26. Taxes

Tax calculation is notoriously unforgiving; one rounding error can

distort your entire ledger and expose your business to penalties.

Odoo 18 streamlines this delicate task by gathering every

configuration point in a single place: Configuration → Taxes.

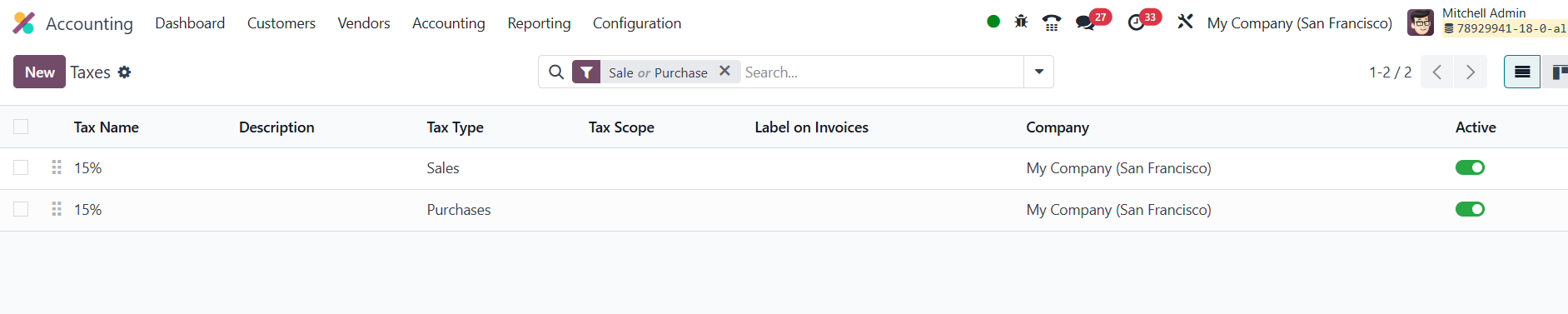

The resulting dashboard lists all existing rules and lets you slice

them any way you like, filtering by Sales or Purchases, narrowing

the view to goods or services, and toggling between active and

archived rates. The list shows the Tax Name, Description, Tax Type,

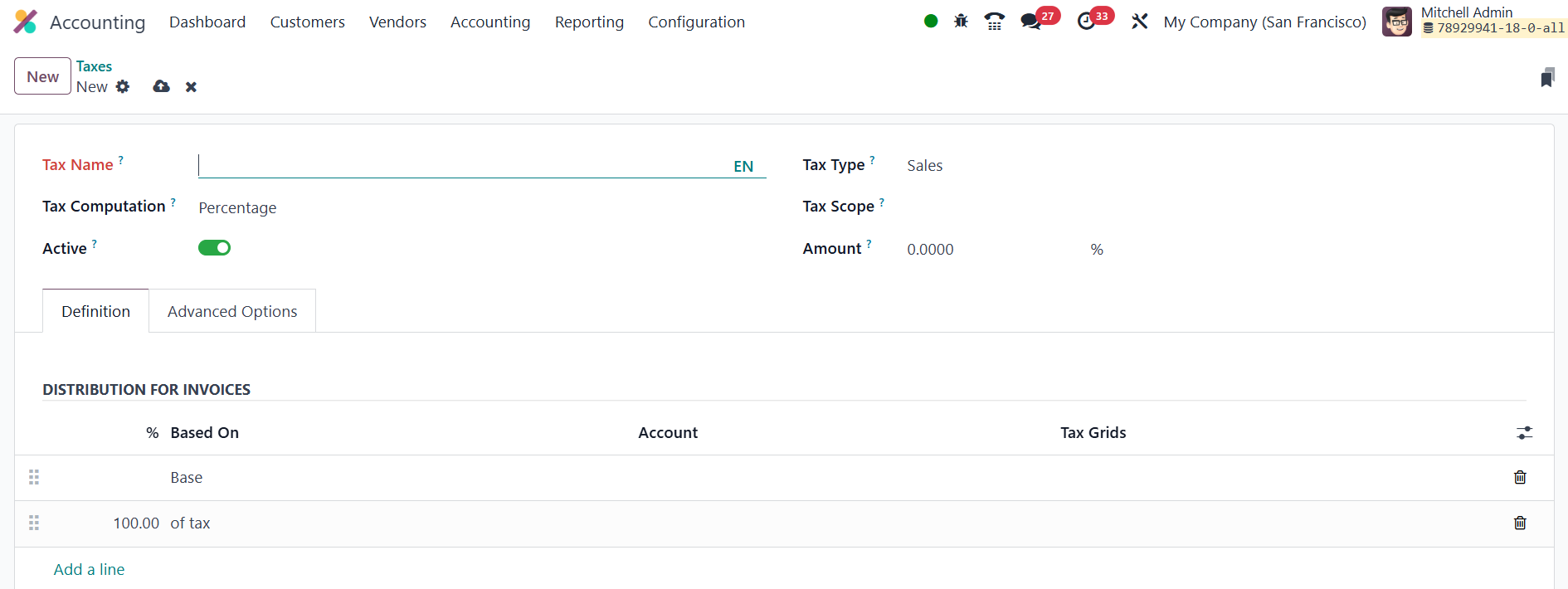

Tax Scope, Label on Invoices, and Company. When you click New, a

concise form appears, and the choices you make there determine

exactly how Odoo will behave on every subsequent invoice or bill.

Begin by giving the rule a descriptive tax name, then decide whether

it belongs to the sales or purchase side of your books. If the levy

only applies to a subset of products, restrict it with the Tax Scope

field; if you merely want to sideline an outdated rate without

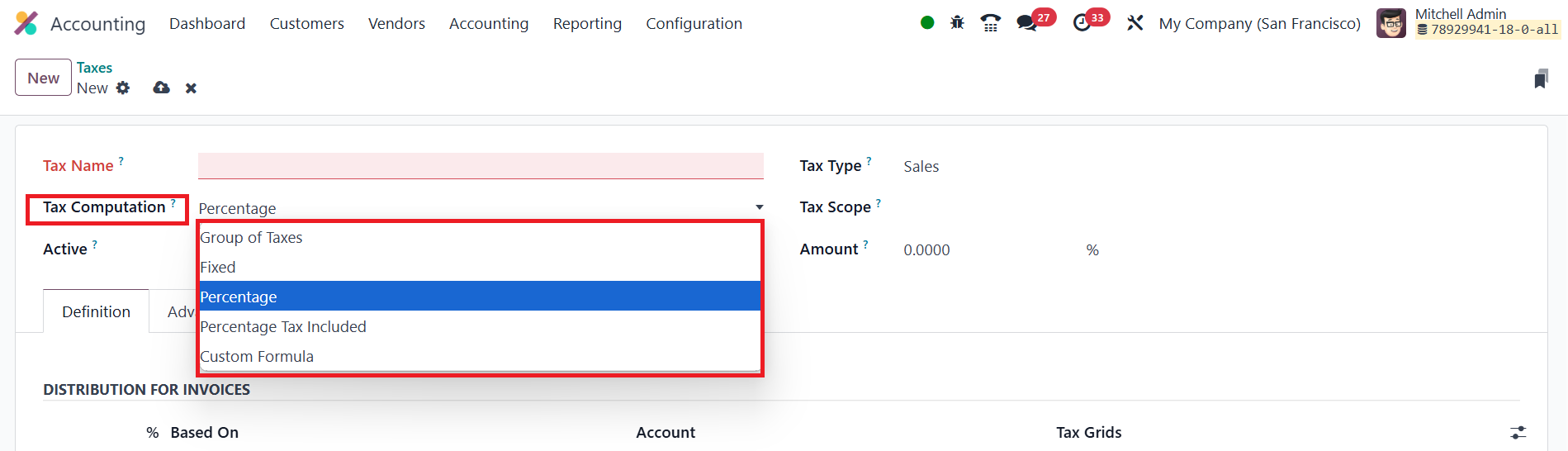

losing its history, untick Active. The most consequential setting is

Tax Computation.

You can instruct Odoo to calculate a fixed amount, a percentage of

the net price, a percentage of a tax‑inclusive price, a custom

Python formula, or even a group that bundles several sub‑taxes.

- Group of Taxes: This method allows the creation of a composite

tax made up of multiple sub-taxes. You can include as many

individual taxes as needed and define the order in which they

should be applied.

- Fixed: This method applies a flat tax amount in the company’s

default currency, regardless of the transaction value. It is

ideal for charges like service fees or environmental levies that

remain constant.

- Percentage of Price: In this method, the tax is calculated as a

percentage of the sales price. The sales price serves as the

taxable base, and the resulting tax is directly proportional to

it.

- Percentage of Price Tax Included: Here, the total price

(including tax) serves as the base. The tax is back-calculated

as a percentage of the total, commonly used in tax-inclusive

pricing models.

- Python Code: This advanced method allows dynamic tax computation

using custom Python code. Two code snippets are used: one to

determine the tax amount and another (Applicable Code) to

specify whether the tax should apply. These are executed in an

environment that includes relevant variables such as unit price,

product, and partner details.

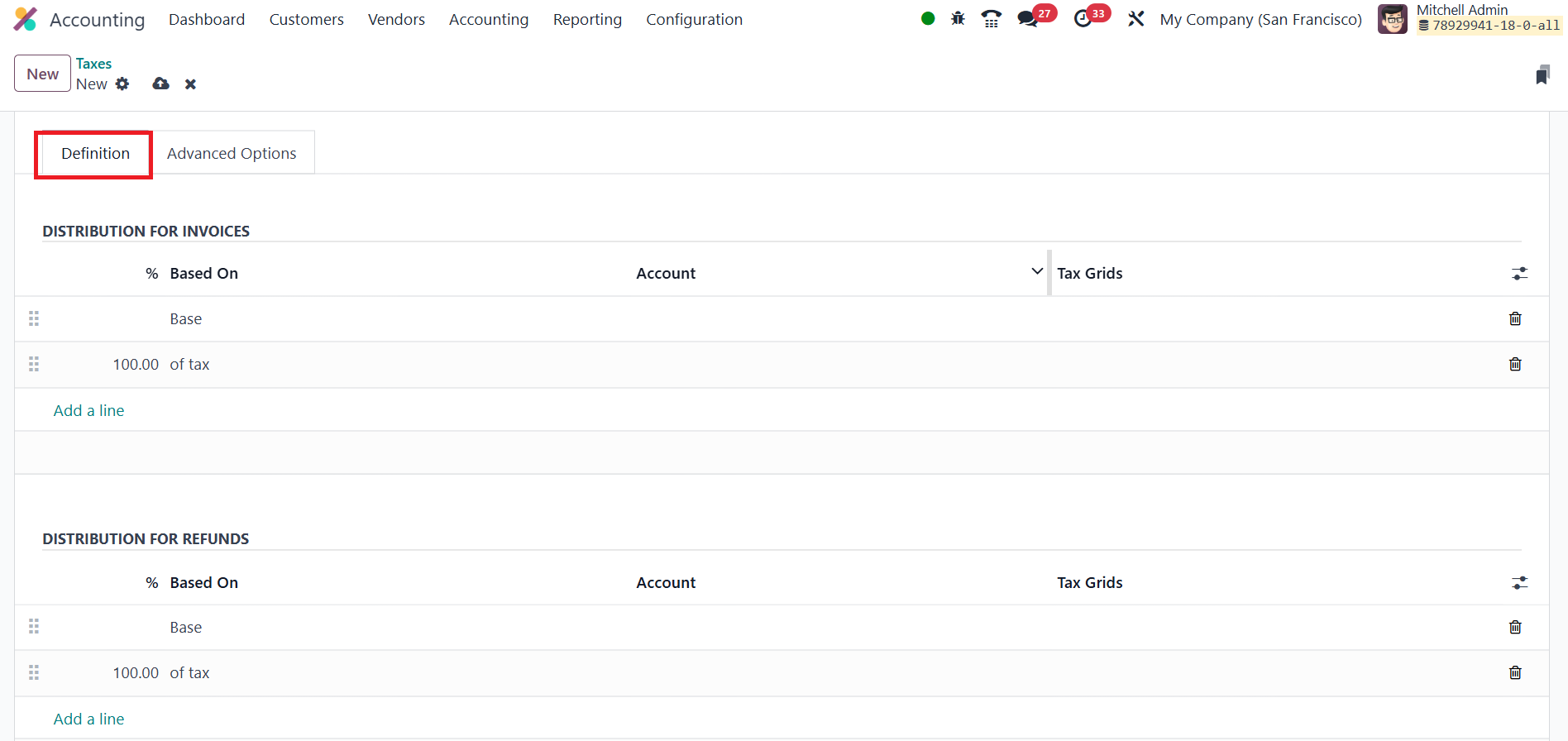

Choose the group option and an extra Definition tab appears, where

you add each sub‑tax line, effectively letting Odoo stack federal,

state, and municipal shares into one seamless rate.

Every computation method shares the same Definition tab.

Here you tell the system which monetary base to use, which

general‑ledger account should receive the posting, and which boxes

on your tax return (the “tax grids”) should receive the numbers,

separately for invoices and refunds.

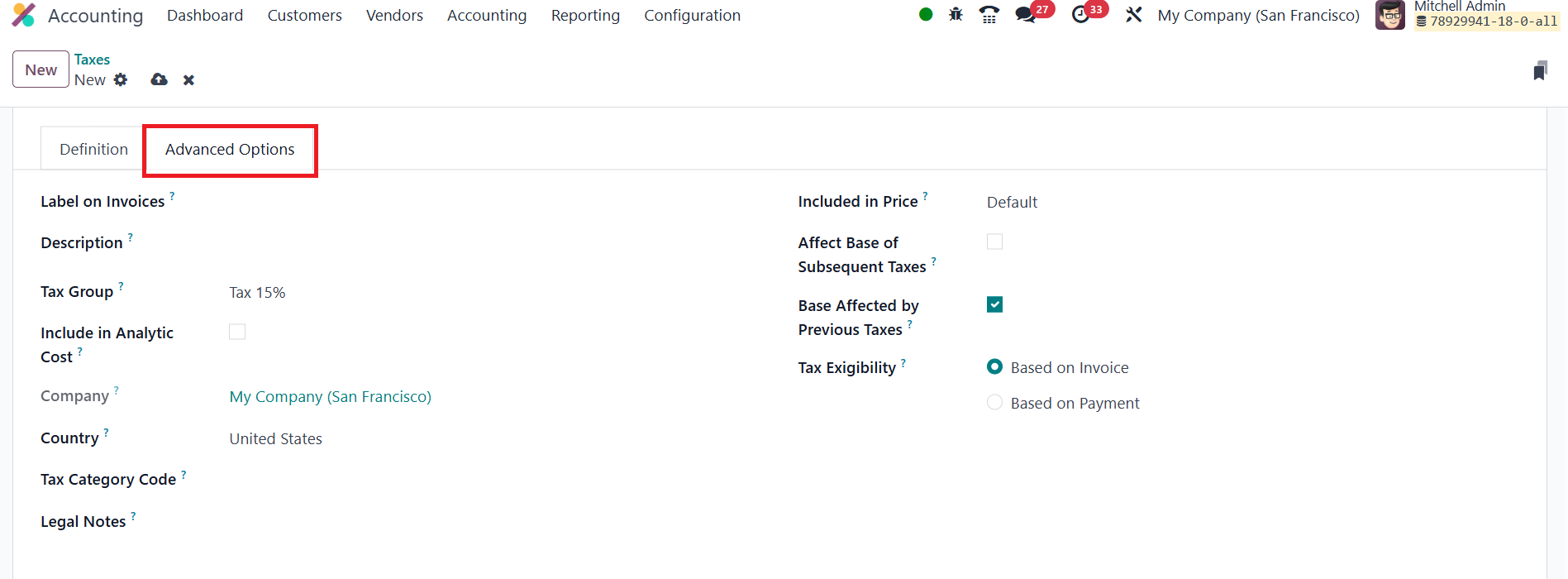

In the Advanced Options tab, you can define the label that prints on

customer documents, assign the rule to a higher‑level tax group for

reporting, and indicate whether the tax amount should flow to the

line’s analytic account. Additional switches handle more complex

cascades: flag Included in Price if your price list already contains

the levy, let the amount inflate the base for subsequent taxes, or

allow it to be altered by a preceding tax with a lower sequence

number. Finally, set Tax Exigibility to recognise the liability

either when you issue the invoice or only when the customer pays,

critical for jurisdictions that run on cash‑basis VAT.

Once the company and country fields are confirmed and you hit save,

Odoo takes over. From that point forward, every invoice, refund, and

vendor bill will pull the correct rate automatically, post it to the

right account, and populate the right grid, turning tax compliance

from a high‑risk manual chore into a background process you barely

notice.

26.1 Cash Basis

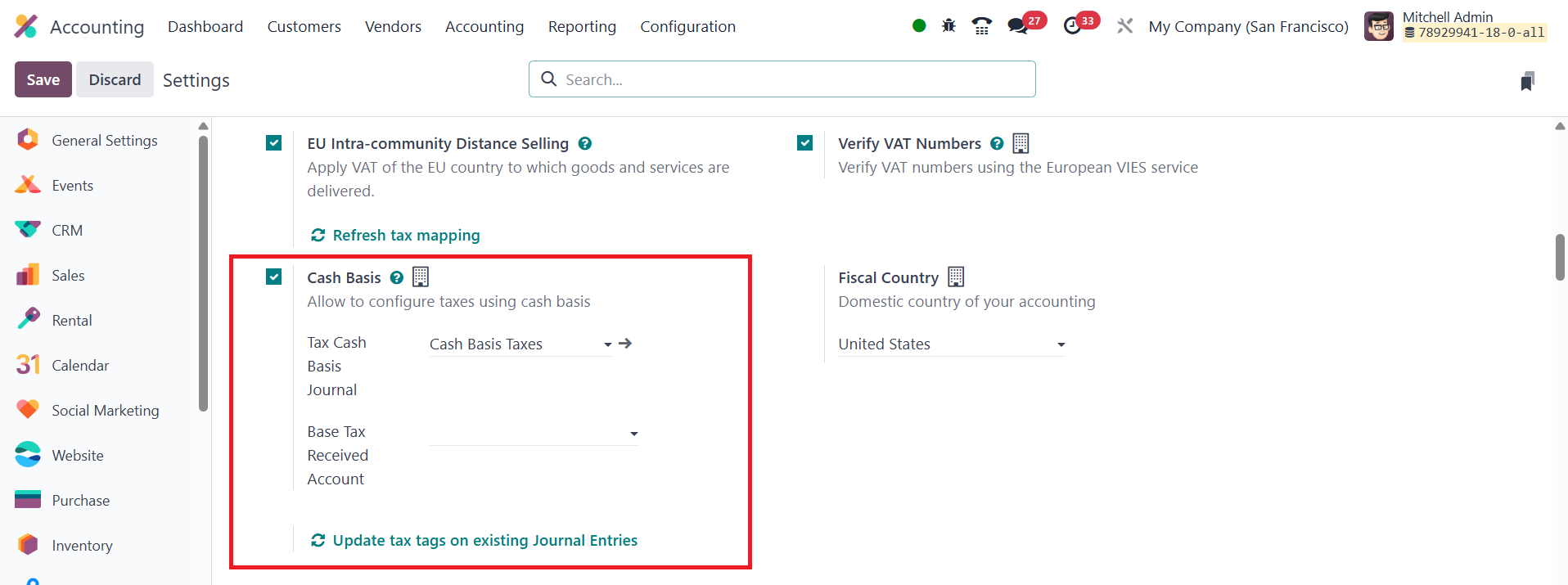

In Odoo 18, you can manage tax calculations on a cash basis, which is

particularly useful for businesses that report taxes when payments

are received or made, rather than when the invoice is issued. To

enable this feature, you need to activate the Cash Basis option in

the Accounting module's settings.

To use the Cash Basis method, you'll need to configure specific

accounts for the taxes. This involves setting up a Base Tax Received

Account and selecting a Tax Cash Basis Journal where the tax amounts

will be posted during reconciliation.

26.2 Tax Groups

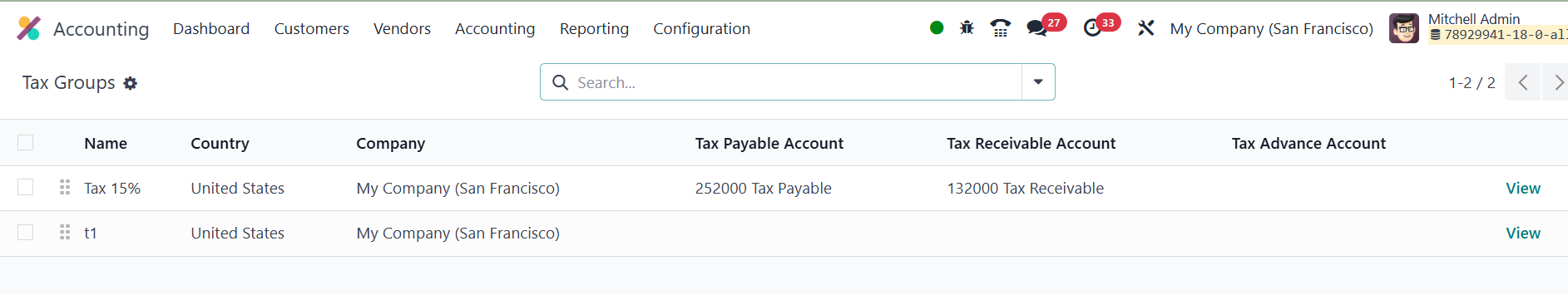

In Odoo 18, taxes can be tailored to suit the specific operations of

your business, whether it's related to goods, services, suppliers,

or different accounts. From the Configuration menu within the

Accounting module, you can easily access the list of Tax Groups that

Odoo supports.

This list provides a clear overview of each tax group, making it

simple to organize and apply taxes based on your business needs.

Each tax group in the list contains essential details that are

important for tax management. These include the Name, which

identifies the tax group, and the Country, indicating where the tax

applies. The Tax Payable Account is the account where taxes owed to

the tax authorities are recorded, while the Tax Received Account

tracks the taxes collected from customers. Additionally, the Tax

Advance Account is used for businesses that make advance tax

payments, helping to manage any upfront tax liabilities.

26.3 Tax Units

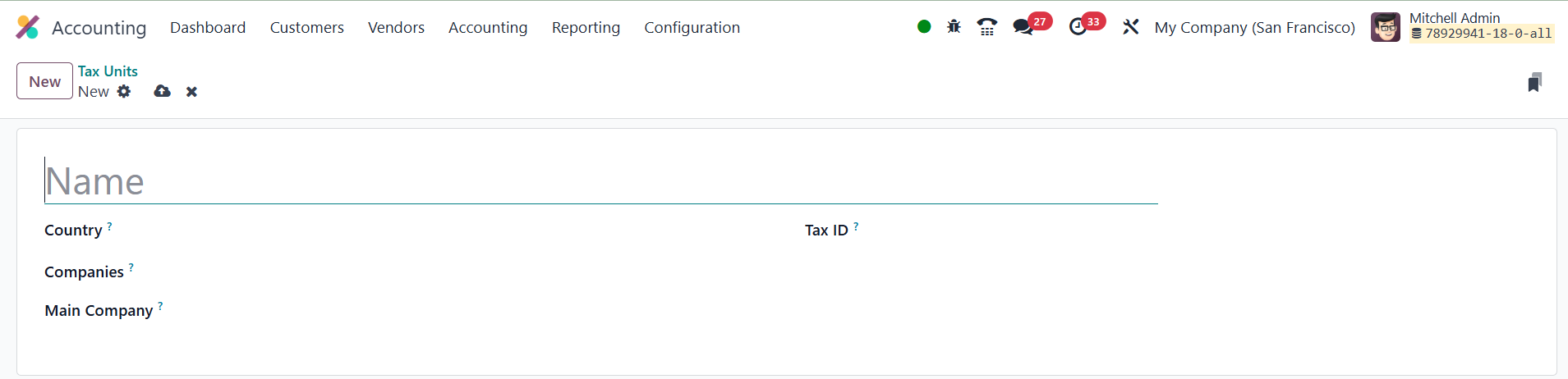

In Odoo 18, the Tax Unit feature within the Configuration menu of the

Accounting module allows businesses to group their tax reports for

easier management and declaration. This feature is especially useful

for companies that need to file taxes for multiple entities or

locations. When you set up a new Tax Unit, a configuration window

will appear, enabling you to define the specifics for tax reporting.

First, you’ll need to provide a Title for the tax unit, which serves

as an identifier for the report. Then, you can specify the Country

where this tax unit applies, helping to ensure that tax reports are

grouped correctly based on geographical location. Additionally, the

configuration allows you to enter the Companies involved, along with

the Main Company, which is the entity responsible for filing and

paying the taxes. This ensures that the correct company is

accountable for the tax obligations.

You can also configure a Tax ID for each tax unit, which is the

identifier used when submitting the tax report for that particular

unit. This helps in streamlining the tax filing process, especially

when dealing with multiple companies or tax jurisdictions. By using

the Tax Unit feature, businesses can organize and simplify their tax

reporting, ensuring compliance and accuracy when submitting

declarations.

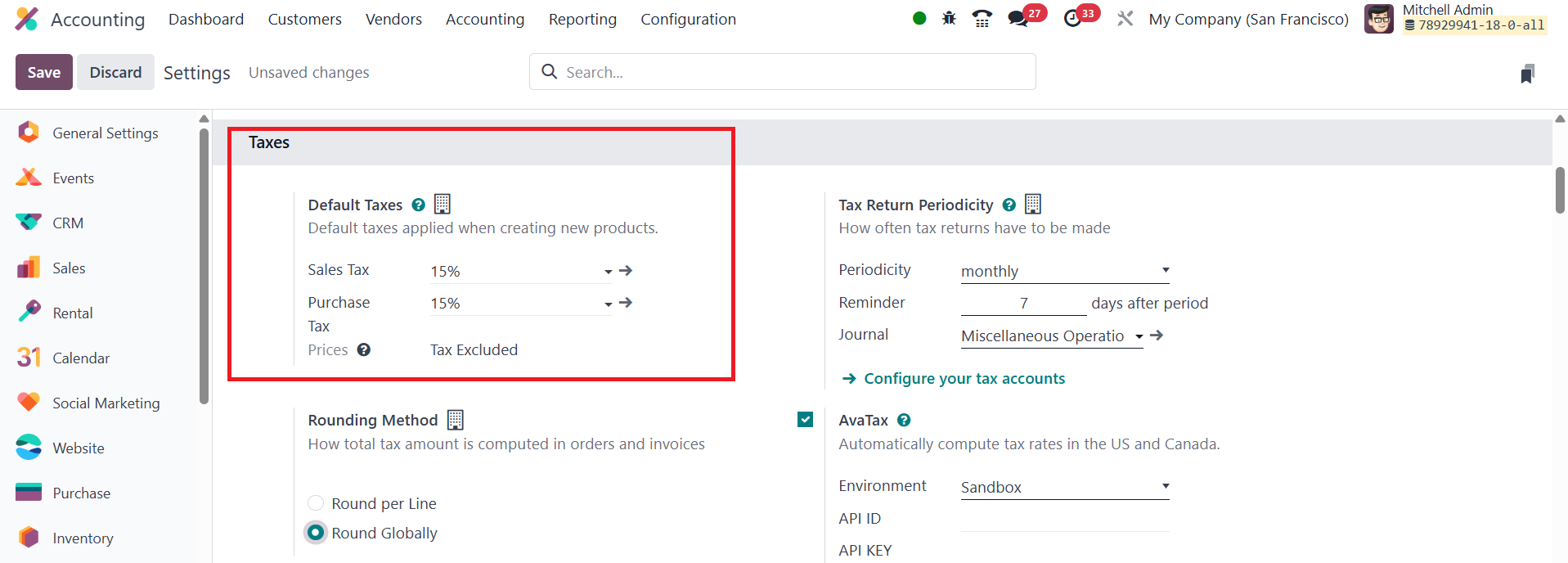

26.4 Default Taxes

In Odoo 18, the Default Taxes feature helps automate the application

of taxes when no specific taxes are indicated for financial

transactions. By default, Odoo will apply the preset taxes for sales

and purchases, which simplifies the process when new items are added

to the system. You can later modify these taxes in the product form

if needed. If no other taxes are defined, the default taxes will be

used, ensuring consistency across transactions.

To modify the default taxes for both sales and purchases, you can

navigate to the Accounting module's Settings menu. From there, you

can adjust the default tax settings by following the internal link

in the Default Taxes section. You can also specify how frequently

tax returns need to be filed by setting the Tax Return Periodicity.

This allows you to manage the frequency of tax submissions and set

reminders for filing deadlines. You can record tax returns in the

appropriate journal and configure periodic reminders to ensure

timely submissions.

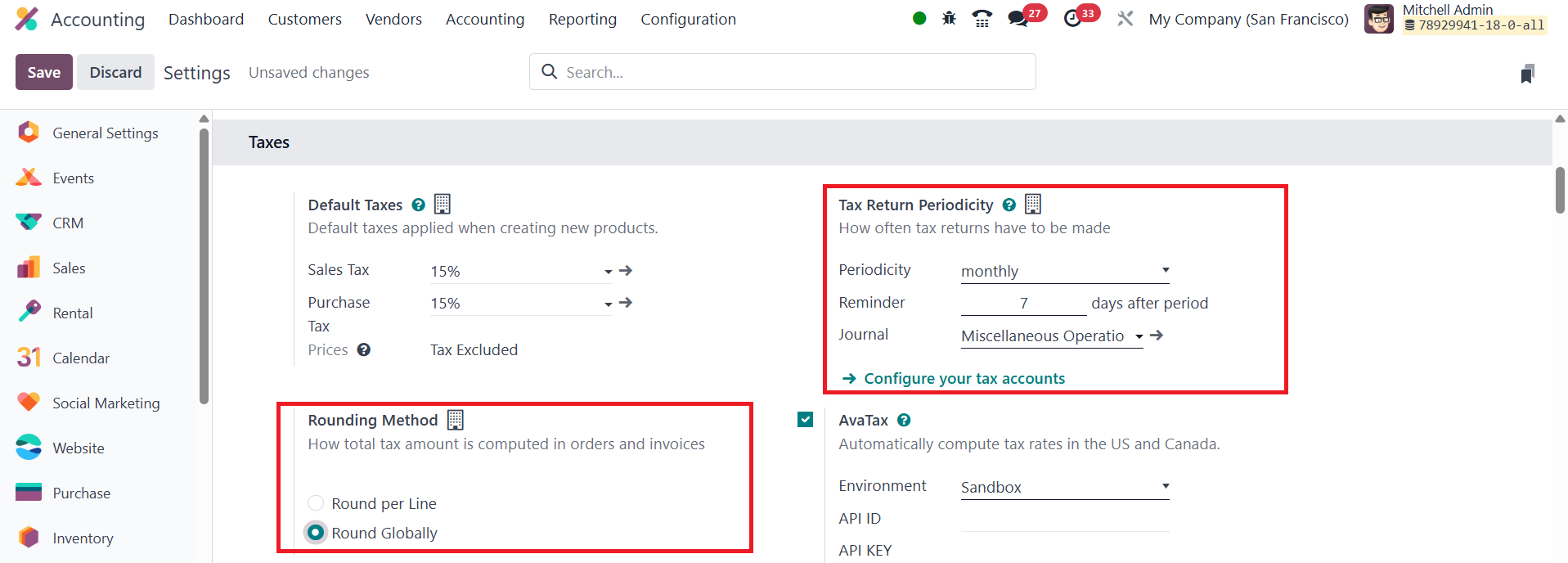

In terms of calculating the total tax amount on orders and invoices,

the Rounding Method section in Odoo allows you to choose between two

options: Round per Line or Round Globally. If your pricing includes

tax, it is generally recommended to round each line individually to

ensure accuracy in tax calculations. The total tax amount will then

be computed by adding the subtotals of each line.

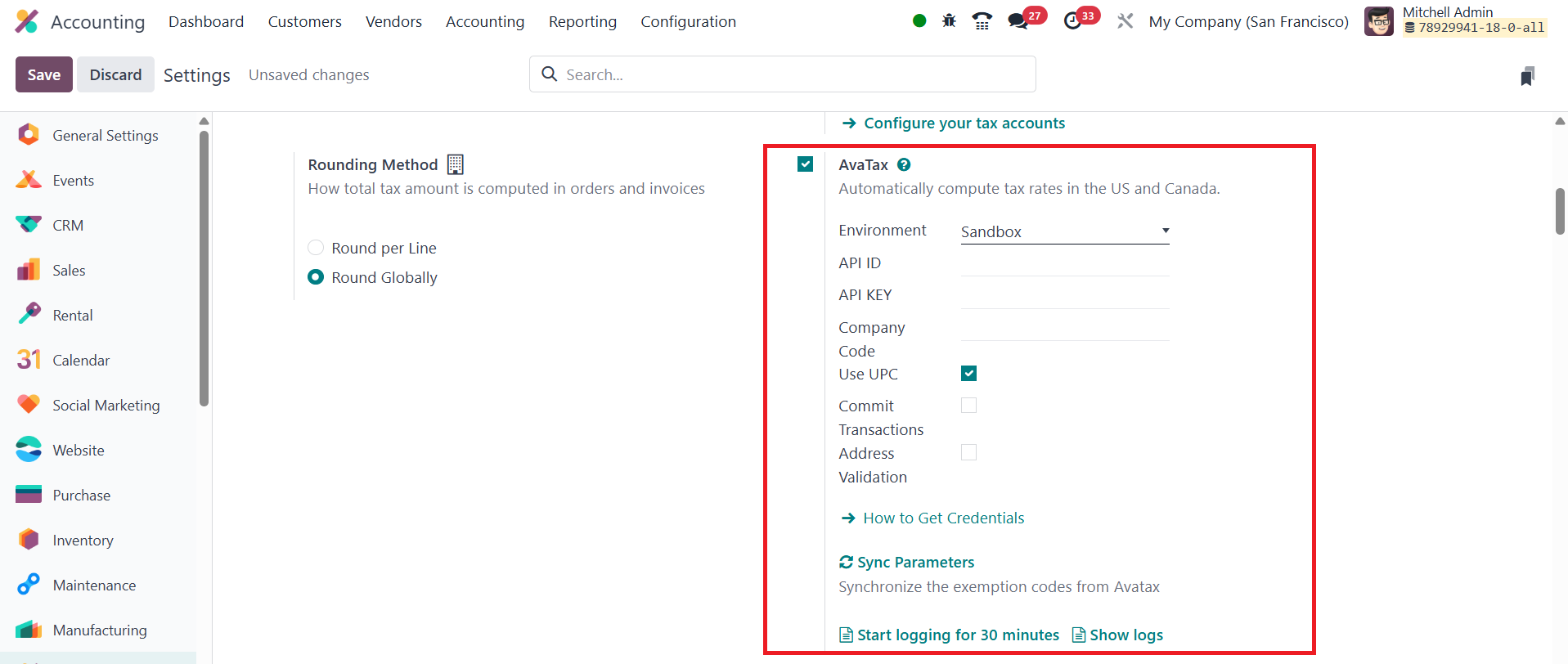

26.5 AvaTax

AvaTax automatically calculates tax rates for orders and invoices.

By configuring the AvaTax settings, such as Environment, API ID, API

Key, and Company Code, you ensure that taxes are computed accurately

and in real time. You can also enable additional options like

Address Validation, Commit Transactions, and Use UPC if needed.

These settings improve the accuracy of tax calculations, ensuring

compliance with tax regulations. AvaTax can be configured with item

and product categories, allowing for seamless integration across

your business operations.

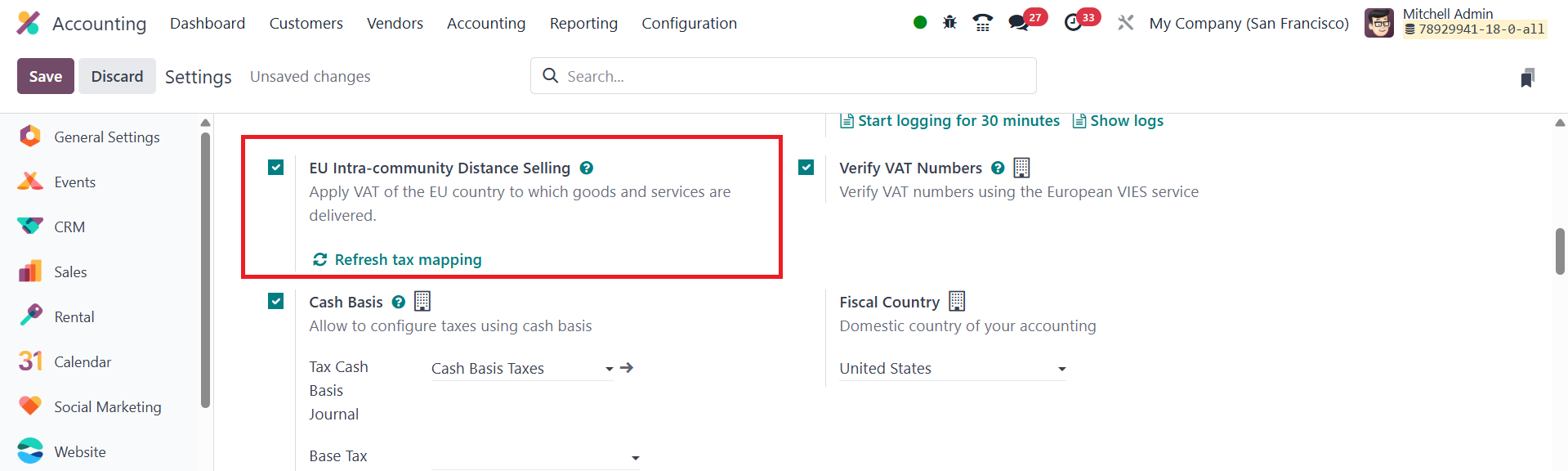

26.6 EU Intra-community Distance

Selling

In Odoo 18, the EU Intra-community Distance Selling feature allows

businesses to apply VAT based on the delivery address when selling

products and services to clients in other EU nations. This is an

important feature for companies that operate within the European

Union, ensuring compliance with VAT rules for cross-border

transactions.

To enable this functionality, you need to turn on the EU

Intra-community Distance Selling option from the Settings menu in

the Accounting module. Once activated, Odoo will automatically

calculate the applicable VAT rates based on the delivery address of

the customer. This ensures that VAT is applied correctly according

to the country where the goods or services are being delivered,

rather than the country where the seller is located