5. Configuration

The Configuration tab in Odoo 18 Payroll allows you to manage the

salary package configurator, job entries, and employee salary data.

Let's now examine the key configuration elements.

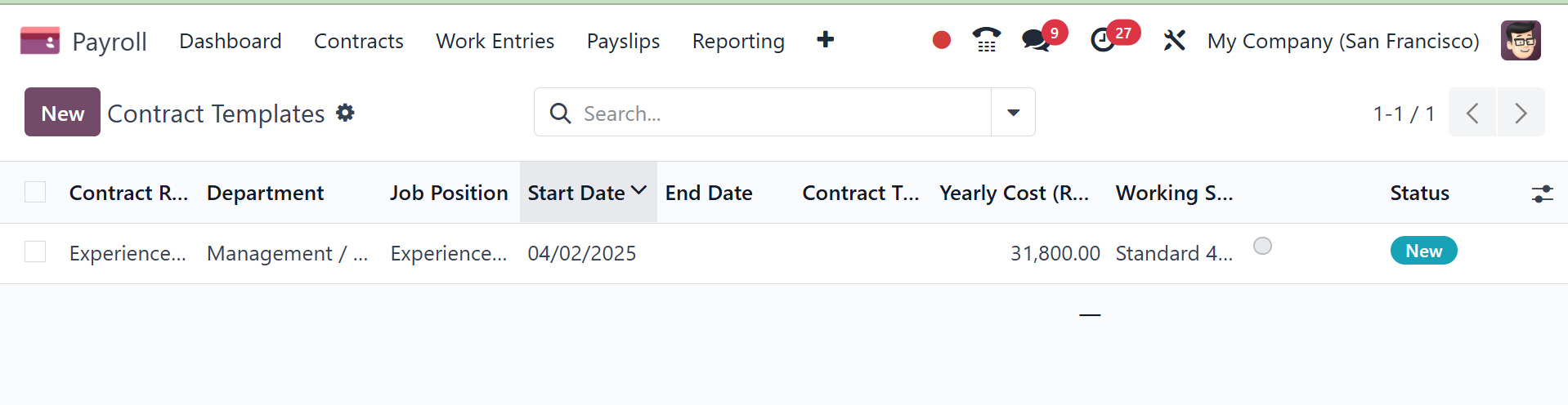

5.1 Template

The contract templates are accessible through the Configuration

menu's Template option. To add a new one, click the New button. The

subjects we discussed in the contract are similar to the form

creation view.

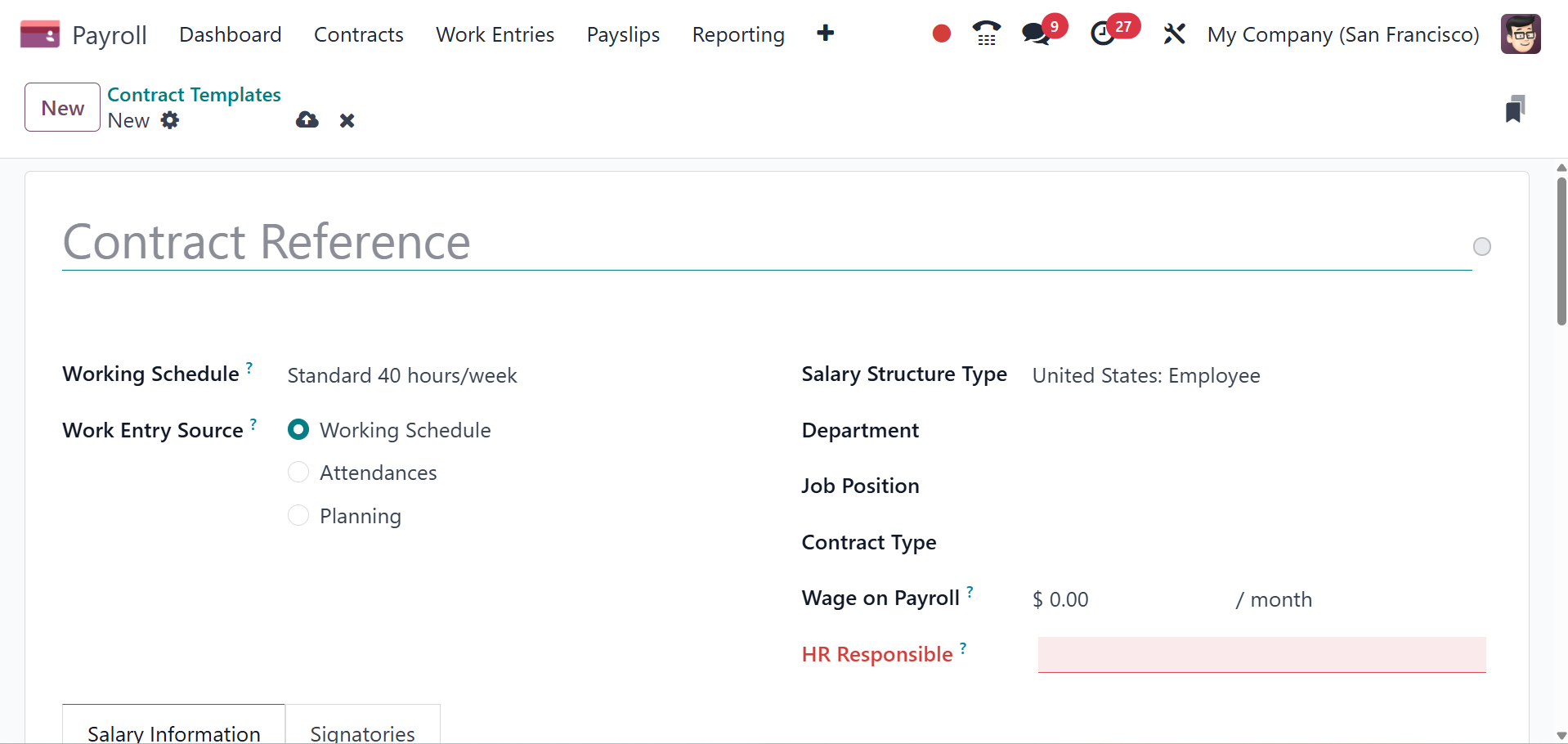

On selecting the NEW option, you can have the creation page, as in

the image below.

Here, you can add the name of the template, working schedule, working

entry source as working schedule, attendances, or planning.

Work Entry Source: select how the work entries are generated. This

field is required. Click the radio button next to the desired

selection. The options are:

Working Schedule: work entries are generated based on

the selected Working Schedule.

Attendances:work entries are generated based on the

employee’s check-in records in the Attendances application. (This

requires the Attendances application).

Planning: work entries are generated based on the

planned schedule for the employee from the Planning application.

(This requires the Planning application).

Salary Structure Type: select one of the salary

structure types from the drop-down menu. The default salary

structure types are Employee or Worker. A new salary structure type

can be created, if needed. Department: select the department the

contract applies to from the drop-down menu. Job Position: select

the specific job position the contract applies to from the drop-down

menu.then, provide the contract type, wage on payroll, and HR

responsible. Wage on Payroll is to enter the employee’s monthly

wage. Contract Type helps to choose either Permanent, Temporary,

Seasonal, Full-Time, or Part-Time from the drop-down menu.

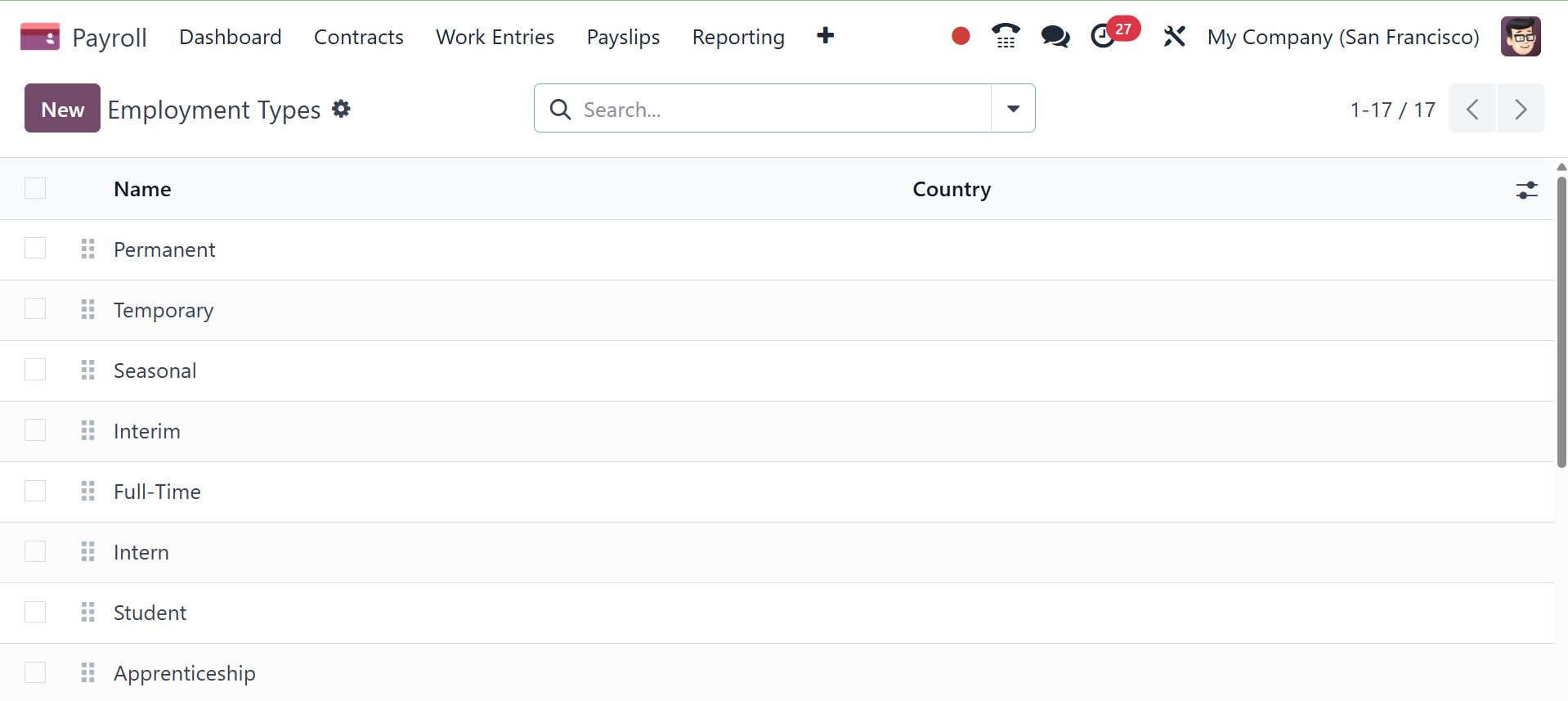

5.2 Employment Types

Every type of employee in a company, including trainees, permanent

employees, and temporary employees, has a different pay plan to suit

their needs. These employee categories can be configured as

Employment types under the Configuration option.

The list includes the name, code, and country. To add a new one,

click the New button. A new line will show up underneath the list.

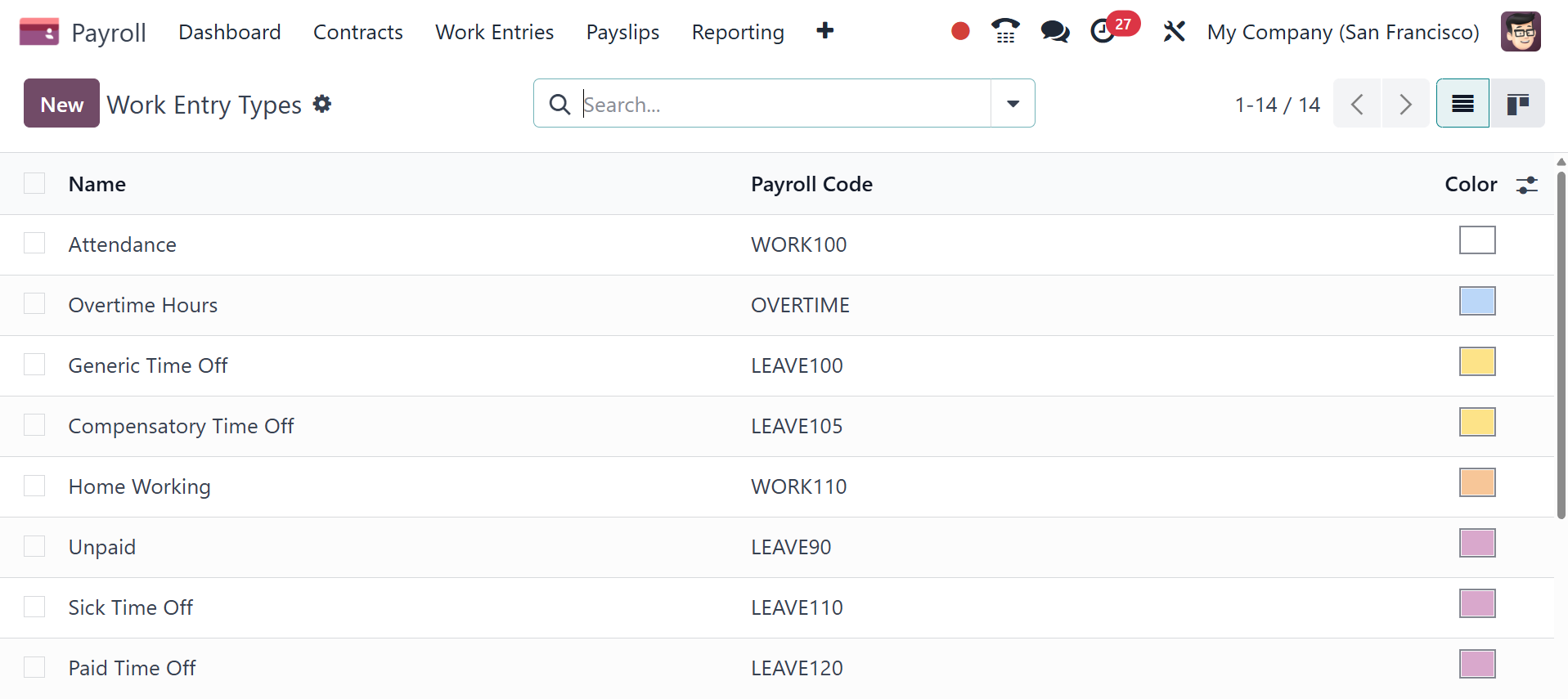

5.3 Work Entry Type

The Configuration menu now displays the list of work entry types. The

Name, Payroll Code, and Color are shown in the list. The New button

can be used to add a new type of work entry.

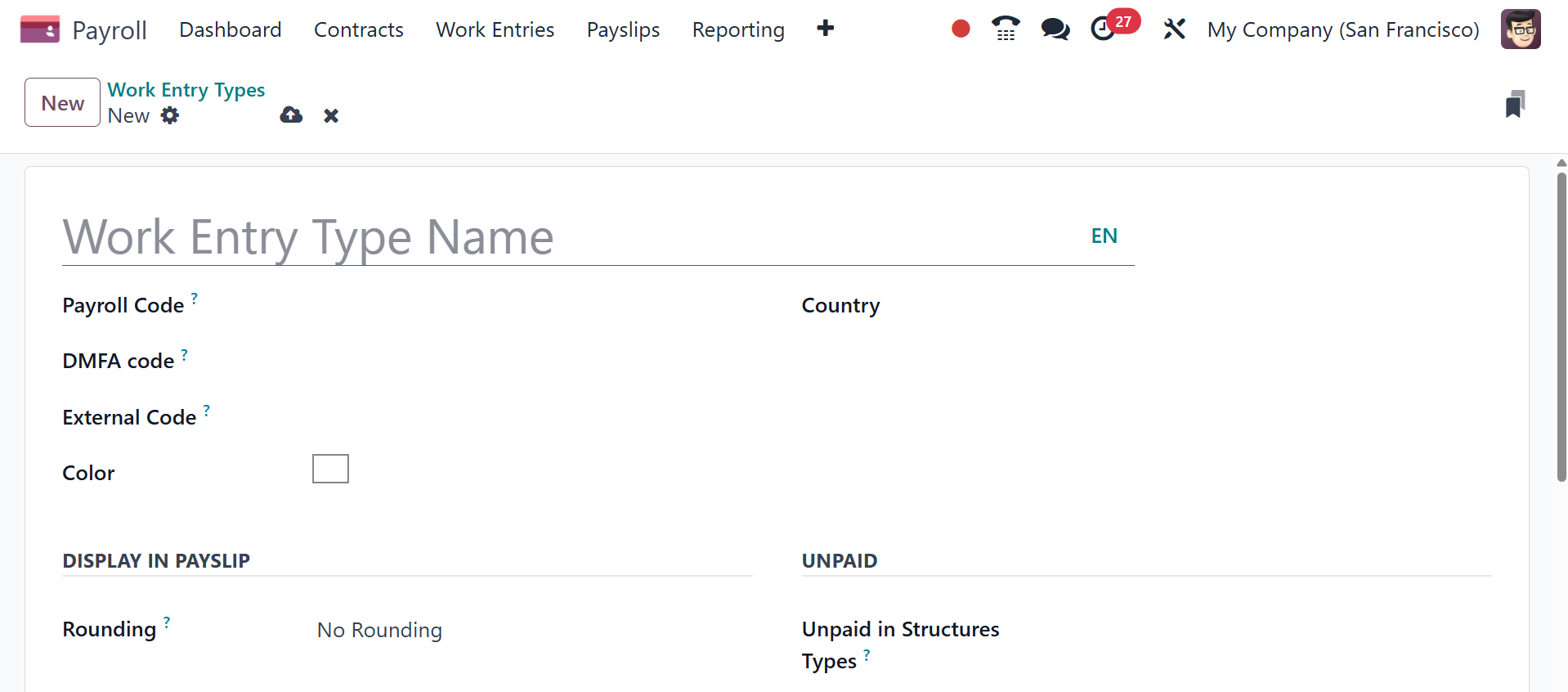

Enter the Workentry Type Name and Payroll Code. The DMFA Code is used

to identify the work entry in the DMFA report. The information was

exported to an external source by the external code. When the entry

is made on the payslip, the value is rounded using the added

rounding method. The worker benefits from the Unpaid Structure

Types, which do not allow the worker to view their payslip.

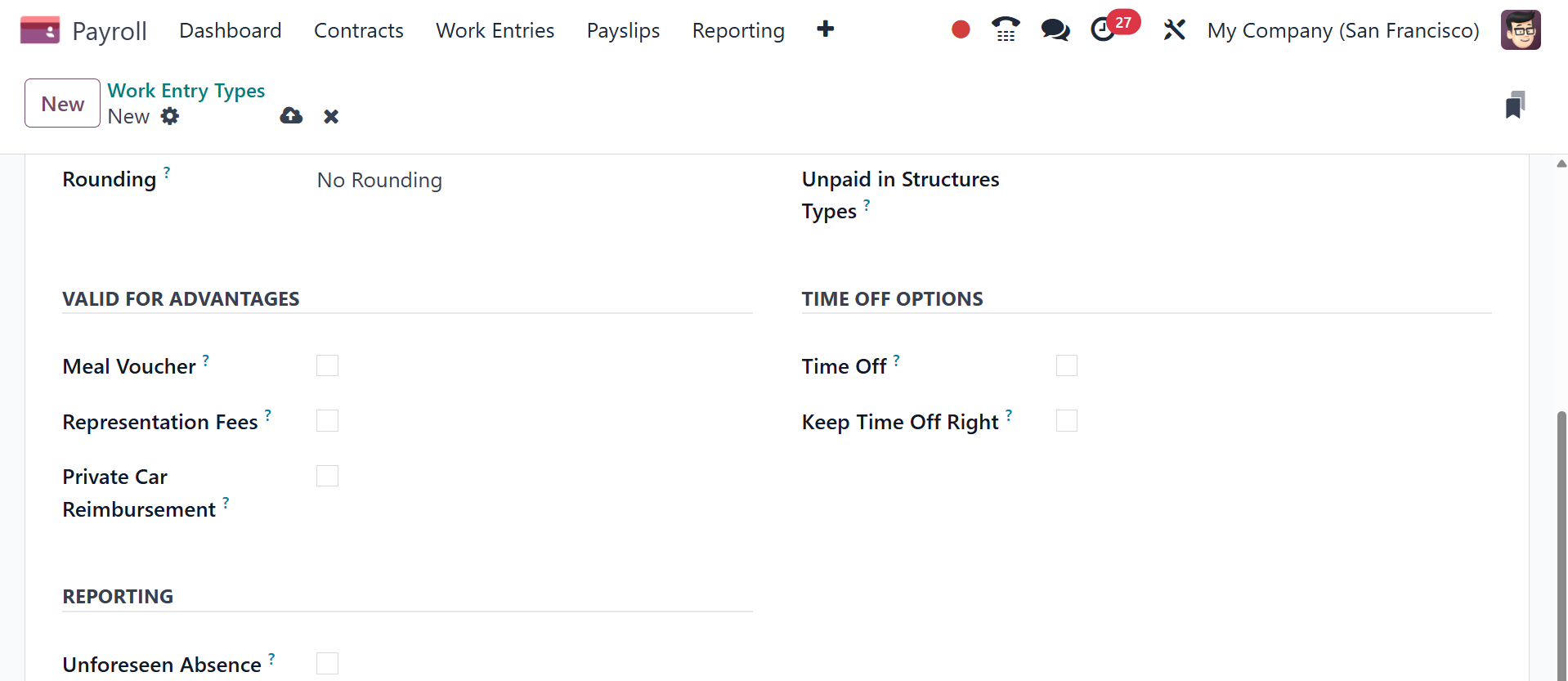

Check boxes can then be enabled under the VALID FOR ADVANTAGES

section. Checking each box makes the job entries eligible for

reimbursement of various expenses, including lunch vouchers,

representation fees, and private vehicle charges.

By activating the Time Off, the job entry type can be connected to

time off types. Keep Time Off Right allows job input to be counted

for vacation time in subsequent years. If Unforeseen Absence is

enabled in the job entry, it will be included in the absenteeism at

work report.

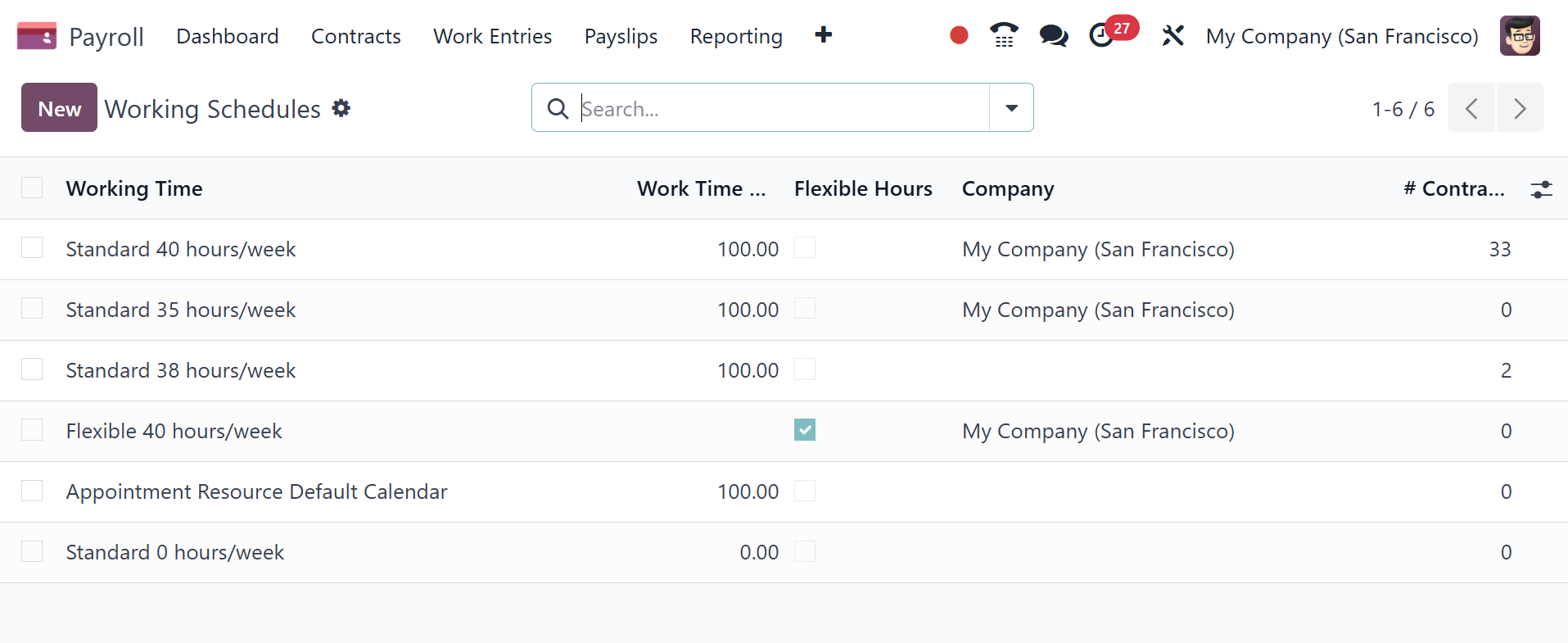

5.4 Working Schedule

The Odoo 18 Payroll module makes it simple for users to monitor their

working hours. With its help, you can boost organizational

productivity. Both companies and employees are given the flexibility

they need to realize their full potential. On the Configuration tab

of Odoo 18 Payroll, select the Working Time menu. In the Working

Times box, we may view data such as Work Time Rate, Contracts using

it, Working Time, and Company. By choosing the New icon, you may

make a new employee work schedule.

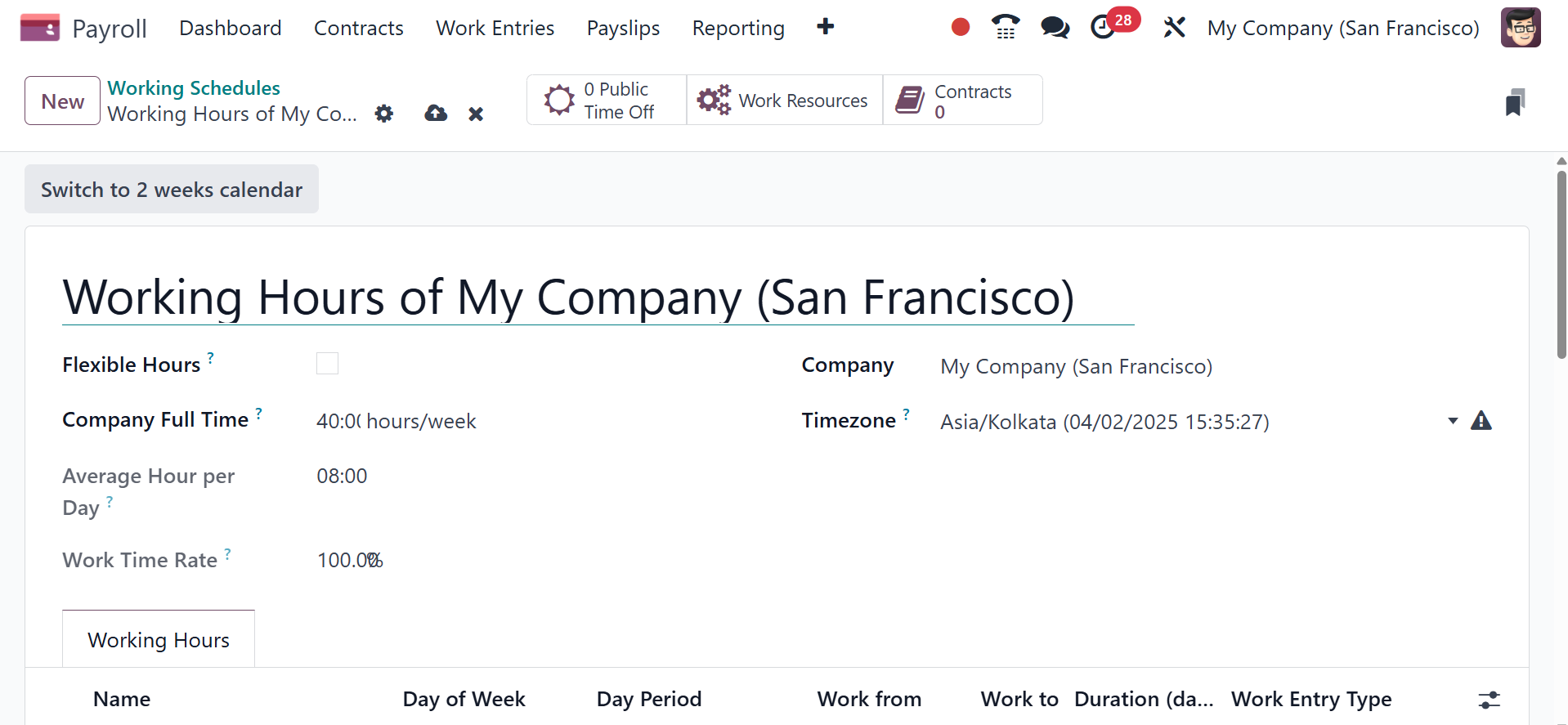

Once the Working schedule window has been launched, the user can

apply the Company, Full Time, Average Hour per Day, and Timezone

data. Among the smart buttons in the Working Times pane are Work

Resources, Contracts, and Public Time Off.

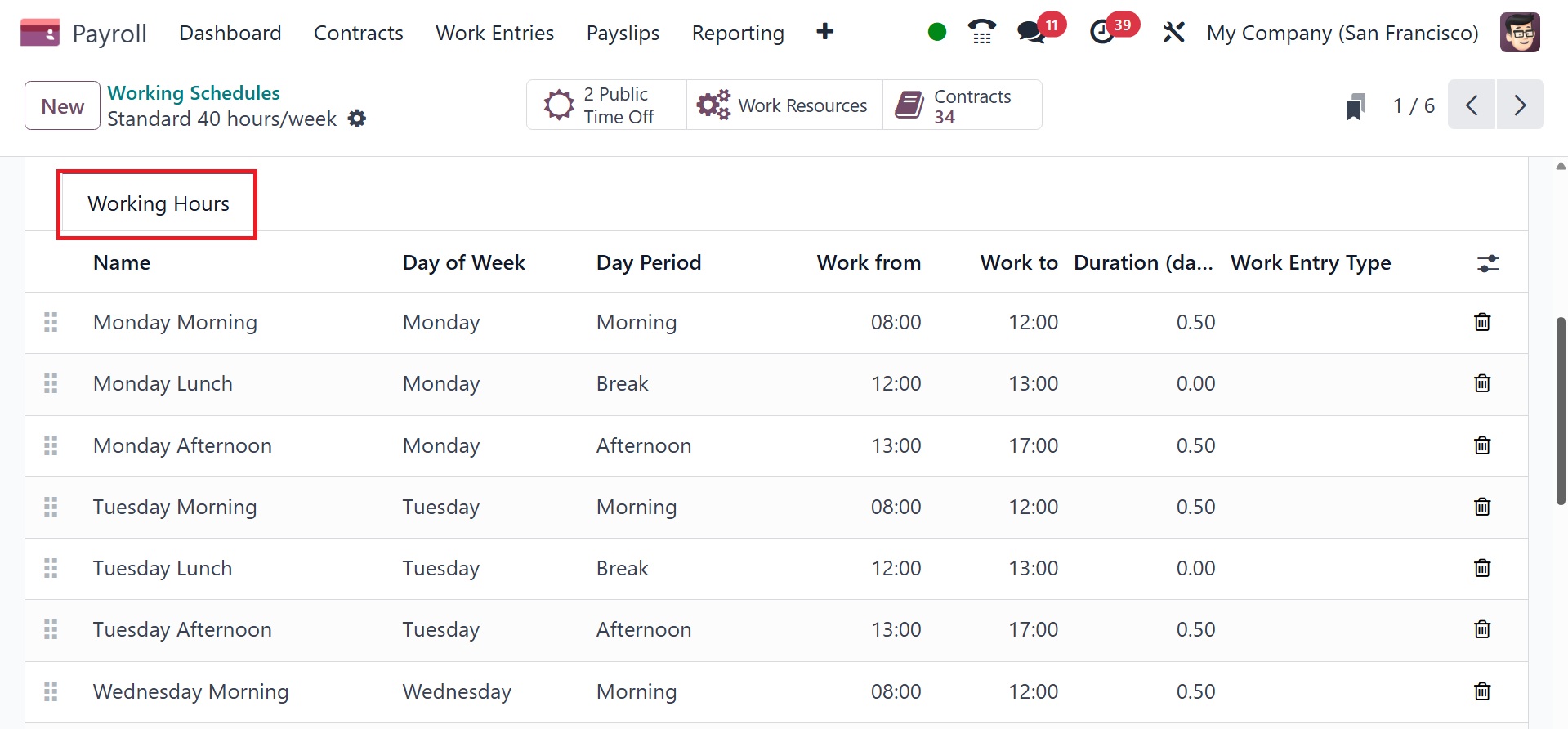

The user can add a new working hour for an employee by choosing Add a

line under the Working Hours tab. The user can enter the name, day

period, type of work entry, day of the week, work from, and other

details under the Working Hours section.

Here, the switch to the 2-week calendar option is available if the

working hours are not consistent each week, and the hours are on a

bi-weekly schedule instead. Click the Switch to 2-week calendar

button at the top of the new default working hours form. This

changes the Working Hours tab to display two weeks of working times

that can be adjusted.

The Salary area of the Configuration tab allows us to define salary

structures and policies. Among the options available in the Salary

area are Rules, Other Input types, Structure kinds, Rule parameters,

Rules, and so on. We can now discuss each of them separately.

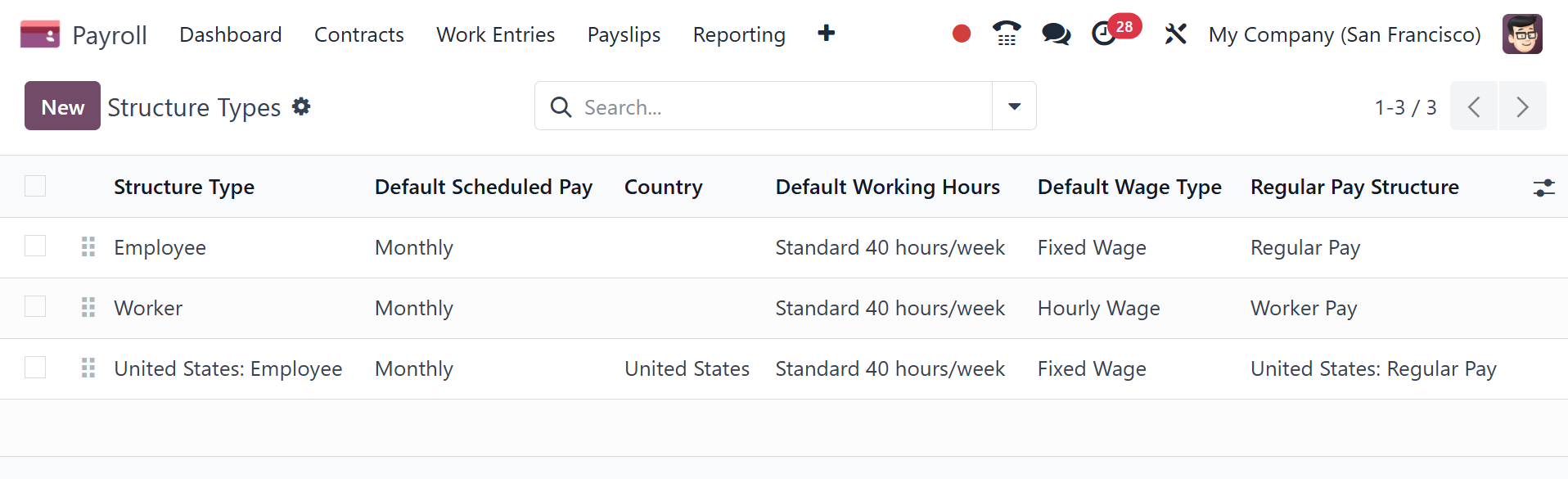

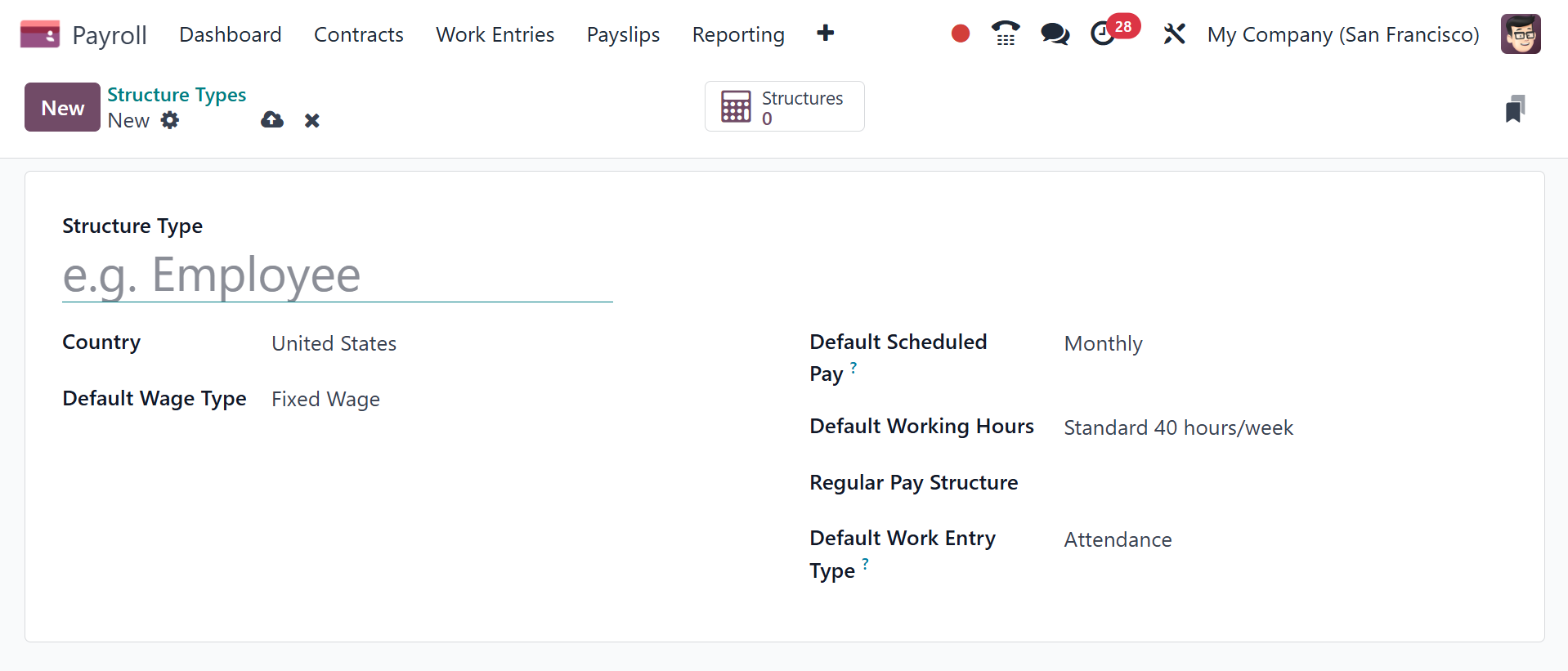

5.5 Structure type

It is possible to configure new types of salary structures in Odoo 18

Payroll. After describing the different wage kinds on a monthly,

hourly, or weekly basis, users can define salary structures for

trainees, employees, and workers within the Odoo18 Payroll system.

Users can designate their employees' pay scales after choosing the

Salary Structures menu on the Configuration tab. The Structure Types

box may contain details on Wage Type, Default Scheduled Pay,

Structure Type, Regular Pay Structure, and other topics. We can

create new structure types in Odoo 18 by clicking the New button.

In the open box, type the name of the structure type and your nation.

It's easy to set the wage type to hourly and fixed monthly.

The frequency of wage payments should then be entered in the Default

Scheduled Pay section. The default working hours for the salary

structure type can then be specified by the user. We can explain the

typical employee pay structure in the Structure Type section. You

can also specify the work entry type related to regular attendance

in the Default Work Entry Type section.

The user can view every structure within each of the structure types

after selecting the Structures smart button.

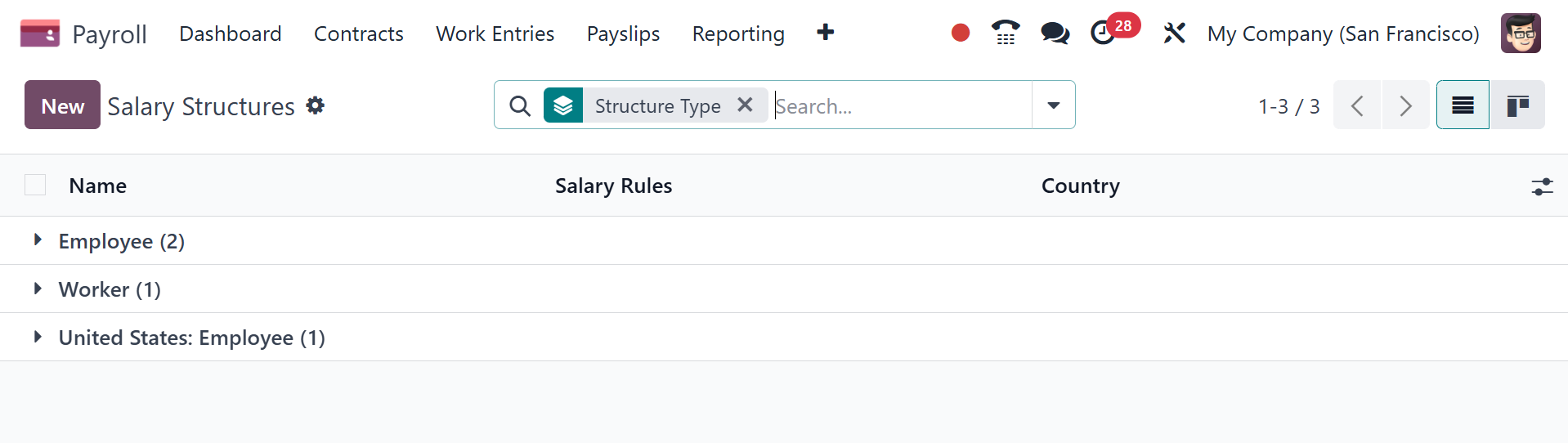

5.6 Salary Structures

We may give payslips for payroll and determine employee wages within

the wage structures based on job advertisements. You can specify

several useful rules for payslip calculations with a wage structure.

The department or group as a whole uses a single salary system.

Users can describe a new compensation structure as soon as they

choose the Structures option in Configuration. Individual salary

schemes for workers and employees are available on the open window.

Along with the employee salary structure, the name, nationality, and

wage regulations of each employee are readily evident. To input the

description of a new salary structure, select the New icon in the

wage Structures box.

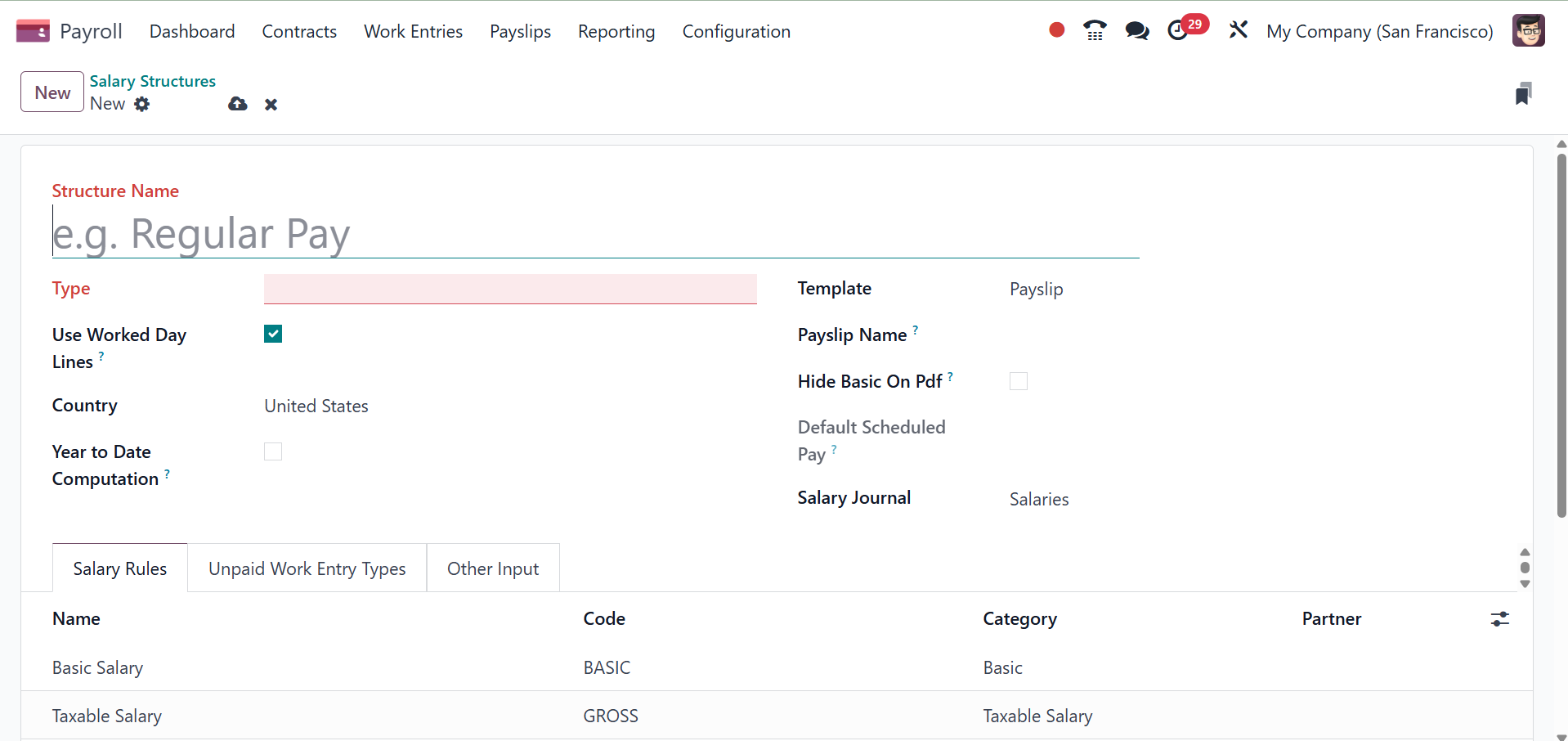

For the category of the structure type, you need to enter

Employee/Worker in the Type and Structure Name fields on the new

screen. To show working days on the employee payslip, select the Use

working Day Lines option. When discussing the employee compensation

plan, mention the nation. Then, you have the options to provide the

country name, year to date computation, template, payslip name, hide

basic on PDF, and salary journal, respectively.

Reports on terminations, pay stubs, and other topics are among the

many reports available to users. Weekly, annual, monthly, and other

wage payment options are also available in the Scheduled Pay

section. We can also choose a certain wage journal in relation to

the pay system.

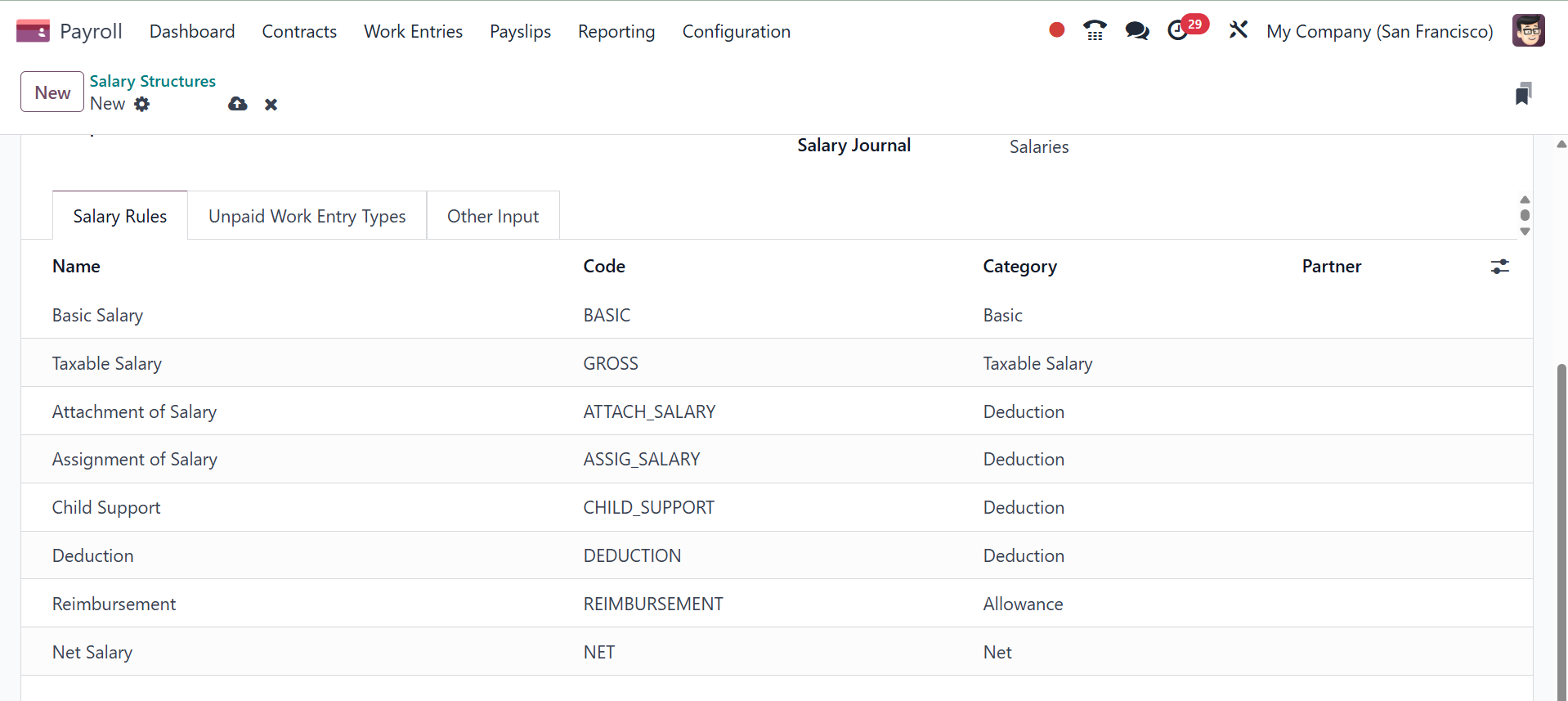

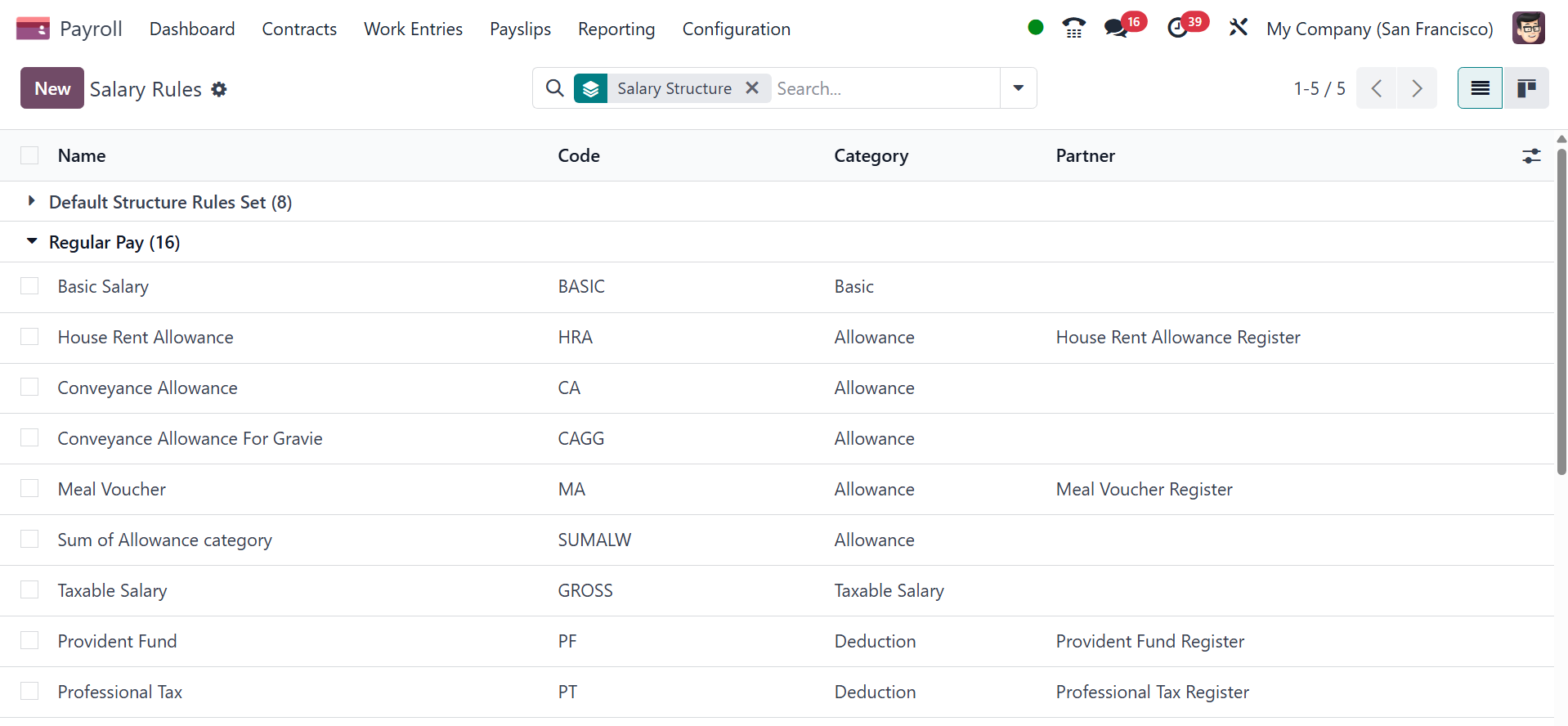

Specific employee salary structure rules can be implemented. Choose

Add a line from the Salary Rules tab and provide the specifications

for your employee's pay scale to do this. You can mention the

Category, Name, Partner, and Code for each salary regulation.

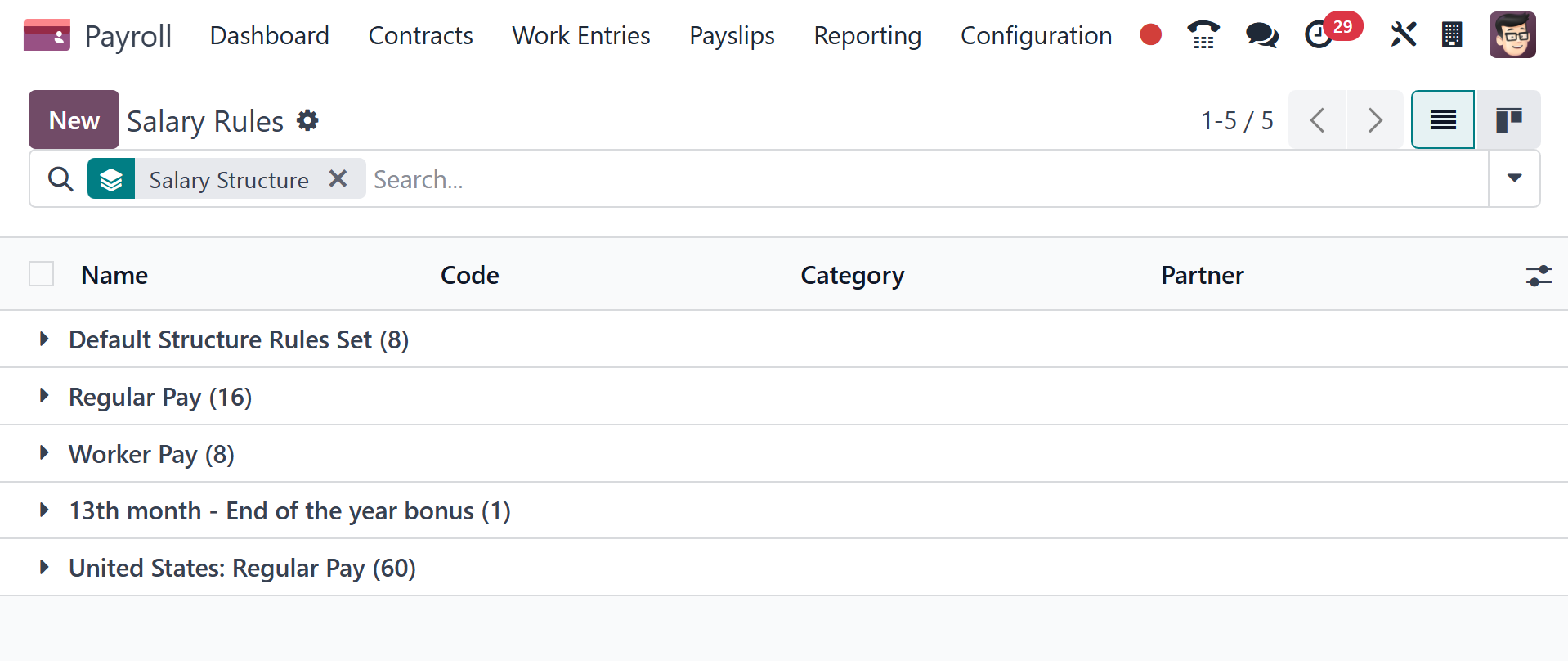

5.7 Salary Rules

One of the most important aspects of every business is the

establishment and maintenance of a fair compensation structure.

Establishing policies, figuring out fair compensation, and planning

ahead are some of the factors that go into effective business

management. These rules ensure that you have the freedom to

determine how much to pay certain organizations. By choosing the

Rules menu item in Configuration, you can access the Salary Rules

pane. All of the wage guidelines set forth in Odoo 18 are accessible

to users. Each compensation rule's salary structures, which include

details like Name, Category, Code, and Partner, are visible to the

user. By choosing the New option in Odoo 18, we can establish a

salary rule.

Under each rule, you can have sub rules, as in the image below.

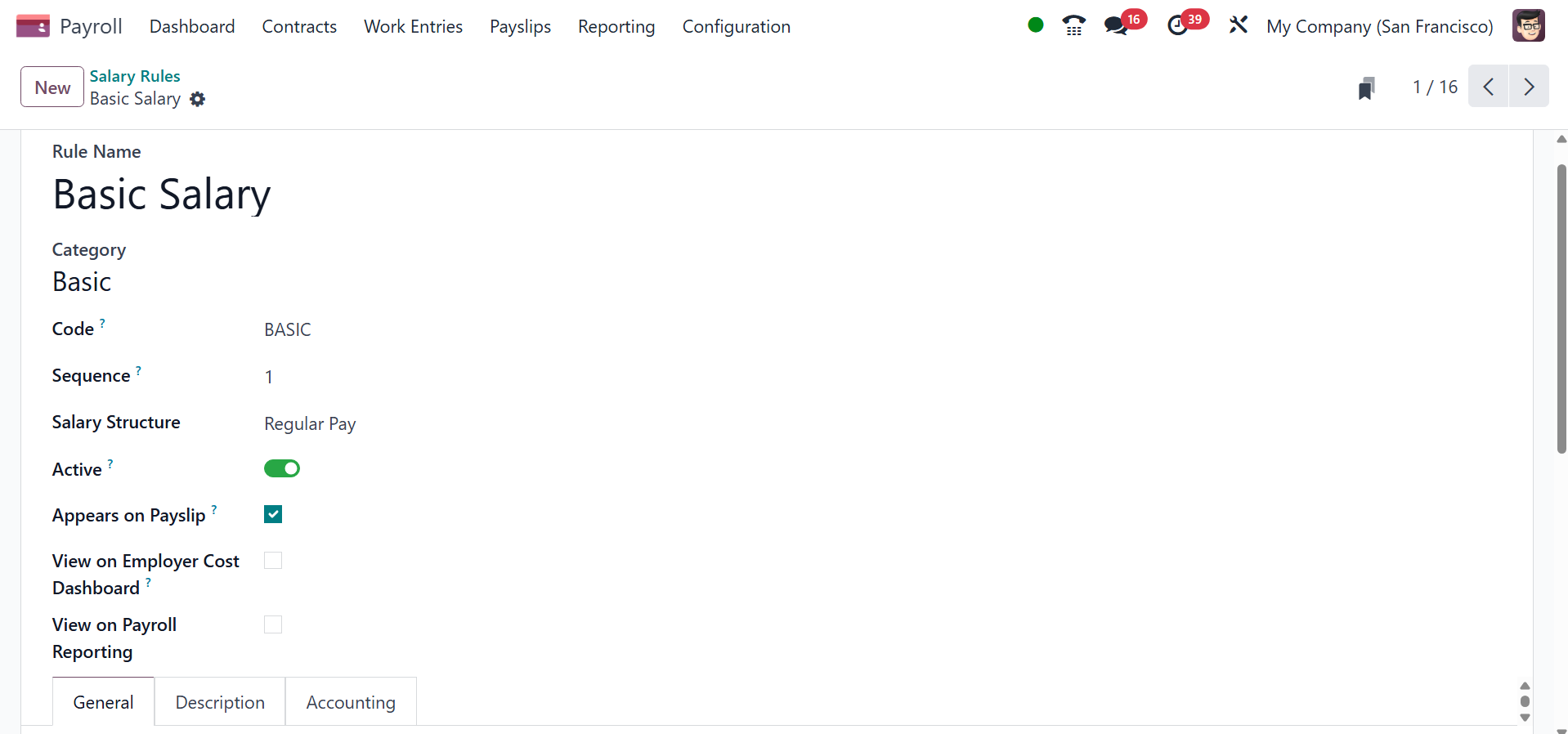

On selecting a particular rule, you will get the details, as in the

image below.

Here, you have the details like

- Rule Name: enter a name for the rule. This field is

required.

- Category: select a category the rule applies to

from the drop-down menu, or enter a new one. This field is

required.

- Code: enter a code to be used for this new rule.

This field is required.

- Sequence: enter a number indicating when this rule

is calculated in the sequence of all other rules.

- Salary Structure: select a salary structure the

rule applies to from the drop-down menu, or enter a new one.

This field is required.

- Active: enable this toggle, so the rule is

available for use. Disable the toggle to continue to show it on

the payslip, but skip the computation.

- Appears on payslip: tick the checkbox to have the

rule appear on employee printed payslip.

- View on Employer Cost Dashboard: tick the checkbox

to have the rule appear on the Employer Cost report, located on

the Payroll app dashboard.

- View on Payroll Reporting: tick the checkbox to

have the rule appear on payroll reports.

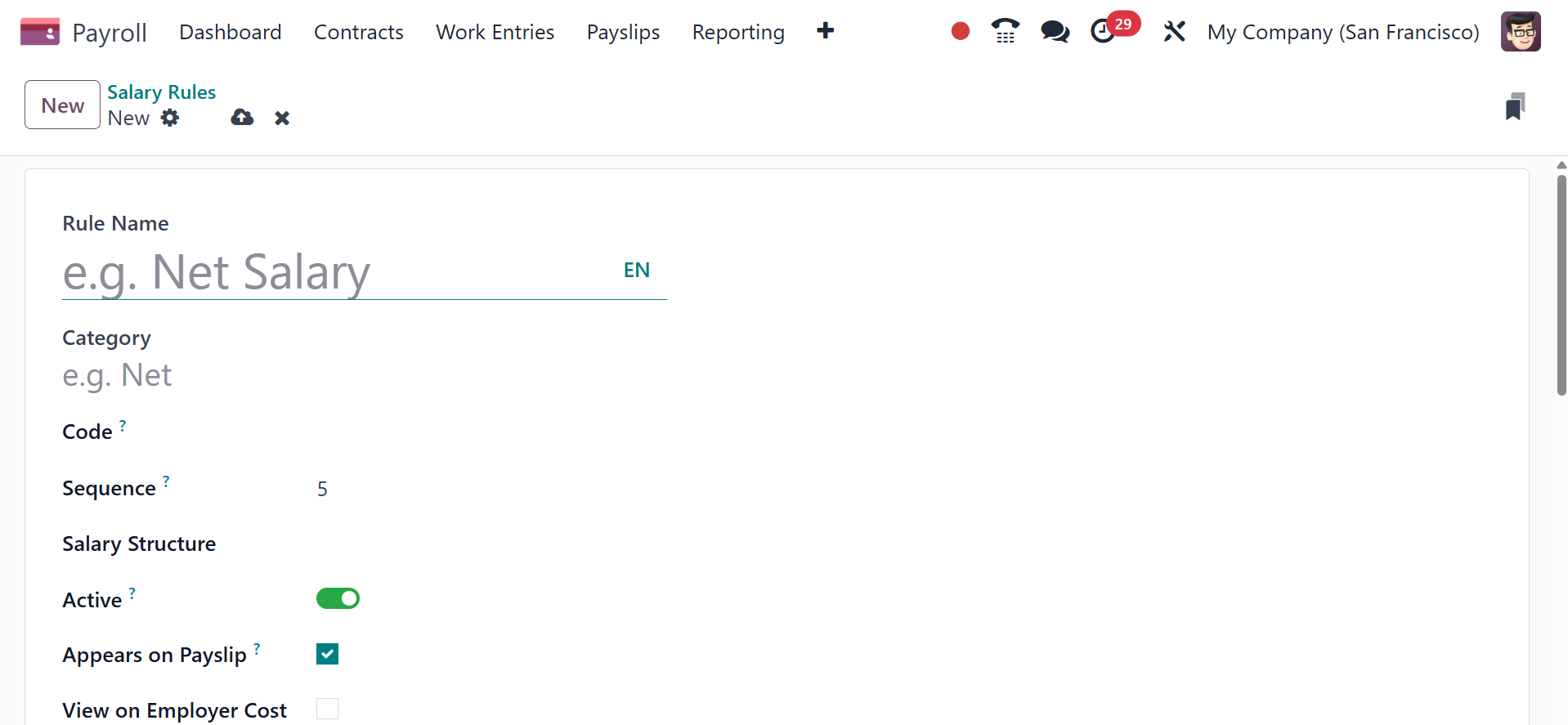

To create a new one, use the NEW icon. Choose Category using the Rule

Name you just added after adding it to the resulting screen. Users

can immediately identify the rule by providing a code. Additionally,

to make sequence calculating easier, don't forget to add a serial

number.

By using the Appears on Payslip option, we may view the salary rule

within a payslip. After turning on the View on Employer Cost

Dashboard, we could see the employer cost value in the dashboard. To

establish the salary rule for payroll reporting, turn on the View on

Payroll Reporting field in the Salary Rules window.

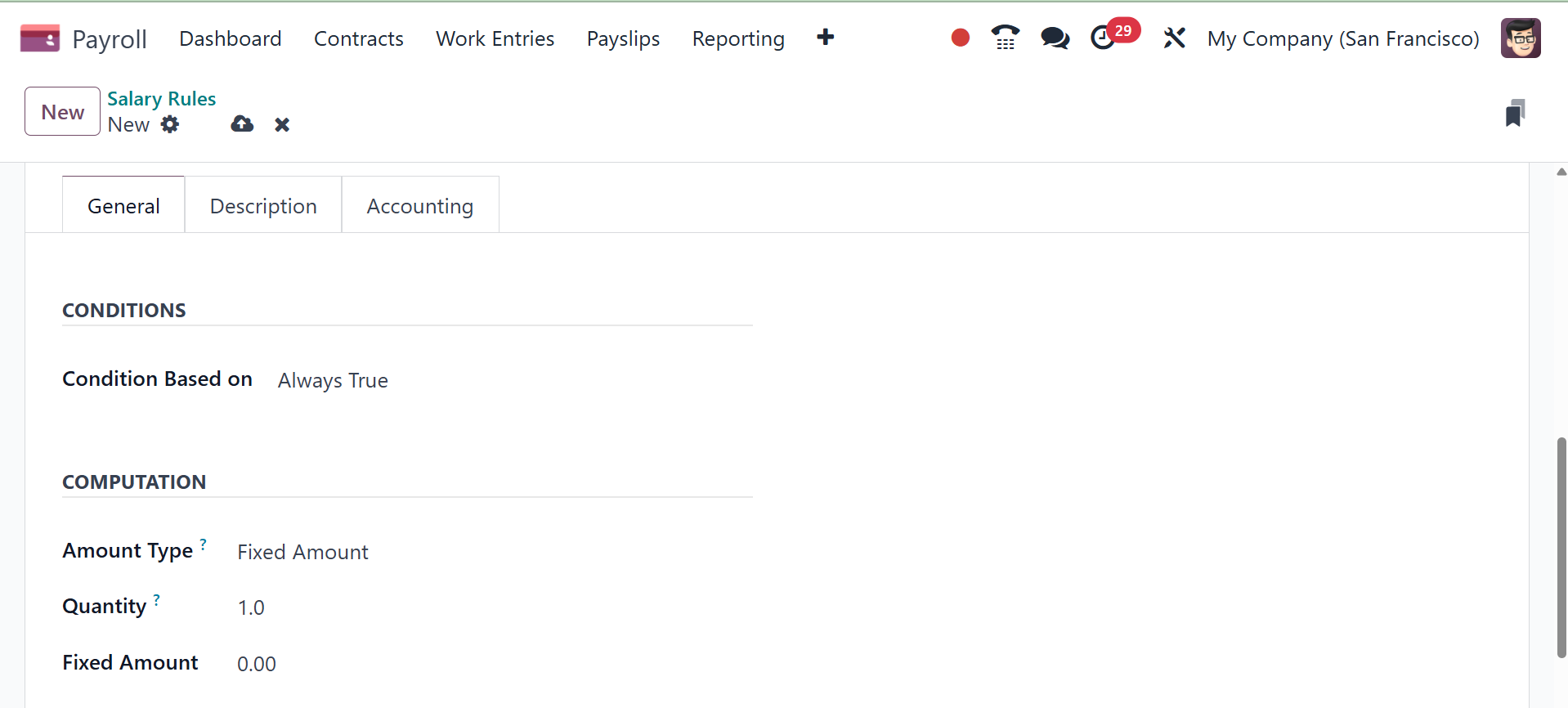

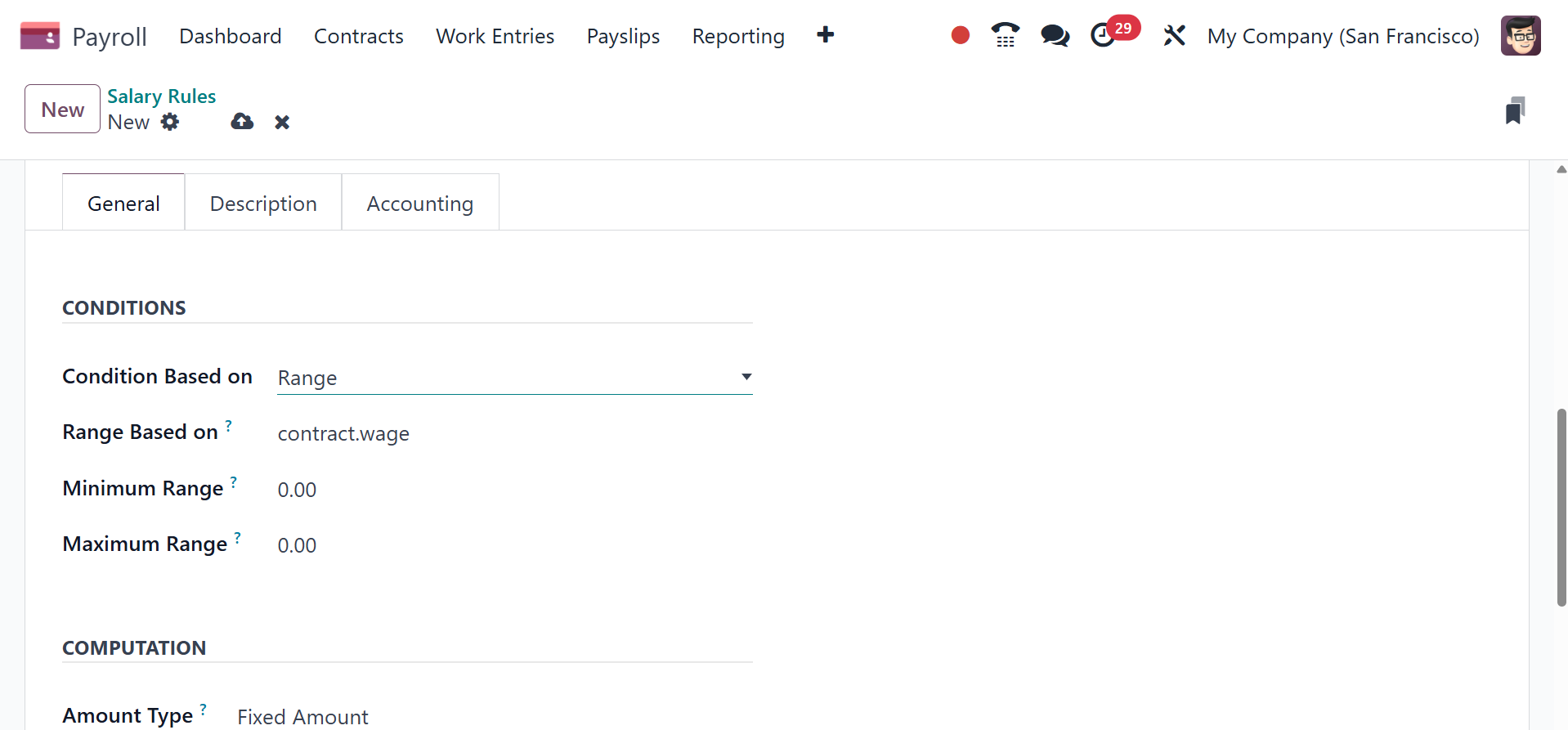

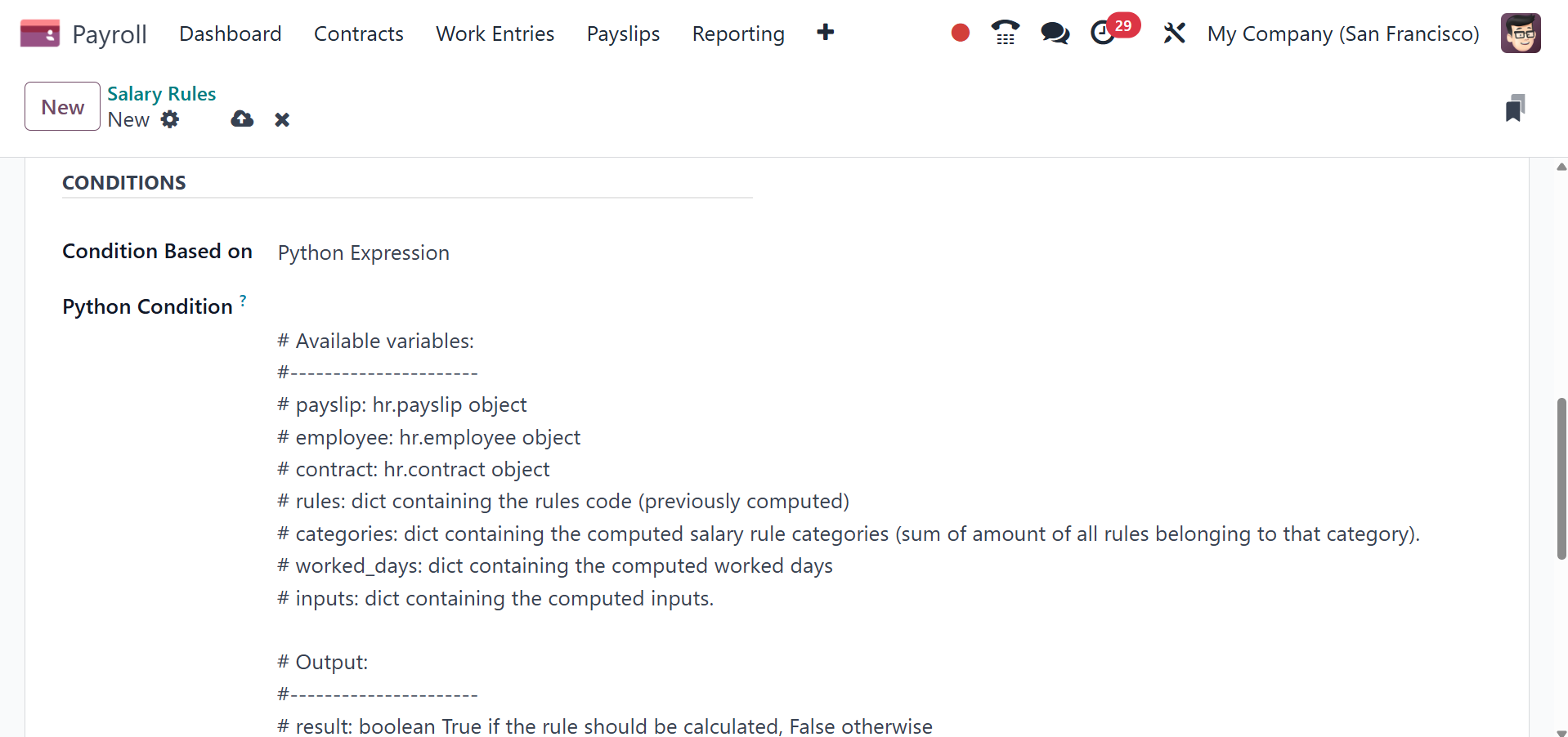

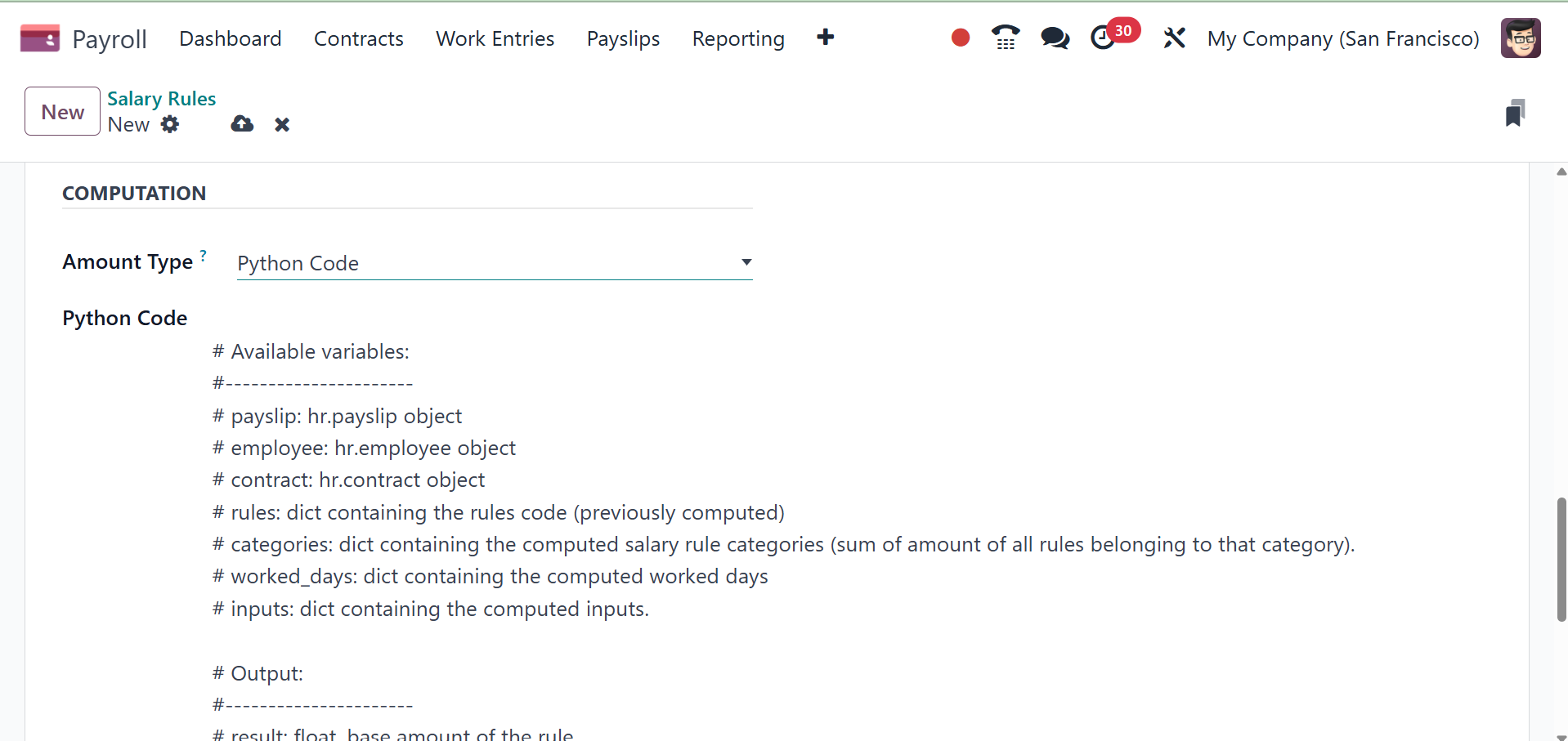

Below the General tab, we are in charge of the calculation, terms,

and corporate contribution. In the "Condition Based on" field, enter

the condition of the salary rule as Range, Always True, and Python

Condition. The required wage rule for salary computation can be

easily configured by choosing the Always True option. You must

provide data for the Maximum Range, Range dependent on, and Minimum

Range after choosing the Range option. The 'Range' Based option is

used to automatically calculate field values.

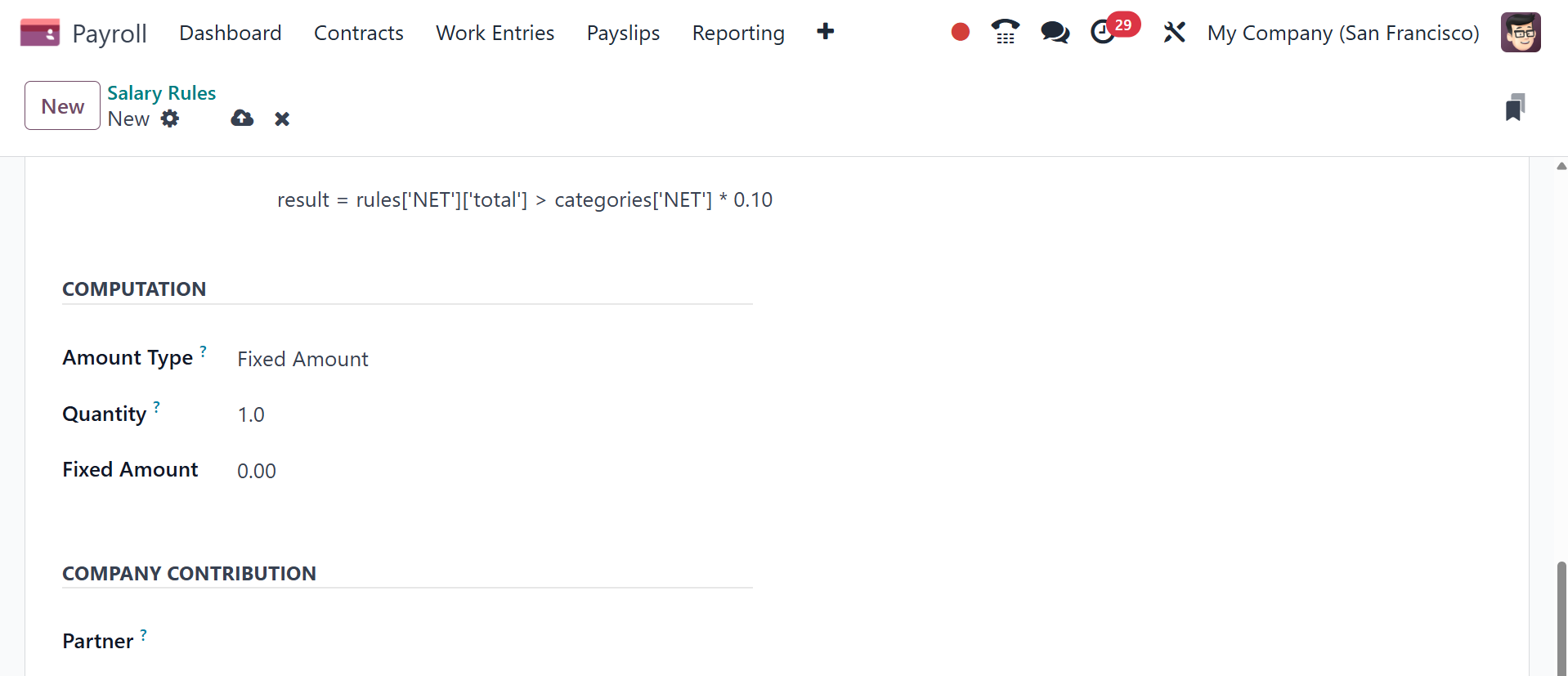

Odoo18 creates equations using the default method when we choose

Python Expression in the Condition Based on field.

We can determine the salary guidelines under COMPUTATION. To do this,

the user can select the calculating technique in the Amount Type box

from Fixed Amount, Python Code, or percentage (%).

We can compute the amount based on the % once we select it as the

amount type. By choosing the Fixed Amount option in the Amount Type

column, we may generate a fixed amount. After selecting Fixed

Amount, you may select the quantity and fixed amount of the salary

rule.

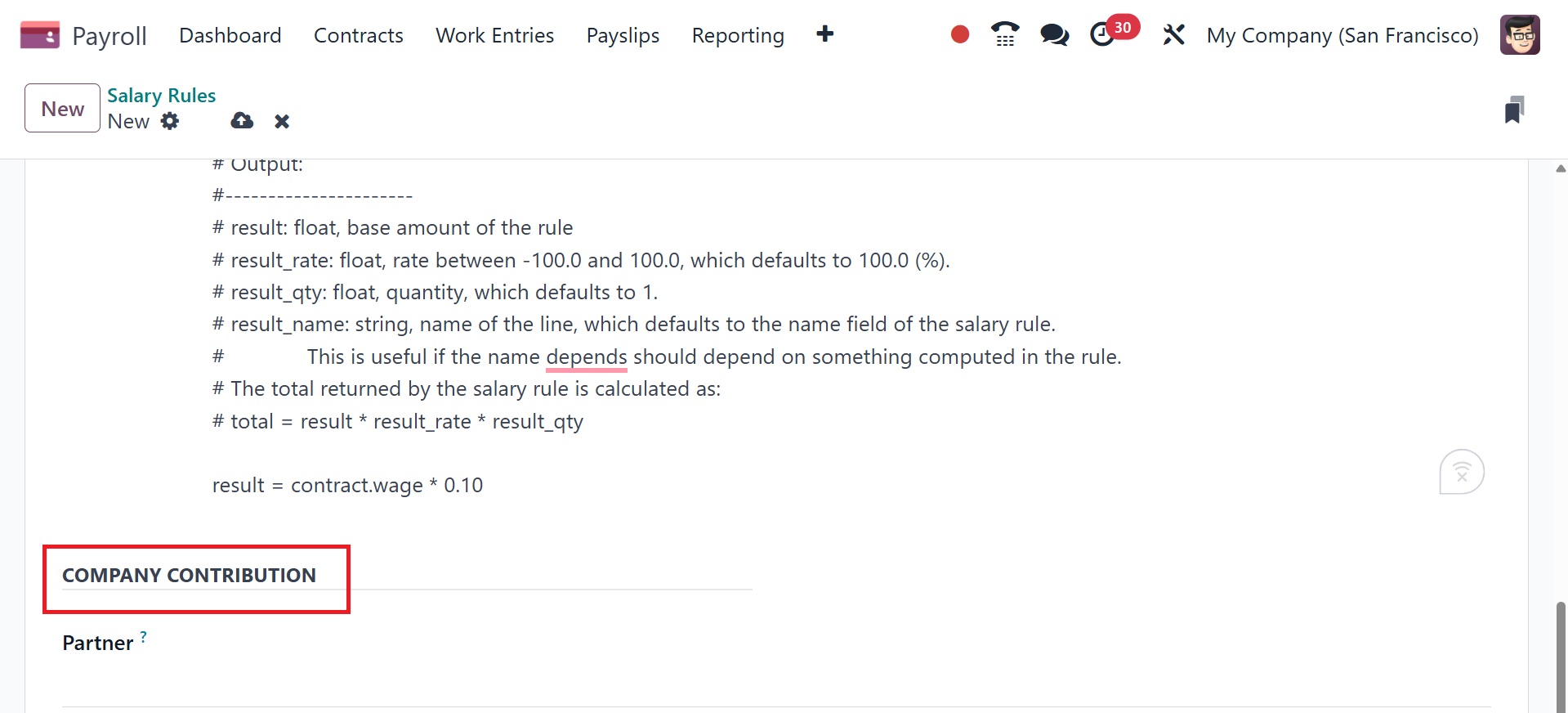

Users can also use Python code to calculate the salary rule. To do

so, enter Python code in the Amount Type column. Later on, you can

define the Python code according to its properties.

In the COMPANY CONTRIBUTION area, we can specify the third party that

is involved in employee salary payments.

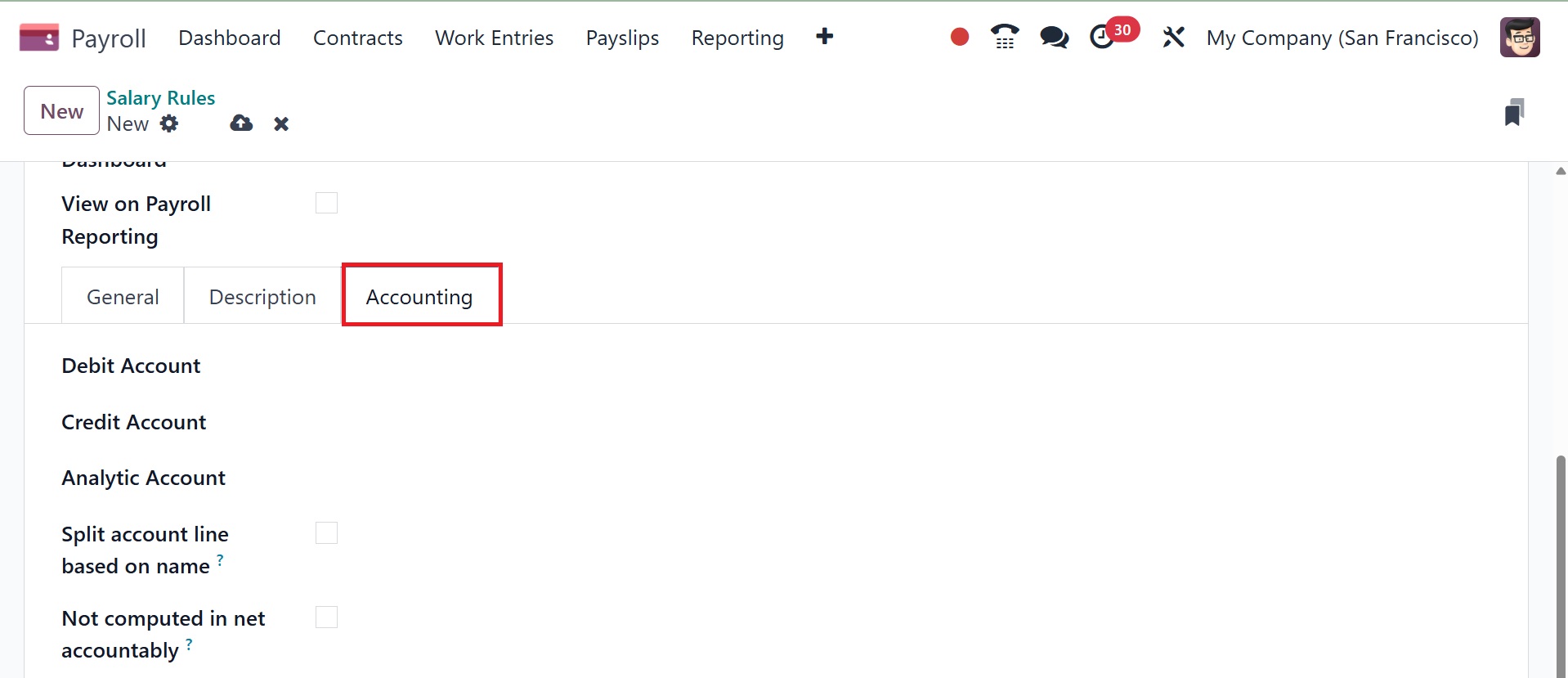

The note regarding the salary rule can be placed beneath the

Description tab. Under the Accounting tab, you can enter details for

the Analytic Account, Debit Account, and Credit Account. You can

eliminate the net salary rule value once you've enabled the Not

Computed in net accountability option in the Accounting section.

The rules are saved in Odoo 18 Payroll.

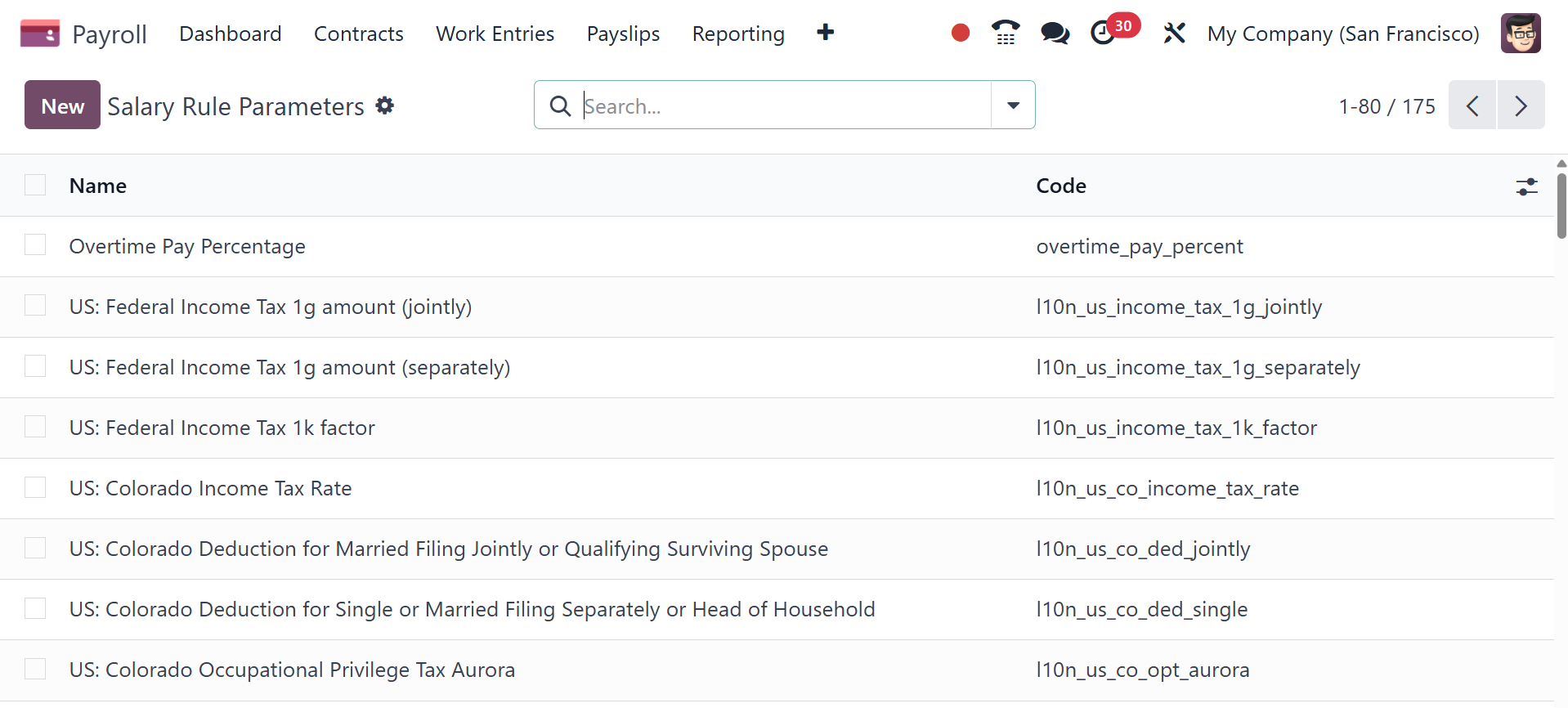

5.8 Rule Parameter

Click the Configuration tab and choose the Rule settings option to

control different rule settings. Each salary rule parameter's code

and name are listed in the Salary Rule Parameters box. To create a

new rule parameter, select the New icon on the Salary Rule

Parameters page.

On the open screen, apply the title of the rule parameter to the Name

option. Add code to the salary rule to include the salary parameter.

You can add extra information about the salary rule parameter in the

Description tab after these specifics have been defined.

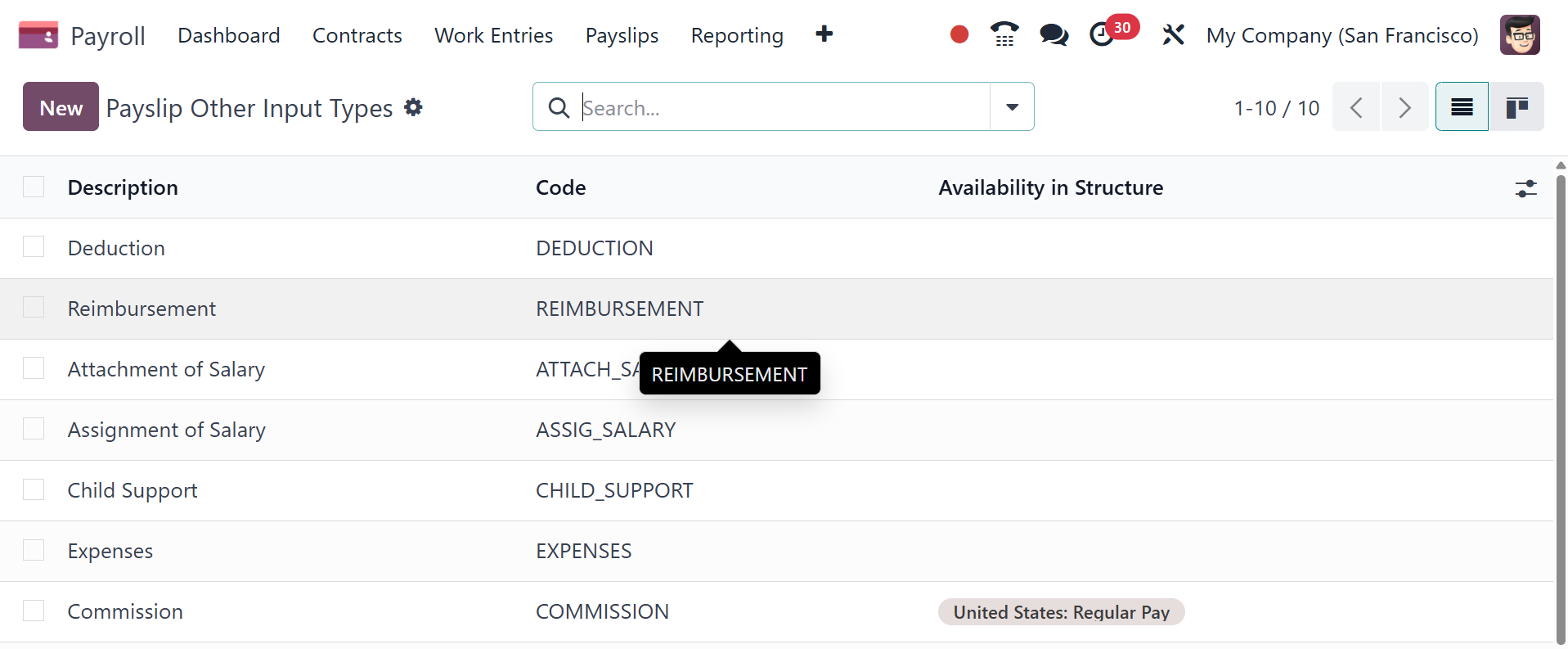

5.9 Other Input Types

The Other Input Types panel, found under Configuration, allows users

to specify a payslip input type. You can see the Code, Description,

and Availability in Structure separately in the List view of the

Payslip Other Input Types box. If you need to export the payslip

input type, select the input types you want and click the Action

icon. You can choose the Export option once you've chosen the

necessary input types in Action.

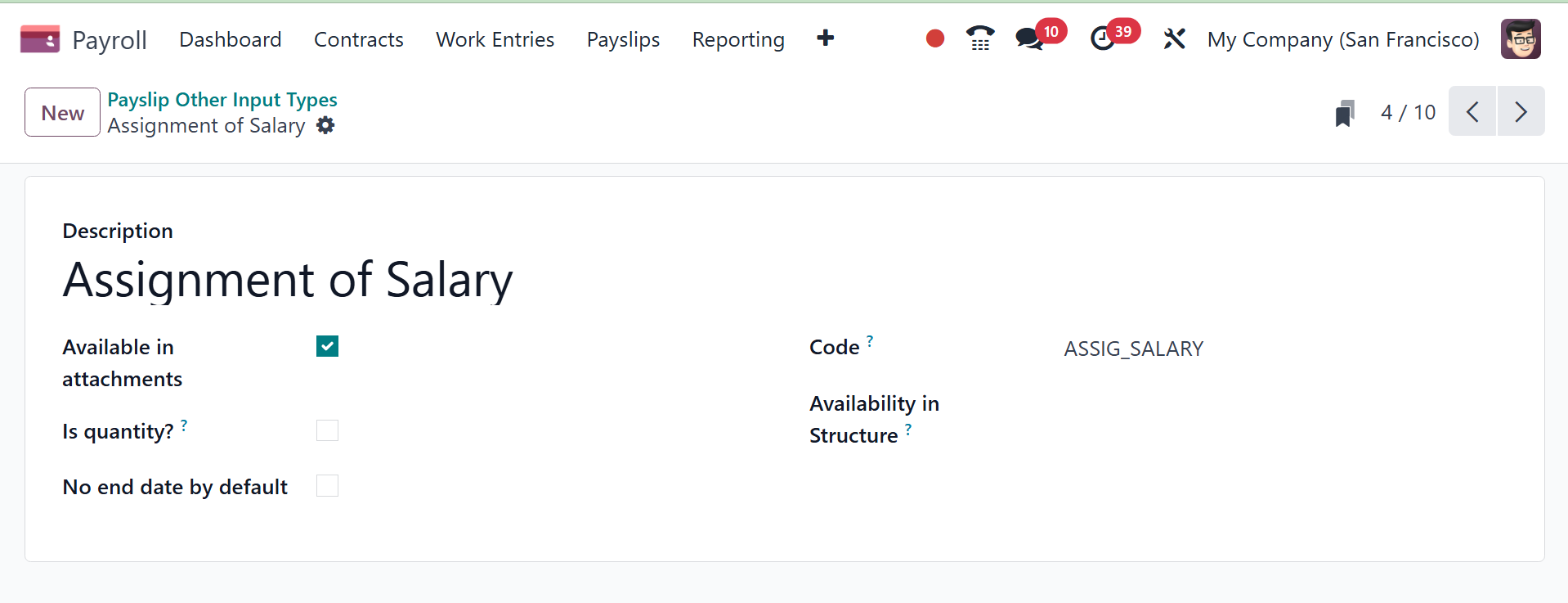

We can create a new payslip with many input types by clicking the New

button. Refer to the description and code used for the salary rule.

Provide the description, activate the available inattachment option,

is quantity option, and no end date by default option. Then, add the

code, availability in structure as well. If the availability is set

up in the structure, the input is available in all structures. If

you leave the field empty, it will appear on each payslip.

5.10 Salary Package Configurator

We may manage the resume, benefits, and personal data on the

Configuration page, which is located beneath the Salary Package

Configurator. Now let's review each detail separately.

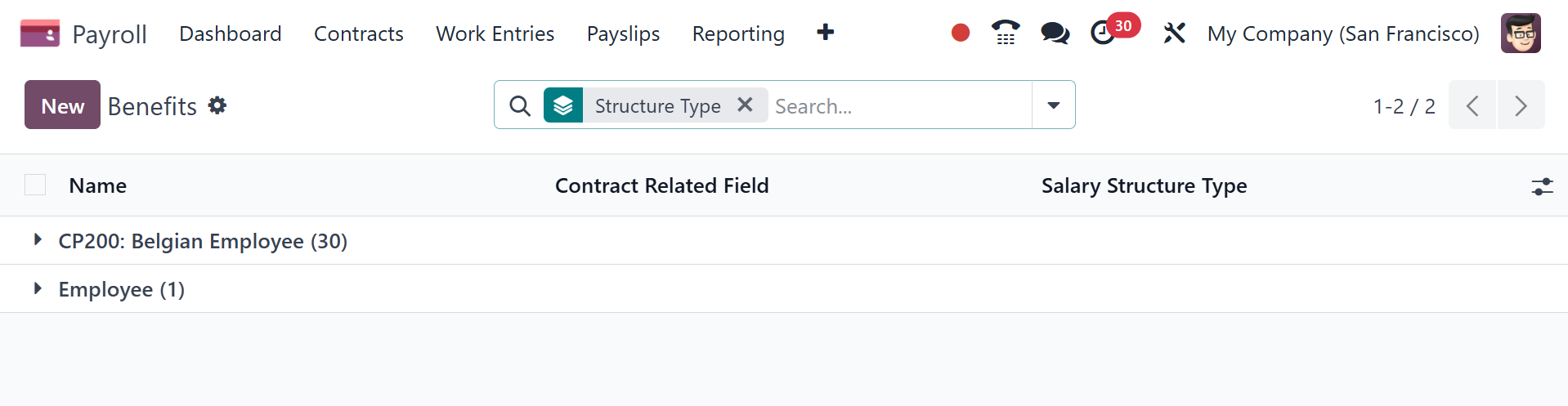

Benefits

The Benefits menu is included in Configuration's Salary Package

Configuration section. You can set up extra compensation benefits

under the Benefits panel. Details of configured advantages include

Name, Benefits field, and Salary Structure Type. By selecting the

New icon, we may specify a new benefit.

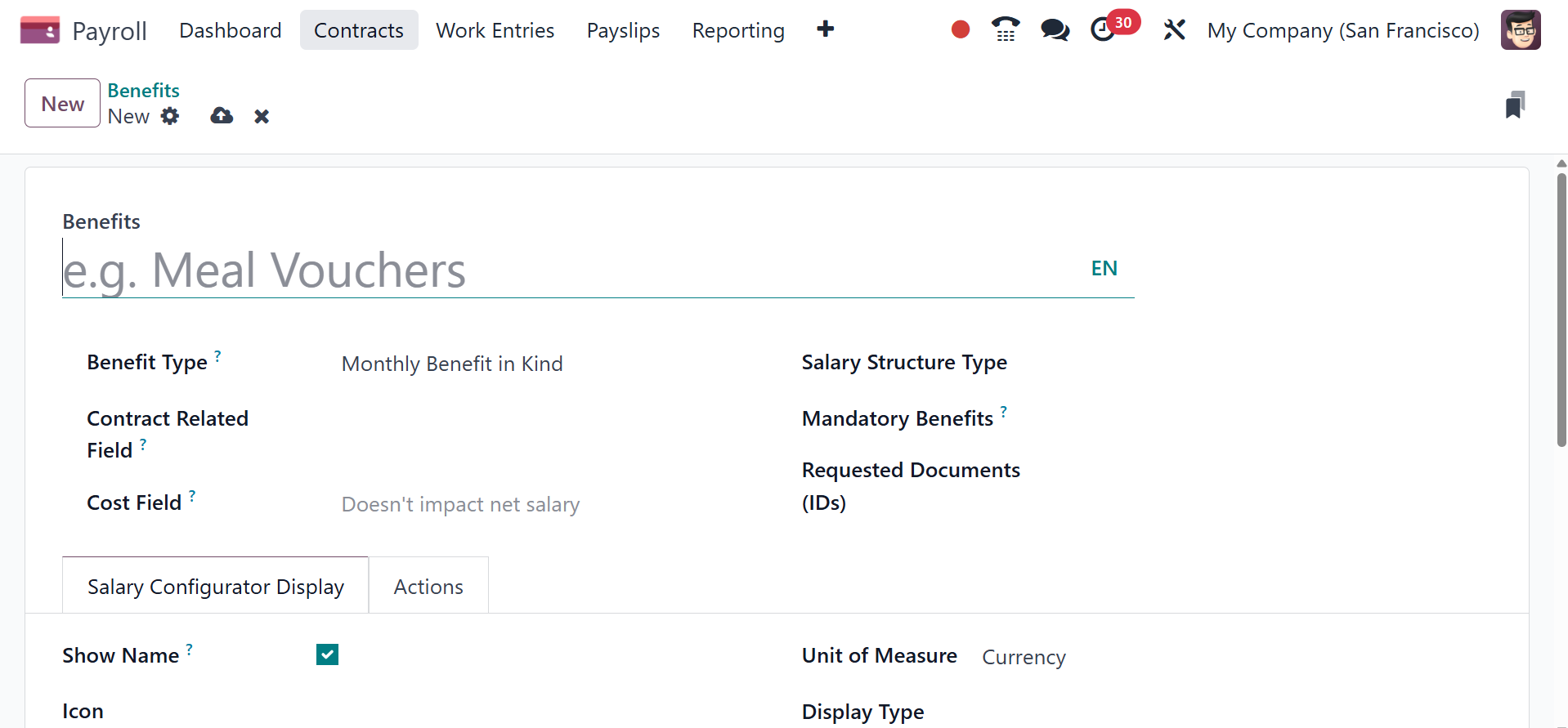

The Benefits Name must be entered in the window that is visible. Both

the contract field associated with an advantage's advantage and the

contract field associated with an advantage's cost should be

mentioned in the Cost field. A range of benefit categories are also

available to you, such as monthly cash benefits, non-monetary

benefits, monthly benefits in kind, and more.

Next, we can choose between the Salary Structure Types of Employee

and Worker. Below that, you have the mandatory benefits option and

requested documents as well. Requested Documents: select any

document that is required to be submitted for this benefit, from the

drop-down menu. Mandatory Benefits: using the drop-down menu, select

the benefit that is required in order for this specific benefit to

be offered to the employee.

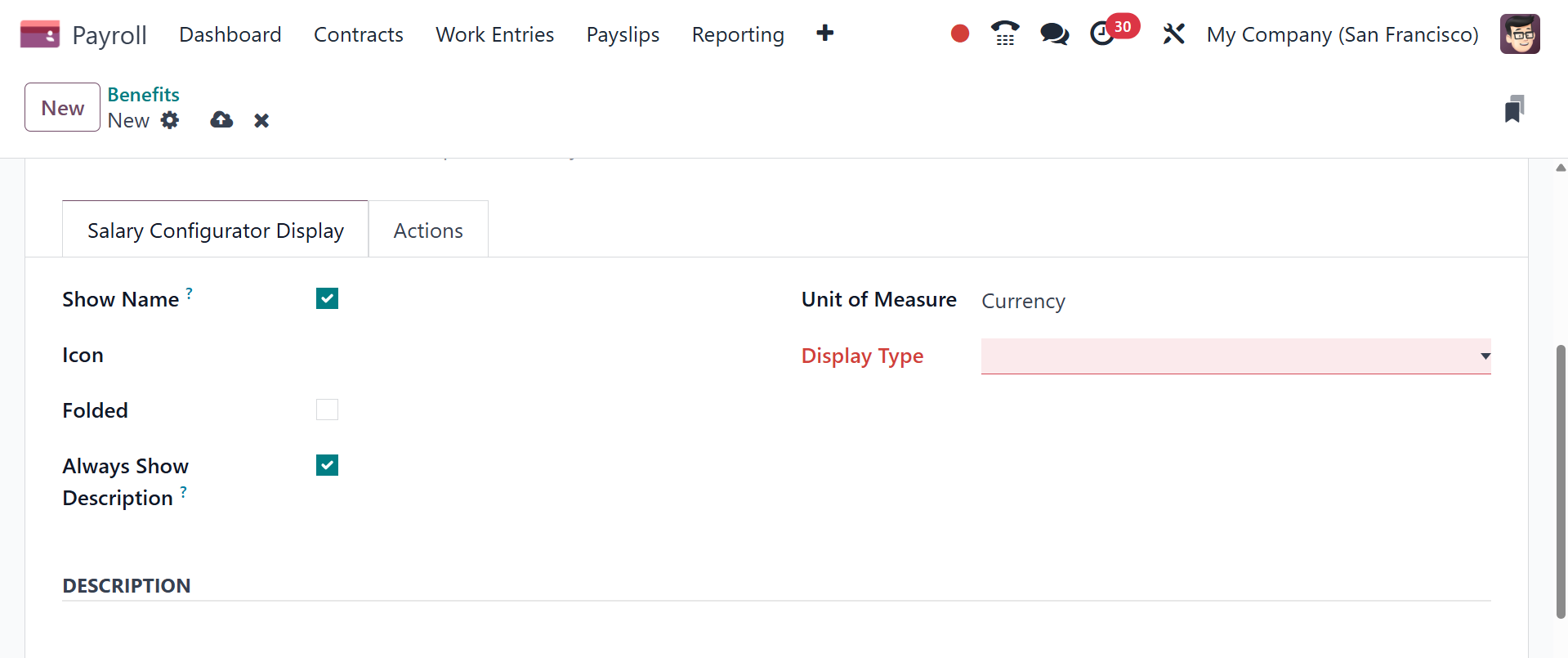

Once the type has been applied, you need to add an icon to the

benefit. To get the net salary, you need to activate the Impacts Net

Salary option. For benefit, we can later specify Currency, Days, and

Percentage as the units of measurement. Under the salary

configurator display, you can enable the show name option, icon,

folded, and always show description as well. Show Name: tick the

checkbox to have the benefit name appear in the salary package

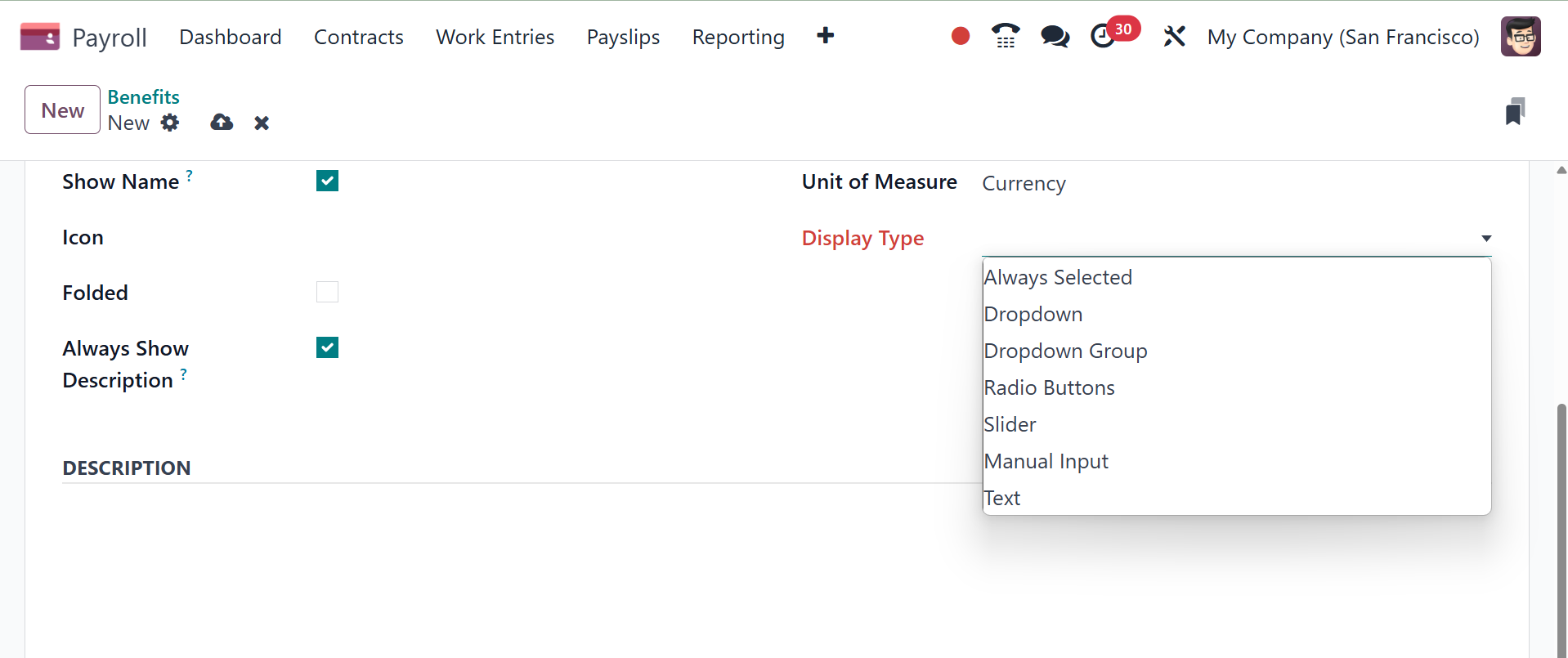

configurator. Display Type: select from the drop-down menu how this

benefit is displayed. The options are Always Selected, Dropdown,

Dropdown Group, Slider, Radio Buttons, Manual Input, or Text. This

field is required.

Folded: if the benefit should be folded, or hidden, because it is

dependant on another benefit selection, tick the checkbox.

One way to describe an activity's benefit is as an email, meeting,

notification, call, etc. The activity type will be produced

automatically after the employee selects the reward. We might add

more details about the benefits in the Description field. You can

conceal the description after using the conceal Description section

if the benefit is not being used.

Beneficial criterion can be enabled or disabled by users within the

Folded field. Provide choices for display types as well, such as

Text, Slider, Dropdown, and others. You can add required documents

to the section for requested documents for an extra advantage. In

order to sign the employee benefit, users can optionally select a

template.

All of these details are automatically saved by Odoo 18 Payroll.

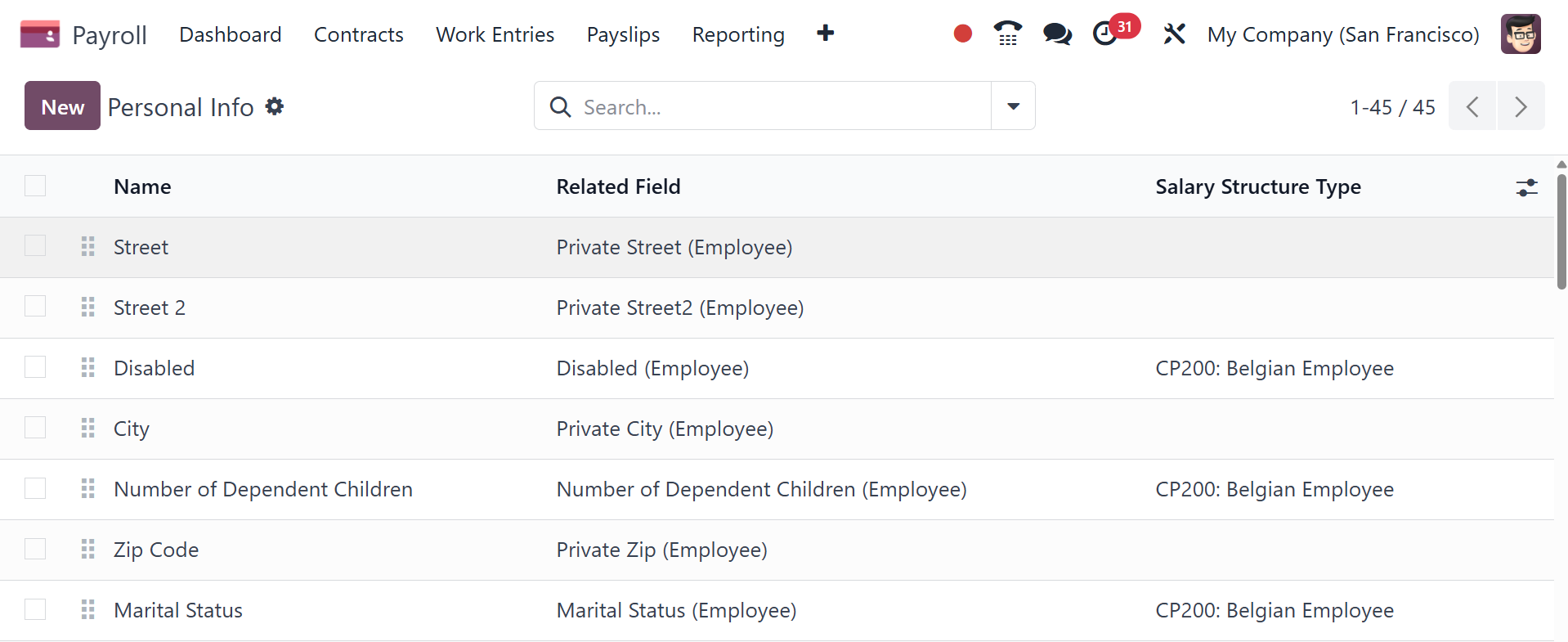

5.11 Personal Info

It is easy to comprehend the personal data associated with each

employee's paystubs by selecting the Personal Info menu in

Configuration. All of the preset personal information, such as Name,

Salary Structure Type, and Related field, is available to us

individually in the Personal Info box. It's easy to describe a new

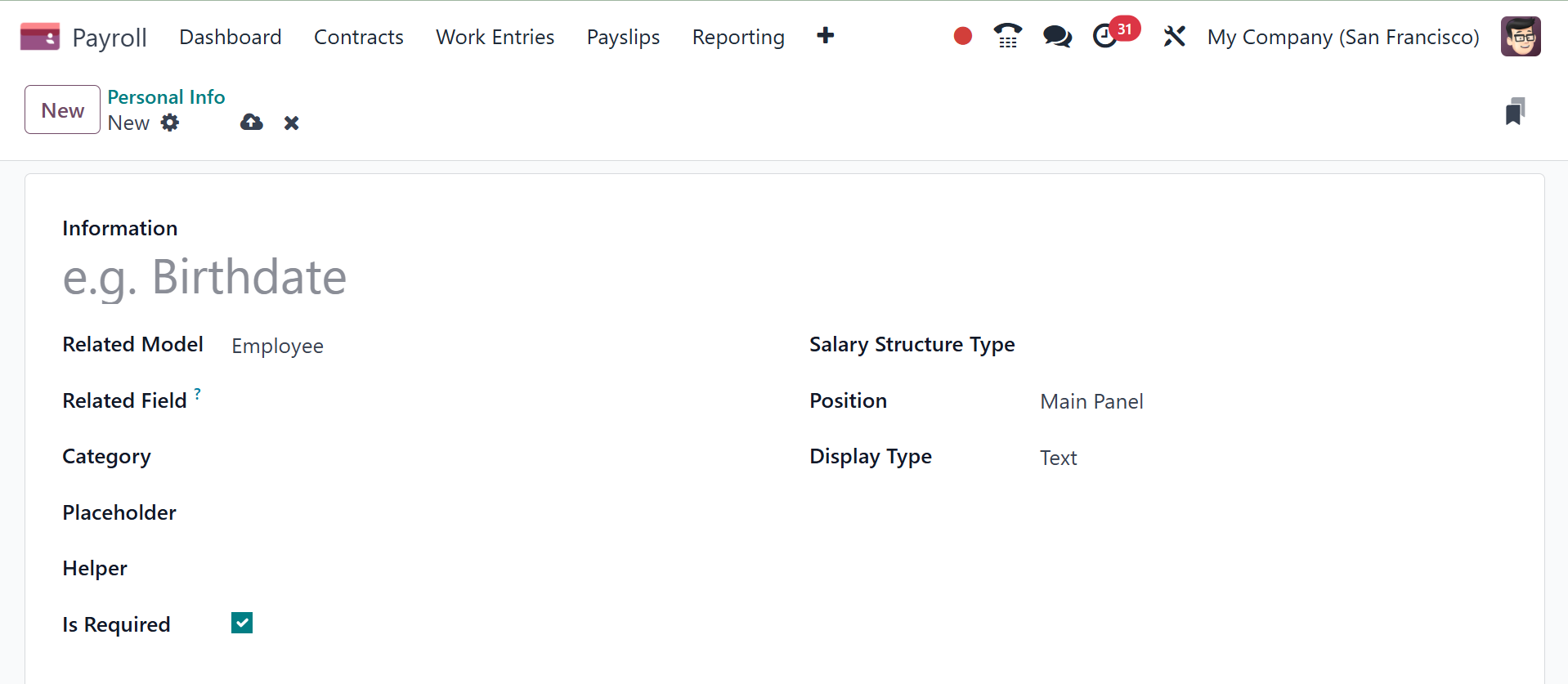

record once you've hit the New button.

In the open window, enter personal information and the individuals it

applies for. applies on-field, including a bank account, an

employee, and others. Users can also provide the field name for

personal data in the Related field. Additionally, you can input a

variety of personal data, like your address, private documents,

current situation, and more.

Next, for your personal data, choose Worker and Employee as the

Salary Structure Types. Regarding employee personal information, you

may also bring up the Placeholder and Helper.

The positions of Main Panel and Side Panel for Personal Information

are open to users. After then, the Display Type might be stated as

Radio, Email, Text, etc. Thus, it is easy to utilize personal

information data in Odoo 18.

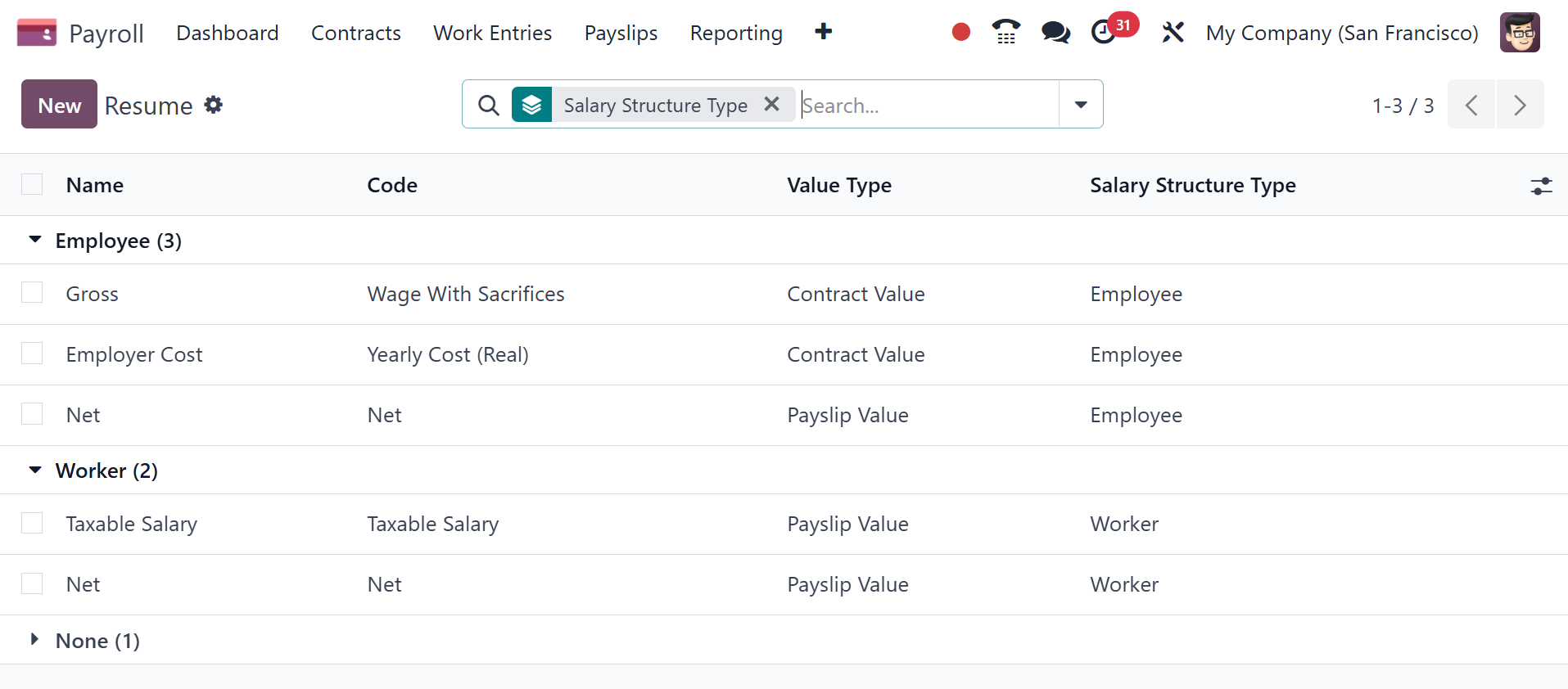

5.12 Resume

We can assign different resume types to a pay structure after

choosing the Resume option on the Configuration tab. The Resume

window defines all freshly created resume data, such as Name, Value

Type, Code, and Salary Structure Type. By choosing the New icon, we

may generate a new resume.

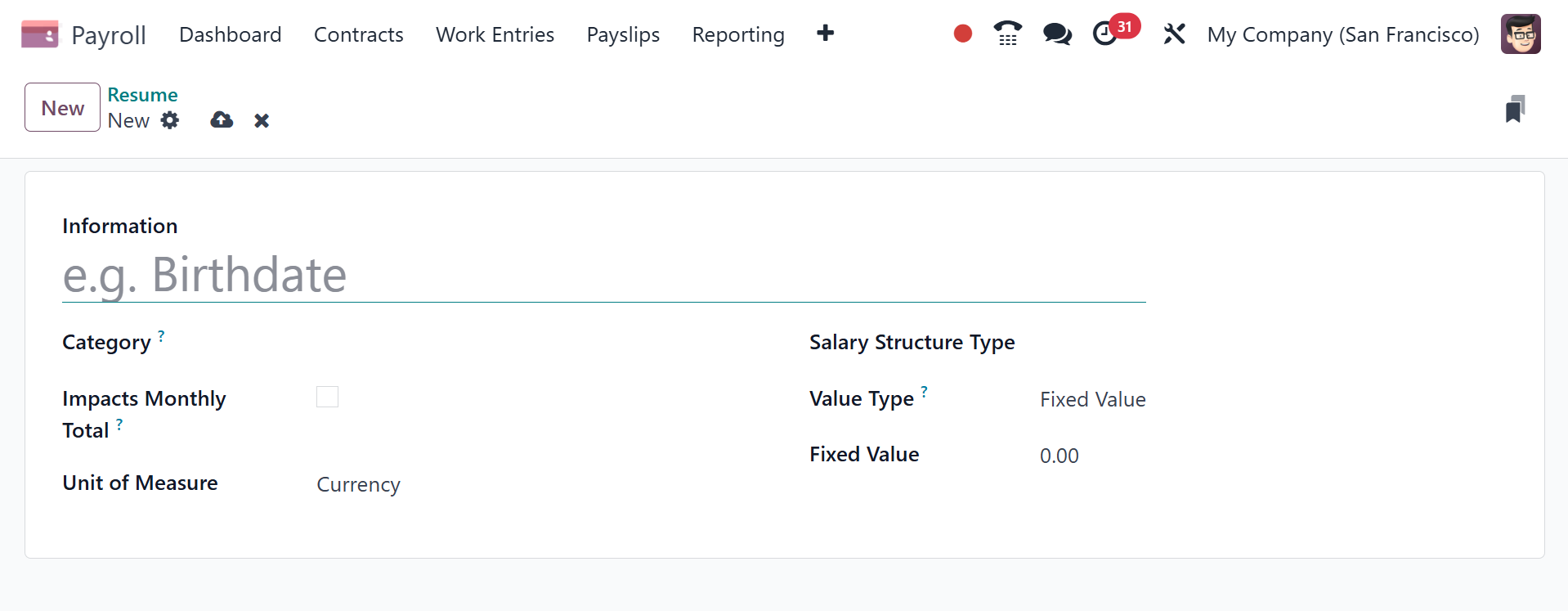

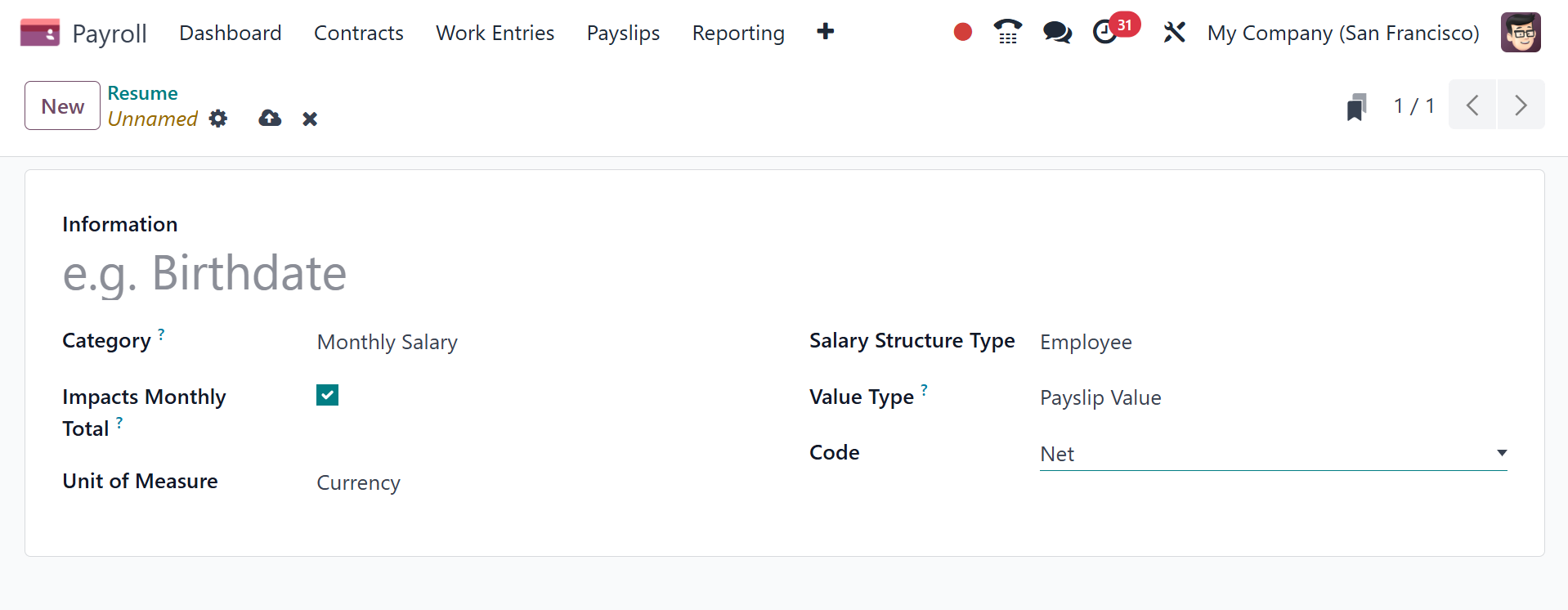

In the open screen's Information box, mention the comprehensive

synopsis. The category that most suits your resume must be chosen,

such as Monthly Salary, Annual Benefits, and so forth. Next, select

your Salary Structure Type on the resume.

To see monthly expenses on the resume, activate the Impacts Monthly

Total option. In the future, choose the preferred unit of

measurement, such as days, percentages, etc. Furthermore, a value

type can be changed to be Payslip value, Monthly Total, Fixed Value,

and more. After choosing the value type, the user can add a certain

amount depending on the value they have selected.

All of them have to deal with the Odoo 18 Payroll Configuration

function.

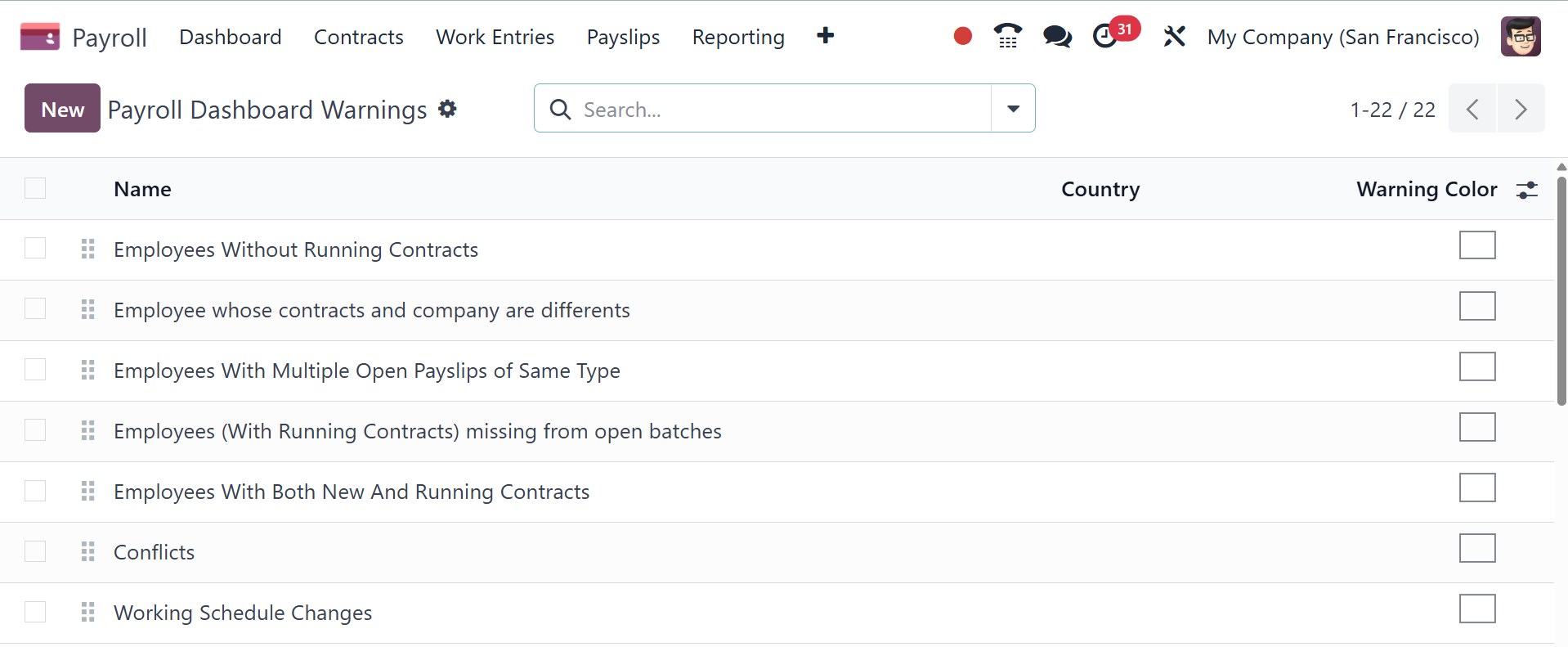

5.13 Dashboard Warnings

Users can locate any significant cautions regarding employment

contracts under the "Warnings" section.

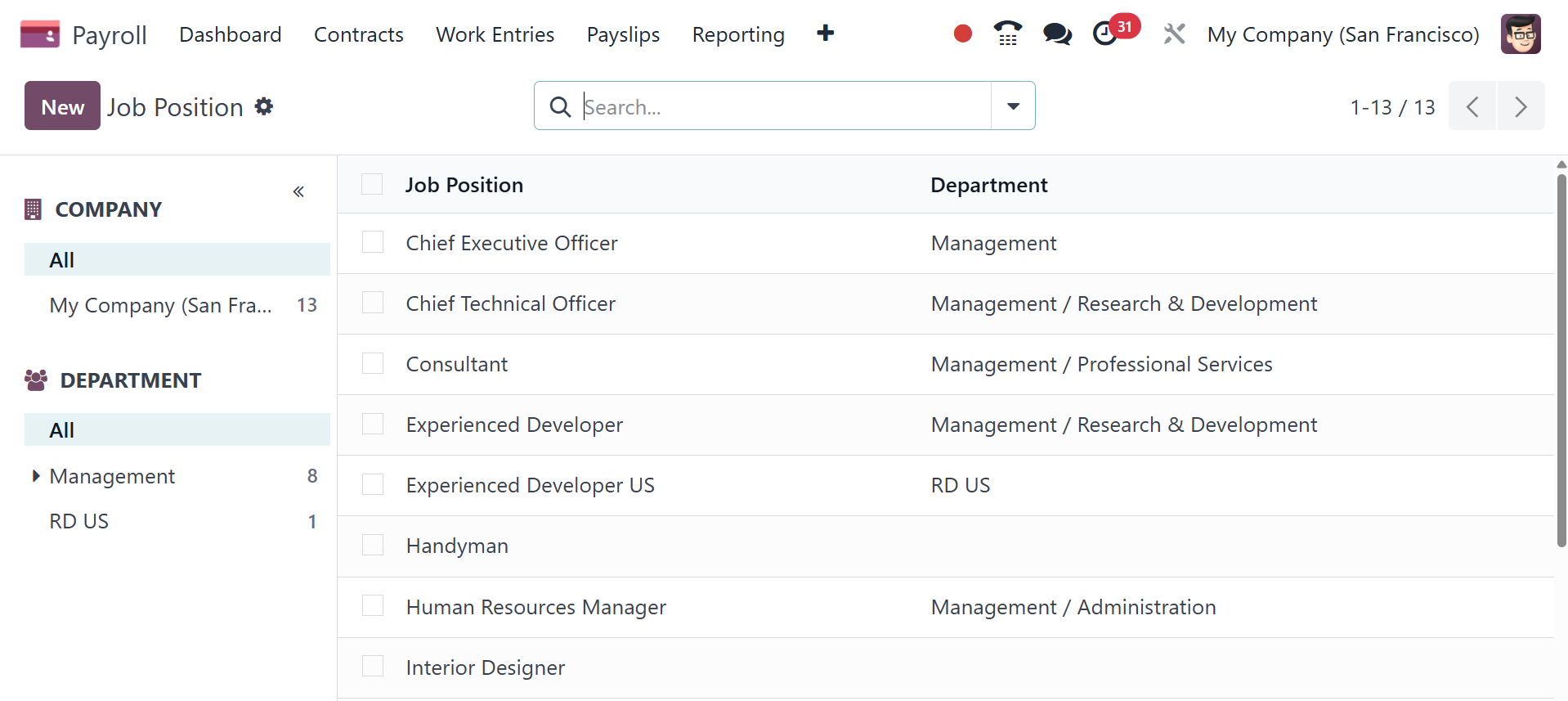

5.14 Job Positions

The Configuration menu contains the Job Position setting. It enables

you to specify several positions inside an organization to which

staff members may be assigned.

Here, you will get the list of already configured job position and

department.

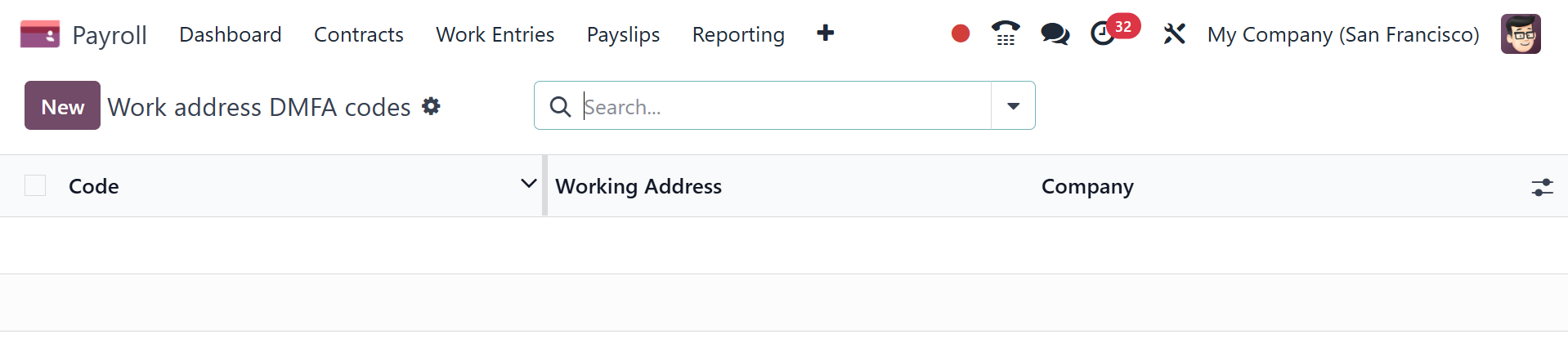

5.15 Work Address DMFA Codes

The Work Address DMFA Codes are included in the Configuration menu of

the Odoo Payroll module. In Belgium, DMFA (Déclaration

Multifonctionnelle) reporting is required for payroll, and these

codes are used for it.

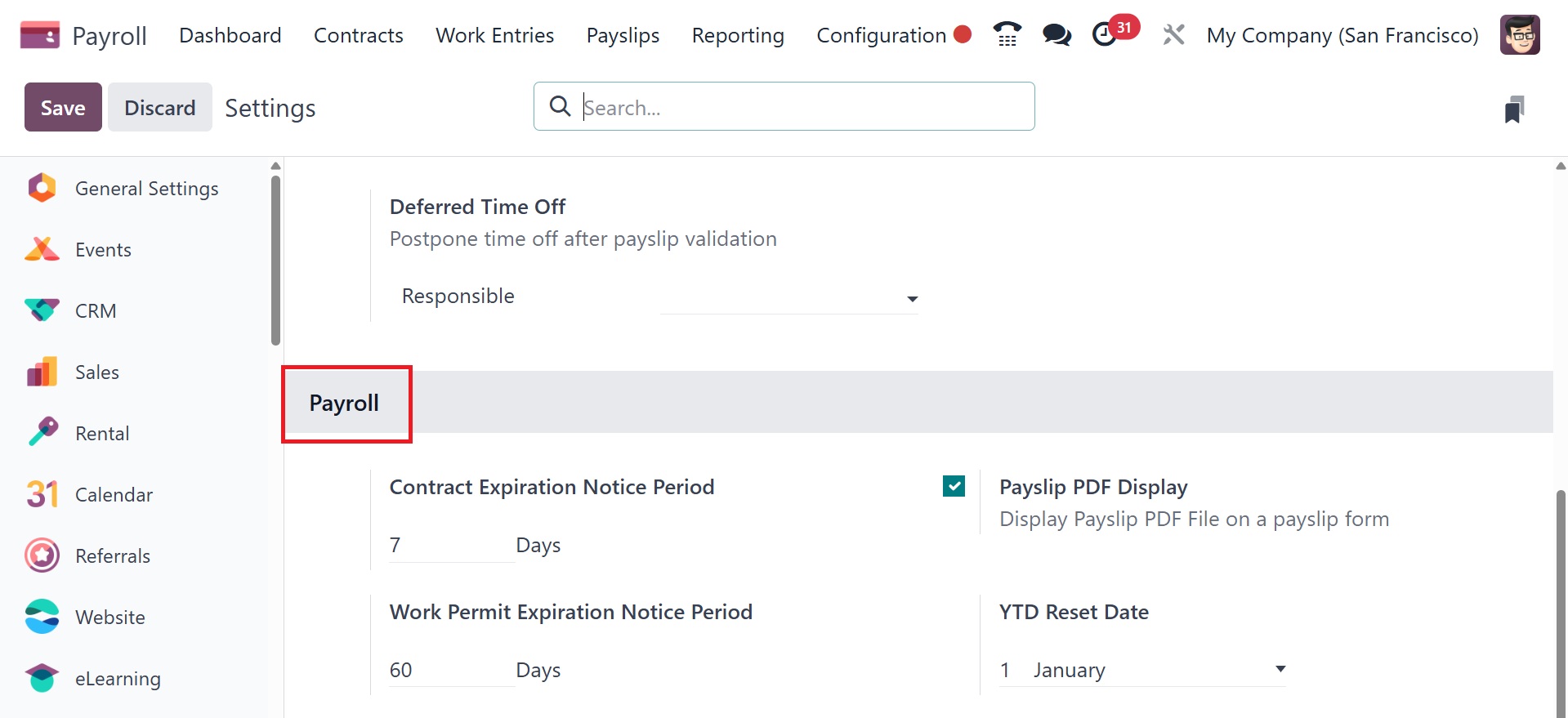

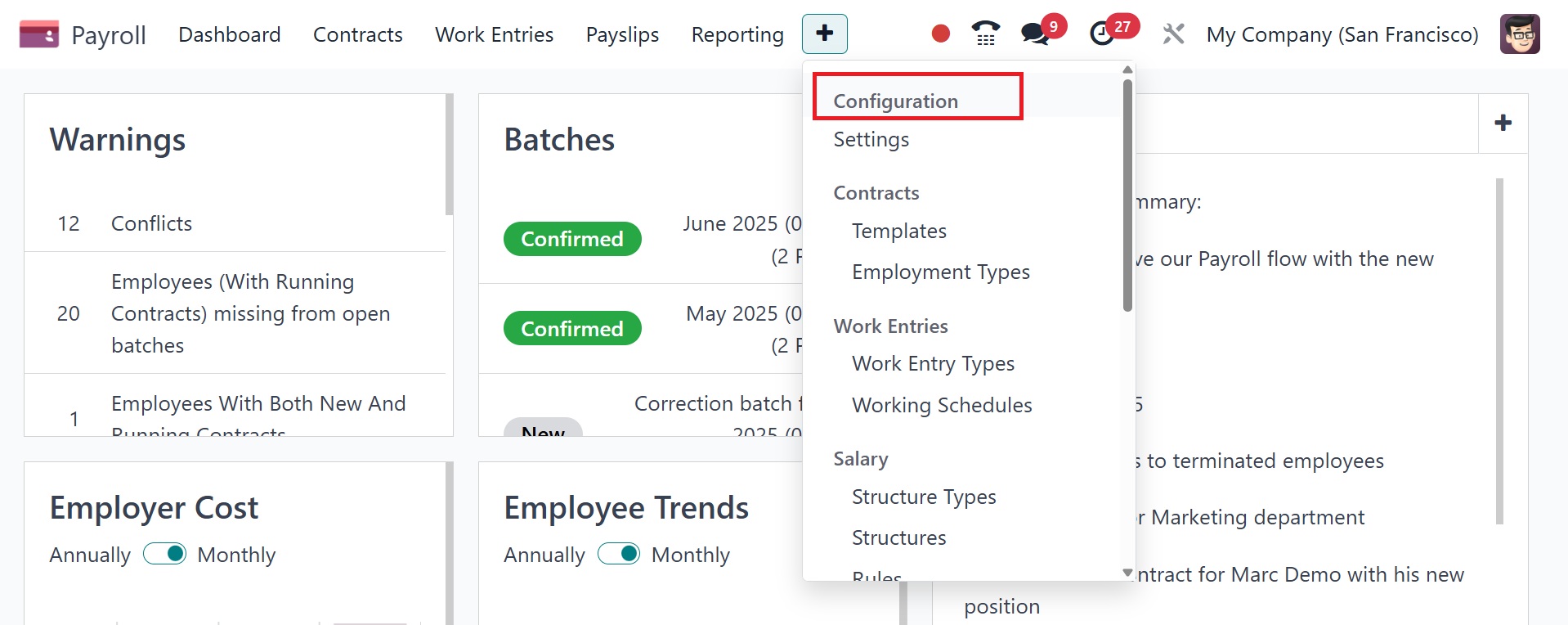

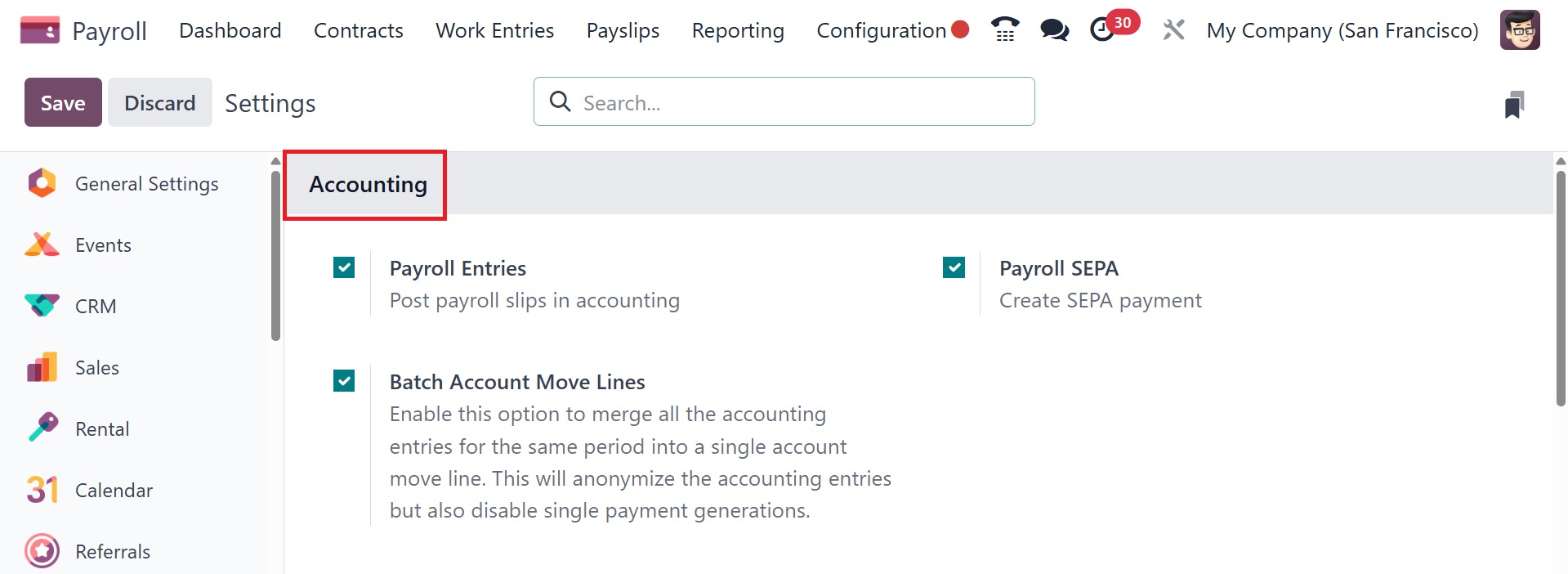

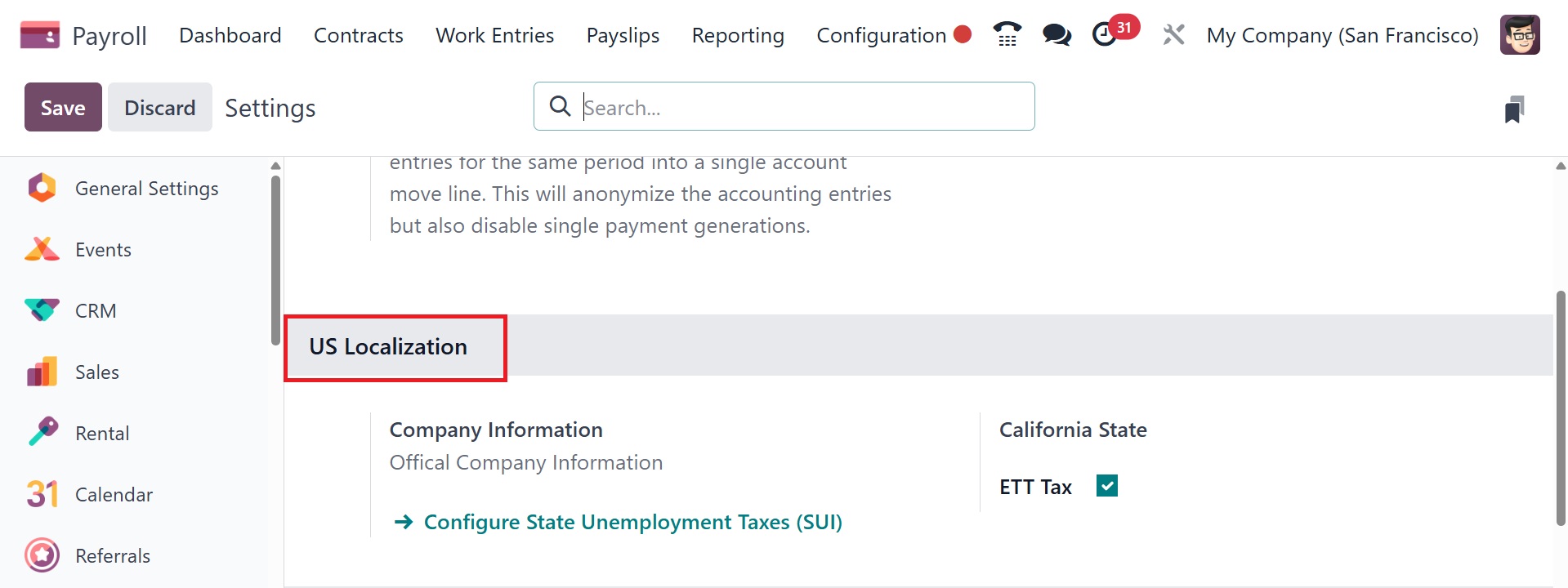

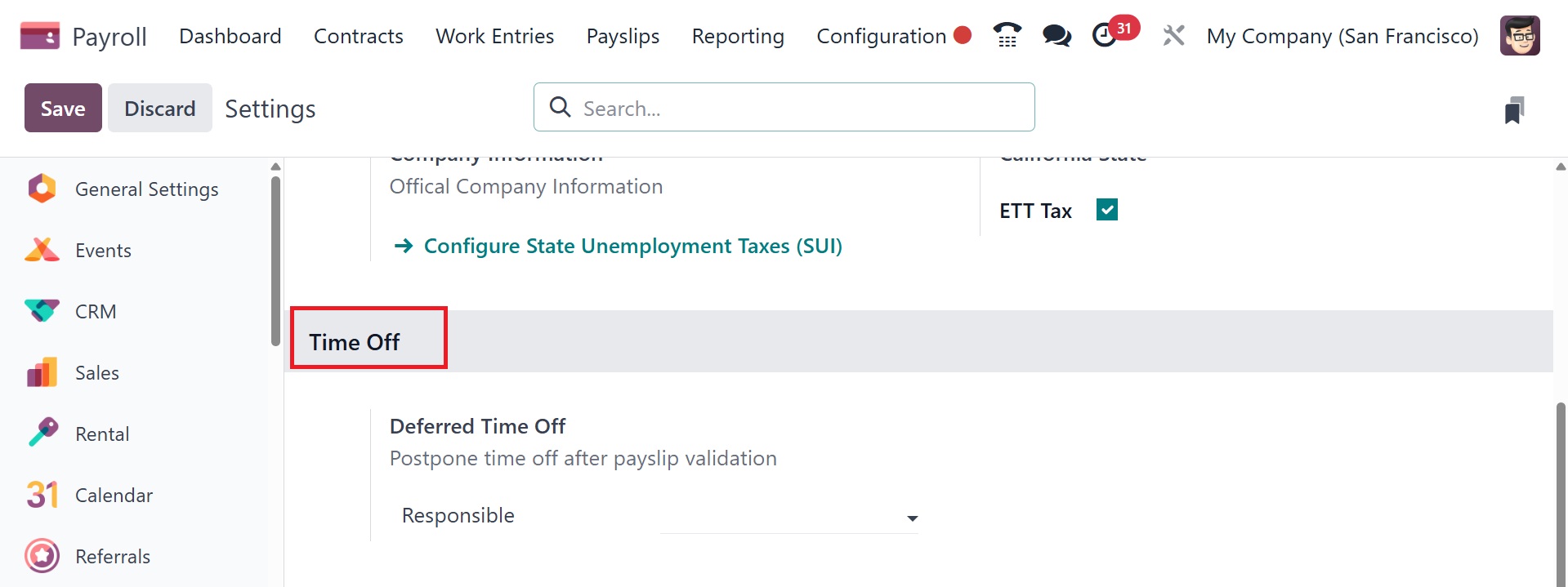

5.16 Settings

The Odoo 18 Payroll Module's "Configuration" menu opens the

"Settings" window. Four options tab parts, including "Accounting,"

"US Localization, Payroll " and "Time Off," are included in this

settings page.

Accounting: under this option, we may configure the "Payroll Entries,

batch account move lines" and "Payroll SEPA" settings. The payroll

entries option posts payroll slips in accounting. Payroll SEPA helps

to create SEPA payments. The batch account move lines option helps

to merge all the accounting entries for the same period into a

single account move line.

US Localization: From this settings page, we may activate the Belgian

localization options, which include company information, and

California state.

Time Off: The "Deferred Time Off" option can be enabled in this area.

Payroll: under the payroll tab, you have the options like contract

expiration notice period, and payslip PDF display option.