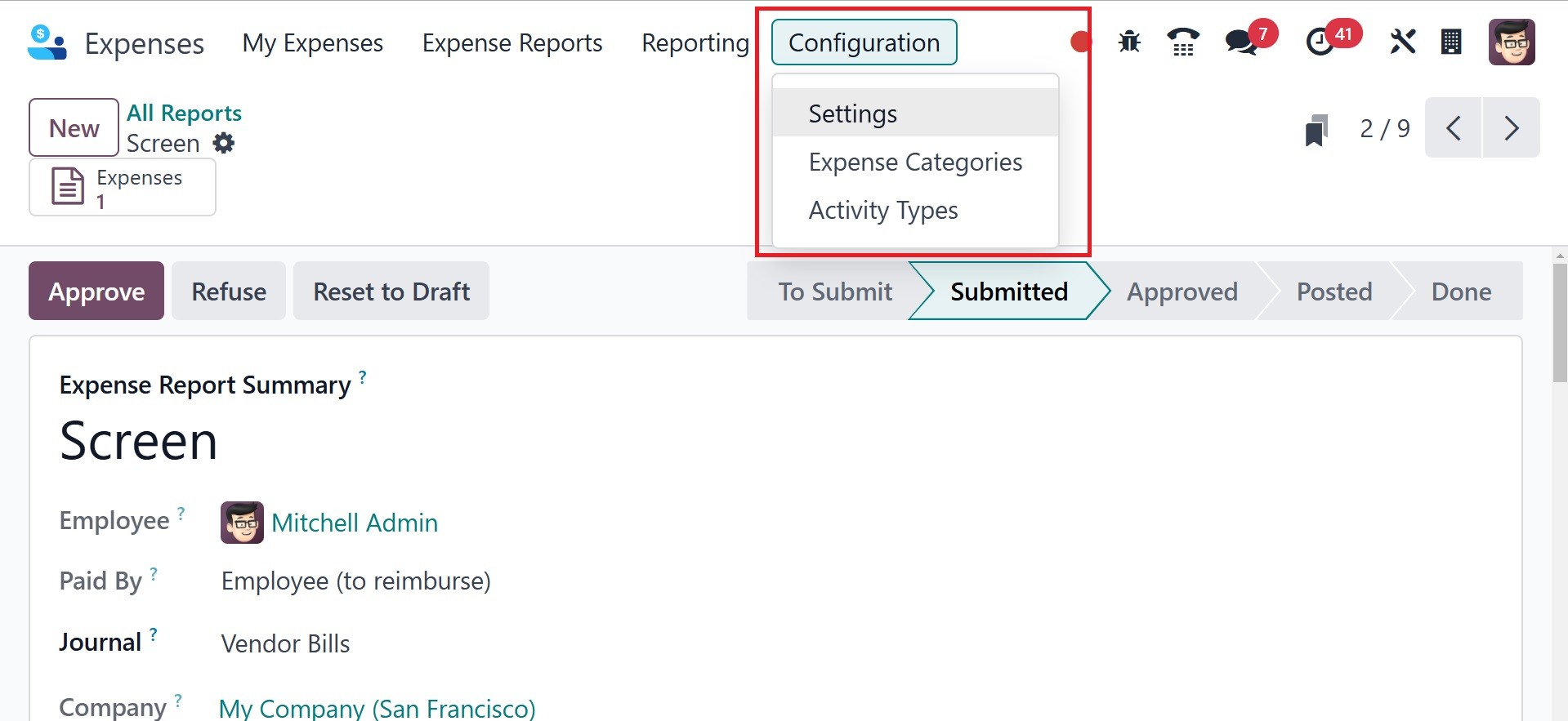

3. Configuration

The configuration function of Odoo 18 allows us to manage the

categories and parameters of expenses. We may now proceed to the

configuration tab after defining each menu.

3.1 Settings

If you select the Configuration tab's Settings option, setting

default journals and expenses is easy.

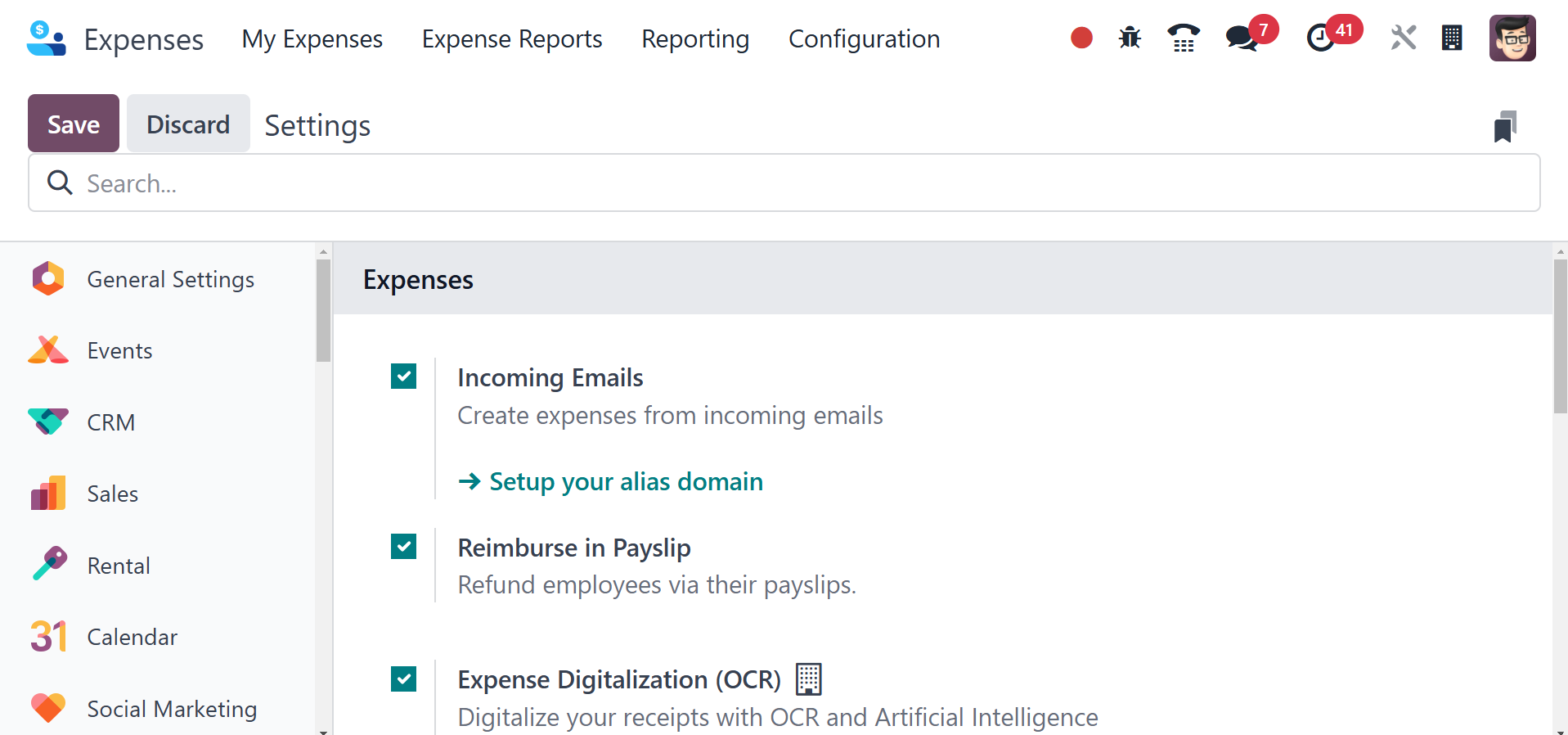

Users can make expenses from emails they receive once they have

enabled the Incoming Emails option under Expenses. First, you need

to make a domain alias. You can forward an email with a receipt

attached after setting up a domain alias.

Once the Expense Digitization (OCR) option is enabled, you can

digitize all of your receipts using OCR and artificial intelligence.

Do not digitize, digitize automatically, and digitize just on-demand

are the three alternatives available to users when choosing a

digitalization method for a significant price. To get expenses on

employee pay stubs, we need to activate the Reimburse in Payslips

option under the Expenses menu.

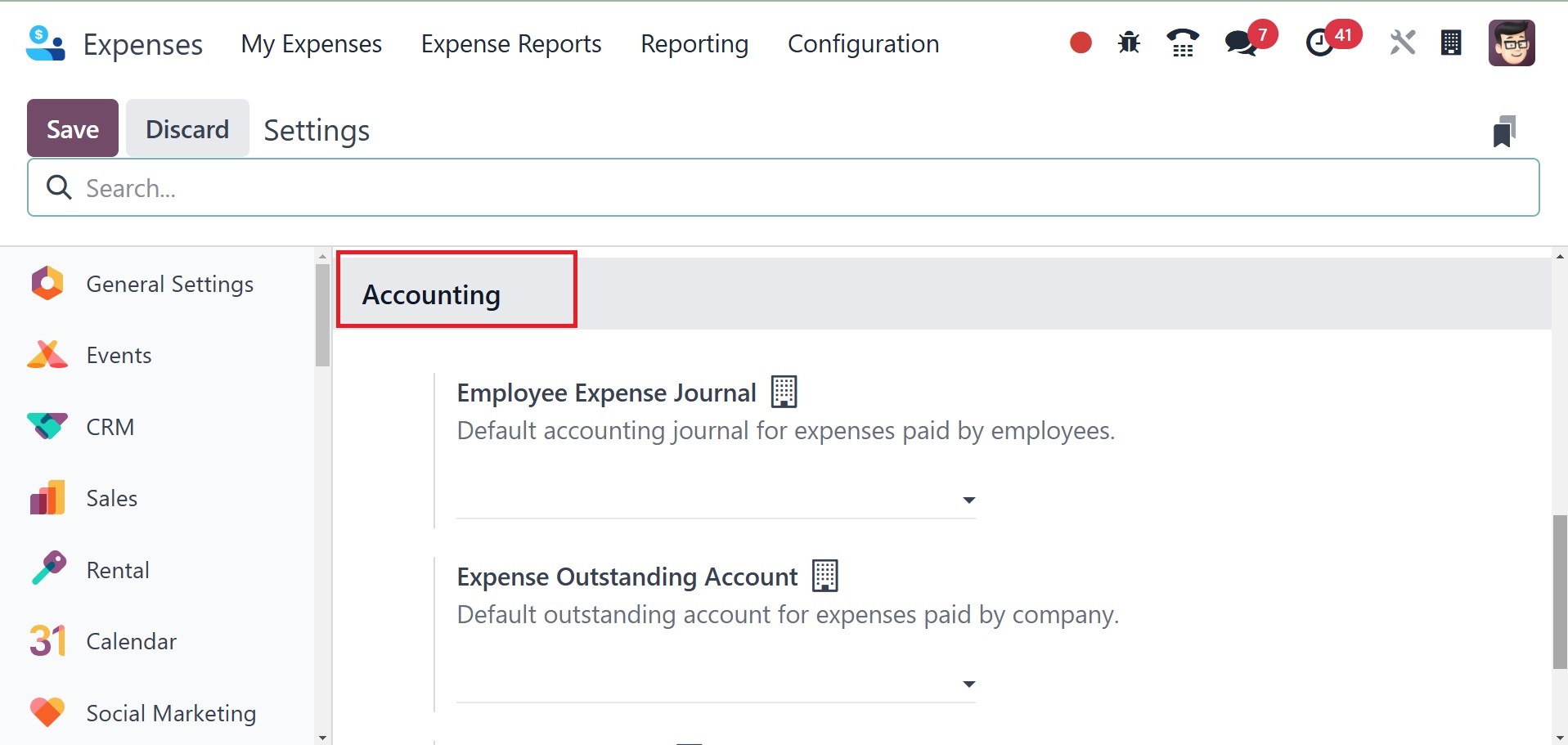

The Employee Expense Journal box in the Default Journals section

allows you to choose a default account journal for employee-paid

expenses. You can also select the default accounting journals for

which the business pays expenditures under the Company Expense

Journal option.

The payment methods allowed for the expenses paid by the company can

be indicated inside the Company payment methods provided under the

Payment section. The Accounting options in Odoo Expenses have the

Expense Outstanding Accounts option. Businesses can use this feature

to keep track of employee-paid expenses that have not yet been

repaid. After enabling all required fields, you must click the SAVE

sign to see further changes in Odoo 18.

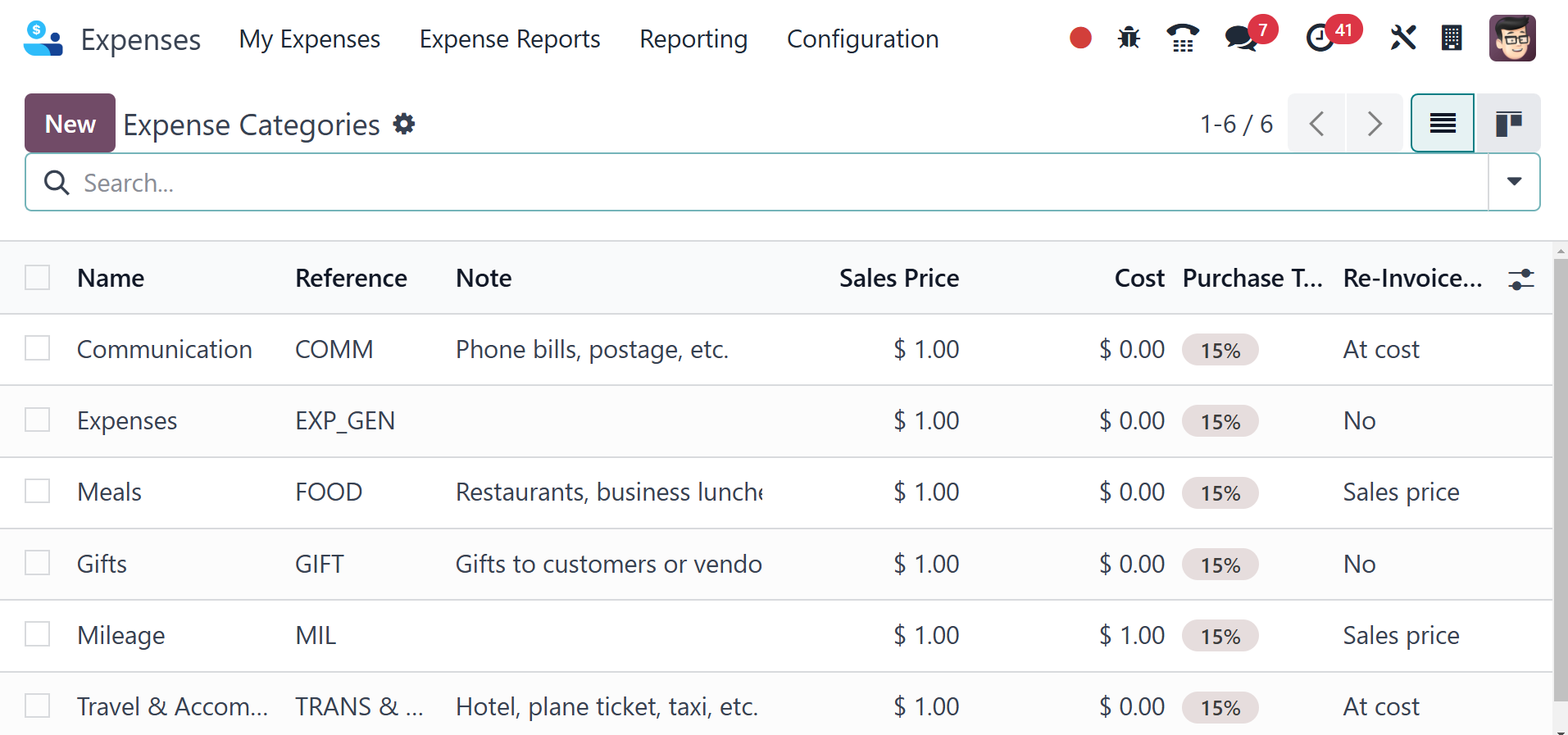

3.2 Expenses Report

Odoo 18's expenditure module can assist you in managing product

categories. It is easy to arrange product costs according to each

category of expense. To add a new category, go to Configuration and

select Expense Categories. The open Expense categories screen

contains details about each charge category, such as name, sales

price, vendor taxes, internal references, re-invoice fees, and more.

Once the NEW symbol has been chosen, you can make a cost category.

This allows us to quickly summarize the many categories of commodity

expenses in Odoo 18.

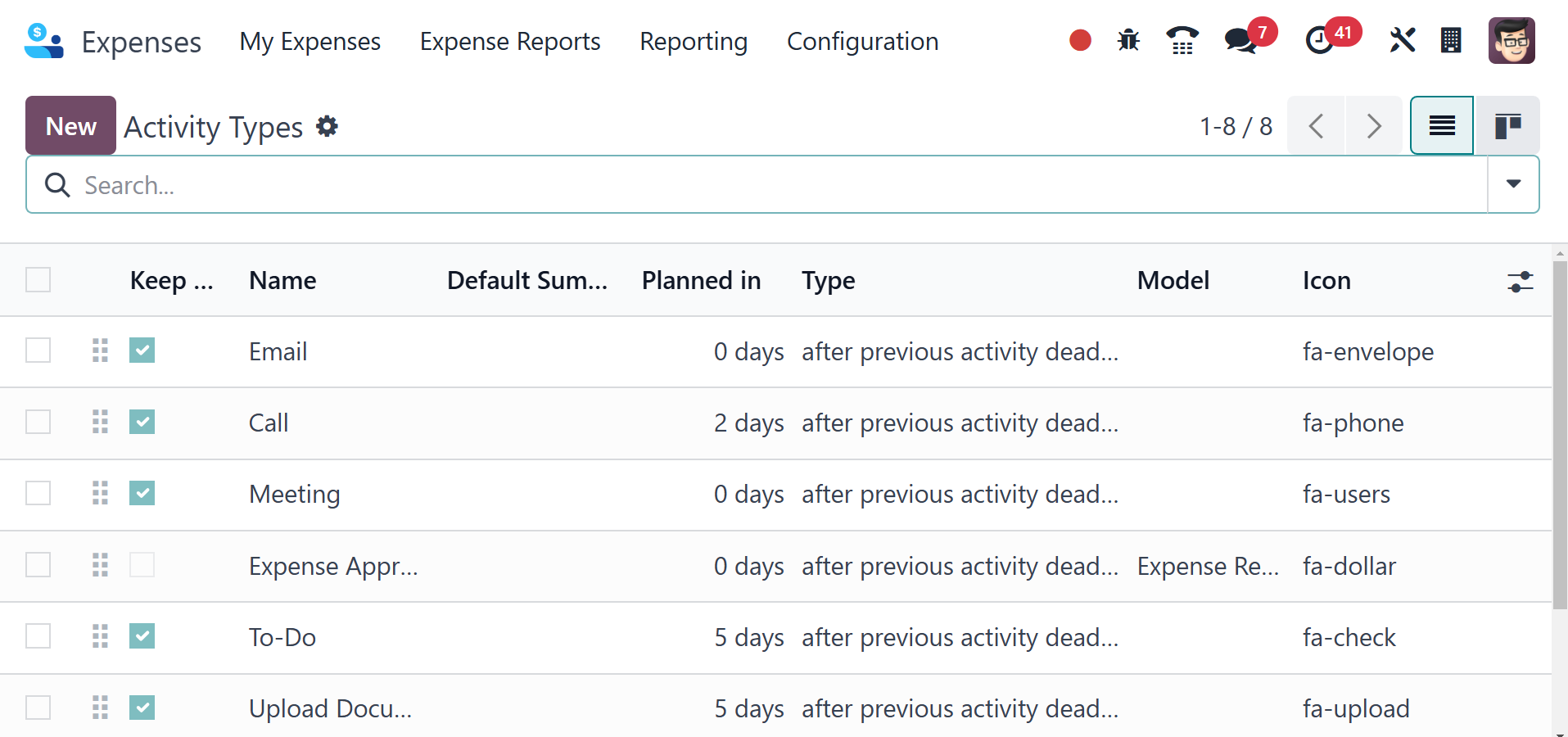

3.3 Activity Types

By specifying specified activities that users might do at various

points during the approval process of an expenditure report,

activity types help to organize and automate workflows. These kinds

of activities facilitate communication, enhance follow-ups, and

guarantee that expenses are processed on time.