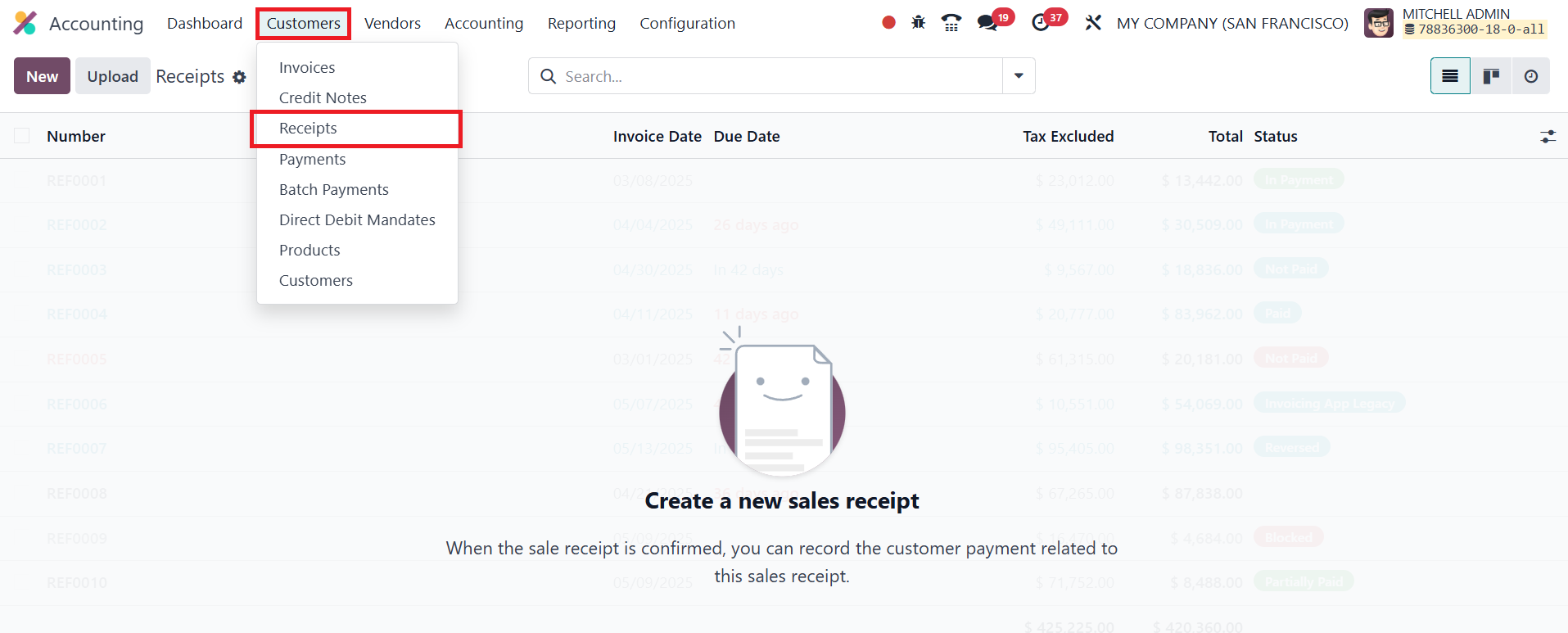

3. Receipts

In Odoo 18 Accounting, receipt management is streamlined through

distinct and organized platforms for Sales Receipts and Purchase

Receipts, available under the Customers and Vendors menus

respectively. These receipts play an essential role in validating

and recording the delivery of goods or services and ensuring proper

documentation of financial transactions within your business

workflow.

A sales receipt serves as an acknowledgment that the customer has

received the products or services specified in a sales order. In

Odoo 18, these receipts operation are automatically generated once a

Sales Order is confirmed, but for financial records users also

manually create from the Receipts option available for the under the

Customers menu in the Accounting module.

The Receipts dashboard presents a clear list view displaying key

details such as Receipt Number, Customer Name, Invoice Date, Due

Date, Tax-Excluded Total, Grand Total, and Status. To enhance

usability, Odoo 18 allows customization of this view through

configurable columns and filtering options. Users can also upload

external receipts using the Upload button to keep all records

centralized in the system.

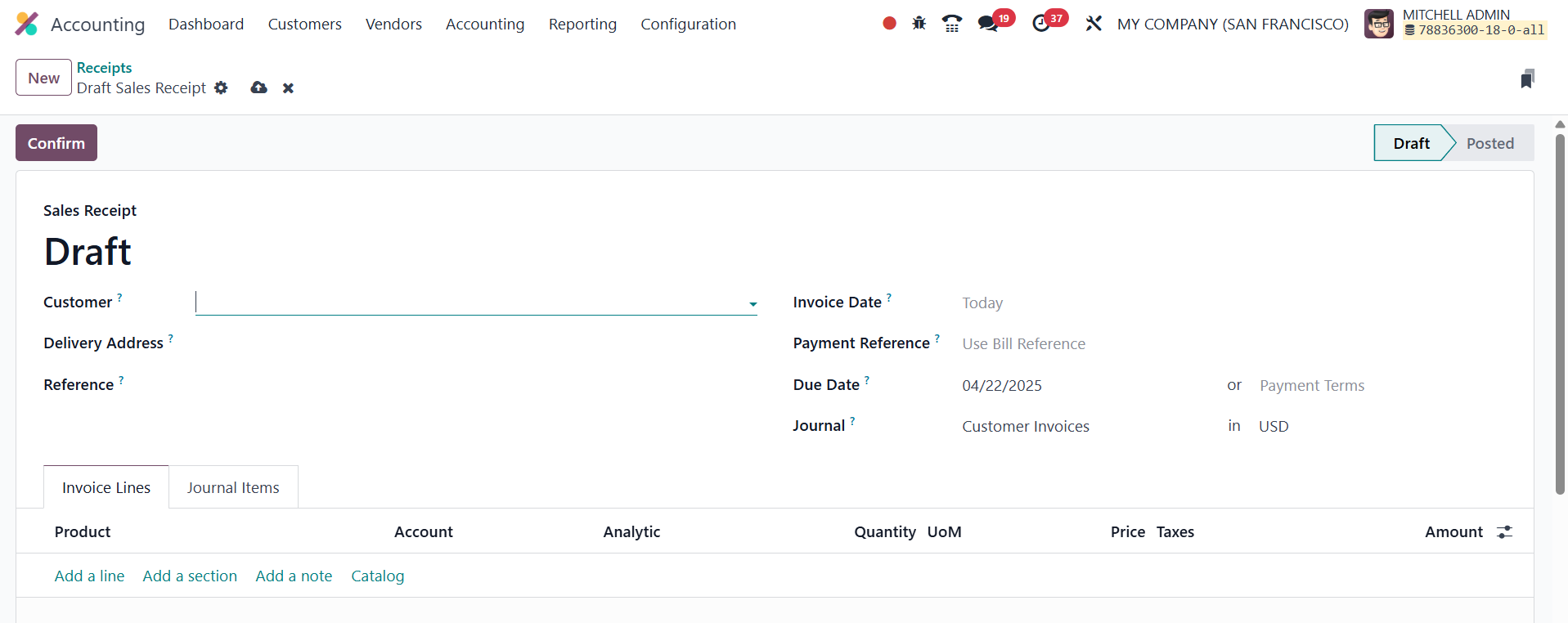

To manually create a new sales receipt, click the New button.

The creation form mirrors the layout of an invoice entry screen. You

can enter fields like Customer, Delivery Address, Reference, Invoice

Date, Payment Reference, Payment Terms, and the Accounting Journal.

Under the Invoice Lines tab, products or services being acknowledged

can be added using the Add a Line button. This section captures

details such as Product Name, Account, Analytic Account, Quantity,

Unit of Measure (UoM), Unit Price, Applicable Taxes, and Subtotal

for each line item.

The Journal Items tab automatically reflects the accounting entries

associated with the receipt, including debit and credit movements,

relevant accounts, and analytic dimensions.

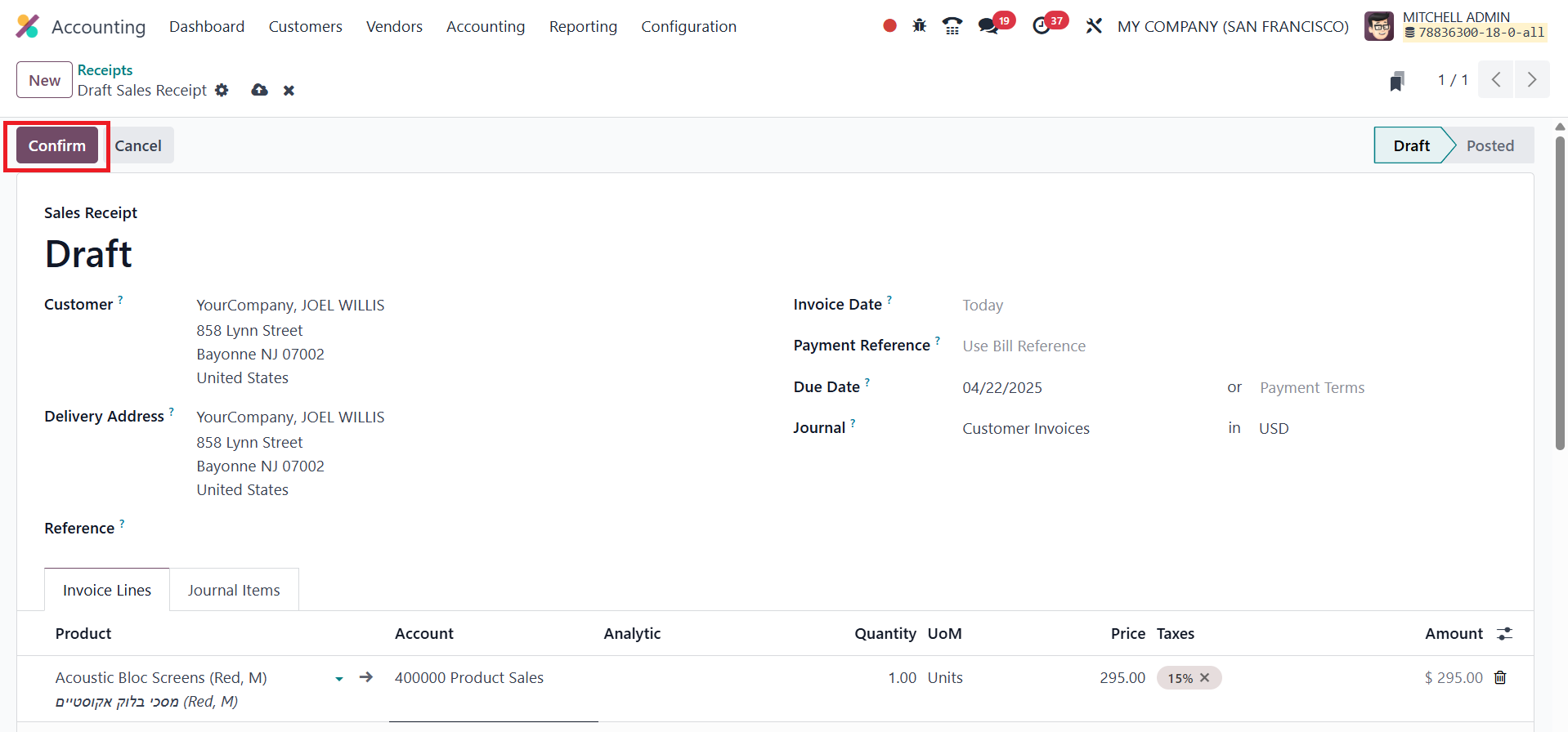

Once all necessary information is filled in, clicking the Confirm

button posts the receipt, officially recognizing the transaction in

your accounting system.

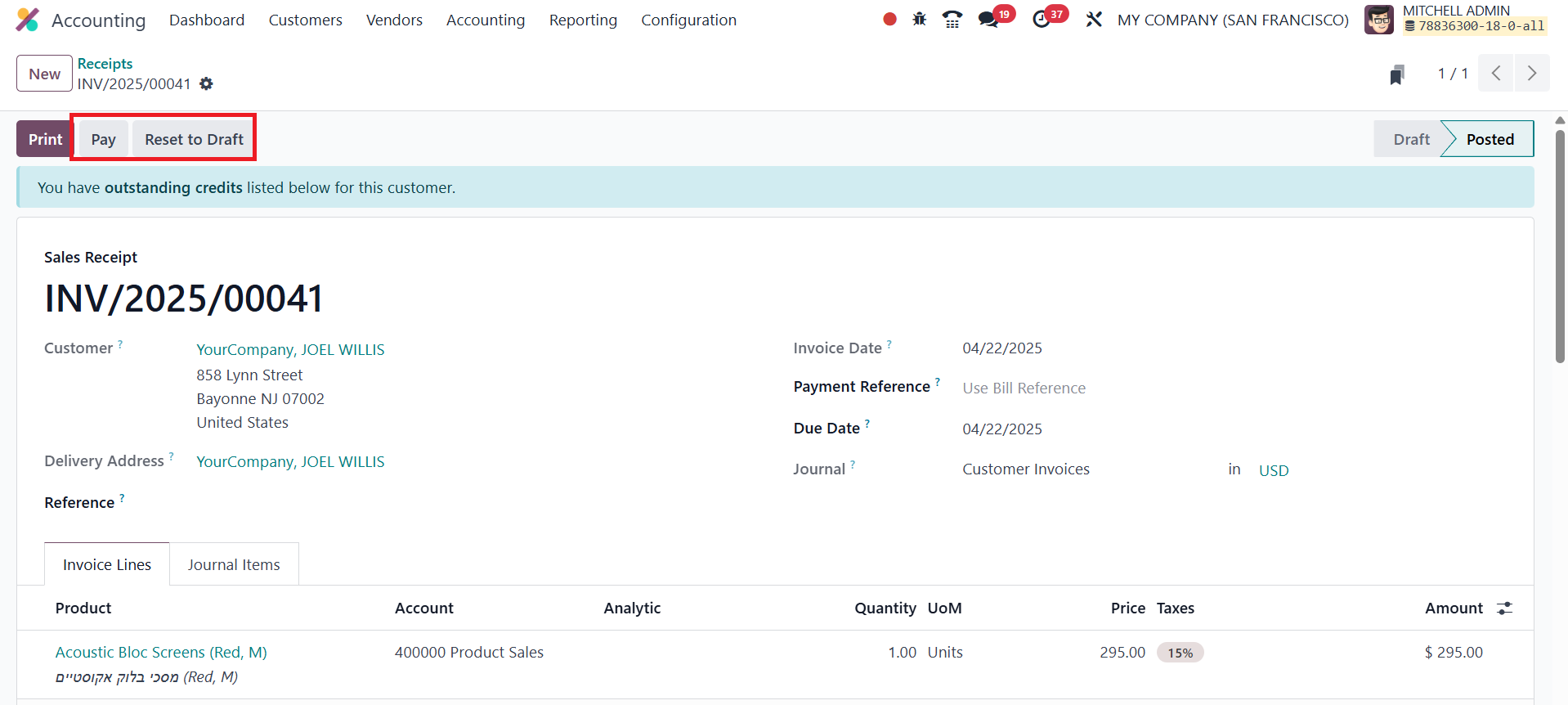

Following confirmation, you can use the Pay button to record the

customer's payment, either partially or in full, based on the amount

received. Odoo’s payment registration window allows specification of

journal, payment method, date, and amount, ensuring a seamless

reconciliation process.

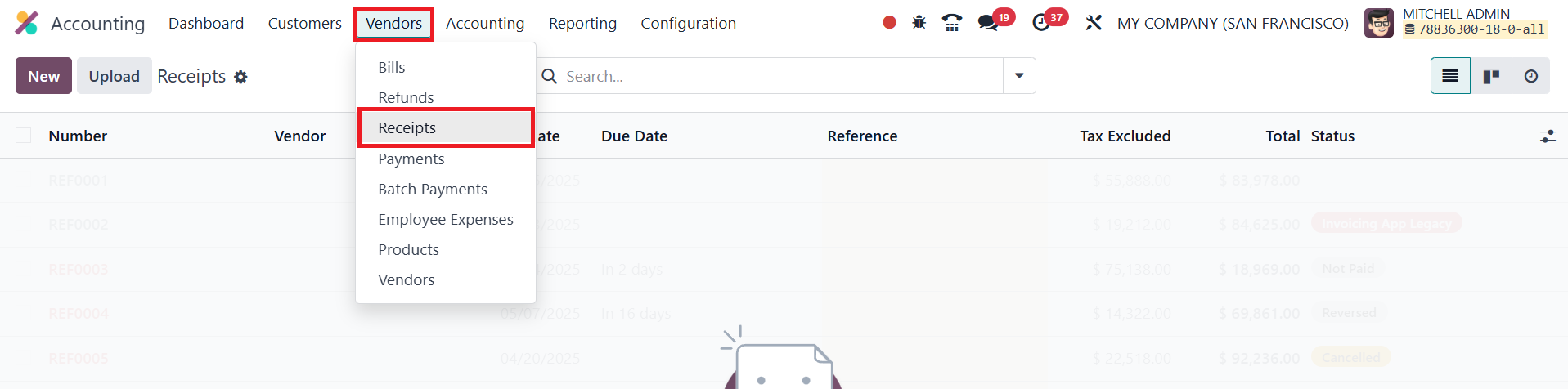

Odoo 18 also provides functionality to manage purchase receipts,

which act as confirmation that your business has received products

or services from a vendor. These are typically generated

automatically once a Purchase Order is confirmed and goods are

received. However, you can also manually create a purchase receipt

by selecting the Receipts option from the Vendor menu within the

Accounting module.

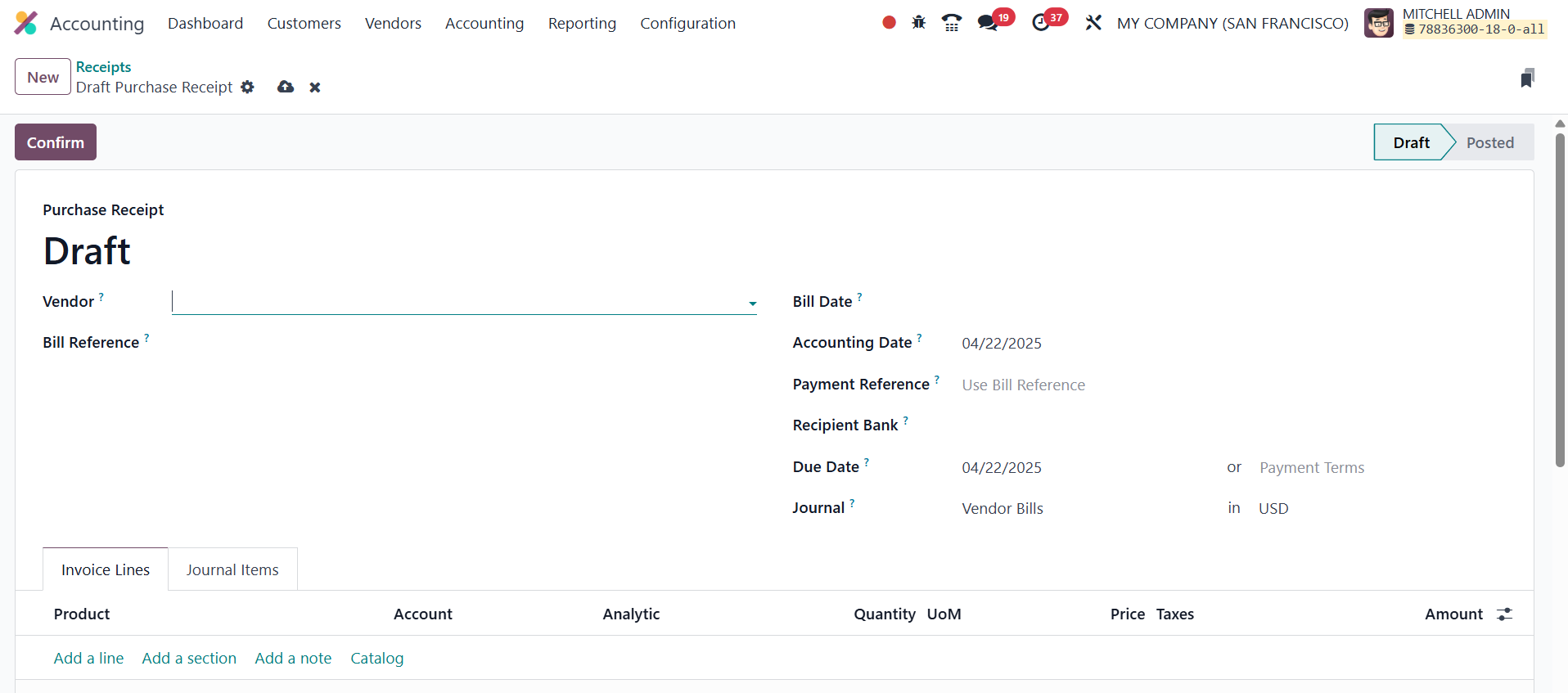

The Receipts platform shares a similar structure with the sales

receipts view, ensuring consistency in user experience. The receipt

creation interface prompts users to input fields such as Vendor,

Bill Reference, Bill Date, Accounting Date, and Recipient Bank

Account. In Odoo 18, the Vendor field identifies the supplier

issuing the bill, the Bill Reference helps track the vendor’s

original invoice number, the Bill Date indicates when the vendor

issued the bill, the Accounting Date determines when the transaction

is recorded in the books, and the Recipient Bank Account specifies

the vendor's bank account to which the payment will be made.

Once all relevant data is entered, the purchase receipt can be

validated by clicking the Confirm button. This confirmation process

not only registers the vendor receipt but also triggers the

accounting entries for the purchase transaction.

By clearly segmenting and structuring sales and purchase receipts,

Odoo 18 Accounting helps businesses maintain transparency in

transaction documentation, improve payment tracking, and enhance

financial accuracy.