17. Loans

In Odoo 18 Accounting, the new Loan Management feature lets you link

long‑term debts; such as mortgages, equipment loans, or vehicle

financing, directly to the related fixed assets and monitor them

through every stage of repayment.

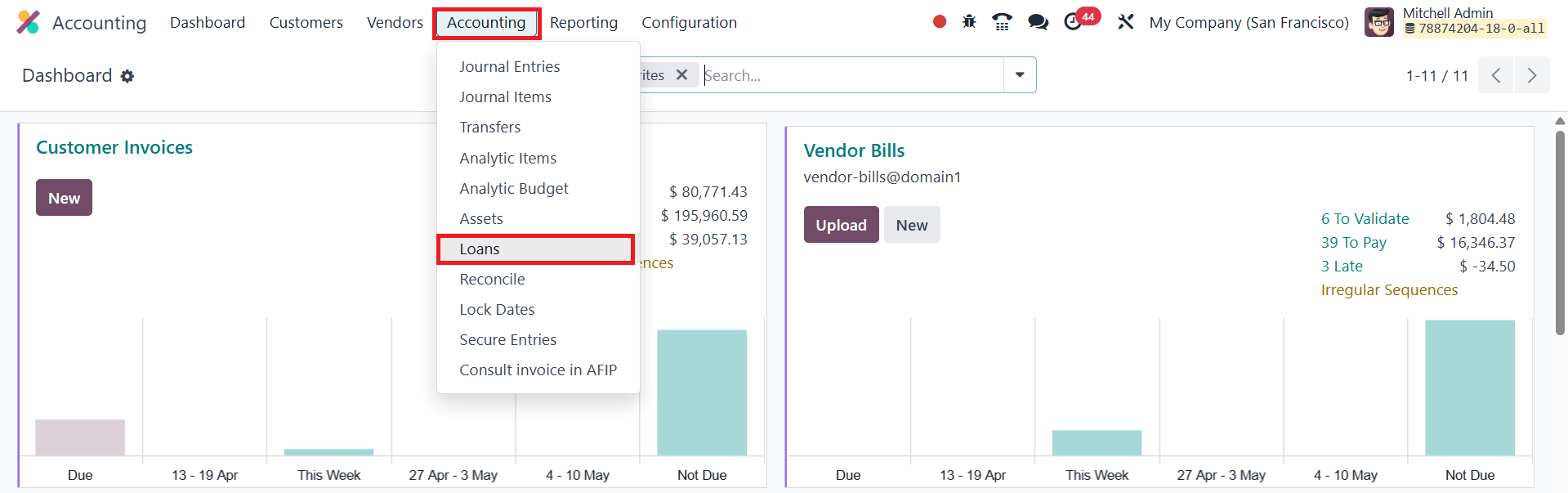

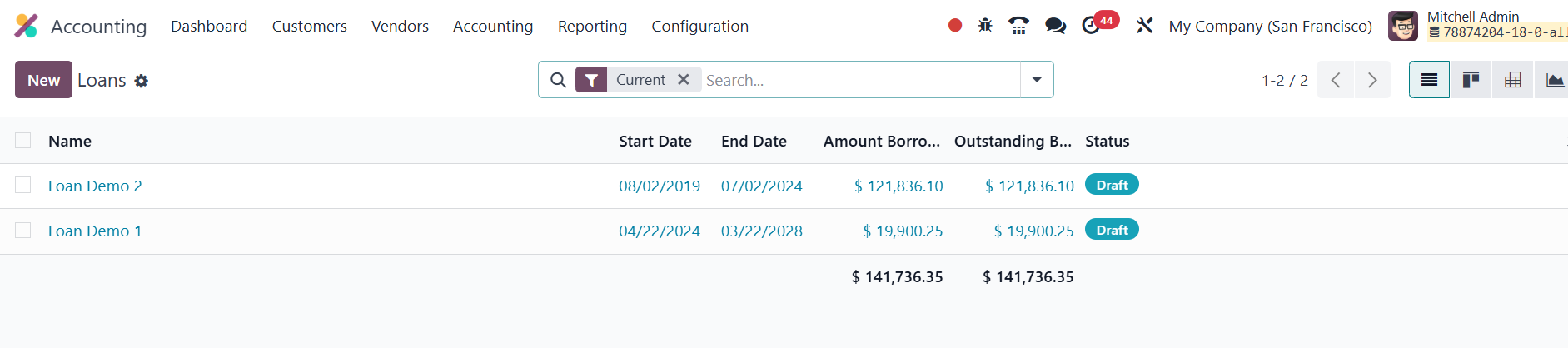

Accessed from Accounting › Loans, the loan dashboard lists each

agreement with its name, start and end dates, amount borrowed,

outstanding balance, and current status.

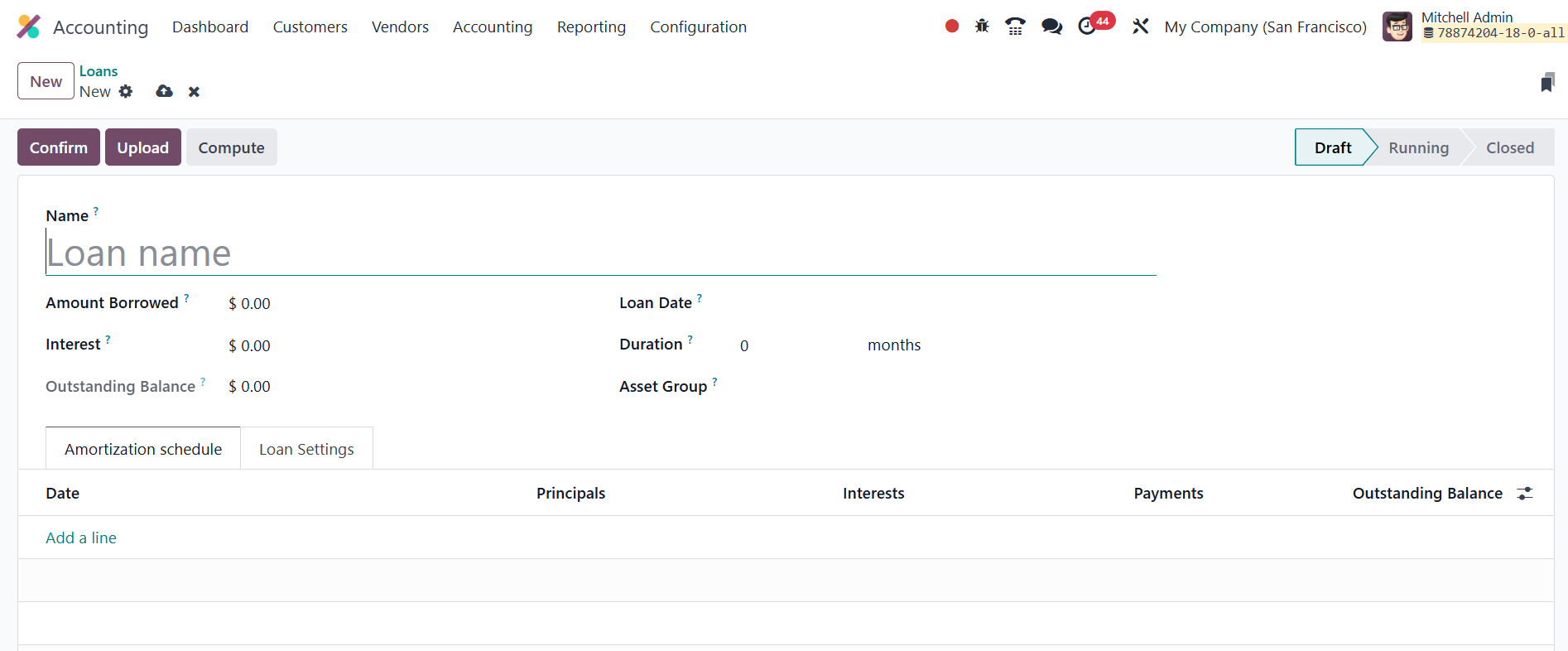

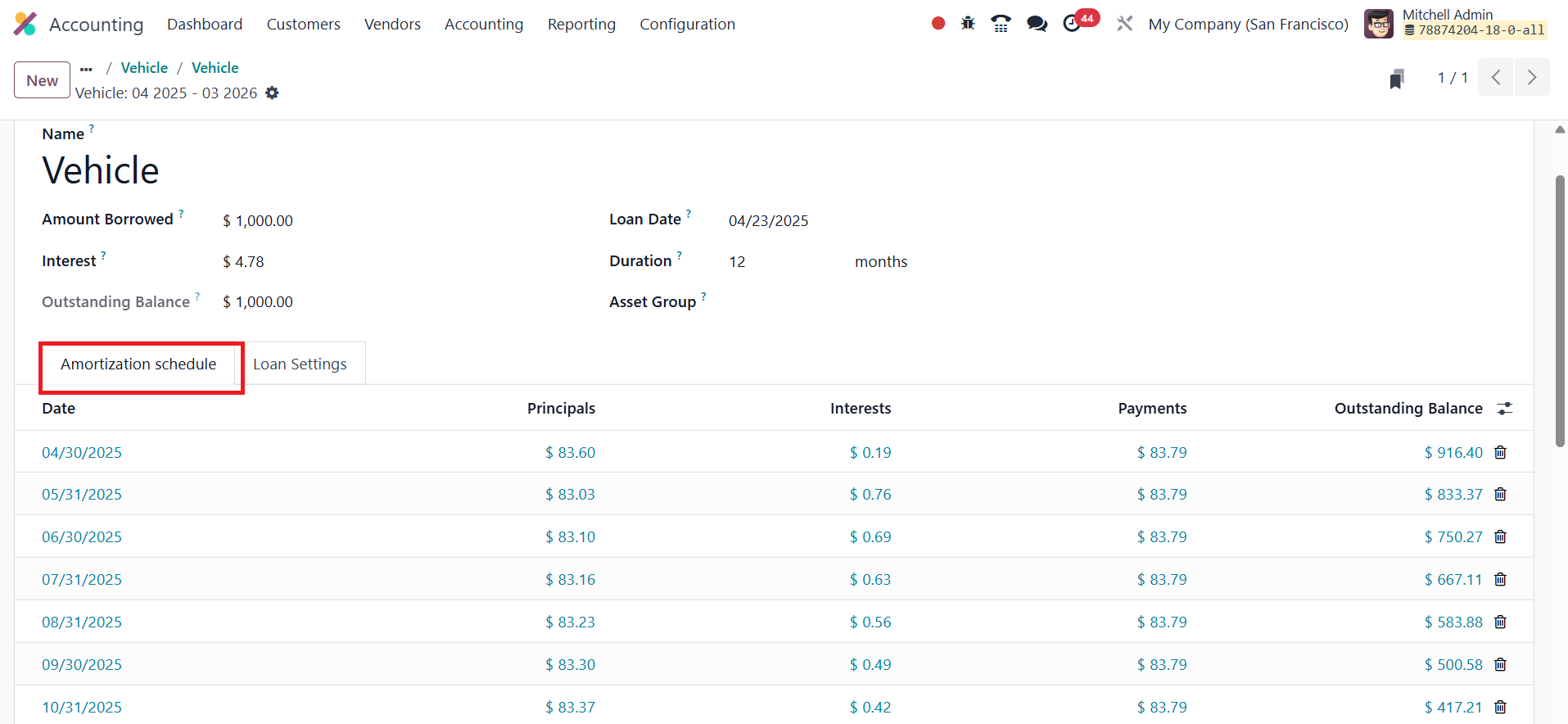

Creating a loan begins by entering a descriptive name, amount

borrowed, interest rate, start date, and loan duration; once you

choose the asset group, Odoo automatically computes the outstanding

balance.

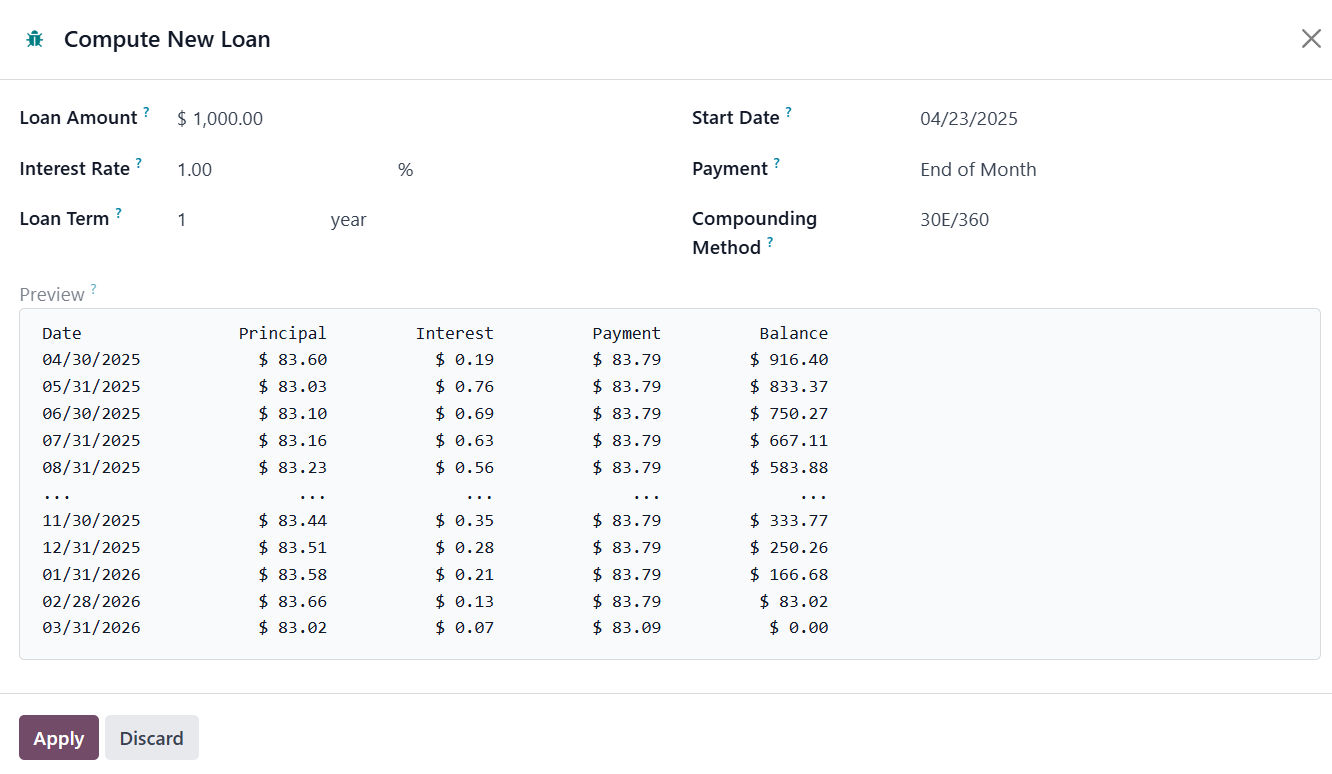

The system can generate a full amortization schedule; itemising every

instalment’s principal and interest, based on the selected

compounding method, or you can add the schedule manually.

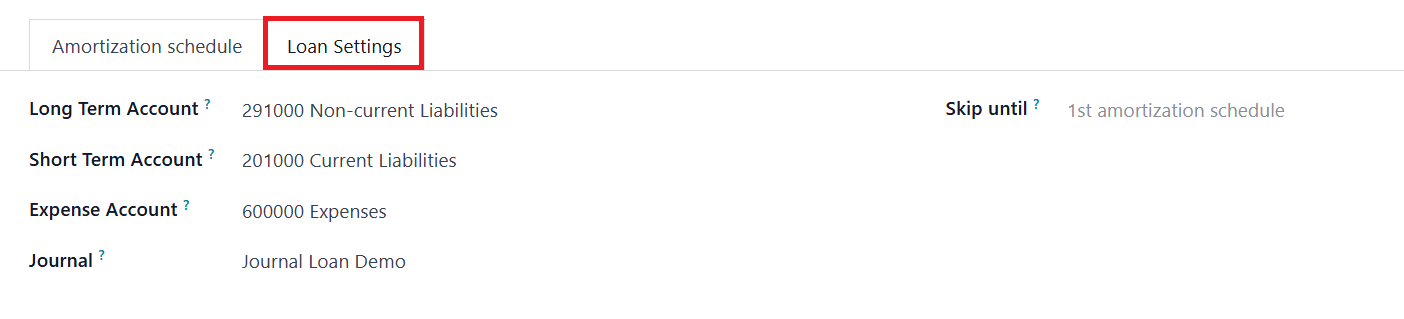

Under Loan Settings you assign the posting Journal along with the

Expense, Long‑Term Liability, and Short‑Term Liability accounts; a

Skip until date is available if earlier installments were posted

manually before the loan record was created. `

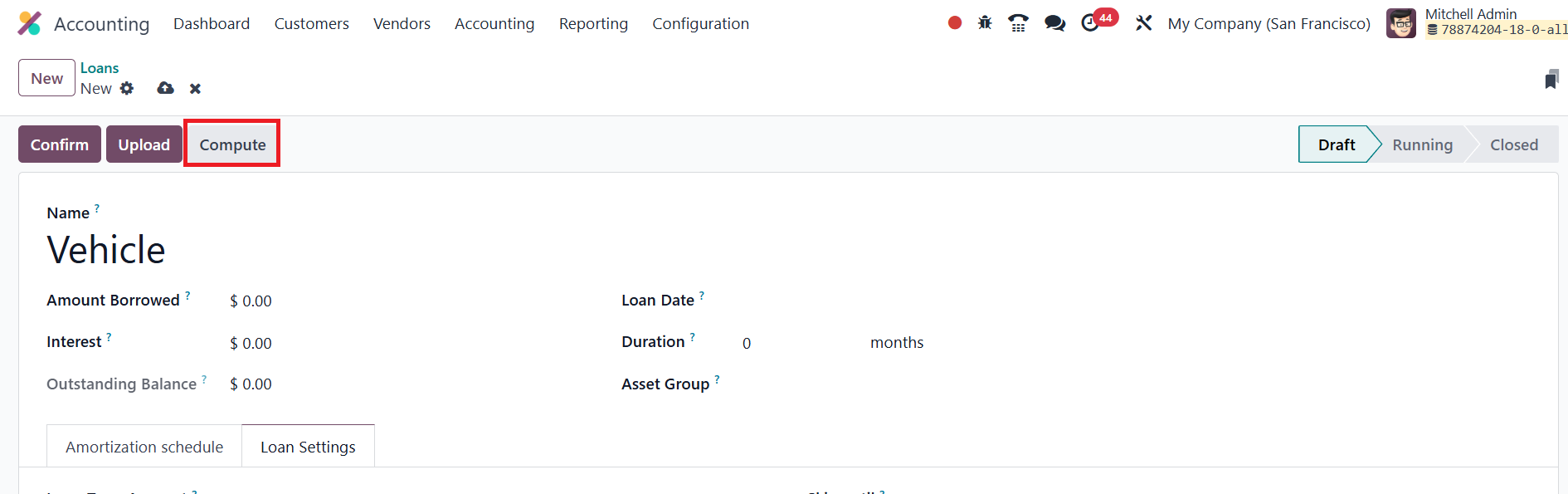

Three actions appear at the top of the form: Confirm (activates the

loan), Upload (attaches supporting documents), and Compute (opens a

wizard where you can recalculate the schedule by entering loan

amount, interest rate, term, start date, and payment frequency).

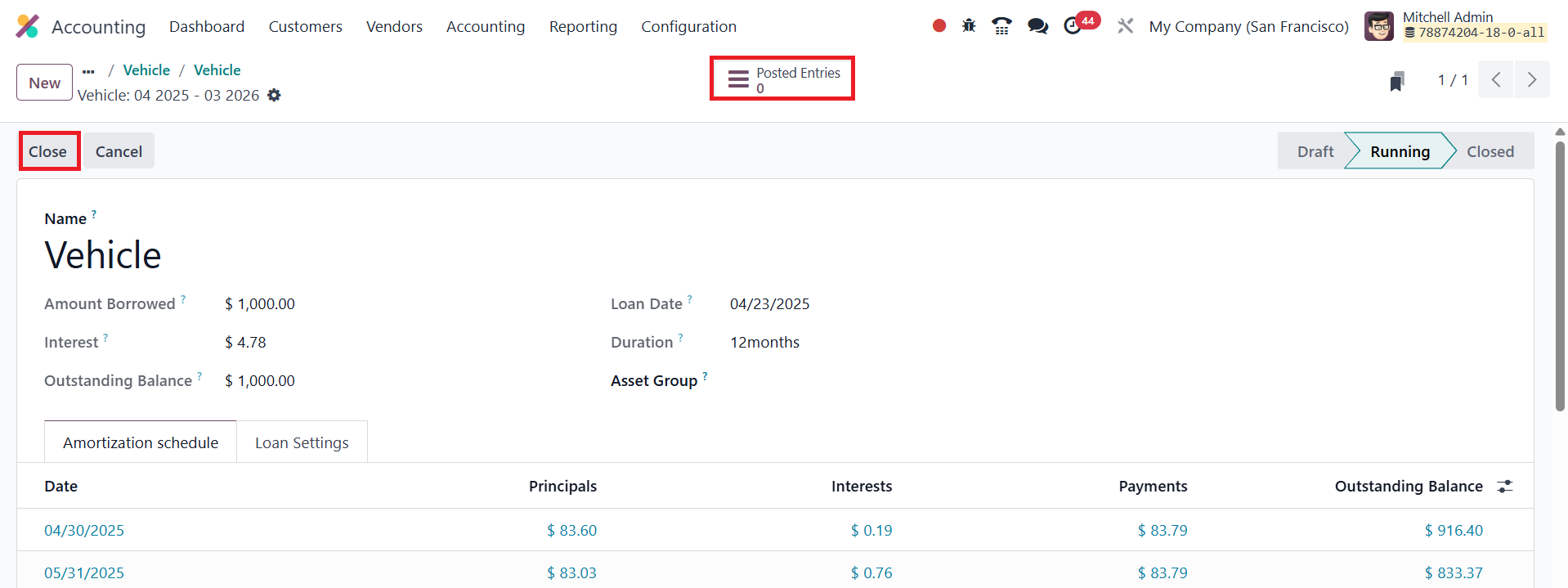

After you apply the computation and confirm, the loan’s stage changes

from Draft to Running, and Odoo begins generating journal entries

automatically.

Each repayment posts a debit to the long‑term liability account

(reducing principal), a credit to the short‑term liability account,

and a debit to the expense account for the interest portion.

A handy Posted Entries smart button lets you review every generated

entry, ensuring complete transparency of principal reduction,

interest expense, and reclassification between long‑ and short‑term

liabilities. When the amortization schedule is finished, the loan

automatically moves to Closed status; alternatively, you can click

Close at any time, which deletes any unposted installments and

finalises the liability.

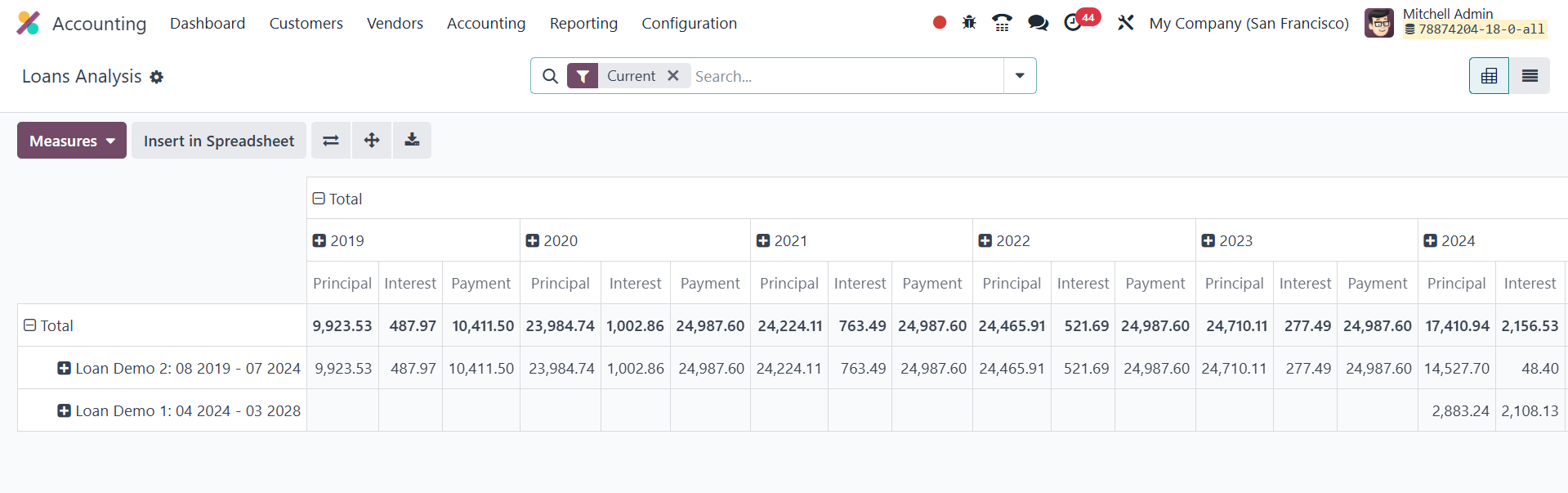

17.1 Loans Analysis

Odoo 18 Accounting complements its loan‑tracking tools with a

dedicated Loan Analysis report that delivers a concise picture of

every active or closed loan’s performance. Accessible from

Reporting › Loan Analysis under Management reports, it opens by

default in a pivot view that lists loan names on the Y‑axis while

the columns display, year by year, the principal repaid, interest

incurred, and total payments.

This layout lets finance teams gauge at a glance how each loan is

progressing and how repayment schedules affect cash flow across

fiscal periods. A switch to list view provides line‑by‑line detail,

and the interface includes quick filters for Current loans, Closed

loans, and Loan Date, along with “Group By” options for Loan, Loan

Date, or Asset Group. Users can add custom filters, create custom

groupings, and even save their preferred search layouts for future

reference.