18. Reconciliation

Reconciling the balances recorded

in your cash and bank

accounts is one of the most

reliable ways to spot and

promptly correct,

discrepancies in your

books. Odoo 18 makes this

control task markedly easier.

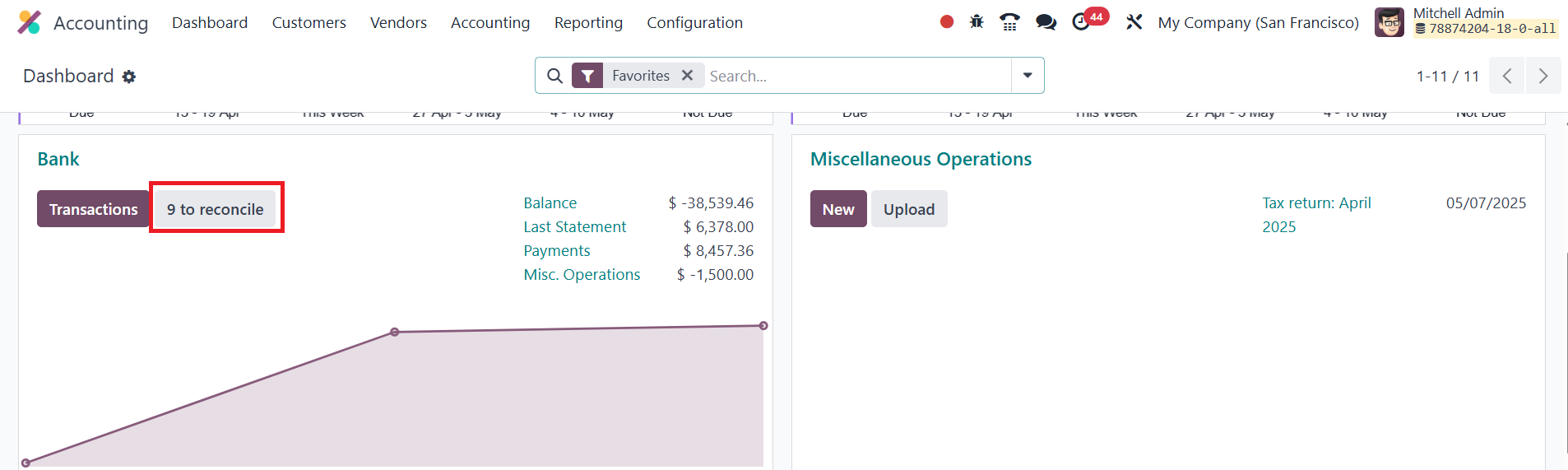

From the moment you open the

Accounting Dashboard, the

system highlights every bank

statement line that still

needs attention.

A single click on Reconcile takes

you straight into the

reconciliation workspace,

where Odoo lines up each

outstanding statement item

against the matching journal

entries and proposes the most

likely counterpart.

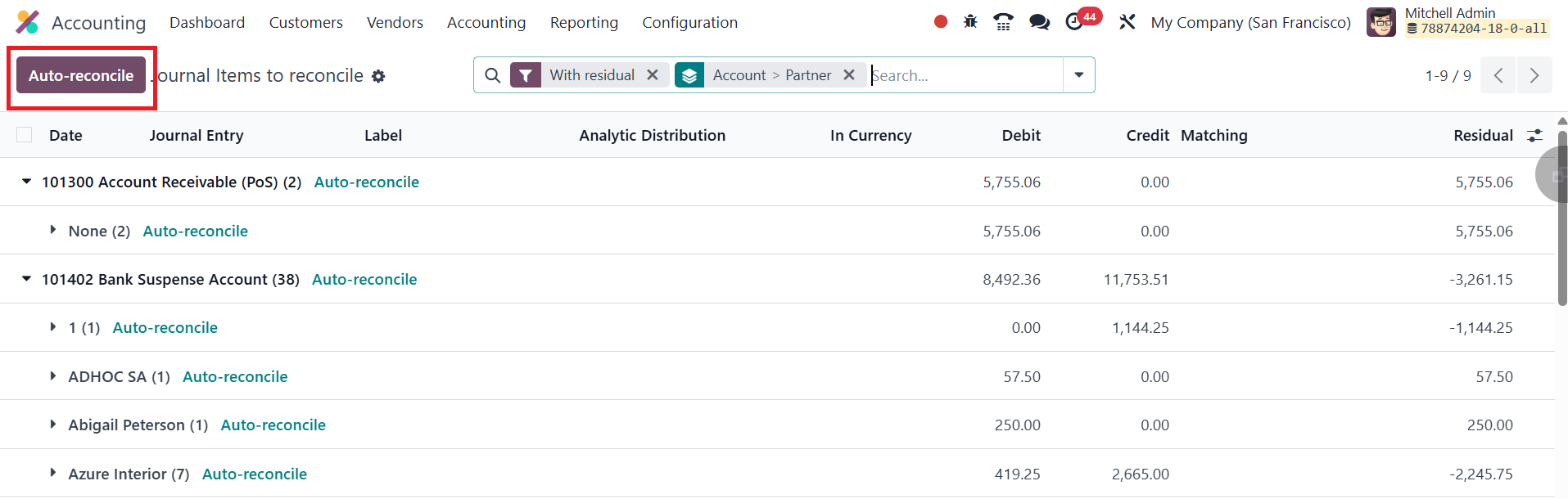

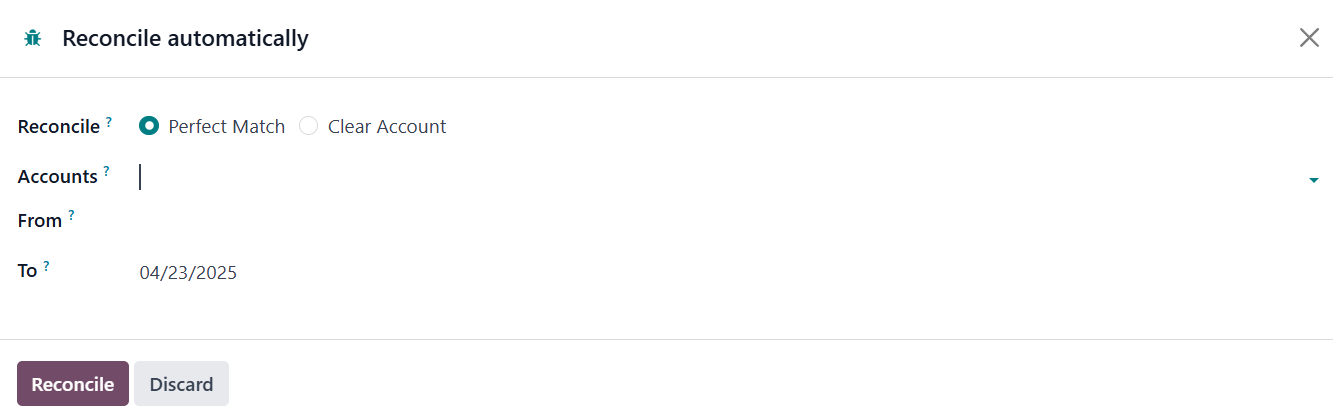

If your process can be fully

automated, you can bypass the

workspace entirely: choose

Auto‑reconcile from the

Accounting ▸ Reconciliation

menu (or the dashboard

ribbon), specify the date

range and the accounts to

scan, and let Odoo create and

post the necessary entries in

one batch; exactly the same

logic that powers payment

matching.

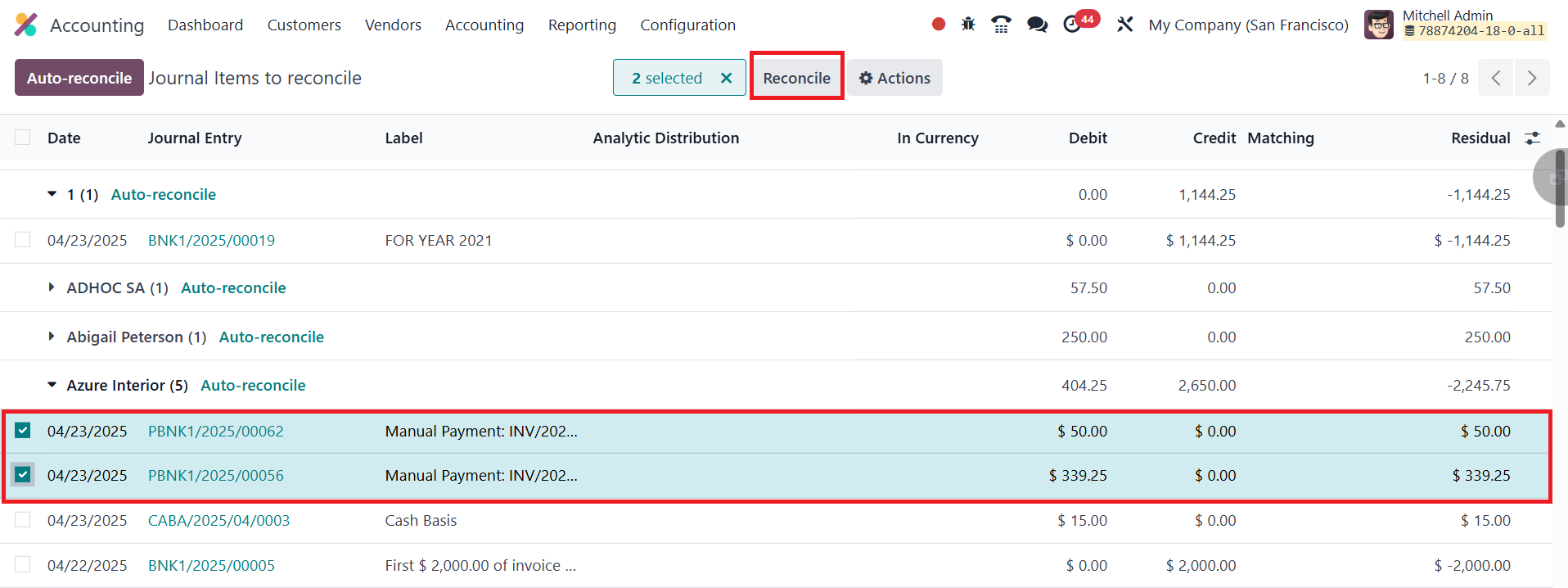

When certain transactions still

need a human eye; perhaps

because narrative text is

vague or a partner is

missing, you can select

Reconcile instead and handle

those items line by line.

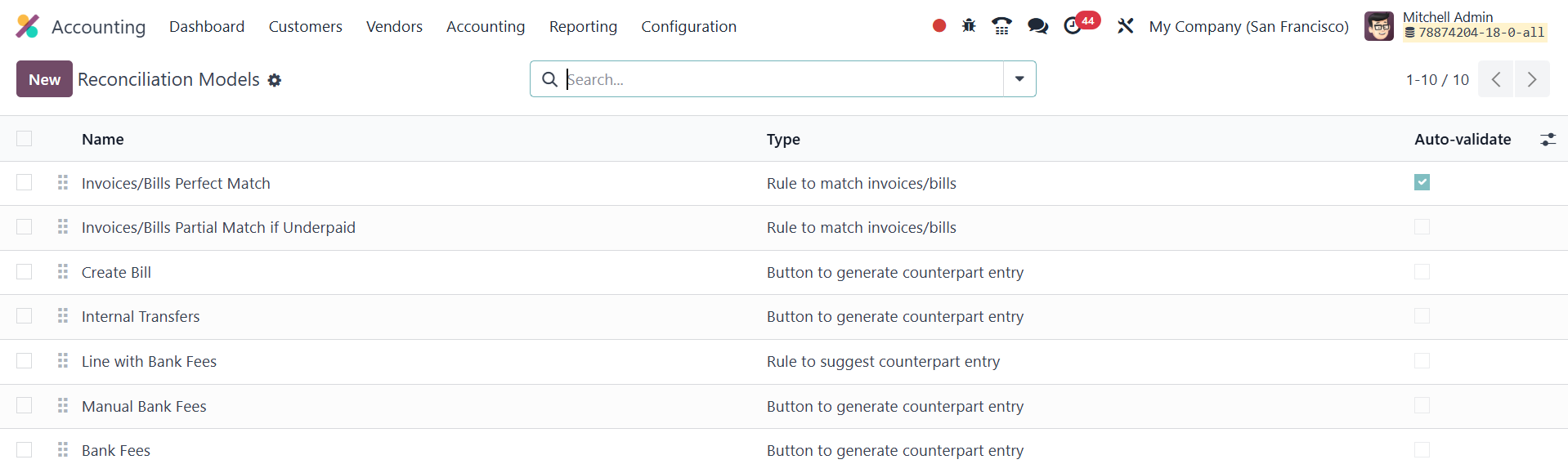

Odoo 18 lets you pre‑define how

the system should treat

recurring patterns through

Configuration ▸

Reconciliation Models. Each

model tells Odoo what to do

when specific criteria are

met, and you can create as

many as you need.

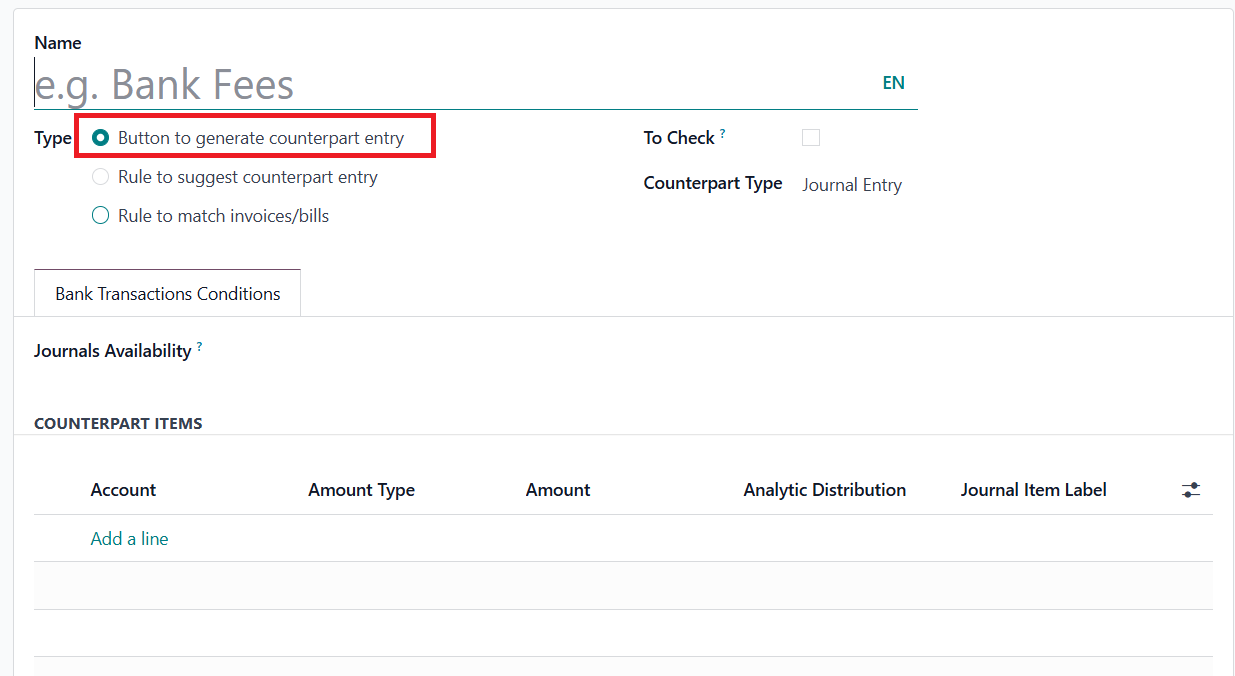

Button to generate counterpart

entry

Use this when a statement line

always posts to the same

expense, revenue, or clearing

account. After naming the

model, select the journals to

which it applies (for

example, only your EUR bank

journal). In the Counterpart

Items tab, fill in the

destination account, decide

whether the amount is fixed

or a percentage of the

statement line, add an

analytic tag if required, and

specify the label you want to

see on the journal entry.

Once saved, this model

appears as a smart button

during reconciliation; one

click and the entry is

produced.

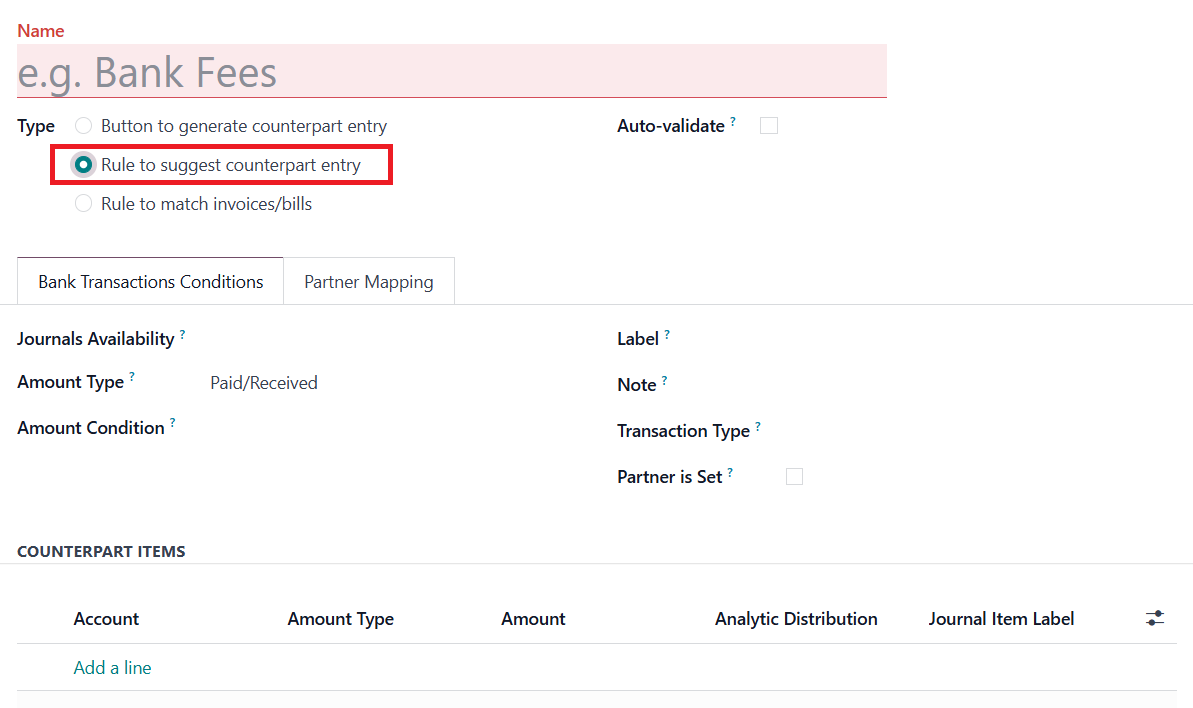

Rule to suggest counterpart

entry

Choose this type when the

counterpart depends on

conditions such as the

amount, the pay‑in/pay‑out

direction, keywords in the

label or note, or whether the

partner is already set. You

can even make the rule

Auto‑validate, so the

statement line is posted

automatically whenever those

conditions are satisfied.

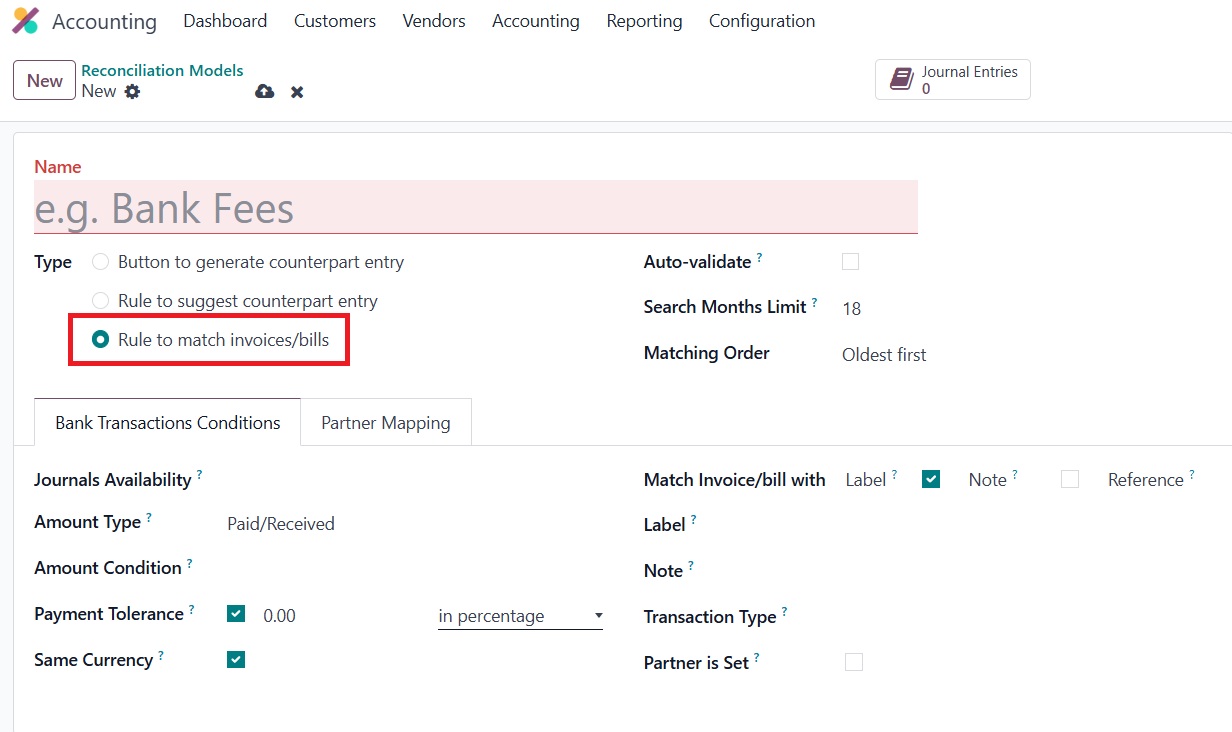

Rule to match

invoices/bills

This model focuses on open

receivables or payables.

Define how far back Odoo

should look (e.g., the last

three months), whether to

propose the oldest or newest

invoice first, and how much

payment tolerance you want to

allow. Optional switches

limit suggestions to the same

currency, or force a match on

reference, label, or memo.

Activate Auto‑validate if you

want Odoo to post the payment

the moment it finds a perfect

match.

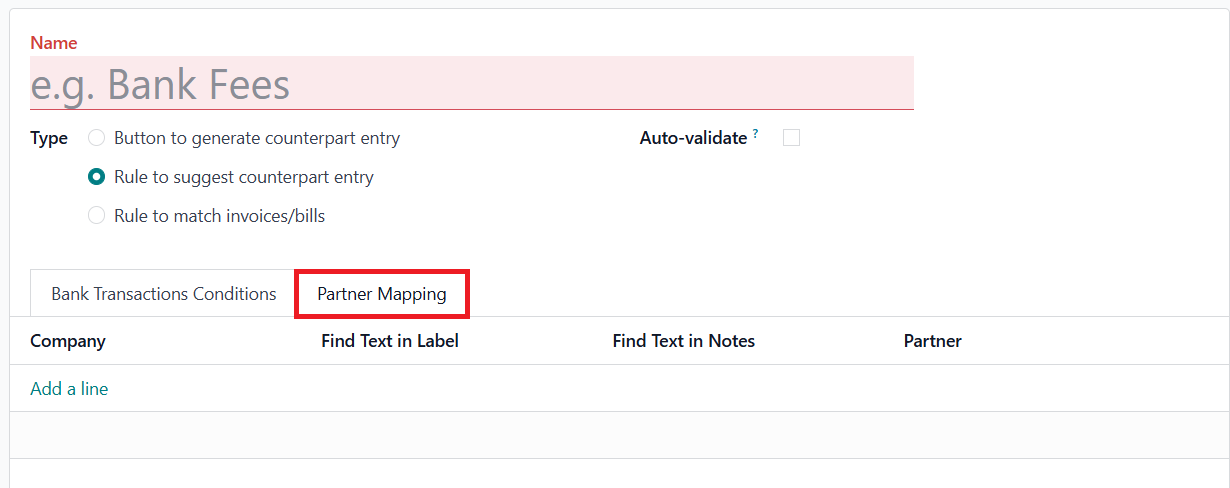

Partner mapping is available on

all rule‑based models,

letting you override the

detected partner or apply the

rule only to specific

customers or vendors.

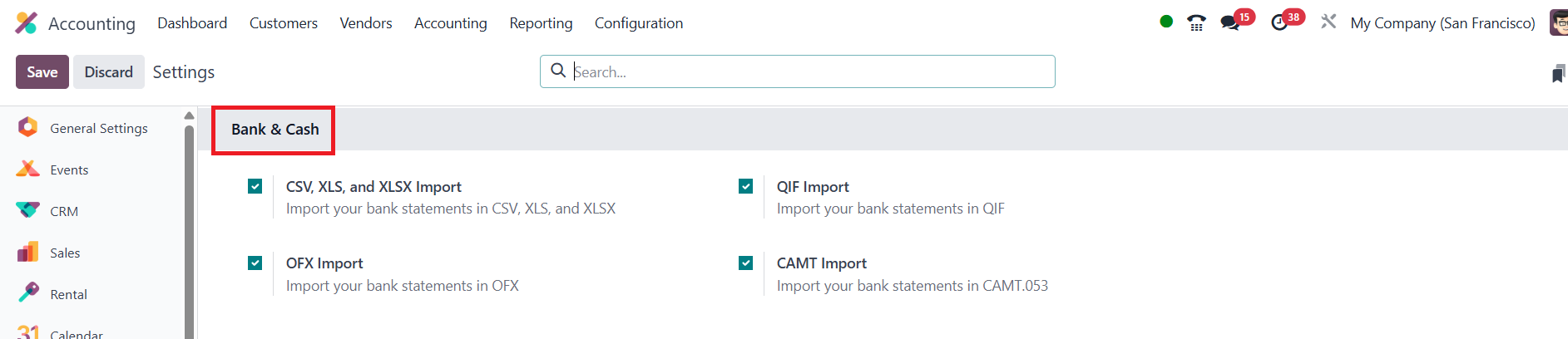

The smoother your data intake,

the less time you spend

reconciling. In Odoo 18 you

can enable support for CSV,

OFX, QIF, and CAMT files

under Settings ▸ Accounting ▸

Bank & Cash.

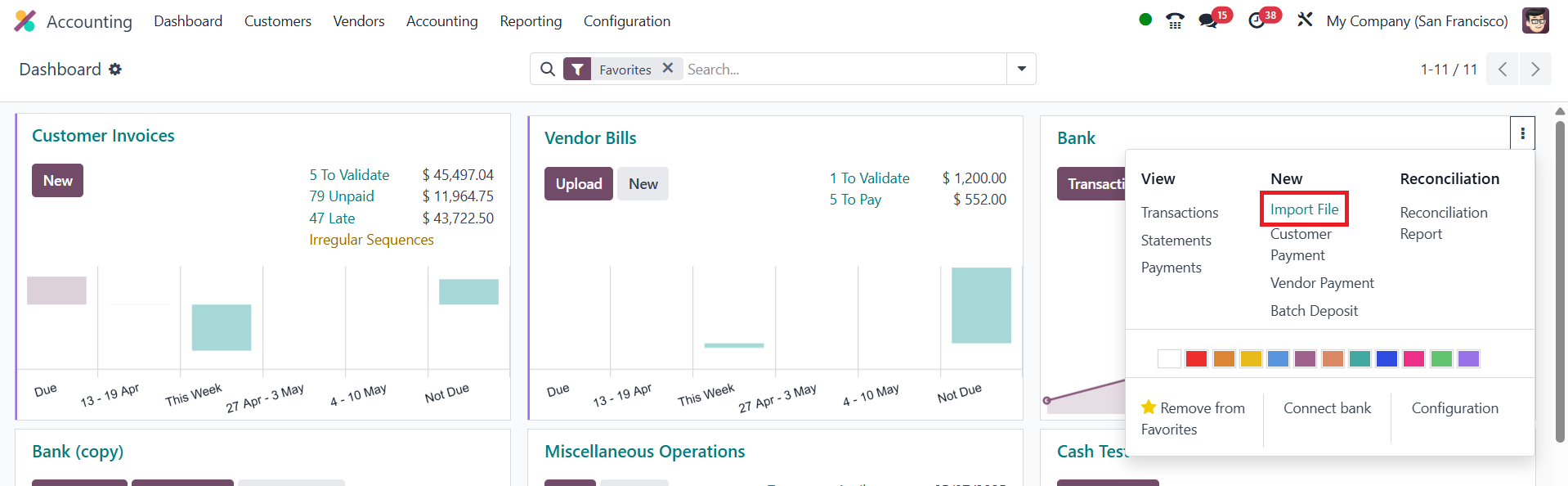

Once activated, the dashboard

shows an Import File button

next; upload the file your

bank provides, and the

statement lines appear

instantly in the

reconciliation queue.

With statement import,

intelligent reconciliation

models, and one‑click

automatic posting, Odoo 18

turns what used to be a

labor‑intensive monthly chore

into a quick daily

checkpoint.