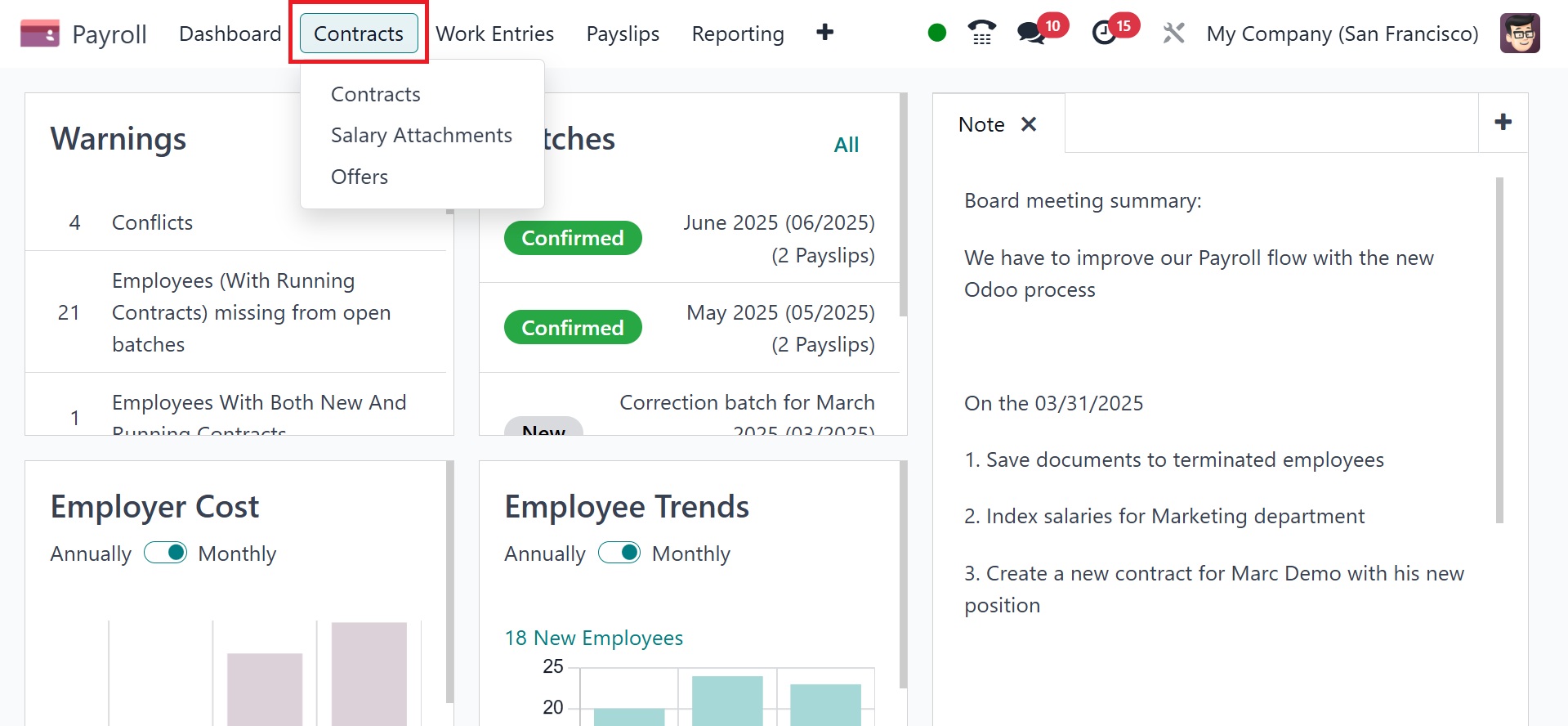

2. Contract

Users can handle employee

contracts and salary

attachments in the Odoo 18

Payroll module's Contracts

menu. Contracts, Salary

Attachments, and Offers are

the three choices that appear

when you choose the Contracts

menu. Let's look at each of

these options separately.

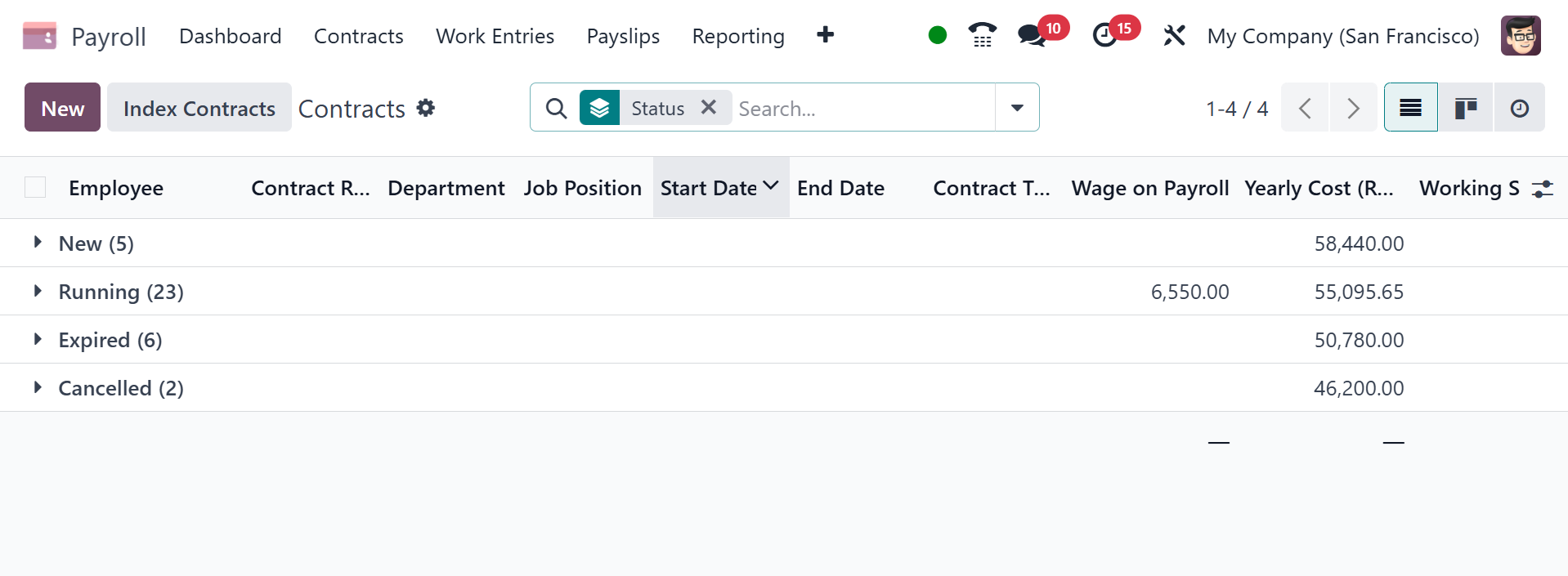

2.1 Contract

You can construct and maintain

employee contracts, including

their specifics such as start

and end dates, pay scales,

working hours, and any

relevant comments, by

selecting the "Contracts"

option. Managing wage

attachments and offers is

another aspect of it. Users

can manage the salary

attachments and employee

contract data within the

Contracts menu of the Odoo 18

Payroll module.

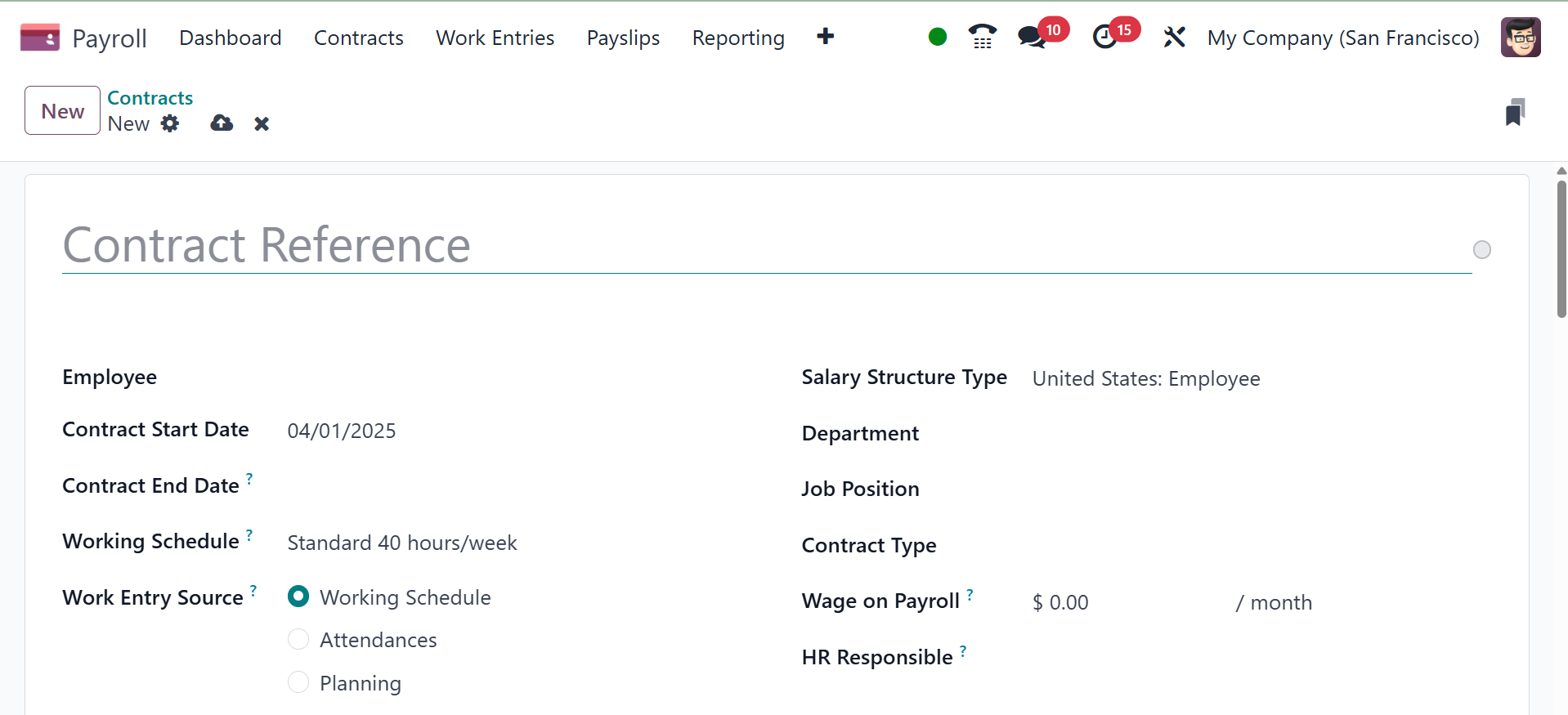

Users can also create a new

employment contract by

clicking the New symbol under

the Contracts. On the open

page, you can select your

employee and type the name of

the contact. The user is

immediately presented with

details about the person's

department, job title, and

contract type after selecting

the employee.

Enter the start date of the

contract in the Contract

Start Date box and the end

date in the Contract End Date

field. After choosing the

sort of salary structure, you

may choose the employees'

work schedule in terms of

hours per week. It is then

possible to describe the

source of work entry in the

contract. Three distinct

sources of work entry include

attendance, working schedule,

and planning. Working entries

are made in accordance with

regular working hours when

the Working Schedule option

is used. If the Planning

option is selected, working

entries will be generated

depending on employee

planning.

Each employee may have a

different salary structure

type. Add the department, job

position, contract type, and

HR responsible as well. The

wage from the contract can

then be entered in the Wage

on Payroll box.

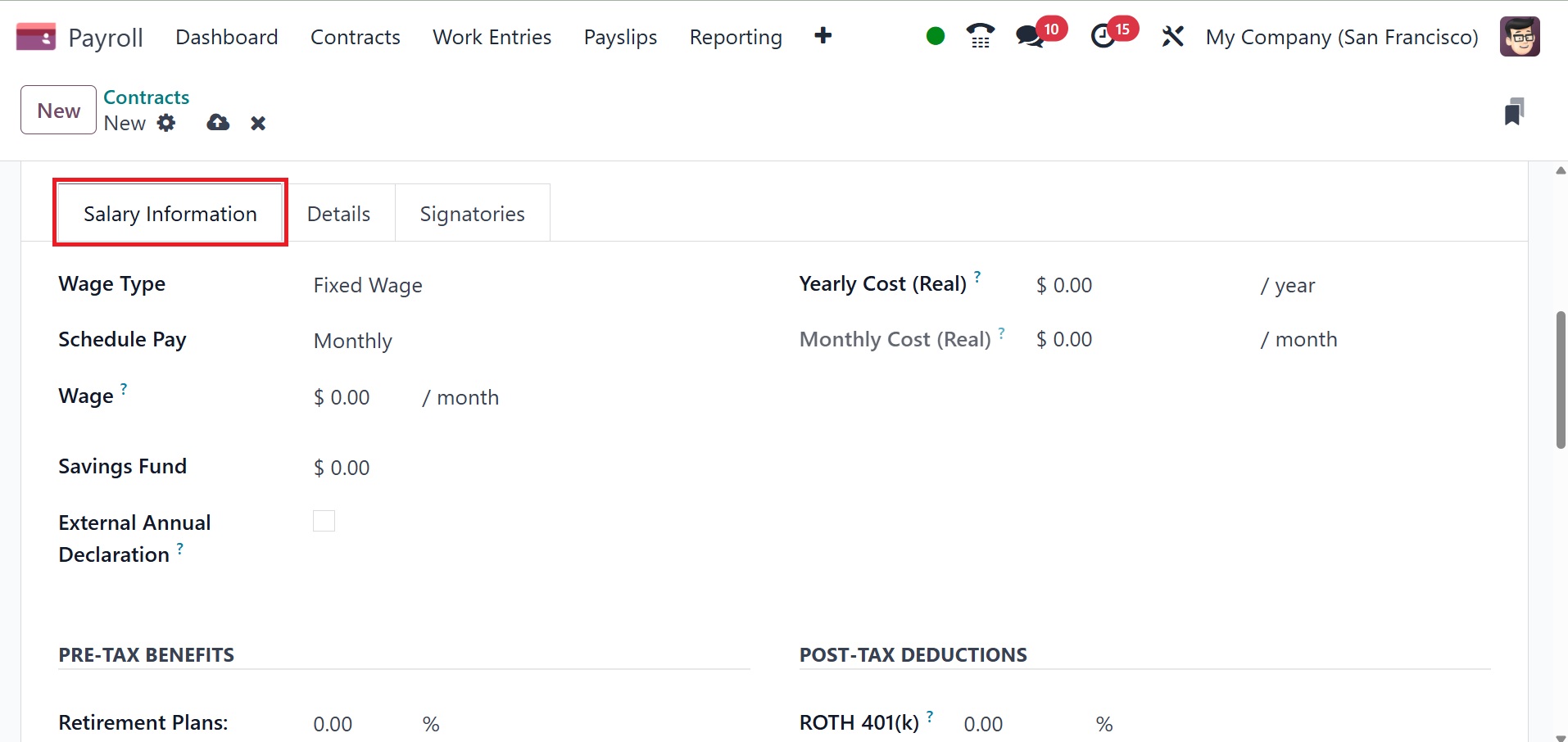

In the Wage part of the Salary

Information, the user can

input their base pay for the

month. Furthermore, the

Yearly Cost (Real) option

automatically enters an

employer's total cost for the

entire year. Additionally,

mention the Wage Type and

Schedule Pay. You can define

an employee's pay by

specifying their wage type

and scheduled pay frequency.

Wage type determines how an

employee is paid (fixed or

hourly), while schedule pay

defines the payment

frequency. Wage type can be

either "Monthly Fixed Wage"

or "Hourly Wage", and the

scheduled pay options include

monthly, quarterly,

semi-annually, annually,

weekly, bi-weekly, or

bi-monthly. Then, provide the

savings fund and external

annual declaration. Below the

pre-tax benefits, and

retirement plans, retirement

plan matching amount, and

retirement plan matching

yearly cap can be added.

Under the post-tax deduction,

add the ROTH 401(K), which is

retirement saving plan

provided to American

employees from US companies.

It can be a percentage of

fixed amount in payslip.

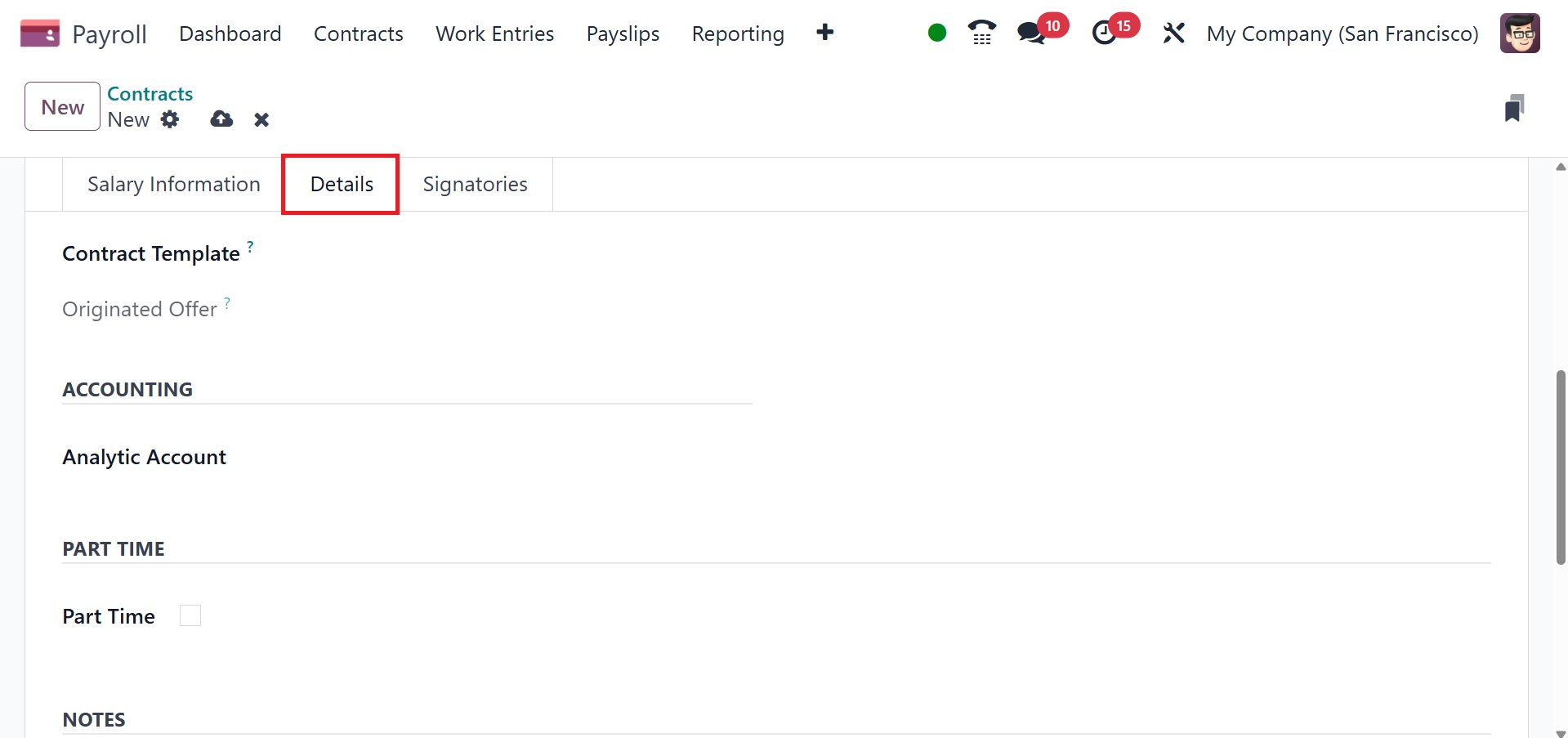

Include the Contract Template. It

is possible to add the

Analytic Account field

beneath the ACCOUNTING

section. The New Contract

Document Template field can

then be used to specify the

default contract that must be

signed in order to accept a

contract offer. The part-time

option can be activated under

the PART TIME section. The

default document template for

employees can be specified by

users in the Contract Update

Document Template field. In

HR Responsible, you may later

define responsible HR. Save

the contract after that.

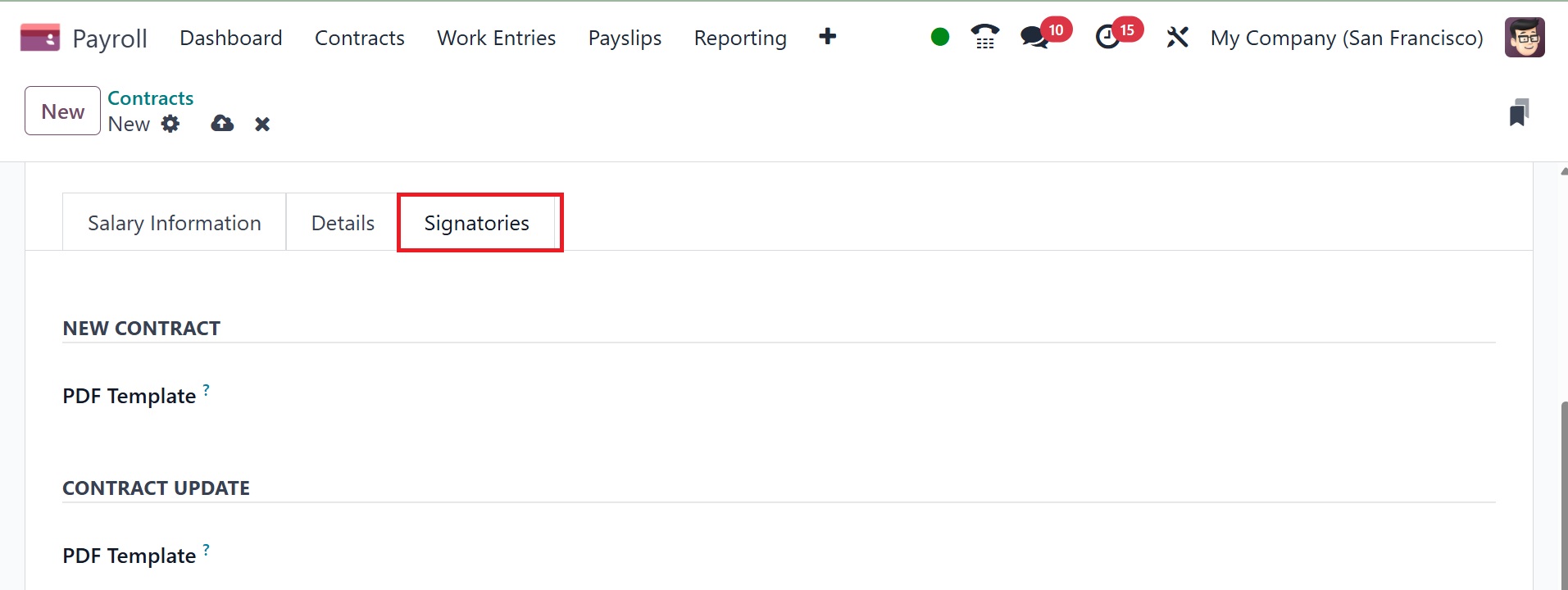

Now, under the Signatories, you

can add the PDF template in

NEW CONTRACT, PDF template

under the CONTRACT TEMPLATE.

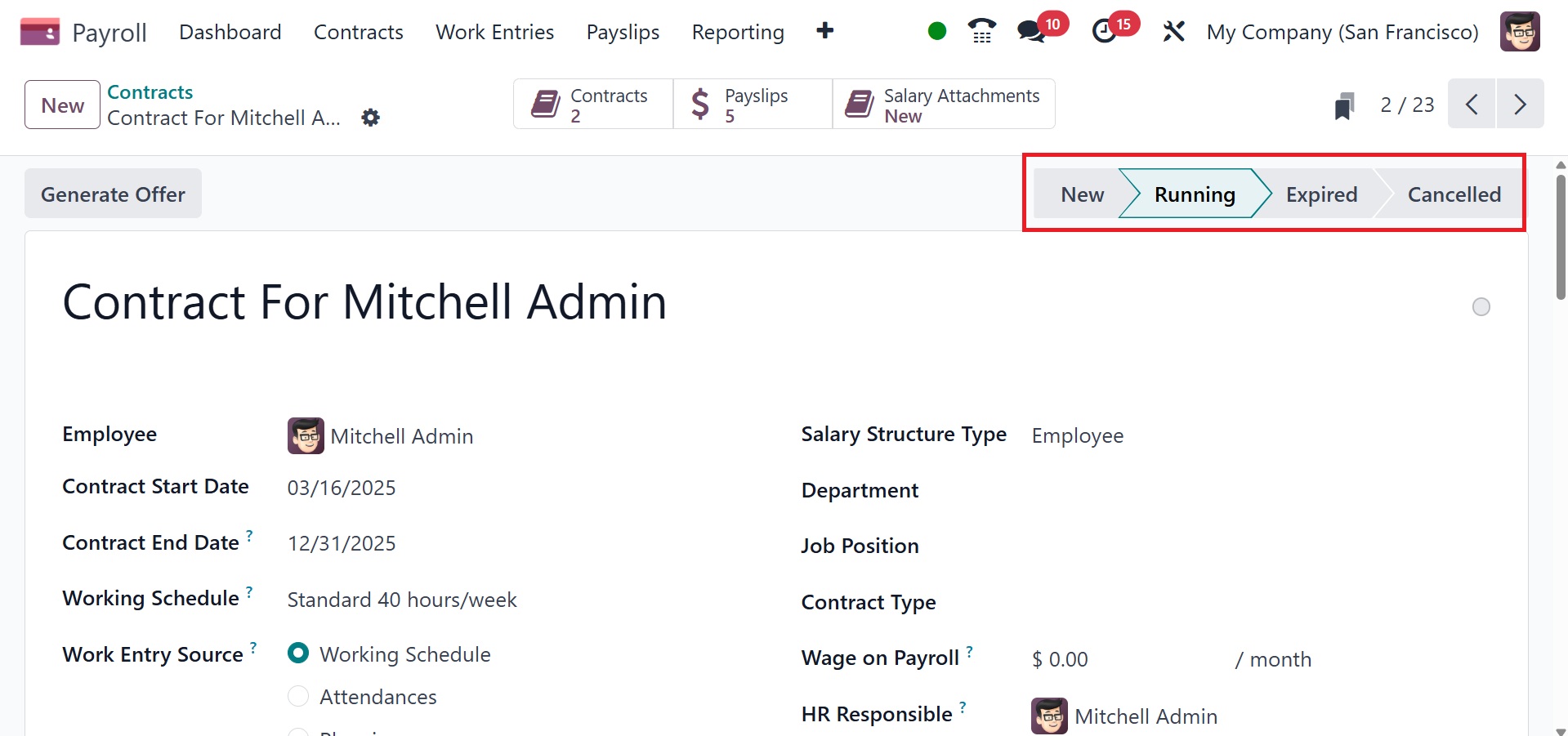

Every detail is instantly saved

via Odoo 18 Payroll. Offers

to the employee can be

created by the user. The

state of the contract can

also be adjusted to New,

Running, Expired, or

Cancelled. Every active

employee in a company must

have a running contract.

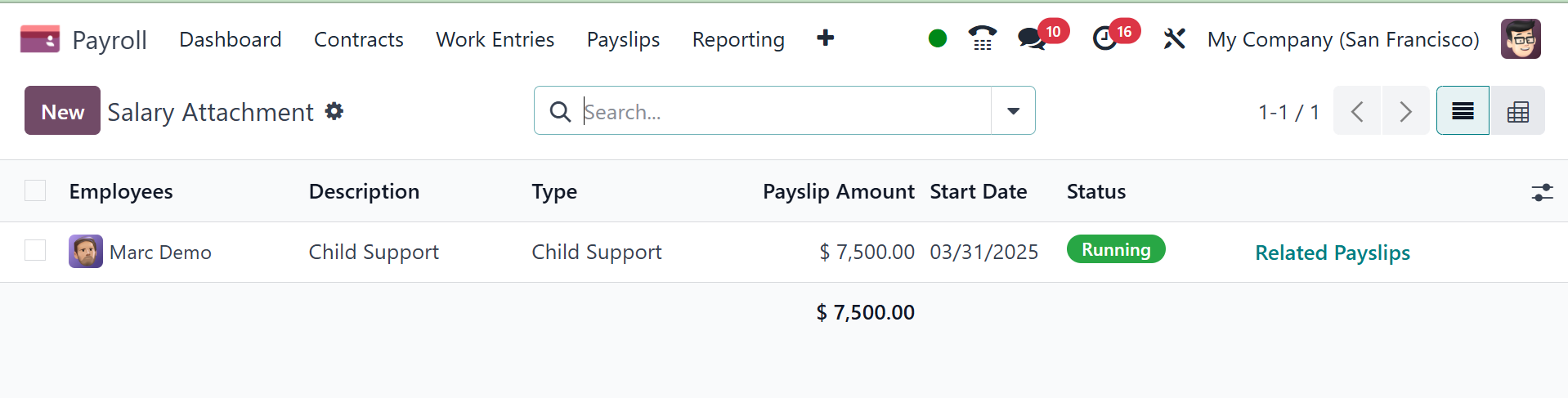

2.2 Salary Attachment

Parts of earnings that are taken

straight from a payslip for a

specific purpose, whether

mandatory or optional, are

known as salary attachments.

Generally, they are seen as

deductions when they are

voluntary. All of these are

commonly referred to as

salary attachments in Odoo.

Keep in mind that salary

attachments can also be used

to deduct from regular

payments. We can obtain a

list of each employee's pay

attachments by choosing the

Salary Attachments menu from

the Contracts tab.

Information about each salary

attachment, such as the

Employee, Type, Status,

Description, Start Date, and

more, is available. By

choosing the New button in

Odoo 18 Payroll, we can

establish a new salary

attachment.

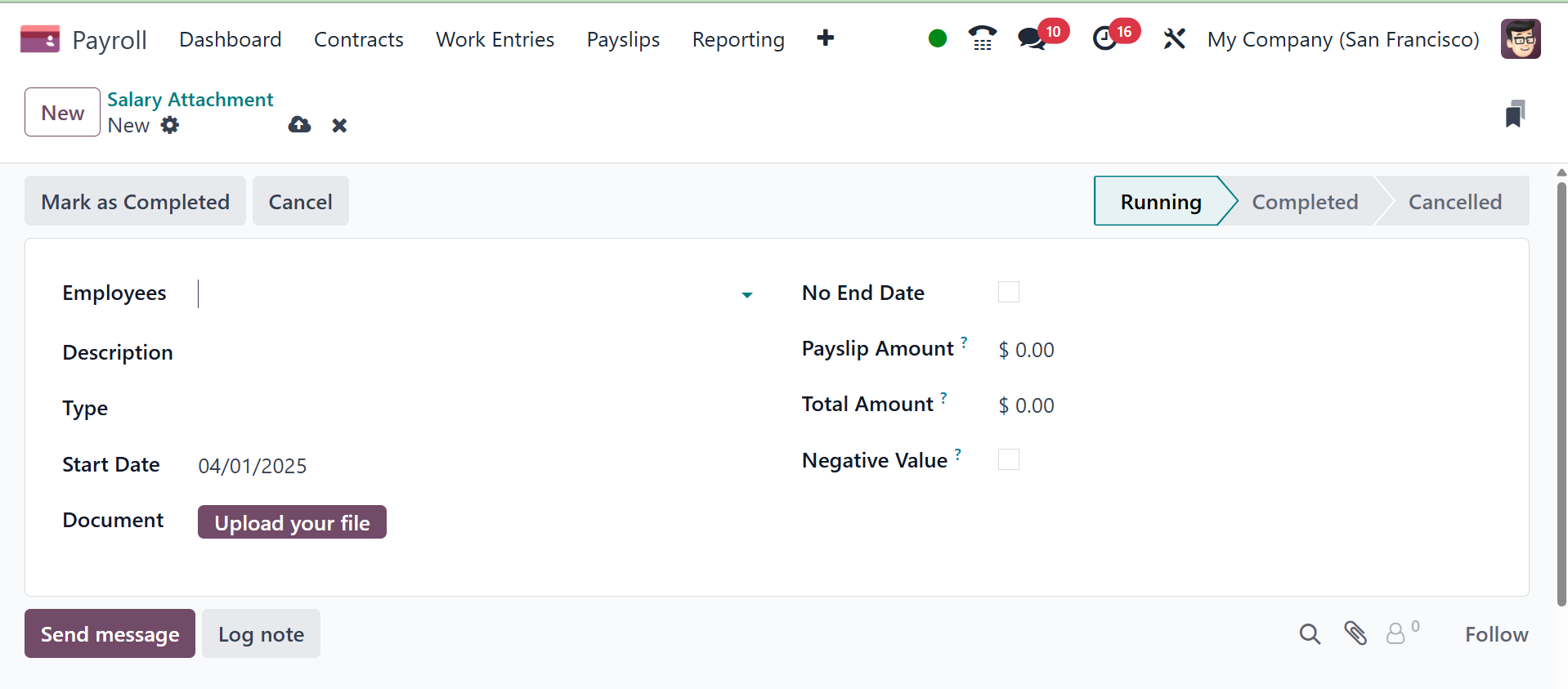

In the Description section of the

window that opens, the user

can select the employee's

name and enter information

about the salary attachment.

For the Type of Salary

Attachment, users can choose

between Child Support,

Assignment of Salary, and

other choices.

In the Odoo Payroll module, the

salary attachment feature

allows you to define and

manage deductions from an

employee's salary for various

reasons, such as child

support, loan repayments, or

other legal obligations. A

blank Salary Attachment Types

form loads when you select

the New button to create a

new kind of salary

attachment. In the relevant

field, type the new salary

attachment type's name. Next,

input the code that is used

to calculate pay stubs

according to the salary

guidelines. Finally, if this

salary attachment never

expires, check the No End

Date box.

The Salary Attachment Types form

additionally has a Country

column if the database

contains many companies with

locations in different

nations. Choose the nation to

which the attachment

pertains, or leave it empty

if it is universal.

To create a new salary

attachment, click the New

button in the top-left

corner, and a blank Salary

Attachment form loads. Enter

the following information on

the form:

- Employees:

Using the

drop-down menu, select

the desired employees.

Multiple employees can

be listed in this

field.

- Description:

Enter a short

description of the

salary attachment.

- Type: Using

the drop-down menu,

select the specific

salary attachment

type.

- Start Date:

Using the

calendar selector,

select the date the

salary attachment goes

into effect.

- Estimated End Date:

This field is

not modifiable and

only appears after the

Monthly Amount field

is populated. This

field is the estimated

date when the salary

attachment will be

completed. Today’s

date populates the

field by default.

Then, when the Total

Amount field is

populated, this date

is updated.

- Document:

If any documentation

is needed, such as a

court order, click the

Upload your file

button, and a file

explorer window loads.

Select the desired

document to attach to

the record. Only one

document can be

attached to a salary

attachment.

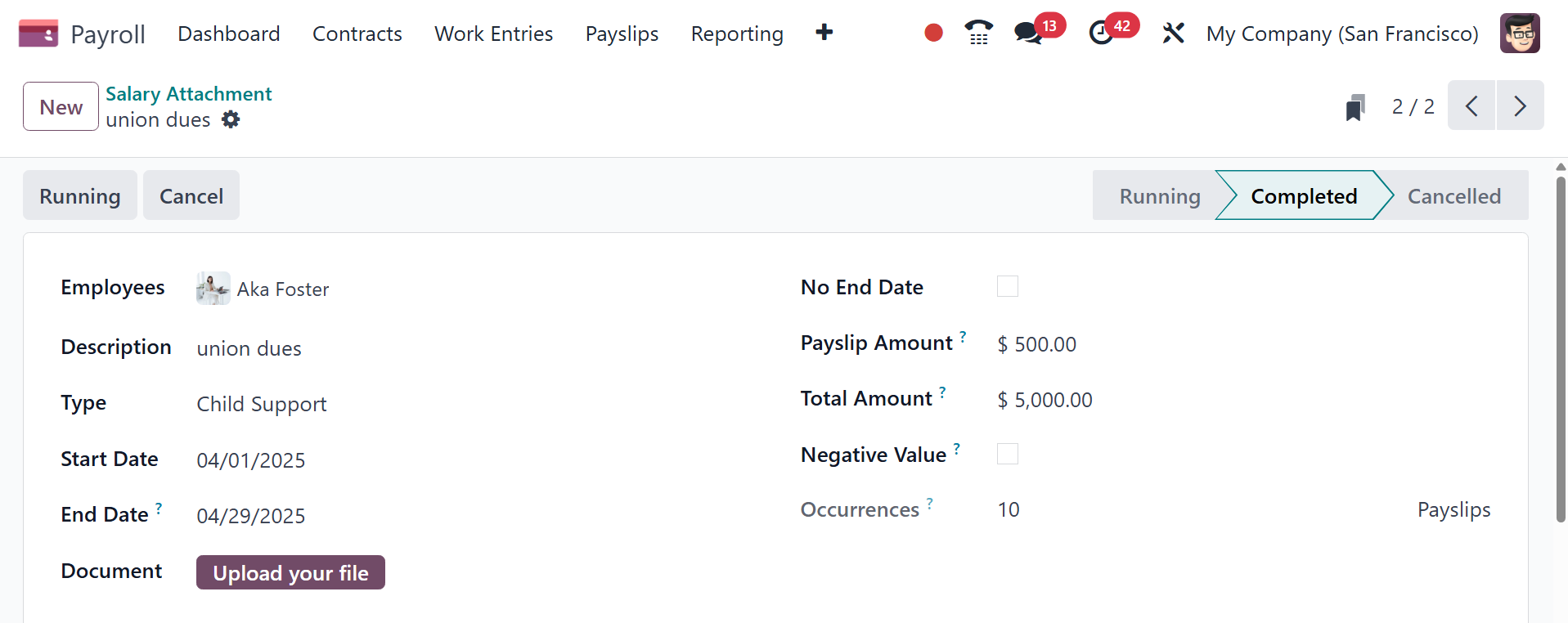

There are three possible statuses

for salary attachments:

Cancelled, Completed, or

Running. Every salary

attachment shows up in the

configuration sequence. A pay

attachment has the status

"Running" when it is created.

The status immediately

changes to Completed and the

employee no longer has the

money deducted from

subsequent paychecks after

the salary attachment is

complete (the total amount

provided on the salary

attachment form has been paid

in full). It is always

possible to cancel any salary

attachment. Click on each

individual attachment record

from the main Salary

Attachment dashboard to

access the record and cancel

it.

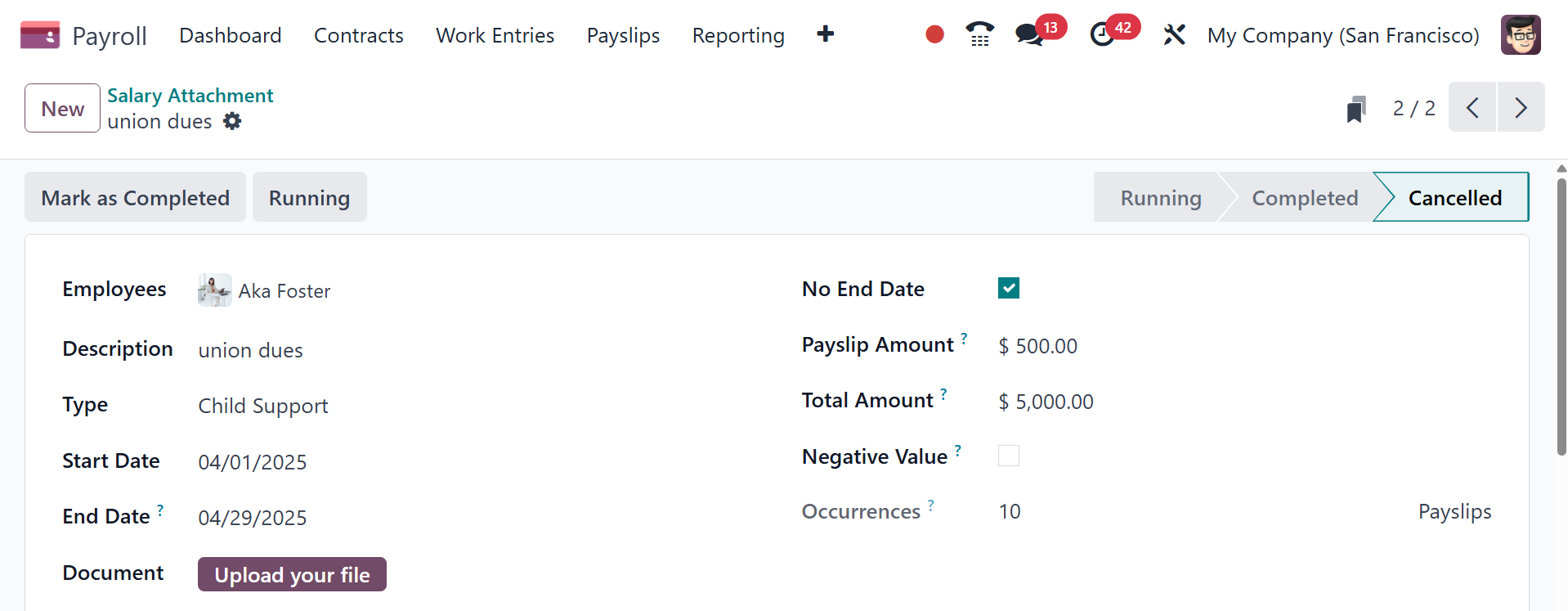

Click the Cancel button on the

Salary Attachment record to

end the salary attachment and

prevent the specified amount

from being deducted from

subsequent paychecks. And it

will show in the cancelled

state.

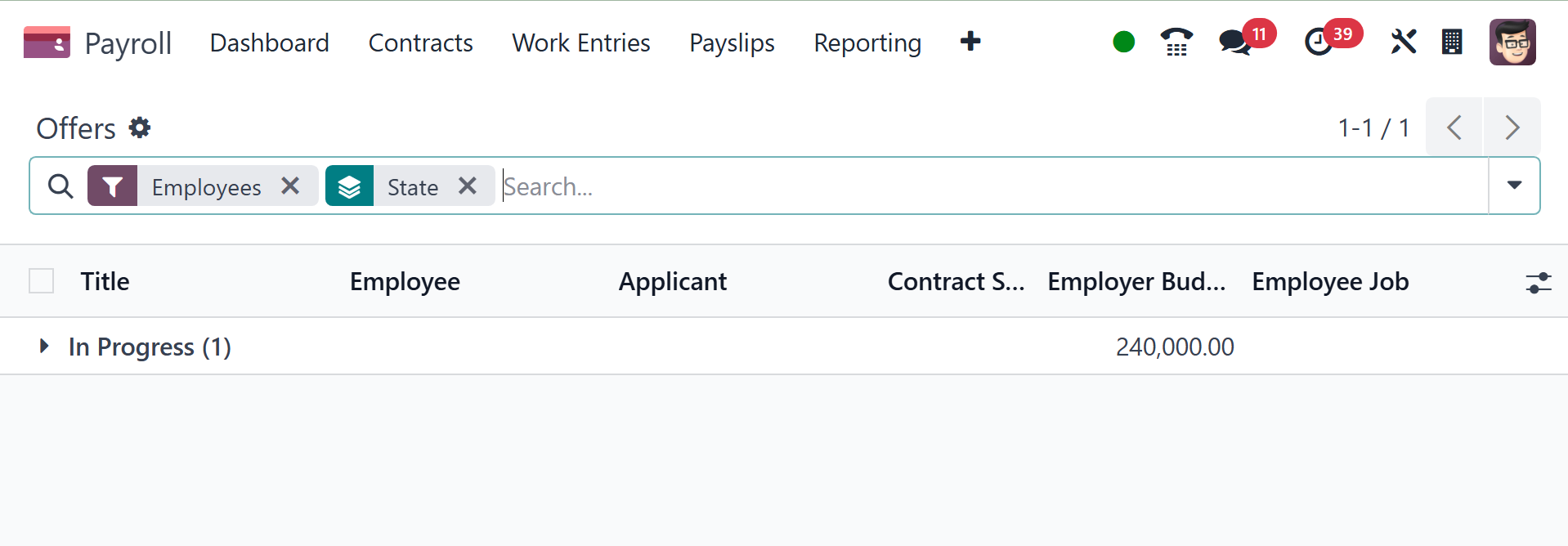

2.3 Offers

Offers made for employees are

also included in payroll. It

is similar to what is

mentioned in the Recruitment

module. Employed Budget,

Title, State, and Offer

Validity Date are shown in

the list view.