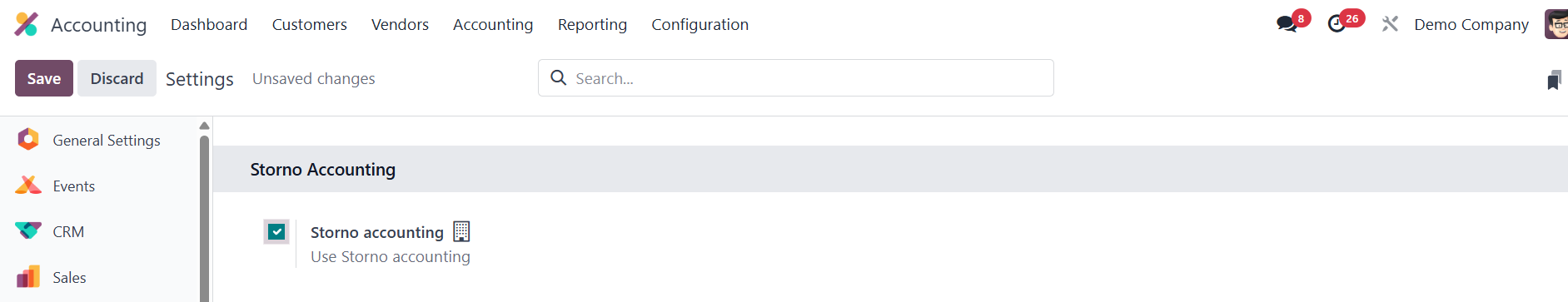

42. Storno Accounting

Storno Accounting is a powerful and practical feature introduced in

Odoo 18 Accounting, designed to simplify the correction of

inaccurate accounting entries. This method uses negative credit or

debit amounts to reverse previously recorded transactions, offering

a more transparent and audit-friendly way to handle errors in

financial reporting.

In essence, when Storno Accounting is enabled and used, Odoo

automatically generates a mirror image of the original journal

entry; only this time, the amounts are represented with a negative

sign. This indicates a full reversal of the original transaction.

Importantly, the process doesn’t delete the erroneous data; rather,

it preserves a complete trail by reversing the incorrect entry and

letting users input the correct one, ensuring clarity and

traceability in financial records.

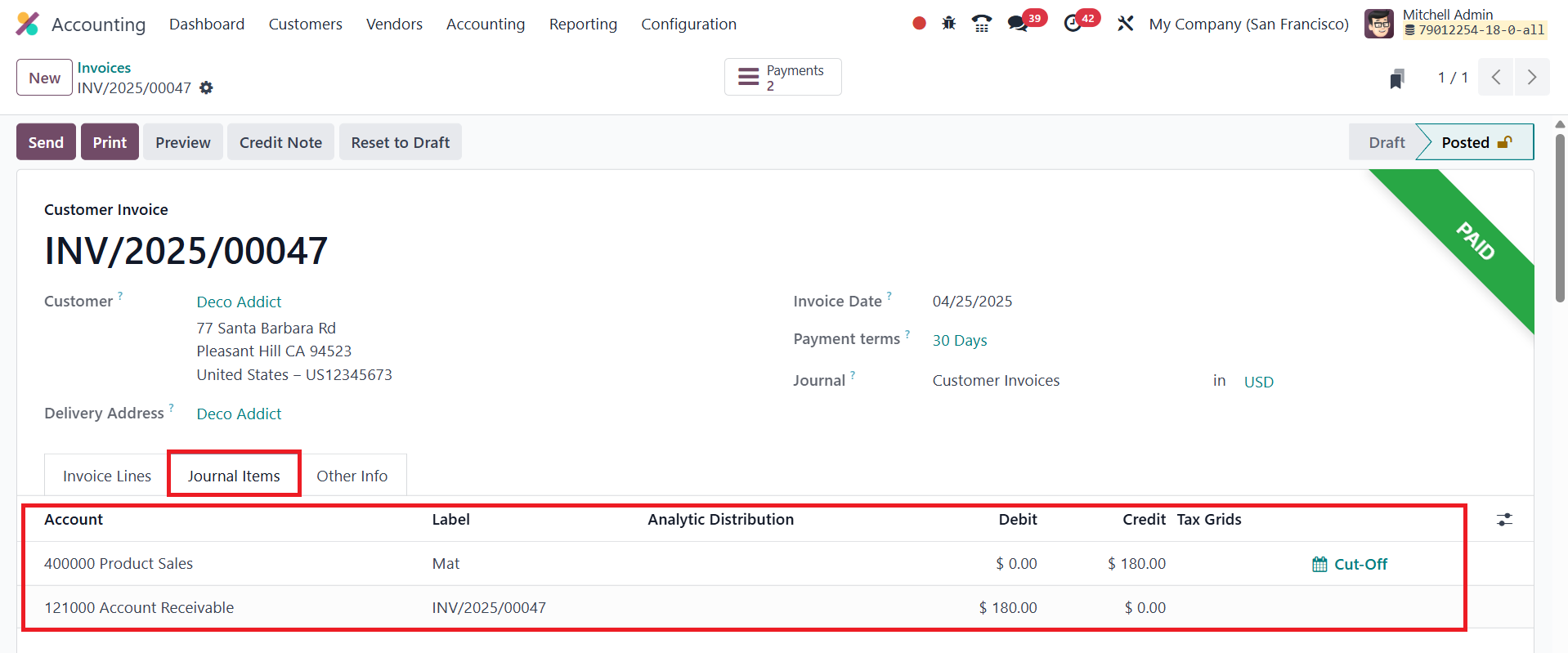

Suppose your company accidentally posts an invoice for $180 instead

of the correct amount, which is $160. Since this discrepancy impacts

your accounting accuracy, the original entry needs to be reversed.

In Odoo 18, this is easily done using the Storno method.

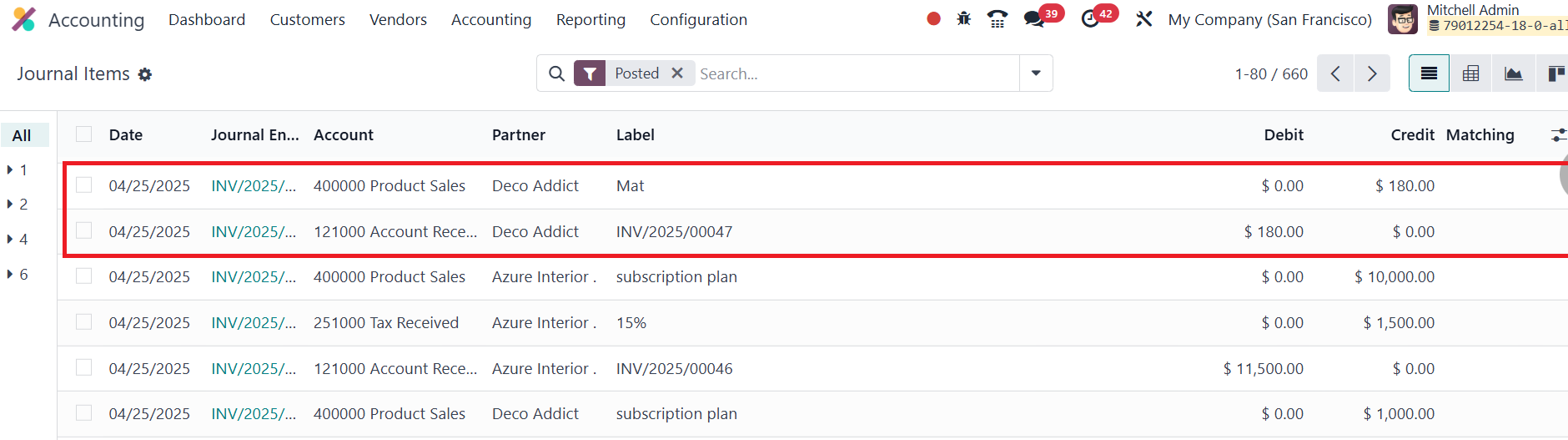

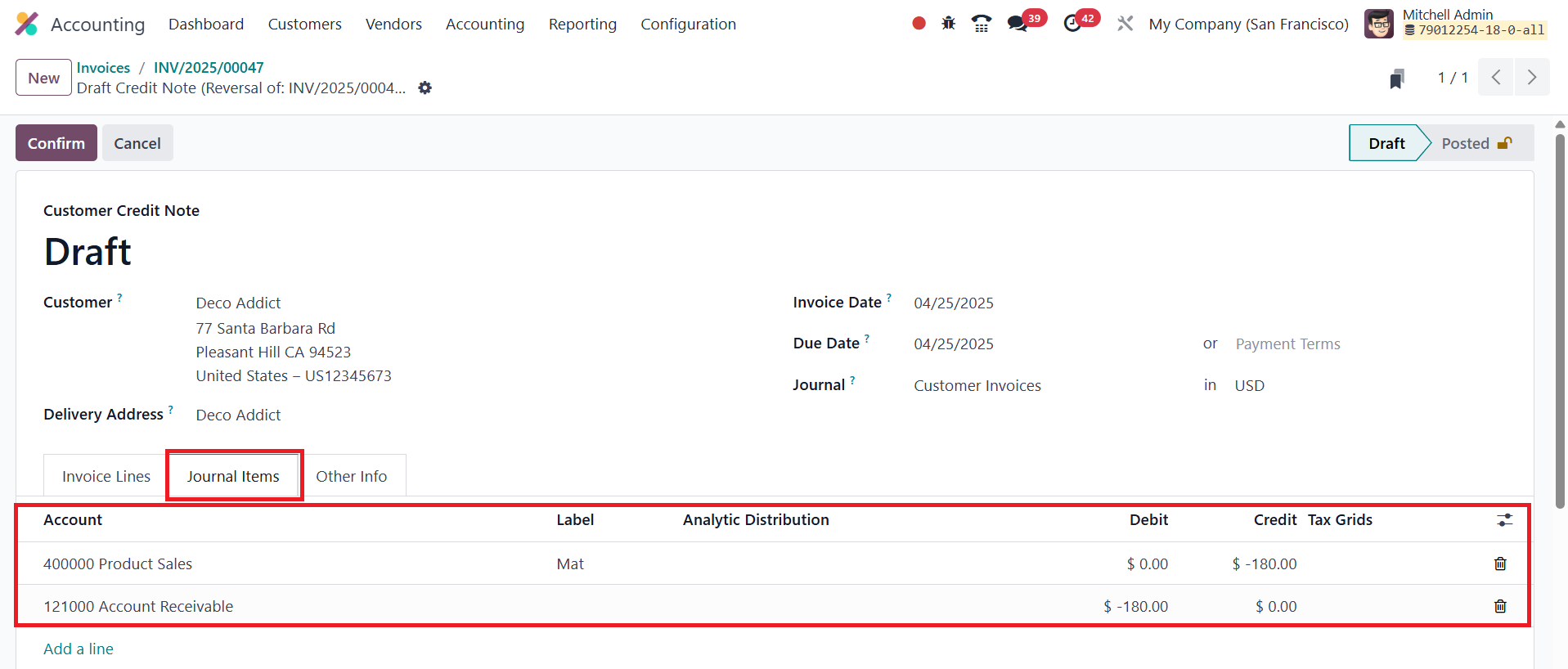

You’ll find the journal entries associated with this transaction

under the Journal Items tab.

As the invoiced amount does not match the actual amount, we will

proceed to reverse the entry.

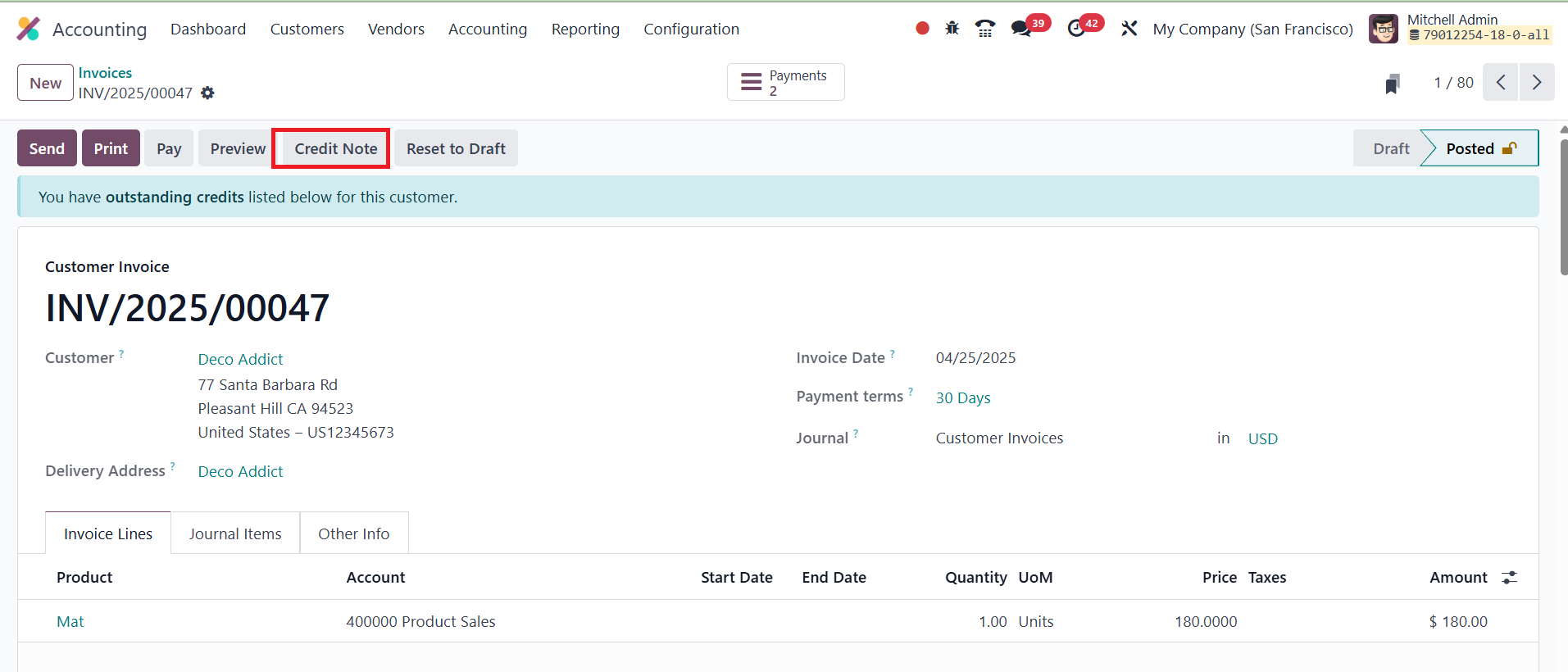

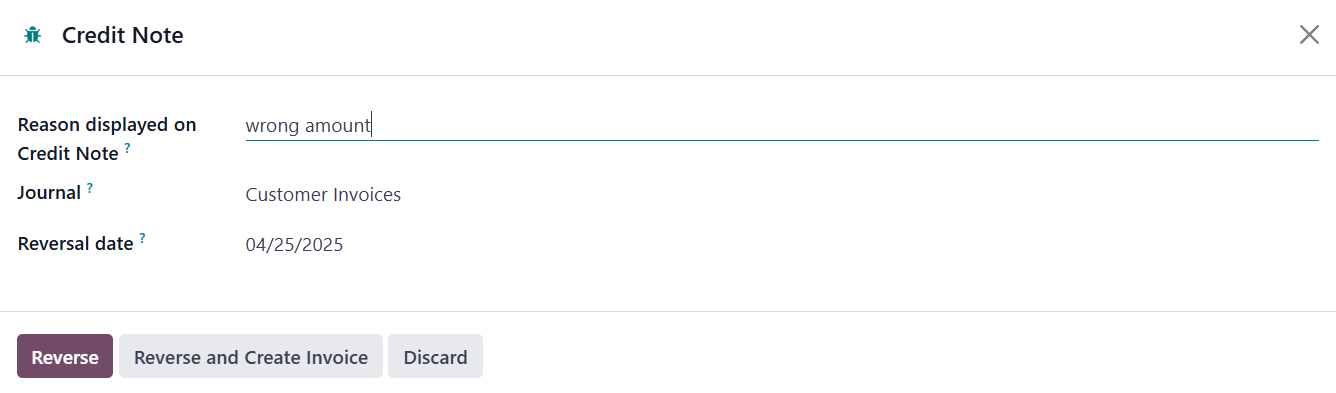

Then, click Add Credit Note.

A pop-up window appears, prompting you to fill in the necessary

credit note details. Once the required information is entered, click

the Reverse button.

Odoo will now create a new journal entry, a Storno entry, that

reflects the original invoice’s values, but with negative amounts.

This negative posting effectively cancels the previous incorrect

transaction, without physically deleting it from the records.

After this reversal is completed, you can proceed to create a new

invoice with the correct amount, in this case, $160. This process

ensures that your accounting books show both the original mistake

and its rectification, followed by the accurate record.

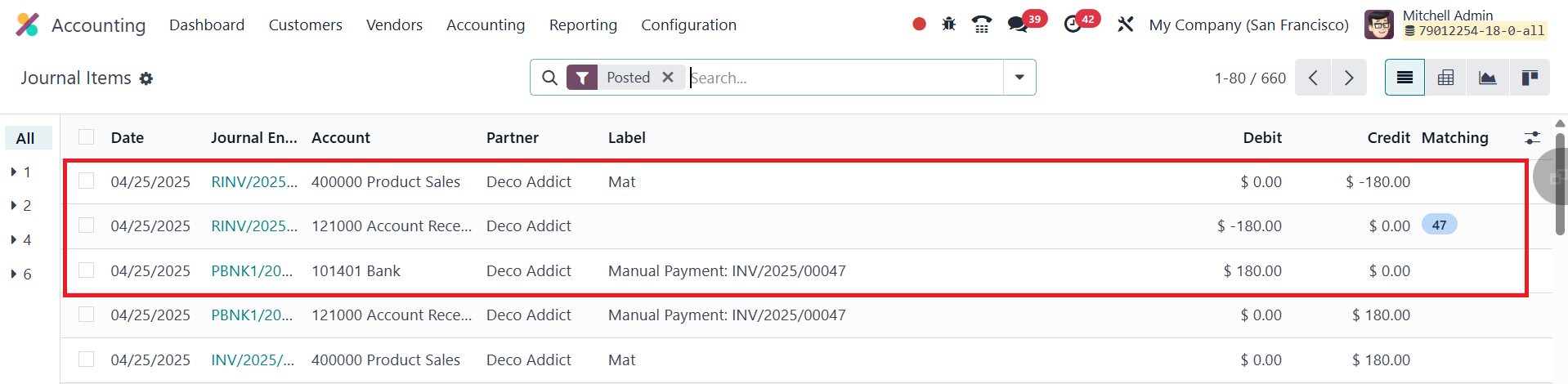

The Journal Items menu within the Accounting module will now display

all three entries: the original (incorrect) invoice, the Storno

entry, and the correct invoice. This chain of records enhances

financial transparency and aligns with best practices in auditing

and compliance.