11. Journals

In Odoo 18 Accounting, accurately recording every financial

transaction is vital for maintaining transparency, ensuring

compliance, and generating reliable reports. This is done through

the use of accounting journals, which are structured logs of

transactions categorized and recorded by date. These journals serve

as the foundational elements of the double-entry accounting system

and help businesses monitor cash flow, revenue, expenses, and other

financial activities. In Odoo 18, you can create and configure

various types of journals including Sales Journal, Purchase Journal,

Bank Journal, Cash Journal, and Miscellaneous Journal, each catering

to specific types of business transactions such as customer

invoices, vendor bills, bank reconciliations, and ad hoc entries.

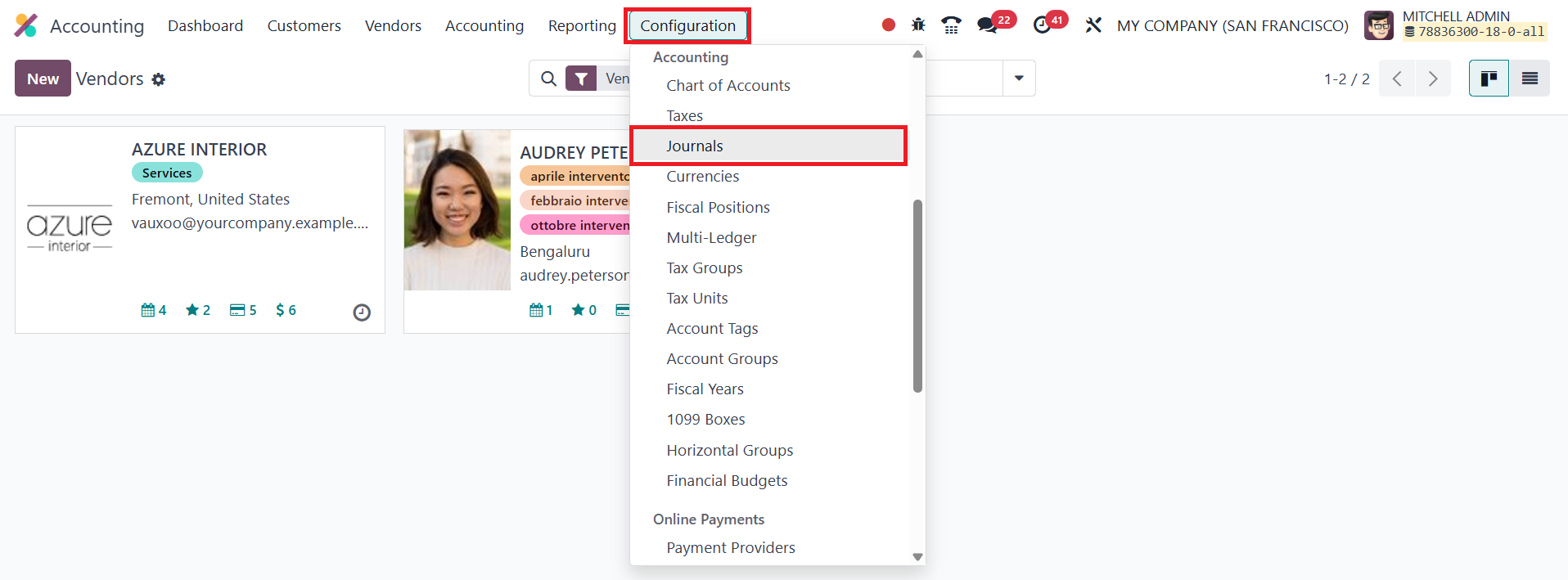

To access and manage journals in Odoo 18, navigate to the

Configuration menu within the Accounting module and select the

Journals option.

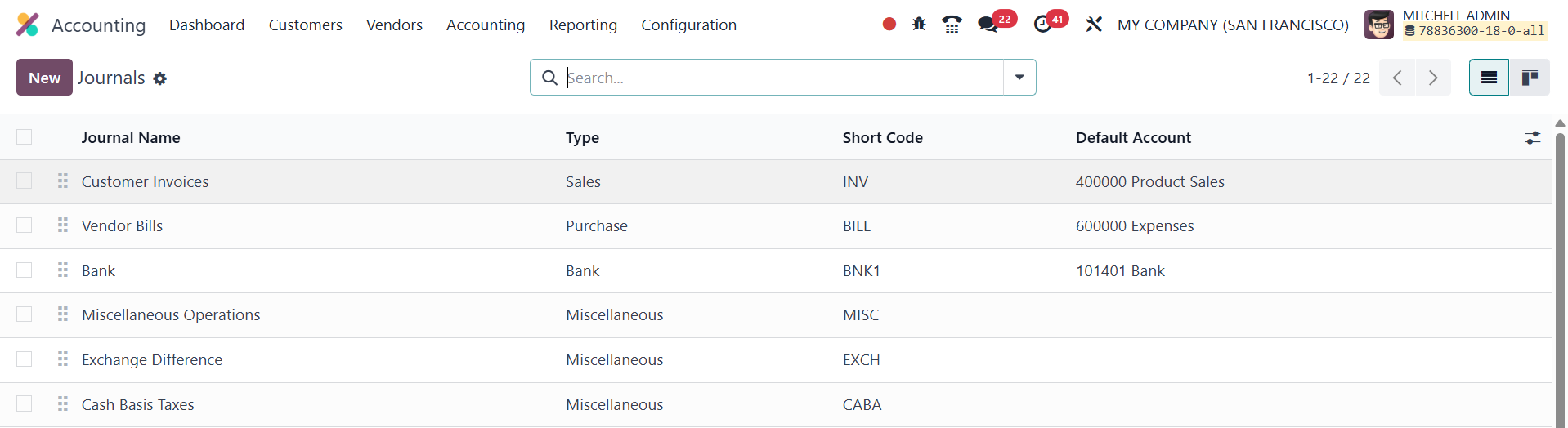

This section presents a comprehensive overview of all the journals

that have been configured in the system.

The list view includes key details such as Journal Name, Type (Sales,

Purchase, etc.), Short Code, and the Default Account associated with

each journal. To create a new journal, click the New button.

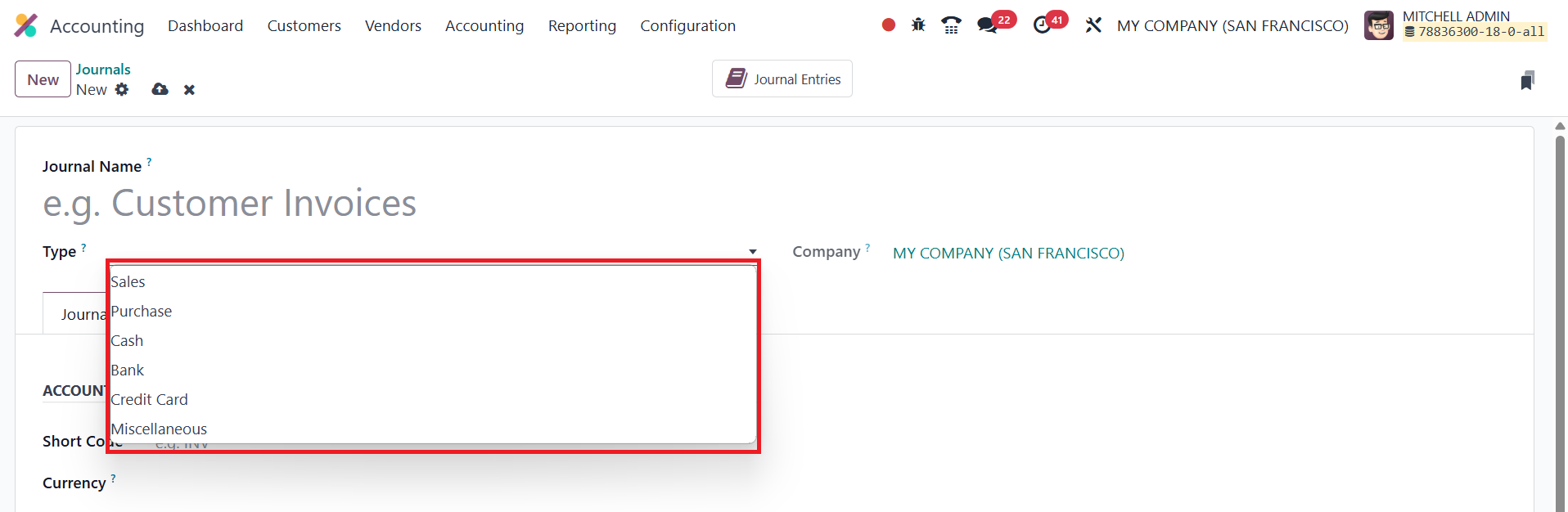

This opens a configuration form where you begin by entering a Journal

Name; for example, “Online Sales” or “Local Purchases.” The Company

field will automatically populate with your current company,

ensuring that the journal is correctly assigned within a

multi-company environment if applicable. The next critical step is

to define the Journal Type, which determines the behavior and

purpose of the journal. In Odoo 18, the available journal types are:

- Sales Journal: Used to record customer invoices and

revenue.

- Purchase Journal: Used for entering vendor bills and

tracking company expenses.

- Cash Journal: Designed for managing cash transactions

such as petty cash expenses or cash payments.

- Bank Journal: Used for bank-related entries including

deposits, withdrawals, and bank statement reconciliations.

- Credit Card Journal: Used to manage and record

transactions made via company credit cards, helping businesses

maintain better oversight of credit-based expenditures.

- Miscellaneous Journal: Reserved for entries that don’t

fit into the above categories, such as adjustments,

depreciation, or opening balances.

The journal type you choose influences the subsequent configuration

options.

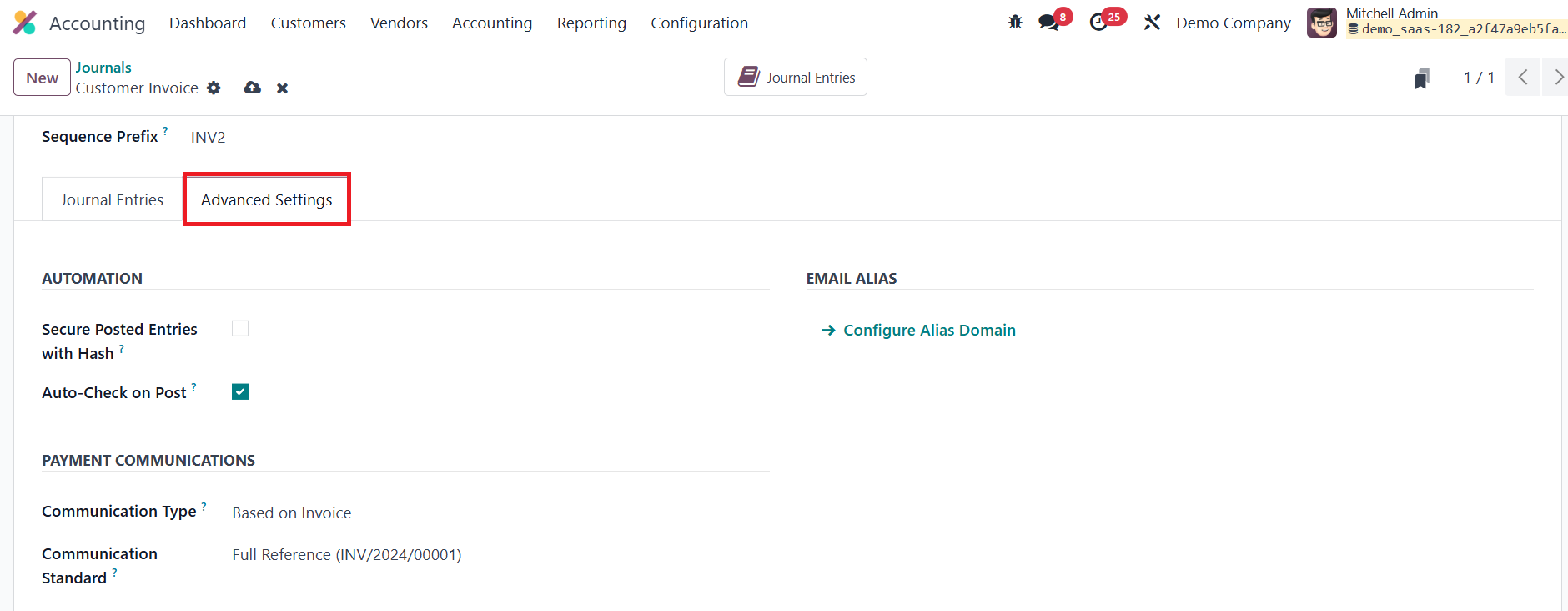

11.1 Sales

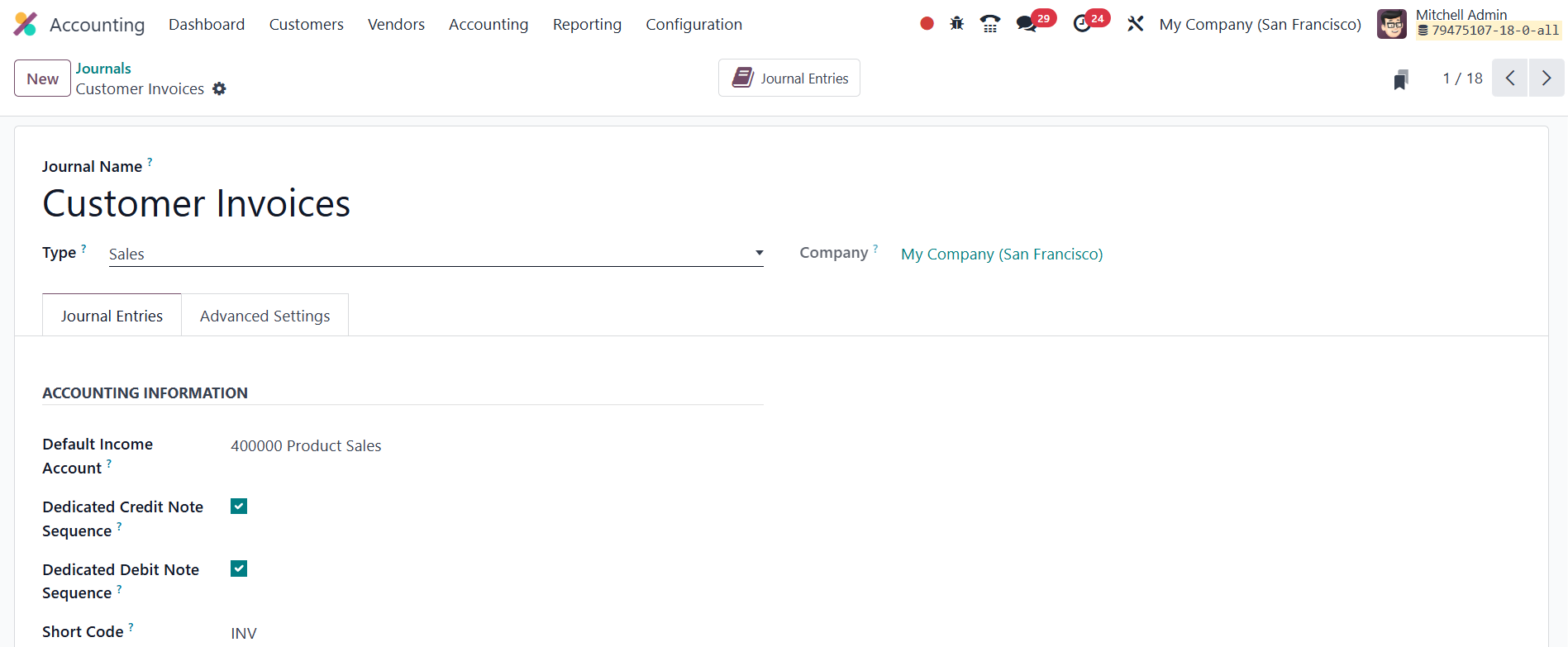

In Odoo 18 Accounting, configuring a Sales Journal allows you to

accurately record entries for customer invoices. When creating a

journal, selecting the Sales journal type opens up specific fields

under both the Journal Entries and Advanced Settings tabs, enabling

precise control and customization.

Within the Journal Entries tab, you can assign a Default Income

Account which will be used for transactions recorded in this

journal. If you prefer to maintain separate sequences for invoices

and credit notes, you can enable the Dedicated Credit Note Sequence

option. This ensures that credit notes issued under this journal

follow a unique numbering pattern, making tracking easier.

Similarly, if you prefer to maintain separate sequences for invoices

and debit notes, you can enable the Dedicated Debit Note Sequence

option. The shorter name used to display can be specified in the

Short Code field.

Moving to the Advanced Settings tab, you have the option to restrict

journal usage by specifying Allowed Accounts. If this field is left

blank, all accounts will be accessible. Enabling Secure Posted

Entries with Hash ensures that once a journal entry is posted, it

receives a secure hash and becomes immutable, promoting data

integrity and compliance with auditing standards.

In the Communication Type section, you can define how the reference

communication appears on the customer’s invoice. This helps

customers identify which invoice they’re paying for. Options include

Based on Invoice, or Based on Customer. Furthermore, under

Communication Standard, you can select reference models, with Odoo’s

internal reference being the default. If you wish to automate

invoice creation via emails, you can specify the Email Servers for

integration.

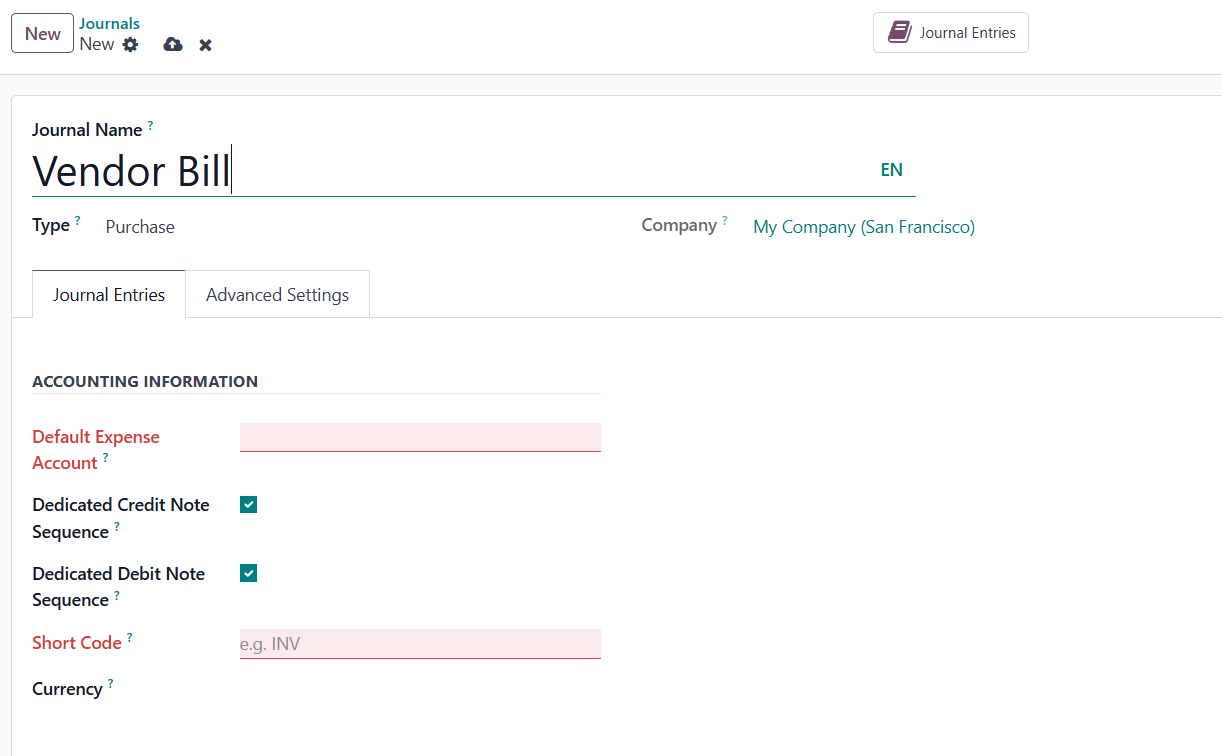

11.2 Purchase

In Odoo 18 Accounting, you can create a Purchase Journal to

efficiently manage and track entries related to vendor bills and

company expenses. To do this, select Purchase as the Journal Type

when configuring a new journal. Much like the Sales Journal, the

Journal Entries and Advanced Settings tabs become available for

customization, although the default configurations are tailored for

purchase-related transactions.

Within the Journal Entries tab, the key field to configure is the

Default Expense Account. This account will automatically be used for

expense entries recorded through this journal, ensuring that costs

are accurately categorized and consistently documented in your

financial records.

You can also assign a Short Code to easily identify this journal in

accounting operations. Additionally, you may set a specific Currency

for the journal, which is especially useful if you handle purchases

in multiple currencies.

In the Advanced Settings tab, you have the option to restrict access

by listing the Allowed Accounts. If you leave this field blank, the

journal will allow posting to all accounts. Enabling the Secure

Posted Entries with Hash option helps maintain the integrity of

posted records by making them immutable once finalized, which is

crucial for compliance and auditing purposes.

These settings ensure that the Purchase Journal in Odoo 18 is

equipped to handle vendor bill processing efficiently while

maintaining accuracy, control, and compliance in your accounting

system.

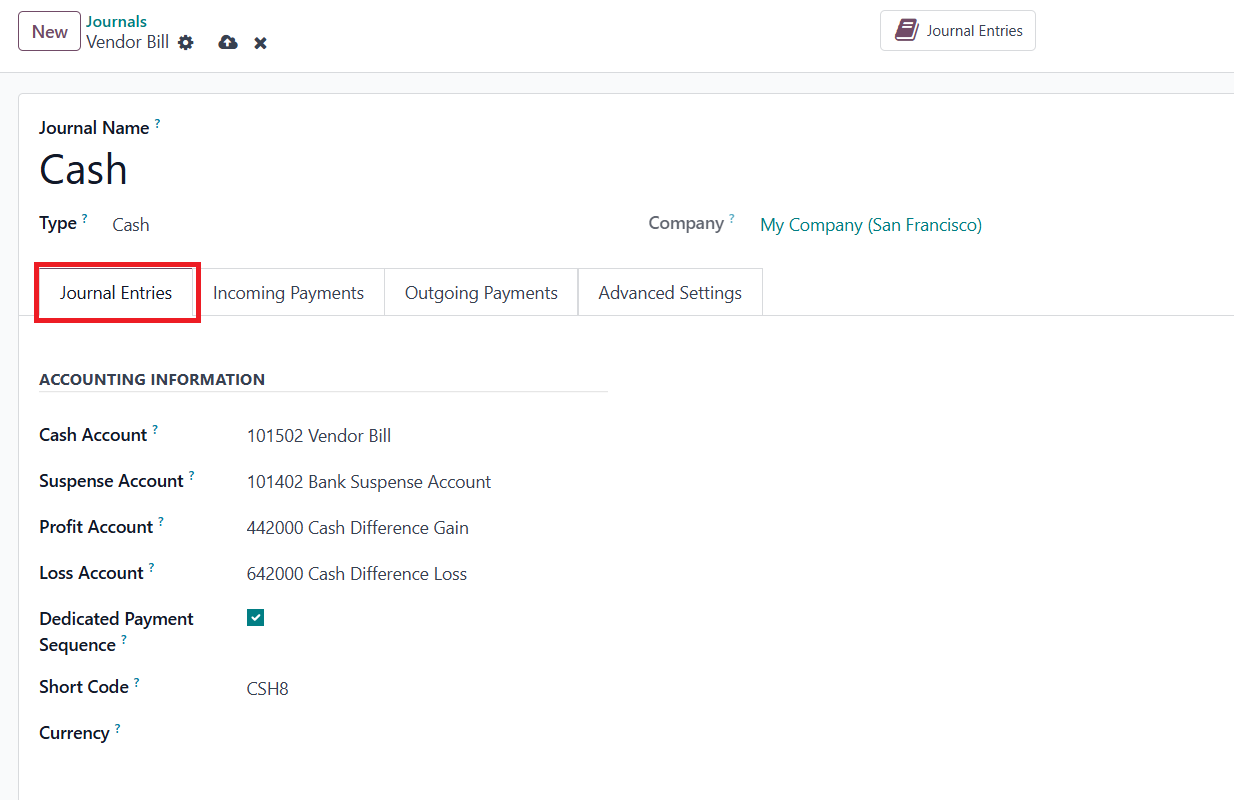

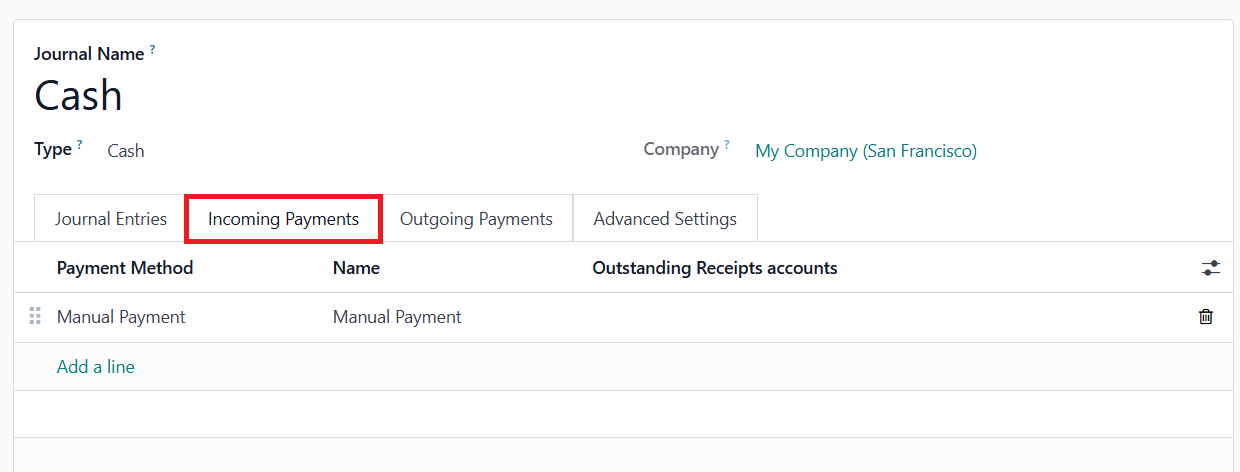

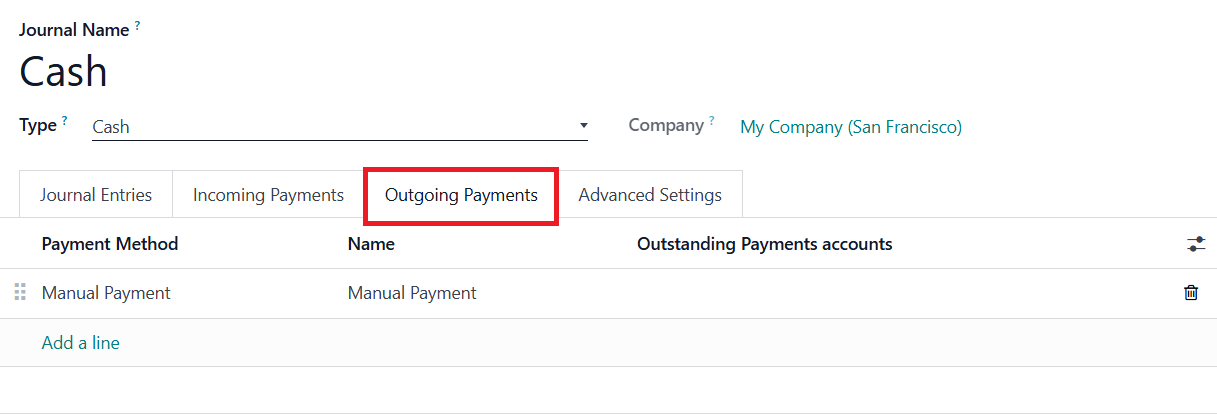

11.3 Cash

In Odoo 18 Accounting, the Cash Journal is designed to handle

accounting entries related to manual cash transactions, such as

petty cash expenses or cash collections. When configuring a Cash

Journal, you will find several dedicated tabs that allow for

detailed customization of journal behavior.

Under the Journal Entries tab, you can assign a specific Cash Account

that will be used to track all cash-related transactions.

Additionally, a Suspense Account can be configured. This account

temporarily holds amounts from cash transactions or bank statements

until proper reconciliation is completed. If there's a discrepancy

between the expected and actual cash register balances, the system

will automatically post the difference to the Profit Account or Loss

Account, as appropriate. To maintain a clear audit trail, you can

enable the Dedicated Payment Sequence feature, which ensures that

payments and cash transactions recorded through this journal follow

a distinct numbering sequence.

The Incoming Payments tab allows you to define the names and methods

for receiving cash payments, while the Outgoing Payments tab lets

you specify the methods used for recording outgoing cash flows.

These customizable options help streamline the management of both

incoming and outgoing cash transactions. Finally, the Advanced

Settings tab provides an option to restrict access by specifying

Allowed Accounts. If no accounts are defined here, the system will

permit entries to all accounts.

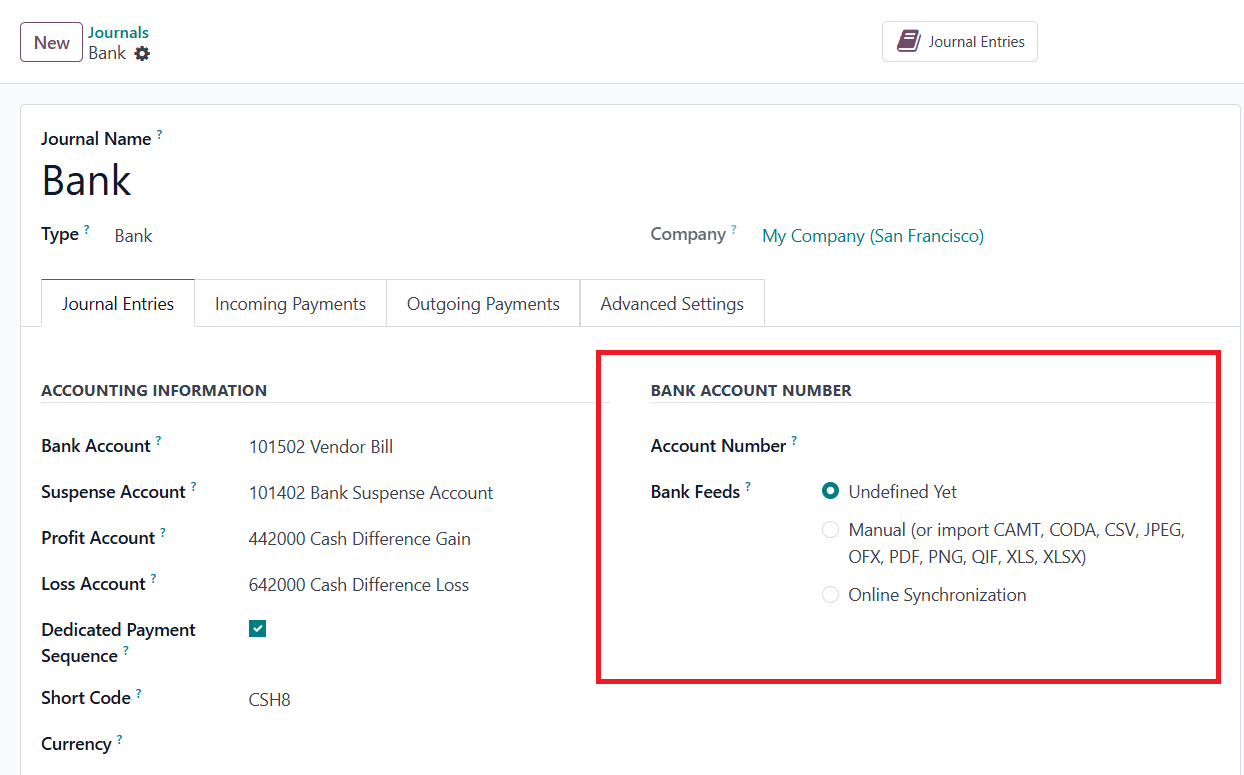

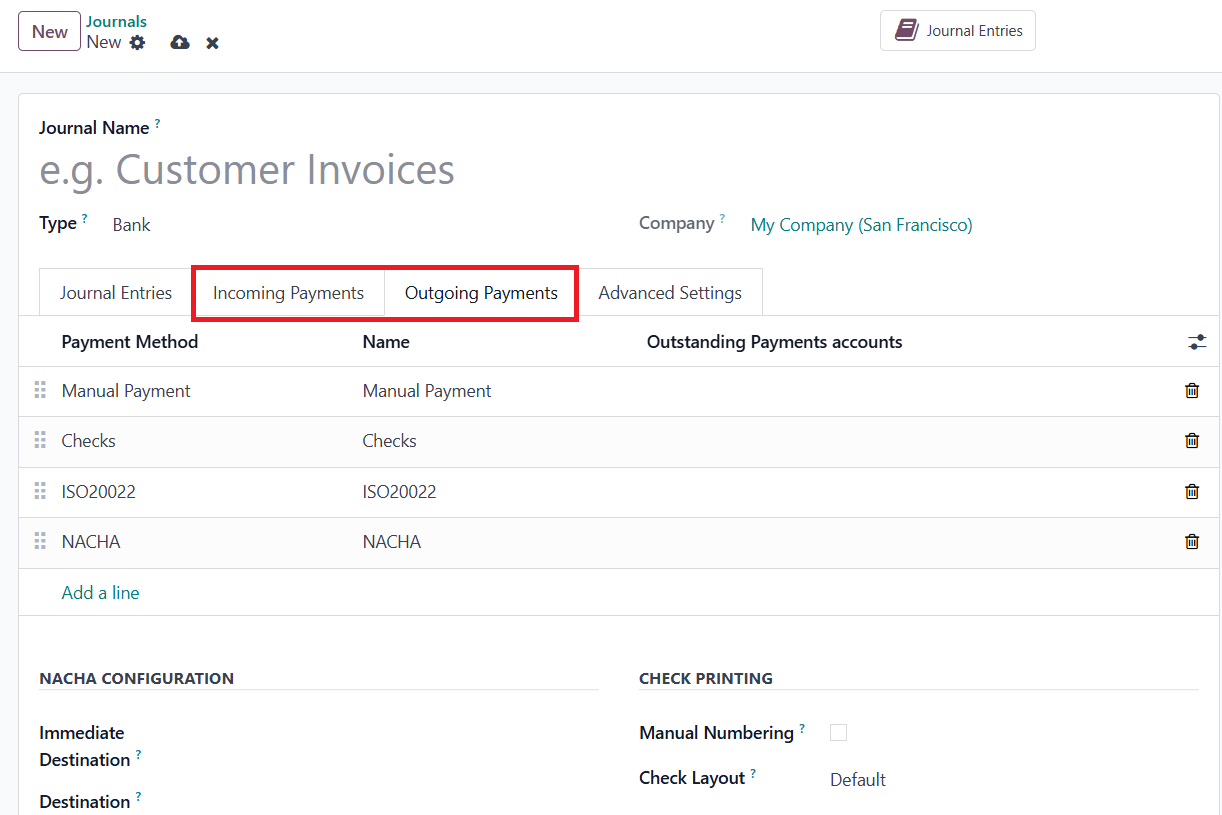

11.4 Bank

In Odoo 18 Accounting, the Bank Journal is utilized for managing and

recording all bank-related transactions, such as deposits,

withdrawals, and statement reconciliations. To configure this

journal, you should select Bank as the Journal Type during creation.

You will be prompted to input details such as the Account Number and

the linked Bank Account. These fields ensure that your bank

transactions are accurately associated with the correct financial

accounts. In the Bank Feeds section, you can decide how bank

statements are to be handled. Odoo offers flexible options such as

manual import of bank statements or automated synchronization with

your bank via supported integrations. If you're not ready to define

this setting during setup, you can select Undefined Yet as a

placeholder.

Odoo 18 also provides dedicated tabs for configuring both Incoming

Payments and Outgoing Payments, allowing you to specify the payment

methods used for each. Based on the methods you select, such as

SEPA, check, or manual, you will be presented with additional

configuration options relevant to that method, ensuring seamless

processing of bank payments and receipts.

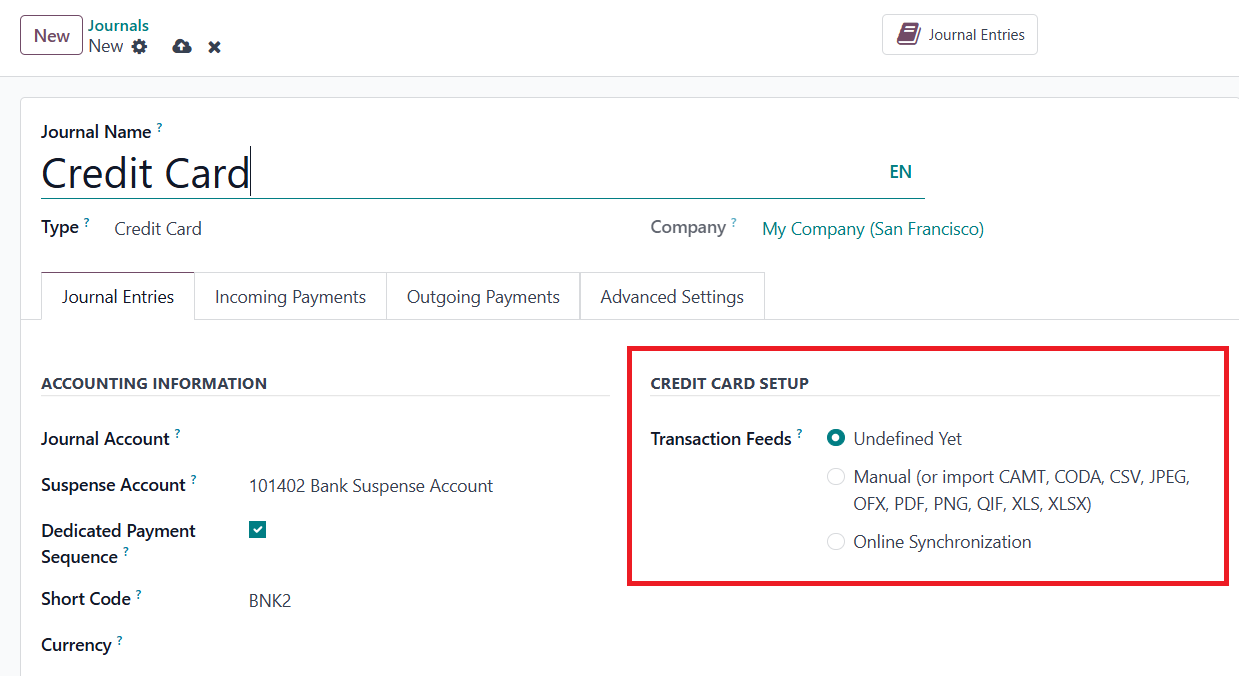

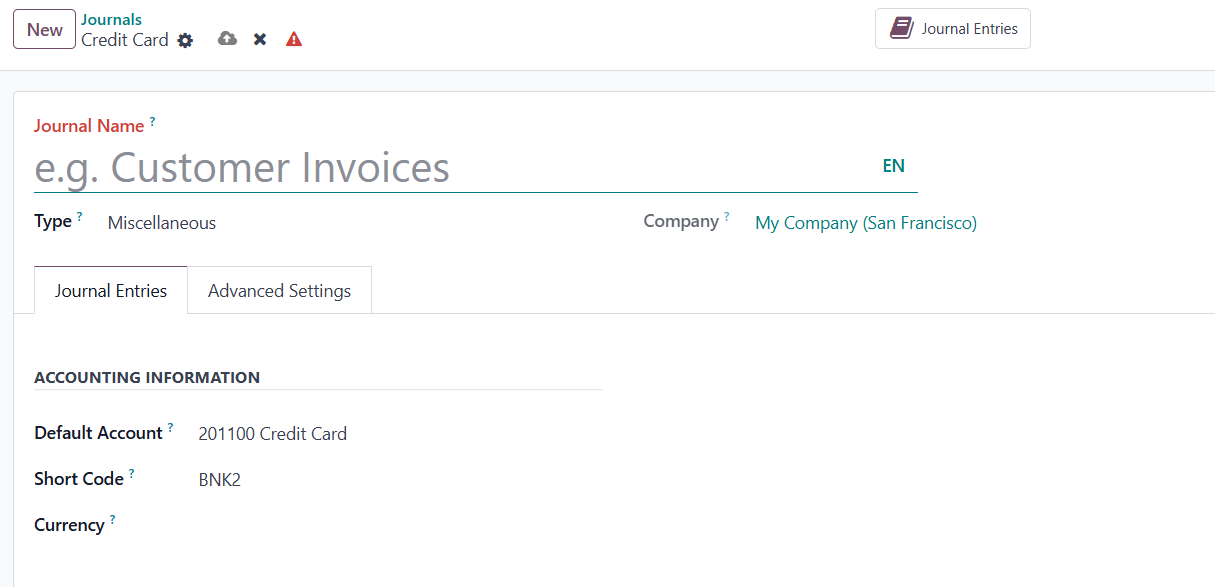

11. 5 Credit Card

In Odoo 18 Accounting, a new Credit Card journal type has been

introduced to manage business-related credit card transactions

efficiently. When setting up a Credit Card journal, you can

designate it as the Journal Type: Credit Card, which will tailor the

journal's configuration fields accordingly.

One of the notable additions in this setup is the Credit Card Setup

section, where you decide how transaction feeds are managed. Under

the Transaction Feeds field, you can choose from various options:

Undefined Yet, Manual (or import), which supports multiple file

formats like CAMT, CODA, CSV, JPEG, OFX, PDF, PNG, QIF, XLS, and

XLSX, or Online Synchronization for automatic fetching of credit

card transactions from your financial institution.

11.6 Miscellaneous

In Odoo 18 Accounting, the Miscellaneous Journal is designed to

accommodate all accounting entries that do not fit neatly into

predefined categories such as sales, purchases, bank, cash, or

credit card transactions. This journal is typically used for

adjustments, opening balances, depreciation entries, and other ad

hoc financial operations.

When configuring a Miscellaneous Journal, you can specify the

necessary accounting and advanced settings just like in other

journal types. Once the journal is created and saved, Odoo will

automatically store it in the system. You can view all the entries

recorded in this journal by clicking the Journal Entries smart

button, which provides a comprehensive list of all the transactions

associated with it. This ensures transparency and facilitates

accurate financial reporting for non-standard accounting activities.