Journal

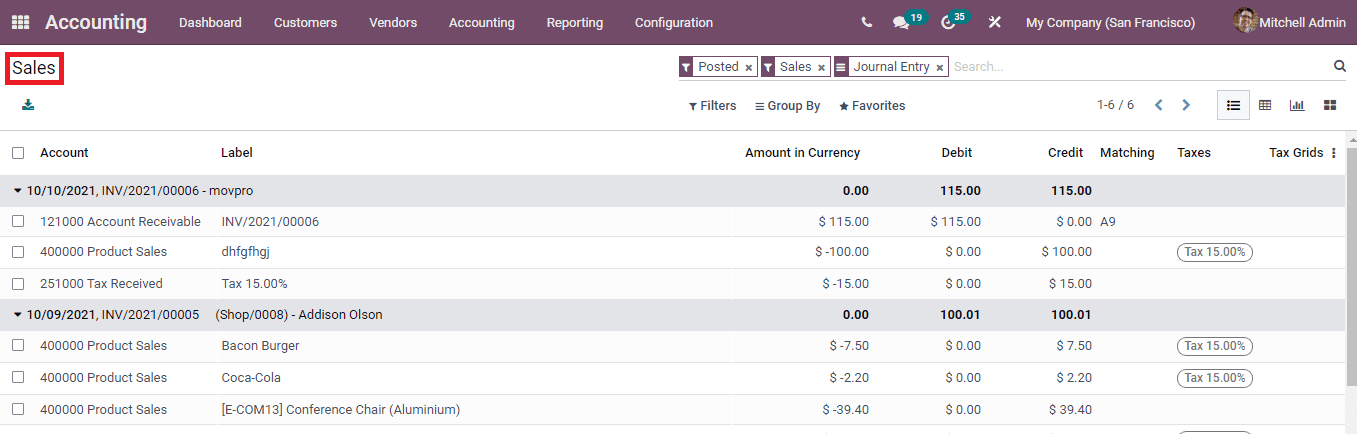

Sales

The sales journal entries keeps you updated with the sales of items purchased by the customers. The debit side records the receivable and credits the revenue. Mostly inventory sales and merchandise sales are recorded in the sales journal. In the Odoo 15 Accounting module you can track the records of the sales journals by selecting the Sales option from the Accounting tab.

At the Sales journal, you can view the name of the Account, Label, Amount in Currency, Debit, Credit amount, Matching, Taxes and Tax Grids. The entries can be grouped by on the basis of Journal Entry, Account, Partner, Journal, and Date. Journals can be displayed in List, Pivot, Graph and Kanban view.

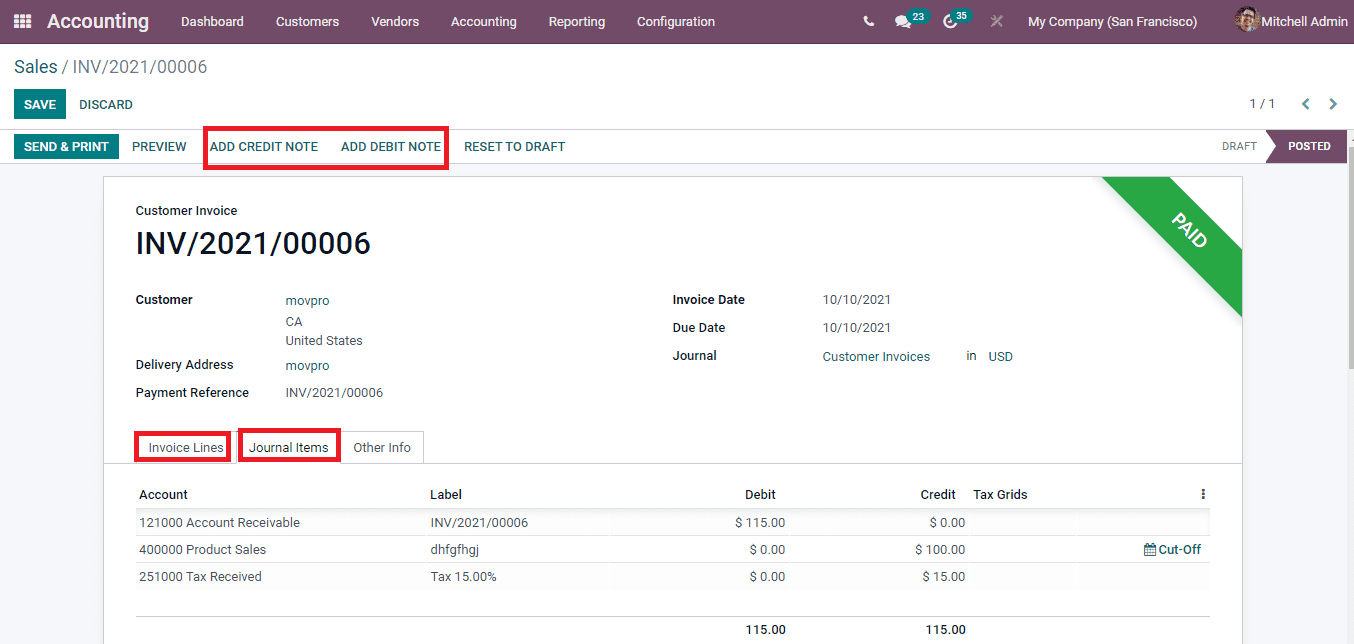

You can edit the details of the journal entry by selecting the edit icon. You will be redirected to the customer invoice profile. You can add credit notes and debit notes to the invoice by selecting the ADD CREDIT NOTE and ADD DEBIT NOTE buttons respectively. Printouts of the invoice can be taken and sent to the customers. By selecting the Invoice Lines you can view the details of the invoice lines. Similarly the journal items can also be checked.

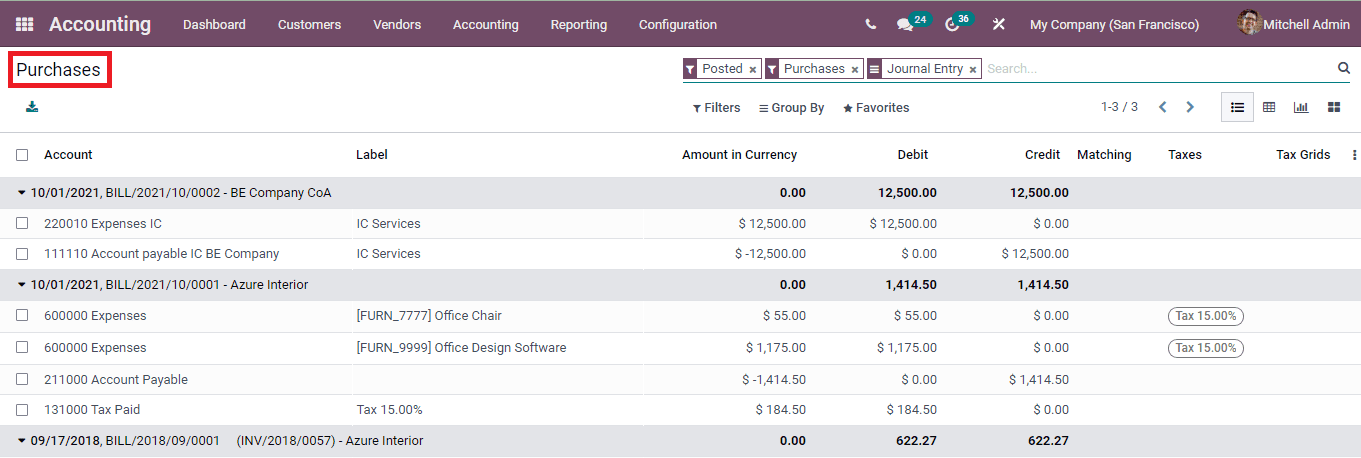

Purchases

All the acquisitions made by the company on credit during a period is recorded at thePurchase journal. With the help of a purchase journal you can keep a track of the orders placed by the company using the accounts payable.

Using the Odoo 15 Accounting module you can view the purchase journal by selecting the Purchase option from the Accounting tab. Similar to the Ses journal you can view the list of purchase journals along with the details such as name of the Account, Label, Amount in Currency, Debit amount, Credit amount, Matching and Taxes. You can reverse the journal entry by selecting the reverse icon. By selecting the edit icon you can edit the entry. Debit notes well as credit notes can be added to the invoices.

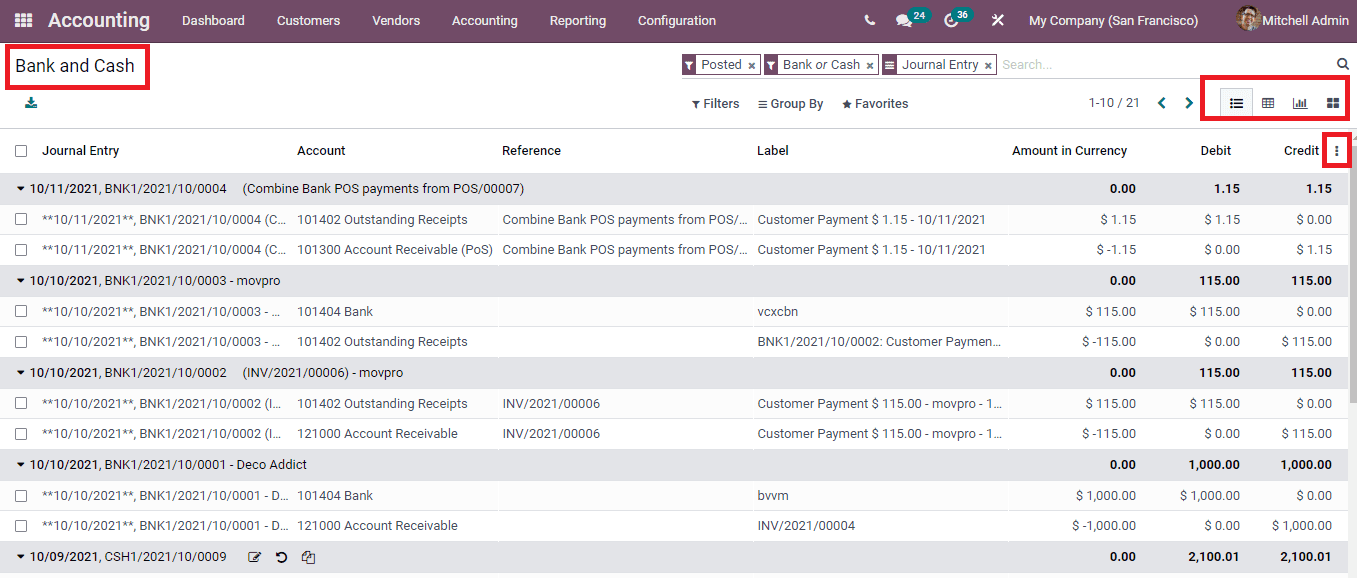

Bank and Cash

The selected document’s bank and cash postings are recorded in the Bank and Cash journals. The transactions with the bank can be monitored and tracked with bank and cash journals. By selecting the Bank and Cash option from the Accounting tab you can view the bank and cash journal entries listed in the Odoo 15 Accounting module. Journal entries are displayed along with the details such as name of the Journal Entry, Account, Reference, Label, Amount in Currency, Debit amount and Credit amount is displayed. More measures can be displayed by selecting the three dots situated at the end of the details. The entries can be seen in List, Pivot, Graph and Kanban view.

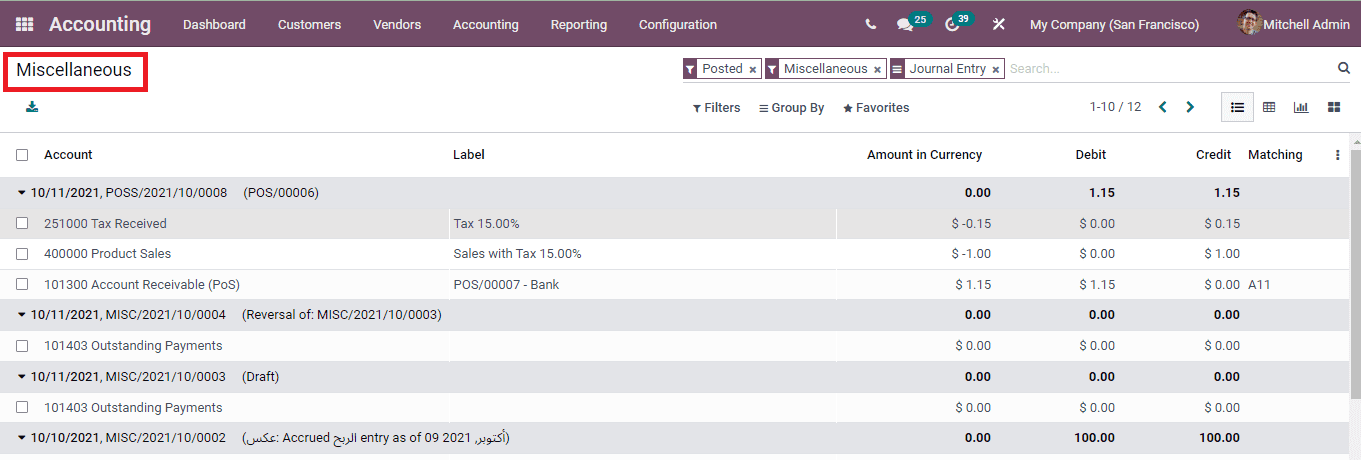

Miscellaneoush

Miscellaneous journal entries record the invoices, payments which do not fit within the specific categories or account ledgers of the company In Odoo 15 you can ew the details of such journal entries by selecting the Miscellaneous option from the Accounting tab. You can reconcile the journal entries that are displayed by selecting them and then pressing the RECONCILE button. The entries can be edited and reversed from the list.