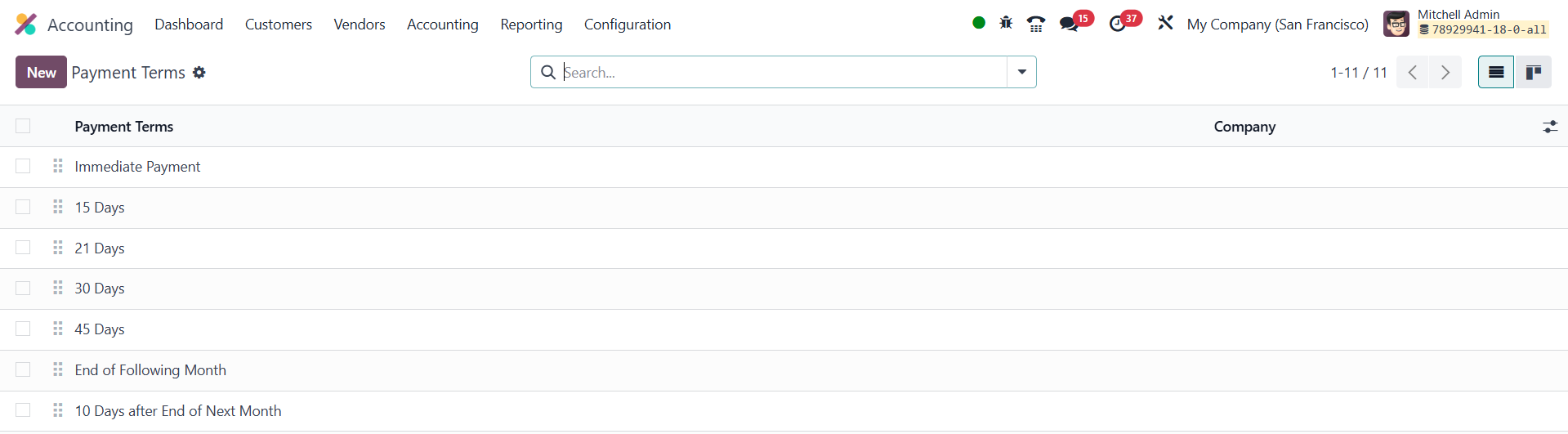

21. Payment Terms

In Odoo 18 Accounting, Payment Terms let you formalize exactly when

and how much a customer or vendor must pay and whether they are

rewarded for settling early. You will get this option in the

Accounting module. Go to the Configuration menu and click on the

Payment Terms.

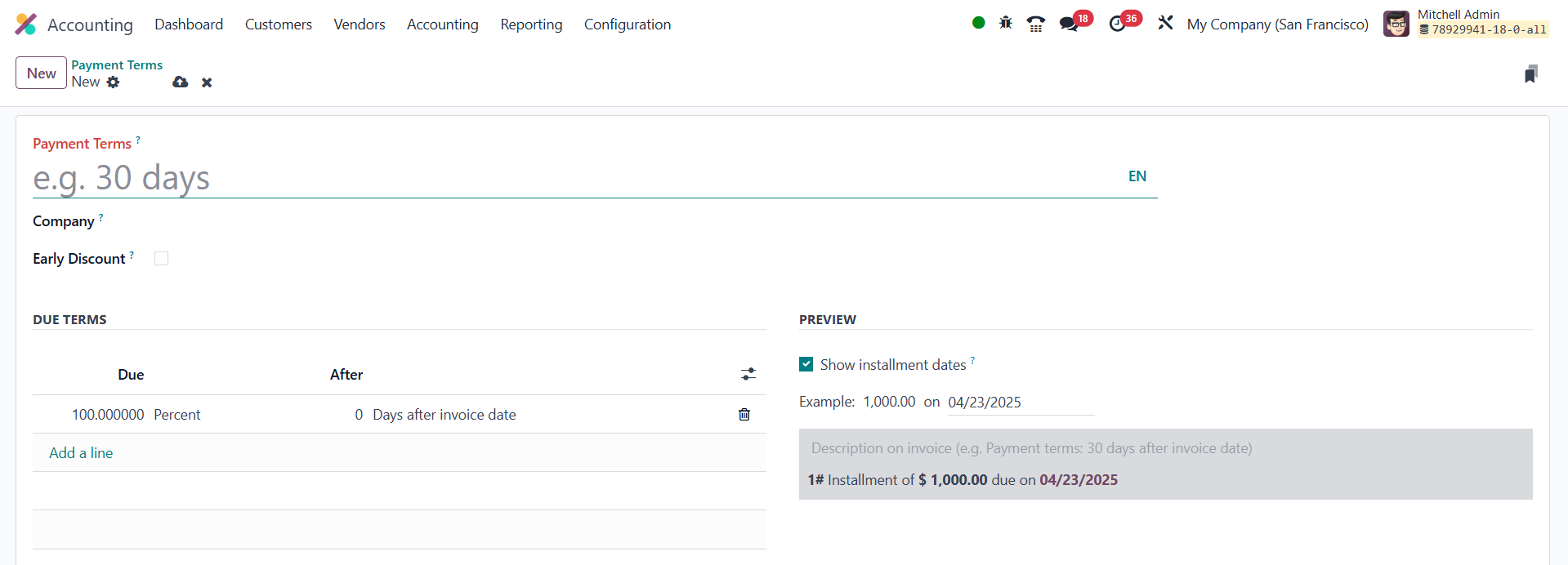

Clicking New button will open a new window to create a new payment

term.

Inside the form you first pick the Company (useful if you operate

multiple firms in the same database) and assign a clear, descriptive

Name so users instantly recognize the policy. If you wish to

incentivize prompt settlement, toggle Early Discount, enter the

percentage and Odoo will automatically compute the reduced amount on

any invoice that respects the early‑payment window you

specify. Next, under Due Terms you add one or more lines that tell

the system when each portion becomes collectible. A single‑line term

such as “100 % , 30 days after invoice date” reproduces the classic

Net 30 arrangement, but you can just as easily split it into

staggered instalments (e.g., 50 % on day 0 and 50 % on day 30) to

match complex contracts.

To help recipients understand their obligations at a glance, you can

fill in the Preview Text and tick Show Installment Dates so that

every printed or emailed invoice lists the exact calendar dates, not

just relative offsets.

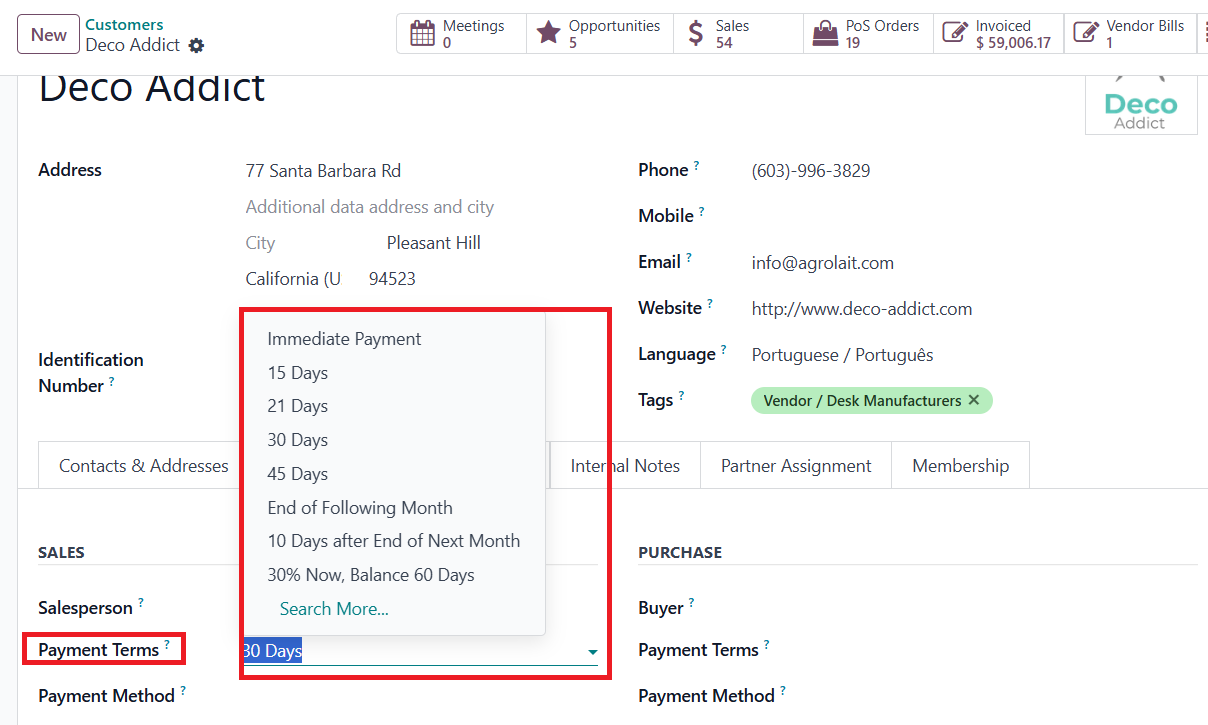

Once your payment terms are configured, assign them in the Sales &

Purchase tab of each contact’s form. Doing so ensures that whenever

you select that vendor or customer, the correct payment term is

automatically applied to their purchase orders or sales orders.

With thoughtfully configured Payment Terms in place, your Odoo 18

Accounting setup turns credit policy into an automated, transparent

process that improves cash‑flow predictability for you and clarity

for your customers.