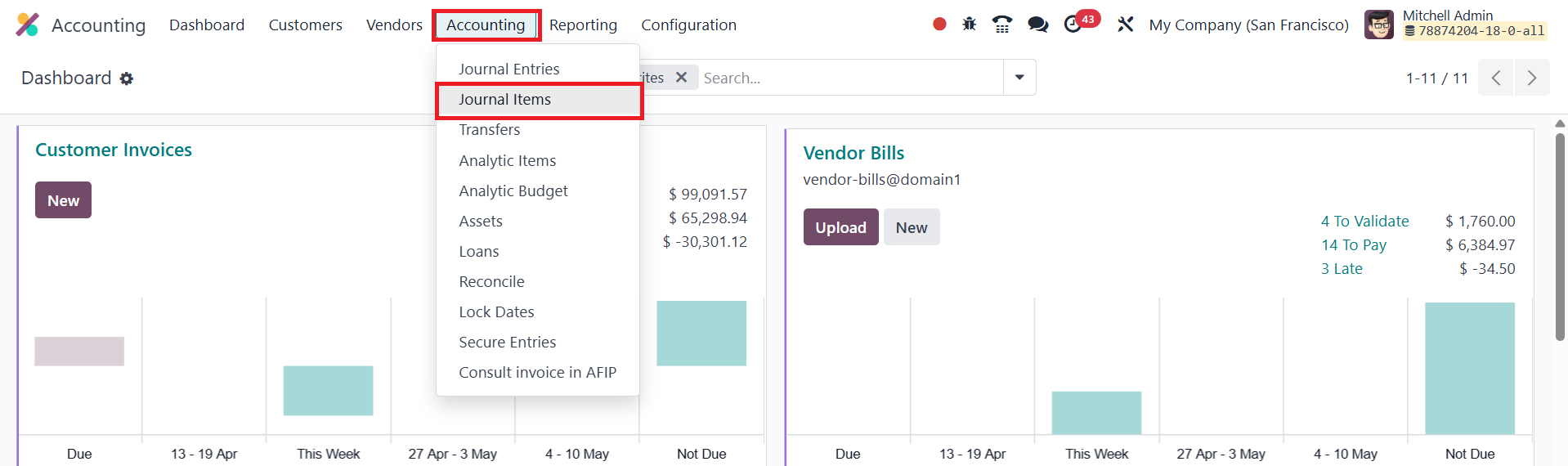

You can access this feature by navigating to the Accounting menu and

selecting the Journal Items option.

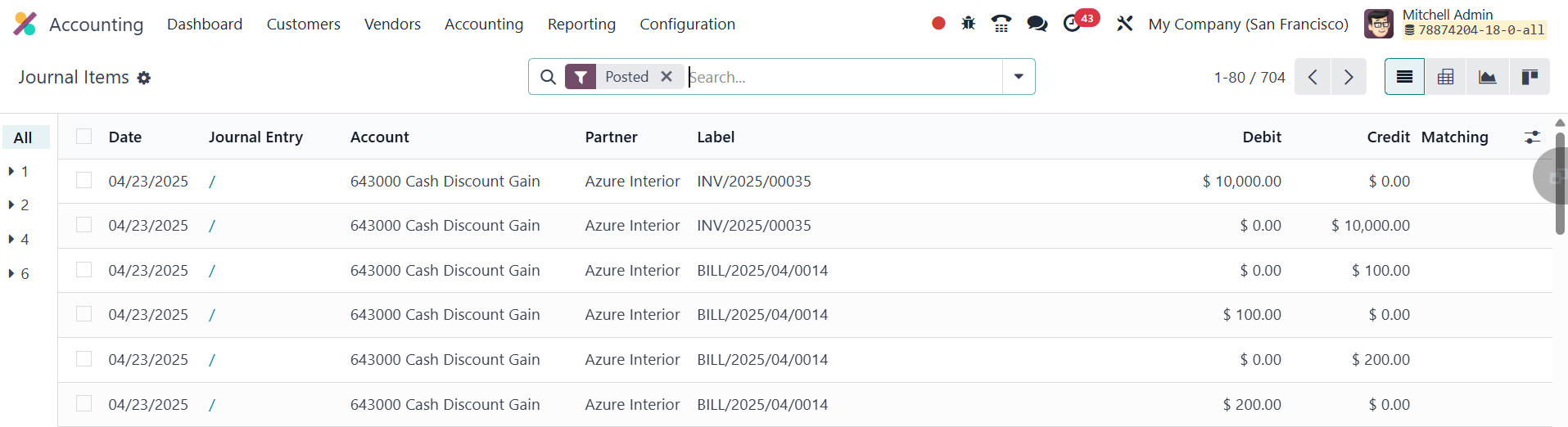

The list view presents detailed information such as the Date, Journal

Entry name or number, Account involved, Partner (if any), Label,

Debit, Credit, and Matching Number.

This organized view makes it easy to monitor, audit, or filter

transactions across different accounts and periods.