47. Settings

Odoo 18 offers several

enhancements in the

Accounting module's settings,

offering businesses more

flexibility and control over

their financial processes.

Here are some notable

features:

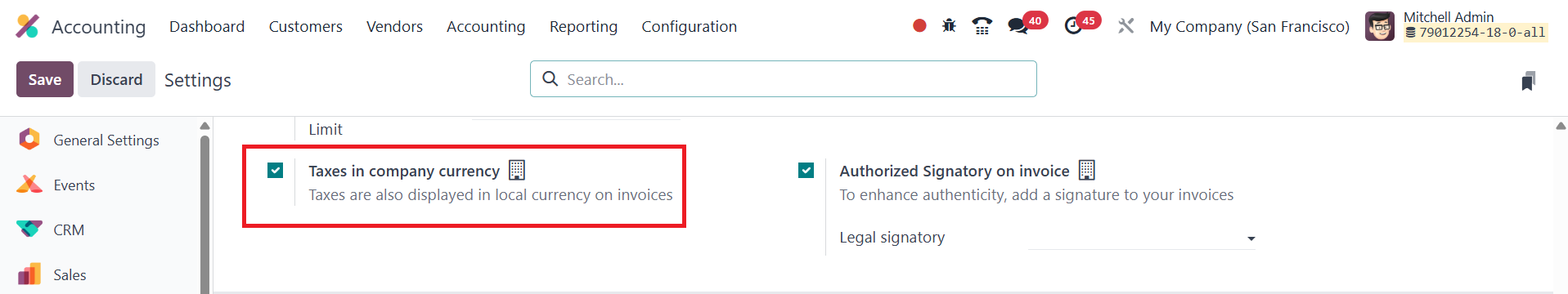

47.1 Taxes in Company

Currency

Odoo 18 introduces a new feature

in the Accounting module that

allows users to configure and

display tax amounts in their

company’s base currency,

regardless of the currency

used in the transaction. This

feature is especially useful

for businesses that operate

internationally or deal with

multiple currencies, as it

helps maintain accurate tax

calculations and simplifies

financial reporting.

To activate this functionality,

users need to navigate to the

Accounting module and open

the Settings menu under the

Configuration tab. In the

Customer Invoices section,

there is an option labeled

Taxes in Company Currency.

Once this option is enabled

and the changes are saved,

Odoo will begin displaying

all tax amounts in the

company's local currency on

invoices, even when the

invoice is created using a

different currency.

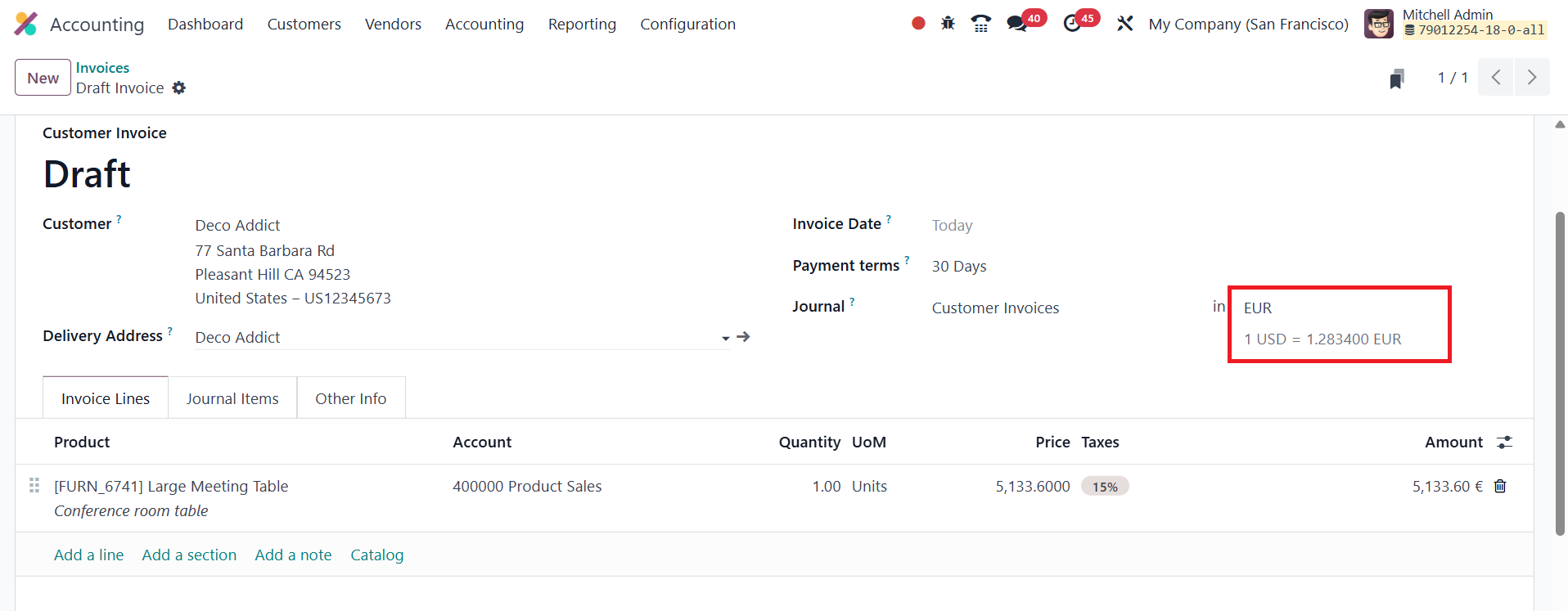

For example, if an invoice is

issued in a foreign currency,

Odoo will automatically

calculate the equivalent

amount in the company’s

currency and display the tax

values accordingly.

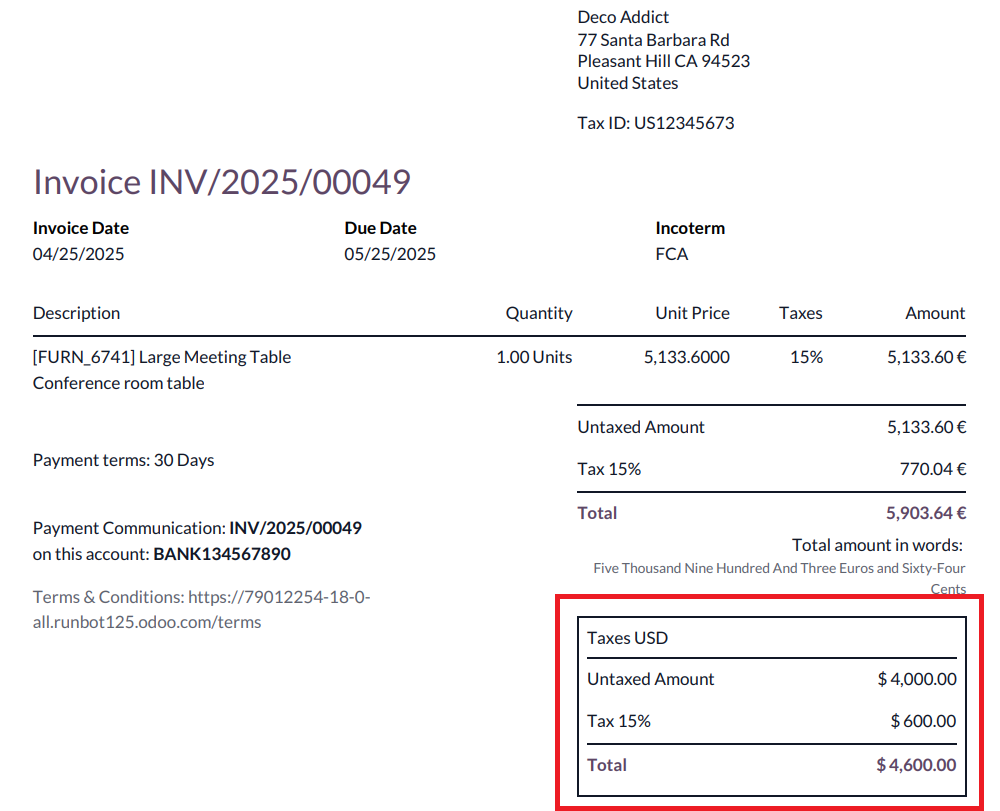

After confirming the invoice,

users can click the Print

button to generate the

invoice document.

The tax amount will then be

visible in the company’s

currency, such as USD, under

the Taxes USD section. This

feature brings added

transparency and consistency

to multi-currency

transactions, supporting more

reliable tax documentation

and financial oversight.

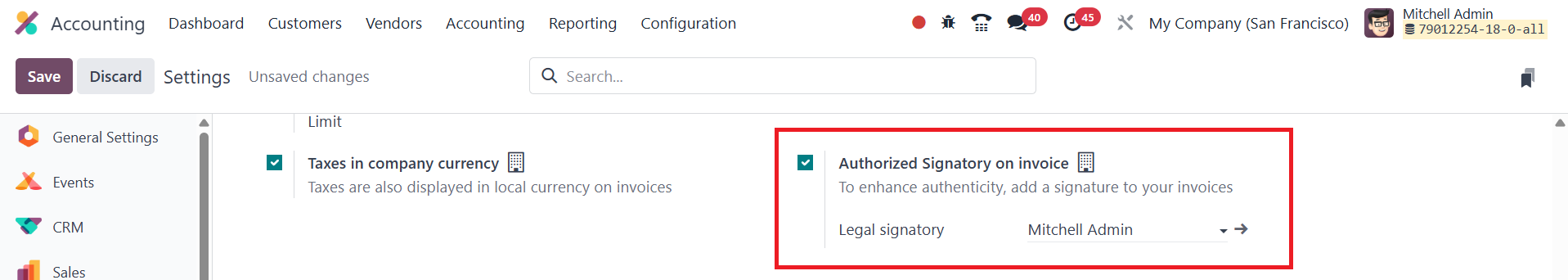

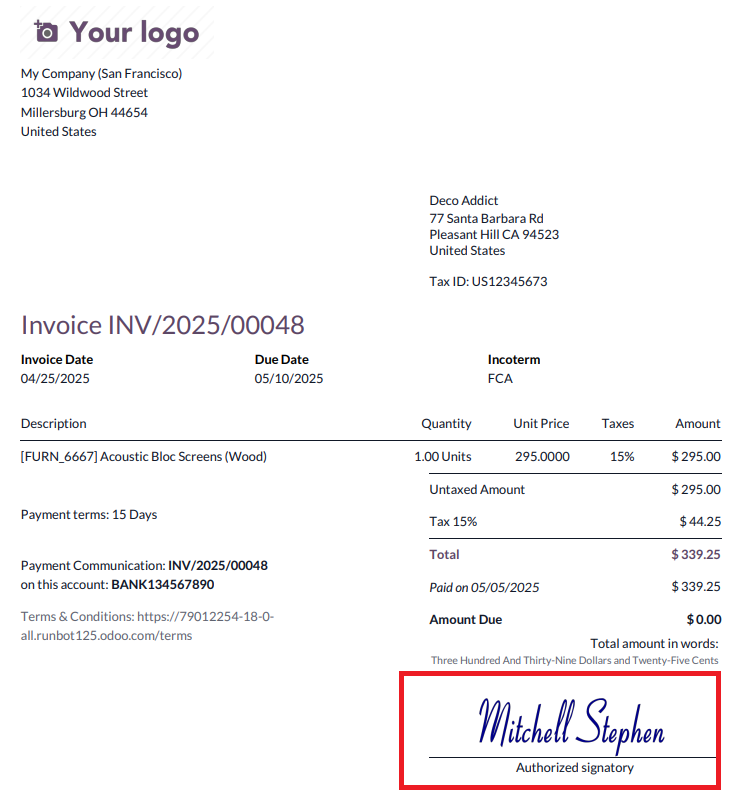

47.2 Authorized Signatory on

Invoice

In Odoo 18, adding an authorized

signatory to invoices is a

valuable feature that

enhances the authenticity and

legal validity of financial

documents. This setup can be

easily managed through the

Accounting module. To begin,

navigate to the Configuration

Settings and locate the

Customer Invoices section.

Here, you’ll find the option

to enable the authorized

signatory feature.

Once this feature is activated, a

dedicated field labeled Legal

Signatory becomes available.

You can use this field to

assign an authorized

individual as the official

signatory for your invoices.

After selecting the

appropriate user, their name

and associated digital

signature (if configured)

will appear on all outgoing

invoices.

This feature not only helps

reinforce the professional

appearance of invoices but

also supports compliance with

business and legal standards,

especially in organizations

where approval hierarchies

are crucial.

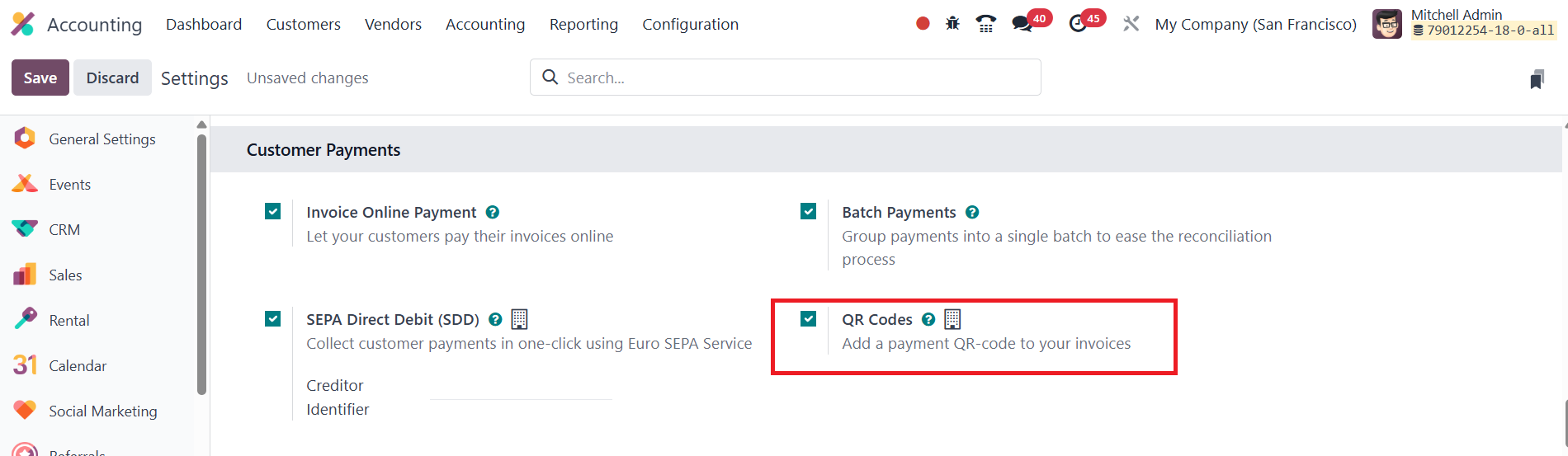

47.3 QR Codes

QR codes in an e-invoicing system

provide a quick and efficient

way to access invoice

details, eliminating the need

for external references. Odoo

simplifies this process by

introducing the ability to

include payment QR codes on

invoices. This feature,

available in the Odoo 18

Accounting module, enables

businesses to offer clients a

seamless payment experience

by incorporating a QR code

directly on the invoice.

To set up payment QR codes in

Odoo 18, begin by navigating

to the Configuration menu and

selecting Settings within the

Accounting module. From

there, activate the QR Codes

feature under the Customer

Payments tab, and be sure to

save your changes. Once this

is done, you can choose the

type of QR code you wish to

generate for payment in the

Other Info section of the

invoice.

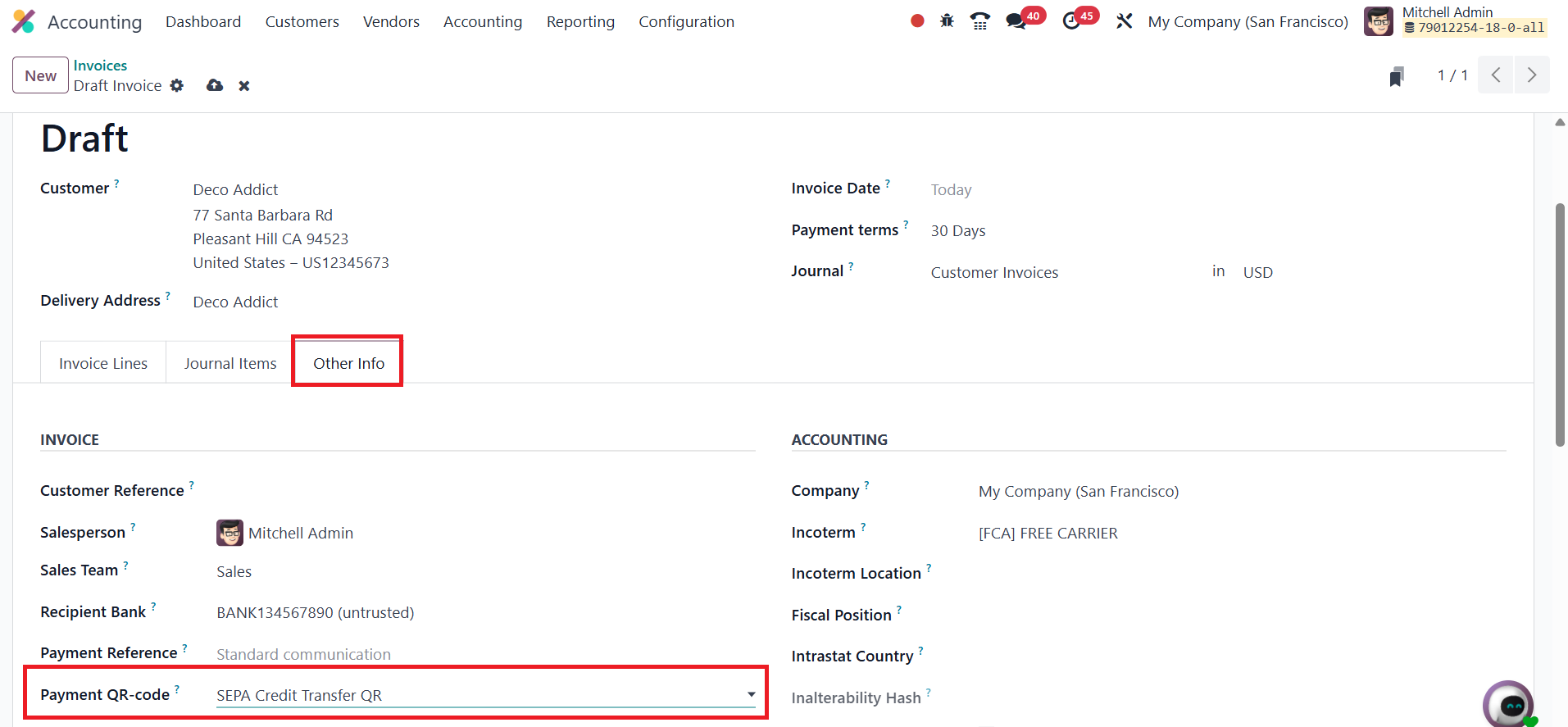

In this section, you will find

the Payment QR-Code field,

where you can specify the

kind of QR code to use. After

entering all the necessary

details, confirm the invoice

by hitting the Confirm

button. Clicking the Preview

button will open a preview

that includes the payment QR

code, allowing your clients

to easily scan and make

payments directly from the

invoice, streamlining the

payment process for both

businesses and customers.

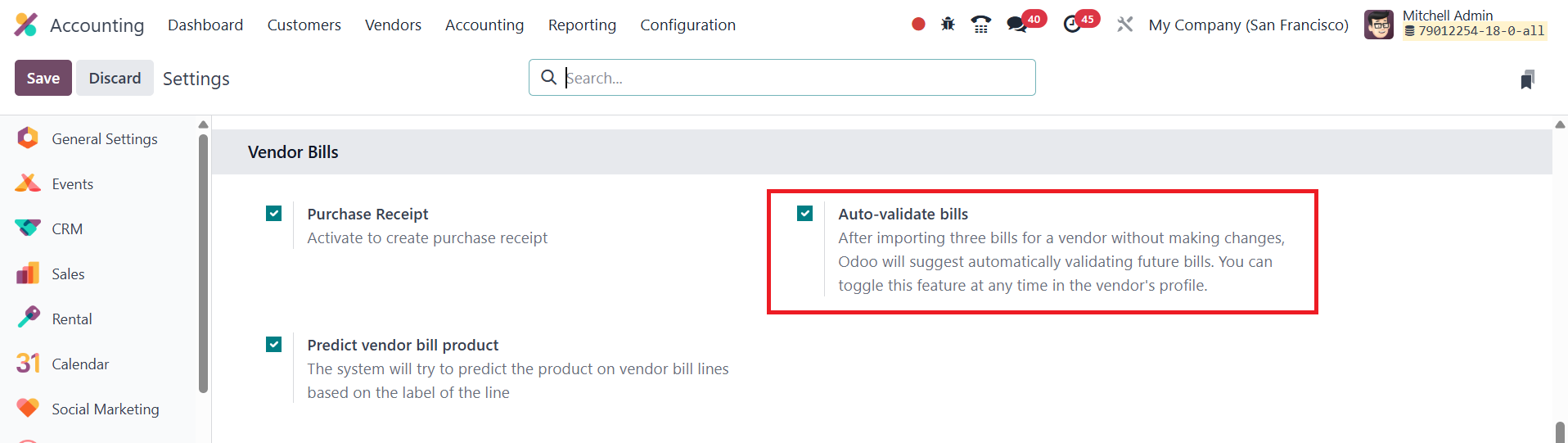

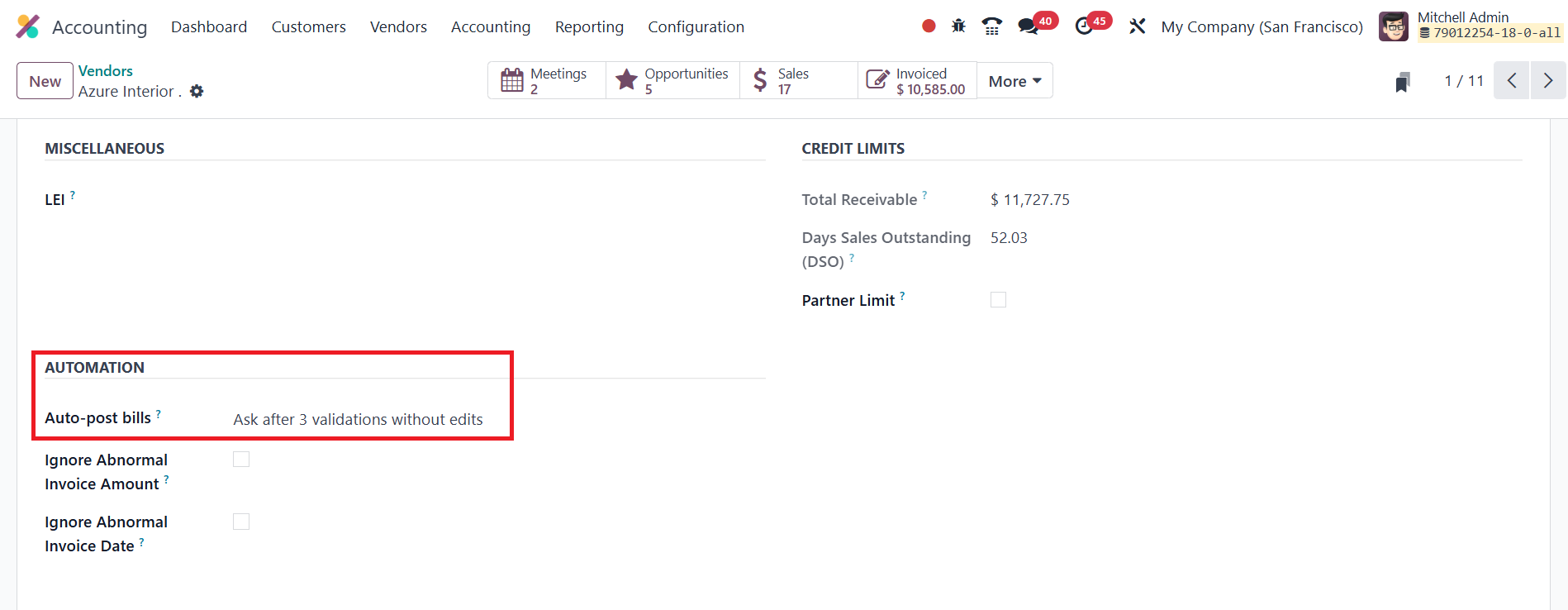

47.4 Auto-Validate Bills

The Auto-validate Bills feature

in Odoo simplifies the

billing process by

automatically validating

vendor bills after they have

been imported, as long as no

changes are made to the bill.

Once you've imported three

bills for a specific vendor

without any modifications,

Odoo will suggest enabling

the automatic validation for

future bills from that

vendor.

This feature can be toggled on or

off at any time in the

vendor’s profile, allowing

businesses to maintain

control over their billing

process while also benefiting

from the convenience of

automated bill validation.

This streamlines workflows,

reduces manual oversight, and

ensures that bills are

processed efficiently without

unnecessary delays.

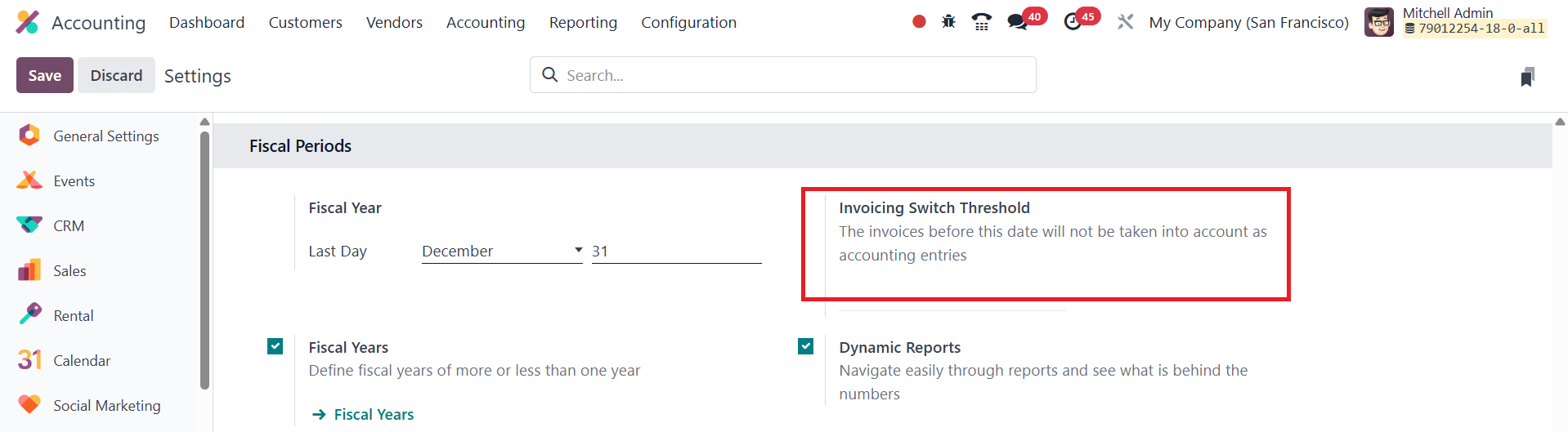

47.5 Invoicing Switch

Threshold

The Invoicing Switch Threshold in

Odoo 18 is an important

feature within the Accounting

module that allows businesses

to set a specific date to

control the inclusion of

invoices in accounting

entries.

Once this threshold date is

defined, any invoices created

before it will not be

considered for accounting

entries, providing greater

flexibility in managing and

organizing financial data.

This option is particularly

useful for businesses that

want to streamline their

accounting processes and

ensure that only invoices

from a certain date forward

are included in the financial

records.

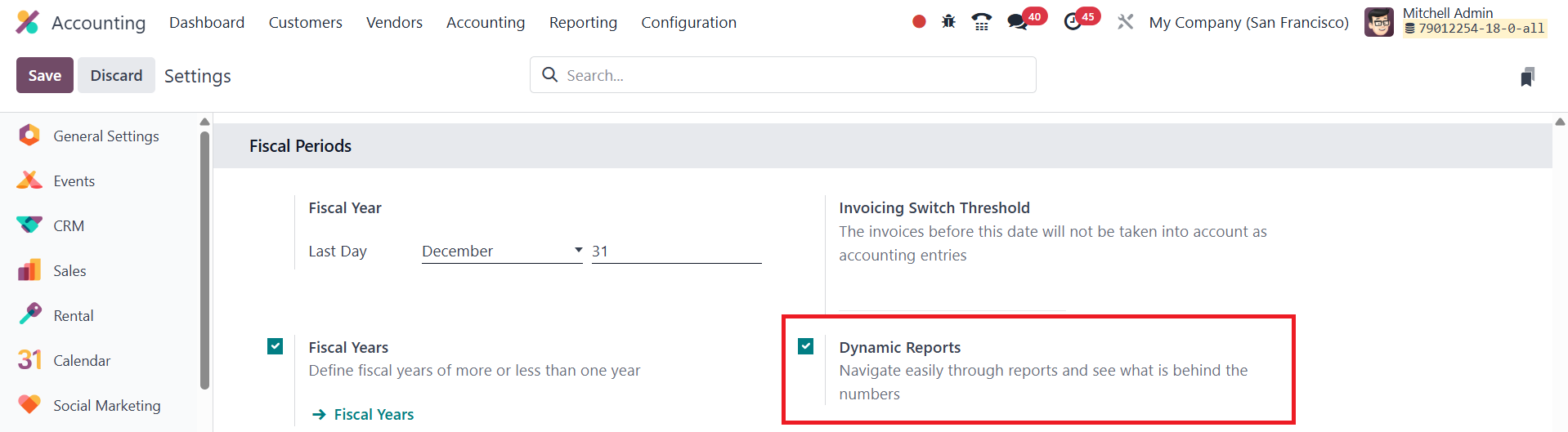

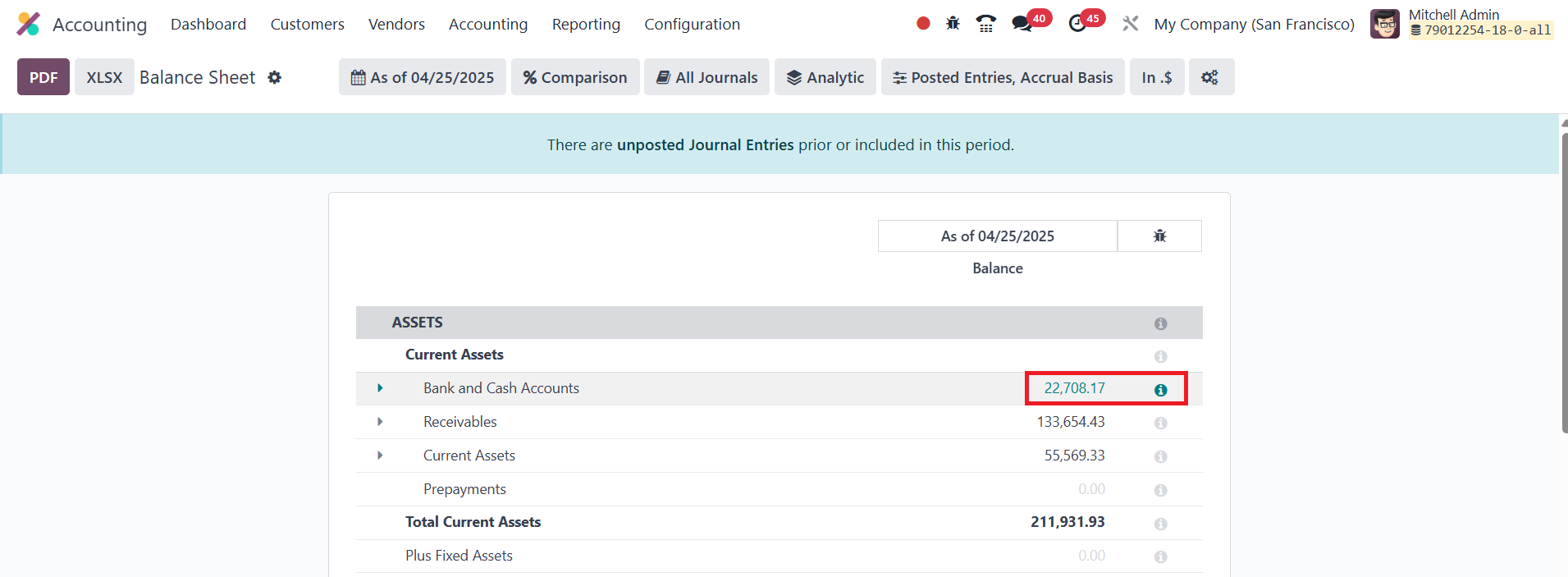

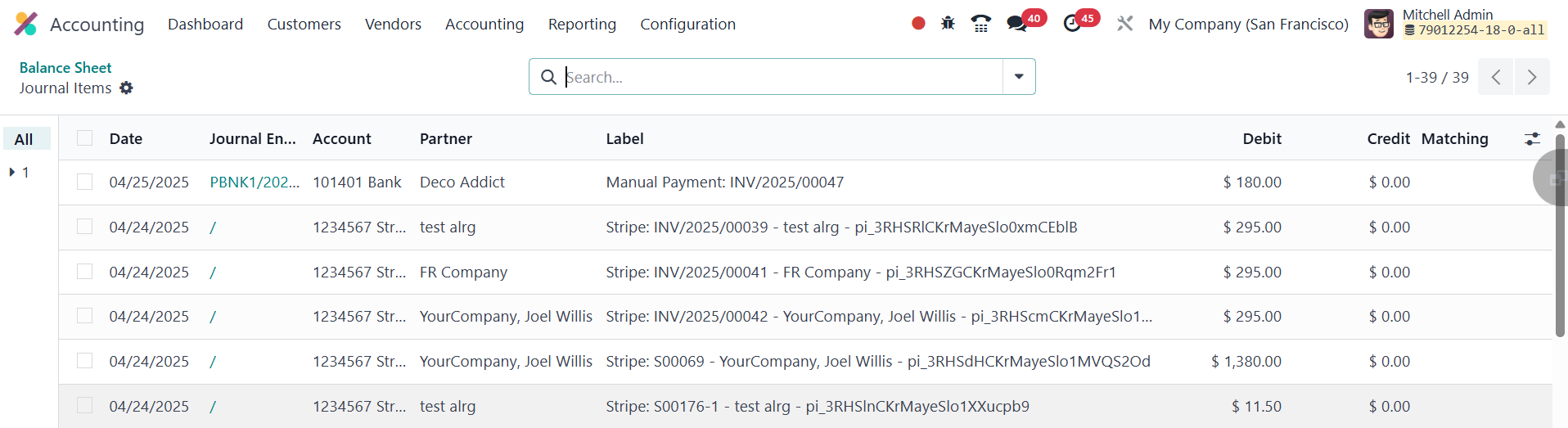

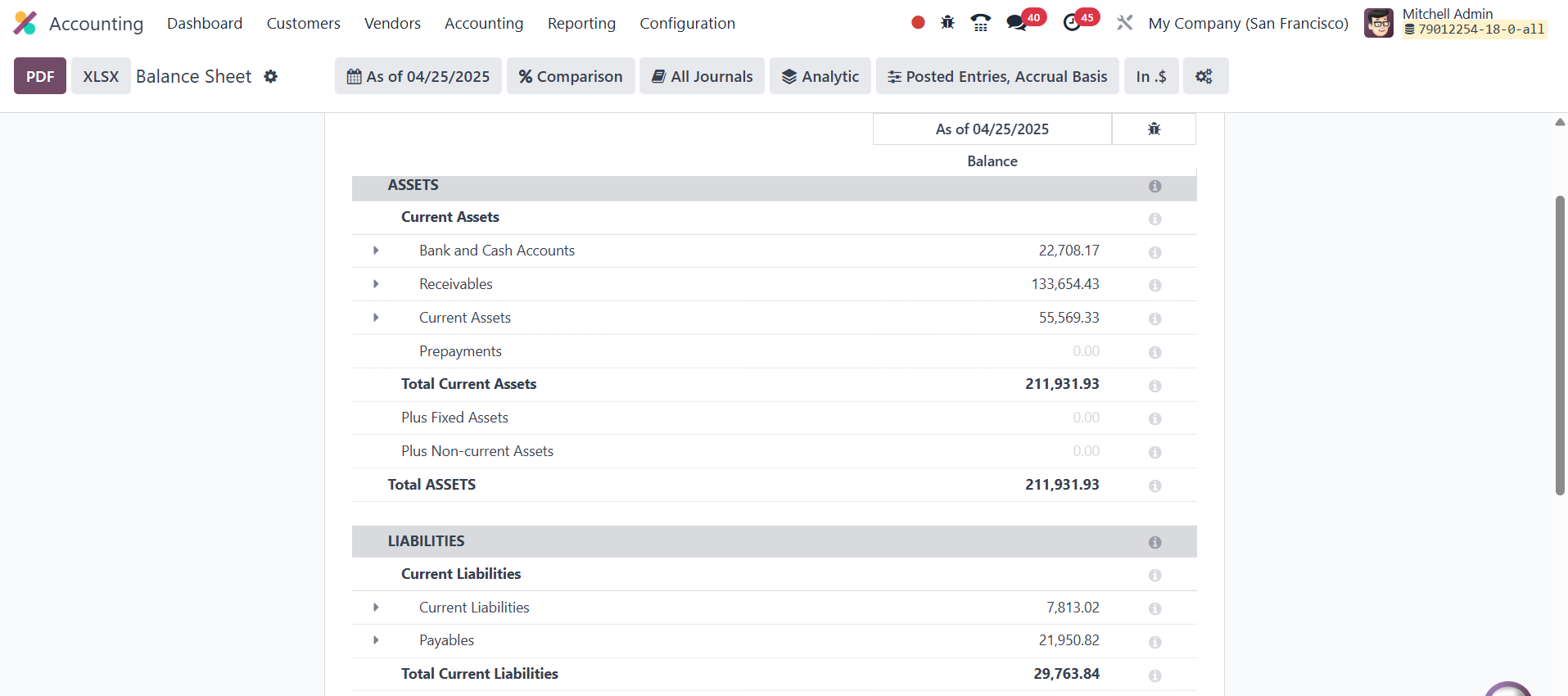

47.6 Dynamic Reports

In Odoo 18 Accounting, the

Dynamic Reports feature

allows users to easily

navigate through reports and

gain a deeper understanding

of the data behind the

numbers.

Once this option is enabled under

the Fiscal Period section in

the Settings, users can

quickly access the underlying

journal entries by selecting

the values within the

reports.

This functionality simplifies the

process of drilling down into

the details, helping users to

view and verify the exact

journal entries associated

with any figure shown in the

report.

By clicking on a value in the

report, users are directly

linked to the corresponding

journal entries, making it

more efficient to trace the

source of the data and

ensuring greater transparency

in financial reporting.

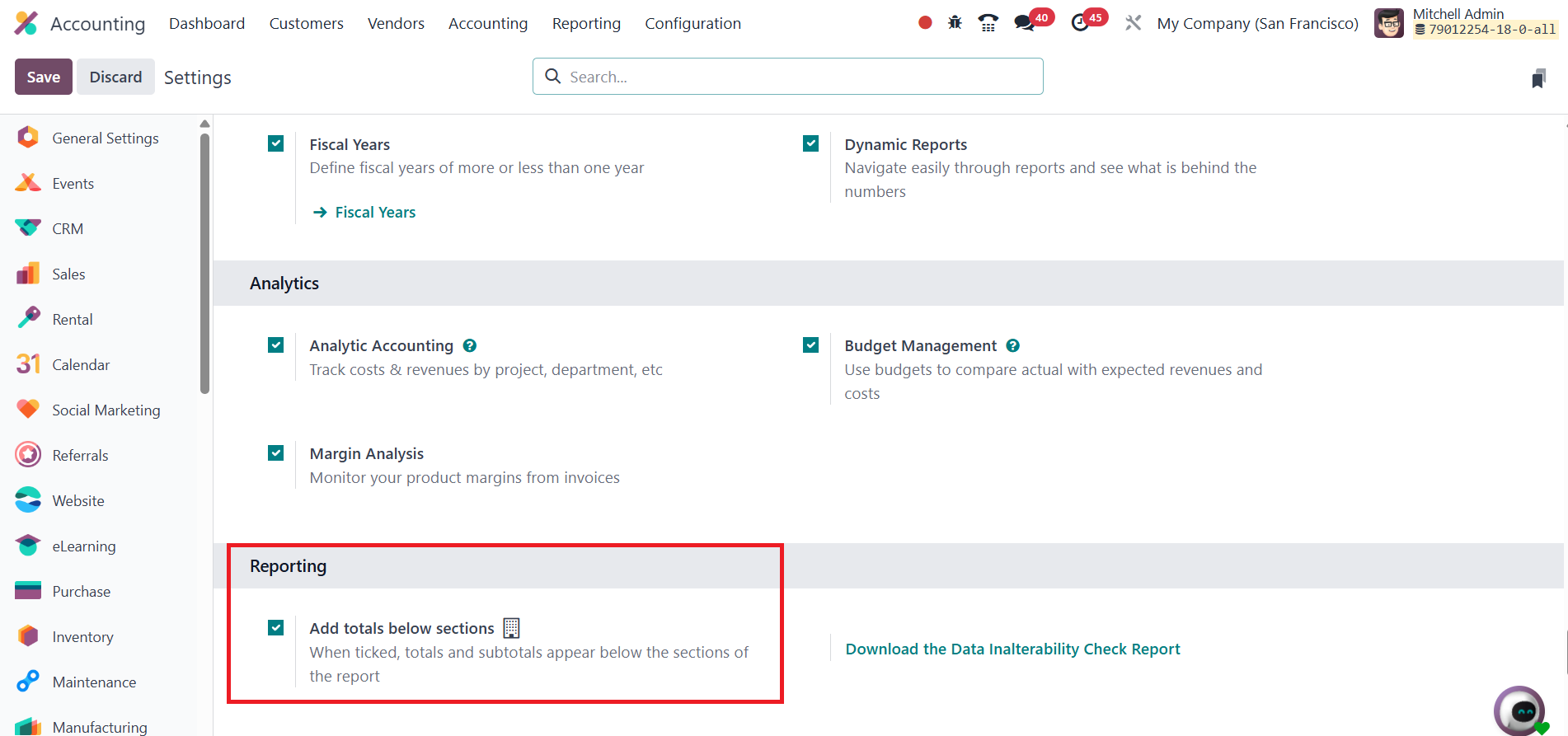

47.7 Add Totals Below

Sections

In Odoo 18 Accounting, the Add

Totals Below Sections option

allows users to display

totals and subtotals at the

bottom of each section within

financial reports. When this

option is enabled, it

provides a clearer breakdown

of the figures by adding

summations of the values for

each section, improving the

readability and

comprehensibility of the

reports.

This feature is especially useful

for users who need to quickly

assess the overall totals for

specific categories, helping

them to better analyze the

financial data and make

informed decisions.

By ticking this option, users can

ensure that important

financial summaries are

readily accessible at the end

of each report section.

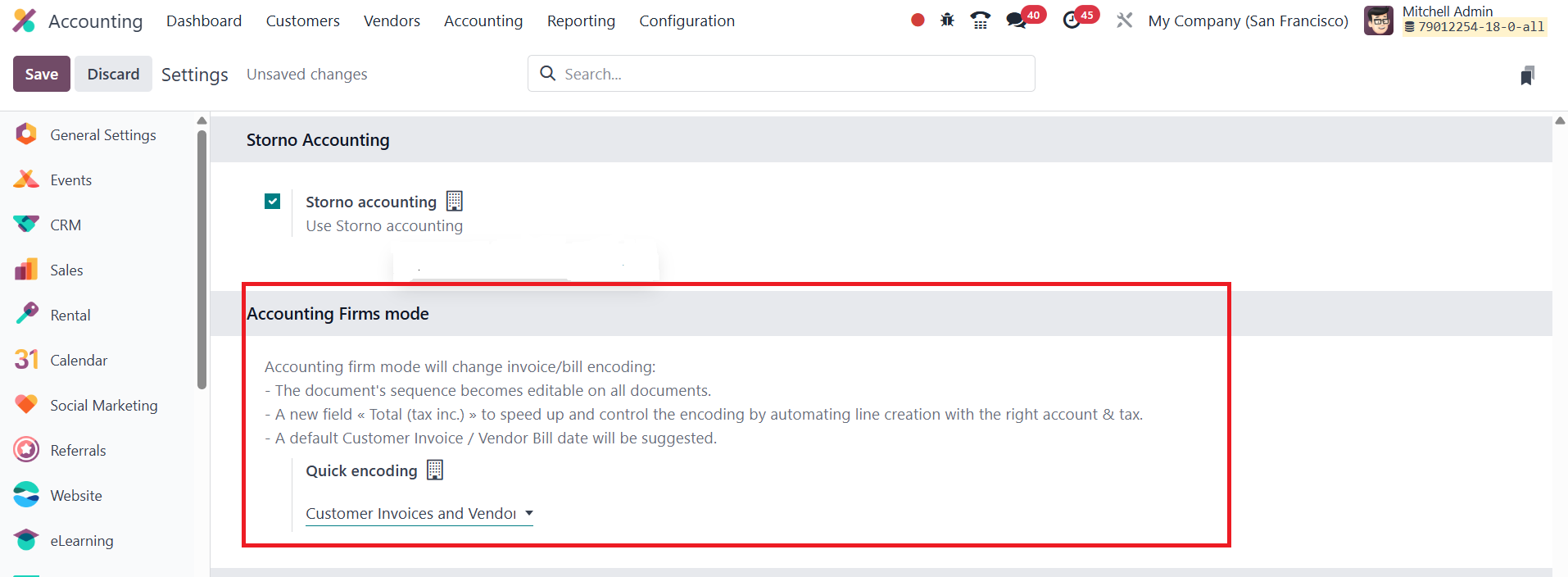

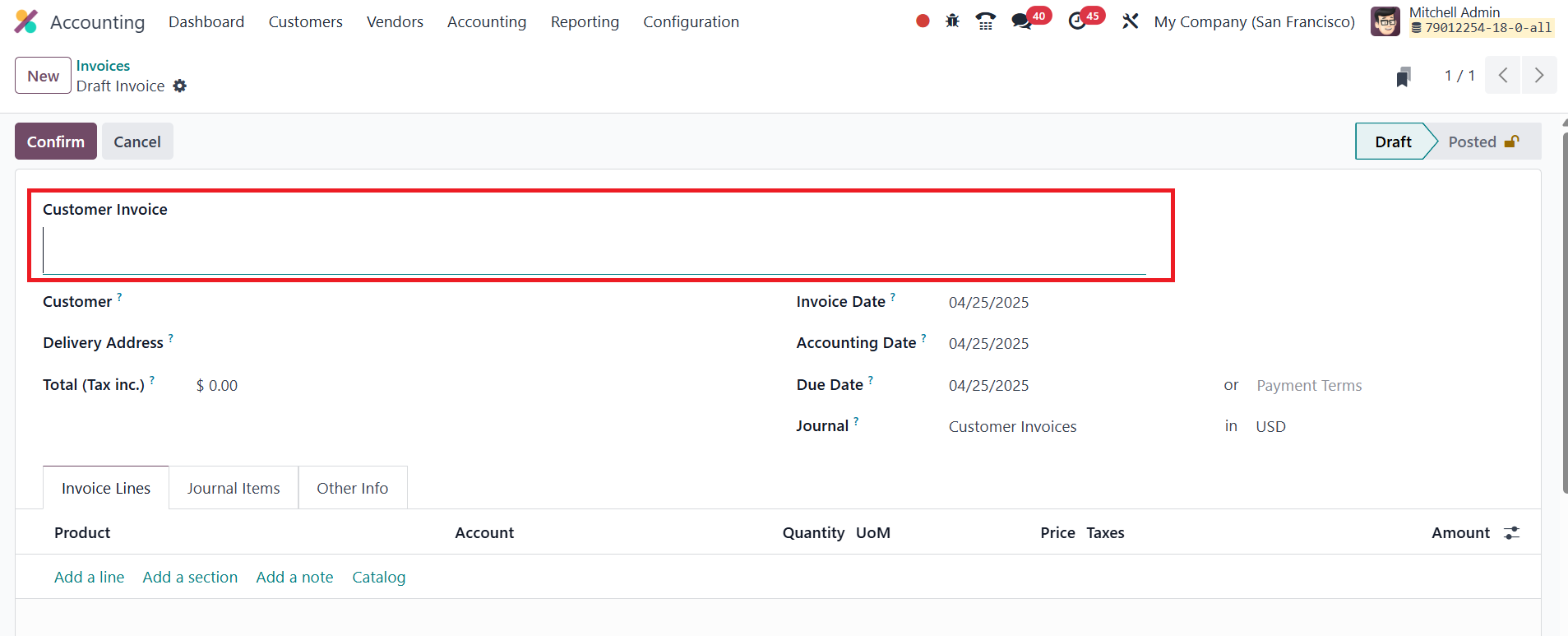

47.8 Accounting Firms Mode

The Odoo 18 offers the Accounting

Firm Mode, which is designed

to streamline and enhance the

invoice and bill encoding

process.

It is available in the Settings

menu of the Odoo Accounting

module. This feature is

beneficial for users who need

to modify invoice or bill

details more efficiently.

When activated, Accounting

Firm Mode provides several

key enhancements. First,

users can modify the sequence

number of invoices and bills,

allowing for better tracking

and organization of

documents. Additionally, the

default date for vendor bills

or customer invoices is

automatically recommended,

which eliminates the need for

manual date entry and speeds

up the process. The feature

also includes a new field

called Total (tax inclusive),

which helps automate the

creation of lines with the

correct account and tax,

ensuring more accurate

encoding.

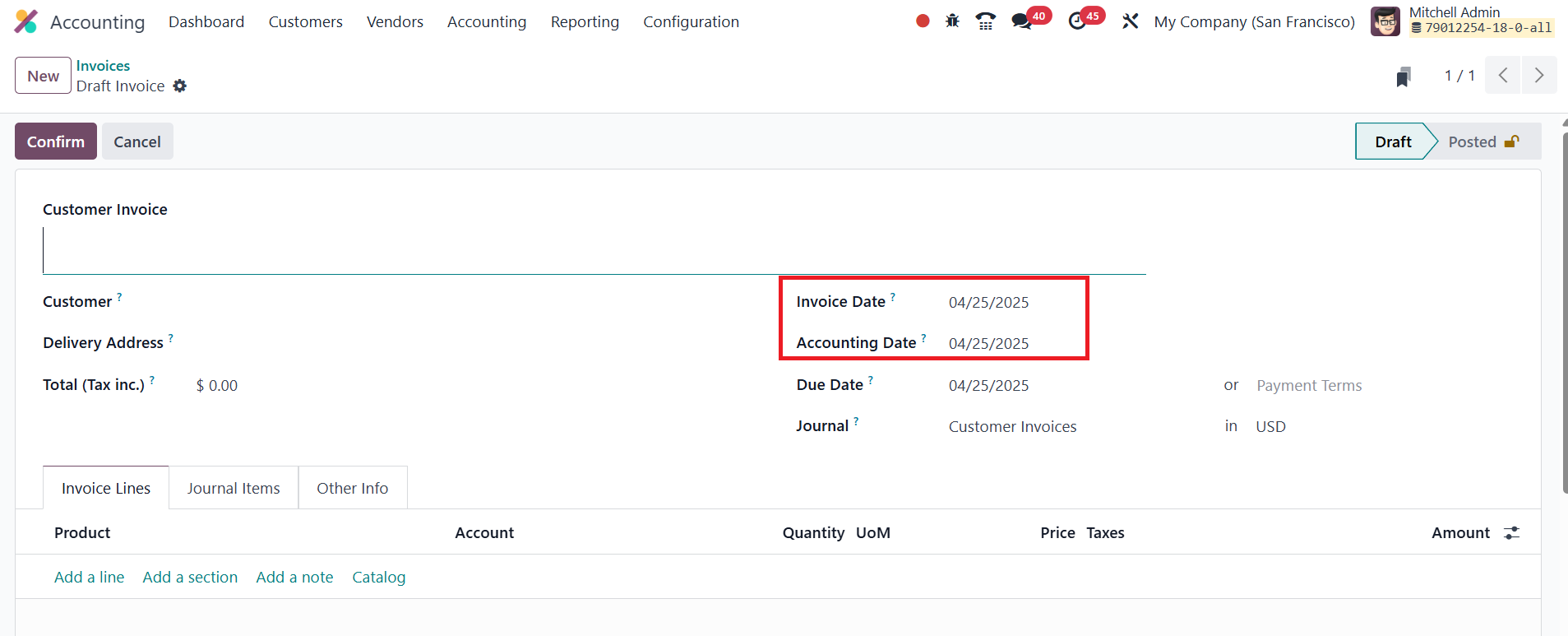

In practical terms, this mode

enables users to specify a

personalized invoice sequence

number during invoice

creation, and Odoo will

automatically append the bill

date and accounting date.

While these dates are suggested,

users still have the option

to modify them if necessary.

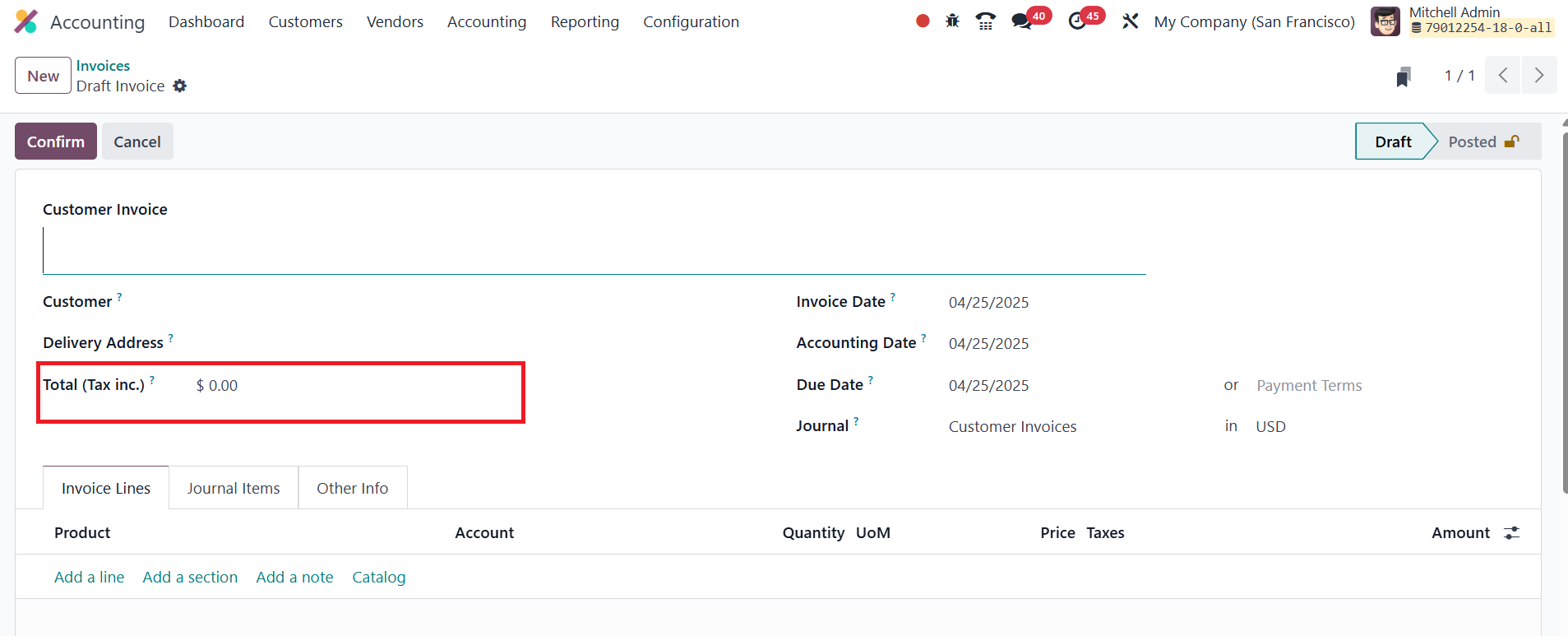

Furthermore, the Accounting

Firm Mode allows users to

enter the total price,

including tax, before adding

products to the invoice line,

with Odoo automatically

adjusting the pricing based

on that input.

This series of enhancements

simplifies invoice and bill

management, making the

process faster and more

accurate for users.

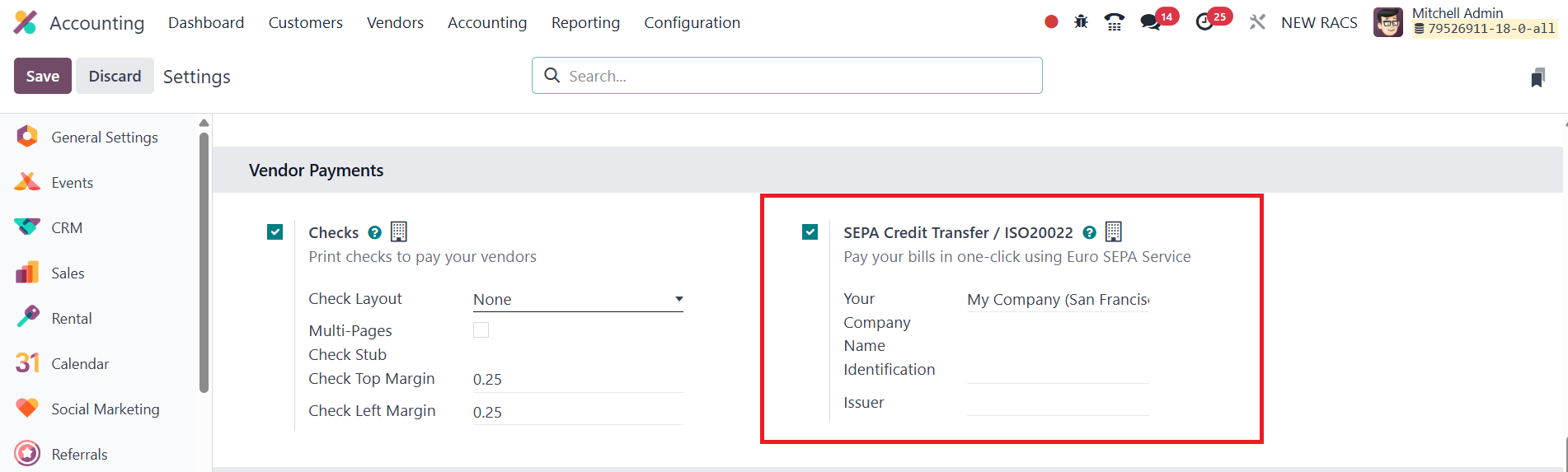

47.9 SEPA Credit Transfer /

ISO20022

SEPA, or the Single Euro Payments

Area, is an EU initiative

aimed at streamlining and

harmonizing euro-denominated

bank transfers across member

countries. It enables

businesses to automate bank

wire transfers by sending

payment instructions directly

to their banks in a

standardized format. In Odoo

18 Accounting, to make use of

SEPA for vendor payments, you

need to activate the SEPA

Credit Transfer (SCT)

feature. This can be done by

navigating to Accounting >

Configuration > Settings >

Vendor Payments and enabling

the SEPA Credit Transfer

(SCT) checkbox.

Once activated and your company

information is properly

filled out (including IBAN

and BIC details), you can

select SCT as a payment

method while paying vendors,

allowing for smooth and

compliant processing of euro

payments through SEPA. In the

specified fields, mention the

Identification and Issuer.

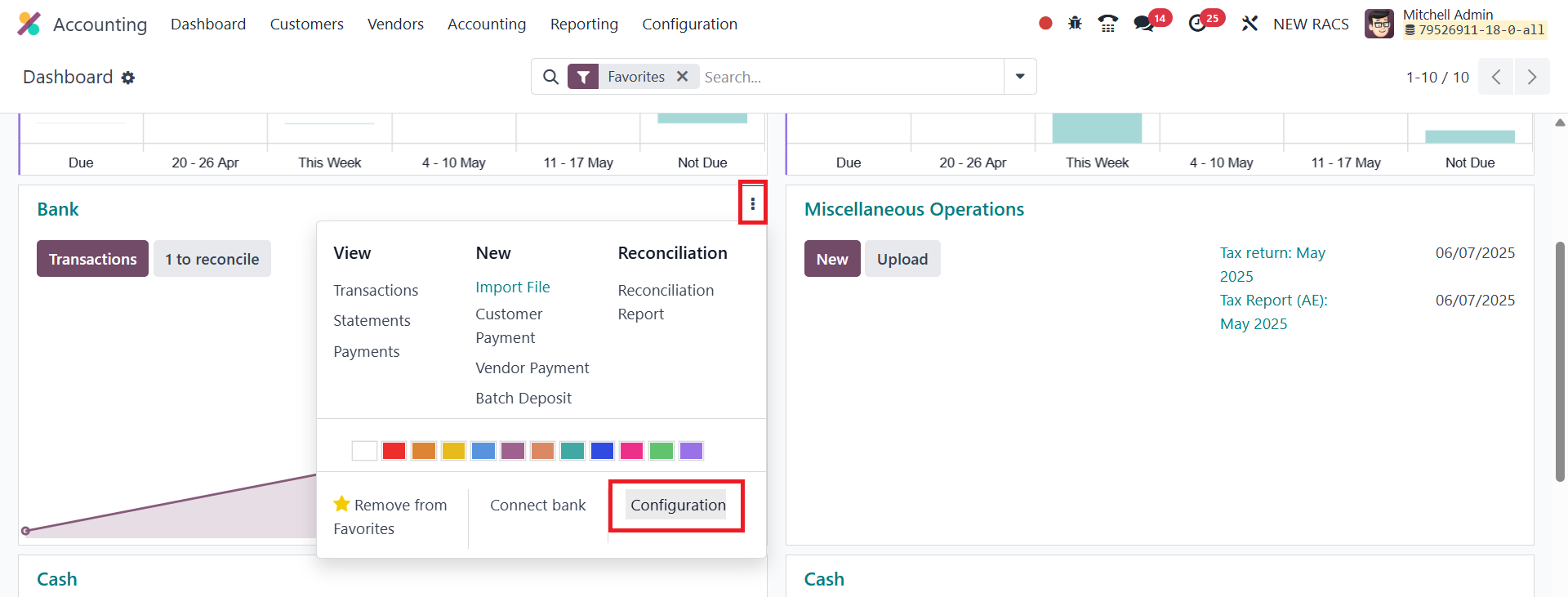

To activate SEPA payment methods

on bank journals in Odoo 18,

go to the Accounting

Dashboard, locate your bank

journal and click on the

three-dot menu (⋮) to open

additional options.

Choose Configuration from the

dropdown.

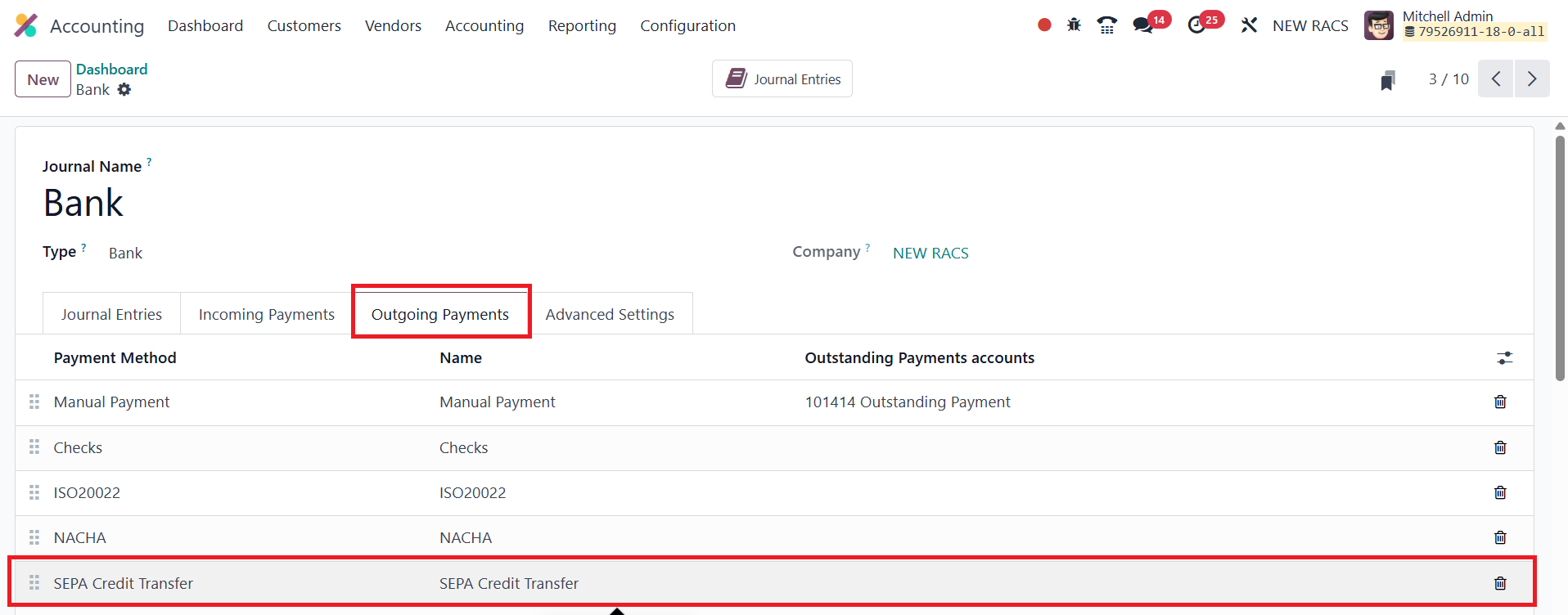

In the Outgoing Payments tab of

the bank journal settings,

ensure that SEPA Credit

Transfer is selected under

Payment Method. If it’s not

already listed, you can add

it using the "Add a line"

option.

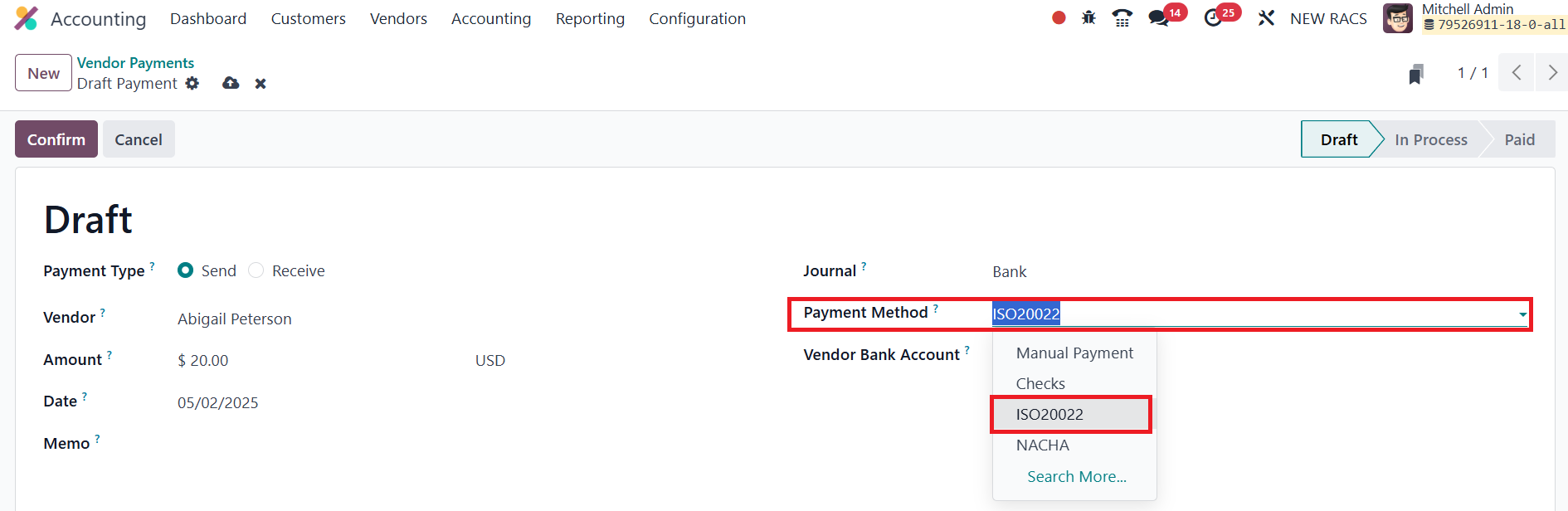

In Odoo 18 Accounting, you can

register vendor payments made

via SEPA Credit Transfer with

ease. To do this, navigate to

Accounting ‣ Vendors ‣

Payments, and when creating a

new payment, simply select

SEPA Credit Transfer/

ISO20022 as the Payment

Method.

For the first SEPA payment to a

vendor, you must fill out the

Recipient Bank Account field

with IBAN, and BIC (Bank

Identifier Code). Odoo will

automatically validate the

IBAN format to ensure it

meets international

standards. For subsequent

payments, Odoo will remember

and automatically suggest the

previously used bank account

details. However, you still

have the flexibility to

select a different account if

needed.

Once the payment is recorded,

make sure to confirm it.

Alternatively, if you're

paying a vendor bill

directly, you can use the Pay

button at the top of the

bill. This method opens the

same payment form, but links

the payment directly to the

bill, allowing automatic

reconciliation between the

bill and the payment.

47.10 Stock

Valuation

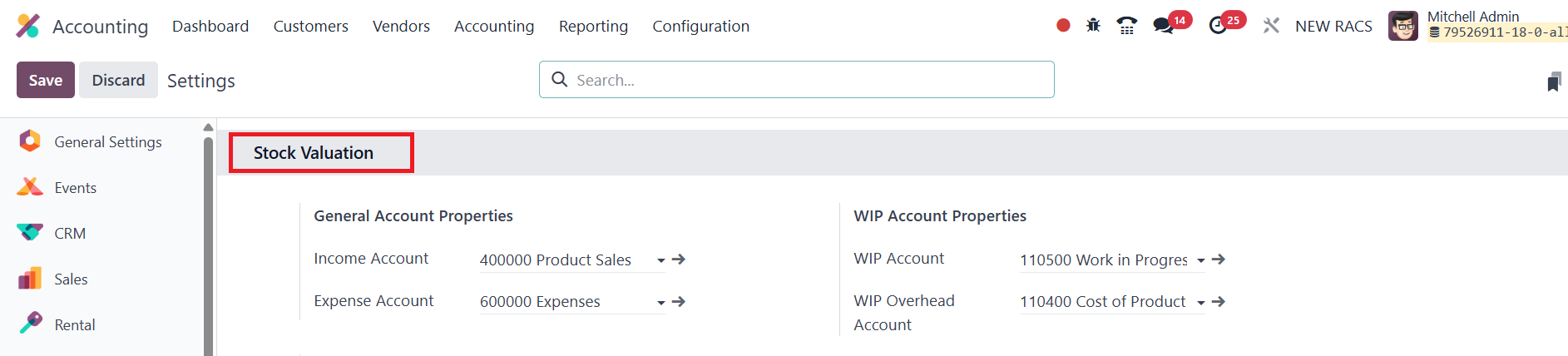

Under the Stock Valuation tab in

the Settings menu of Odoo 18

Accounting, the General

Account Properties field

includes configuration

options such as the Income

Account and Expense Account.

The Income Account is the

account that records the

revenue generated from the

sale of stockable products.

It reflects the income side

of stock transactions and is

essential for recognizing

sales in your financial

statements. The Expense

Account, on the other hand,

records the cost associated

with purchasing stockable

products. It reflects the

outgoing value when stock is

received or consumed and is

important for accurate cost

accounting and profit

calculation.

These account fields are

essential for automating the

financial impact of inventory

movements and ensuring that

income and expenses related

to inventory are properly

tracked in your books.

In Odoo 18 Accounting,

Work-in-Progress (WIP)

accounts are used to track

the value of unfinished goods

during the production

process. These accounts

temporarily hold the costs

incurred; such as materials

and labor, until the

manufacturing of the product

is completed. Once the

production is finalized, the

accumulated costs are

transferred from the WIP

account to the appropriate

inventory or expense account.

Two key types of WIP accounts can

be configured:

- WIP Account: This account

stores the direct

production costs

associated with goods

in progress. It

typically includes raw

materials consumed and

any direct labor

applied during the

manufacturing phase.

- WIP Overhead Account:

This account tracks

the indirect

production costs, such

as factory overheads

(utilities,

depreciation, etc.),

that are associated

with goods under

production but not

directly tied to any

one unit.

By using both accounts,

businesses can accurately

capture and allocate total

production costs, ensuring

proper valuation of inventory

and better visibility into

manufacturing efficiency.

Odoo 18 Accounting continues to

enhance business efficiency

with its comprehensive

features, ensuring

streamlined financial

management. With these

advanced tools, companies can

simplify their accounting

processes, improve accuracy,

and stay ahead in a rapidly

evolving financial landscape.