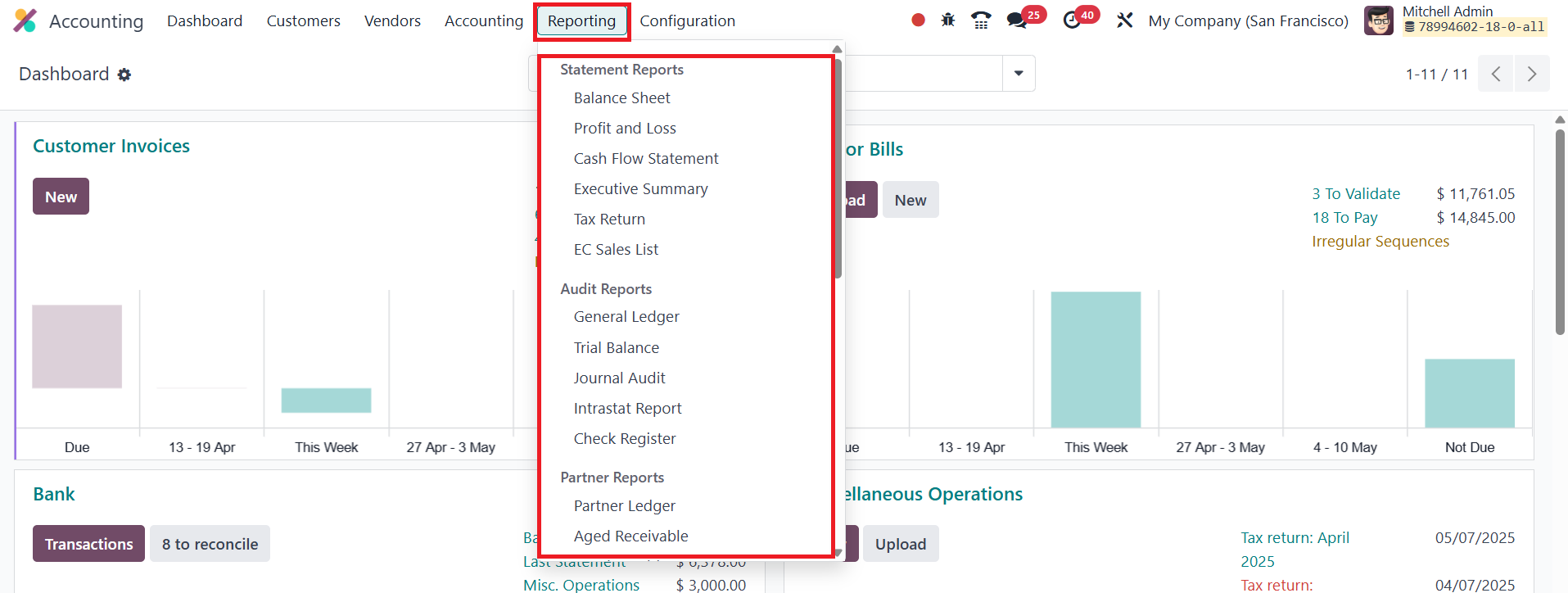

39. Reporting

Every business requires reports

to assess the progress of

operations and analyze

workflows. A well-structured

reporting platform simplifies

the analysis process,

enabling informed

decision-making even in

high-pressure situations.

Reports are essential for

gaining real-time insights

into the management of

finances, particularly in the

context of a company's

internal financial

activities.

In this section, we will explore

the various reporting

features offered by the Odoo

Accounting module in detail.

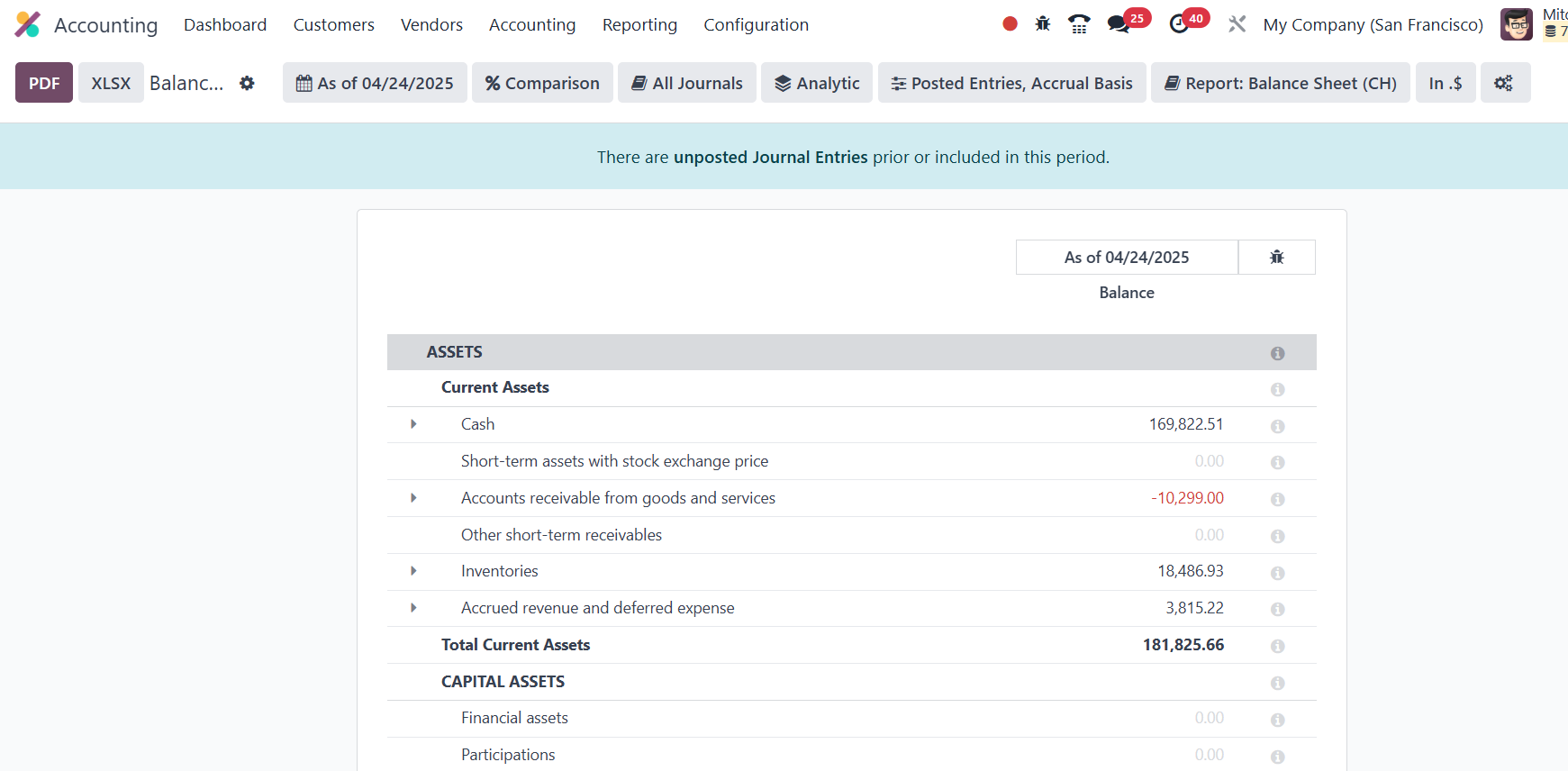

39.1 Balance Sheet

The Balance Sheet report provides

a comprehensive view of an

organization's assets,

liabilities, and equity at

any given point in time. Odoo

allows you to create

customized reports using its

additional functionalities.

By selecting a specific date

from the calendar icon on the

screen, you can generate the

balance sheet for that

precise date.

The Comparison tool allows you to

compare reports from

different timeframes. If you

need the balance sheet report

for a particular journal, you

can select the specific

journal from the Journals

option. Additionally,

advanced filters are

available, giving you the

flexibility to organize the

available data according to

your requirements.

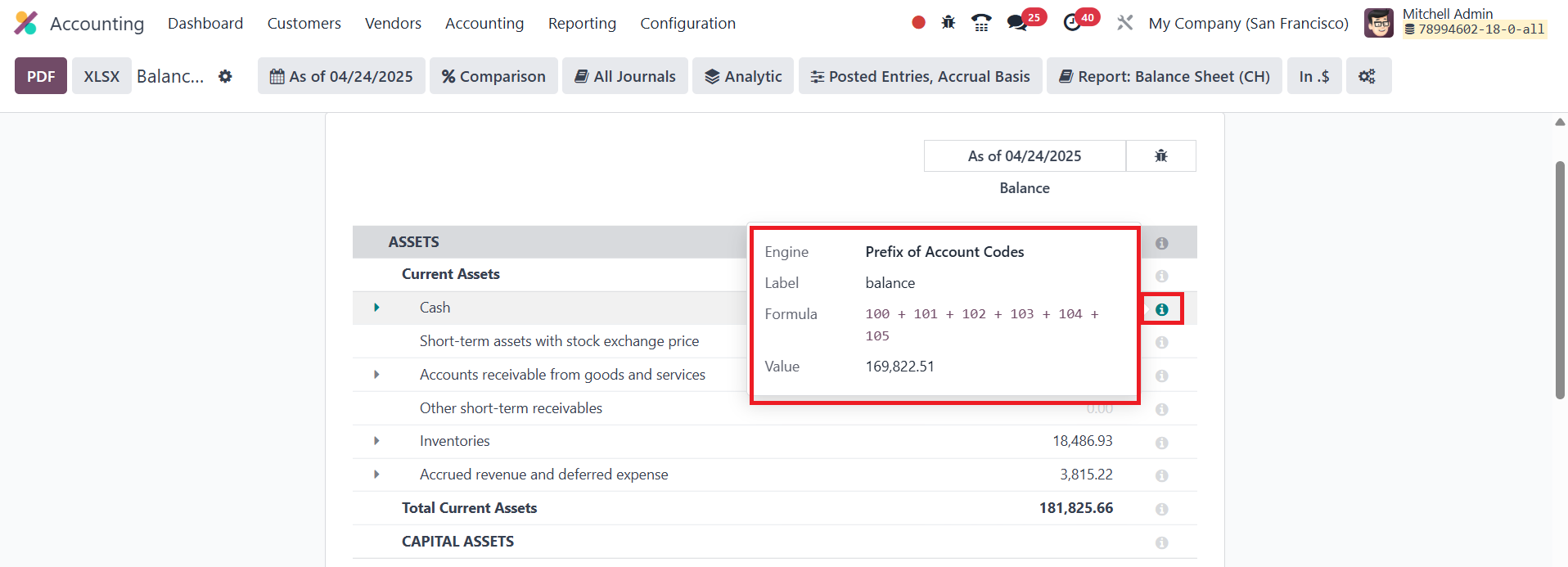

Once developer mode is activated,

an 'i' icon appears at the

end of each reporting line.

This icon reveals the

calculation formula behind

each reporting line. You can

adjust the format of your

data by selecting the PDF or

XLSX options.

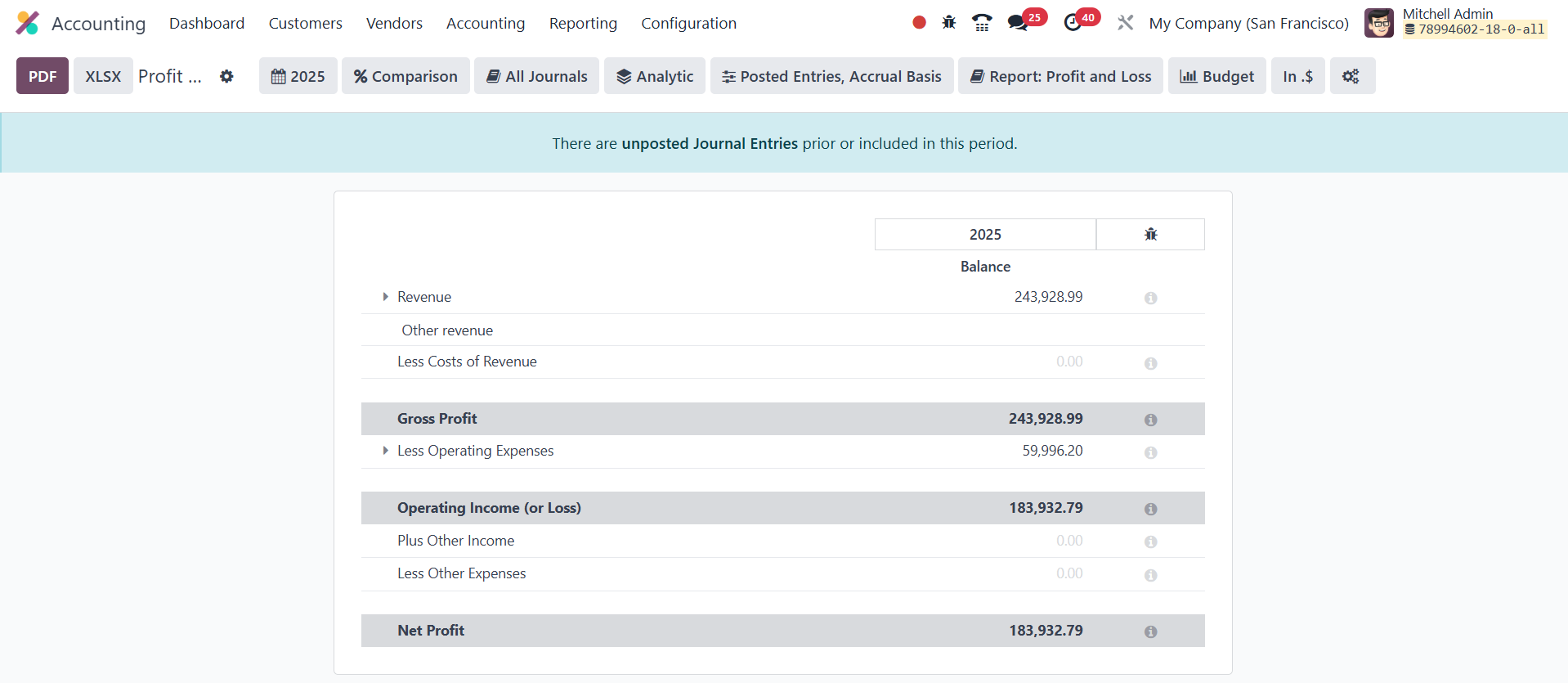

39.2 Profit & Loss

The Profit & Loss report is one

of the most essential

elements of financial

reporting, providing a clear

overview of an organization's

income, expenses, profits,

and losses over a specific

period. This report gives

valuable insight into the

financial performance of a

company within a defined

timeframe.

Unlike the balance sheet, the

ending balance of the Profit

& Loss report does not carry

over to the next accounting

period. Each period stands

alone, offering a snapshot of

financial health for that

particular time frame.

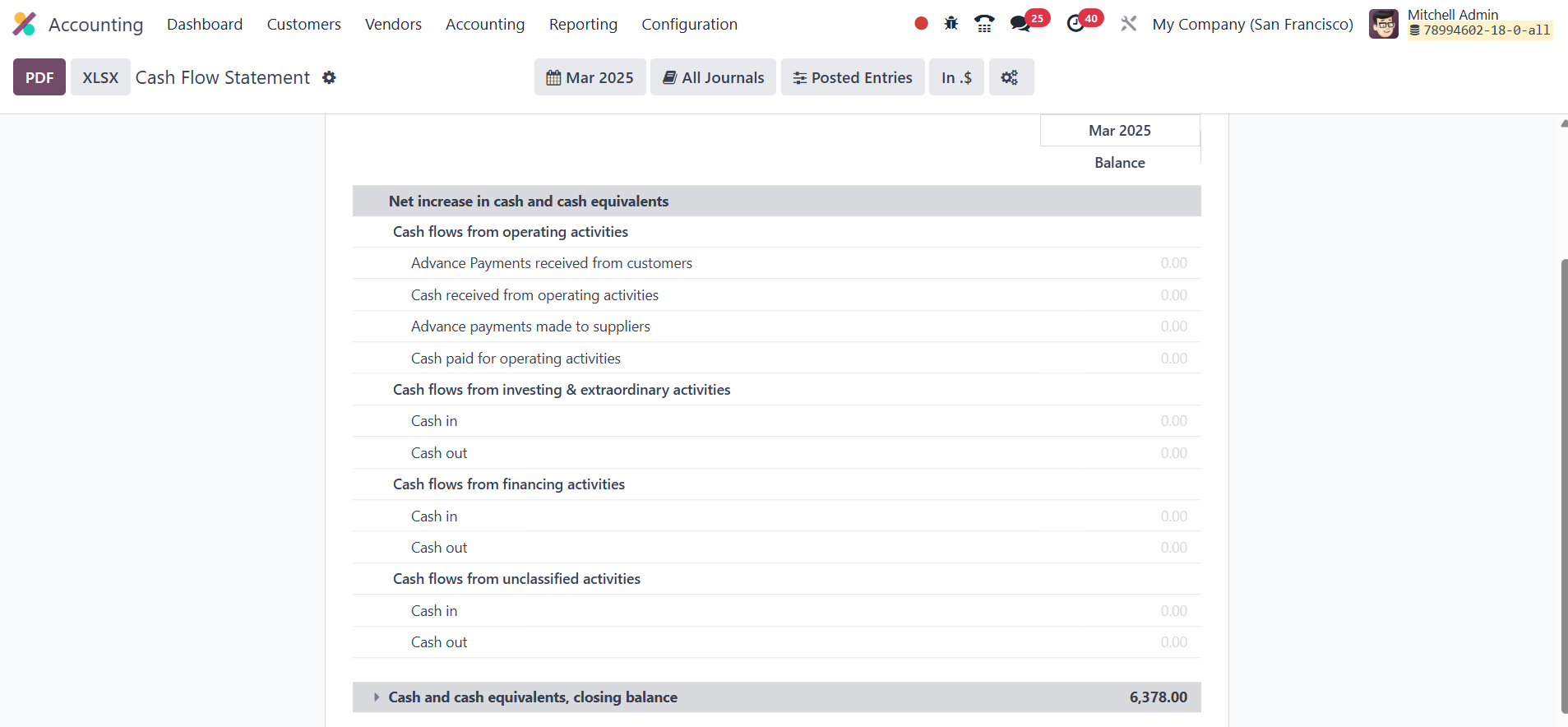

39.3 Cash Flow Statement

The Cash Flow Statement report

provides a detailed overview

of all cash inflows and

outflows within a specific

period. It is based on the

accounts set up for the cash

flow statement in the system.

This report is categorized into

three main activities:

operating, investing, and

financing operations. By

analyzing these sections, you

can gain insights into the

company’s liquidity and

financial health, helping you

assess how cash is being

generated and used across

various business activities.

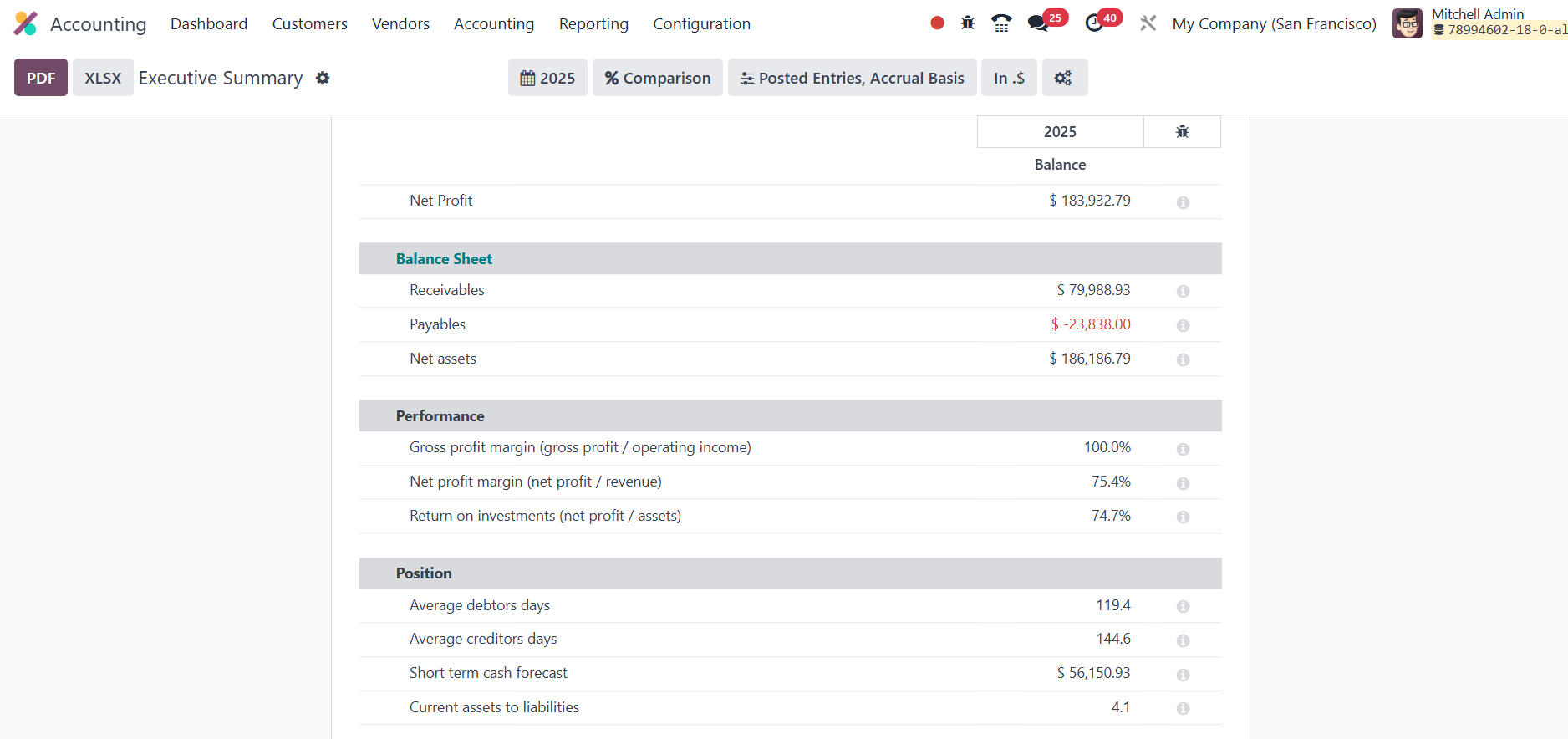

39.4 Executive Summary

The Executive Summary report

consolidates key financial

insights, including cash

flow, profitability, and

balance sheet reports, for a

specific period. This

comprehensive summary can be

accessed from the Reporting

menu. The Performance tab

provides critical performance

indicators such as Return on

Investment (ROI), Gross

Profit Margin, and Net Profit

Margin, helping you assess

the overall financial

performance of the business.

In addition, the Position tab

offers insights into the

company's financial standing,

displaying metrics like

Average Debtors Day, Average

Creditors Days, Short-Term

Cash Forecast, and the ratio

of Current Assets to

Liabilities. These indicators

are essential for

understanding liquidity,

efficiency, and financial

stability.

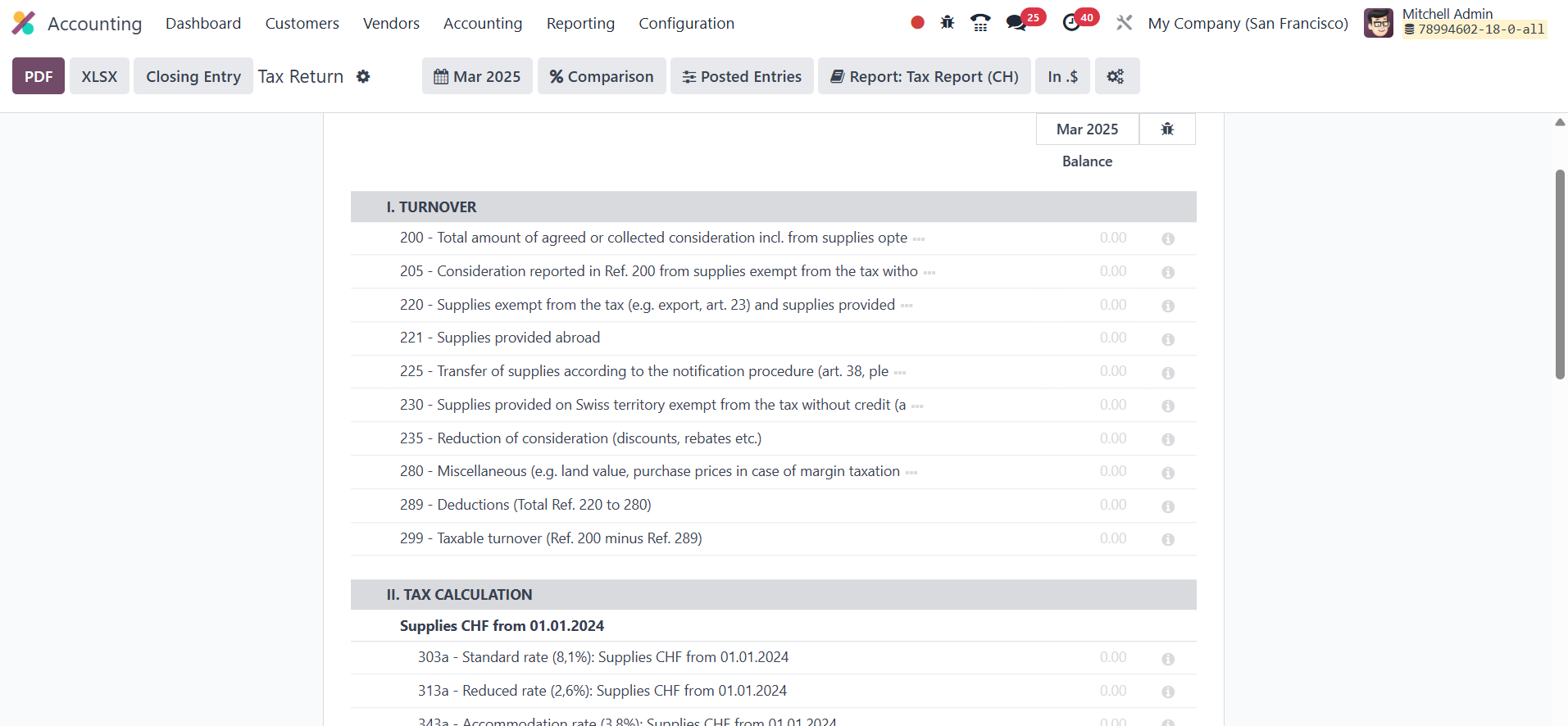

39.5 Tax Return

The Tax Return platform,

available through the

Reporting menu, allows you to

generate detailed reports on

both sales and purchase taxes

for a specific period.

These reports provide an overview

of your tax obligations and

can help ensure compliance

with tax regulations.

Additionally, the Closing

Entry option enables you to

submit the return tax for the

selected period, streamlining

the process of filing your

tax returns.

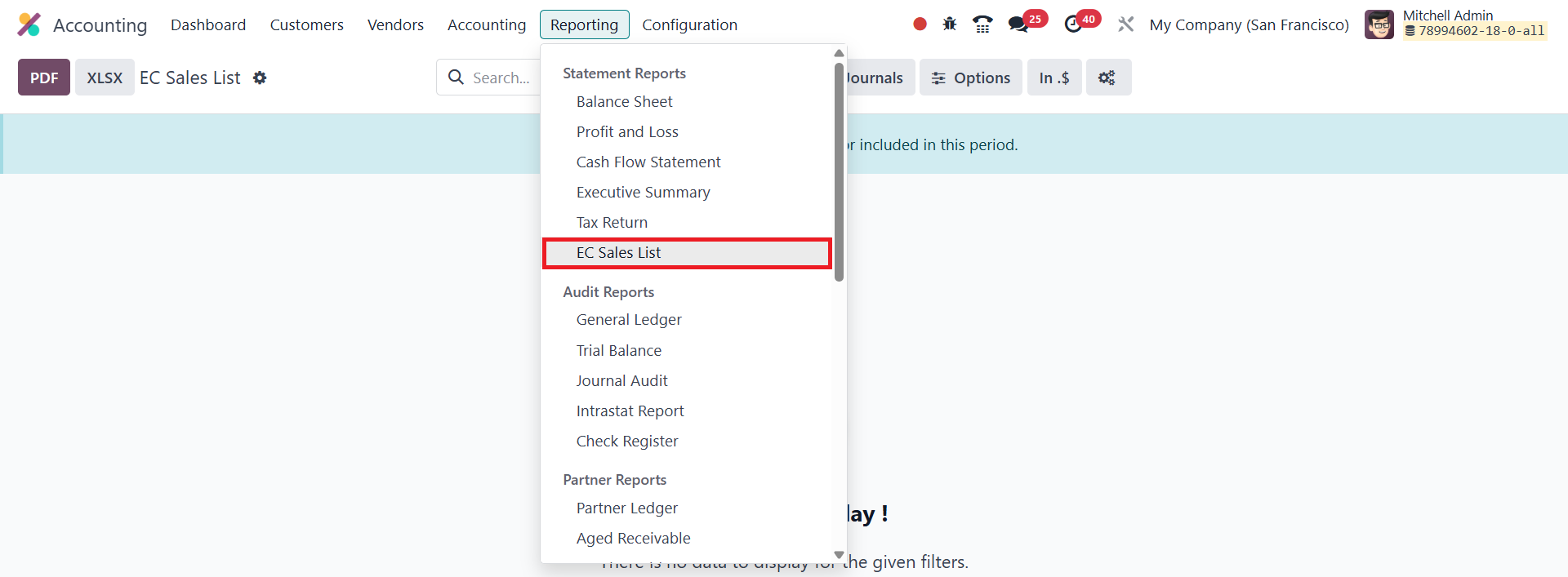

39.6 EC Sales List

In Odoo 18 Accounting, the EC

Sales List (ECSL) is a

reporting tool designed to

track the sales and transfers

of goods and services to

VAT-registered companies in

other EU countries.

This report helps VAT-registered

businesses, particularly in

the UK, meet their reporting

obligations to Her Majesty's

Revenue and Customs (HMRC).

The ECSL provides a clear

overview of sales to EU

companies and is easily

accessible through the

Reporting tab in the Odoo

Accounting module, ensuring

compliance with VAT

regulations.

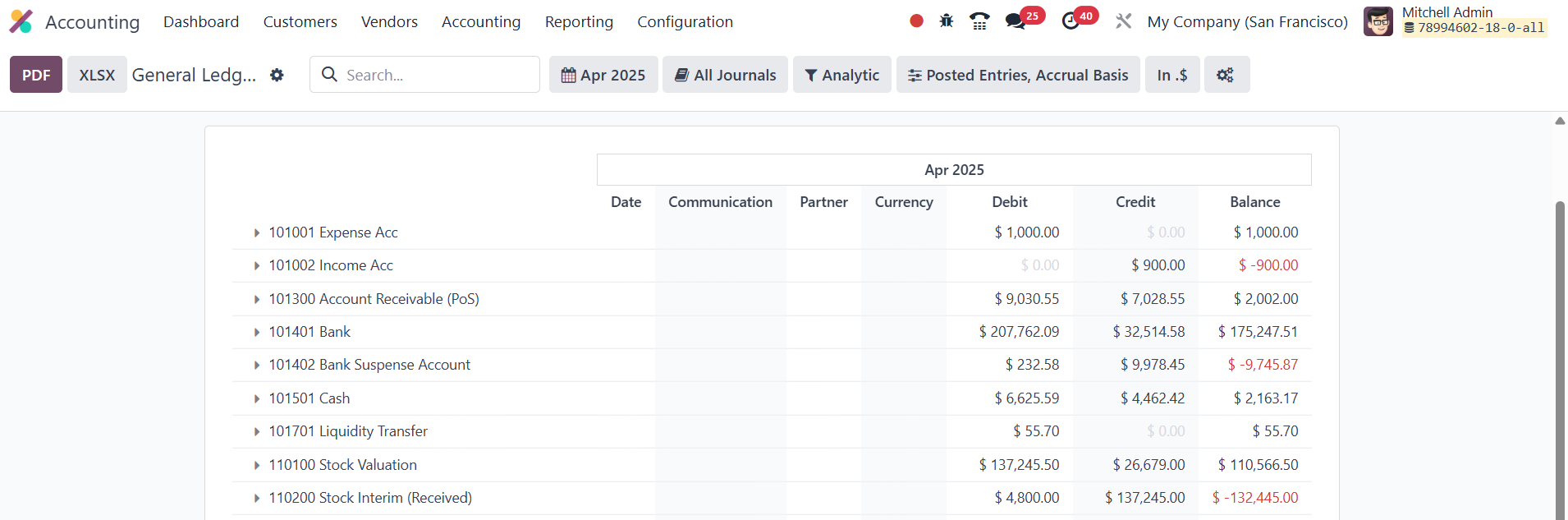

39.7 General Ledger

The General Ledger report in Odoo

provides a comprehensive

overview of all financial

transactions across all

accounts set up in your

system for a selected time

period.

It displays key details such as

the account name, Date,

Communication, Partner,

Currency, Debit, Credit, and

Balance for each transaction.

This report serves as a

complete record of your

organization's financial

activities throughout the

fiscal year, allowing you to

track and analyze all

accounting entries

systematically.

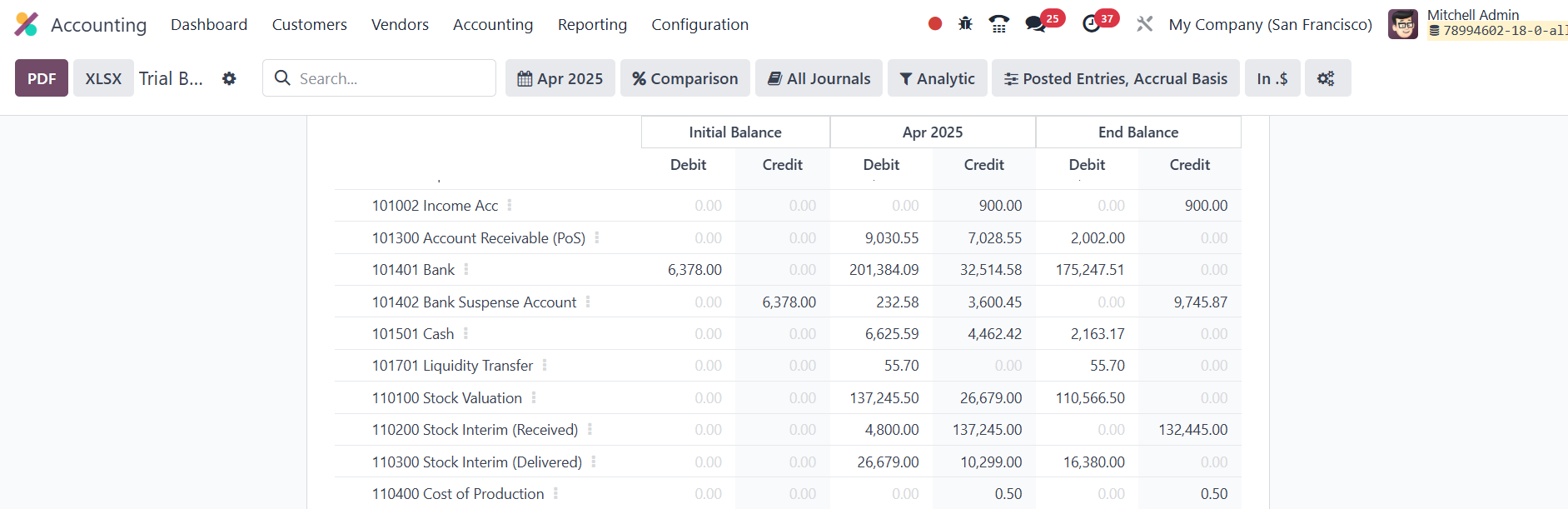

39.8 Trial Balance

The Trial Balance report is an

essential accounting report

that summarizes the outcomes

of all accounting entries

made through various

journals. It is typically

generated at the end of the

organization's financial year

and plays a crucial role in

the auditing process.

The report displays key

information, including the

credit and debit amounts from

the opening balance, the

chosen month/year, and the

final balance of the journal

entries. This provides a

clear picture of the overall

financial position of the

organization, helping ensure

that the books are balanced

and accurate.

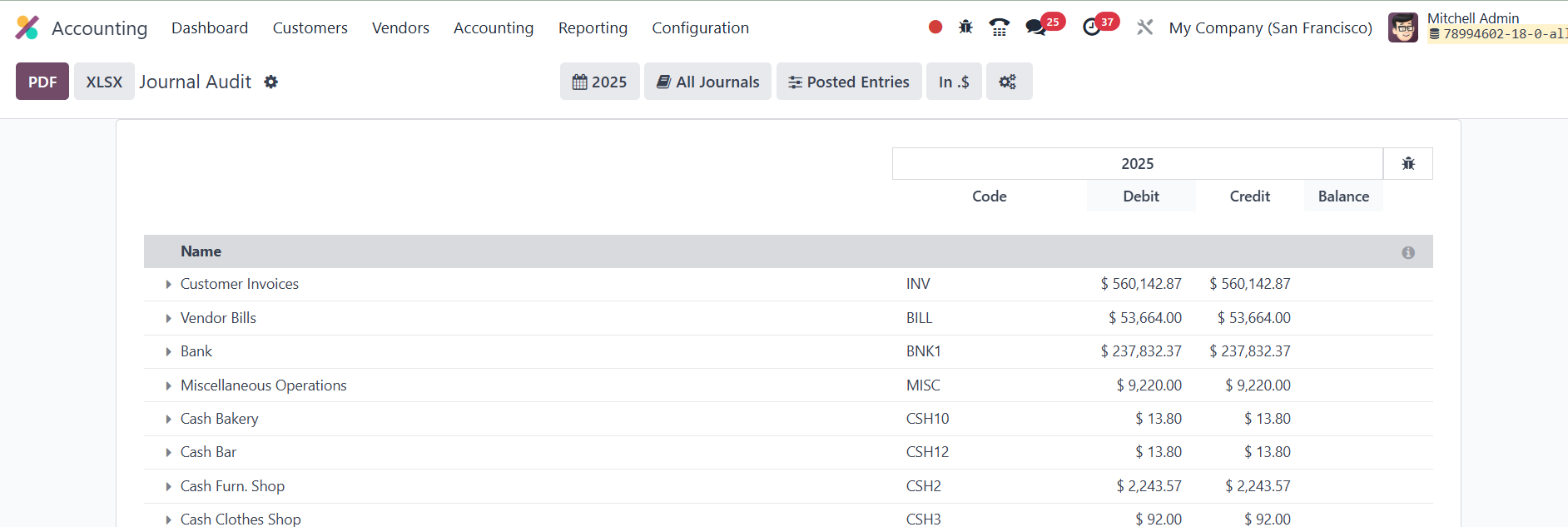

39.9 Journal Audit

The Journal Audit feature lets

you generate detailed

accounting reports for any

journal configured in the

Accounting module.

For each journal, you’ll see a

list of its corresponding

entries; complete with the

entry Name, Code, Debit,

Credit, and Balance, so you

can review activity and

balances at a glance.

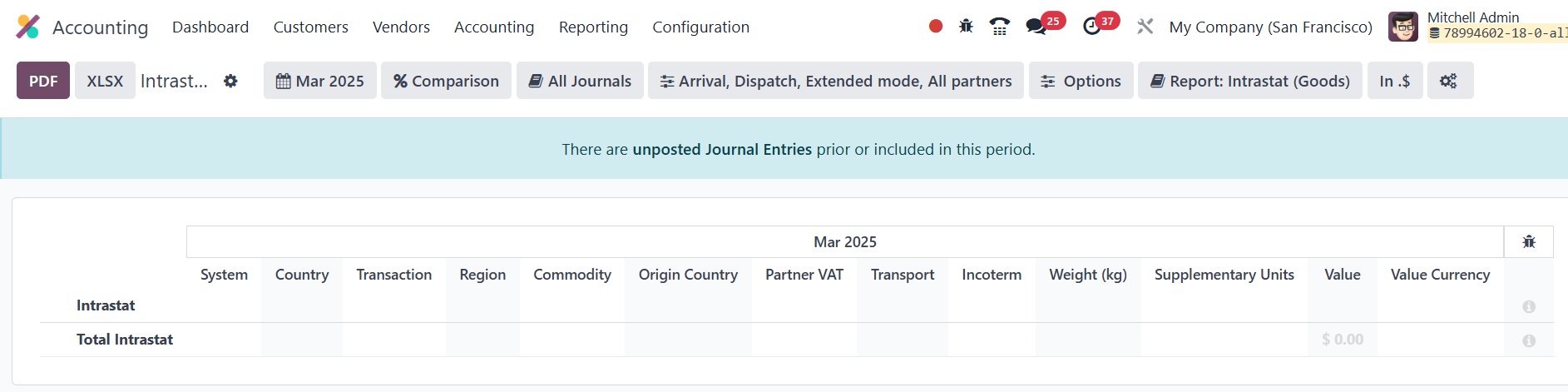

39.10 Intrastat

Report

The Intrastat report records the

movement of goods between EU

member states, helping

businesses comply with EU

trade‑statistics

requirements. In Odoo

Accounting you can access it

from Reporting ▸ Intrastat

Report.

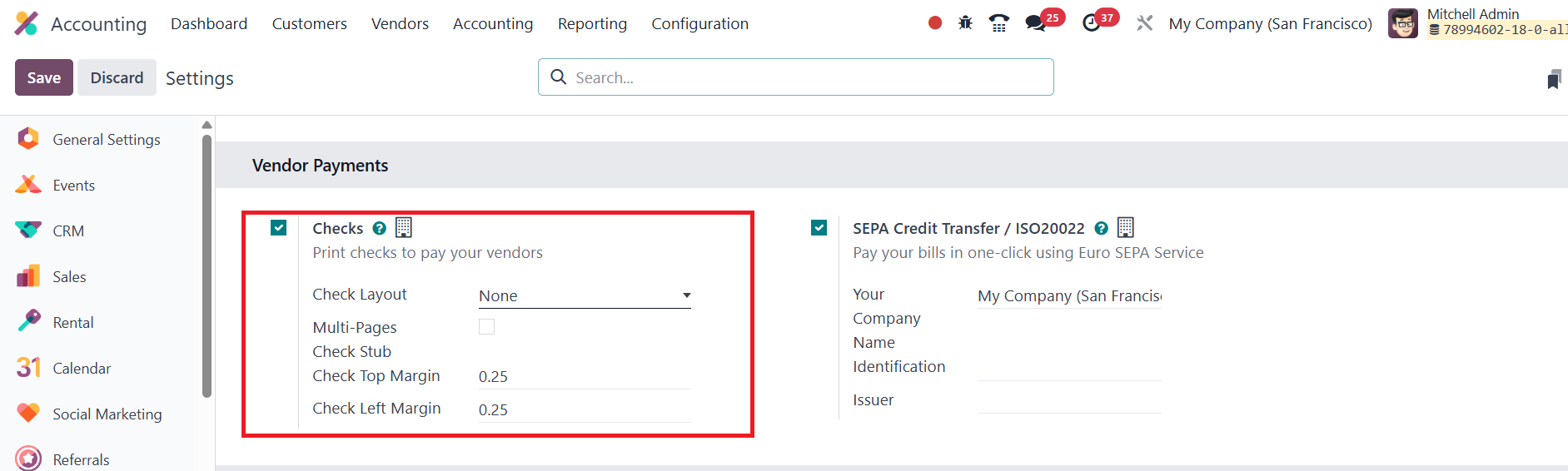

39.11 Check Register

In Odoo 18 Accounting, you can

handle large vendor payments

by issuing and printing

checks once you activate

the Checks feature

in Settings › Accounting ›

Payments.

After enabling it, specify your

preferred checks layout along

with the top and left

margins, then save the

configuration.

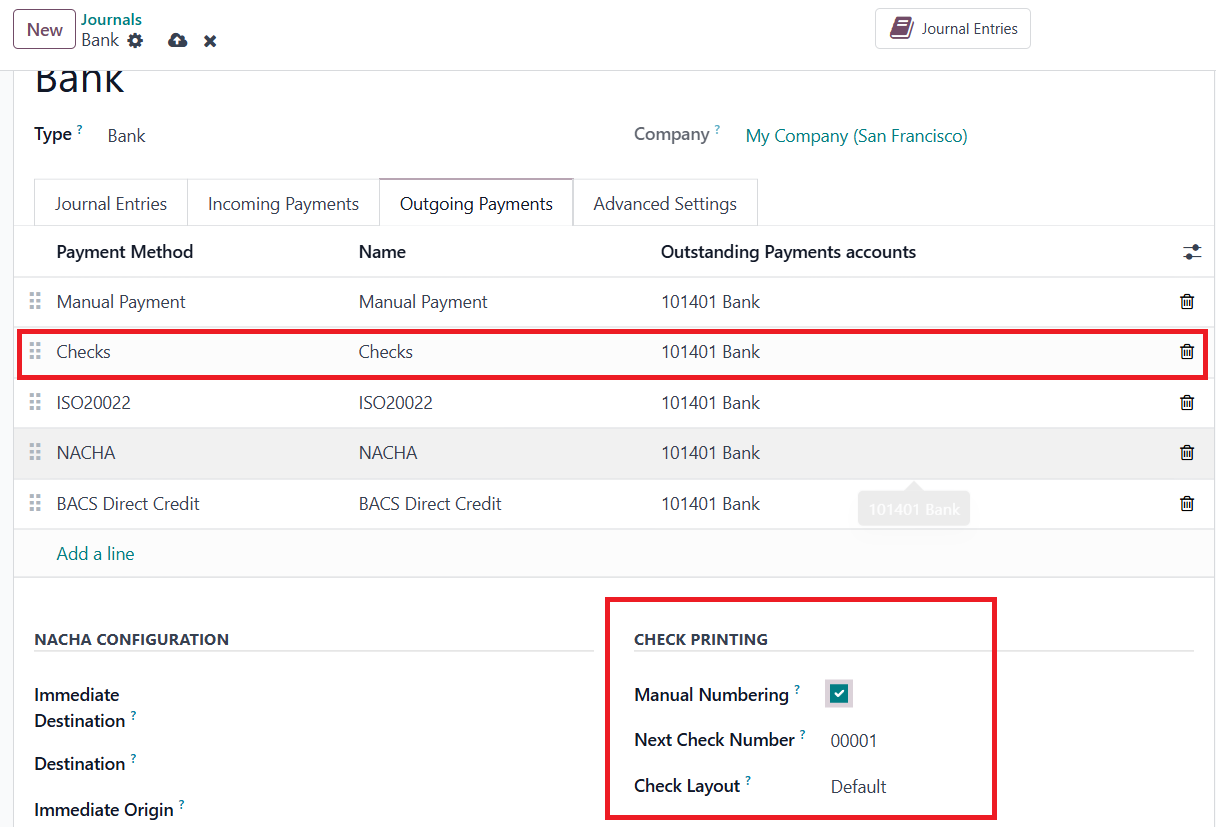

Next, open your relevant bank

journal, switch to the

Outgoing Payments tab, and

add Checks as an available

payment method.

A new Check Printing section

appears at the lower‑right of

the journal form;

enable Manual Numbering there

and enter

the Next Check Number, Odoo

will automatically increment

this number with each new

check.

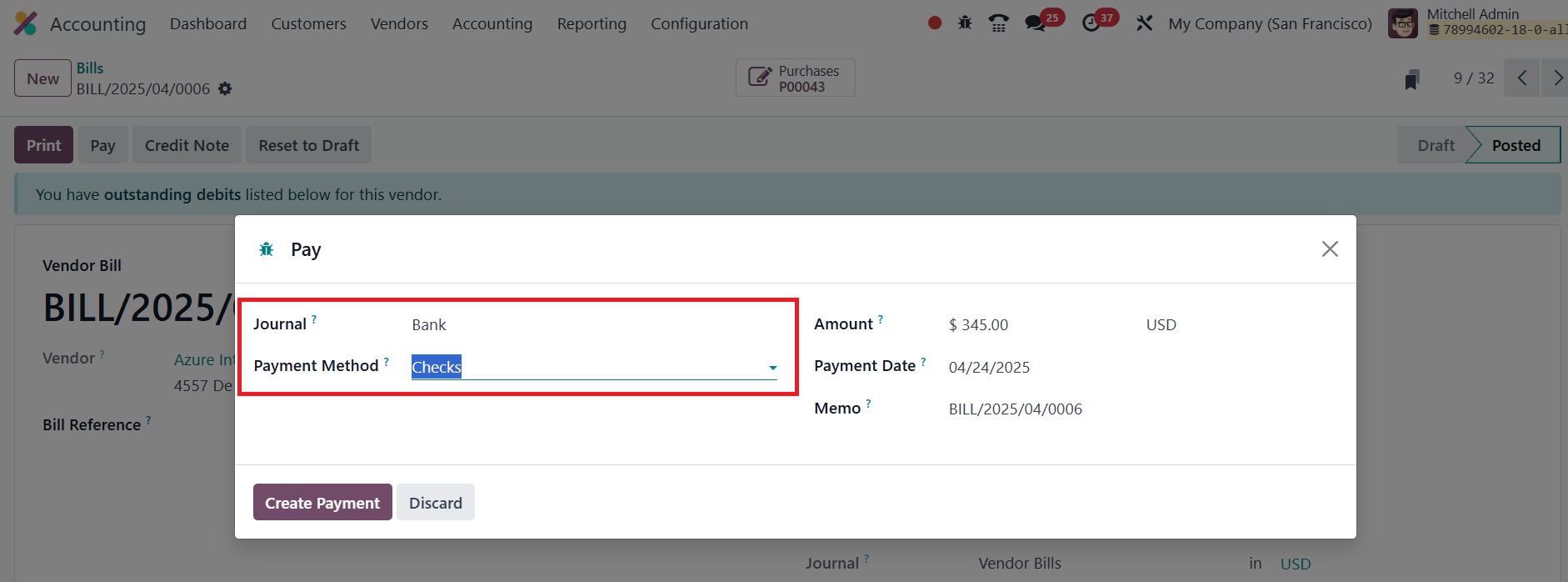

When paying a vendor bill, click

Pay on the bill, choose the

bank journal you configured,

and select Check as the

payment method. After

validating, you can print the

check directly.

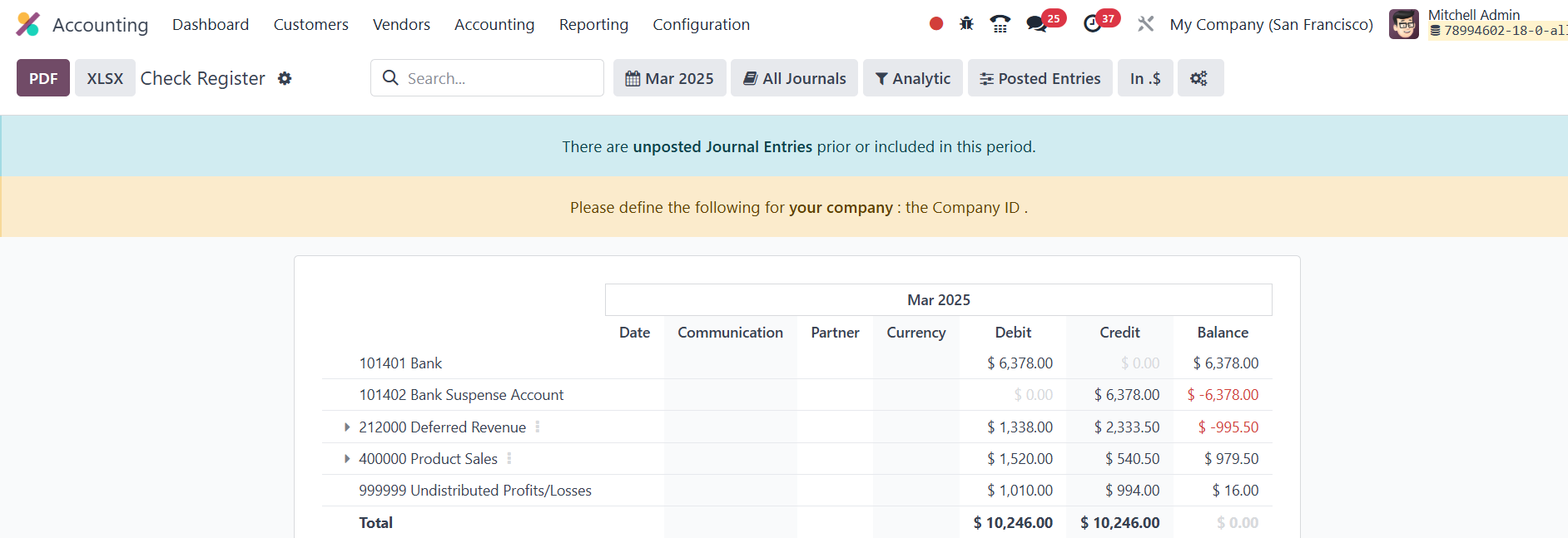

For auditing purposes, go

to Reporting and select Check

Register. This report lists

every check‑based payment,

supports filters for quickly

isolating the data you need,

and can be exported to PDF if

required.

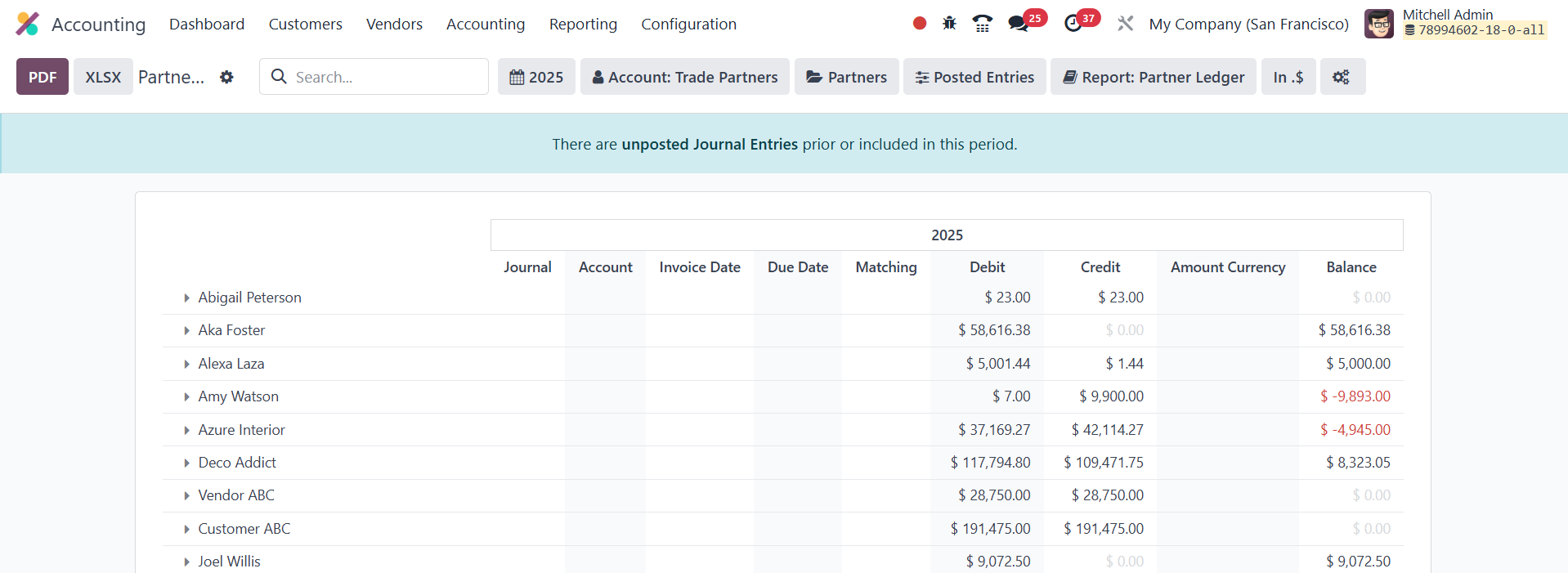

39.12 Partner Ledger

The Partner Ledger report in

Odoo 18 gives you a

consolidated view of every

receivable and payable

journal entry linked to each

partner for a selected

period.

For every partner it lists the

associated journal, account,

internal reference, due date,

matching number, debit,

credit, original amount,

transaction currency, and the

running balance.

39.13

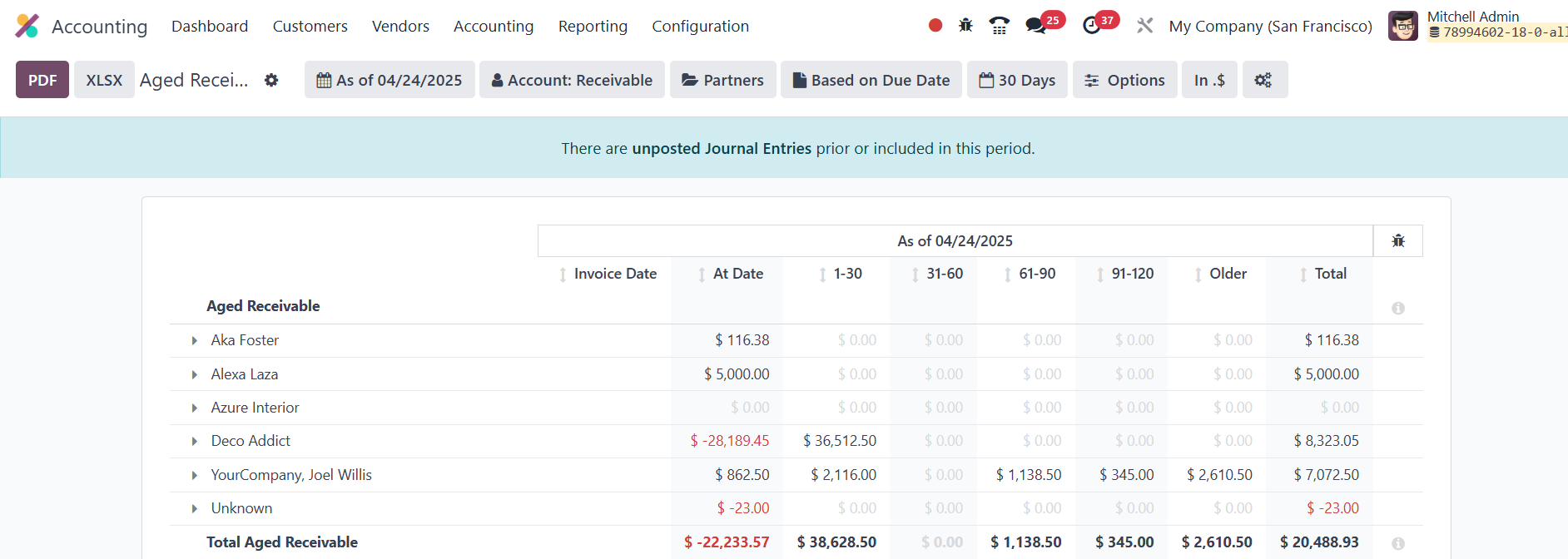

Aged Receivable

In Odoo 18’s Aged Receivable

report, found under the

Reporting, you can instantly

see every customer invoice

that remains unpaid as of a

specific cut‑off date.

The report organises each open

item into ageing buckets

based on the payment terms

you defined, so any invoice

that has drifted past its due

date is flagged as part of

your aged receivables. When

generating reports in Odoo

18, you can choose specific

criteria to filter and refine

your results. Common

filtering options include

Date, which lets you select a

specific month, quarter,

fiscal year, or custom range;

Journal, allowing you to

narrow down entries by the

journal type, such as

customer invoices or vendor

bills; and Partner, which

filters results based on

specific customers or

vendors. Depending on the

type of report, you may also

filter using other fields,

such as product category,

user, or analytic account,

helping you gain more

targeted and insightful

financial data.

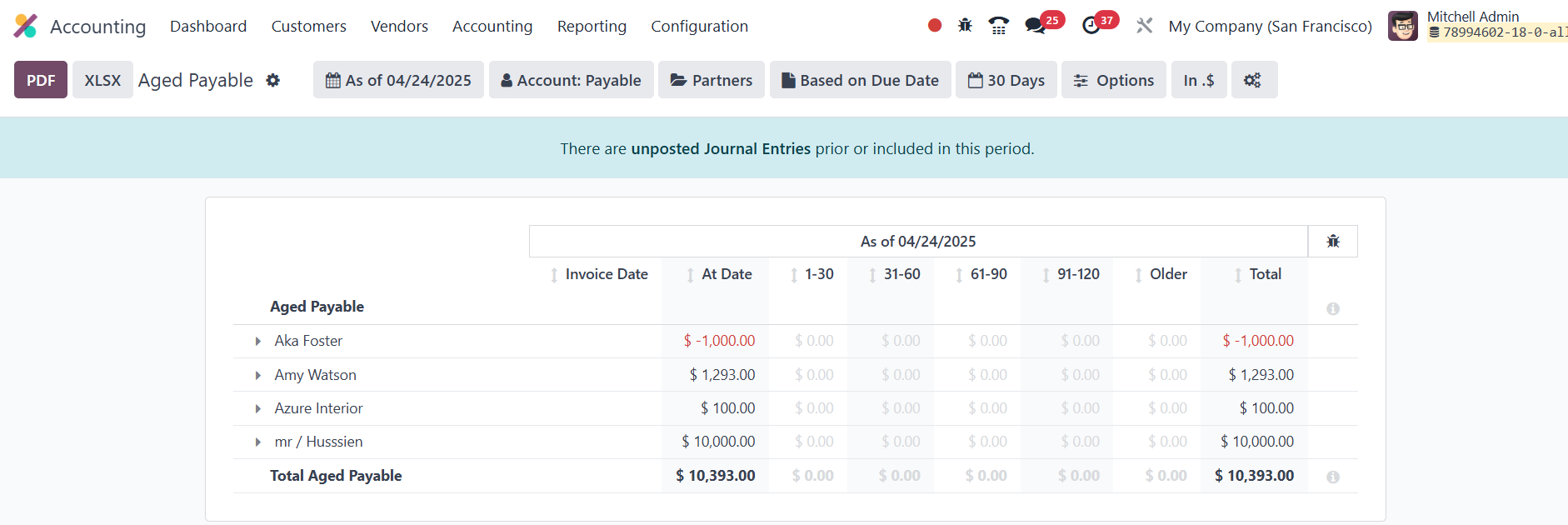

39.14 Aged Payable

The Aged Payable report in

Odoo 18 mirrors the logic of

the Aged Receivable view but

focuses on your company’s

overdue supplier bills.

It lists every vendor invoice

that remained unpaid past its

contractual due date as of

the chosen cut‑off date,

grouping the amounts into

ageing buckets so you can see

how long each liability has

been outstanding.

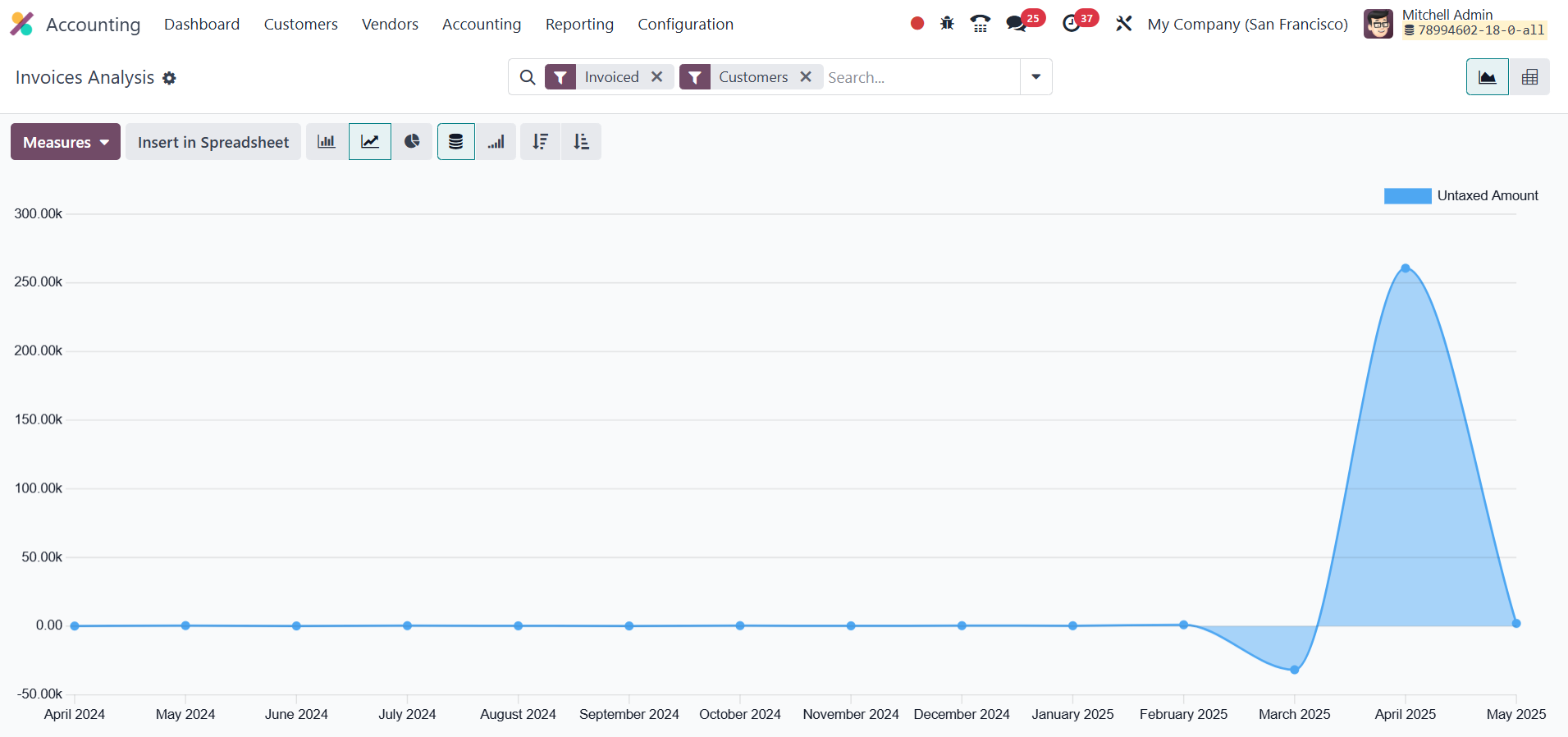

39.15 Invoice

Analysis

In Odoo 18, you can analyze sales

and purchase performance by

opening Reporting ›

Invoice Analysis and

selecting the accounting

period you want to study.

The view can be switched between

dynamic graphs and an

interactive pivot table,

letting you slice data

however you prefer.

Key measures available

include Average Price, Product Quantity, Total, Untaxed Total,

and a simple

transaction Count. Built‑in

filters; such as My Invoice,

To Invoice, Customer, Vendor,

Invoice/Credit Note,

Invoice Date, and Due Date,

let you narrow the dataset

instantly, while the

Customize panel allows you to

add your own fields and

conditions so you can build

bespoke filters for deeper

invoice analysis.

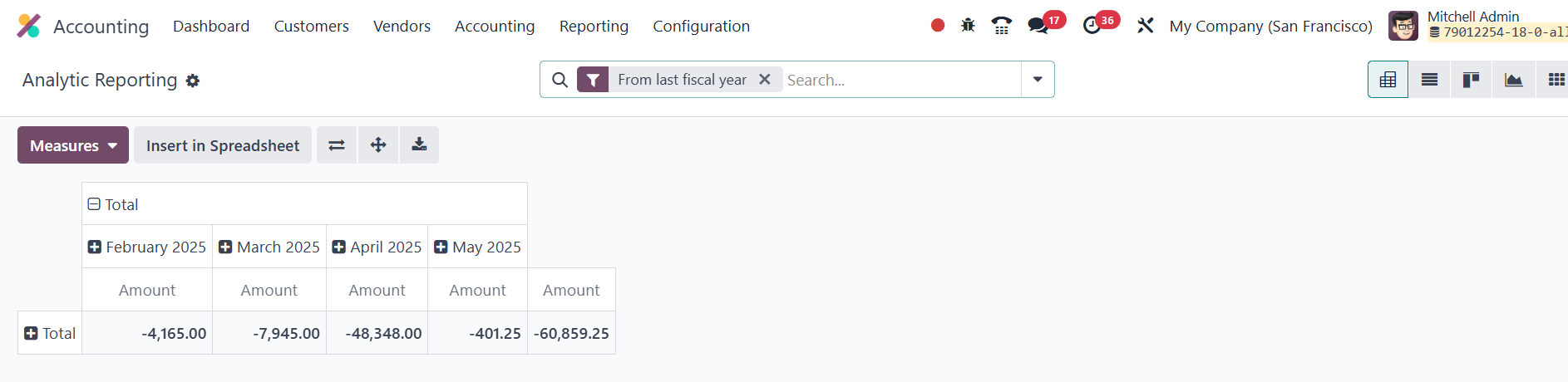

39.16 Analytic

Report

The Analytical Accounting report

in Odoo 18 serves as a

powerful tool for drilling

into your company’s financial

data. By leveraging analytic

accounts and tags, it lets

you interpret costs,

revenues, and margins across

projects, departments, or any

dimension you define in your

chart of accounts.

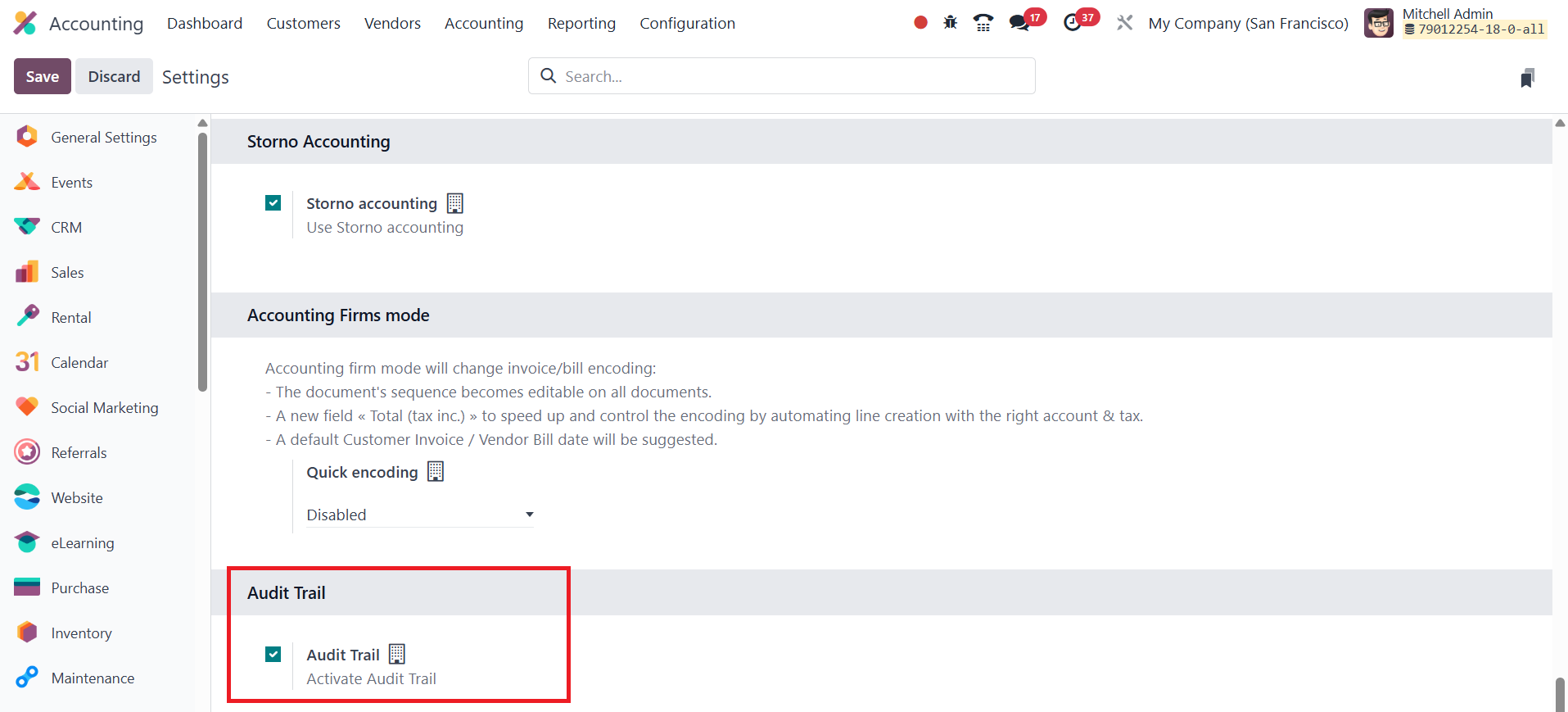

39.17 Audit Trails

Audit trails are vital for

accountability and

transparency: they log every

step of a financial

transaction so auditors can

verify accuracy, spot errors

or fraud, and ensure

compliance. In Odoo 18

Accounting, you can activate

this safeguard by enabling

Audit Trail in Settings ›

Accounting.

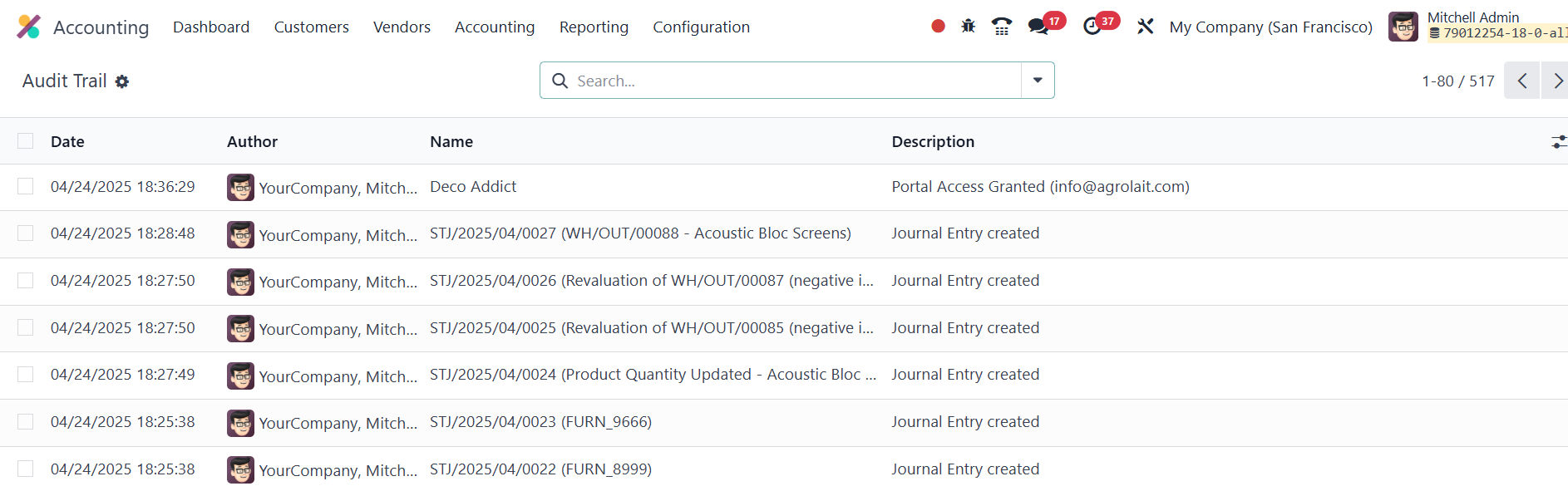

Once turned on, every change a

user makes to an invoice is

timestamped and stored.

Clicking the Audit Trail from

the Reporting menu opens a

detailed ledger that lists

the date of each

modification, the user who

made it, the affected journal

entry, and a concise

description of what changed.

This chronological record lets

auditors trace alterations

easily, bolstering data

integrity and reinforcing

stakeholder confidence in

your financial statements.

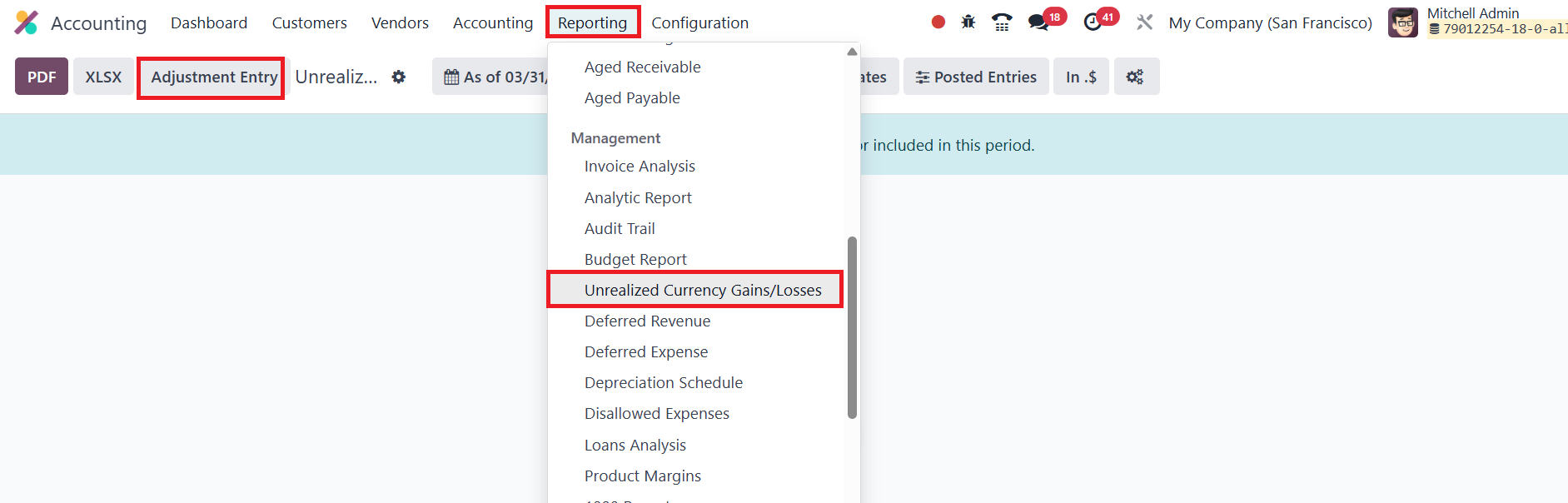

39.18 Unrealized

Currency Gains/Losses

In Odoo 18 Accounting, the

Unrealized Currency

Gains/Losses report under the

Reporting menu provides a

detailed view of all open

accounts on your balance

sheet that need to be

re-evaluated based on the

current exchange rates.

The report is grouped by the

currency used in each account

and displays key information,

such as Balance in Foreign

Currency, Balance at

Operation Rate, Balance at

Current Rate, and the

Adjustment details. If

needed, you can make

adjustments to your entries

using the Adjustment Entry

button.

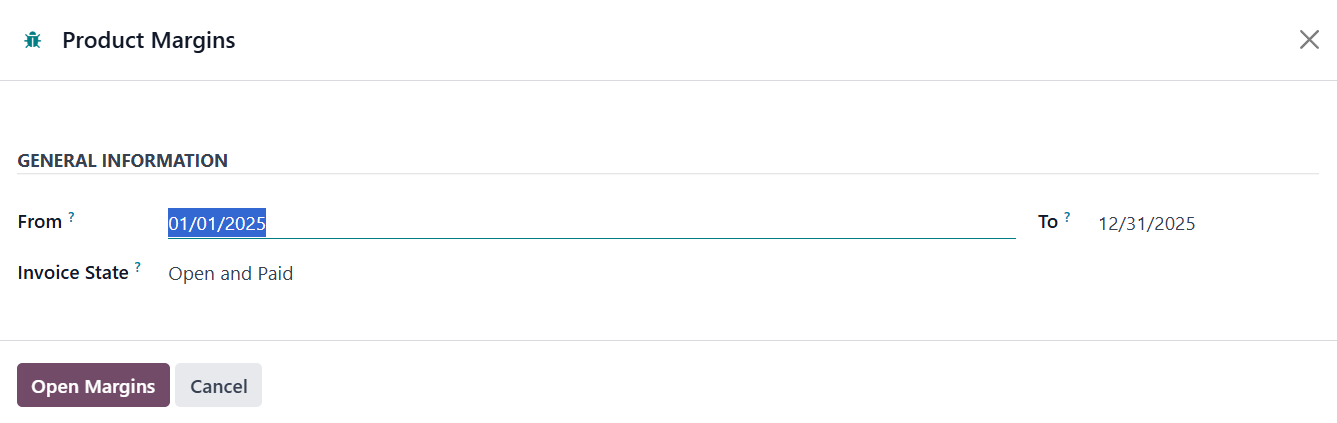

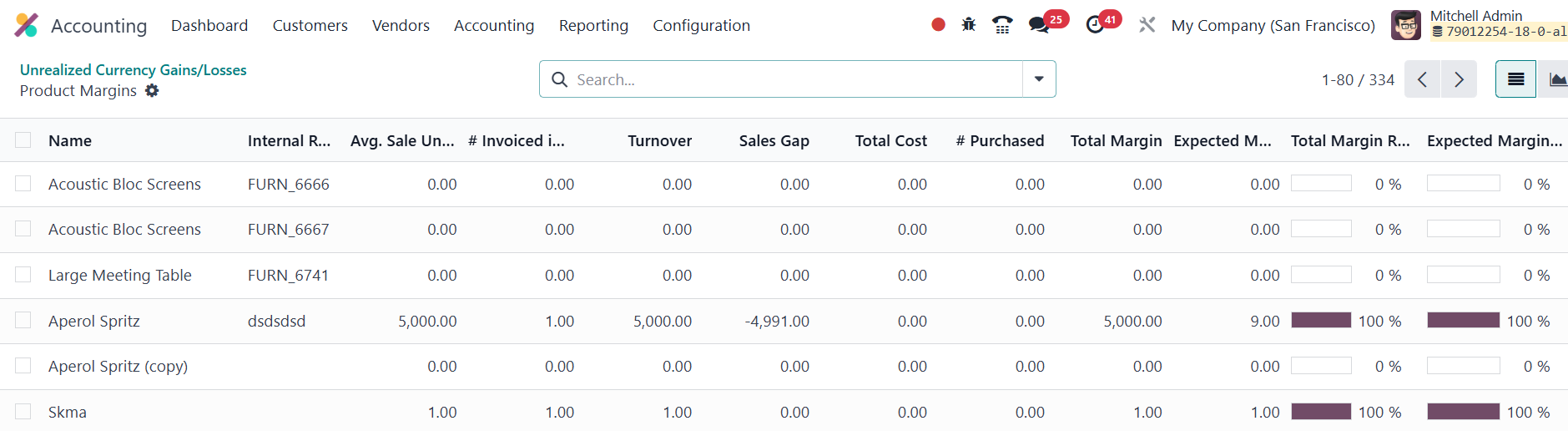

39.19 Product Margin

Odoo 18’s Product Margin report

lets you drill into the

profitability of each item

you sell. Open it

through Reporting ›

Product Margin and enter a

date range; you can also

filter by invoice state to

focus on Paid, Open and Paid,

and Draft, Open, and Paid.

Click Open Margin and Odoo

generates a table that lists

every product alongside its

internal reference, average

selling price, invoiced

quantity, turnover, sales gap

(difference between turnover

and cost), total cost,

purchased quantity, realised

margin, expected margin,

margin rate, and the

percentage variance from the

expected margin.

These metrics give you a clear

snapshot of which products

are driving profit, where

costs may be eroding returns,

and how actual performance

compares to your forecasts.